Содержание

- 2. Building Users Differentiated by Users/Tenants Major Institutional/Professional Occupied by banks, insurance companies, professionals, corporate headquarters General

- 3. Building Users Differentiated by Users/Tenants Quasi-industrial may be located in industrial parks flex and/or research and

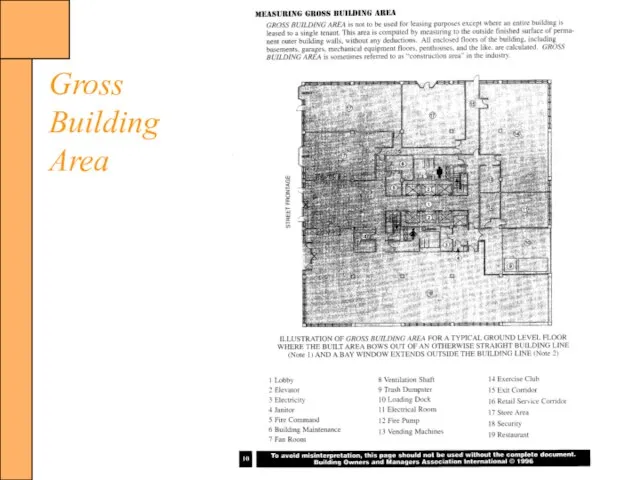

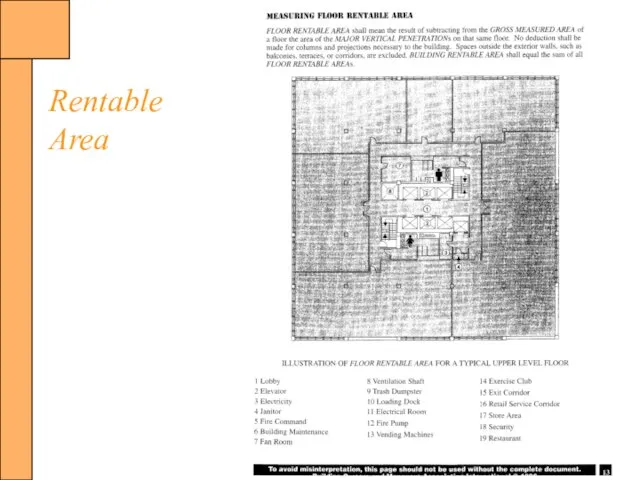

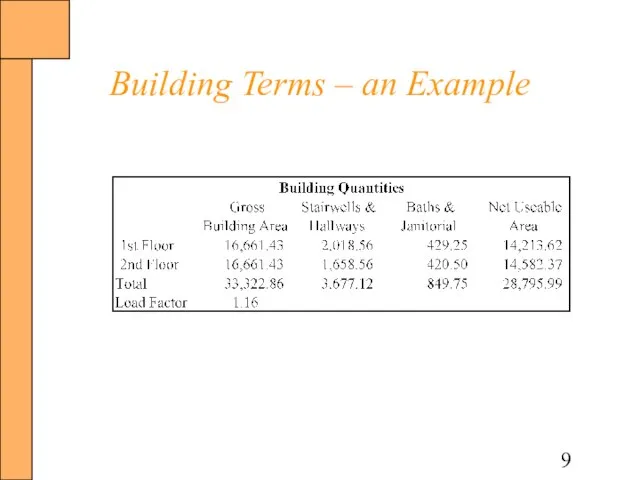

- 4. Building Terms Gross Building Area (GBA) Total area of the building in square feet Rentable Area

