Содержание

- 2. Our previous lecture : Timofeeva A.A. 2020 c

- 3. Timofeeva A.A. 2020 c

- 4. The forms of international economic relations International trade in goods and services; The international movement of

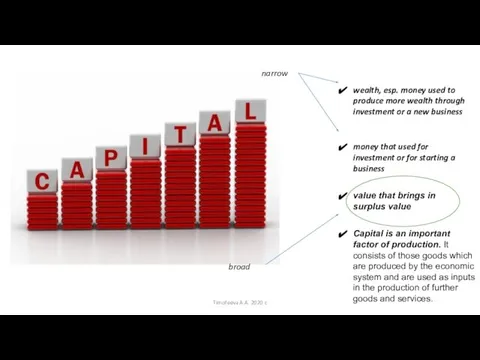

- 5. Timofeeva A.A. 2020 c Capital

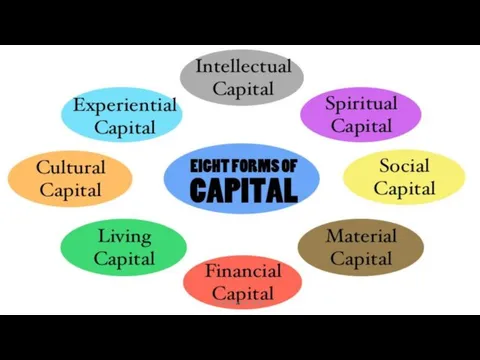

- 6. Timofeeva A.A. 2020 c

- 7. wealth, esp. money used to produce more wealth through investment or a new business money that

- 8. Timofeeva A.A. 2020 c

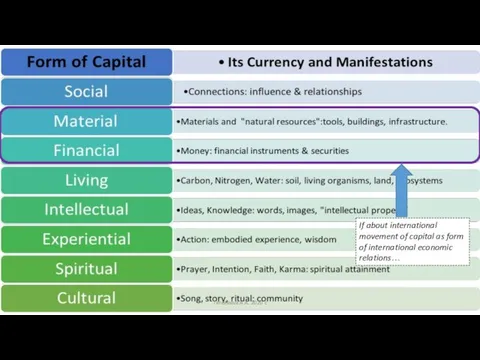

- 9. If about international movement of capital as form of international economic relations… Timofeeva A.A. 2020 c

- 10. Timofeeva A.A. 2020 c Forms of international capital movement

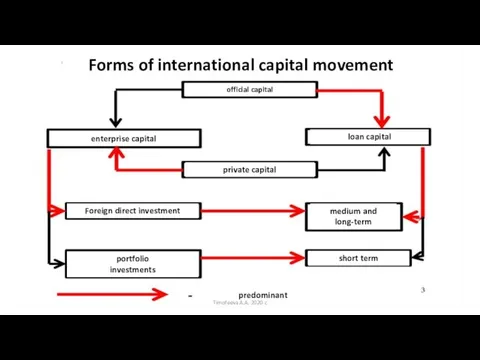

- 11. Forms of international capital movement Timofeeva A.A. 2020 c

- 12. Forms of international capital movement official capital enterprise capital loan capital private capital Foreign direct investment

- 13. Timofeeva A.A. 2020 c

- 14. Timofeeva A.A. 2020 c FDI

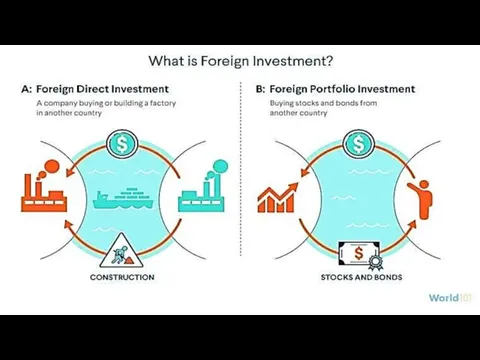

- 15. Timofeeva A.A. 2020 c A foreign direct investment (FDI) is an investment in the form of

