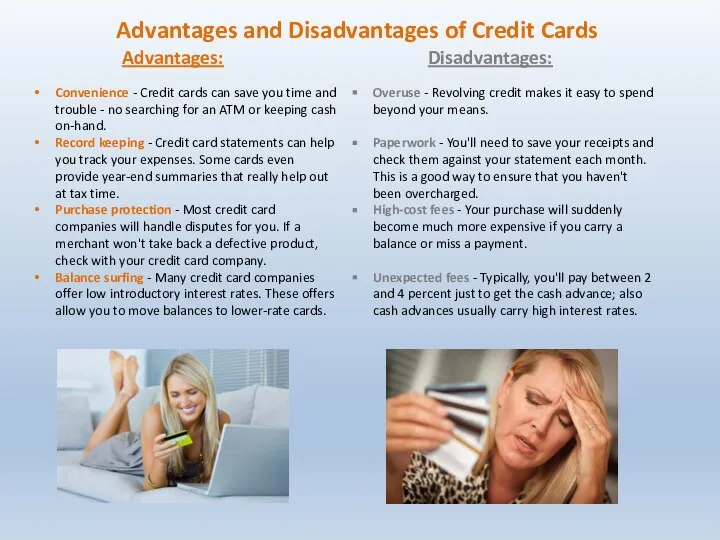

time and trouble - no searching for an ATM or keeping cash on-hand.

Record keeping - Credit card statements can help you track your expenses. Some cards even provide year-end summaries that really help out at tax time.

Purchase protection - Most credit card companies will handle disputes for you. If a merchant won't take back a defective product, check with your credit card company.

Balance surfing - Many credit card companies offer low introductory interest rates. These offers allow you to move balances to lower-rate cards.

Overuse - Revolving credit makes it easy to spend beyond your means.

Paperwork - You'll need to save your receipts and check them against your statement each month. This is a good way to ensure that you haven't been overcharged.

High-cost fees - Your purchase will suddenly become much more expensive if you carry a balance or miss a payment.

Unexpected fees - Typically, you'll pay between 2 and 4 percent just to get the cash advance; also cash advances usually carry high interest rates.

My Family. Spotlight 3. English for my Kids

My Family. Spotlight 3. English for my Kids At the mall

At the mall Easter

Easter Говорение. Грамматика. Лексика классного обихода. Императив. Интенсив, день 3. 5 класс

Говорение. Грамматика. Лексика классного обихода. Императив. Интенсив, день 3. 5 класс How many witches?

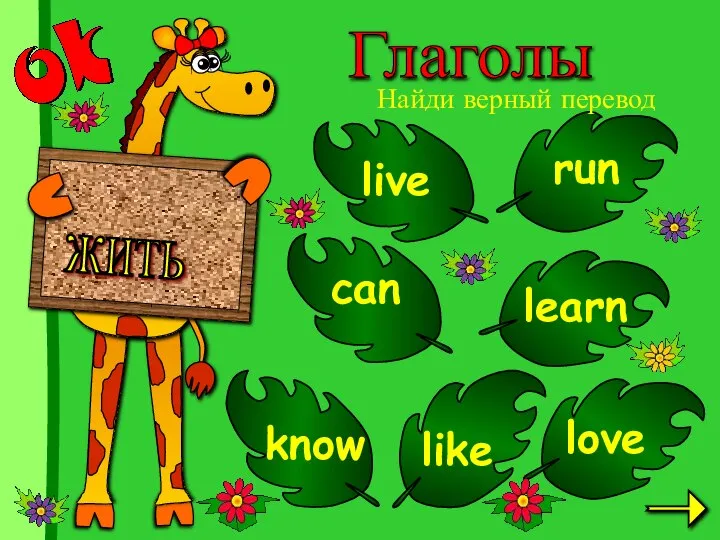

How many witches? Verbs in English

Verbs in English Saint-Petersburg

Saint-Petersburg Времена группы Past

Времена группы Past My day off

My day off Внеклассное мероприятие по английскому языку

Внеклассное мероприятие по английскому языку Predictions of a Magic Jar

Predictions of a Magic Jar Welcome to the cafe

Welcome to the cafe What to prepare before the lesson!

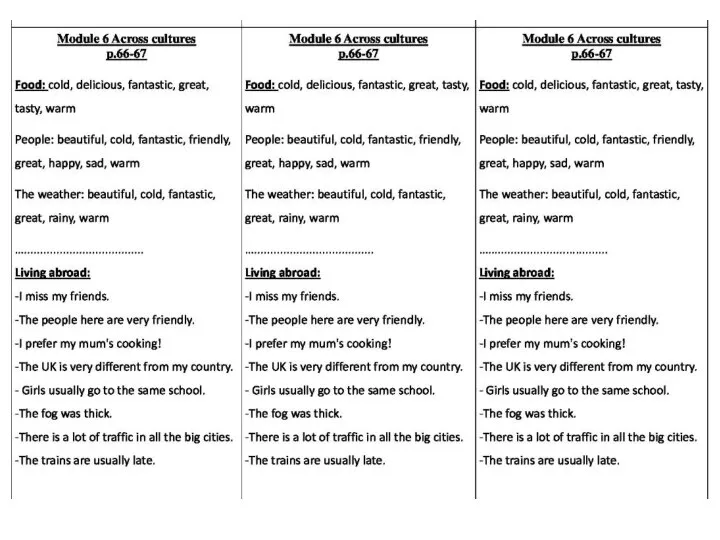

What to prepare before the lesson! Can Imperative

Can Imperative Personal letter. Подготовка к ОГЭ

Personal letter. Подготовка к ОГЭ The tribes of the Maya

The tribes of the Maya In the future…

In the future… Around the house

Around the house Game Naruto the ending

Game Naruto the ending Special occasions

Special occasions A game. Who got ruler

A game. Who got ruler English idioms with the names of animals

English idioms with the names of animals Preparing for SAT. Grade 1

Preparing for SAT. Grade 1 Form plural

Form plural Lesson 2. Grammar and song

Lesson 2. Grammar and song Читаем по-английски. Сочетания ee, ea, oo, ck

Читаем по-английски. Сочетания ee, ea, oo, ck Loading and Unloading Minifilters

Loading and Unloading Minifilters Duke Ellington

Duke Ellington