Содержание

- 2. International Trade Theory What is international trade? Exchange of raw materials and manufactured goods (and services)

- 3. Classical Trade Theories Mercantilism (pre-16th century) Takes an us-versus-them view of trade Other country’s gain is

- 4. The New Trade Theory As output expands with specialization, an industry’s ability to realize economies of

- 5. New Trade Theory Global Strategic Rivalry Firms gain competitive advantage trough: intellectual property, R&D, economies of

- 6. Mercantilism/Neomercantilism Prevailed in 1500 - 1800 Export more to “strangers” than we import to amass treasure,

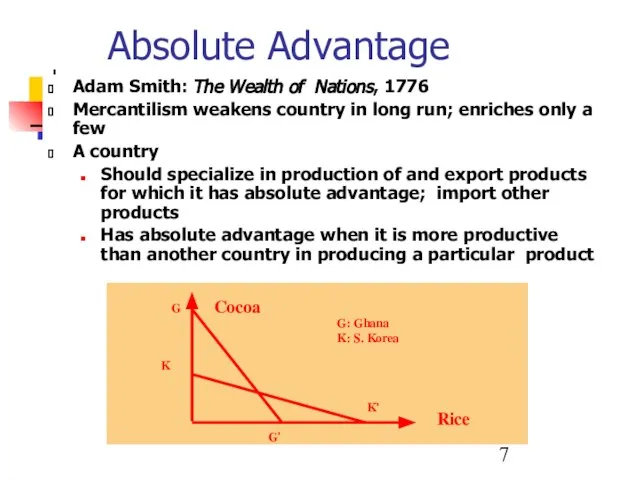

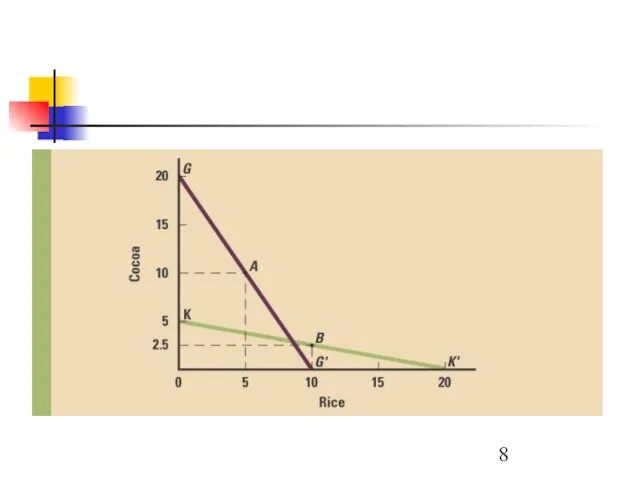

- 7. Absolute Advantage Adam Smith: The Wealth of Nations, 1776 Mercantilism weakens country in long run; enriches

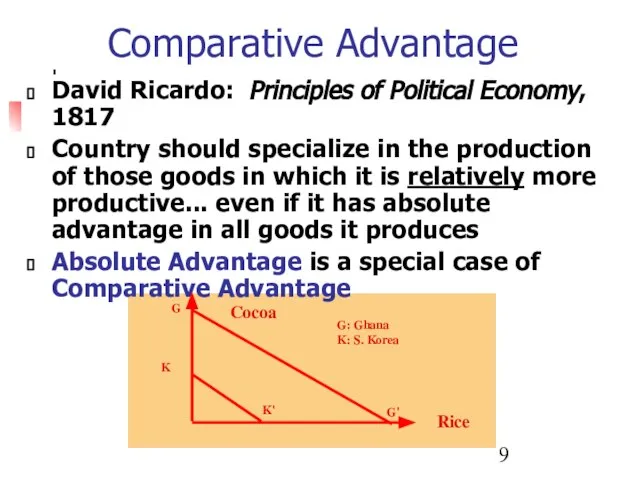

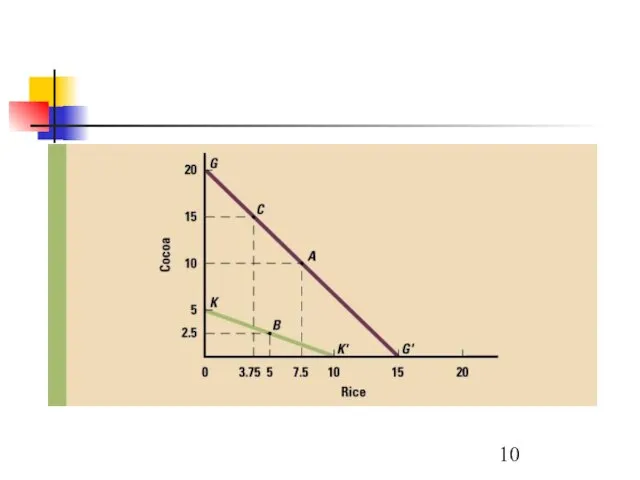

- 9. Comparative Advantage David Ricardo: Principles of Political Economy, 1817 Country should specialize in the production of

- 11. Heckscher (1919)-Ohlin (1933) Differences in factor endowments not on differences in productivity determine patterns of trade

