- Главная

- Английский язык

- taxes 2021 BATIS

Содержание

- 2. Chapter 1: TAXATION AND ITS ECONOMIC EFFECTS Overview of Taxation Principles A tax (from the Latin

- 3. Tax Collection In modern taxation systems, governments levy taxes in money; but in-kind and corvée taxation

- 4. Purposes of Taxation Purposes of Taxation The levying of taxes aims to raise revenue to fund

- 5. Economic Effects of Taxation Economic Effects of Taxation Imposition of taxes may have the following effects:

- 6. Tax Incidence Tax incidence is the division of the burden of a tax between buyers and

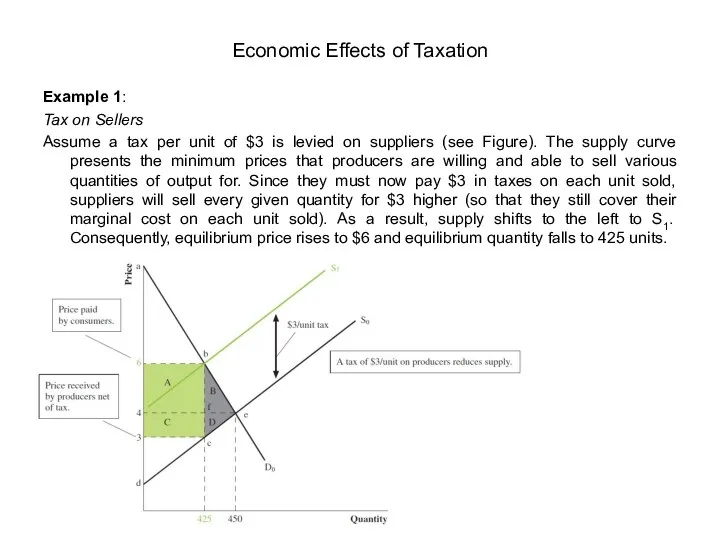

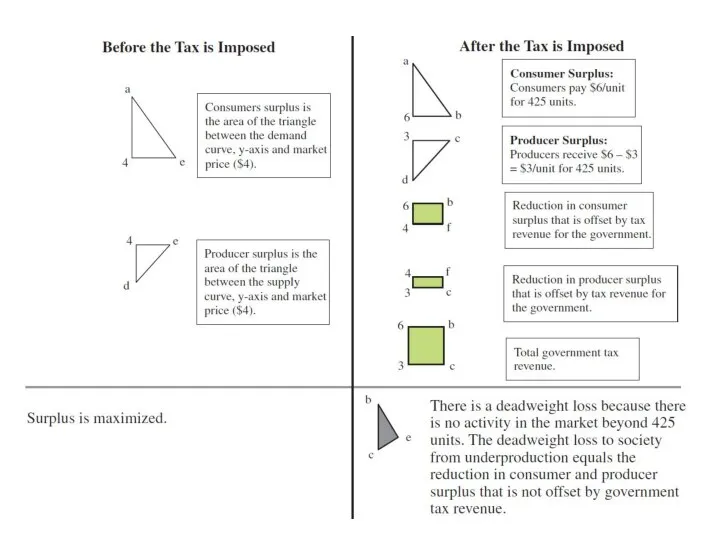

- 7. Example 1: Tax on Sellers Assume a tax per unit of $3 is levied on suppliers

- 9. Consumers purchase 425 units and pay $6/unit. Effectively prices paid by consumers have gone up by

- 10. Example 2: Why taxes result in deadweight losses Imagine that Joe cleans Jane’s house each week

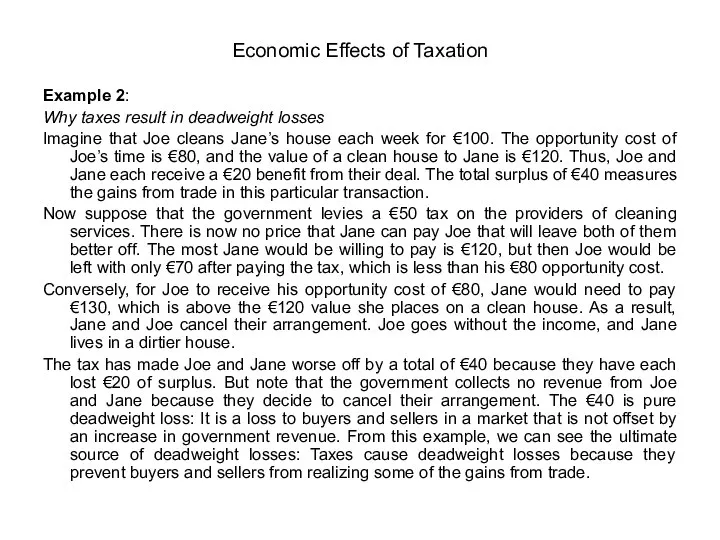

- 11. Example 3: Tax on Buyers Now assume that instead of being levied upon producers, the same

- 12. The impact of a tax on a market outcome is the same whether the tax is

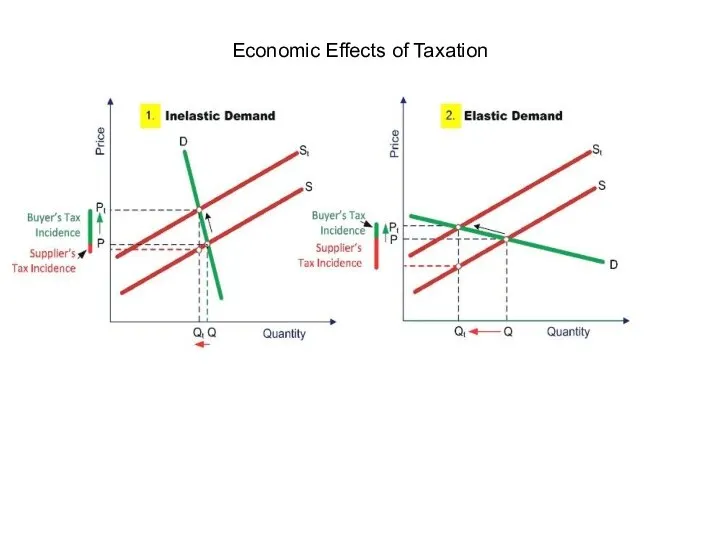

- 13. Tax Incidence and Elasticity of Demand The division of the tax between buyers and sellers depends

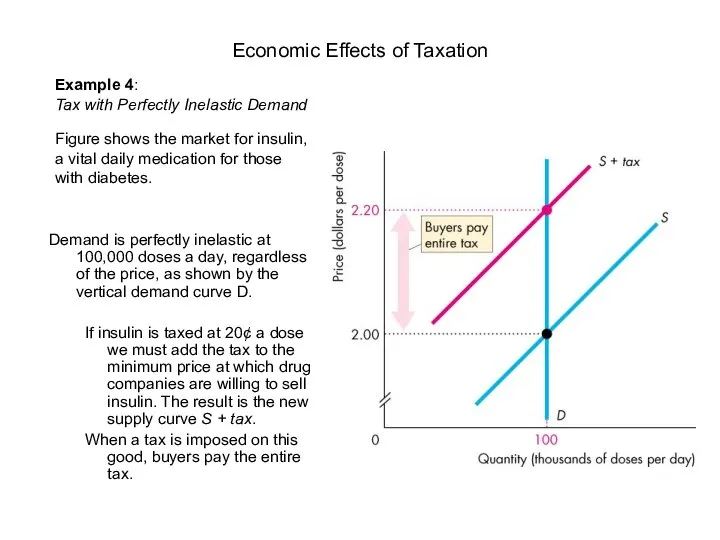

- 14. Economic Effects of Taxation

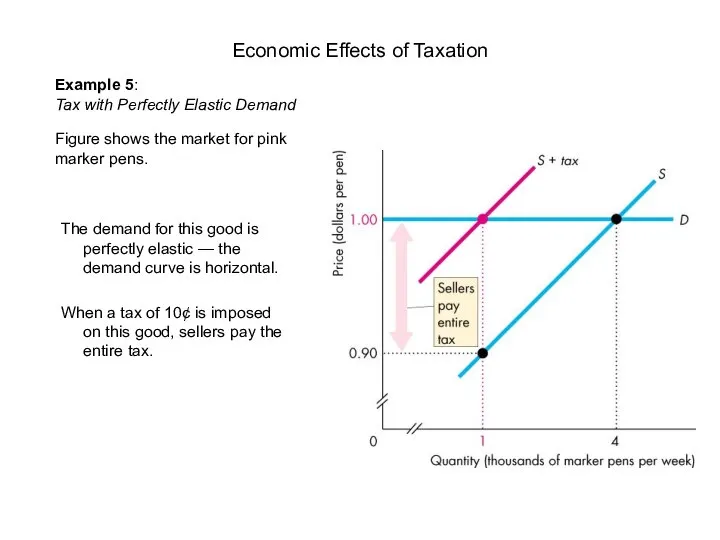

- 15. Demand is perfectly inelastic at 100,000 doses a day, regardless of the price, as shown by

- 16. The demand for this good is perfectly elastic — the demand curve is horizontal. When a

- 17. Tax Incidence and Elasticity of Supply The division of the tax between buyers and sellers also

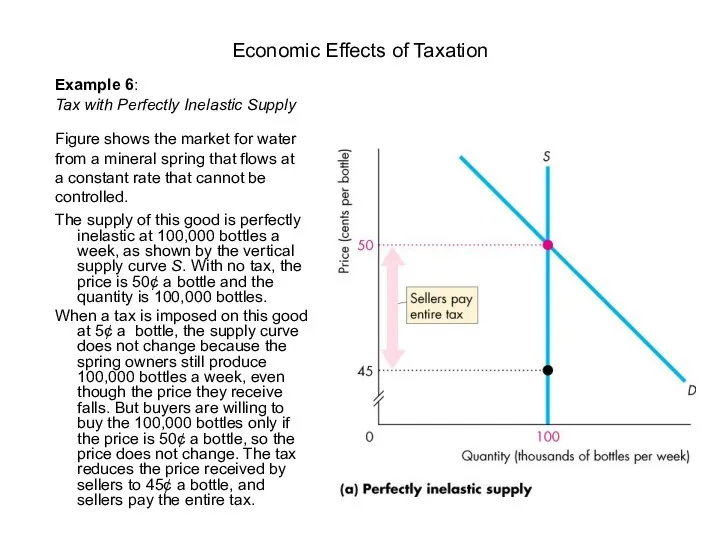

- 19. The supply of this good is perfectly inelastic at 100,000 bottles a week, as shown by

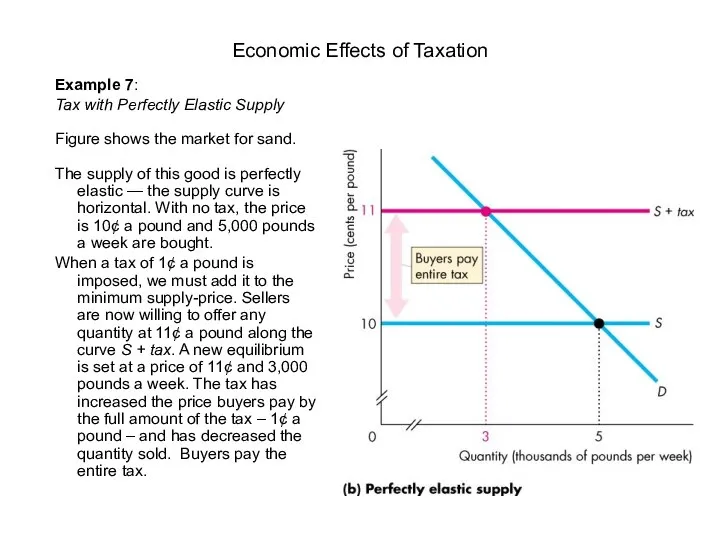

- 20. The supply of this good is perfectly elastic — the supply curve is horizontal. With no

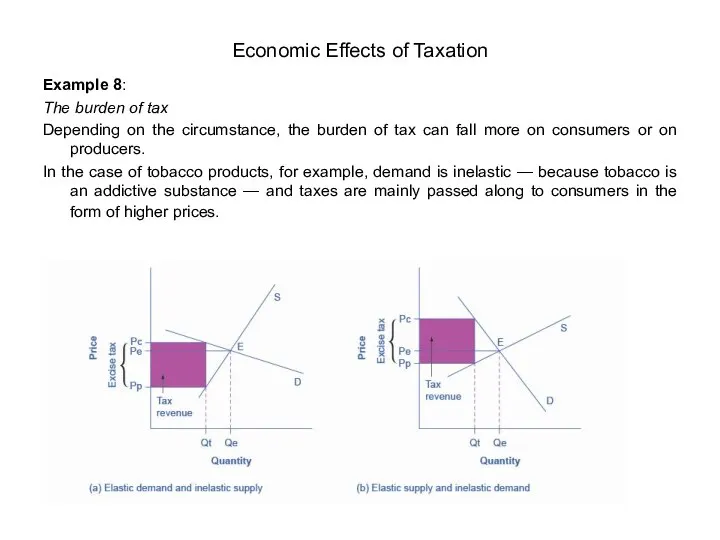

- 21. Example 8: The burden of tax Depending on the circumstance, the burden of tax can fall

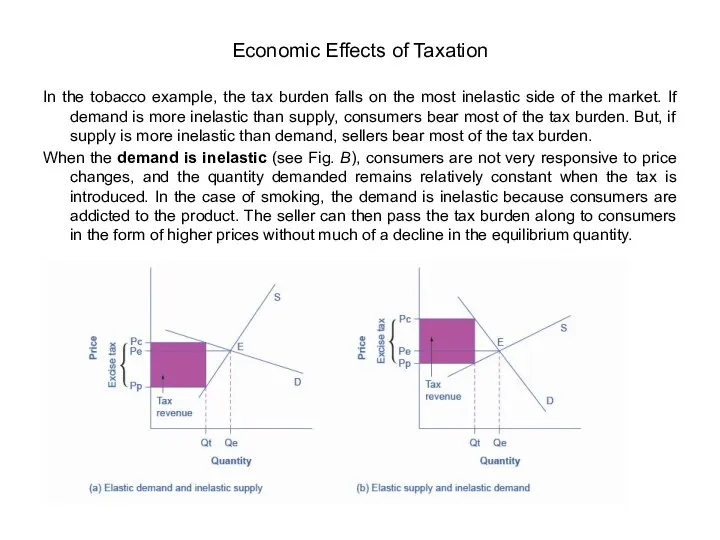

- 22. In the tobacco example, the tax burden falls on the most inelastic side of the market.

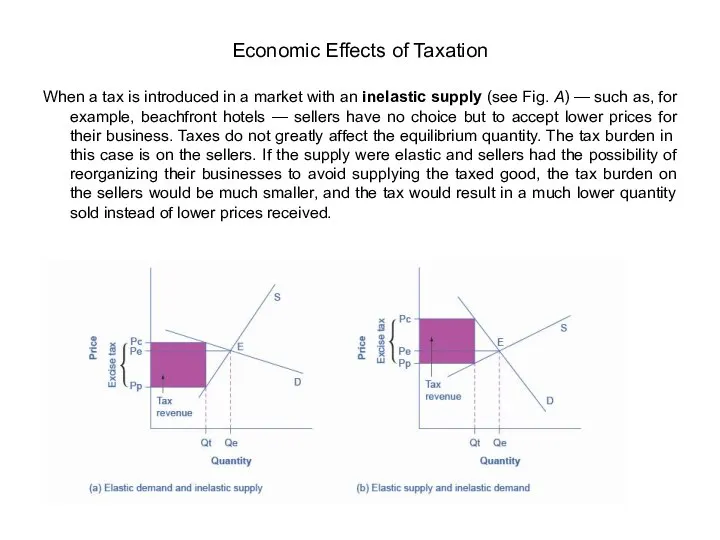

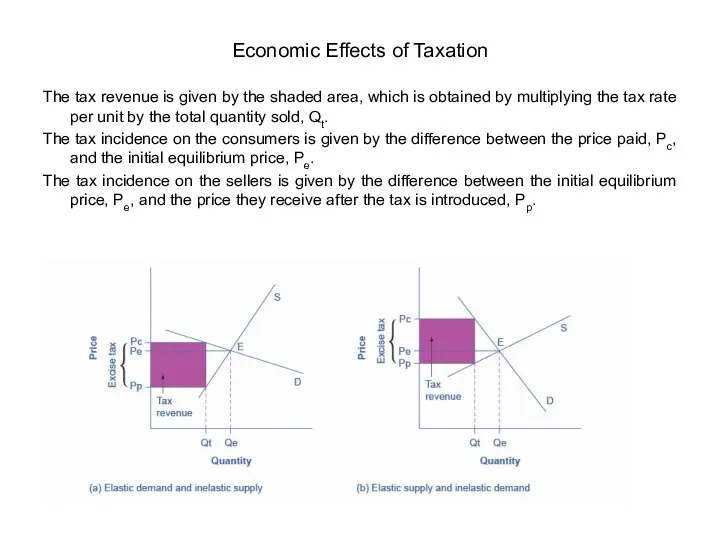

- 23. When a tax is introduced in a market with an inelastic supply (see Fig. A) —

- 24. In Fig. A, the supply is inelastic and the demand is elastic — as it is

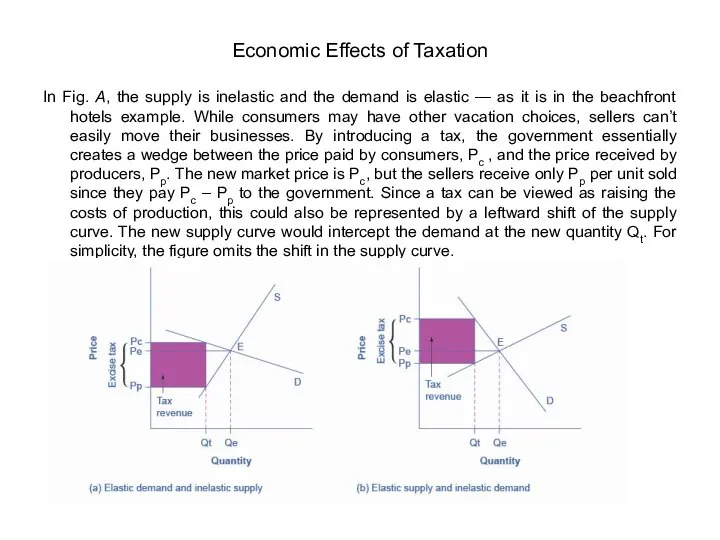

- 25. The tax revenue is given by the shaded area, which is obtained by multiplying the tax

- 26. In figure A, the tax burden falls disproportionately on the sellers, and a larger proportion of

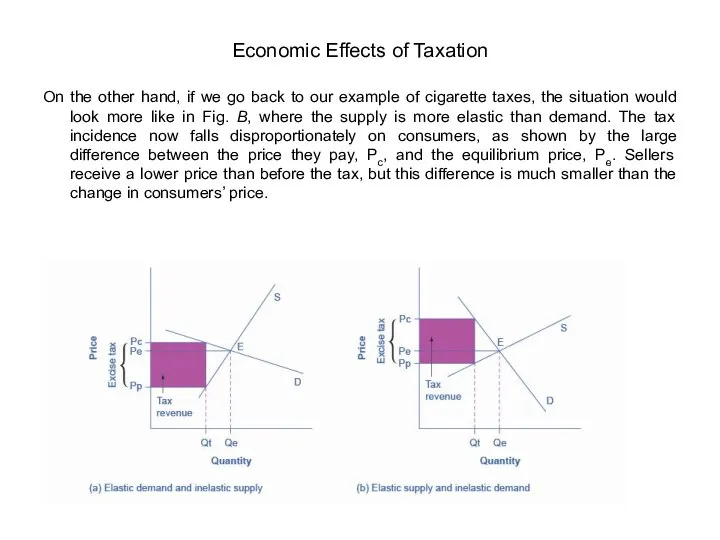

- 27. On the other hand, if we go back to our example of cigarette taxes, the situation

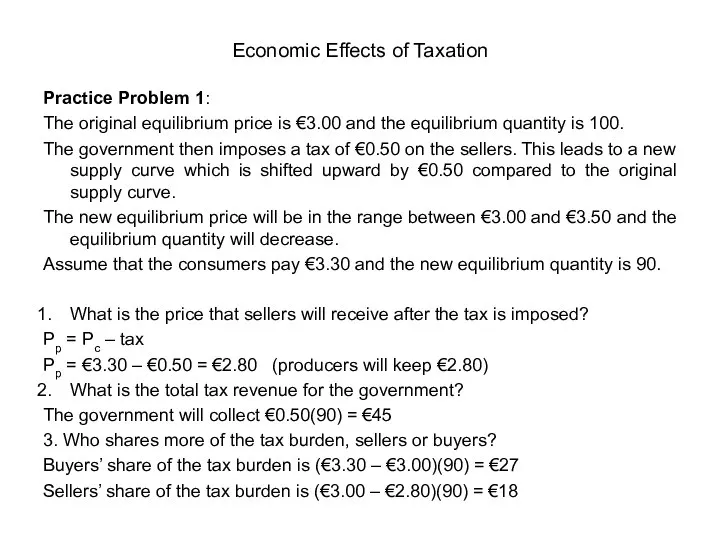

- 28. Practice Problem 1: The original equilibrium price is €3.00 and the equilibrium quantity is 100. The

- 29. Other economic effects of taxation Redistribution of Income This effect is felt most in developing countries.