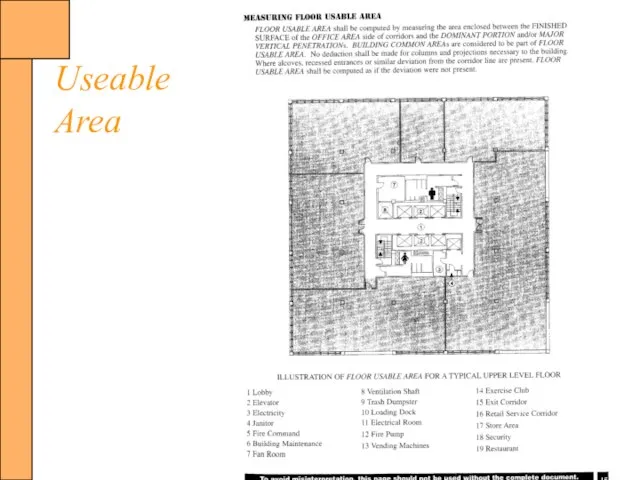

- 5. Building Terms Rented Area Amount of space under lease in a building Net Occupied Space (Useable)

- 6. Gross Building Area

- 7. Rentable Area

- 8. Useable Area

- 9. Building Terms – an Example

- 10. Building Types Trophy highest quality building, one-of-a-kind unique architectural design outstanding location Class A excellent location

- 11. Building Types Class B good location and good construction may suffer from physical deterioration and some

- 12. General Concepts and Terms Analysis of Competition should recognize differences between building types segmentation of supply

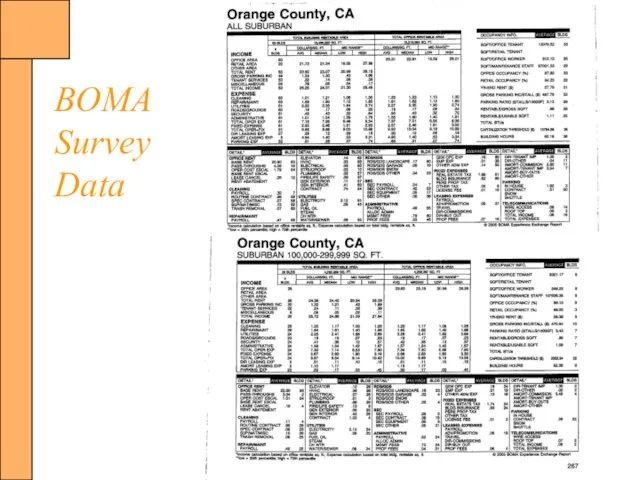

- 13. BOMA Survey Data

- 14. Market Analysis: the Six Steps Step 1: Define the Product (property productivity analysis) Step 2: Define

- 15. Step 1: Define the Product Property Productivity Analysis Identify the type of Office Building tenants and

- 17. Location Analysis Often reflects its convenience to office workers, support facilities and executive housing areas Office

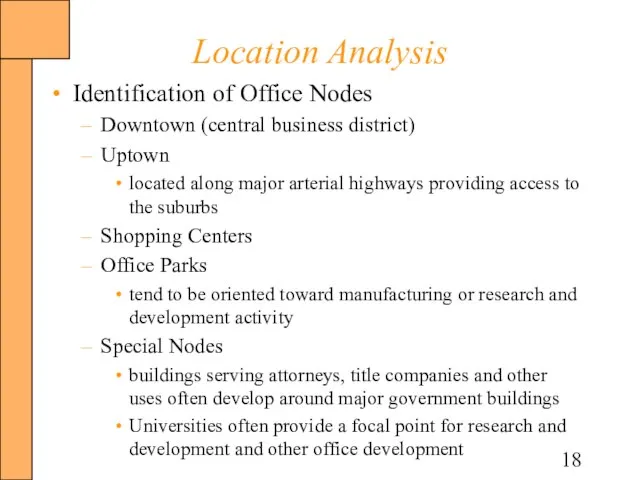

- 18. Location Analysis Identification of Office Nodes Downtown (central business district) Uptown located along major arterial highways

