Содержание

- 2. Check is a document that orders a bank to pay a specific amount of money from

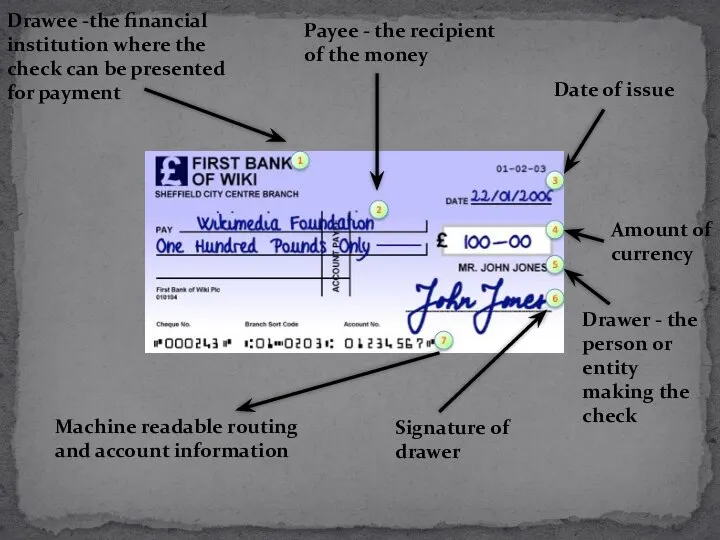

- 3. Payee - the recipient of the money Date of issue Amount of currency Drawee -the financial

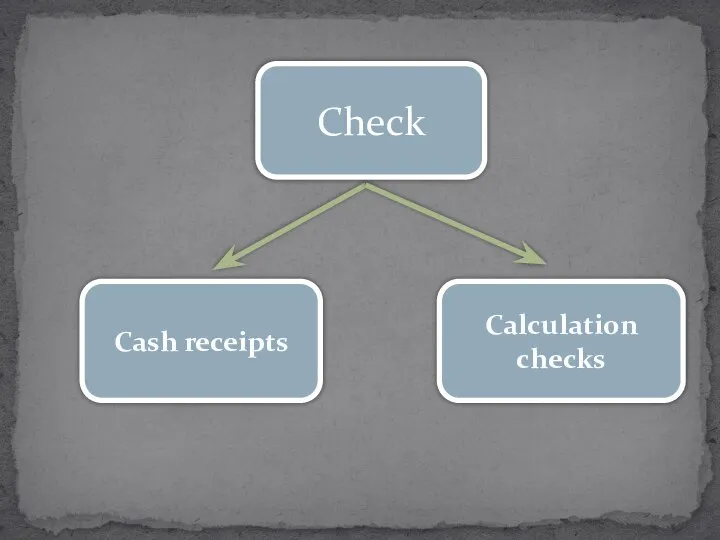

- 4. Check Cash receipts Calculation checks

- 5. Declining use Although forms of cheques have been in use since ancient times and at least

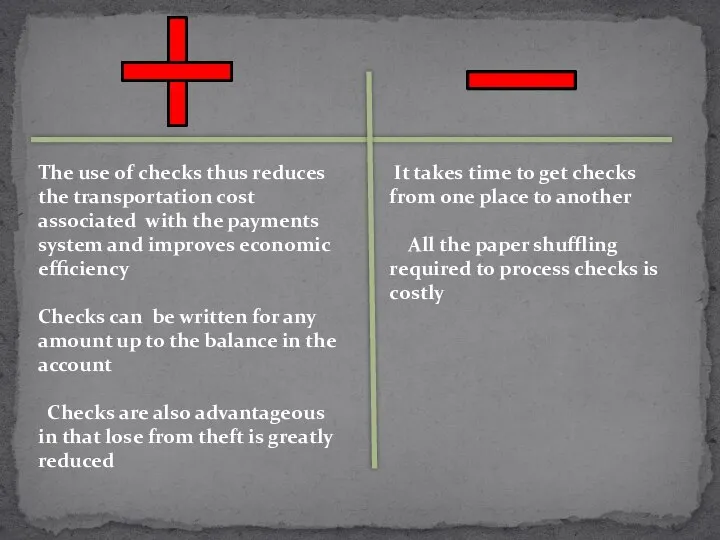

- 6. The use of checks thus reduces the transportation cost associated with the payments system and improves

