Слайд 2Lecture timetable

Regulatory Framework of Securities Markets in the EU: Regulatory Principles, MiFID/MiFIR,

MAR/CSMAD, Overview of recent developments

Regulatory Framework of Securities Markets Primary Market: Definition of Securities, Registration, Public Offer of Securities, Prospectus, Crowdfunding

Regulatory Framework for Securities Secondary Market: Post-listing disclosure, Market Abuse, Anti-Money Laundering

Discussion class 1

Regulatory framework for Investment Services: client classification and provision of services, differentiation between investment services and ancillary investment services, Investment service providers (conduct of business rules), Tests before providing investment services, PRIPS

Regulatory Framework for Investment Funds: Structure of fund management, Types, rules and peculiarities of different investment funds, alternative fund rules (AIFMD)

Discussion class 2

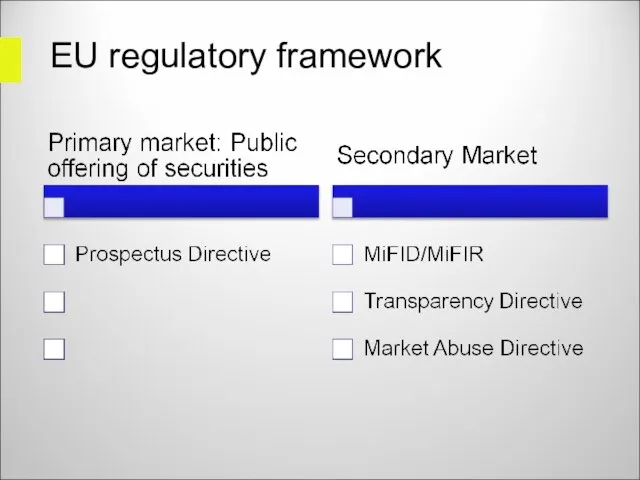

Слайд 4EU regulatory framework

Directive 2004/39/EC Markets in Financial Instruments Directive (MiFID)

Directive 2004/109/EC Transparency

Directive (TD)

Directive 2003/6/EC Market Abuse Directive (MAD)

Directive 2003/71/EC Prospectus Directive (PD)

Directive 2002/47/EC Financial Collateral Directive

Regulation 648/2012 European Market Infrastructure Regulation (EMIR)

Слайд 6EU regulatory framework

Directive 2004/39/EC Markets in Financial Instruments Directive (MiFID):

Directive 2014/65/EU on

markets in financial instruments

Regulation (EU) No 600/2014 on markets in financial instruments

Both adopted 15.04.2014, Member State must adopt rules by 27.01.2017

Слайд 7EU regulatory framework

Directive 2003/6/EC Market Abuse Directive (MAD)

Regulation (EU) No 596/2014 on

market abuse

Directive 204/57/EU on criminal sanctions for market abuse

Both adopted 15.04.2014

Will enter into force July 2016

Слайд 8EU regulatory framework

Directive – not directly applicable, has to be transposed into

Member State law:

Minimum/maximum harmonization

Actual direct application in technical issues: sufficiently exact rules

Regulation – directly applicable (no additional Member State law must be passed)

Слайд 9EU Regulatory framework

Tenents of EU law

Establishment of an internal market

Free movement

of capital

Capital markets not exclusive competence, interference subject to principle of subsidiarity

Слайд 10Historical overview

1957 Treaty of Rome established the principle of free movement of

capital

This did not bring about any significant law-making in the field of capital markets

1966 Segre Report:

Significant shortcomings in Member State laws relating to financial sector

Need for a EU approach

Слайд 11Historical overview

Cassis de Dijon judgment (C-262/81): if an instrument was acceptable

in one MS then it ought to be considered to be acceptable in another MS

The principle was expanded to the field of services by Citadel v Cine-Vog Films judgment in 1982

1985 Commission issued a White Paper “Completing the Internal Market”

Слайд 12Historical overview

Investment Services Directive in 1993

Financial Services Action Plan 1999:

ISD

was clearly outdated by 1999

Need for faster and more modern EU level legislation

Lamfalussy Report of 2001

4 level methodology for creation of EEU directives

Originally aimed at securities markets but has mainly been implemented on financial services