- 30. Other economic effects of taxation A Reduction in Incentive It may be argued that increased taxation

- 31. Other economic effects of taxation 3. A Reduction in Business Activity Entrepreneurs undertake investment in anticipation

- 32. Other economic effects of taxation 4. Effects on the Ability to Work, Save and Invest Imposition

- 33. Other economic effects of taxation It is suggested that effects of taxes upon the willingness to

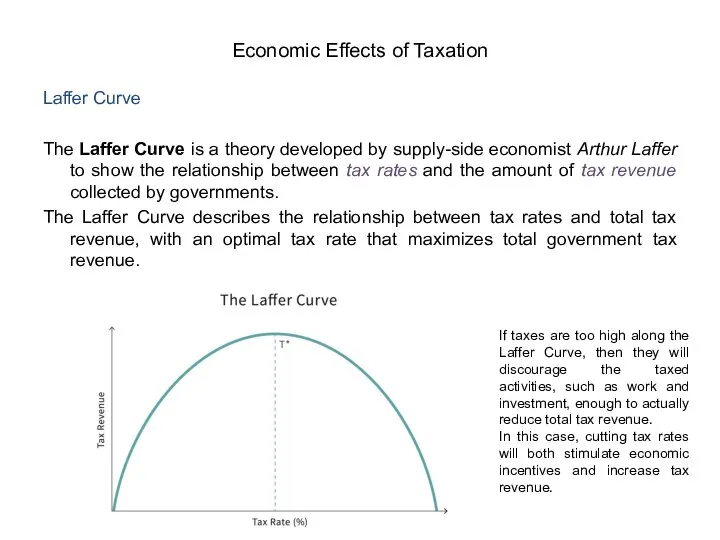

- 34. Laffer Curve The Laffer Curve is a theory developed by supply-side economist Arthur Laffer to show

- 35. Chapter 2: BASIC PRINCIPLES OF TAXATION Goals of an Ideal Taxing System Principles of taxation vary

- 36. 1. Equality Taxpayers should bear a fair level of tax relative to their economic positions (e.g.,

- 37. Vertical equity: When taxpayers are in different economic positions, the taxpayer with the greatest ability to

- 38. 2. Certainty Taxpayer knows when, how, and how much tax is paid. It would protect the

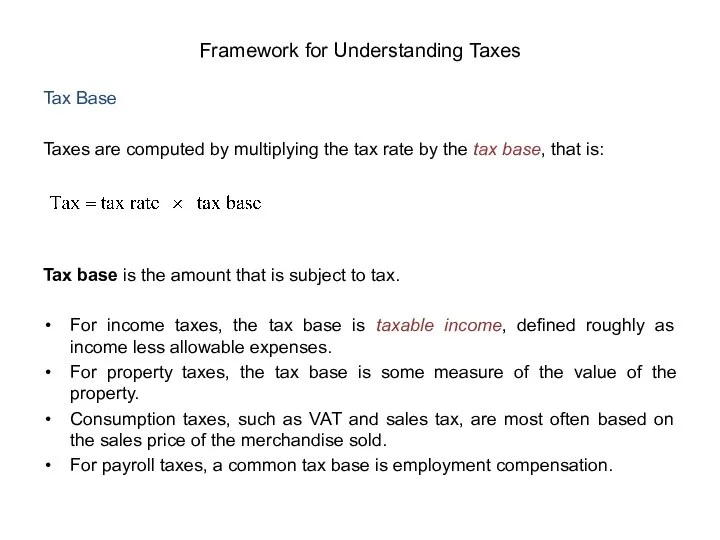

- 39. Tax Base Taxes are computed by multiplying the tax rate by the tax base, that is:

- 40. Tax Deduction Tax deduction is a reduction of income that is able to be taxed and

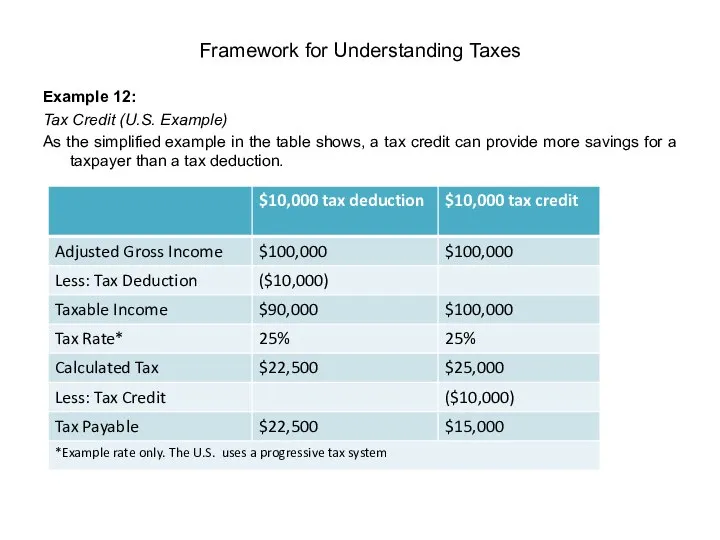

- 41. Example 12: Tax Credit (U.S. Example) As the simplified example in the table shows, a tax

- 42. Tax Rates For most taxes there are four types of tax rates: statutory rates marginal rates

- 43. Example 13: At the end of the year, XYZ Corporation has taxable income of $50,000. Its

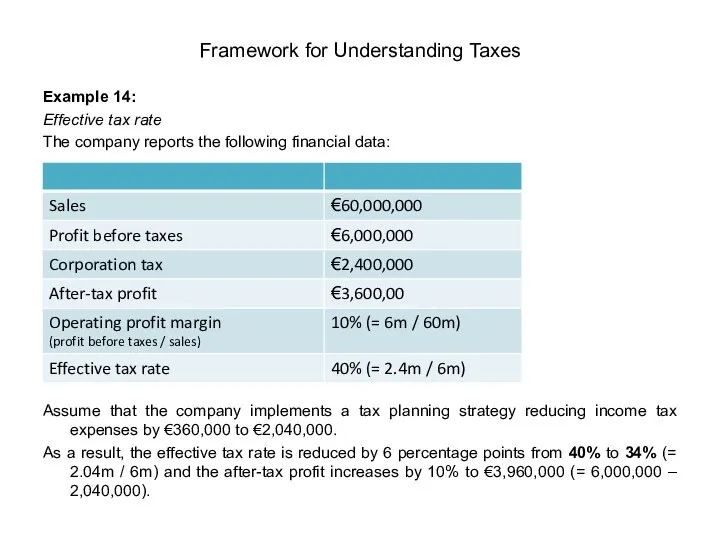

- 44. Example 14: Effective tax rate The company reports the following financial data: Assume that the company

- 45. Effective Tax Rate vs. Marginal Tax Rate The effective tax rate is a more accurate representation

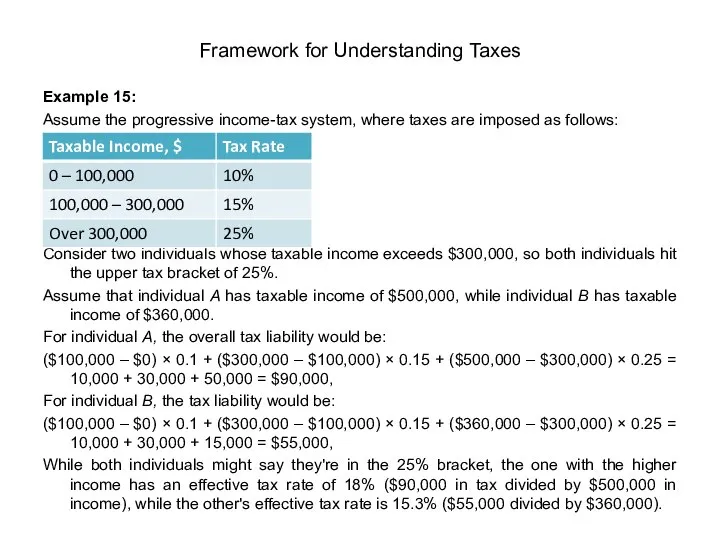

- 46. Example 15: Assume the progressive income-tax system, where taxes are imposed as follows: Consider two individuals

- 47. Tax Rate Structures In most tax jurisdictions, a tax rate structure applies to ordinary income (such

- 48. Though many countries have a progressive tax regime when it comes to income tax, certain levies

- 49. Example 17: U.S. User Fees (regressive) User fees levied by the U.S. government are another form

- 50. Other examples of regressive taxes Gambling taxes Those on low incomes have a high propensity to

- 51. A progressive tax system is one in which the average tax rate (taxes paid ÷ personal

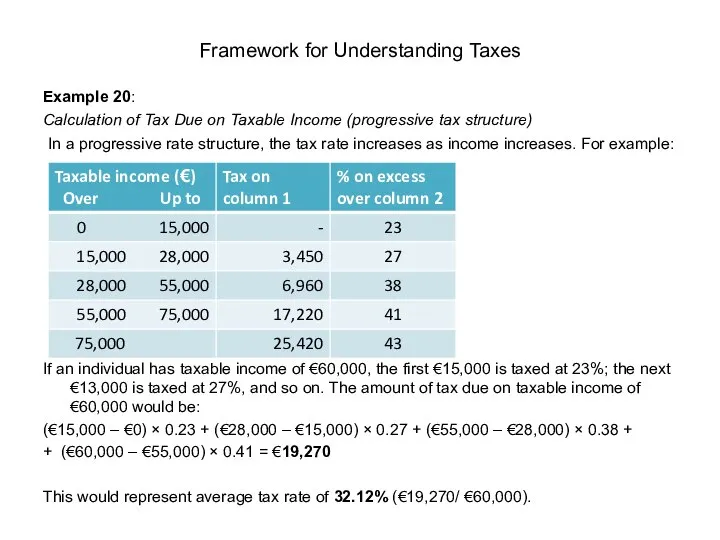

- 52. Example 20: Calculation of Tax Due on Taxable Income (progressive tax structure) In a progressive rate

- 53. A proportional tax system (a.k.a., flat tax system) is the one in which a tax imposed

- 54. Important Principles and Concepts in Tax Law Most tax systems have developed around fundamental concepts that

- 55. Entity Principle Under the entity principle, an entity (such as a corporation) and its owners (for

- 56. Arm’s Length Principle The condition or the fact that the parties to a transaction are independent

- 57. Example 24: Arm’s Length Principle Assume that in Example 23 the corporation pays its entire $250,000

- 58. Example 25: Arm’s Length Test Assume that an entrepreneur sells an asset to his corporation, and

- 59. Arm’s Length Principle: Business Expenses Ordinary and necessary business expenses are deductible only to the extent

- 60. Example 27: Business Deductions Assume John hired four part-time employees and paid them $10 an hour

- 61. All-Inclusive Income Principle This principle basically means that if some simple tests are met, then receipt

- 62. Example 28: Realization Principle A corporation owns two assets that have gone up in value. It

- 63. Business Purpose Concept Relates to tax deductions. Here, business expenses are deductible only if they have

- 64. Tax-Benefit Rule Under the tax-benefit rule, if a taxpayer receives a refund of an item for

- 65. Substance over Form Doctrine Under the doctrine of substance over form, even when the form of

- 66. Pay-As-You-Earn Concept (PAYE) Taxpayers must pay part of their estimated annual tax liability throughout the year,

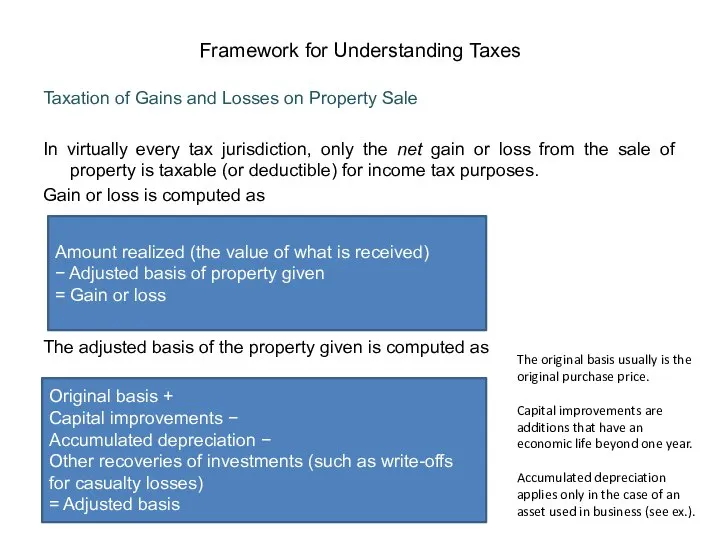

- 67. Taxation of Gains and Losses on Property Sale In virtually every tax jurisdiction, only the net

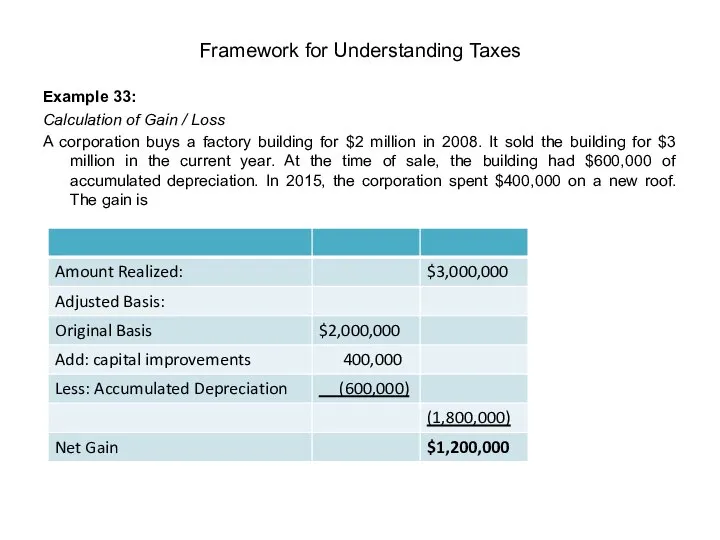

- 68. Example 33: Calculation of Gain / Loss A corporation buys a factory building for $2 million

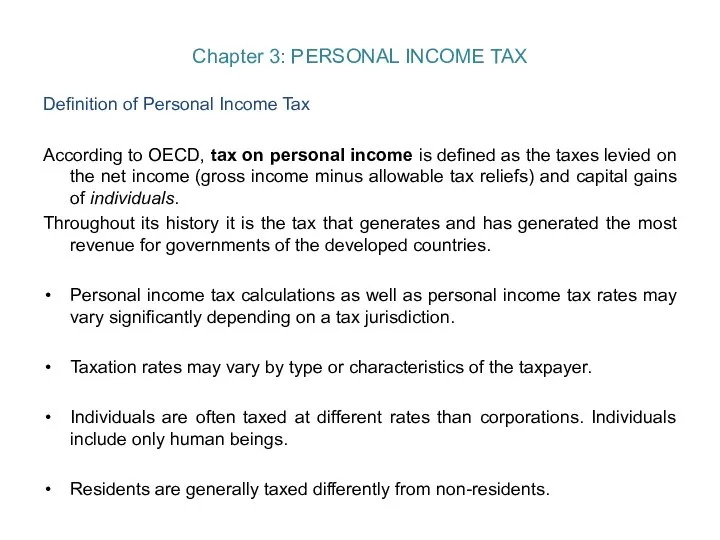

- 69. Chapter 3: PERSONAL INCOME TAX Definition of Personal Income Tax According to OECD, tax on personal

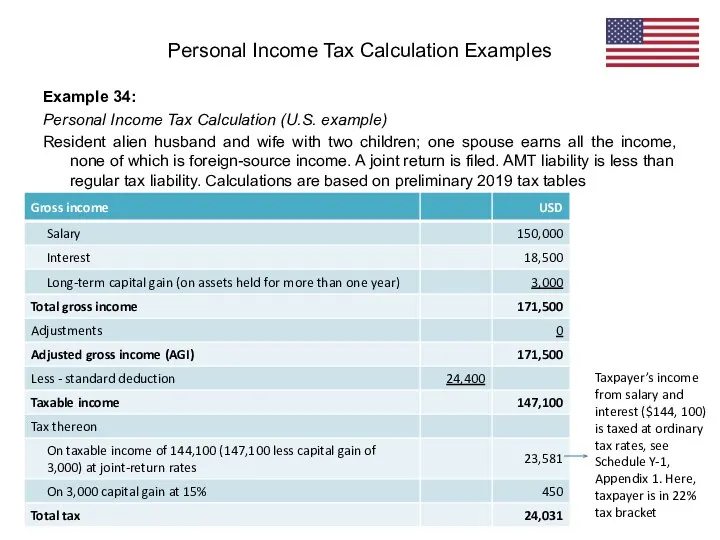

- 70. Example 34: Personal Income Tax Calculation (U.S. example) Resident alien husband and wife with two children;

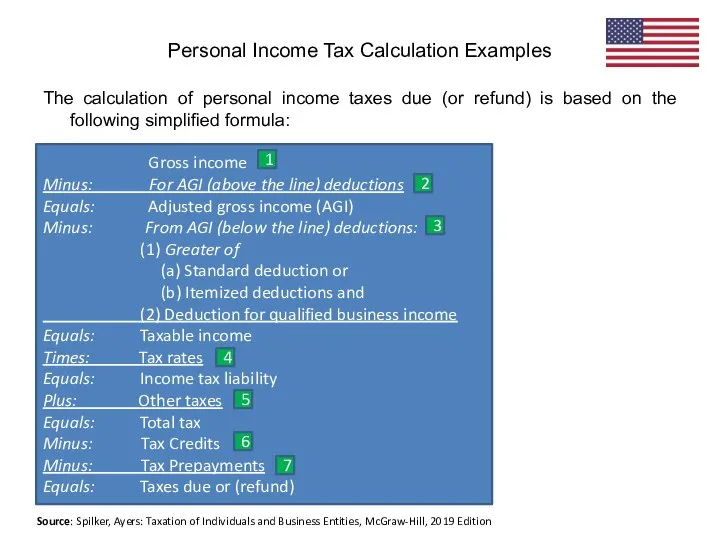

- 71. The calculation of personal income taxes due (or refund) is based on the following simplified formula:

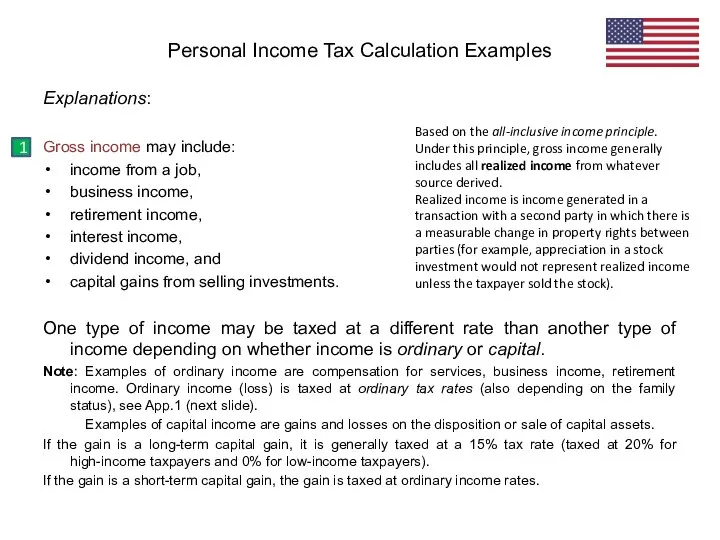

- 72. Explanations: Gross income may include: income from a job, business income, retirement income, interest income, dividend

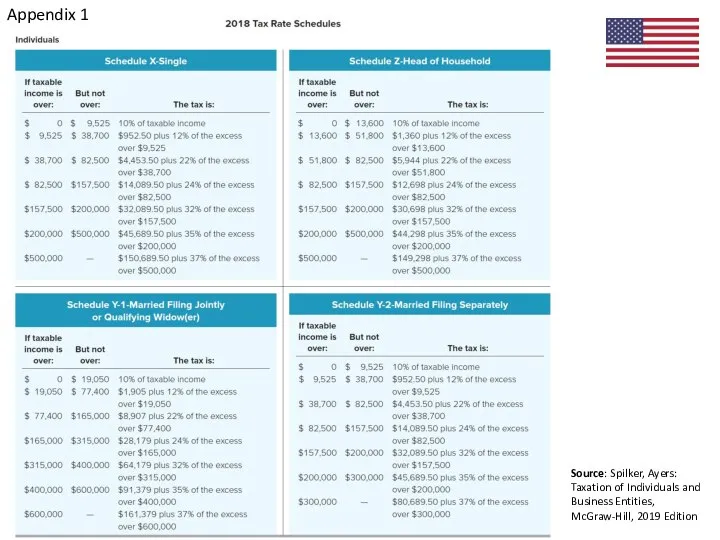

- 73. Appendix 1 Source: Spilker, Ayers: Taxation of Individuals and Business Entities, McGraw-Hill, 2019 Edition

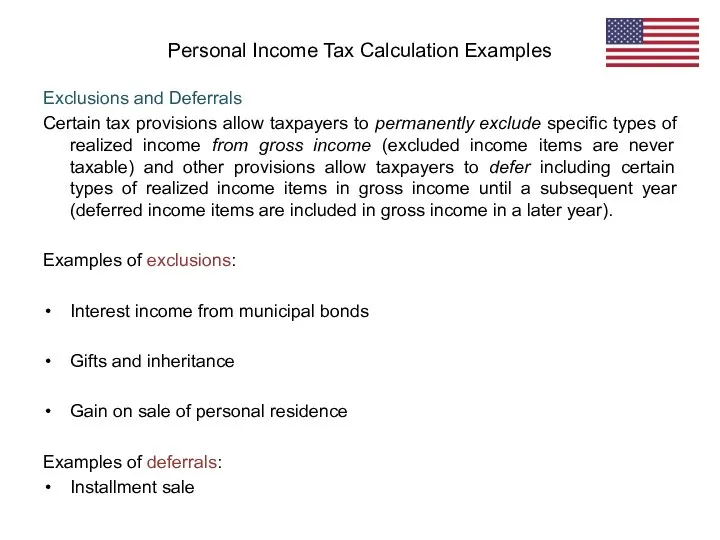

- 74. Exclusions and Deferrals Certain tax provisions allow taxpayers to permanently exclude specific types of realized income

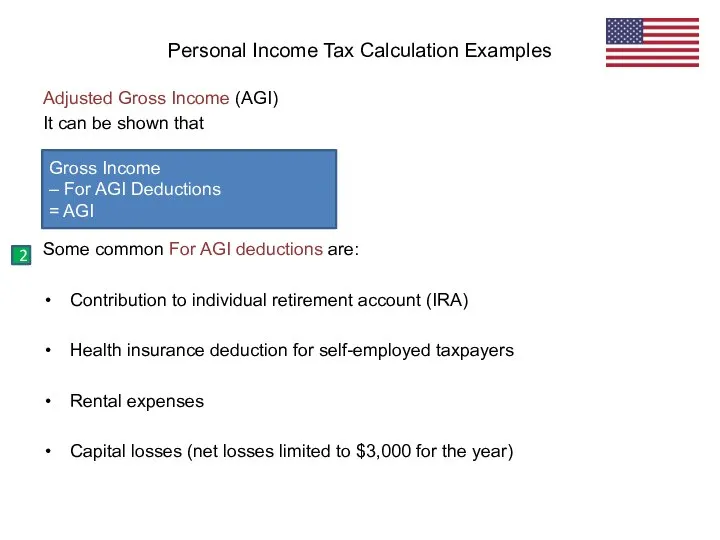

- 75. Adjusted Gross Income (AGI) It can be shown that Some common For AGI deductions are: Contribution

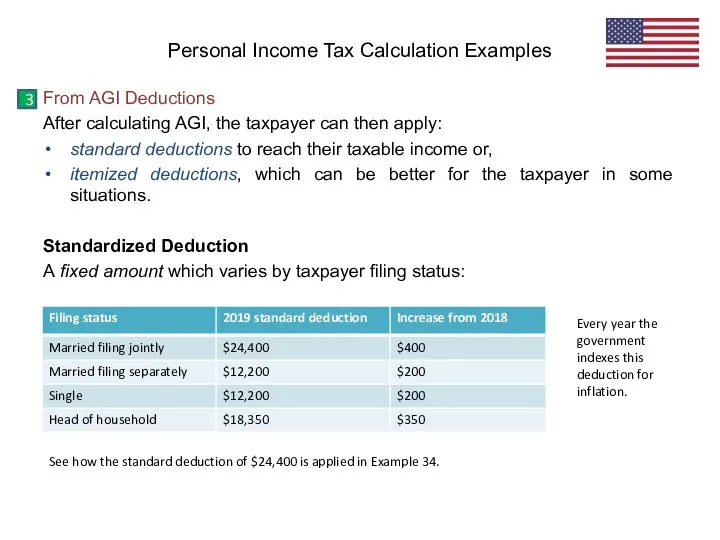

- 76. From AGI Deductions After calculating AGI, the taxpayer can then apply: standard deductions to reach their

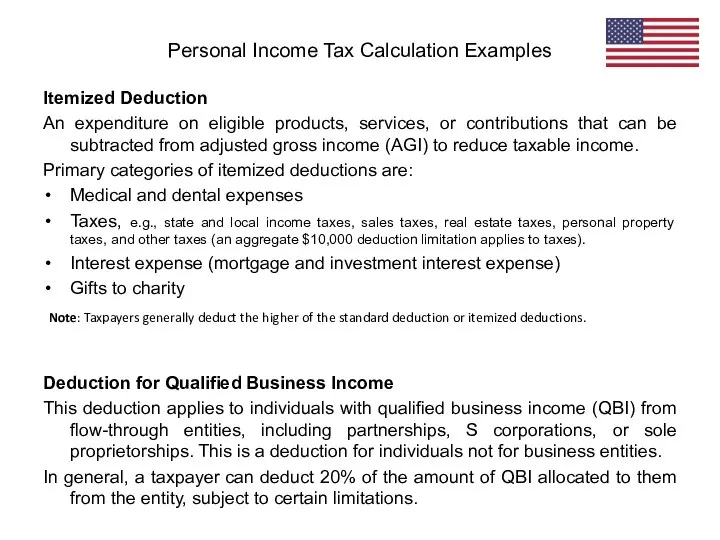

- 77. Itemized Deduction An expenditure on eligible products, services, or contributions that can be subtracted from adjusted

- 78. Tax Rates After determining taxable income, taxpayers can generally calculate their regular income tax liability using

- 79. Tax Prepayments These include: withholdings, or income taxes withheld from the taxpayer’s salary or wages by

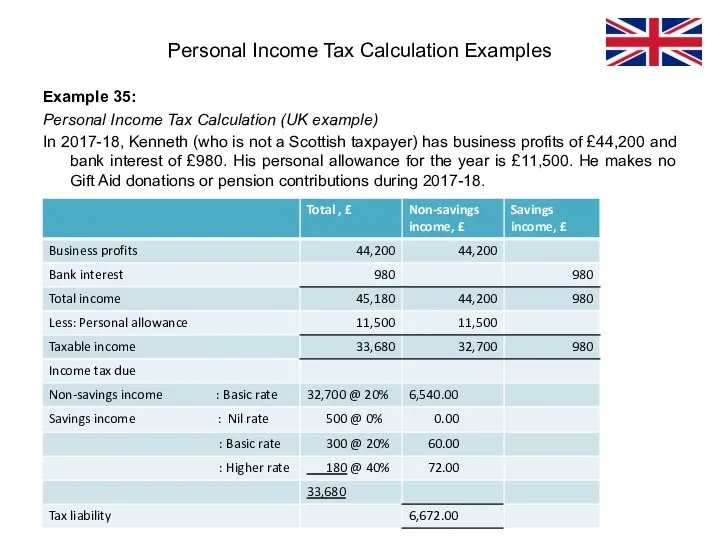

- 80. Example 35: Personal Income Tax Calculation (UK example) In 2017-18, Kenneth (who is not a Scottish