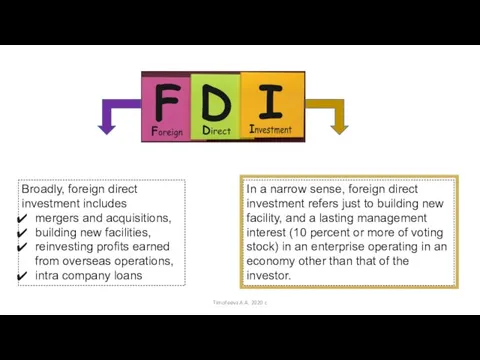

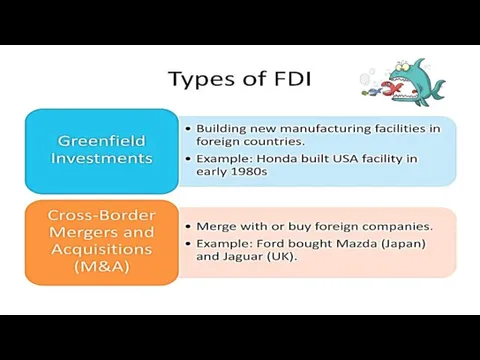

- 16. Timofeeva A.A. 2020 c Broadly, foreign direct investment includes mergers and acquisitions, building new facilities, reinvesting

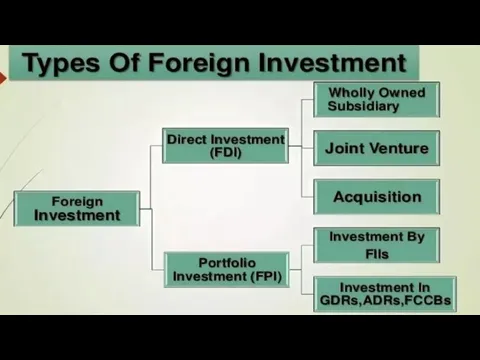

- 17. Timofeeva A.A. 2020 c FDI TYPES

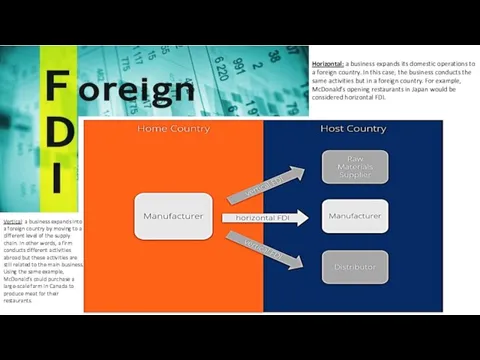

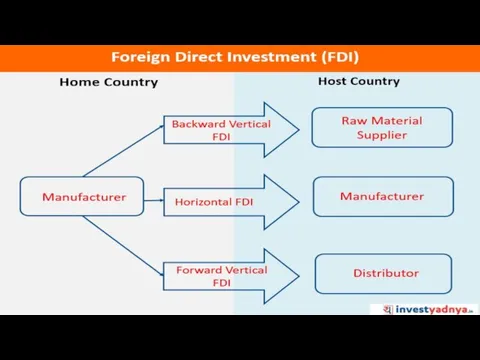

- 18. Timofeeva A.A. 2020 c Horizontal: a business expands its domestic operations to a foreign country. In

- 19. Timofeeva A.A. 2020 c

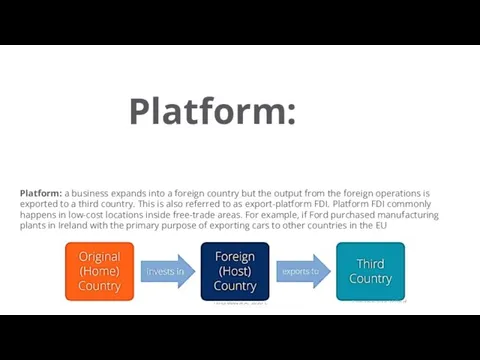

- 20. Timofeeva A.A. 2020 c Platform: a business expands into a foreign country but the output from