Слайд 13General Principles

Lamfalussy methodology

Framework principles (MIFID)

Implementing measures (ESMA consultation papers, MID and

MIFID Regulation)

Cooperation between the national supervisors through EU level guidelines (CESR rules)

Implementation

Слайд 14Implementation

Recent EU rules (MiFID/MiFIR) has raised the importance of acts of lower

hierarchy

Delegated acts

RTS

Guidelines

EU supervisors are responsible for drafting of the acts - ESMA

Слайд 15General Principles of EU rules

Passporting

Banks, investment funds, fund managers

Prospectuses

General

principles

Provision of investment services

Fit&Proper rules

Слайд 16MiFID General Principles

Composition of securities markets:

Concentrating not only on classical regulated markets

but also on MTF’s and systematic internalizers

Principle-based approach

Shift from detailed rules on provision of financial services to more principles-based regulation

More to the local regulator to decide how detailed rules to establish

Passporting

Слайд 17MiFID General Principles

Mifid regulatory framework:

Mifid itself (2004/39/EC)

Mifid implementation directive (2006/73/EC)

Mifid implementation regulation

(1287/2006)

CESR/ESMA guidelines implemented by member State FSAs

Слайд 18MiFID General Principles

Transposition into local law

See as overview

http://ec.europa.eu/internal_market/securities/isd/mifid_implementation/index_en.htm

Different Member States:

FSMA 2000

in UK

WpHG/WpÜG in Germany

VPTS in Estonia

Laki sijoituspalveluyrityksistä, Laki arvopaperimarkkinalain in Finland

Слайд 19MiFID General Principles

Anticipated benefits

Competition between market service providers and securities markets generally

Improved

investor protection

Increased transparency for customers as to the practices of services providers, their obligations and costs

Increased transparency as to the available investment markets in relation to pre-transaction information

Слайд 20MiFID General Principles

Anticipated benefits

More effective and approximate regulation between Member States across

EU

Principle-based regulation makes the core principles of financial regulation more evident

Слайд 21MiFID General Principles

Contents of MiFID can be divided into three categories

Authorisation and

organisation of investment firms

Conduct of business obligations in Mifid

Securities Markets and market transparency

Слайд 22MiFID General Principles

Exemptions (art 2)

Insurance undertakings

Persons providing investment services exclusively for their

parent undertakings, for their subsidiaries or for other subsidiaries of their parent undertakings

Investment service provided in an incidental manner in the course of a professional activity and that activity is regulated by legal or regulatory provisions or a code of ethics governing the profession which do not exclude the provision of that service

ECB and central banks

Слайд 23MiFID General Principles

Exemptions (art 2)

Persons who do not provide any investment services

or activities other than dealing on own account unless they are market makers or deal on own account outside a regulated market or an MTF on an organised, frequent and systematic basis by providing a system accessible to third parties in order to engage in dealings with them

Employee-participation schemes

Investment advice in the course of providing another professional activity not covered by Mifid and provision of such advice is not specifically remunerated

Слайд 24Market definitions

Regulated market

Classical notion of a exchange

Operated and/or managed

by a market operator

Brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and/or systems, and which is authorized and functions regularly;

Слайд 25Market definitions

MiFID itself gives only rough principles on:

Organizational requirements (including compliance)

Fit&Proper

rules

Pre-trade and post-trade transparency

Rules on access to the regulated market and obligation to comply with the FSA (suspension and removal orders, see art 41)

Слайд 26Market definitions

Authorization needed

Disclosure of a programme of operations setting out inter

alia the types of business envisaged and the organisational structure as a prerequisite (see also art 43), also fit&proper tests

Member State FSAs have the right to withdraw the authorisation

Слайд 27Market definitions

Organizational requirements (art 39)

Rules on COI

Risk avoiding and identification systems

Arrangements for the sound management of technical operation of the system

Rules and procedures providing for fair and orderly trading and establish objective criteria for the efficient execution of orders

Sufficient financial resources to facilitate its orderly functioning

Слайд 28Market definitions

Multilateral trading facility (MTF)

Multilateral system, operated by an investment firm

or a market operator,

Brings together multiple third-party buying and selling interests in financial instruments in a way that results in a contract

General pre-trade and post-trade transparency requirements apply (art 30)

