Содержание

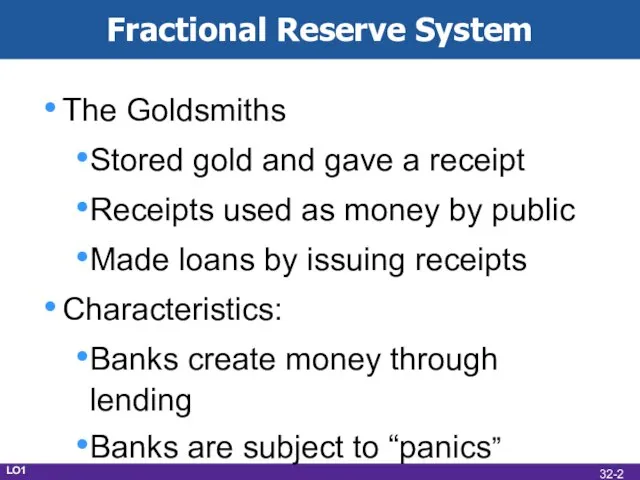

- 2. Fractional Reserve System The Goldsmiths Stored gold and gave a receipt Receipts used as money by

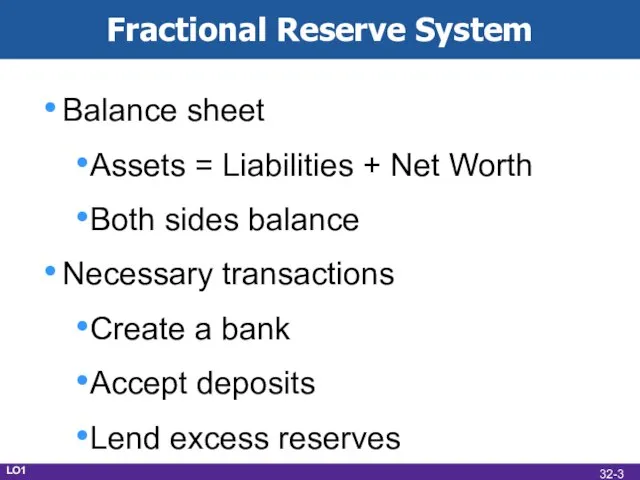

- 3. Fractional Reserve System Balance sheet Assets = Liabilities + Net Worth Both sides balance Necessary transactions

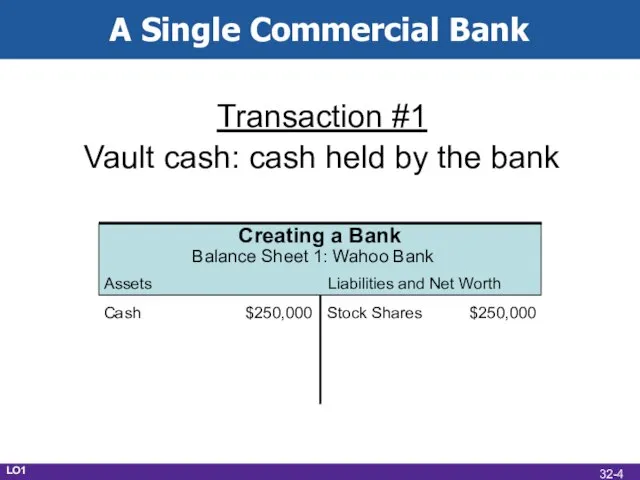

- 4. A Single Commercial Bank Transaction #1 Vault cash: cash held by the bank LO1 32-

