Содержание

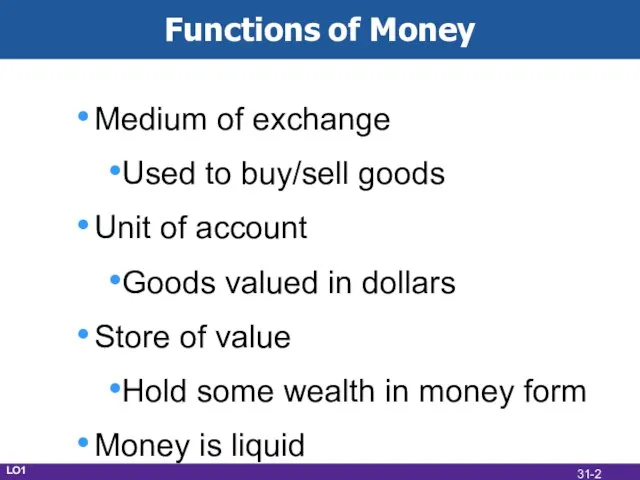

- 2. Functions of Money Medium of exchange Used to buy/sell goods Unit of account Goods valued in

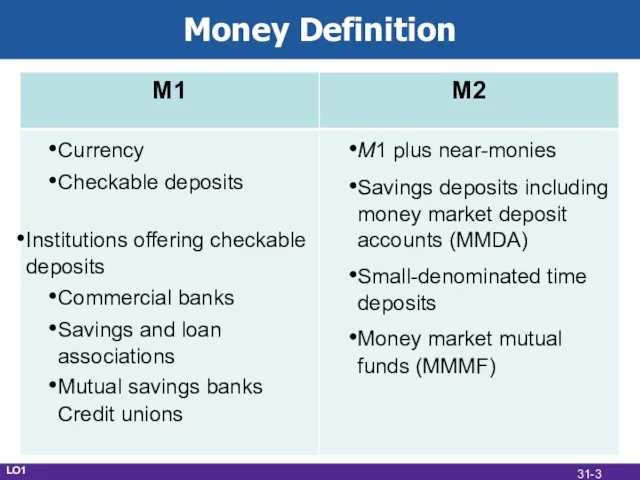

- 3. Money Definition LO1 31-

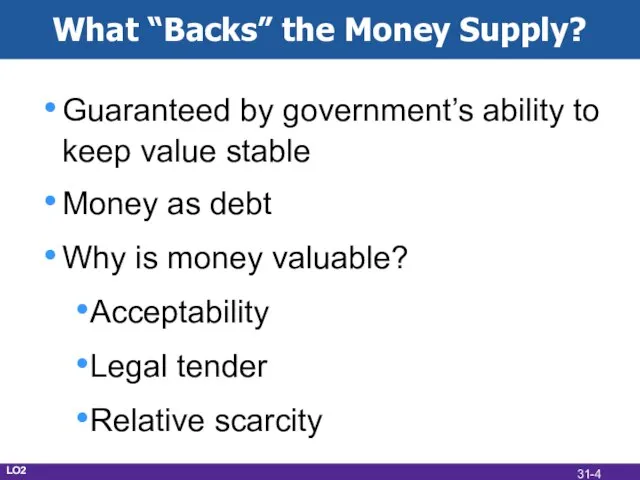

- 4. What “Backs” the Money Supply? Guaranteed by government’s ability to keep value stable Money as debt

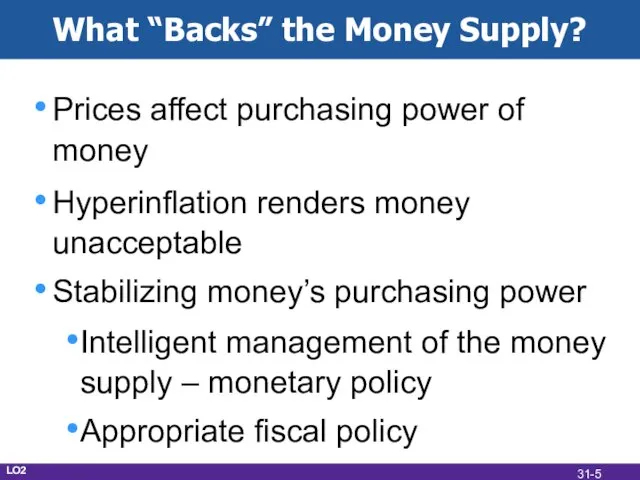

- 5. What “Backs” the Money Supply? Prices affect purchasing power of money Hyperinflation renders money unacceptable Stabilizing

- 6. Federal Reserve - Banking System Historical background Board of Governors 12 Federal Reserve Banks Serve as

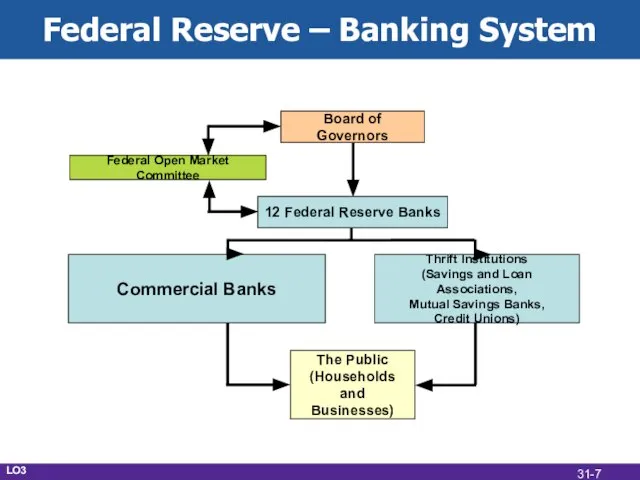

- 7. Federal Reserve – Banking System Commercial Banks Thrift Institutions (Savings and Loan Associations, Mutual Savings Banks,