- 12. Theory of Relative Factor Endowments (Heckscher-Ohlin) Factor endowments vary among countries Products differ according to the

- 13. International Product Life-Cycle (Vernon) Most new products conceived / produced in the US in 20th century

- 14. Classic Theory Conclusion Free Trade expands the world “pie” for goods/services Theory Limitations: Simple world (two

- 15. New Trade Theories Increasing returns of specialization due to economies of scale (unit costs of production

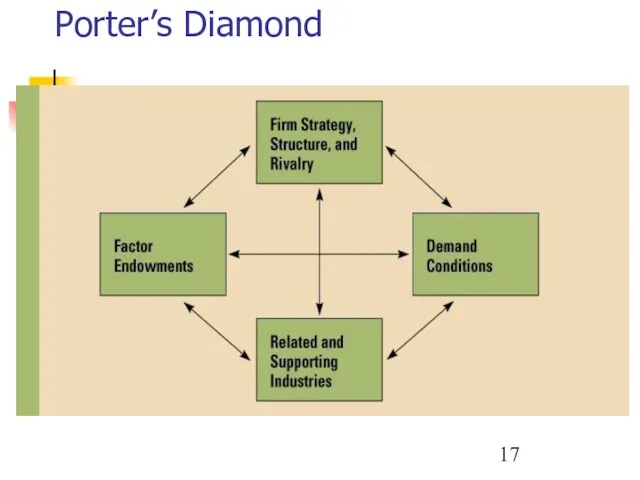

- 16. National Competitive Advantage (Porter, 1990) Factor endowments land, labor, capital, workforce, infrastructure (some factors can be

- 17. Porter’s Diamond

- 19. Скачать презентацию

Games people play: negotiations

Games people play: negotiations Самоанализ результатов управленческой деятельности

Самоанализ результатов управленческой деятельности Анализ тенденций развития химии на примере анализа Нобелевских премий по химии

Анализ тенденций развития химии на примере анализа Нобелевских премий по химии Губительная Сигарета

Губительная Сигарета Презентация на тему Биография Марина Цветаева

Презентация на тему Биография Марина Цветаева Фестиваль подводных профессий Погружение в Арктику

Фестиваль подводных профессий Погружение в Арктику chat-bot

chat-bot Лавка чудесных подарков. Магазин необычных подарков

Лавка чудесных подарков. Магазин необычных подарков О С Т Е О П О Р О З

О С Т Е О П О Р О З История и символика древнерусской иконописи

История и символика древнерусской иконописи Планирование и организация инновационного процесса на предприятии. Освоение новых видов продукции

Планирование и организация инновационного процесса на предприятии. Освоение новых видов продукции ПОЛИТОЛОГИЯ

ПОЛИТОЛОГИЯ Характеристика товара. Логистическая технология хранения готовой продукции

Характеристика товара. Логистическая технология хранения готовой продукции Маяковский В. В. Богоборческие мотивы в творчестве

Маяковский В. В. Богоборческие мотивы в творчестве Эмоциональные и волевые процессы

Эмоциональные и волевые процессы Число "Пи" в современной математике

Число "Пи" в современной математике Как искать работу и представлять себя на рынке труда Марина Маковий, директор Headhunter.COM.UA

Как искать работу и представлять себя на рынке труда Марина Маковий, директор Headhunter.COM.UA  Исследование эффективности применяемых в настоящее время устройств компенсации емкостного тока

Исследование эффективности применяемых в настоящее время устройств компенсации емкостного тока  Конфликты в менеджменте

Конфликты в менеджменте «Плотоядные» растения

«Плотоядные» растения Коммерческие сделки: понятие, виды, технология заключения

Коммерческие сделки: понятие, виды, технология заключения Механизм чтения и его составляющие

Механизм чтения и его составляющие Архитектура

Архитектура Государственньй бюджет

Государственньй бюджет Volvo Financial Services в России

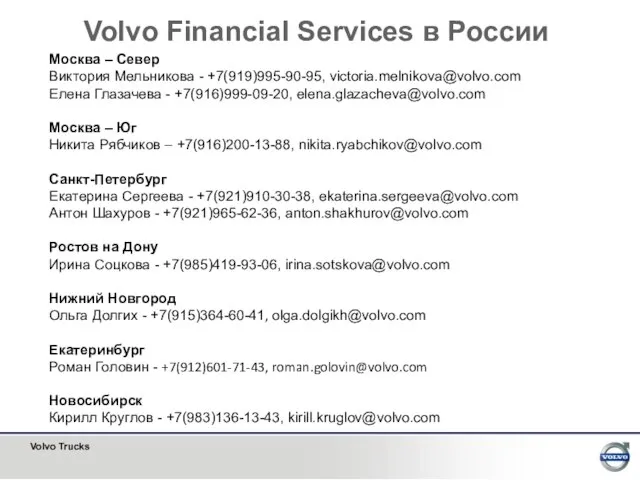

Volvo Financial Services в России Информационные технологии – оружие России

Информационные технологии – оружие России Dana Navrova

Dana Navrova Исследования формирования ожидаемой доходности и затрат на капитал компании на развивающихся рынках

Исследования формирования ожидаемой доходности и затрат на капитал компании на развивающихся рынках