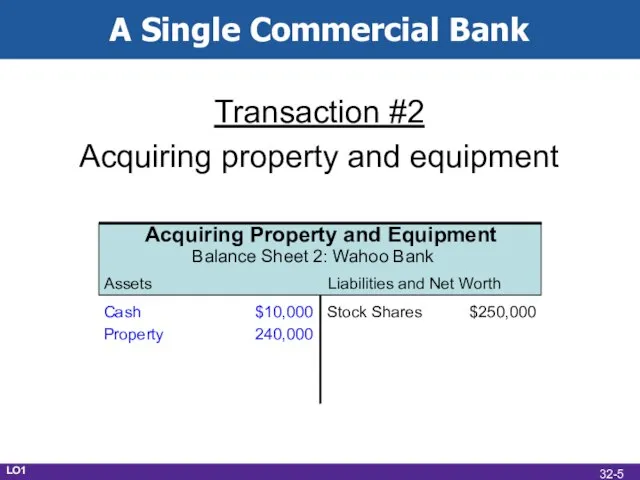

- 5. A Single Commercial Bank Transaction #2 Acquiring property and equipment LO1 32-

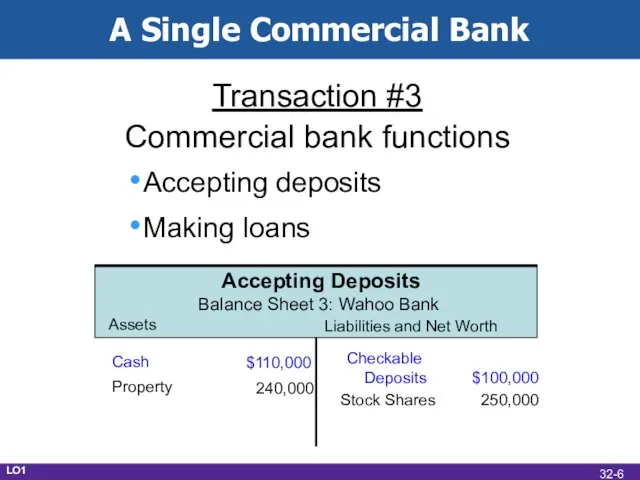

- 6. A Single Commercial Bank Transaction #3 Commercial bank functions Accepting deposits Making loans Accepting Deposits Balance

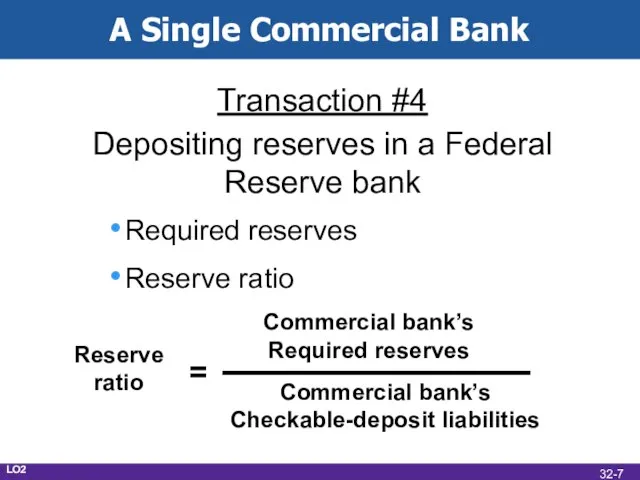

- 7. A Single Commercial Bank Transaction #4 Depositing reserves in a Federal Reserve bank Required reserves Reserve

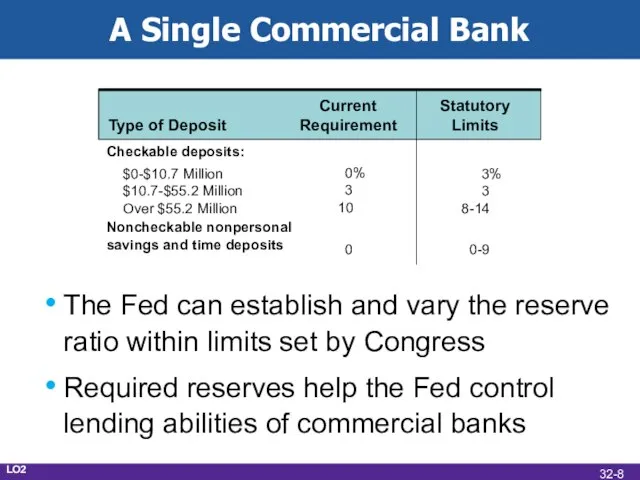

- 8. A Single Commercial Bank The Fed can establish and vary the reserve ratio within limits set