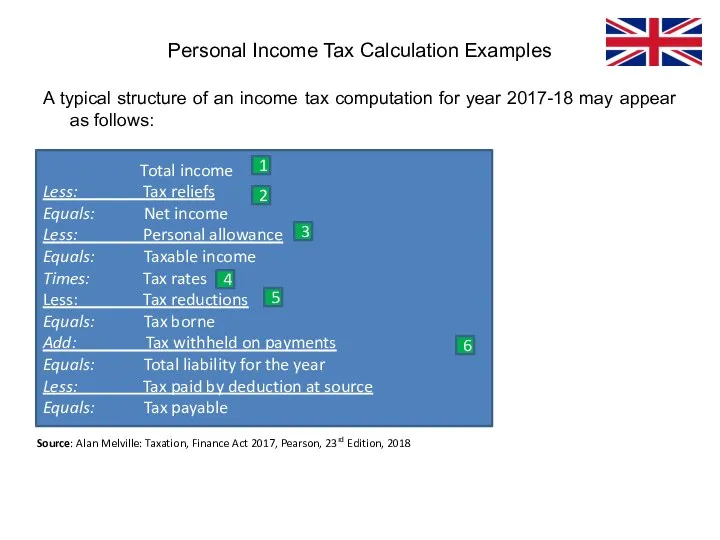

- 81. A typical structure of an income tax computation for year 2017-18 may appear as follows: Personal

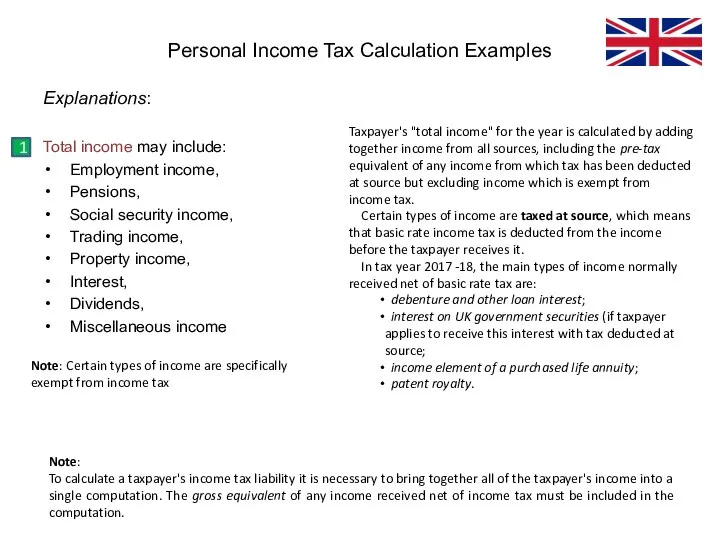

- 82. Explanations: Total income may include: Employment income, Pensions, Social security income, Trading income, Property income, Interest,

- 83. Savings Income and Non-Savings Income Tax liability on a taxpayer's "savings income" is calculated differently from

- 84. Tax reliefs may include: Certain payments made by the taxpayer (e.g., eligible interest payments, certain “annual

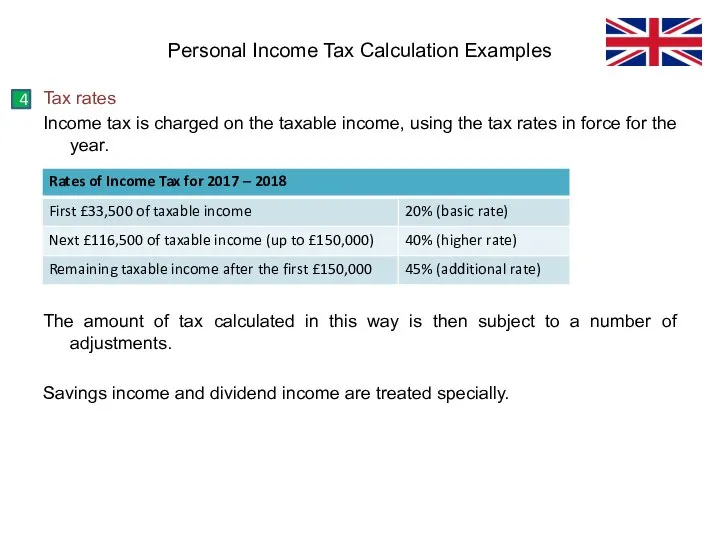

- 85. Tax rates Income tax is charged on the taxable income, using the tax rates in force

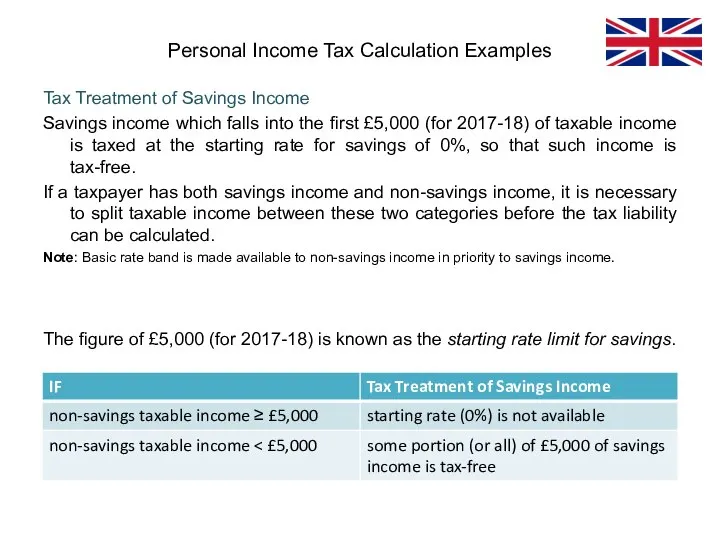

- 86. Tax Treatment of Savings Income Savings income which falls into the first £5,000 (for 2017-18) of

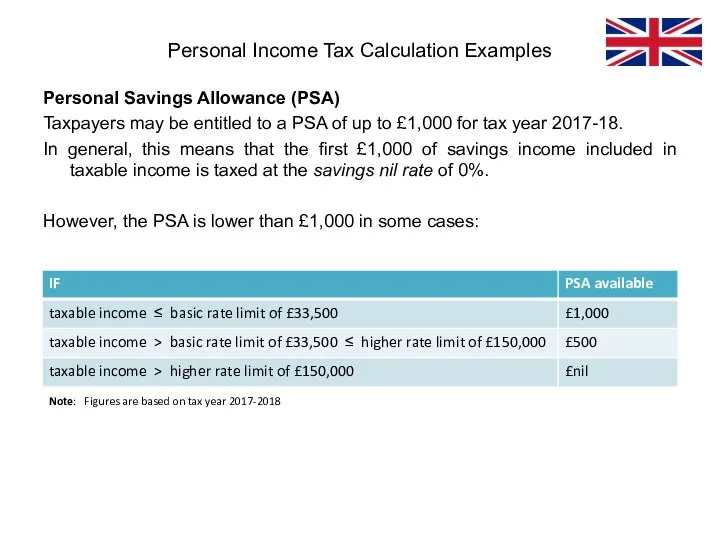

- 87. Personal Savings Allowance (PSA) Taxpayers may be entitled to a PSA of up to £1,000 for

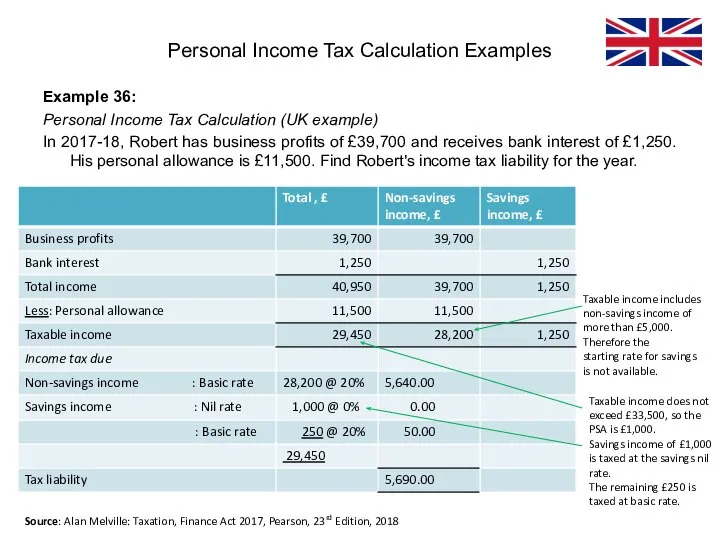

- 88. Example 36: Personal Income Tax Calculation (UK example) In 2017-18, Robert has business profits of £39,700

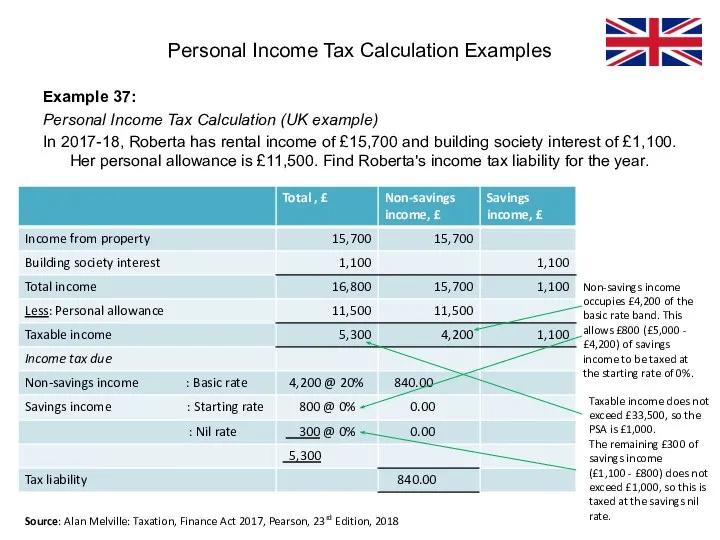

- 89. Example 37: Personal Income Tax Calculation (UK example) In 2017-18, Roberta has rental income of £15,700

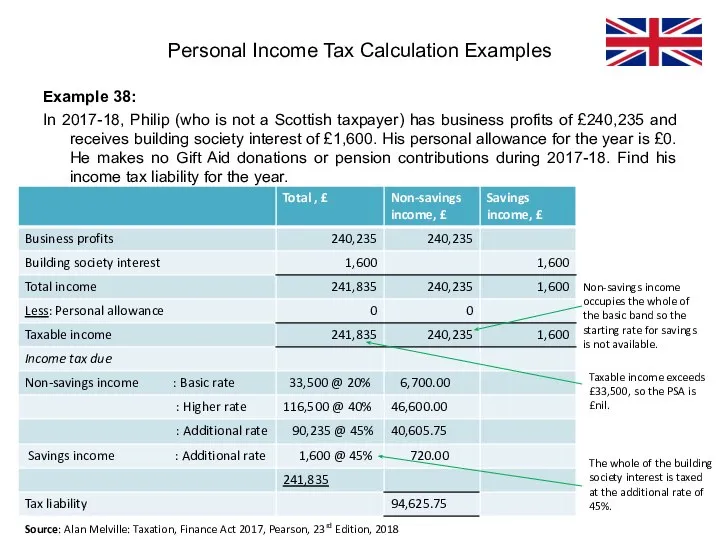

- 90. Example 38: In 2017-18, Philip (who is not a Scottish taxpayer) has business profits of £240,235

- 91. Chapter 4: TAXATION OF INVESTMENT INCOME Definition of Investment Income Investment income is income that comes

- 92. Taxation of Interest and Dividends (US. Case) For tax purposes, individual investors typically are taxed on

- 93. Example 39: Assume Courtney (head of household filing status) decides to purchase dividend-paying stocks to achieve

- 94. Example 39: Assume Courtney (head of household filing status) decides to purchase dividend-paying stocks to achieve

- 95. Example 39: Assume Courtney (head of household filing status) decides to purchase dividend-paying stocks to achieve

- 96. Taxation of Capital Gains and Losses (US. Case) A capital gains tax is a tax on

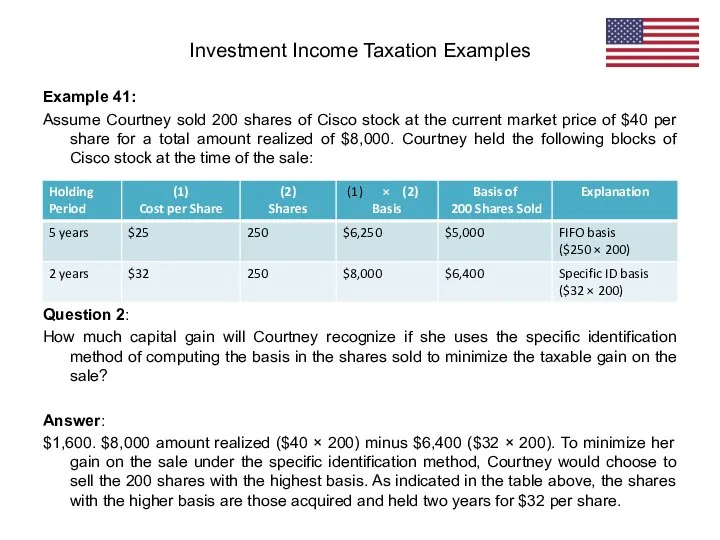

- 97. FIFO method and Specific Identification Method When taxpayers sell a capital asset, e.g., stock, they may

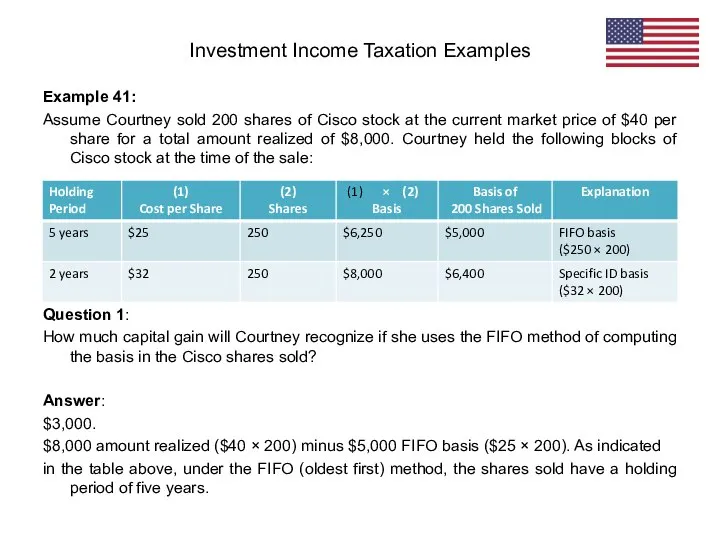

- 98. Example 41: Assume Courtney sold 200 shares of Cisco stock at the current market price of

- 99. Example 41: Assume Courtney sold 200 shares of Cisco stock at the current market price of

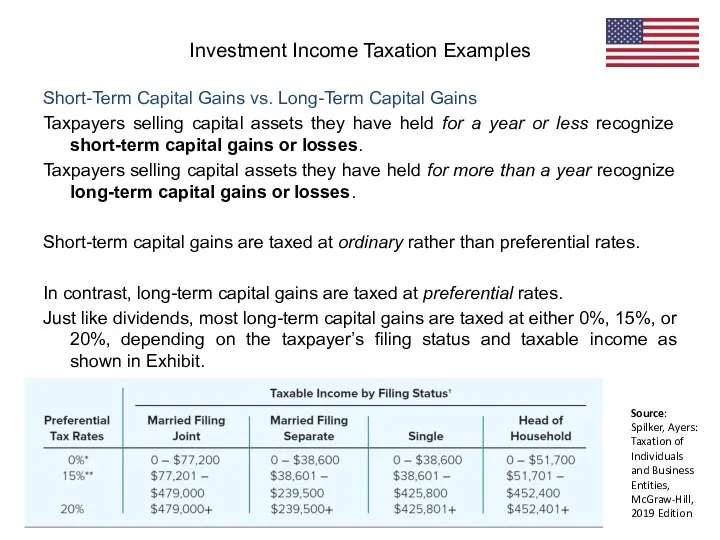

- 100. Short-Term Capital Gains vs. Long-Term Capital Gains Taxpayers selling capital assets they have held for a

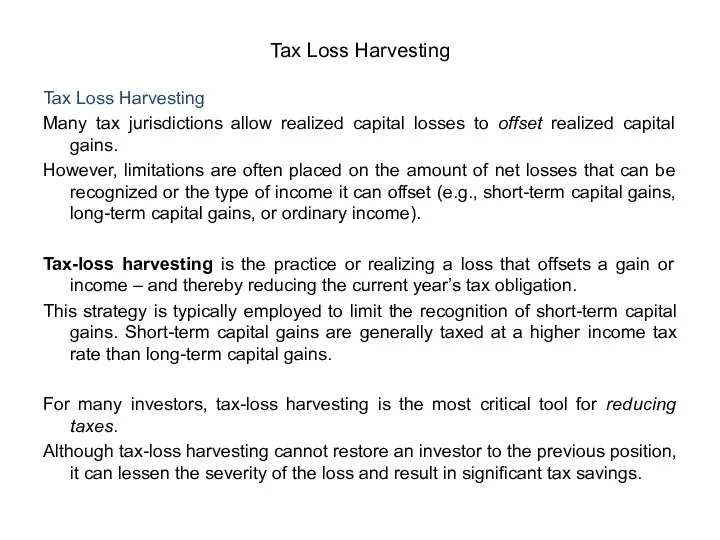

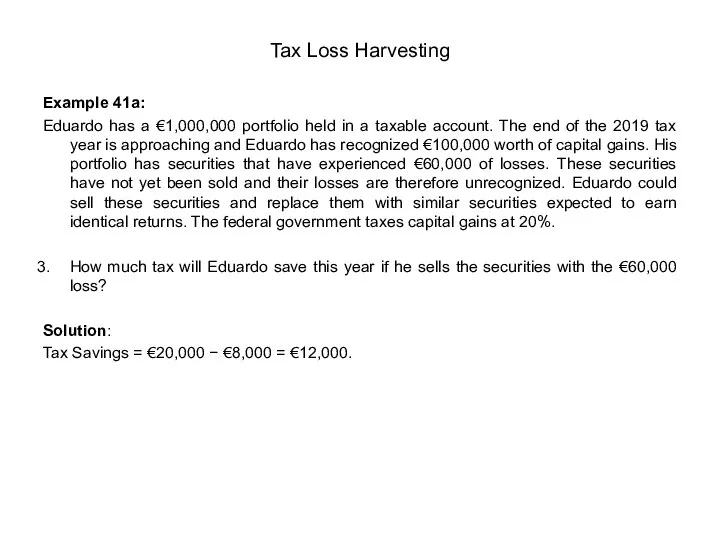

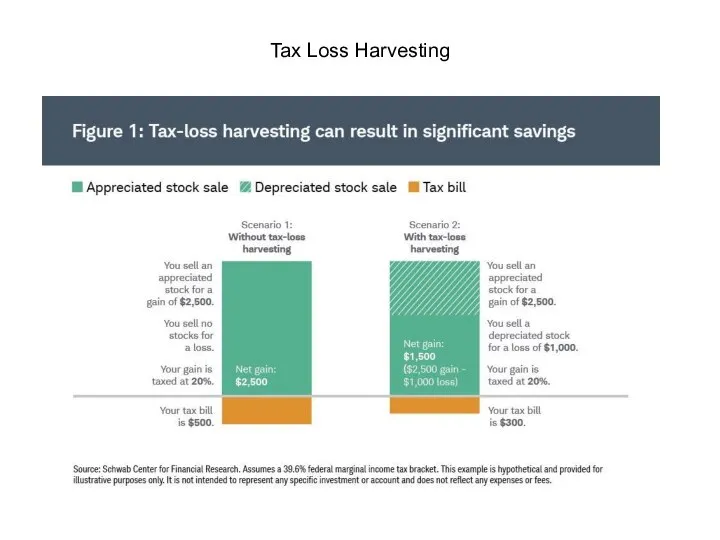

- 101. Tax Loss Harvesting Many tax jurisdictions allow realized capital losses to offset realized capital gains. However,

- 102. Tax Loss Harvesting Example 41a: Eduardo has a €1,000,000 portfolio held in a taxable account. The

- 103. Tax Loss Harvesting Example 41a: Eduardo has a €1,000,000 portfolio held in a taxable account. The

- 104. Tax Loss Harvesting

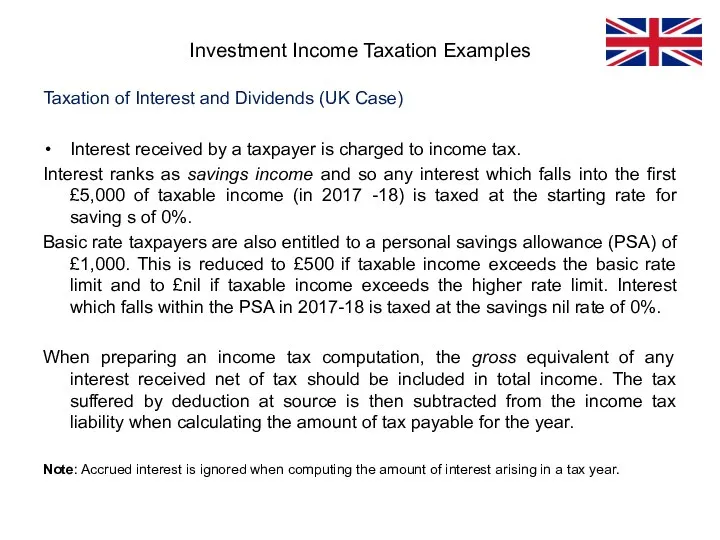

- 105. Taxation of Interest and Dividends (UK Case) Interest received by a taxpayer is charged to income

- 106. Example 42: In 2017-18, Alfred had business profits of £15,870 and received net debenture interest of

- 107. The income tax liability on a taxpayer's dividend income is calculated differently from the liability on

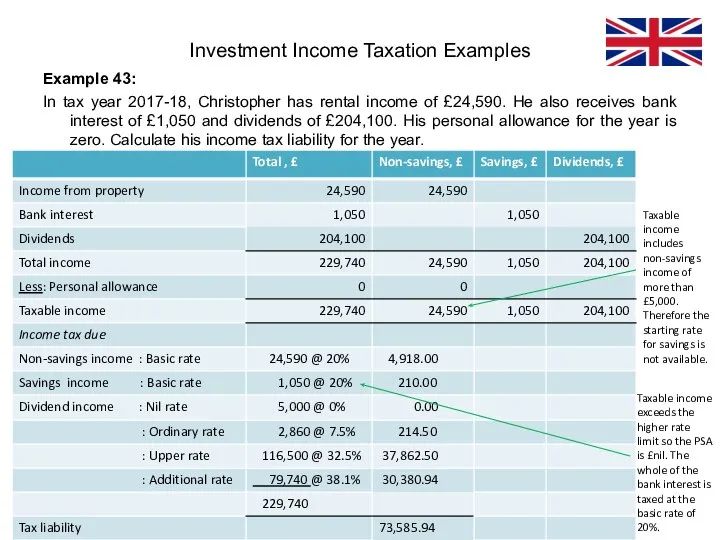

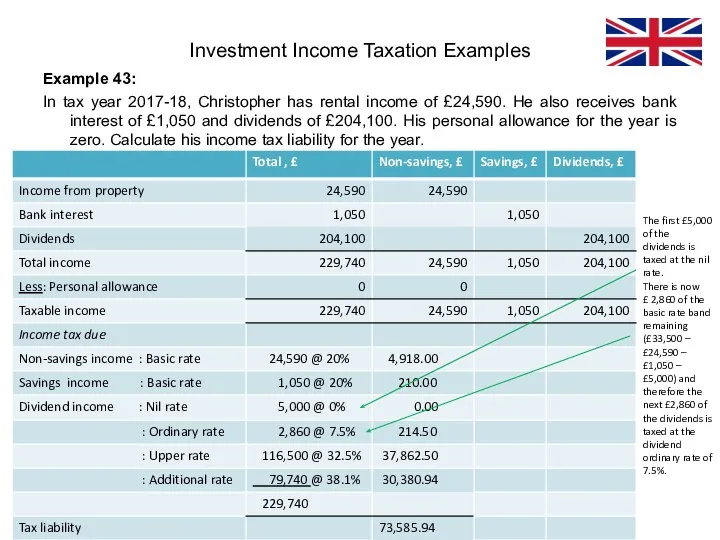

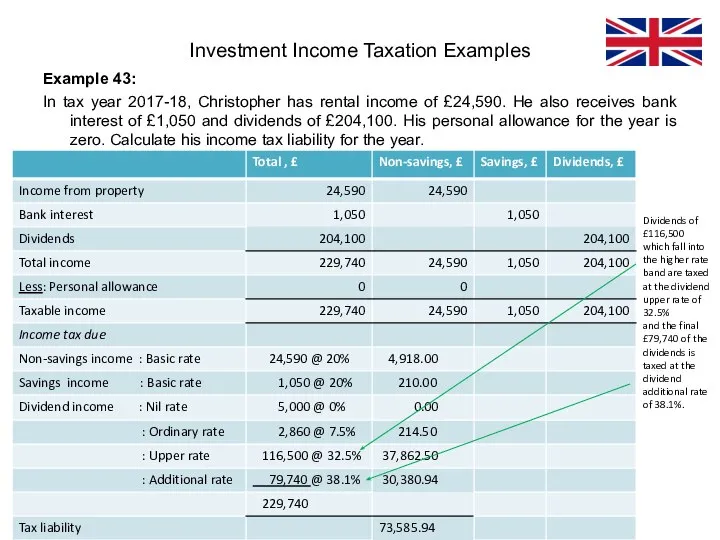

- 108. Example 43: In tax year 2017-18, Christopher has rental income of £24,590. He also receives bank