Слайд 29Market definitions

Requirements for MTFs

Transparent and non-discretionary rules and procedures for (art

14)

fair and orderly trading and establish objective criteria for the efficient execution of orders

Criteria for determining the financial instruments that can be traded under its systems

Access to its fasility

Inform its users of their respective responsibilities for the settlement of the transactions executed in that facility

Слайд 30Market definitions

Requirements for MTFs

General obligations to protect integrity of the market

(art 25)

Organisational requirements for investment firms (art 13, see further)

Obligation to comply immediately to FSAs instruction to suspend or remove a financial instrument from trading (art 14)

Obligation to render compliance systems (art 25)

Слайд 31Market definitions

See list of AIMs/MTFs - http://mifiddatabase.esma.europa.eu/Index.aspx?sectionlinks_id=22&language=0&pageName=MTF_Display&subsection_id=0

Criteria for Regulated Market vs

First North in the Baltics

See http://www.nasdaqomxbaltic.com/en/exchange-information/listing-center/how-to-get-listed/first-north-vs-regulated-market/

Слайд 32Market definitions

‘Systematic internaliser’

Investment firm - any legal person whose regular

occupation or business is the provision of one or more investment services to third parties and/or the performance of one or more investment activities on a professional basis

Deals on organized, frequent and systematic basis on own account by executing client orders outside a regulated market or an MTF

Слайд 33Market definitions

Hence following requirements

The internalizing activity must be performed on

an organized and frequent basis in a systematic manner;

The activity has a material commercial role for the firm, and is carried on in accordance with non-discretionary rules and procedures;

The activity is carried on by personnel, or by means of an automated technical system, assigned to that purpose, irrespective of whether those personnel or that system are used exclusively for that purpose;

The activity is available to clients on a regular or continuous basis.

Слайд 34Market definitions

Reasons for being SI:

SI can create a market in a

specific financial instrument, create its own business hours and trading rules. Market makers will have to operate through a regulated market and only during the market business hours.

SIs can stimulate a market in instruments not listed in the 'local' market´.

See further: Hingway, Anand Ravindra , Purandare, Rajshekhar and Bharathulwar, Shravan V., MiFID and Systematic Internalization (June 26, 2008). Available at SSRN: http://ssrn.com/abstract=1151649 or http://dx.doi.org/10.2139/ssrn.1151649

Слайд 35Market definitions

See ESMA database: http://mifiddatabase.esma.europa.eu/Index.aspx?sectionlinks_id=16&language=0&pageName=MiFIDSystematicSearch&subsection_id=0

Слайд 36Obligations before the client

Applicable to investment firms and also in large extent

to credit institutions

Organizational obligations

Direct obligations before the client:

Before investment decision

Client order handling

Слайд 37Organizational requirements

General obligations

Proper organisation of business

Compliance with all relevant legal

requirements

Responsibility of management

Risk management

Adequate resources of personnel and material

Emergency plan

Слайд 38Organizational requirements

Directive 2006/73/EC (‘Mifid implementation directive’):

Risk management

Internal audit

Compliance

Senior management liability

COI

Outsourcing

Слайд 39Organizational requirements

Obligation to have an apt system of handling complaints

2006/73/EC art 10

Additional

guidelines by EFSA: http://www.fi.ee/public/kaebused.pdf

Coherent system of compliance

2006/73/EC art 6

Additional guidelines by ESMA/EFSA from 21.01.2013. http://www.fi.ee/public/0finantsinstrumentide_turgude_direktiivis_MiFID_satestatud_vastavuskontrolli_funktsiooni_kasitlevate_nouete_teatud_aspektide_kohta.pdf

Слайд 40General conduct of business rules

Investor protection through conduct of business rules and

organisational requirements for investment firms:

Still responsible decisions on well informed basis by clients allowed

Authorisation and ongoing supervision of investment firms

Client may ignore information, fail to compare, save on qualified advice, take unreasonable decisions

Слайд 41General conduct of business rules

An investment firm shall act honestly, fairly and

professionally in accordance with the best interests of its clients (art 18)

Service provider has to grant clients‘ interests preference to his own economic interests (art 18)