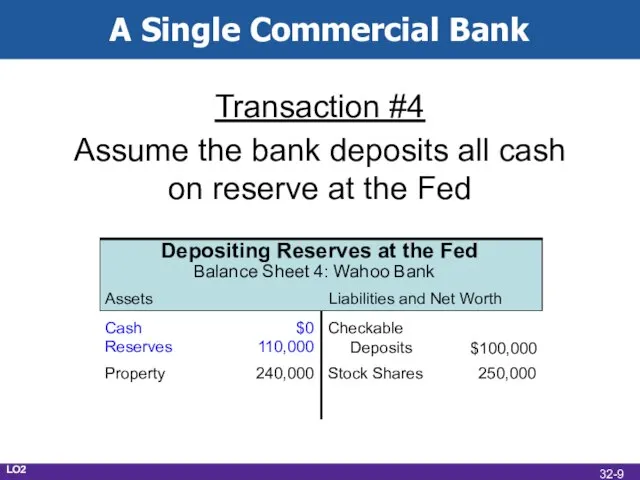

- 9. A Single Commercial Bank Transaction #4 Assume the bank deposits all cash on reserve at the

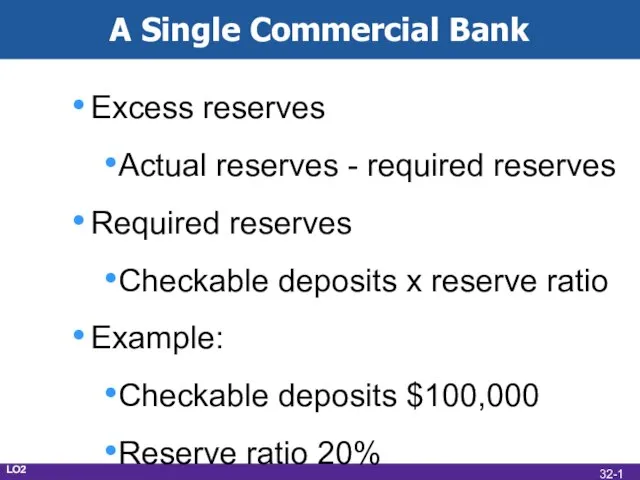

- 10. A Single Commercial Bank Excess reserves Actual reserves - required reserves Required reserves Checkable deposits x

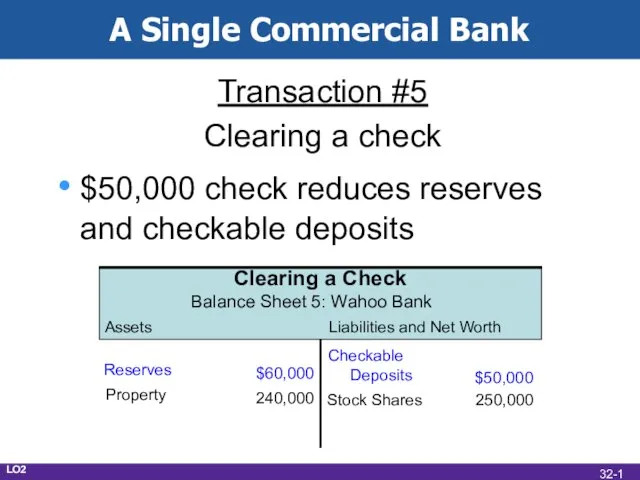

- 11. A Single Commercial Bank Transaction #5 Clearing a check $50,000 check reduces reserves and checkable deposits