- 21. Timofeeva A.A. 2020 c

- 22. Timofeeva A.A. 2020 c FDI+ and -

- 23. Timofeeva A.A. 2020 c

- 24. Timofeeva A.A. 2020 c

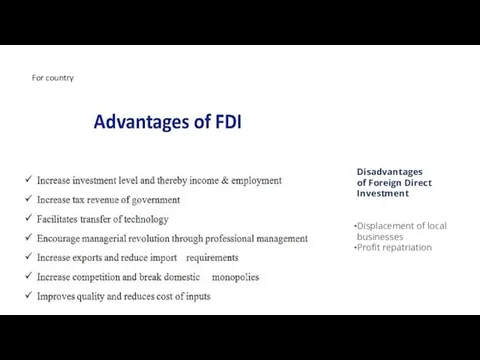

- 25. Timofeeva A.A. 2020 c For country Disadvantages of Foreign Direct Investment Displacement of local businesses Profit

- 26. Timofeeva A.A. 2020 c For company

- 27. Timofeeva A.A. 2020 c FDI in strategies

- 28. Timofeeva A.A. 2020 c

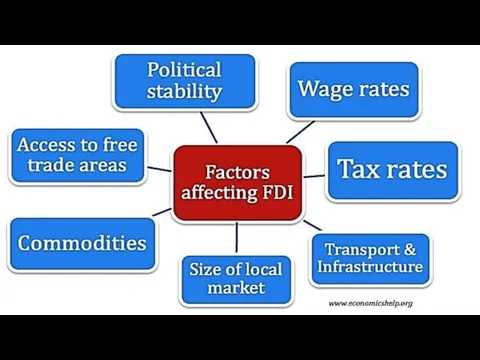

- 29. Timofeeva A.A. 2020 c

- 30. Timofeeva A.A. 2020 c FDI in numbers

- 31. Stock of direct foreign investment - abroad: $33.6 trillion (31 December 2017 est.) $28.4 trillion (31

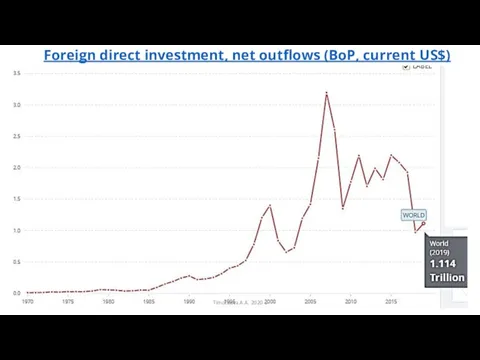

- 32. Foreign direct investment, net outflows (BoP, current US$) Timofeeva A.A. 2020 c

- 33. Timofeeva A.A. 2020 c

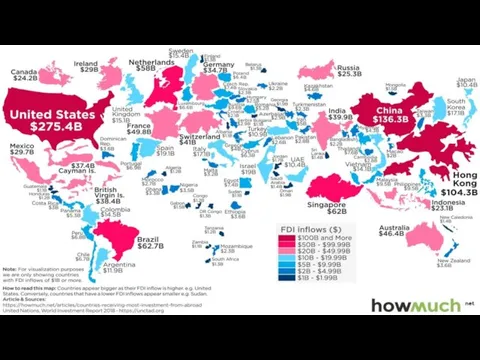

- 34. Timofeeva A.A. 2020 c top 15 countries and jurisdictions receiving FDI inflows:

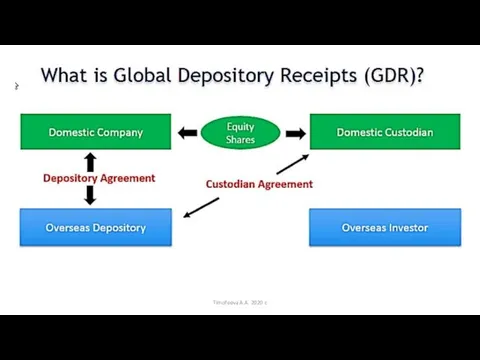

- 35. Timofeeva A.A. 2020 c Portfolio investment

- 36. Timofeeva A.A. 2020 c

- 37. Timofeeva A.A. 2020 c

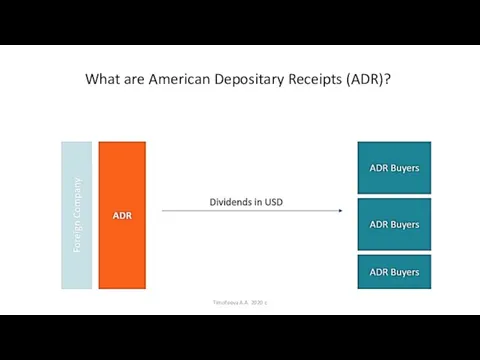

- 38. Timofeeva A.A. 2020 c What are American Depositary Receipts (ADR)?

- 40. Скачать презентацию

Расчет теплоусвоения внутренней поверхности полов

Расчет теплоусвоения внутренней поверхности полов Оболочечная модель ядра

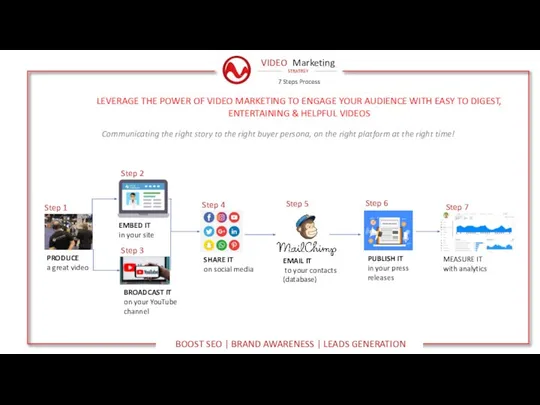

Оболочечная модель ядра Draft video marketing strategy poster

Draft video marketing strategy poster Требования к развивающей предметно-пространственной среде по ФГОС

Требования к развивающей предметно-пространственной среде по ФГОС Whats on the box

Whats on the box Общая характеристика стандартизации

Общая характеристика стандартизации Уровневая модель методической системы школы

Уровневая модель методической системы школы Подростковый возраст и его особенности

Подростковый возраст и его особенности Презентация на тему ФОРМИРОВАНИЕ ПОЗНАВАТЕЛЬНОГО ИНТЕРЕСА К МАТЕМАТИКЕ

Презентация на тему ФОРМИРОВАНИЕ ПОЗНАВАТЕЛЬНОГО ИНТЕРЕСА К МАТЕМАТИКЕ  Зимний пейзаж 6 класс

Зимний пейзаж 6 класс Java Enterprise обучение, работа, перспективы

Java Enterprise обучение, работа, перспективы Международное авторское право. Тесты

Международное авторское право. Тесты ПОЖАРНАЯ БЕЗОПАСНОСТЬ

ПОЖАРНАЯ БЕЗОПАСНОСТЬ Великий сын России

Великий сын России День Знаний в 3 классе

День Знаний в 3 классе Подросток в мире вредных привычек

Подросток в мире вредных привычек Хамелеон - мастер маскировки

Хамелеон - мастер маскировки Домашние опасности

Домашние опасности СМК ЮФУ:Адаптивная Среда ТестированияАст-Тест

СМК ЮФУ:Адаптивная Среда ТестированияАст-Тест Презентация на тему М.М. Пришвин «Кладовая солнца»

Презентация на тему М.М. Пришвин «Кладовая солнца»  Презентация на тему: Почему люди предпочитают носить одежду из натуральных тканей?

Презентация на тему: Почему люди предпочитают носить одежду из натуральных тканей? Мутация- источник формирования биологического разнообразия

Мутация- источник формирования биологического разнообразия Сложение и вычитание дробей

Сложение и вычитание дробей История женского футбола

История женского футбола Лис фенек

Лис фенек Конфликт

Конфликт Итоги заседания общего собрания РАО 17.05.2018

Итоги заседания общего собрания РАО 17.05.2018 Информатика для направления130102 «Технологии геологической разведки» (двухсеместровая программа: семестр 2)

Информатика для направления130102 «Технологии геологической разведки» (двухсеместровая программа: семестр 2)