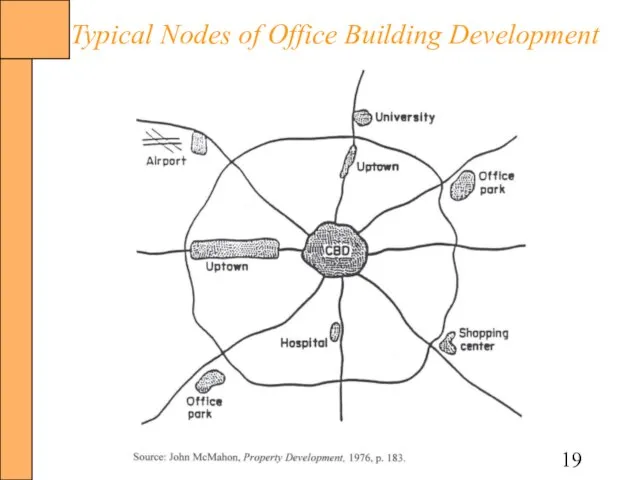

- 19. Typical Nodes of Office Building Development

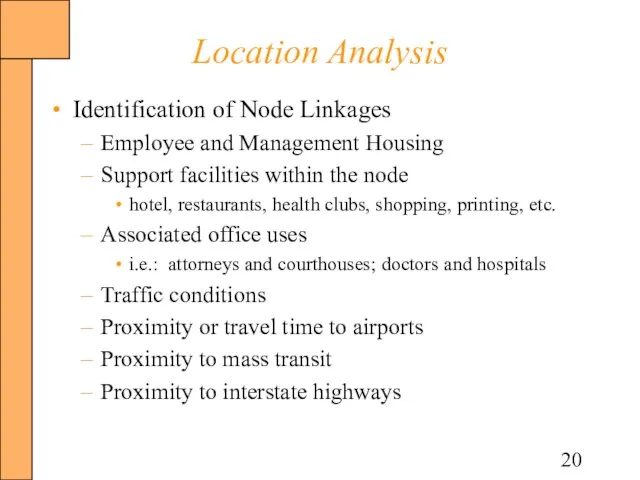

- 20. Location Analysis Identification of Node Linkages Employee and Management Housing Support facilities within the node hotel,

- 22. Location Analysis Land Use considerations Reputation of the area Nuisances in the area Traffic conditions adjacent

- 23. Location Analysis Citywide growth analysis Procedure for analysis map current major urban centers and housing areas

- 24. Step 2: Define the Users of the Property Market Delineation Specify the market of possible property

- 25. Step 3: Forecast Demand Factors Inferred (trend) methods general employment growth (decline) trends general secondary data