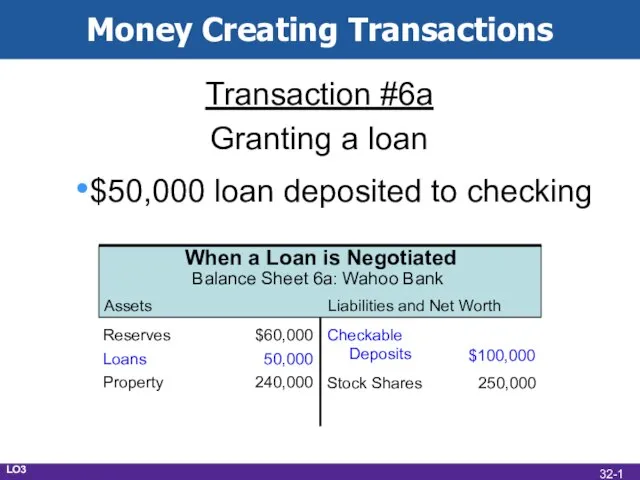

- 12. Money Creating Transactions Transaction #6a Granting a loan $50,000 loan deposited to checking LO3 32-

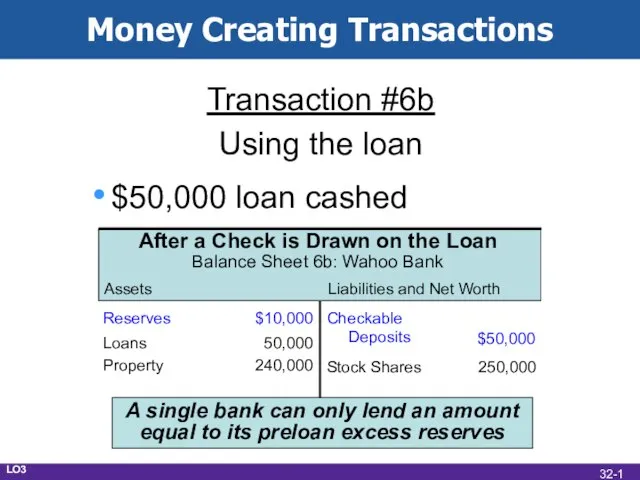

- 13. Money Creating Transactions Transaction #6b Using the loan $50,000 loan cashed LO3 32-

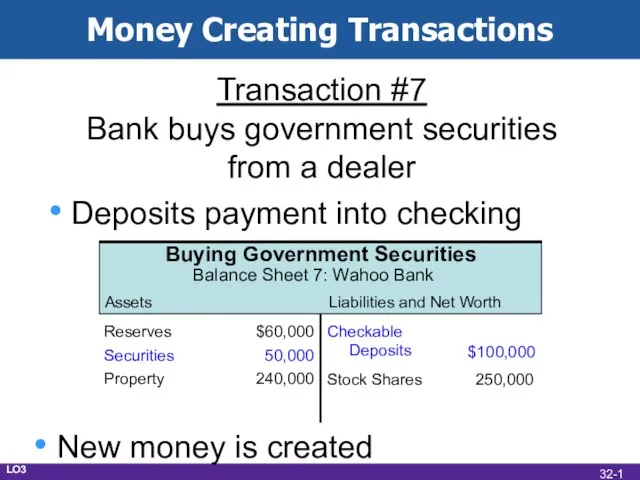

- 14. Money Creating Transactions Transaction #7 Bank buys government securities from a dealer Deposits payment into checking

- 15. Profits, Liquidity, and the Fed Funds Market Conflicting goals Earn profit Make loans to earn interest

- 17. Скачать презентацию

Обособление приложений

Обособление приложений Кто такие звери?