- 109. Example 43: In tax year 2017-18, Christopher has rental income of £24,590. He also receives bank

- 110. Example 43: In tax year 2017-18, Christopher has rental income of £24,590. He also receives bank

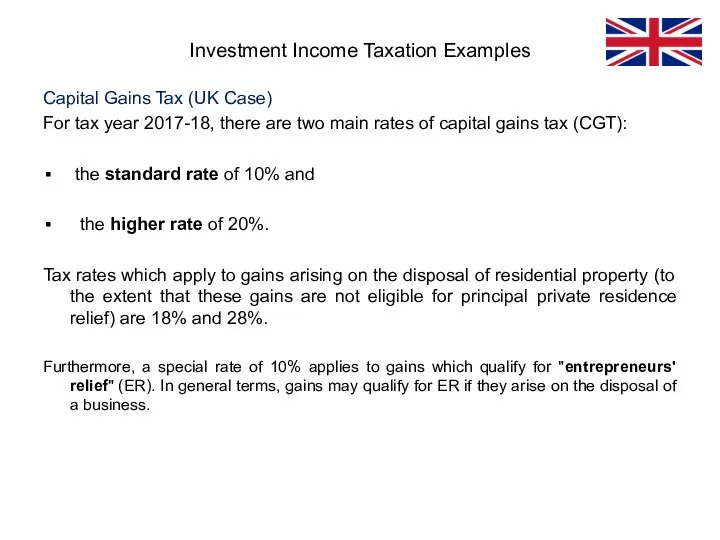

- 111. Capital Gains Tax (UK Case) For tax year 2017-18, there are two main rates of capital

- 112. Capital Gains Tax: Basis of Assessment A person's CGT liability for a tax year is based

- 113. (c) If there are net gains for the year, these are reduced first by any unrelieved

- 114. Example 44: Four taxpayers each make three chargeable disposals during 2017-18. Compute their taxable gains for

- 115. Example 44: Four taxpayers each make three chargeable disposals during 2017-18. Compute their taxable gains for

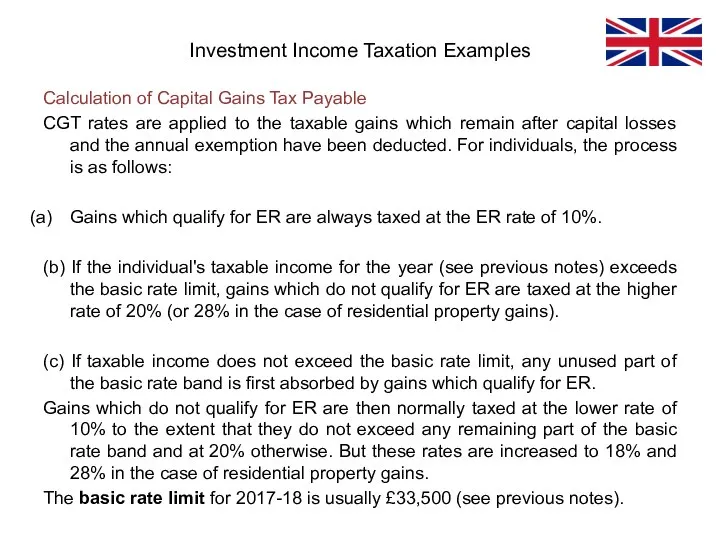

- 116. Calculation of Capital Gains Tax Payable CGT rates are applied to the taxable gains which remain

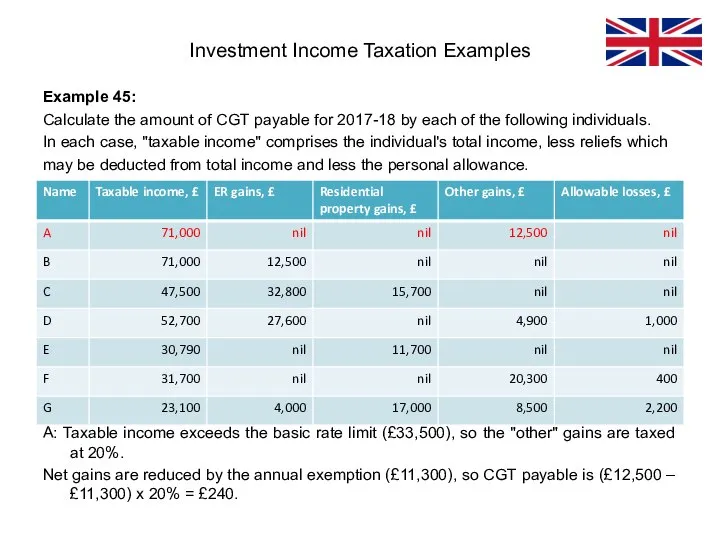

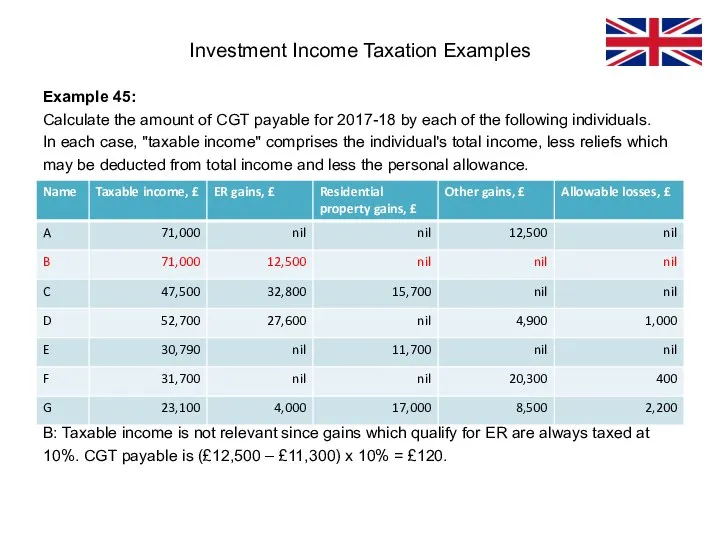

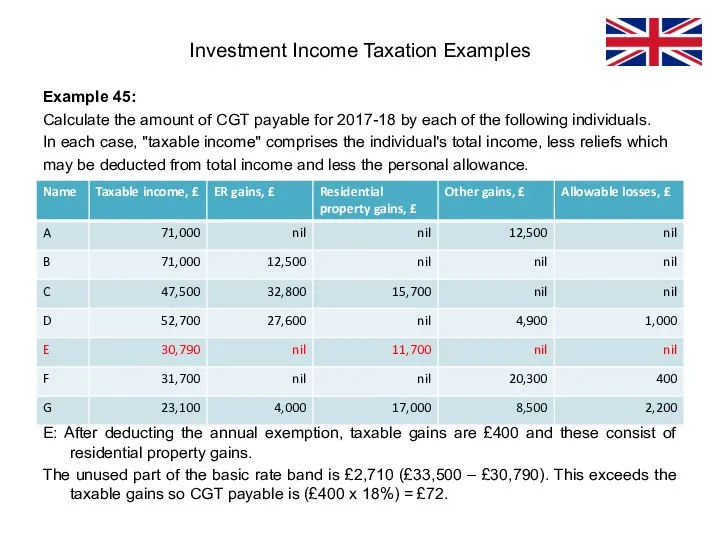

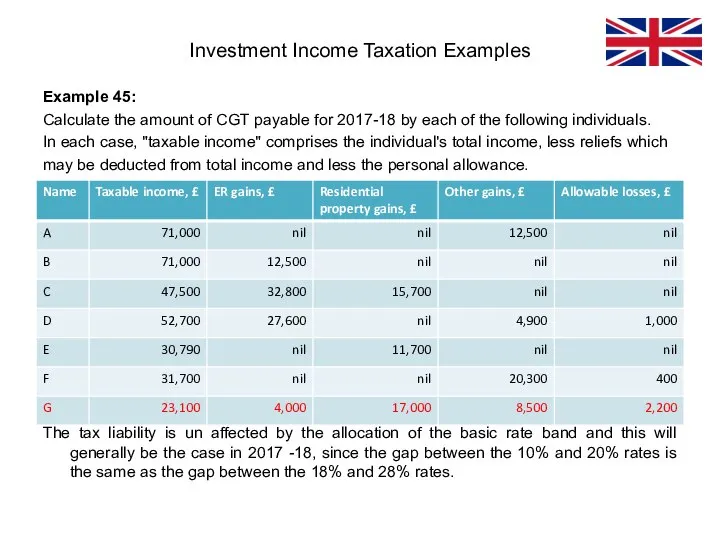

- 117. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 118. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

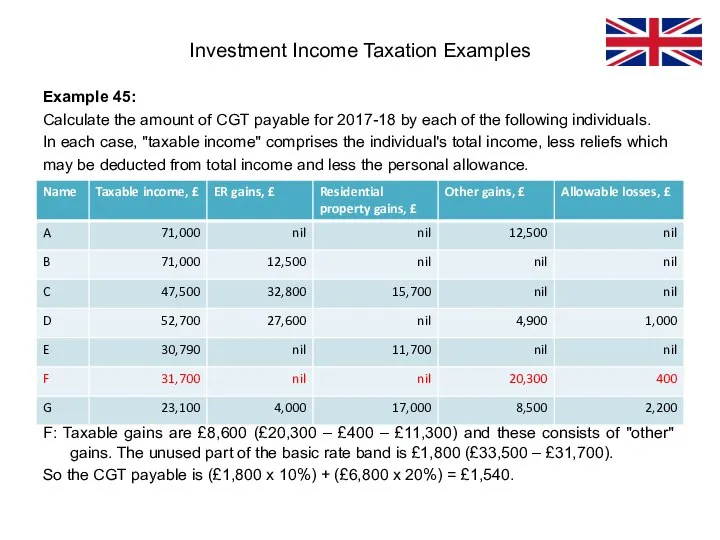

- 119. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 120. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

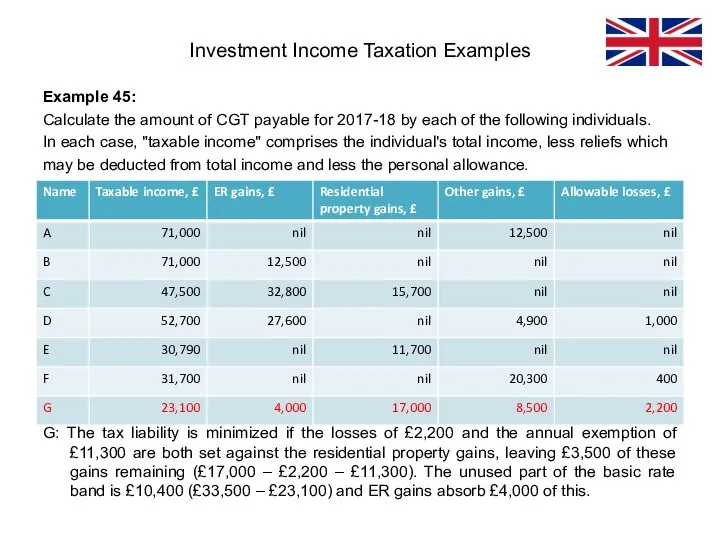

- 121. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 122. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

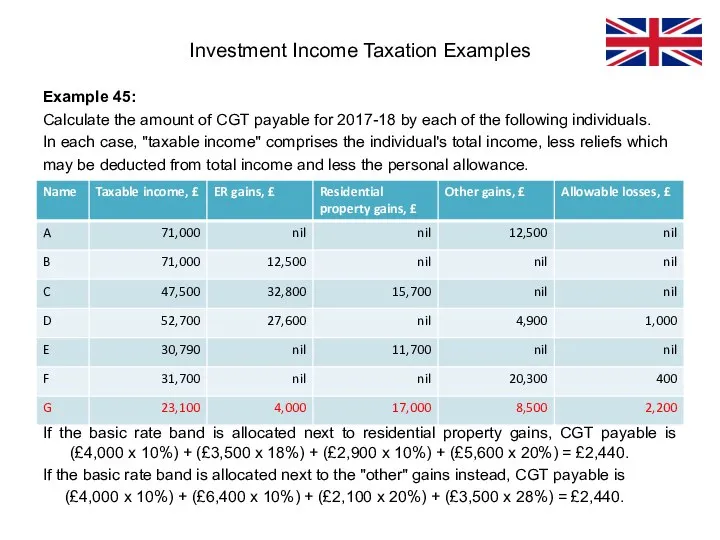

- 123. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 124. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 125. Example 45: Calculate the amount of CGT payable for 2017-18 by each of the following individuals.

- 126. Effect of Taxes on Investment Returns After-Tax Accumulations and Returns for Taxable Accounts Taxes on investment

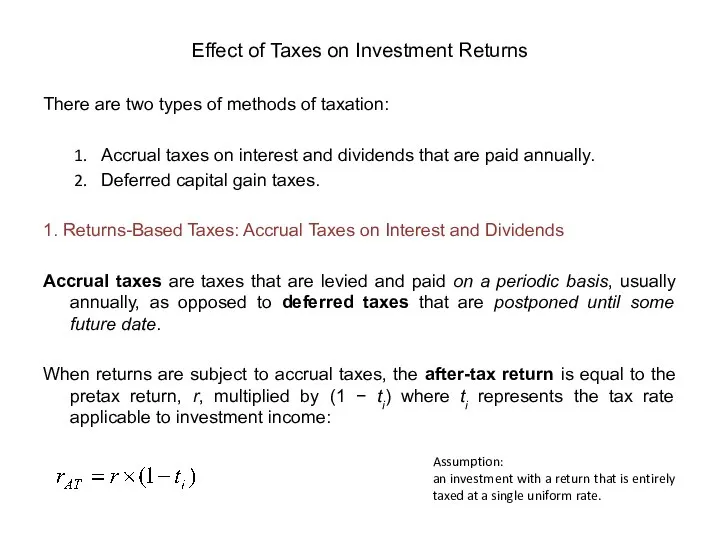

- 127. Effect of Taxes on Investment Returns There are two types of methods of taxation: Accrual taxes

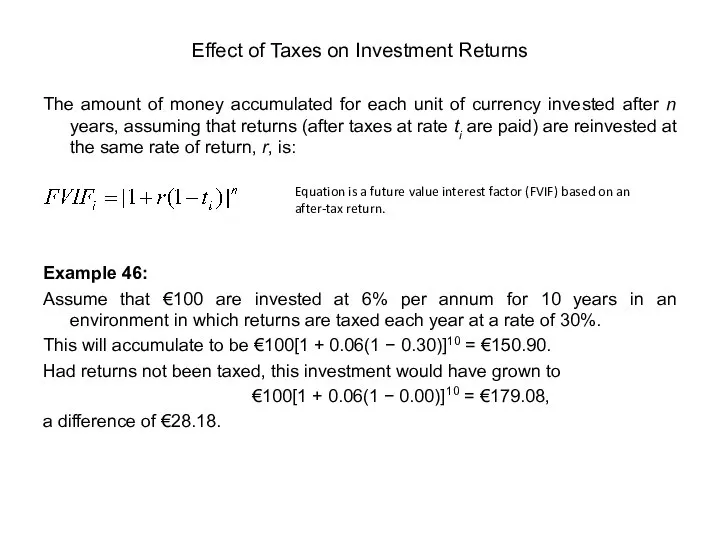

- 128. Effect of Taxes on Investment Returns The amount of money accumulated for each unit of currency

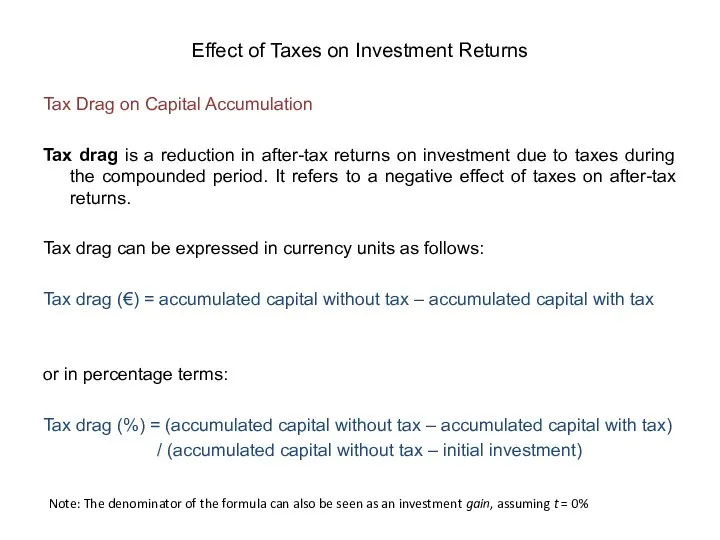

- 129. Effect of Taxes on Investment Returns Tax Drag on Capital Accumulation Tax drag is a reduction

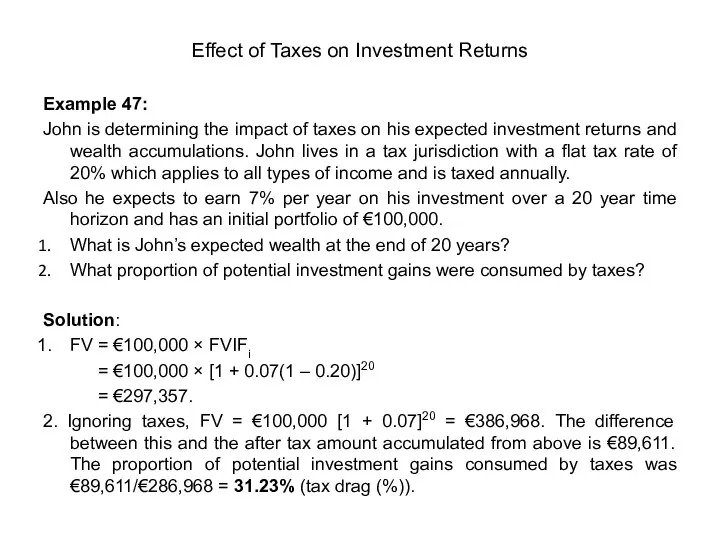

- 130. Effect of Taxes on Investment Returns Example 47: John is determining the impact of taxes on

- 131. Effect of Taxes on Investment Returns Implications of tax drag (assuming accrual taxation) When investment returns

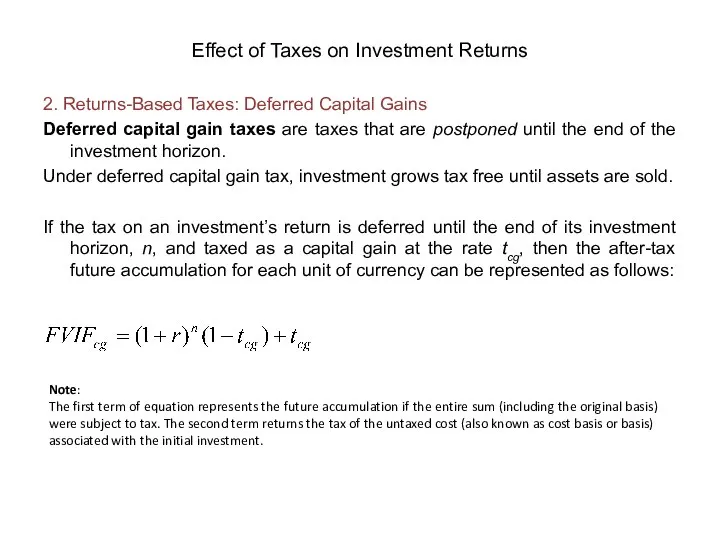

- 132. Effect of Taxes on Investment Returns 2. Returns-Based Taxes: Deferred Capital Gains Deferred capital gain taxes

- 133. Effect of Taxes on Investment Returns Example 48: Assume that €100 are invested at 6% per

- 134. Effect of Taxes on Investment Returns Implications of tax drag (assuming taxes on capital gains are

- 135. Effect of Taxes on Investment Returns 3. Wealth-Based Taxes Some jurisdictions impose a wealth tax, which

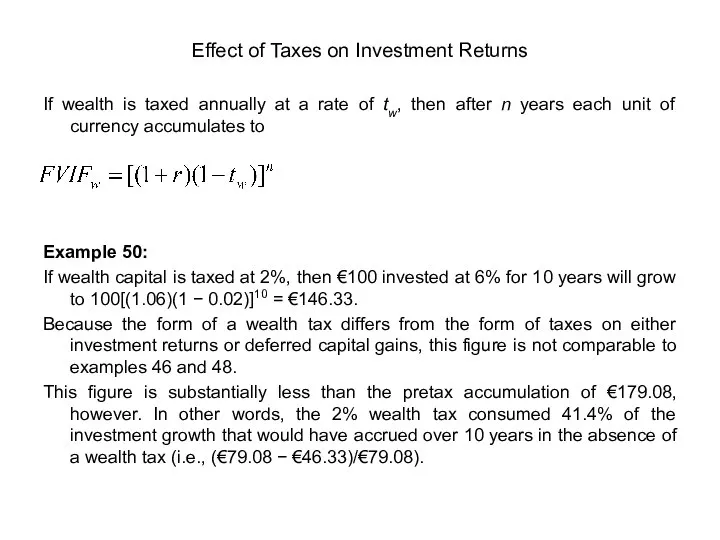

- 136. Effect of Taxes on Investment Returns If wealth is taxed annually at a rate of tw,

- 137. Effect of Taxes on Investment Returns Implications of tax drag (assuming tax on wealth) Tax drag

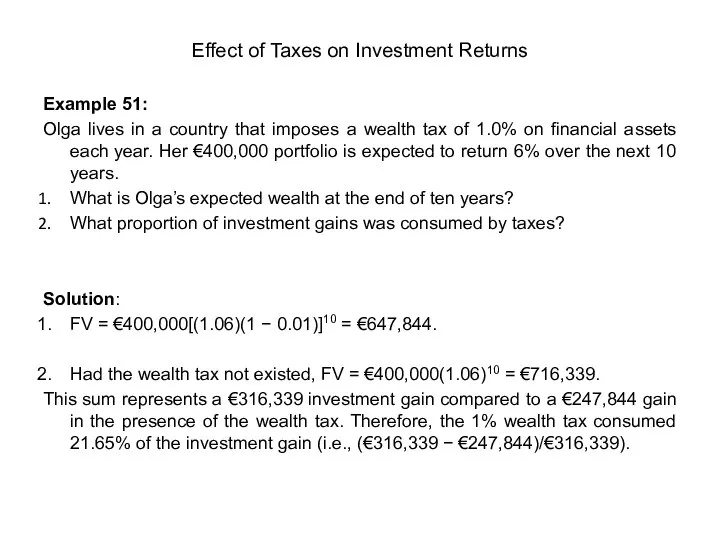

- 138. Effect of Taxes on Investment Returns Example 51: Olga lives in a country that imposes a

- 139. Effect of Taxes on Investment Returns Blended Taxing Environments In reality, investment portfolios are subject to

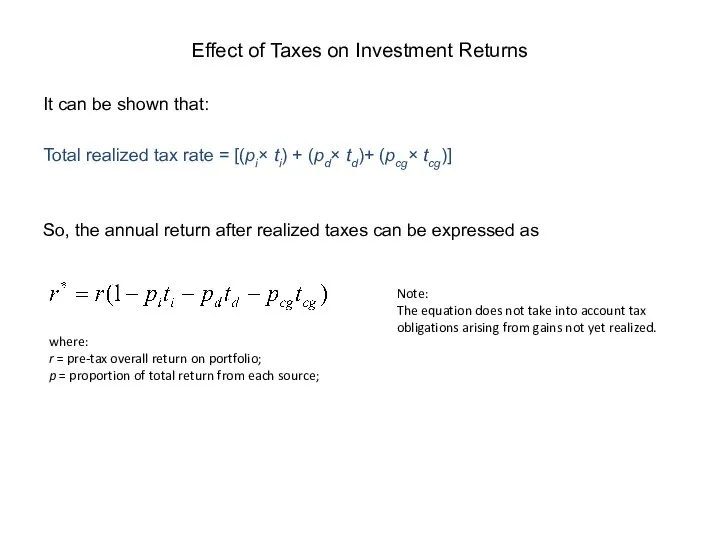

- 140. Effect of Taxes on Investment Returns It can be shown that: Total realized tax rate =