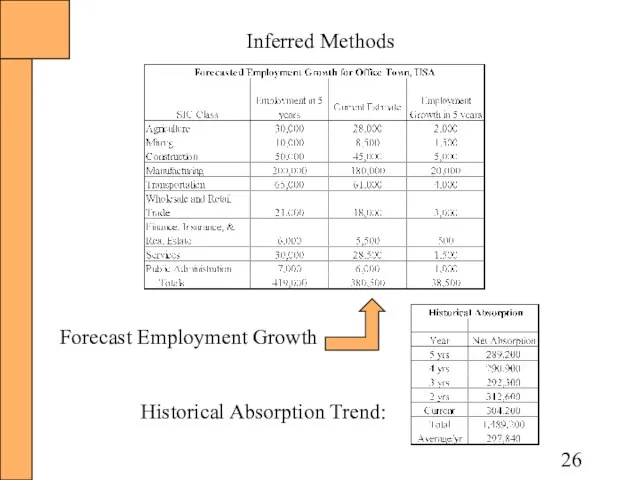

- 26. Inferred Methods Historical Absorption Trend: Forecast Employment Growth

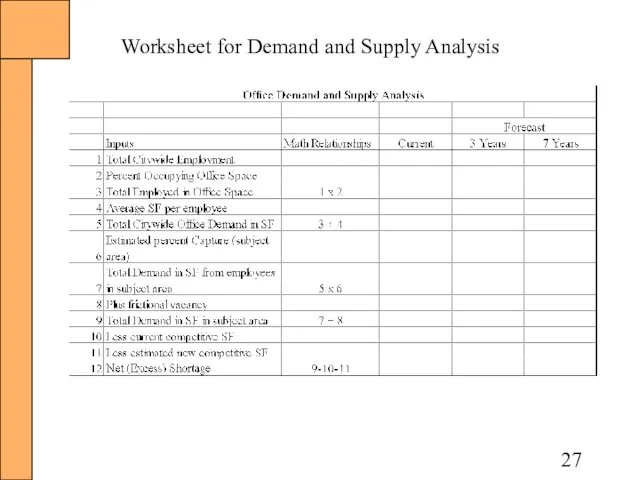

- 27. Worksheet for Demand and Supply Analysis

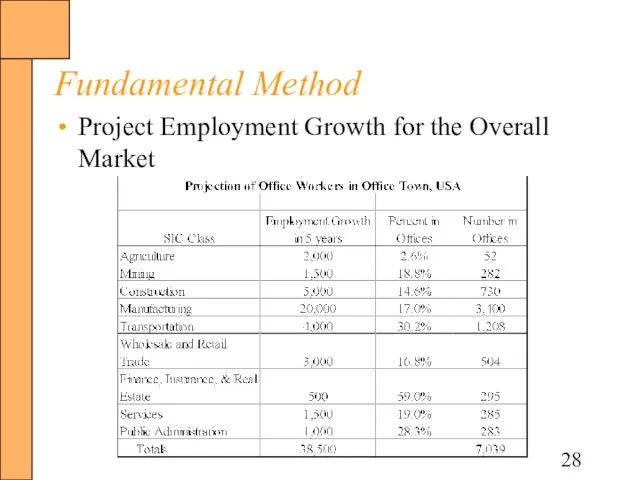

- 28. Fundamental Method Project Employment Growth for the Overall Market

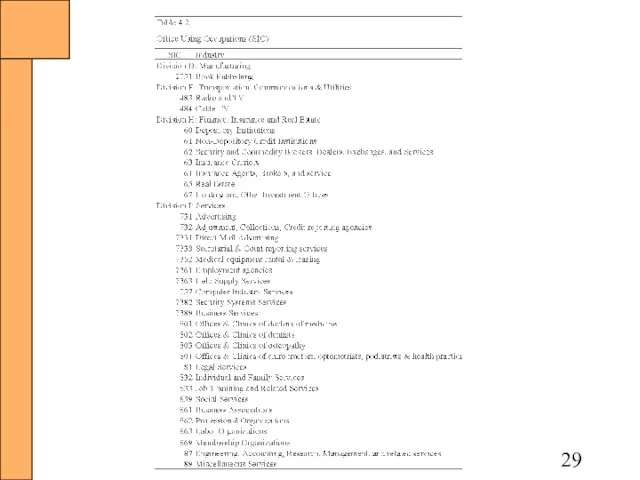

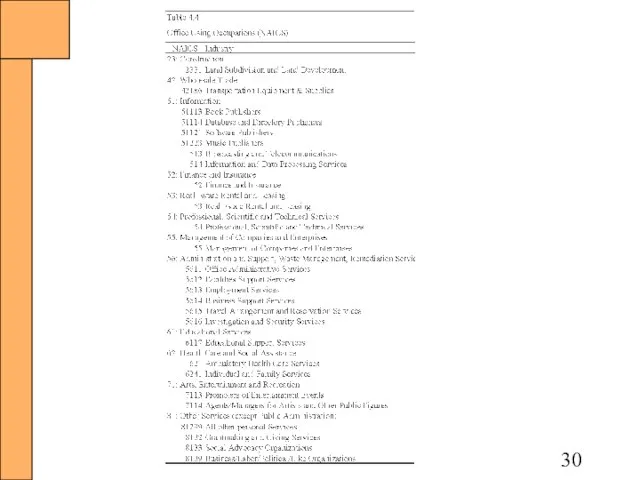

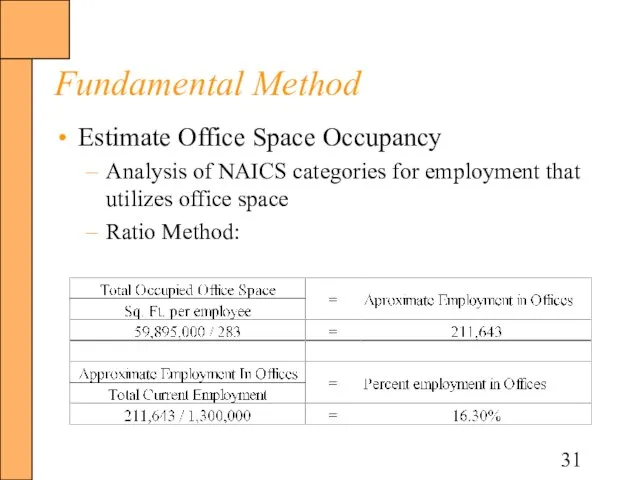