Кто такие звери? ГЛАВНЫЙ ПРОДУКТ

ГЛАВНЫЙ ПРОДУКТ Национальный центр искусства и культуры Жоржа Помпиду

Национальный центр искусства и культуры Жоржа Помпиду Доказательства происхождения человека от животных

Доказательства происхождения человека от животных Итоговое сочинение - 2018

Итоговое сочинение - 2018 Параллельность плоскостей 10 класс

Параллельность плоскостей 10 класс Лекция № 4

Лекция № 4 для Саши 20 лет

для Саши 20 лет Свободный, кросс-платформенный, основанный на стандартах, защищенный, современный, расширяемый, настраиваемый пакет приложений дл

Свободный, кросс-платформенный, основанный на стандартах, защищенный, современный, расширяемый, настраиваемый пакет приложений дл Подготовка к сочинению-рассуждению на лингвистическую тему

Подготовка к сочинению-рассуждению на лингвистическую тему Познание

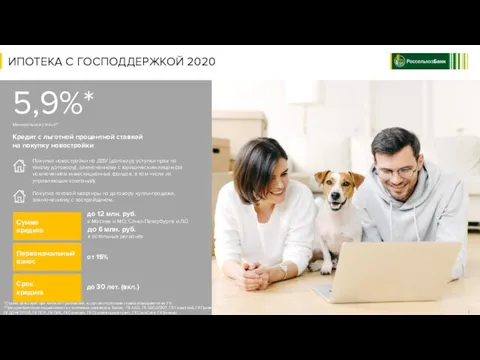

Познание Ипотека с господдержкой 2020

Ипотека с господдержкой 2020 И помнит мир спасенный

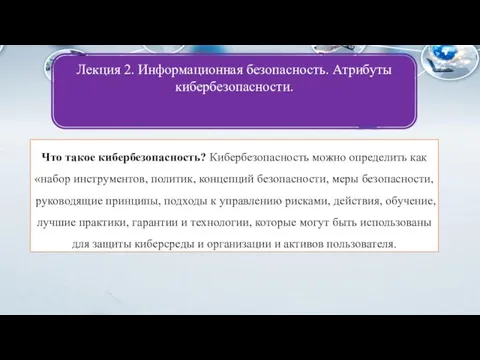

И помнит мир спасенный лекція 2 кібербезпека для СВ 2022

лекція 2 кібербезпека для СВ 2022 Prezentatsia1

Prezentatsia1 Условия назначения, порядок выплаты и размеры компенсаций неработающим женам военнослужащих

Условия назначения, порядок выплаты и размеры компенсаций неработающим женам военнослужащих Российско- Финляндское приграничное сотрудничество

Российско- Финляндское приграничное сотрудничество Пространственное распределение живого

Пространственное распределение живого  Социальная инженерия

Социальная инженерия Яблоня – символ жизни, здоровья, красоты

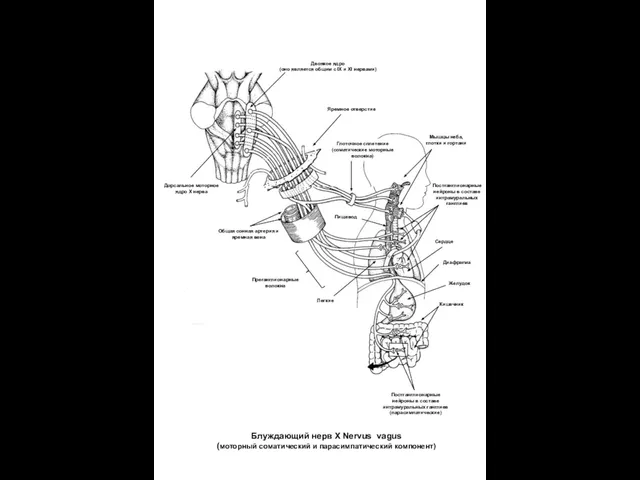

Яблоня – символ жизни, здоровья, красоты Двоякое ядро

Двоякое ядро OTHER ABBREVIATIONS

OTHER ABBREVIATIONS  Набросок фигуры человека с натуры

Набросок фигуры человека с натуры Смена дня и ночи 2 класс

Смена дня и ночи 2 класс Гражданский процесс

Гражданский процесс Презентация на тему: Письмо

Презентация на тему: Письмо Окружной конкурс на лучшее оформление здания образовательной организации к Новому году Новогодняя феерия

Окружной конкурс на лучшее оформление здания образовательной организации к Новому году Новогодняя феерия