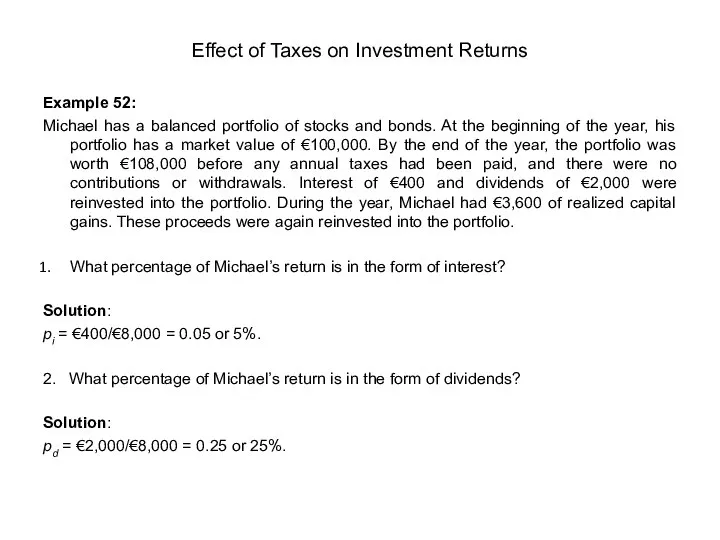

- 141. Effect of Taxes on Investment Returns Example 52: Michael has a balanced portfolio of stocks and

- 142. Effect of Taxes on Investment Returns Example 52: Michael has a balanced portfolio of stocks and

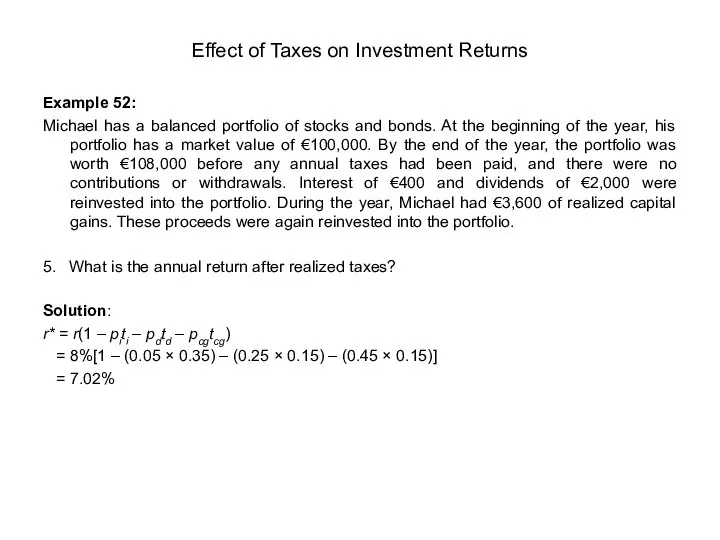

- 143. Effect of Taxes on Investment Returns Example 52: Michael has a balanced portfolio of stocks and

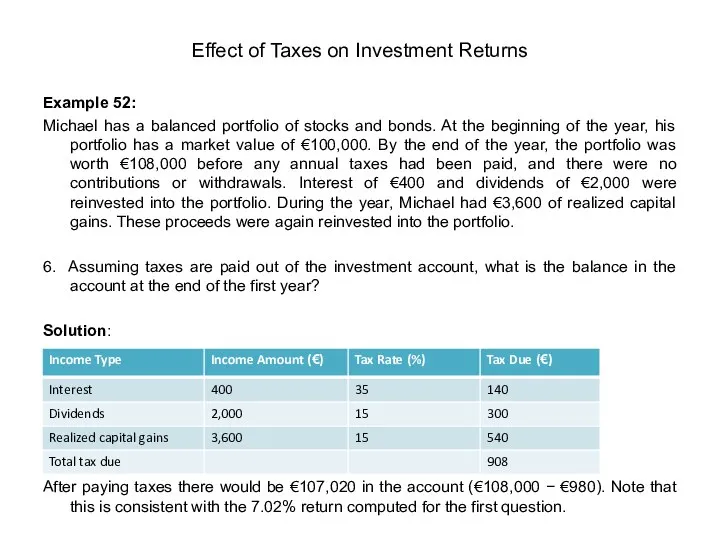

- 144. Effect of Taxes on Investment Returns Example 52: Michael has a balanced portfolio of stocks and

- 145. Chapter 5: CORPORATION TAX Definition of Corporate Tax Corporate tax (a.k.a. corporation tax) is a direct

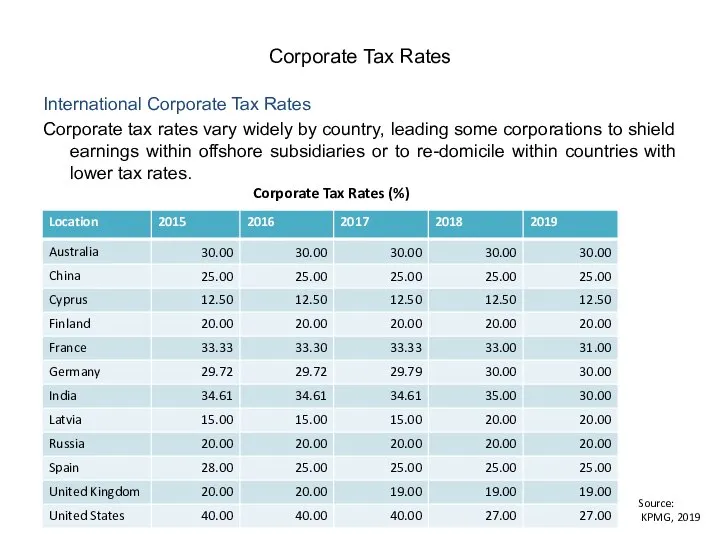

- 146. Corporate Tax Rates International Corporate Tax Rates Corporate tax rates vary widely by country, leading some

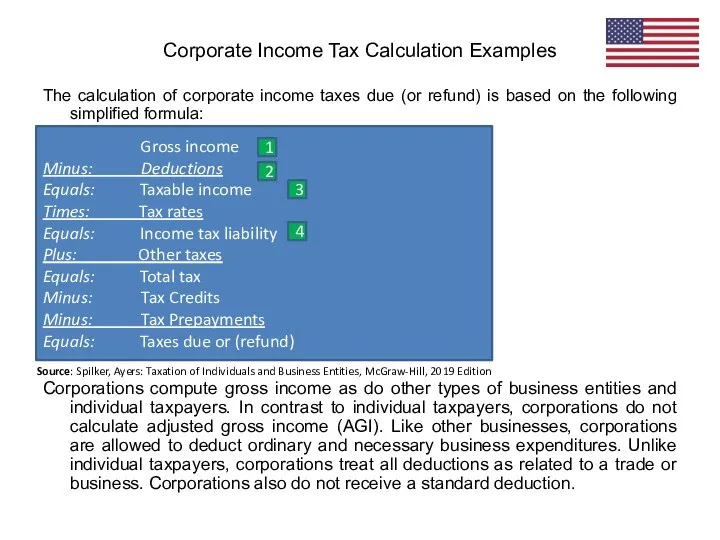

- 147. The calculation of corporate income taxes due (or refund) is based on the following simplified formula:

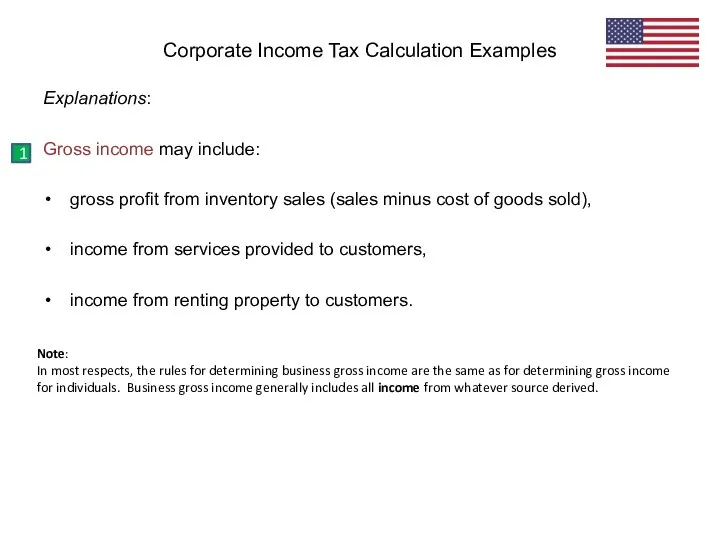

- 148. Explanations: Gross income may include: gross profit from inventory sales (sales minus cost of goods sold),

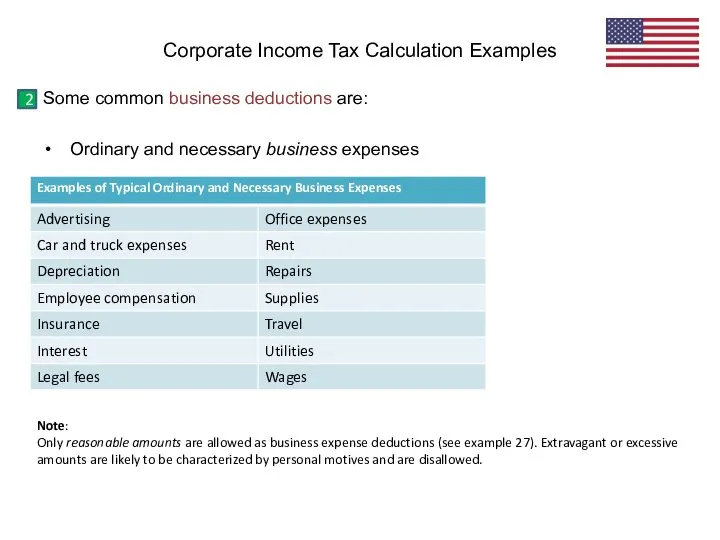

- 149. Some common business deductions are: Ordinary and necessary business expenses Corporate Income Tax Calculation Examples 2

- 150. Some limitations on business deductions: Capital expenditures (e.g., expenditures for tangible assets such as buildings, machinery,

- 151. Business interest expense Deduction for business interest expense is limited to the sum of business interest

- 152. Computing corporate taxable income To compute taxable income, most corporations begin with book (financial reporting) income

- 153. In addition to the favorable/unfavorable distinction, book–tax differences can be categorized as permanent or temporary. •

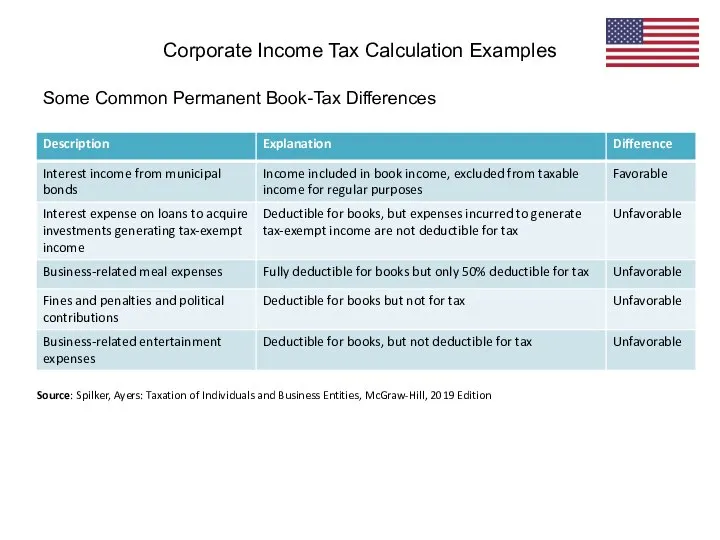

- 154. Some Common Permanent Book-Tax Differences Corporate Income Tax Calculation Examples Source: Spilker, Ayers: Taxation of Individuals

- 155. • Temporary book–tax differences arise in one year and reverse in a subsequent year. Corporations experience

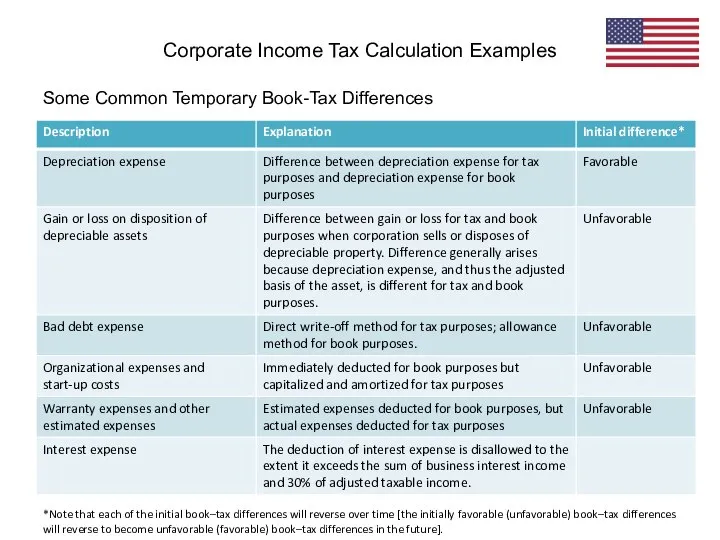

- 156. Some Common Temporary Book-Tax Differences Corporate Income Tax Calculation Examples *Note that each of the initial

- 157. Corporate-Specific Deductions and Book-Tax Differences Net Capital Losses For corporations, all net capital gains (long- and

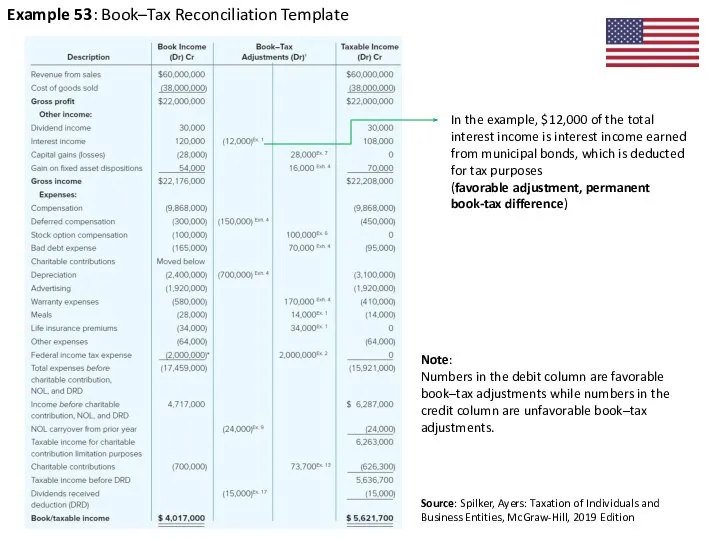

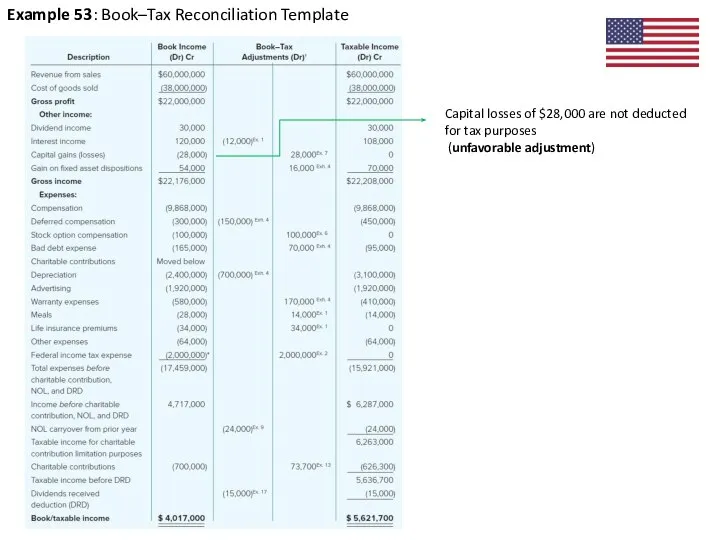

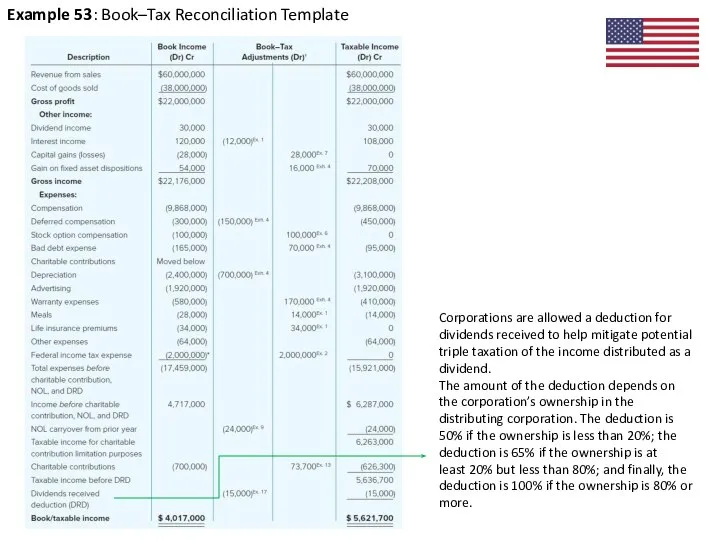

- 158. Example 53: Book–Tax Reconciliation Template Source: Spilker, Ayers: Taxation of Individuals and Business Entities, McGraw-Hill, 2019

- 159. Example 53: Book–Tax Reconciliation Template Capital losses of $28,000 are not deducted for tax purposes (unfavorable

- 160. Example 53: Book–Tax Reconciliation Template Initial estimated fair value of stock options is deducted in books,

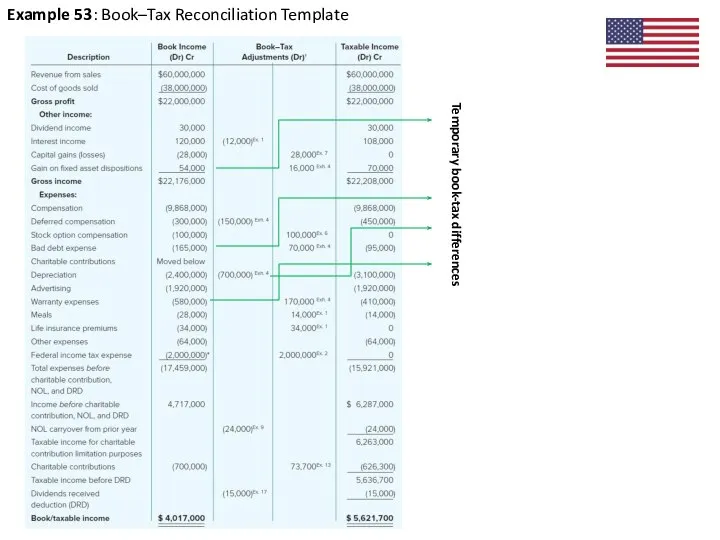

- 161. Example 53: Book–Tax Reconciliation Template Temporary book-tax differences

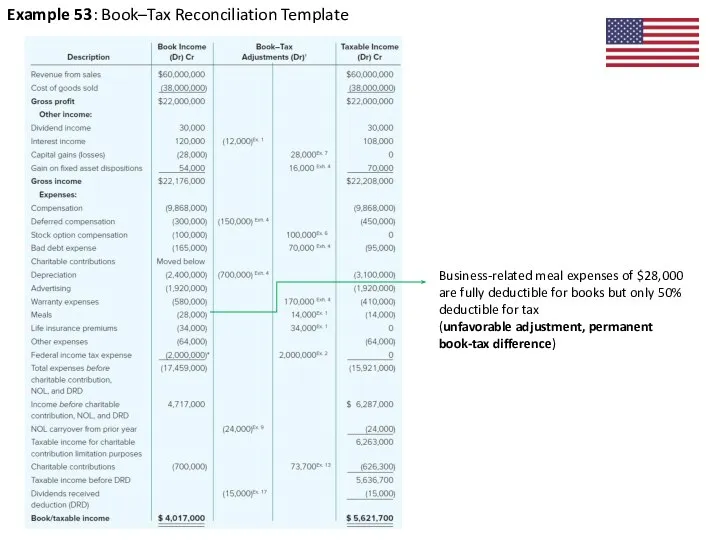

- 162. Example 53: Book–Tax Reconciliation Template Business-related meal expenses of $28,000 are fully deductible for books but

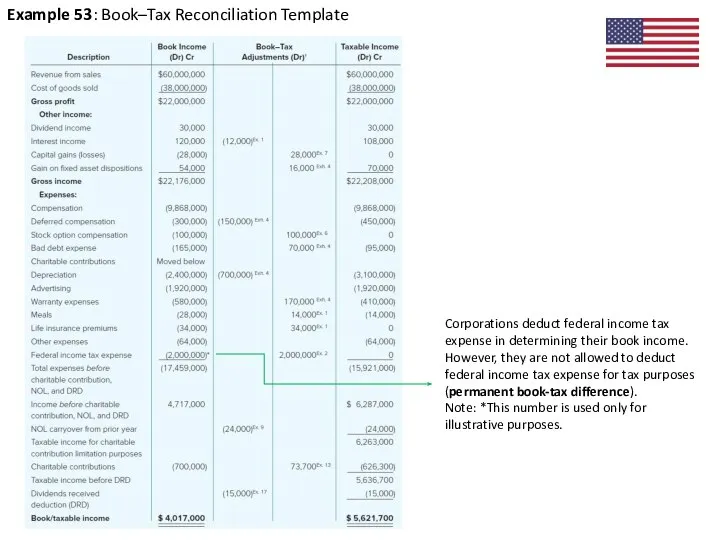

- 163. Example 53: Book–Tax Reconciliation Template Corporations deduct federal income tax expense in determining their book income.

- 164. Example 53: Book–Tax Reconciliation Template Corporations are allowed a deduction for dividends received to help mitigate

- 165. Corporate income tax liability: When corporations calculate their taxable income, they compute their tax liability using

- 166. Scope of Corporation Tax (U.K. case) A company's taxable total profits include both its income and

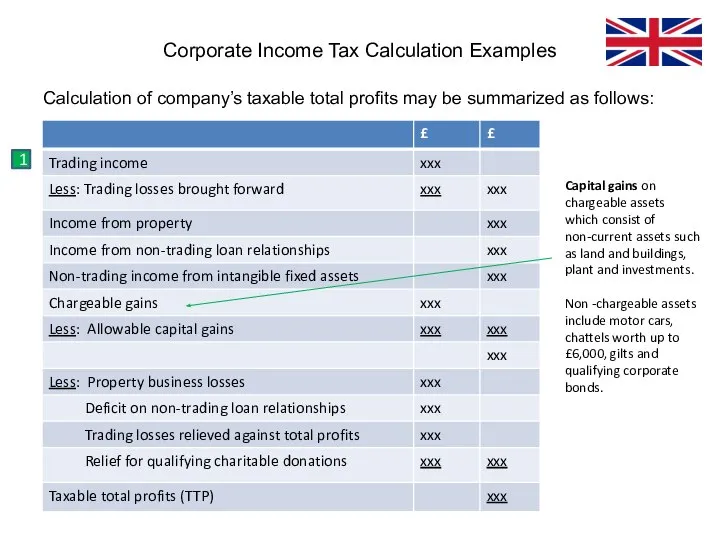

- 167. Calculation of company’s taxable total profits may be summarized as follows: Corporate Income Tax Calculation Examples

- 168. Calculation of company’s taxable total profits may be summarized as follows: Corporate Income Tax Calculation Examples

- 169. Notes: Trading income consists of company’s trading profit for an accounting period, as adjusted for tax

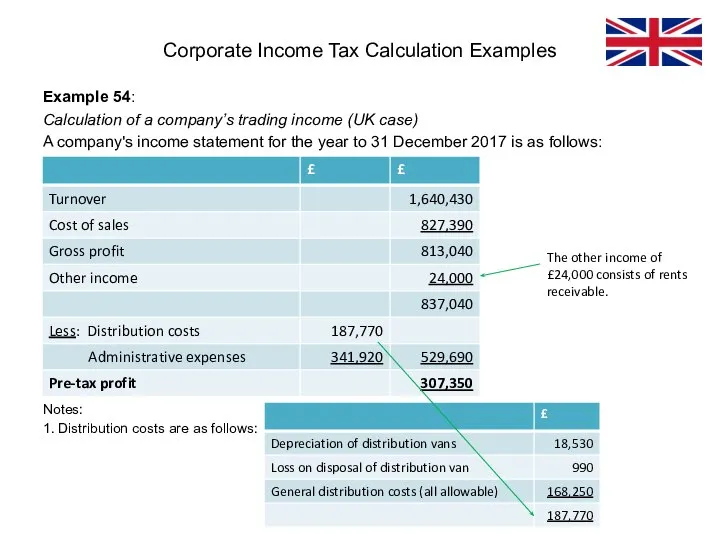

- 170. Example 54: Calculation of a company’s trading income (UK case) A company's income statement for the

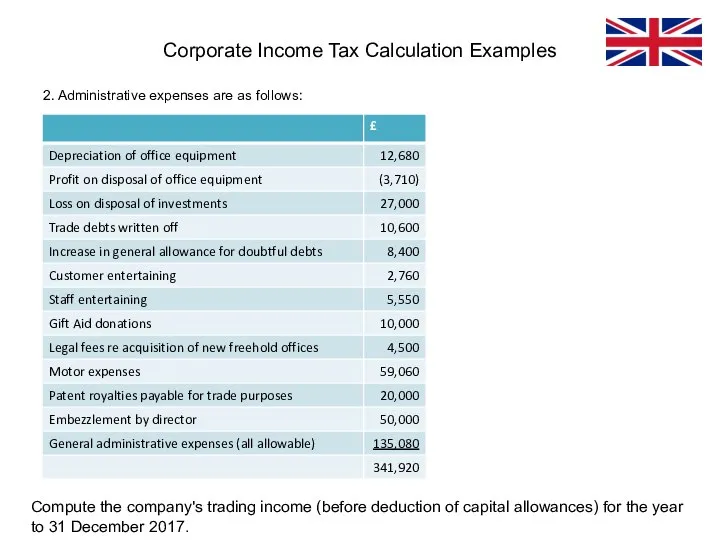

- 171. 2. Administrative expenses are as follows: Corporate Income Tax Calculation Examples Compute the company's trading income

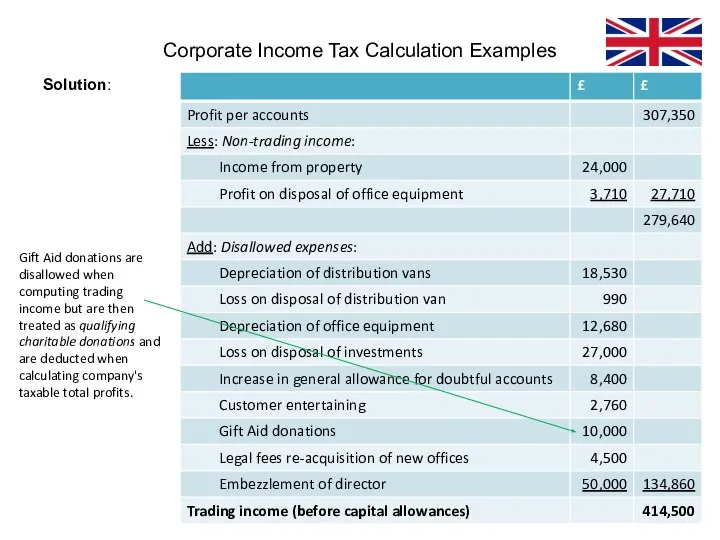

- 172. Solution: Corporate Income Tax Calculation Examples Gift Aid donations are disallowed when computing trading income but

- 173. Solution: Corporate Income Tax Calculation Examples Losses caused by the dishonesty of a director are disallowed.