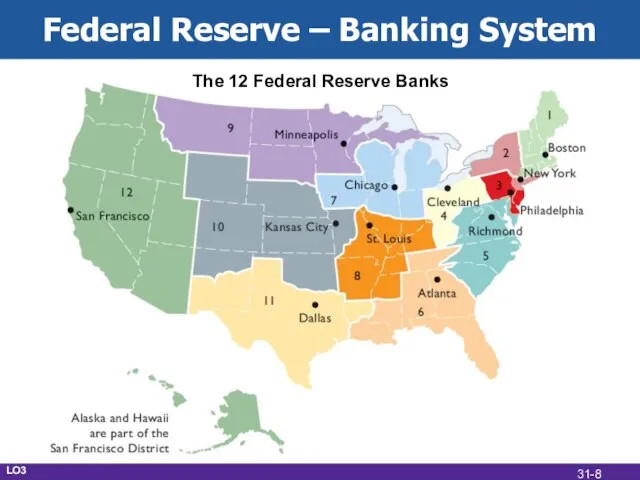

- 8. Federal Reserve – Banking System LO3 The 12 Federal Reserve Banks 31-

- 9. Federal Reserve – Banking System Federal Open Market Committee Aids Board of Governors in setting monetary

- 10. Federal Reserve Functions Issue currency Set reserve requirements Lend money to banks Collect checks Act as

- 11. Federal Reserve Independence Established by Congress as an independent agency Protects the Fed from political pressures

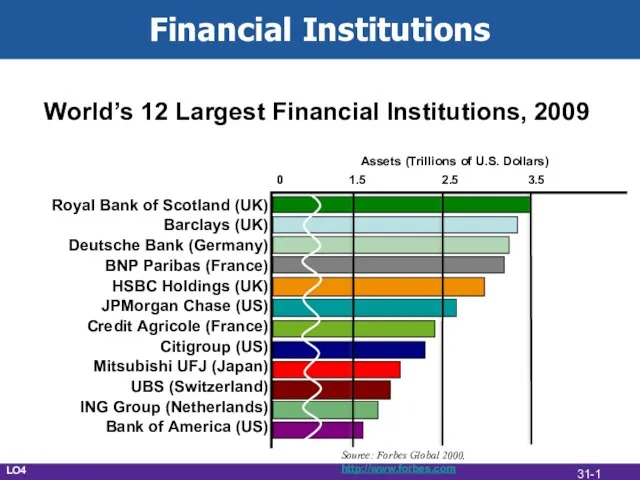

- 12. Financial Institutions World’s 12 Largest Financial Institutions, 2009 Royal Bank of Scotland (UK) Barclays (UK) Deutsche

- 13. The Financial Crisis of 2007 and 2008 Mortgage Default Crisis Many causes Government programs that encouraged

- 14. The Financial Crisis of 2007 and 2008 Securitization: the process of slicing up and bundling groups

- 15. The Financial Crisis of 2007 and 2008 Failures and near-failures of financial firms Countrywide: second largest

- 16. The Financial Crisis of 2007 and 2008 Troubled Asset Relief Program (TARP) Allocated $700 billion to

- 17. The Financial Crisis of 2007 and 2008 The Fed’s lender-of-last-resort activities Primary Dealer Credit Facility Term

- 19. Скачать презентацию

Глагол have to

Глагол have to Усі знаки зодіаку

Усі знаки зодіаку Новое свойство квадратных уравнений

Новое свойство квадратных уравнений Бандитизм как социальная опасность

Бандитизм как социальная опасность Декоративно-прикладное искусство в современном мире

Декоративно-прикладное искусство в современном мире Занятие 14

Занятие 14 Недвижимость Санкт-Петербурга и Ленинградской области

Недвижимость Санкт-Петербурга и Ленинградской области Хлеб

Хлеб Музыкальные обработки

Музыкальные обработки Что такое гостиничный бизнес?

Что такое гостиничный бизнес? Анонимные Наркоманы

Анонимные Наркоманы  Презентация на тему Литература 18 века Классицизм в России

Презентация на тему Литература 18 века Классицизм в России  ФГОС ООО: особенности содержания, назначение

ФГОС ООО: особенности содержания, назначение Debaty_v_textovom_formate

Debaty_v_textovom_formate КОМПЬЮТЕР И ВИДЕОКАМЕРА КАК ИНСТРУМЕНТЫ ОБУЧЕНИЯ ФИЗИКЕ

КОМПЬЮТЕР И ВИДЕОКАМЕРА КАК ИНСТРУМЕНТЫ ОБУЧЕНИЯ ФИЗИКЕ Подготовленная аварийная посадка на воду

Подготовленная аварийная посадка на воду Ранняя профилактика социального неблагополучия и жестокого обращения с детьми в семьях

Ранняя профилактика социального неблагополучия и жестокого обращения с детьми в семьях Средства защиты информации

Средства защиты информации The strategic interests of the United States in the Balkans in the late 20th and early 21st centuries

The strategic interests of the United States in the Balkans in the late 20th and early 21st centuries Презентация на тему День победы

Презентация на тему День победы  Праздник Троицы

Праздник Троицы Кодирование информации

Кодирование информации Металлургический комплекс

Металлургический комплекс Финансы бюджетных учреждений

Финансы бюджетных учреждений Презентация1

Презентация1 Будь благословен

Будь благословен Презентация на тему Система и структура трудового права

Презентация на тему Система и структура трудового права  Графический дизайн. Азбука журналистики

Графический дизайн. Азбука журналистики