- 31. Fundamental Method Estimate Office Space Occupancy Analysis of NAICS categories for employment that utilizes office space

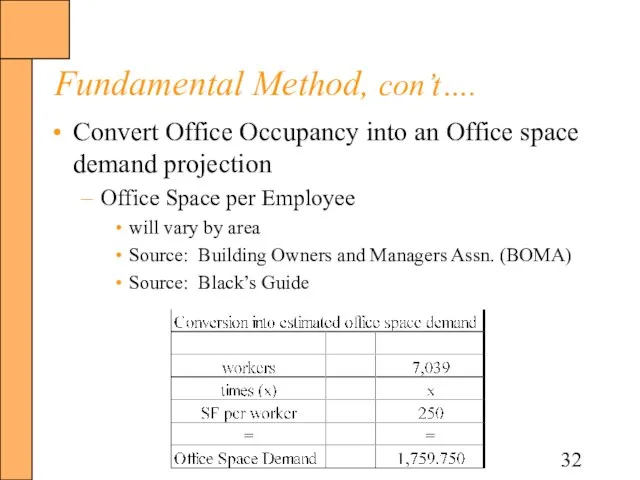

- 32. Fundamental Method, con’t…. Convert Office Occupancy into an Office space demand projection Office Space per Employee

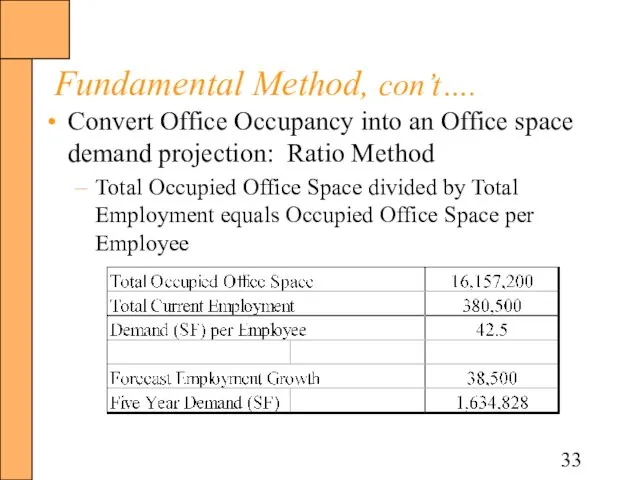

- 33. Fundamental Method, con’t…. Convert Office Occupancy into an Office space demand projection: Ratio Method Total Occupied