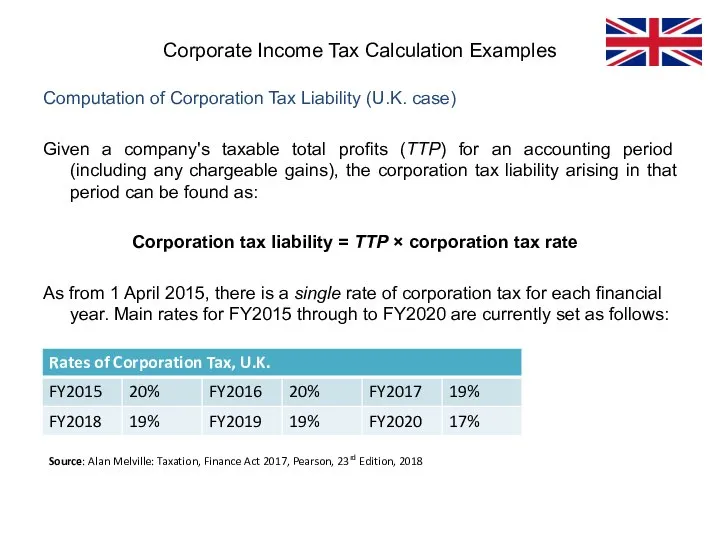

- 174. Computation of Corporation Tax Liability (U.K. case) Given a company's taxable total profits (TTP) for an

- 175. Chapter 6: INDIRECT TAXES: VALUE-ADDED TAX Definition of Value Added Tax Value added tax (VAT) is

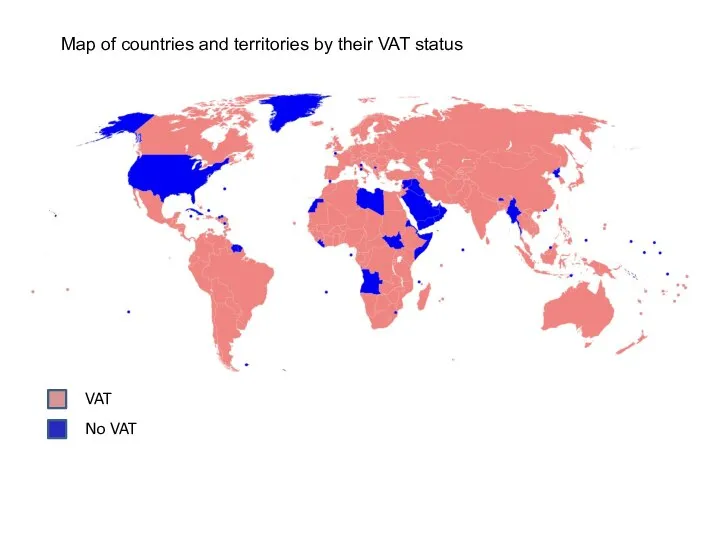

- 176. Map of countries and territories by their VAT status VAT No VAT

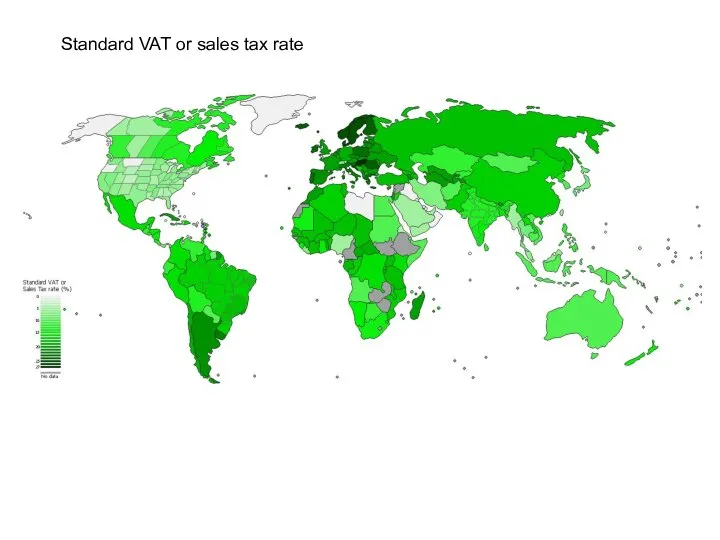

- 177. Standard VAT or sales tax rate

- 178. Value Added Tax Rates in Europe

- 179. VAT Calculation Principles A VAT is levied on the gross margin at each point in the

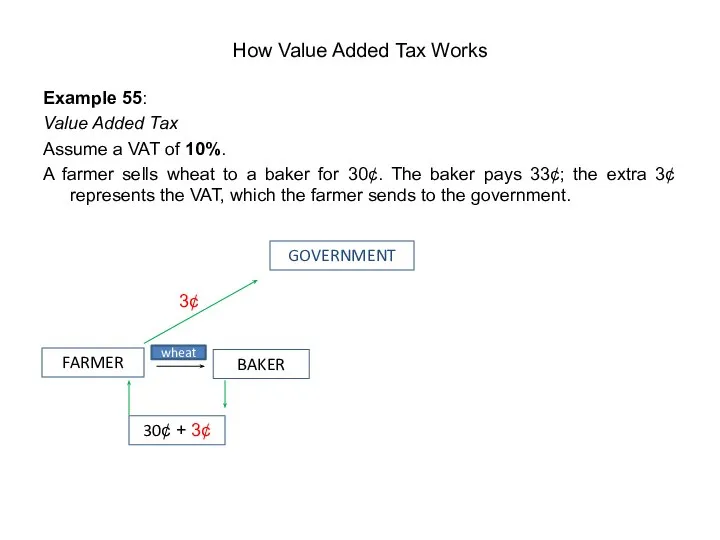

- 180. Example 55: Value Added Tax Assume a VAT of 10%. A farmer sells wheat to a

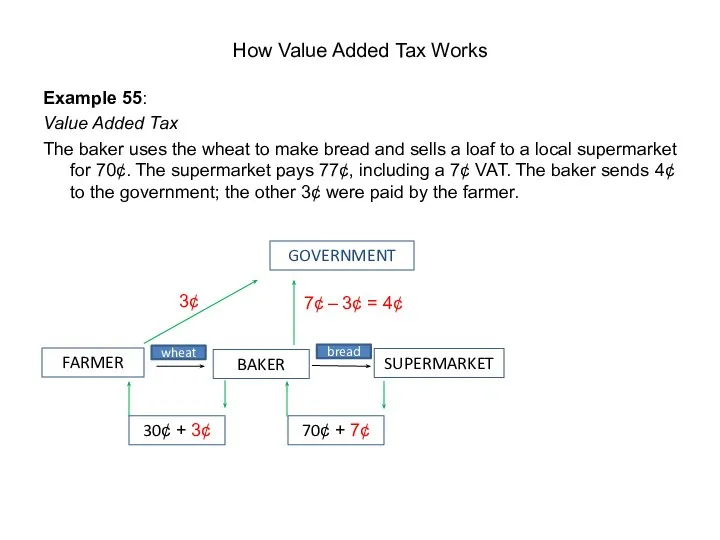

- 181. Example 55: Value Added Tax The baker uses the wheat to make bread and sells a

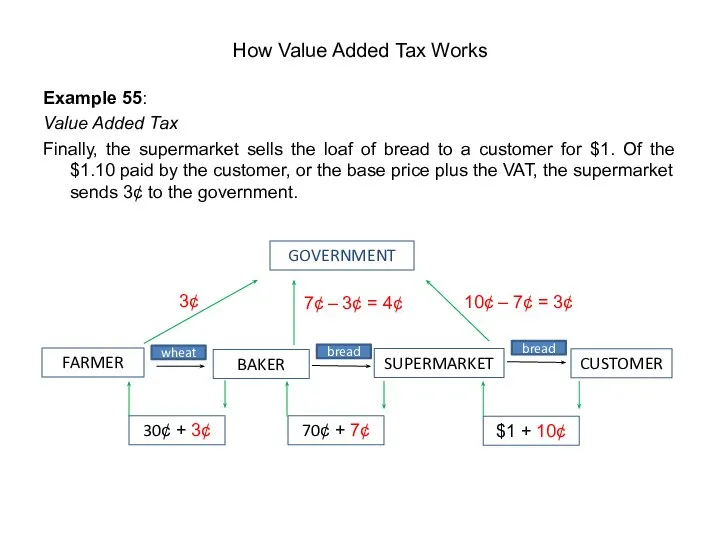

- 182. Example 55: Value Added Tax Finally, the supermarket sells the loaf of bread to a customer

- 183. VAT vs. Sales Tax Sales tax is assessed only once at the final stage of the

- 184. VAT: Advantages Adoption of a regressive tax system, such as VAT, gives people a stronger incentive

- 185. VAT: Disadvantages Unlike the income tax rate, which varies at different levels of income, VAT is

- 186. Value Added Tax (U.K. case) The basic principle of VAT is that tax should be charged

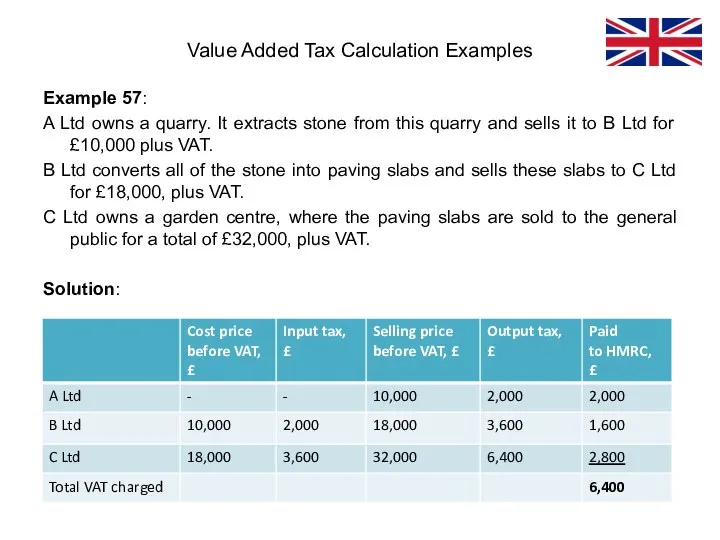

- 187. Example 57: A Ltd owns a quarry. It extracts stone from this quarry and sells it

- 188. Example 57: A Ltd owns a quarry. It extracts stone from this quarry and sells it

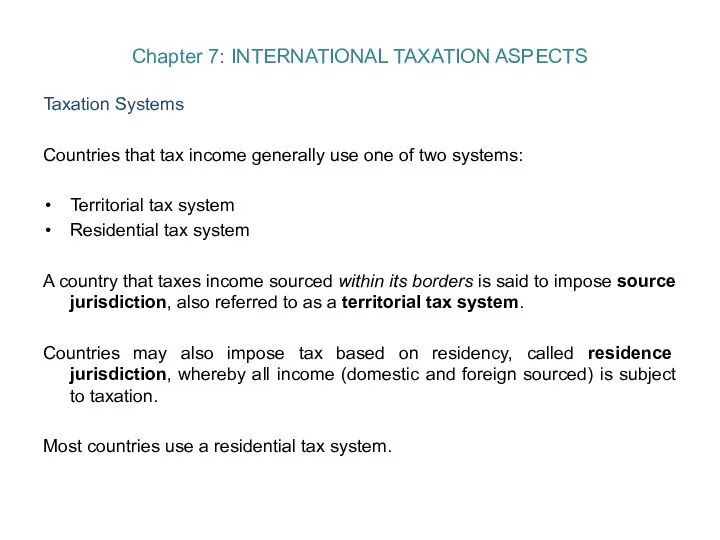

- 189. Chapter 7: INTERNATIONAL TAXATION ASPECTS Taxation Systems Countries that tax income generally use one of two

- 191. Taxation of income Under source jurisdiction a country levies taxes on all income generated within its

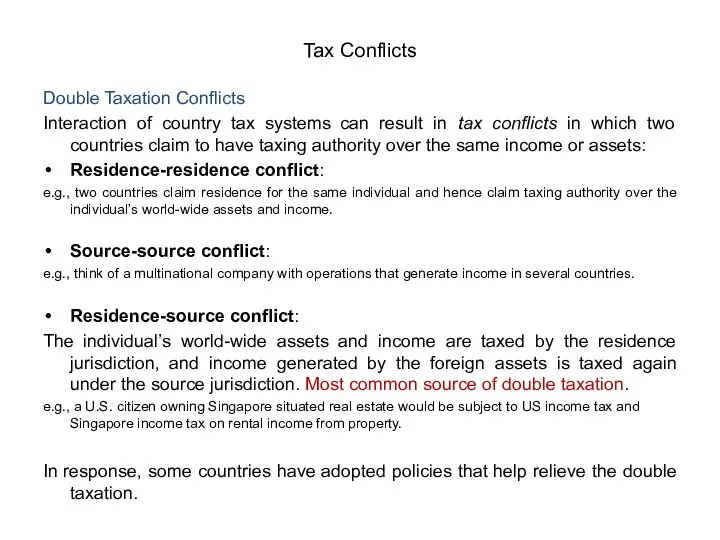

- 192. Double Taxation Conflicts Interaction of country tax systems can result in tax conflicts in which two

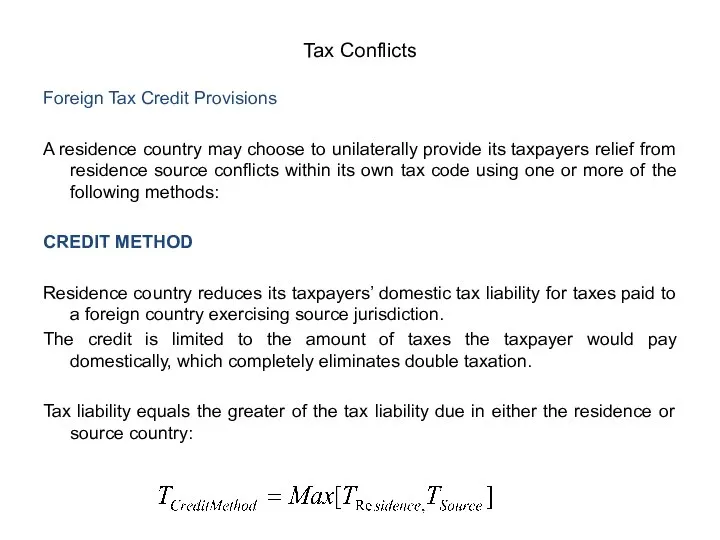

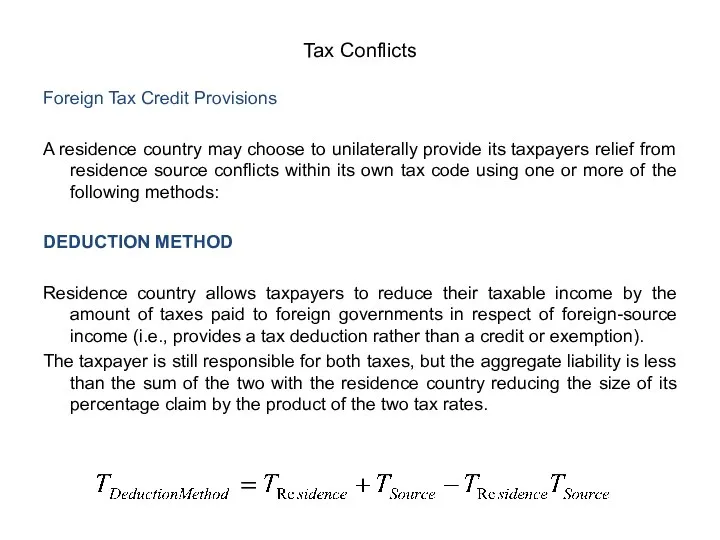

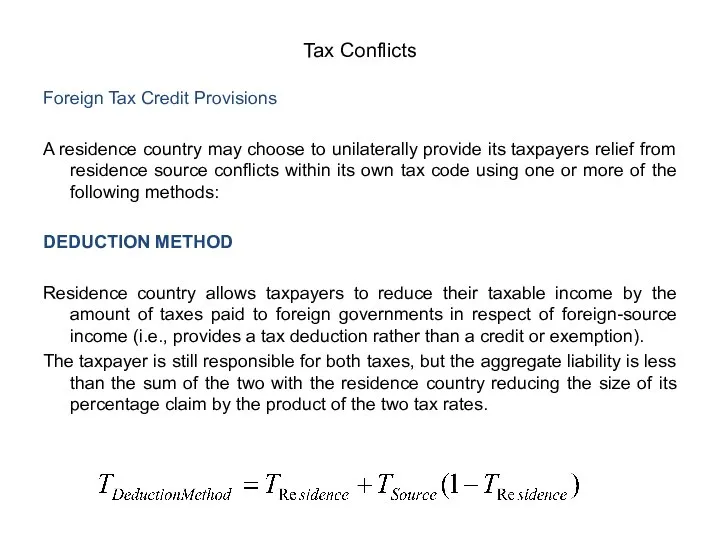

- 193. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 194. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 195. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

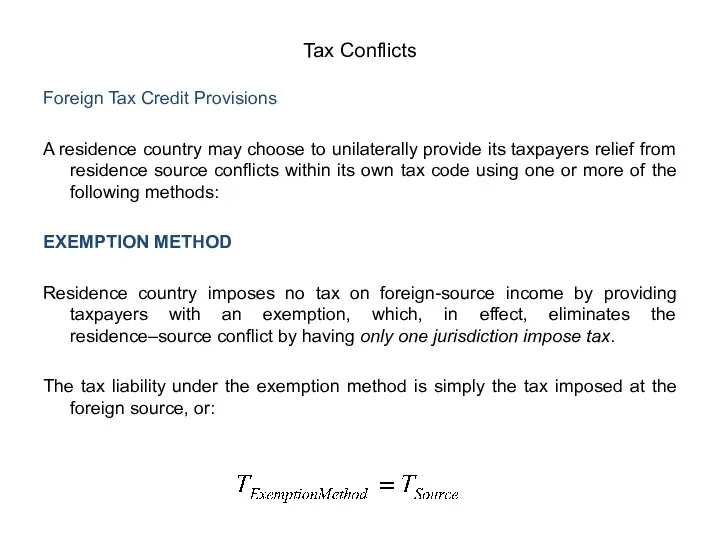

- 196. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 197. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 198. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 199. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 200. Foreign Tax Credit Provisions A residence country may choose to unilaterally provide its taxpayers relief from

- 201. Double Taxation Treaties Relief from double taxation may be provided through a double taxation treaty (DTT)

- 202. Double Taxation Treaties In addition to residence–source conflicts, DTTs resolve residence–residence conflicts. A resident is taxable

- 203. Tax Avoidance vs. Tax Evasion Tax avoidance (a.k.a. “tax minimization”) uses legal means to lower the

- 204. Current Trends in International Transparency and Information Exchange Most countries attempt to maximize the amount of

- 205. Current Trends in International Transparency and Information Exchange Most countries attempt to maximize the amount of

- 206. Current Trends in International Transparency and Information Exchange Most countries attempt to maximize the amount of

- 207. Common Tax Evasion Schemes Falsifying information on tax return This occurs when a taxpayer understates its

- 208. Transfer Pricing Transfer pricing is an accounting practice that represents the price that one division in

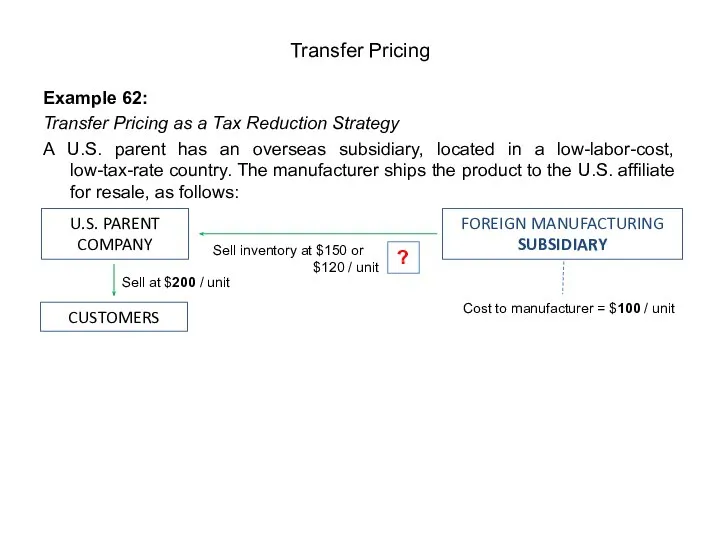

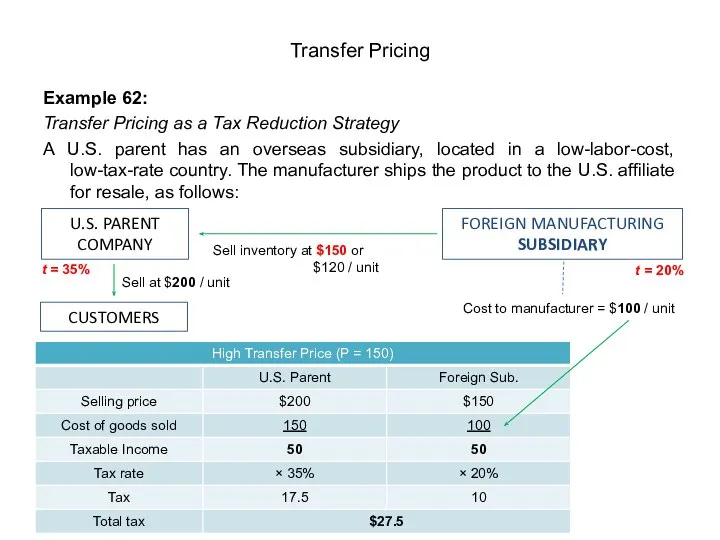

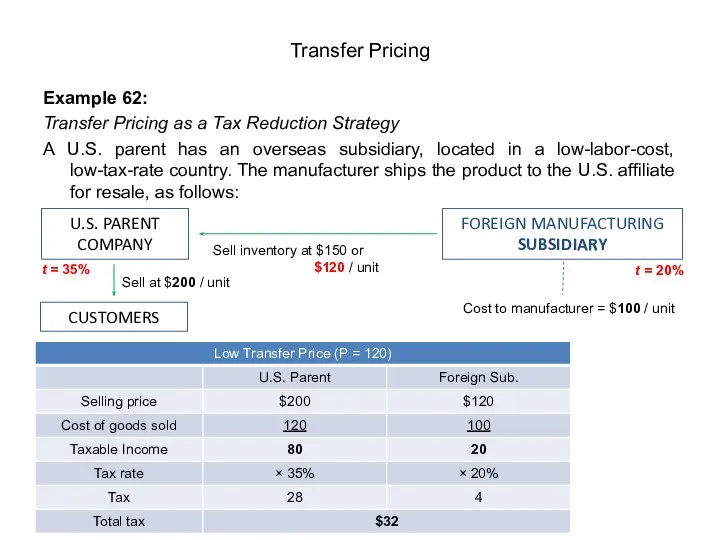

- 209. Example 62: Transfer Pricing as a Tax Reduction Strategy A U.S. parent has an overseas subsidiary,