- 8. Скачать презентацию

Презентация на тему Education of Great Britain and Russia

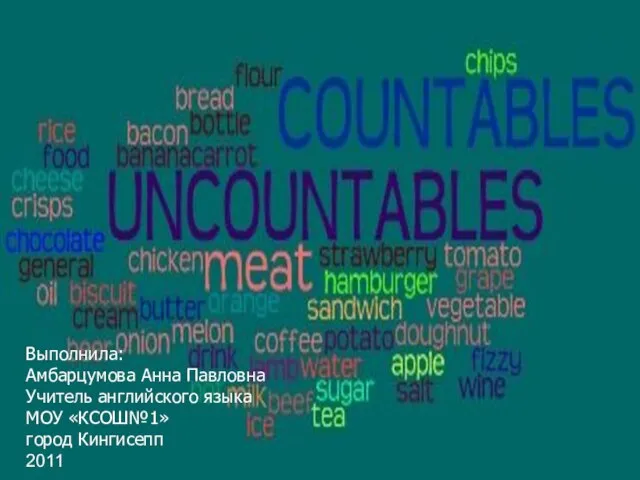

Презентация на тему Education of Great Britain and Russia  Презентация на тему Исчисляемые и неисчисляемые существительные

Презентация на тему Исчисляемые и неисчисляемые существительные  Речевое воздействие в англоязычном экологическом дискурсе

Речевое воздействие в англоязычном экологическом дискурсе The Strongest One Writing

The Strongest One Writing Organic compounds

Organic compounds Unscramble the words

Unscramble the words City Creatures

City Creatures Insight Link L4. Background Link PPT

Insight Link L4. Background Link PPT Dvizh. Spotlight 8

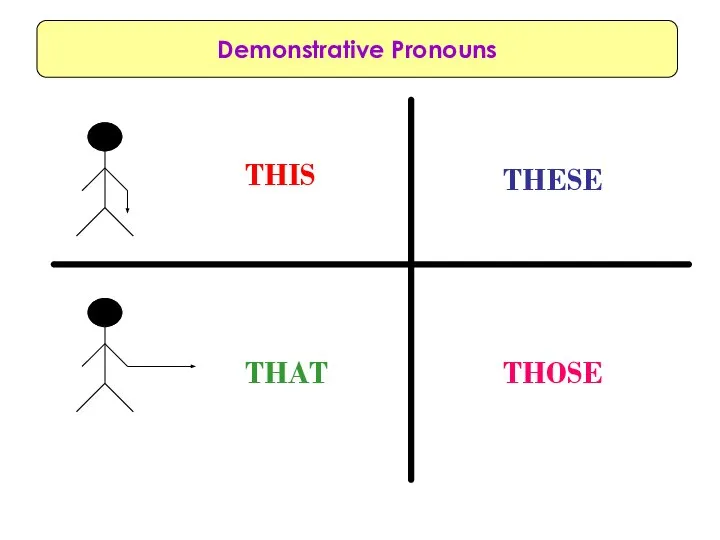

Dvizh. Spotlight 8 Demonstrative pronouns

Demonstrative pronouns Passive Voice. Пассивный залог в Present Simple

Passive Voice. Пассивный залог в Present Simple Classroom objects. Hidden picture

Classroom objects. Hidden picture Герундий или инфинитив? Упражнения

Герундий или инфинитив? Упражнения Устная часть ЭГЕ по английскому языку

Устная часть ЭГЕ по английскому языку Health idioms

Health idioms Boggle. Notes to the teacher:

Boggle. Notes to the teacher: Flowers. Match the words

Flowers. Match the words Going places (unit 7 lesson 7)

Going places (unit 7 lesson 7) To be family animals

To be family animals Ознакомительный тест

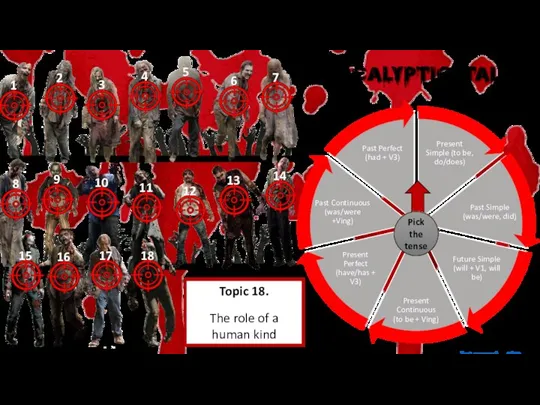

Ознакомительный тест Apocalyptic talks

Apocalyptic talks Английский язык Грамматические упражнения 4 класс There is / There are

Английский язык Грамматические упражнения 4 класс There is / There are The Indefinite Article (неопределённый артикль)

The Indefinite Article (неопределённый артикль) Describing people: appearance

Describing people: appearance Компания Сюкден в России

Компания Сюкден в России Связь прошлого (действия) и настоящего (результата, следа)

Связь прошлого (действия) и настоящего (результата, следа) To be - 7 лет

To be - 7 лет Город. Промышленные предприятия. Чтение. Тема 11

Город. Промышленные предприятия. Чтение. Тема 11