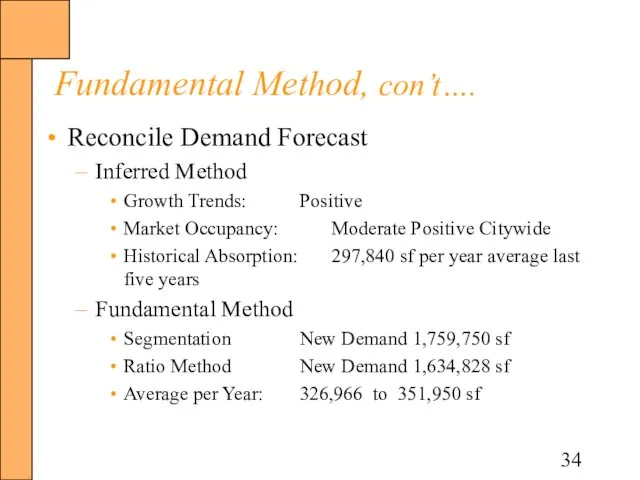

- 34. Fundamental Method, con’t…. Reconcile Demand Forecast Inferred Method Growth Trends: Positive Market Occupancy: Moderate Positive Citywide

- 35. Step 4: Inventory and Forecast Competitive Supply Inventory the current competitive office space within the subject’s

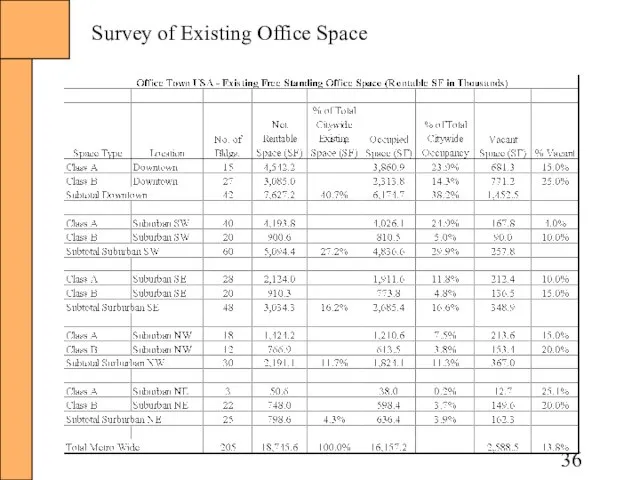

- 36. Survey of Existing Office Space

- 37. Inventory of Space Under Construction and Forecast of New Planned Space Review of Building Permits yields:

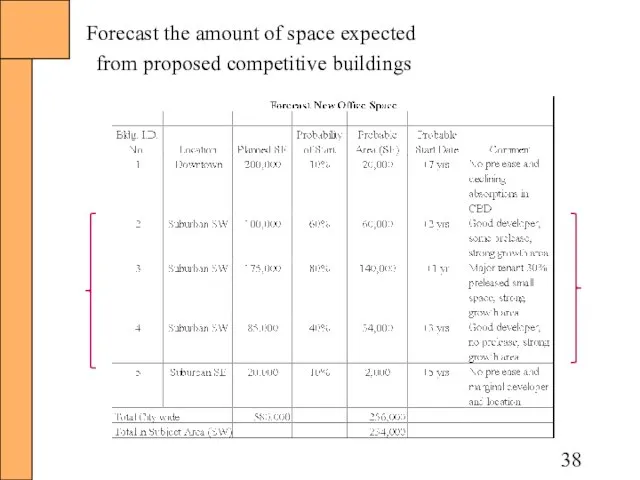

- 38. Forecast the amount of space expected from proposed competitive buildings

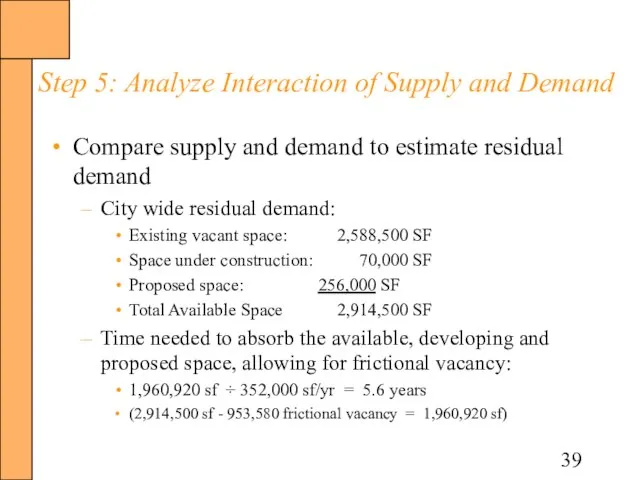

- 39. Step 5: Analyze Interaction of Supply and Demand Compare supply and demand to estimate residual demand