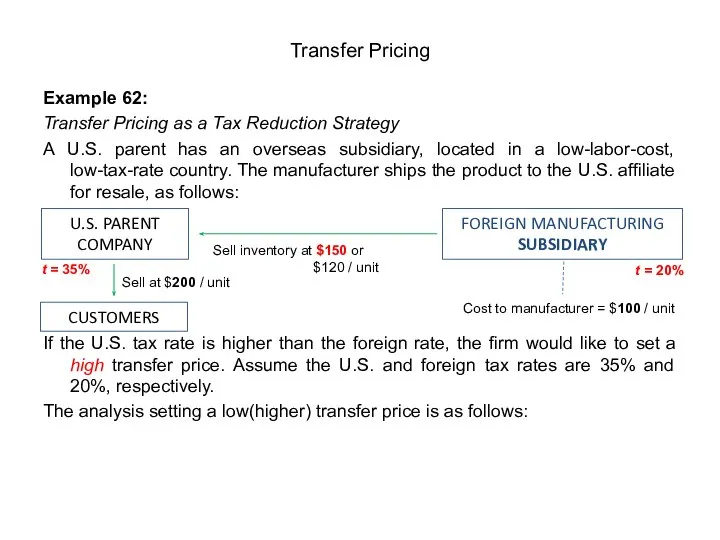

- 210. Example 62: Transfer Pricing as a Tax Reduction Strategy A U.S. parent has an overseas subsidiary,

- 211. Example 62: Transfer Pricing as a Tax Reduction Strategy A U.S. parent has an overseas subsidiary,

- 212. Example 62: Transfer Pricing as a Tax Reduction Strategy A U.S. parent has an overseas subsidiary,

- 213. Example 62: Transfer Pricing as a Tax Reduction Strategy A U.S. parent has an overseas subsidiary,

- 214. Transfer Pricing via Tax Haven Transfer pricing is a technique used by multinational corporations to shift

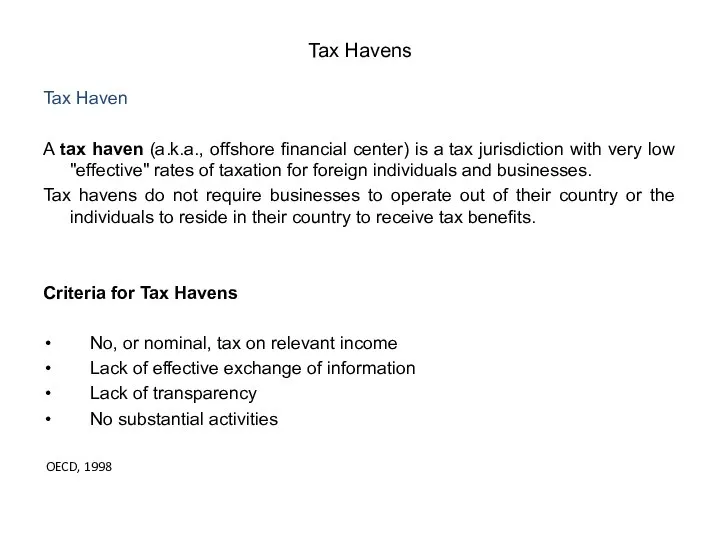

- 215. Tax Haven A tax haven (a.k.a., offshore financial center) is a tax jurisdiction with very low

- 217. Скачать презентацию

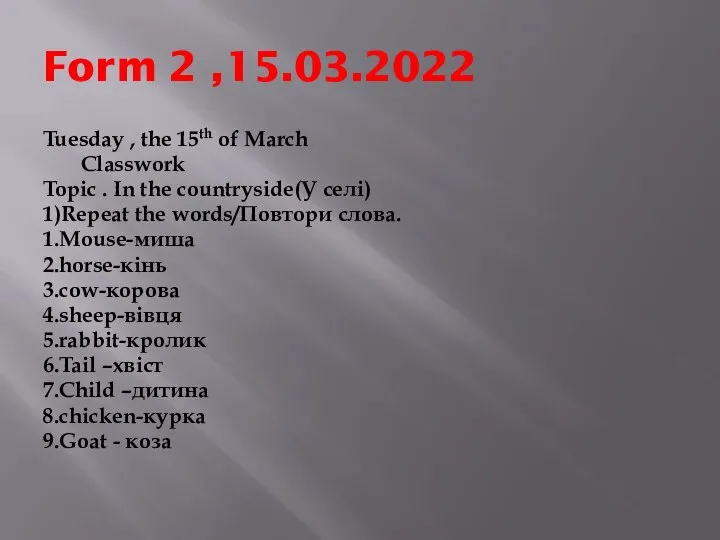

Слайд 2Chapter 1: TAXATION AND ITS ECONOMIC EFFECTS

Overview of Taxation Principles

A tax (from

Chapter 1: TAXATION AND ITS ECONOMIC EFFECTS

Overview of Taxation Principles

A tax (from

Most countries have a tax system in place to pay for public, common or agreed national needs and government functions.

Some levy a flat percentage rate of taxation on personal annual income, but most scale taxes based on annual income amounts.

Most countries charge a tax on individual income as well as on corporate income.

Countries often also impose wealth taxes, inheritance taxes, estate taxes, gift taxes, property taxes, sales taxes, payroll taxes or tariffs.

Слайд 3Tax Collection

In modern taxation systems, governments levy taxes in money; but in-kind

Tax Collection

In modern taxation systems, governments levy taxes in money; but in-kind

The method of taxation and the government expenditure of taxes raised is often highly debated in politics and economics.

Tax collection is performed by a government agency, for example:

Canada Revenue Agency,

Internal Revenue Service (IRS) in the United States,

Her Majesty's Revenue and Customs (HMRC) in the UK

Federal Tax Service in Russia

VID in Latvia.

When taxes are not fully paid, the state may impose civil penalties (such as fines or forfeiture) or criminal penalties (such as incarceration) on the non-paying entity or individual.

Слайд 4Purposes of Taxation

Purposes of Taxation

The levying of taxes aims to

raise revenue

Purposes of Taxation

Purposes of Taxation

The levying of taxes aims to

raise revenue

alter prices in order to affect demand.

Governments use money provided by taxation to carry out many functions, e.g.:

expenditures on economic infrastructure (roads, public transportation, sanitation, legal systems, public safety, education, health-care systems),

military,

scientific research,

culture and the arts,

public insurance, and

the operation of government itself.

A government's ability to raise taxes is called its fiscal capacity.

When expenditures exceed tax revenue, a government accumulates debt. A portion of taxes may be used to service past debts.

Слайд 5Economic Effects of Taxation

Economic Effects of Taxation

Imposition of taxes may have the

Economic Effects of Taxation

Economic Effects of Taxation

Imposition of taxes may have the

Taxes cause an income effect because they reduce purchasing power to taxpayers.

Taxes cause a substitution effect when taxation causes a substitution between taxed goods and untaxed goods.

Both buyers and sellers are worse off when a good is taxed:

A tax raises the price buyers pay and lowers the price sellers receive. This can be shown with the concept of a tax incidence.

Слайд 6Tax Incidence

Tax incidence is the division of the burden of a tax

Tax Incidence

Tax incidence is the division of the burden of a tax

When the government imposes a tax on the sale of a good or services, the price paid by buyers might rise by:

the full amount of the tax,

a lesser amount, or

not at all.

If the price paid by buyers rises by the full amount of the tax, then the burden of the tax falls entirely on buyers—the buyers pay the tax.

If the price paid by buyers rises by a lesser amount than the tax, then the burden of the tax falls partly on buyers and partly on sellers.

And if the price paid by buyers doesn’t change at all, then the burden of the tax falls entirely on sellers.

Economic Effects of Taxation

Слайд 7Example 1:

Tax on Sellers

Assume a tax per unit of $3 is levied

Example 1:

Tax on Sellers

Assume a tax per unit of $3 is levied

Economic Effects of Taxation

Слайд 9Consumers purchase 425 units and pay $6/unit. Effectively prices paid by consumers

Consumers purchase 425 units and pay $6/unit. Effectively prices paid by consumers

Producers sell 425 units at $6/unit but only pocket $3/unit after paying the tax. Effectively, their realized prices have fallen by $4 − $3 = $1. Producer surplus has therefore fallen by Rectangle C and Triangle D.

The government earns tax revenue of $3/unit on 425 units that are sold. So part of the loss in consumer surplus (Rectangle A) and producer surplus (Rectangle C) is transferred to the government.

However, some consumer surplus (Triangle B) and producer surplus (Triangle D) remains untransferred and is lost due to the imposition of the tax. These two triangles comprise society’s deadweight loss.

Even though this tax was levied on suppliers only, consumers and producers share the

actual burden of the tax as consumer and producer surplus both decline once the tax is

imposed.

Further, in our example, consumers actually end up bearing the brunt of the tax in the form of an effective increase in prices of $2, versus an effective decrease in producer realized prices of only $1. Note that consumer surplus transferred to the government, Rectangle A, is greater than producer surplus transferred to the government, Rectangle C. This is because the demand curve is steeper than the supply curve. If the supply curve were steeper, the reverse would be true regardless of whom the tax was imposed upon by law.

Economic Effects of Taxation

Слайд 10Example 2:

Why taxes result in deadweight losses

Imagine that Joe cleans Jane’s house

Example 2:

Why taxes result in deadweight losses

Imagine that Joe cleans Jane’s house

Now suppose that the government levies a €50 tax on the providers of cleaning services. There is now no price that Jane can pay Joe that will leave both of them better off. The most Jane would be willing to pay is €120, but then Joe would be left with only €70 after paying the tax, which is less than his €80 opportunity cost.

Conversely, for Joe to receive his opportunity cost of €80, Jane would need to pay €130, which is above the €120 value she places on a clean house. As a result, Jane and Joe cancel their arrangement. Joe goes without the income, and Jane lives in a dirtier house.

The tax has made Joe and Jane worse off by a total of €40 because they have each lost €20 of surplus. But note that the government collects no revenue from Joe and Jane because they decide to cancel their arrangement. The €40 is pure deadweight loss: It is a loss to buyers and sellers in a market that is not offset by an increase in government revenue. From this example, we can see the ultimate source of deadweight losses: Taxes cause deadweight losses because they prevent buyers and sellers from realizing some of the gains from trade.

Economic Effects of Taxation

Слайд 11Example 3:

Tax on Buyers

Now assume that instead of being levied upon producers,

Example 3:

Tax on Buyers

Now assume that instead of being levied upon producers,

Economic Effects of Taxation

Слайд 12The impact of a tax on a market outcome is the same

The impact of a tax on a market outcome is the same

When a tax is levied on buyers, the demand curve shifts downward by the size of the tax;

when it is levied on sellers, the supply curve shifts upward by that amount.

In either case, when the tax is enacted, the price paid by buyers rises, and the price received by sellers falls.

In the end, the elasticities of supply and demand determine how the tax burden is distributed between producers and consumers. This distribution is the same regardless of how it is levied.

Economic Effects of Taxation

Слайд 13Tax Incidence and Elasticity of Demand

The division of the tax between buyers

Tax Incidence and Elasticity of Demand

The division of the tax between buyers

Price elasticity of demand is a measure of the responsiveness of the quantity demanded of a good to a change in its price when all other influences on buying plans remain the same.

There are two extreme cases:

Perfectly inelastic demand Buyers pay the entire tax.

Perfectly elastic demand Sellers pay the entire tax.

Also, the more inelastic the demand (relative to supply), the larger is the buyers’ share of the tax.

See Fig. 1 and 2 (next slide)

Economic Effects of Taxation

Слайд 14Economic Effects of Taxation

Economic Effects of Taxation

Слайд 15Demand is perfectly inelastic at 100,000 doses a day, regardless of the

Demand is perfectly inelastic at 100,000 doses a day, regardless of the

If insulin is taxed at 20¢ a dose we must add the tax to the minimum price at which drug companies are willing to sell insulin. The result is the new supply curve S + tax.

When a tax is imposed on this good, buyers pay the entire tax.

Economic Effects of Taxation

Example 4:

Tax with Perfectly Inelastic Demand

Figure shows the market for insulin, a vital daily medication for those

with diabetes.

Слайд 16The demand for this good is perfectly elastic — the demand curve

The demand for this good is perfectly elastic — the demand curve

When a tax of 10¢ is imposed on this good, sellers pay the entire tax.

Economic Effects of Taxation

Example 5:

Tax with Perfectly Elastic Demand

Figure shows the market for pink marker pens.

Слайд 17Tax Incidence and Elasticity of Supply

The division of the tax between buyers

Tax Incidence and Elasticity of Supply

The division of the tax between buyers

The elasticity of supply measures the responsiveness of the quantity supplied to a change in the price of a good, when all other influences on selling plans remain the same.

Again, there are two extreme cases:

Perfectly inelastic supply Sellers pay the entire tax.

Perfectly elastic supply Buyers pay the entire tax.

Also, the more elastic the supply (relative to demand), the larger is the amount of the tax paid by buyers.

See Fig. 3 and 4 (next slide)

Economic Effects of Taxation

Слайд 19The supply of this good is perfectly inelastic at 100,000 bottles a

The supply of this good is perfectly inelastic at 100,000 bottles a

When a tax is imposed on this good at 5¢ a bottle, the supply curve does not change because the spring owners still produce 100,000 bottles a week, even though the price they receive falls. But buyers are willing to buy the 100,000 bottles only if the price is 50¢ a bottle, so the price does not change. The tax reduces the price received by sellers to 45¢ a bottle, and sellers pay the entire tax.

Economic Effects of Taxation

Example 6:

Tax with Perfectly Inelastic Supply

Figure shows the market for water from a mineral spring that flows at a constant rate that cannot be controlled.

Слайд 20The supply of this good is perfectly elastic — the supply curve

The supply of this good is perfectly elastic — the supply curve

When a tax of 1¢ a pound is imposed, we must add it to the minimum supply-price. Sellers are now willing to offer any quantity at 11¢ a pound along the curve S + tax. A new equilibrium is set at a price of 11¢ and 3,000 pounds a week. The tax has increased the price buyers pay by the full amount of the tax – 1¢ a pound – and has decreased the quantity sold. Buyers pay the entire tax.

Economic Effects of Taxation

Example 7:

Tax with Perfectly Elastic Supply

Figure shows the market for sand.

Слайд 21Example 8:

The burden of tax

Depending on the circumstance, the burden of tax

Example 8:

The burden of tax

Depending on the circumstance, the burden of tax

In the case of tobacco products, for example, demand is inelastic — because tobacco is an addictive substance — and taxes are mainly passed along to consumers in the form of higher prices.

Economic Effects of Taxation

Слайд 22In the tobacco example, the tax burden falls on the most inelastic

In the tobacco example, the tax burden falls on the most inelastic

When the demand is inelastic (see Fig. B), consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. In the case of smoking, the demand is inelastic because consumers are addicted to the product. The seller can then pass the tax burden along to consumers in the form of higher prices without much of a decline in the equilibrium quantity.

Economic Effects of Taxation

Слайд 23When a tax is introduced in a market with an inelastic supply

When a tax is introduced in a market with an inelastic supply

Economic Effects of Taxation

Слайд 24In Fig. A, the supply is inelastic and the demand is elastic

In Fig. A, the supply is inelastic and the demand is elastic

Economic Effects of Taxation

Слайд 25The tax revenue is given by the shaded area, which is obtained

The tax revenue is given by the shaded area, which is obtained

The tax incidence on the consumers is given by the difference between the price paid, Pc, and the initial equilibrium price, Pe.

The tax incidence on the sellers is given by the difference between the initial equilibrium price, Pe, and the price they receive after the tax is introduced, Pp.

Economic Effects of Taxation

Слайд 26In figure A, the tax burden falls disproportionately on the sellers, and

In figure A, the tax burden falls disproportionately on the sellers, and

Economic Effects of Taxation

Слайд 27On the other hand, if we go back to our example of

On the other hand, if we go back to our example of

Economic Effects of Taxation

Слайд 28Practice Problem 1:

The original equilibrium price is €3.00 and the equilibrium quantity

Practice Problem 1:

The original equilibrium price is €3.00 and the equilibrium quantity

The government then imposes a tax of €0.50 on the sellers. This leads to a new supply curve which is shifted upward by €0.50 compared to the original supply curve.

The new equilibrium price will be in the range between €3.00 and €3.50 and the equilibrium quantity will decrease.

Assume that the consumers pay €3.30 and the new equilibrium quantity is 90.

What is the price that sellers will receive after the tax is imposed?

Pp = Pc – tax

Pp = €3.30 – €0.50 = €2.80 (producers will keep €2.80)

What is the total tax revenue for the government?

The government will collect €0.50(90) = €45

3. Who shares more of the tax burden, sellers or buyers?

Buyers’ share of the tax burden is (€3.30 – €3.00)(90) = €27

Sellers’ share of the tax burden is (€3.00 – €2.80)(90) = €18

Economic Effects of Taxation

Слайд 29Other economic effects of taxation

Redistribution of Income

This effect is felt most in

Other economic effects of taxation

Redistribution of Income

This effect is felt most in

A proportional tax will not affect the distribution of income, but both progressive and regressive taxes will cause a change in income distribution.

With progressive taxes, the post-tax distribution of income is more equal than the pre-tax distribution, whereas with regressive taxes the post-tax distribution is more unequal than the pre-tax distribution.

Economic Effects of Taxation

Слайд 30Other economic effects of taxation

A Reduction in Incentive

It may be argued that

Other economic effects of taxation

A Reduction in Incentive

It may be argued that

However, it may be argued that workers may want to maintain their present standard of living or may have heavy financial commitments so that if income tax was increased, they would work for longer hours to make up for the income lost in tax.

There are, therefore, conflicting views on the effect of incentives.

Economic Effects of Taxation

Слайд 31Other economic effects of taxation

3. A Reduction in Business Activity

Entrepreneurs undertake investment

Other economic effects of taxation

3. A Reduction in Business Activity

Entrepreneurs undertake investment

If, however, profits are heavily taxed, the entrepreneurs may feel that it is not worth taking such risks and so they will be far more cautious in their attitudes.

Such caution may lead to reduced progress and efficiency with a consequent deterioration in the ability of domestic producers to complete with foreign rivals.

Economic Effects of Taxation

Слайд 32Other economic effects of taxation

4. Effects on the Ability to Work, Save

Other economic effects of taxation

4. Effects on the Ability to Work, Save

Imposition of taxes results in the reduction of disposable income of the taxpayers. This will reduce their expenditure on necessaries which are required to be consumed for the sake of improving efficiency.

As efficiency suffers ability to work declines. This ultimately adversely affects savings and investment. However, this happens in the case of poor persons.

Taxation on rich persons has the least effect on the efficiency and ability to work.

Note: Not all taxes, however, have adverse effects on the ability to work. There are some harmful goods, such as cigarettes, whose consumption has to be reduced to increase ability to work. That is why high rate of taxes are often imposed on such harmful goods to curb their consumption.

But all taxes adversely affect ability to save. Since rich people save more than the poor, progressive rate of taxation reduces savings potentiality. This means low level of investment. Lower rate of investment has a dampening effect on economic growth of a country.

Thus, on the whole, taxes have the disincentive effect on the ability to work, save and invest.

Economic Effects of Taxation

Слайд 33Other economic effects of taxation

It is suggested that effects of taxes upon

Other economic effects of taxation

It is suggested that effects of taxes upon

Income elasticity of demand measures the responsiveness of demand for a particular good to a change in income, holding all other things constant.

Income elasticity of demand varies from individual to individual.

If the income demand of an individual taxpayer is inelastic, a cut in income consequent upon the imposition of taxes will induce him to work more and to save more so that the lost income is at least partially recovered.

On the other hand, the desire to work and save of those people whose demand for income is elastic will be affected adversely.

Thus, we have conflicting views on the incentives to work. It would seem logical that there must be a disincentive effect of taxes at some point but it is not clear at what level of taxation that crucial point would be reached.

Economic Effects of Taxation

Слайд 34Laffer Curve

The Laffer Curve is a theory developed by supply-side economist Arthur

Laffer Curve

The Laffer Curve is a theory developed by supply-side economist Arthur

The Laffer Curve describes the relationship between tax rates and total tax revenue, with an optimal tax rate that maximizes total government tax revenue.

Economic Effects of Taxation

If taxes are too high along the Laffer Curve, then they will discourage the taxed activities, such as work and investment, enough to actually reduce total tax revenue.

In this case, cutting tax rates will both stimulate economic incentives and increase tax revenue.

Слайд 35Chapter 2: BASIC PRINCIPLES OF TAXATION

Goals of an Ideal Taxing System

Principles of

Chapter 2: BASIC PRINCIPLES OF TAXATION

Goals of an Ideal Taxing System

Principles of

The basic objective of taxation is to raise revenues to finance governments.

Governments also attempt to achieve other objectives in designing and implementing tax systems. These objectives are frequently complicated by the dynamics of political, economic, and social forces.

People designing tax systems have often considered the criteria for good taxation formulated by Adam Smith (1776):

Equality

Certainty

Convenience

Economy

Слайд 361. Equality

Taxpayers should bear a fair level of tax relative to their

1. Equality

Taxpayers should bear a fair level of tax relative to their

Equality can be defined in terms of horizontal and vertical equity.

Horizontal equity:

Two similarly situated taxpayers are taxed the same.

Example 9:

Bill’s income for the year consists solely of $15,000 in dividends. Ted’s income consists solely of $15,000 in interest income.

Both pay a tax rate of 15%, or $2,250 in taxes; there is horizontal equity.

Example 10:

Corporation A has net income from the sales of widgets of $15,000. Corporation B has net income of $15,000 from the performance of services.

Both pay a tax of $2,250; there is horizontal equity.

Canons of Taxation

Слайд 37Vertical equity:

When taxpayers are in different economic positions, the taxpayer with the

Vertical equity:

When taxpayers are in different economic positions, the taxpayer with the

Example 11:

Refer back to Example 9. Assume, in addition to the $15,000 of income, Bill has an additional $45,000 of dividend income, giving him a total of $60,000 in income.

If he is still taxed a 15% rate, there is no vertical equity;

if he is taxed a higher rate (say, 25%) there may be vertical equity, since Bill pays proportionately more taxes than Ted.

Note:

Income taxes tend to be progressive. That is, higher tax rates apply when there are higher levels of the amount being taxed. For income taxes, this amount—called the tax base—is taxable income.

However, consumption-related taxes (such as VAT) are rarely progressive (and are often considered regressive) because there is typically only one tax rate.

Canons of Taxation

Слайд 382. Certainty

Taxpayer knows when, how, and how much tax is paid.

It

2. Certainty

Taxpayer knows when, how, and how much tax is paid.

It

3. Convenience

Taxes should be levied at the time it is most likely to be convenient for the taxpayer to make the payment. This generally occurs as they receive income because this is when they are most likely to have the ability to pay.

e.g. tax on dividends is usually paid when dividends are received and tax on capital gains is paid when shares are sold

4. Economy

A tax should have minimum compliance and administrative costs. That is, it should require a minimum of time and effort for the taxpayer to calculate and pay the tax. Administrative costs are expenses incurred by the government to collect the tax. Compliance and administrative costs are highest for income taxes, because of their complexity.

Canons of Taxation

Слайд 39Tax Base

Taxes are computed by multiplying the tax rate by the tax

Tax Base

Taxes are computed by multiplying the tax rate by the tax

Tax base is the amount that is subject to tax.

For income taxes, the tax base is taxable income, defined roughly as income less allowable expenses.

For property taxes, the tax base is some measure of the value of the property.

Consumption taxes, such as VAT and sales tax, are most often based on the sales price of the merchandise sold.

For payroll taxes, a common tax base is employment compensation.

Framework for Understanding Taxes

Слайд 40Tax Deduction

Tax deduction is a reduction of income that is able to

Tax Deduction

Tax deduction is a reduction of income that is able to

e.g. A tax deduction reduces the taxable income of a taxpayer. If a single filer’s taxable income for the tax year is $75,000 and he falls in the 25% marginal tax bracket, his total marginal tax bill will be 25% x $75,000 = $18,750. However, if he qualifies for an $8,000 tax deduction, he will be taxed on $75,000 - $8,000 = $67,000 taxable income, not $75,000. The reduction of his taxable income is a tax relief for the taxpayer who ends up paying less in taxes to the government.

Tax Credit

Tax credit is a tax relief that provides more tax savings for an entity than a tax deduction as it directly reduces a taxpayer’s bill, rather than just reducing the amount of income subject to taxes.

In other words, a tax credit is applied to the amount of tax owed by the taxpayer after all deductions are made from his or her taxable income.

e.g. If an individual owes $3,000 to the government and is eligible for a $1,100 tax credit, he will only have to pay $1,900 after the tax relief is applied.

Framework for Understanding Taxes

Слайд 41Example 12:

Tax Credit (U.S. Example)

As the simplified example in the table shows,

Example 12:

Tax Credit (U.S. Example)

As the simplified example in the table shows,

Framework for Understanding Taxes

Слайд 42Tax Rates

For most taxes there are four types of tax rates:

statutory rates

marginal

Tax Rates

For most taxes there are four types of tax rates:

statutory rates

marginal

average rates

effective rates

Statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate.

Marginal tax rate is the tax rate that will be paid on the next dollar of tax base (i.e., the rate on the next dollar of income for income taxes).

Average tax rate is computed as the total tax divided by the total tax base.

Framework for Understanding Taxes

Слайд 43Example 13:

At the end of the year, XYZ Corporation has taxable income

Example 13:

At the end of the year, XYZ Corporation has taxable income

1. What is the marginal tax rate?

Marginal tax rate on this income is 25%.

2. What is the average tax rate?

Average tax rate is ($7,500 + $5,000) / $70,000 = 17.9%

Effective tax rate is the average tax rate paid by a corporation or an individual.

The effective tax rate for individuals is the average rate at which their earned income, such as wages, and unearned income, such as stock dividends, are taxed.

The effective tax rate for a corporation is the average rate at which its pre-tax profits are taxed.

Framework for Understanding Taxes

Слайд 44Example 14:

Effective tax rate

The company reports the following financial data:

Assume that the

Example 14:

Effective tax rate

The company reports the following financial data:

Assume that the

As a result, the effective tax rate is reduced by 6 percentage points from 40% to 34% (= 2.04m / 6m) and the after-tax profit increases by 10% to €3,960,000 (= 6,000,000 – 2,040,000).

Framework for Understanding Taxes

Слайд 45Effective Tax Rate vs. Marginal Tax Rate

The effective tax rate is a

Effective Tax Rate vs. Marginal Tax Rate

The effective tax rate is a

The marginal tax rate refers to the highest tax bracket into which their income falls.

In a progressive income-tax system, income is taxed at differing rates that rise as income reaches certain thresholds. Two individuals or companies with income in the same upper marginal tax bracket may end up with very different effective tax rates, depending on how much of their income was in the top bracket.

Framework for Understanding Taxes

Слайд 46Example 15:

Assume the progressive income-tax system, where taxes are imposed as follows:

Example 15:

Assume the progressive income-tax system, where taxes are imposed as follows:

Consider two individuals whose taxable income exceeds $300,000, so both individuals hit the upper tax bracket of 25%.

Assume that individual A has taxable income of $500,000, while individual B has taxable income of $360,000.

For individual A, the overall tax liability would be:

($100,000 – $0) × 0.1 + ($300,000 – $100,000) × 0.15 + ($500,000 – $300,000) × 0.25 = 10,000 + 30,000 + 50,000 = $90,000,

For individual B, the tax liability would be:

($100,000 – $0) × 0.1 + ($300,000 – $100,000) × 0.15 + ($360,000 – $300,000) × 0.25 = 10,000 + 30,000 + 15,000 = $55,000,

While both individuals might say they're in the 25% bracket, the one with the higher income has an effective tax rate of 18% ($90,000 in tax divided by $500,000 in income), while the other's effective tax rate is 15.3% ($55,000 divided by $360,000).

Framework for Understanding Taxes

Слайд 47Tax Rate Structures

In most tax jurisdictions, a tax rate structure applies to

Tax Rate Structures

In most tax jurisdictions, a tax rate structure applies to

Investment income is often taxed differently based on the nature of the income: interest, dividends, or capital gains and losses.

Tax rates vary from country to country. Some countries implement a progressive tax system, while others use regressive or proportional tax rates.

A regressive tax system is one in which the tax rate increases as the taxable amount decreases.

A regressive tax is a tax applied uniformly, taking a larger percentage of income from low-income earners than from high-income earners.

Note: A regressive tax affects people with low incomes more severely than people with high incomes because it is applied uniformly to all situations, regardless of the taxpayer. While it may be fair in some instances to tax everyone at the same rate, it is seen as unjust in other cases. As such, most income tax systems employ a progressive schedule that taxes high-income earners at a higher percentage rate than low-income earners, while other types of taxes are uniformly applied.

Framework for Understanding Taxes

Слайд 48Though many countries have a progressive tax regime when it comes to

Though many countries have a progressive tax regime when it comes to

e.g., in the U.S., some of regressive taxes include state sales taxes, user fees, and, to some degree, property taxes.

Example 16:

U.S. Sales tax (regressive)

Governments apply sales tax uniformly to all consumers based on what they buy. Even though the tax may be uniform (such as a 7% sales tax), lower-income consumers are more affected.

For example, imagine two individuals each purchase $100 of clothing per week, and they each pay $7 in tax on their retail purchases. The first individual earns $2,000 per week, making the sales tax rate on her purchase 0.35% of income. In contrast, the other individual earns $320 per week, making her clothing sales tax 2.2% of income. In this case, although the tax is the same rate in both cases, the person with the lower income pays a higher percentage of income, making the tax regressive.

Framework for Understanding Taxes

Слайд 49Example 17:

U.S. User Fees (regressive)

User fees levied by the U.S. government are

Example 17:

U.S. User Fees (regressive)

User fees levied by the U.S. government are

For example, if two families travel to the Grand Canyon National Park and pay a $30 admission fee, the family with the higher income pays a lower percentage of its income to access the park, while the family with the lower income pays a higher percentage. Although the fee is the same amount, it constitutes a more significant burden on the family with the lower income, again making it a regressive tax.

Example 18:

Property Taxes (regressive)

Property taxes are fundamentally regressive because, if two individuals in the same tax jurisdiction live in properties with the same values, they pay the same amount of property tax, regardless of their incomes.

However, they are not purely regressive in practice because they are based on the value of the property. Generally, it is thought that lower income earners live in less expensive homes, thus partially indexing property taxes to income.

Framework for Understanding Taxes

Слайд 50Other examples of regressive taxes

Gambling taxes

Those on low incomes have a

Other examples of regressive taxes

Gambling taxes

Those on low incomes have a

Fuel tax

Those on high income may spend more on petrol, but it is unlikely to be too significant, therefore as your income rises, the percentage of income going on petrol tax is likely to fall.

Sin taxes

Taxes levied on products that are deemed to be harmful to society.

These are added to the prices of goods like alcohol and tobacco in order to dissuade people from using them.

These taxes are generally regressive, because they are more burdensome to low-income earners rather than their high-income counterparts.

Framework for Understanding Taxes

Слайд 51A progressive tax system is one in which the average tax rate

A progressive tax system is one in which the average tax rate

Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay.

Example 19:

U.S. Tax Rates and Brackets, 2019

Framework for Understanding Taxes

Слайд 52Example 20:

Calculation of Tax Due on Taxable Income (progressive tax structure)

In

Example 20:

Calculation of Tax Due on Taxable Income (progressive tax structure)

In

If an individual has taxable income of €60,000, the first €15,000 is taxed at 23%; the next €13,000 is taxed at 27%, and so on. The amount of tax due on taxable income of €60,000 would be:

(€15,000 – €0) × 0.23 + (€28,000 – €15,000) × 0.27 + (€55,000 – €28,000) × 0.38 +

+ (€60,000 – €55,000) × 0.41 = €19,270

This would represent average tax rate of 32.12% (€19,270/ €60,000).

Framework for Understanding Taxes

Слайд 53A proportional tax system (a.k.a., flat tax system) is the one in

A proportional tax system (a.k.a., flat tax system) is the one in

The amount of the tax is in proportion to the amount subject to taxation, so that the marginal tax rate is equal to the average tax rate.

Proponents of proportional taxes believe they stimulate the economy by encouraging people to work more because there's no tax penalty for earning more.

They also believe that businesses are likely to spend and invest more under a flat tax system, thus stimulating the economy.

Example 21:

Proportional Tax Rate System

In a proportional tax system, all taxpayers are required to pay the same percentage of their income in taxes. For example, if the rate is set at 20%, a taxpayer earning $10,000 pays €2,000 and a taxpayer earning €50,000 pays €10,000. Similarly, a person earning €1 million would pay €200,000.

Framework for Understanding Taxes

Слайд 54Important Principles and Concepts in Tax Law

Most tax systems have developed around

Important Principles and Concepts in Tax Law

Most tax systems have developed around

Ability-to-Pay Principle

Under the ability-to-pay principle, the tax is based on what a taxpayer can

afford to pay.

One concept that results from this is that taxpayers are generally taxed on their net incomes.

Example 22:

Ability-to-Pay Principle

X and Y firms each have sales revenues of €500,000. Expenses for the two firms are €100,000 and €300,000, respectively. Firm X will pay more taxes, because it has greater net income and cash flows, and thus can afford to pay more.

Framework for Understanding Taxes

Слайд 55Entity Principle

Under the entity principle, an entity (such as a corporation)

Entity Principle

Under the entity principle, an entity (such as a corporation)

As such, the operations, record keeping, and taxable incomes of the entity and its owners (or affiliates) are separate.

Example 23:

Entity Principle

An entrepreneur forms a corporation that develops and sells the entrepreneur’s software products. During the year, the corporation has $200,000 in revenue and $50,000 in expenses. The entrepreneur also has a salary of $100,000.

The corporation will file a corporate tax return showing $50,000 in taxable income, and the entrepreneur will file an individual tax return showing $100,000 of income.

Framework for Understanding Taxes

Слайд 56Arm’s Length Principle

The condition or the fact that the parties to

Arm’s Length Principle

The condition or the fact that the parties to

Arm’s Length Transaction

A business deal in which the buyers and sellers act independently and do not have any relationship to each other. The concept of an arm's length transaction assures that both parties in the deal are acting in their own self-interest and are not subject to any pressure from the other party.

Note: Deals between family members or companies with related shareholders are usually not considered arm's length transactions.

Tax laws throughout the world are designed to treat the results of a transaction differently when parties are dealing at arm's length and when they are not.

e.g., if the sale of a house between father and son is taxable, tax authorities may require the seller to pay taxes on the gain he would have realized had he been selling to a neutral third party. They would disregard the actual price paid by the son.

Framework for Understanding Taxes

Слайд 57Example 24:

Arm’s Length Principle

Assume that in Example 23 the corporation pays its

Example 24:

Arm’s Length Principle

Assume that in Example 23 the corporation pays its

Suppose that a reasonable salary for a president of a small software company is $100,000.

The effect of the salary is to reduce the corporation’s taxable income to zero, so that it does not have to pay any taxes. While salaries in such closely held corporations are deductible in general, in this case the arm’s length test is not met.

As a result, only $100,000 (i.e., the reasonable portion) of the salary will be deductible by the corporation. The remaining $150,000 will be considered a dividend.

Arm's Length vs. Arm-in-Arm Transactions

In determining whether the arm’s length rule is likely to be violated with regard to expenses and losses, tax authorities look to see if the transaction is between related taxpayers.

Related taxpayers generally include individuals related by blood and marriage, and business entities owned more than 50% by a single entity or individual.

Framework for Understanding Taxes

Слайд 58Example 25:

Arm’s Length Test

Assume that an entrepreneur sells an asset to his

Example 25:

Arm’s Length Test

Assume that an entrepreneur sells an asset to his

Since the loss is not between related taxpayers, it may be considered arm’s length.

In applying the ownership test, constructive ownership is considered. That is, indirect ownership and chained ownership are considered.

Example 26:

Arm’s Length Test

Assume the same facts as Example 25, except that the other 51% of the stock is owned by Z Corporation, which is owned 100% by the entrepreneur.

By the rules of attribution and constructive ownership, the entrepreneur is considered to own 100% of the stock: by direct ownership in the first corporation, plus the stock owned by the Z Corporation.

Thus, the transaction is not arm’s length, and none of the loss would be deductible.

Framework for Understanding Taxes

Слайд 59Arm’s Length Principle: Business Expenses

Ordinary and necessary business expenses are deductible only

Arm’s Length Principle: Business Expenses

Ordinary and necessary business expenses are deductible only

Tax authorities have interpreted this requirement to mean that an expenditure is not reasonable when it is extravagant or exorbitant.

If the expenditure is extravagant in amount, it may be presumed that the excess amount is spent for personal rather than business reasons and, therefore, is not deductible.

Generally, tax authorities test for extravagance by comparing the amount of the expense to a market price or an arm’s length amount.

If the amount of the expense is within the range of amounts typically charged in the market by unrelated persons, the amount is considered to be reasonable.

Framework for Understanding Taxes

Слайд 60Example 27:

Business Deductions

Assume John hired four part-time employees and paid them $10

Example 27:

Business Deductions

Assume John hired four part-time employees and paid them $10

When things finally slowed down in late fall, John released his four part-time employees. John paid a total of $22,000 in compensation to the four employees.

He still needed some extra help now and then, so he hired his brother, Devin, on a part-time basis. Devin performed the same duties as the prior part-time employees (his quality of work was about the same). However, John paid Devin $25 per hour because Devin is a college student and John wanted to provide some additional support for Devin’s education.

At year-end, Devin had worked a total of 100 hours and received $2,500 from John.

Question:

What amount can John deduct for the compensation he paid to his employees?

Answer:

$23,000. John can deduct the entire $22,000 paid to the four part-time employees. However, he can only deduct $10 an hour for Devin’s compensation because the extra $15 per hour John paid Devin is unreasonable in amount. Hence, John can deduct a total of $23,000 for compensation expense this year [$22,000 + ($10 × 100)].

Framework for Understanding Taxes

Слайд 61All-Inclusive Income Principle

This principle basically means that if some simple tests

All-Inclusive Income Principle

This principle basically means that if some simple tests

The tests are as follows (each test must be met if an item is considered to be income):

Does it seem like income?

This test is meant to eliminate things that cannot be income.

Is there a transaction with another entity?

This test is the realization principle from accounting; that is, for income to be recognized, there must be a measurable transaction with another entity.

Framework for Understanding Taxes

For example, making an expenditure cannot generate income.

Слайд 62Example 28:

Realization Principle

A corporation owns two assets that have gone up in

Example 28:

Realization Principle

A corporation owns two assets that have gone up in

It sells the stock for its fair market value, but not the land.

Income is recognized only on the stock; there has been no realization on the land.

Is there an increase in wealth?

This test means that unless there is a change in net wealth, no income will be recognized. This eliminates a number of transactions from taxation.

Example 29:

Increase-in-wealth test

A corporation borrows $5 million from a bank, issues $1 million in common stock, and floats a bond issue for which it receives $10 million. Although each of these transactions involves cash inflows and transactions with other entities, there is no change in net wealth. This because for each of the three cash inflows, there is an offsetting increase in liabilities (or equity) payable.

Framework for Understanding Taxes

Слайд 63Business Purpose Concept

Relates to tax deductions.

Here, business expenses are deductible only if

Business Purpose Concept

Relates to tax deductions.

Here, business expenses are deductible only if

Example 30:

Business Purpose Test

An entrepreneur owns 100% of the stock of her corporation. She has the corporation buy an aircraft to facilitate any out-of-town business trips she might make. The entrepreneur, who also happens to enjoy flying as a hobby, rarely makes out-of-town business trips.

Since the plane will not really help the business, and there is a tax-avoidance motive (the plane would generate tax-depreciation deductions), there is no business purpose to the aircraft. Accordingly, any expenses related to the aircraft, including depreciation, are nondeductible.

Framework for Understanding Taxes

Слайд 64Tax-Benefit Rule

Under the tax-benefit rule, if a taxpayer receives a refund of

Tax-Benefit Rule

Under the tax-benefit rule, if a taxpayer receives a refund of

Example 31:

Tax-Benefit Rule

A company pays a consulting firm $100,000 for consulting services in one year. Because this is a normal business expense, the corporation takes a tax deduction for $100,000.

Early the next year, the consulting firm realizes it has made a billing mistake and refunds $20,000 of the fees.

The $20,000 is taxable income to the corporation in second year because it received a tax benefit in the prior year.

Framework for Understanding Taxes

Слайд 65Substance over Form Doctrine

Under the doctrine of substance over form, even when

Substance over Form Doctrine

Under the doctrine of substance over form, even when

Example 32:

Substance over Form Doctrine

An entrepreneur is the sole stockholder of his corporation. The corporation never pays dividends to the entrepreneur, and instead, each year it pays out 100% of the corporation’s net income as a salary to the entrepreneur (who also serves as company’s chief executive officer).

The doctrine of substance over form empowers tax authorities to tax at least part of the salary as if it were a dividend.

Framework for Understanding Taxes

Слайд 66Pay-As-You-Earn Concept (PAYE)

Taxpayers must pay part of their estimated annual tax liability

Pay-As-You-Earn Concept (PAYE)

Taxpayers must pay part of their estimated annual tax liability

For individuals, the most common example is income tax withholding.

Typically, withholding is required to be done by the employer of someone else, taking the tax payment funds out of the employee or contractor's salary or wages. The withheld taxes are then paid by the employer to the government body that requires payment, and applied to the account of the employee, if applicable.

This ensures the taxes will be paid first and will be paid on time, rather than risk the possibility that the tax-payer might default at the time when tax falls due.

Note:

In most countries, amounts withheld are determined by employers but subject to government review.

Framework for Understanding Taxes

Слайд 67Taxation of Gains and Losses on Property Sale

In virtually every tax jurisdiction,

Taxation of Gains and Losses on Property Sale

In virtually every tax jurisdiction,

Gain or loss is computed as

The adjusted basis of the property given is computed as

Framework for Understanding Taxes

Original basis +

Capital improvements −

Accumulated depreciation −

Other recoveries of investments (such as write-offs for casualty losses)

= Adjusted basis

Amount realized (the value of what is received)

− Adjusted basis of property given

= Gain or loss

The original basis usually is the original purchase price.

Capital improvements are additions that have an economic life beyond one year.

Accumulated depreciation applies only in the case of an asset used in business (see ex.).

Слайд 68Example 33:

Calculation of Gain / Loss

A corporation buys a factory building for

Example 33:

Calculation of Gain / Loss

A corporation buys a factory building for

Framework for Understanding Taxes

Слайд 69Chapter 3: PERSONAL INCOME TAX

Definition of Personal Income Tax

According to OECD, tax

Chapter 3: PERSONAL INCOME TAX

Definition of Personal Income Tax

According to OECD, tax

Throughout its history it is the tax that generates and has generated the most revenue for governments of the developed countries.

Personal income tax calculations as well as personal income tax rates may vary significantly depending on a tax jurisdiction.

Taxation rates may vary by type or characteristics of the taxpayer.

Individuals are often taxed at different rates than corporations. Individuals include only human beings.

Residents are generally taxed differently from non-residents.

Слайд 70Example 34:

Personal Income Tax Calculation (U.S. example)

Resident alien husband and wife with

Example 34:

Personal Income Tax Calculation (U.S. example)

Resident alien husband and wife with

Personal Income Tax Calculation Examples

Taxpayer’s income from salary and interest ($144, 100) is taxed at ordinary tax rates, see Schedule Y-1, Appendix 1. Here, taxpayer is in 22% tax bracket

Слайд 71The calculation of personal income taxes due (or refund) is based on

The calculation of personal income taxes due (or refund) is based on

Personal Income Tax Calculation Examples

Gross income

Minus: For AGI (above the line) deductions

Equals: Adjusted gross income (AGI)

Minus: From AGI (below the line) deductions:

(1) Greater of

(a) Standard deduction or

(b) Itemized deductions and

(2) Deduction for qualified business income

Equals: Taxable income

Times: Tax rates

Equals: Income tax liability

Plus: Other taxes

Equals: Total tax

Minus: Tax Credits

Minus: Tax Prepayments

Equals: Taxes due or (refund)

Source: Spilker, Ayers: Taxation of Individuals and Business Entities, McGraw-Hill, 2019 Edition

1

2

3

4

5

6

7

Слайд 72Explanations:

Gross income may include:

income from a job,

business income,

retirement income,

interest

Explanations:

Gross income may include:

income from a job,

business income,

retirement income,

interest

dividend income, and

capital gains from selling investments.

One type of income may be taxed at a different rate than another type of income depending on whether income is ordinary or capital.

Note: Examples of ordinary income are compensation for services, business income, retirement income. Ordinary income (loss) is taxed at ordinary tax rates (also depending on the family status), see App.1 (next slide).

Examples of capital income are gains and losses on the disposition or sale of capital assets.

If the gain is a long-term capital gain, it is generally taxed at a 15% tax rate (taxed at 20% for high-income taxpayers and 0% for low-income taxpayers).

If the gain is a short-term capital gain, the gain is taxed at ordinary income rates.

Personal Income Tax Calculation Examples

Based on the all-inclusive income principle. Under this principle, gross income generally includes all realized income from whatever source derived.

Realized income is income generated in a transaction with a second party in which there is a measurable change in property rights between parties (for example, appreciation in a stock investment would not represent realized income unless the taxpayer sold the stock).

1

Слайд 73Appendix 1

Source: Spilker, Ayers: Taxation of Individuals and Business Entities, McGraw-Hill, 2019

Appendix 1

Source: Spilker, Ayers: Taxation of Individuals and Business Entities, McGraw-Hill, 2019

Слайд 74Exclusions and Deferrals

Certain tax provisions allow taxpayers to permanently exclude specific types

Exclusions and Deferrals

Certain tax provisions allow taxpayers to permanently exclude specific types

Examples of exclusions:

Interest income from municipal bonds

Gifts and inheritance

Gain on sale of personal residence

Examples of deferrals:

Installment sale

Personal Income Tax Calculation Examples

Слайд 75Adjusted Gross Income (AGI)

It can be shown that

Some common For AGI

Adjusted Gross Income (AGI)

It can be shown that

Some common For AGI

Contribution to individual retirement account (IRA)

Health insurance deduction for self-employed taxpayers

Rental expenses

Capital losses (net losses limited to $3,000 for the year)

Personal Income Tax Calculation Examples

Gross Income

– For AGI Deductions

= AGI

2

Слайд 76From AGI Deductions

After calculating AGI, the taxpayer can then apply:

standard deductions to

From AGI Deductions

After calculating AGI, the taxpayer can then apply:

standard deductions to

itemized deductions, which can be better for the taxpayer in some situations.

Standardized Deduction

A fixed amount which varies by taxpayer filing status:

Personal Income Tax Calculation Examples

Every year the government indexes this deduction for

inflation.

See how the standard deduction of $24,400 is applied in Example 34.

3

Слайд 77Itemized Deduction

An expenditure on eligible products, services, or contributions that can be

Itemized Deduction

An expenditure on eligible products, services, or contributions that can be

Primary categories of itemized deductions are:

Medical and dental expenses

Taxes, e.g., state and local income taxes, sales taxes, real estate taxes, personal property taxes, and other taxes (an aggregate $10,000 deduction limitation applies to taxes).

Interest expense (mortgage and investment interest expense)

Gifts to charity

Deduction for Qualified Business Income

This deduction applies to individuals with qualified business income (QBI) from flow-through entities, including partnerships, S corporations, or sole proprietorships. This is a deduction for individuals not for business entities.

In general, a taxpayer can deduct 20% of the amount of QBI allocated to them from the entity, subject to certain limitations.

Personal Income Tax Calculation Examples

Note: Taxpayers generally deduct the higher of the standard deduction or itemized deductions.

Слайд 78Tax Rates

After determining taxable income, taxpayers can generally calculate their regular

Tax Rates

After determining taxable income, taxpayers can generally calculate their regular

However, as shown above, certain types of income included in taxable income are taxed at rates different from those in tax rate schedules (e.g., 15% tax applicable to capital gains, see. Ex.34).

Other Taxes

In addition to the individual income tax, individuals may also be required to pay other taxes such as the alternative minimum tax (AMT) or self-employment taxes. These taxes are imposed on tax bases other than the individual’s regular taxable income.

Tax Credits