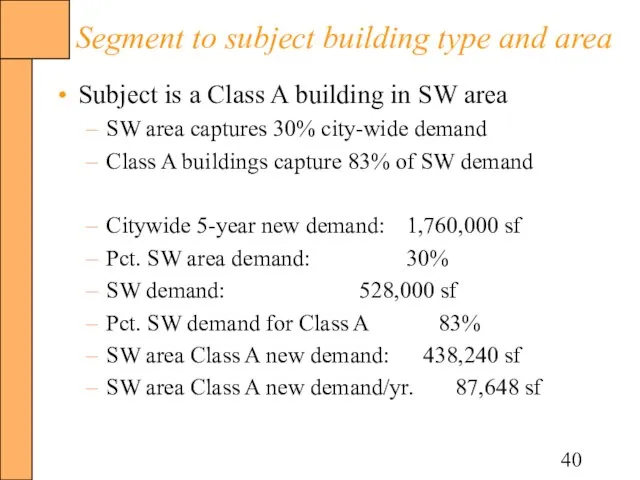

- 40. Segment to subject building type and area Subject is a Class A building in SW area

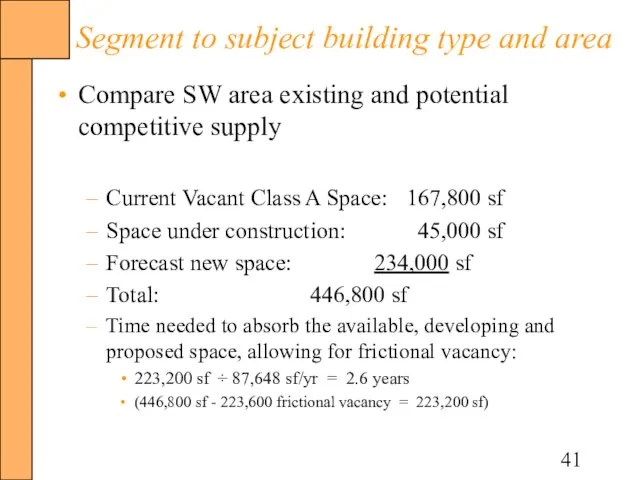

- 41. Segment to subject building type and area Compare SW area existing and potential competitive supply Current

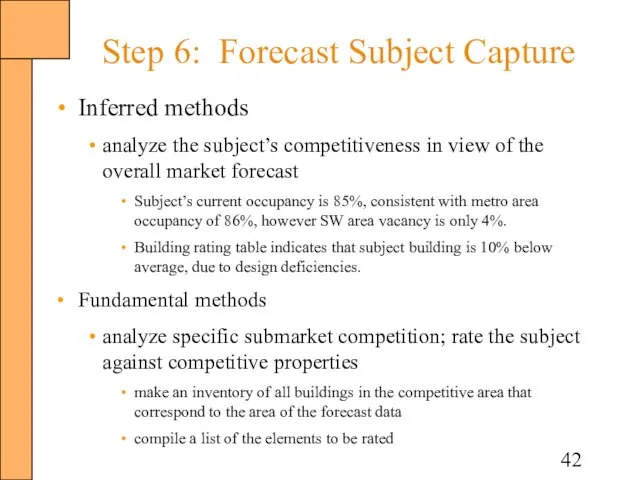

- 42. Step 6: Forecast Subject Capture Inferred methods analyze the subject’s competitiveness in view of the overall

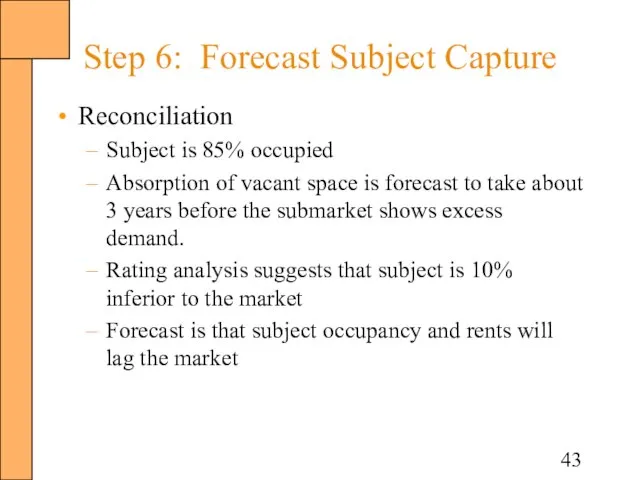

- 43. Step 6: Forecast Subject Capture Reconciliation Subject is 85% occupied Absorption of vacant space is forecast

- 45. Скачать презентацию

Введення в Macromedia Flash CS3

Введення в Macromedia Flash CS3 Возможности и ограничения применения общенаучных методов познания в методических системах предметного обучения Аспирант кафед

Возможности и ограничения применения общенаучных методов познания в методических системах предметного обучения Аспирант кафед Сыворотка-бустер с пептидами морского коллагена

Сыворотка-бустер с пептидами морского коллагена Военные реформы Петра I

Военные реформы Петра I Лаборатория робототехники и программирования

Лаборатория робототехники и программирования Словосполучення. Будова і види словосполучень за способами вираження головного слова

Словосполучення. Будова і види словосполучень за способами вираження головного слова Конвенции о защите прав человека в судах РФ

Конвенции о защите прав человека в судах РФ Прионы и вирииды

Прионы и вирииды Презентация на тему Руды металлов

Презентация на тему Руды металлов Книга - наш лучший друг

Книга - наш лучший друг Информационно-коммуникационные технологии (ИКТ) - использование компьютера для поиска, передачи, сохранения, структурирования и о

Информационно-коммуникационные технологии (ИКТ) - использование компьютера для поиска, передачи, сохранения, структурирования и о Лицо. Овынъ

Лицо. Овынъ Процесс управления маркетингом

Процесс управления маркетингом Компьютерные вирусы

Компьютерные вирусы Айратекс. Бизнес-пакеты

Айратекс. Бизнес-пакеты Сущность права

Сущность права Лекция 2

Лекция 2 Презентация на тему Как выполняли арифметические действия в Древнем Риме

Презентация на тему Как выполняли арифметические действия в Древнем Риме  Перспективні напрямки інтернет-проектів в Україні

Перспективні напрямки інтернет-проектів в Україні Презентация на тему Особенности международной сегментации

Презентация на тему Особенности международной сегментации  О захвате самолета

О захвате самолета День семьи, любви и верности

День семьи, любви и верности Виконала студентка Херсонського кооперативного економіко-правового коледжу групи П-291 Кулик Вікторія Херсон крізь призму розвитк

Виконала студентка Херсонського кооперативного економіко-правового коледжу групи П-291 Кулик Вікторія Херсон крізь призму розвитк Презентация на тему Возрастные особенности кровеносных сосудов

Презентация на тему Возрастные особенности кровеносных сосудов Как пополнить Ваш счет и вывести средства

Как пополнить Ваш счет и вывести средства Поделки из соленого теста

Поделки из соленого теста 王磐 朝天子·咏喇叭 阿廖娜

王磐 朝天子·咏喇叭 阿廖娜 Античне мистецтво. Давня Греція. Культура етрусків

Античне мистецтво. Давня Греція. Культура етрусків