Avoid conflicts of interests

Disclose unavoidable conflicts of interests

Слайд 42General conduct of business rules

Minimum requirements for information and marketing

All information, including

marketing communications, addressed by the investment firm to clients or potential clients shall be fair, clear and not misleading

Marketing communications should be clearly identifiable

Investment research, which does not fulfill organizational requirements, has to be labeled as marketing communication

Слайд 43General conduct of business rules

Information provided has to be:

Understandable for clients, no

contradictions

Describe benefits and risks

No „hiding“ of relevant information or warnings

Comparisons of financial instruments by significant criteria

Warning with information on costs and taxes

Слайд 44General conduct of business rules

Suitability test (investment advice, portfolio management)

Obtain information about

Client‘s

knowledge, experience in investment field

Investment objectives (duration, purpose, readyness to assume risk)

Financial situation (regular income/expenses, assets)

Test: transaction envisaged is

Comprehensible regarding risks involved

Consistent with investment objectives and fin. Situation

Слайд 45General conduct of business rules

Appropriateness test (other investment services)

Obtain information about client‘s

knowledge, experience in investment field

Test: transaction envisaged is comprehensible for client regarding risks involved

Otherwise: warning

Transaction/investment service inappropriate or

Appropriateness test impossible

No prohibition to execute orders

Слайд 46General conduct of business rules

Client

Natural or legal person

Prospective client

Reclassification possible

Retail client:

maximum protection

Professional client: no testing of ability to assume risks and establishment of experience

Eligible counterparties: minimal duties

Слайд 47General conduct of business rules

Professional clients

investment firms

UCITs

insurance companies

public (int.)

institutions

large undertakings: 2 out of 3

20 mill. € balance sheet total

40 mill. € net turnover

2 mill. € own funds

Optional: agreement + experience + turnover

Слайд 48General conduct of business rules

Best execution principle (art 21)

Obligation to take

all reasonable steps to obtain, when executing orders, the best possible result for their clients taking into account price, costs, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of the order.

Whenever there is a specific instruction from the client the investment firm shall execute the order following the specific instruction.

Слайд 49General conduct of business rules

Best execution principle (art 21)

Obligation to monitor

the effectiveness of their order execution arrangements and execution policy in order to identify and, where appropriate, correct any deficiencies.

Obligation to notify clients of any material changes to their order execution arrangements or execution policy.

Слайд 50Authorization of investment firms

Rather similar procedure in relation to banks and fund

managers

Authorization from the local FSA has to be submitted

Cross-border services are allowed

FSA can withdraw the authorization

Similar rules on majority shareholding

Fit&Proper tests for directors and also to some extent shareholders

Слайд 51EU movements

Single Supervision Mechanism for banks:

Large banks shall be supervised by the

ECB

EU wide measures such as single supervision resolutions (incl imposition of fines)

Reform of capital markets law

MiFID into MiFID II

MAD into MAR/CSMAD

Слайд 52EU movements

MiFID II

EC proposal 20.10.2011, the directive and regulation adopted April 2014

Specified COI rules (question on inducements)

Additional rules on internal control and reporting

Larger ambit of application

Слайд 53EU movements

EU into ‘trendy’ areas

Alternative Funds directive

Outside regulated market traded facilities –

EMIR (European Market Infrastructure Regulation)

FX aka Forex aka Foreign Exchange: EMIR + public consultation on spots and derivatives

Crowdfunding: public consultation

Steve Jobs

Steve Jobs  Картины художника Леонида Афремова

Картины художника Леонида Афремова Презентация по физикетема « Линзы »

Презентация по физикетема « Линзы » Химические вещества, улучшающие качество нефти

Химические вещества, улучшающие качество нефти Проектирование сайтов четвертого поколения Алексей Сидоренко Компания «Группа Махаон» www.machaon.ru.

Проектирование сайтов четвертого поколения Алексей Сидоренко Компания «Группа Махаон» www.machaon.ru. СЕМЕН ЗАХАРЫЧ МАРМЕЛАДОВ

СЕМЕН ЗАХАРЫЧ МАРМЕЛАДОВ Обоснование Н(М)ЦК

Обоснование Н(М)ЦК За здоровый бег

За здоровый бег Презентация problems of censorship

Презентация problems of censorship Закон Божий. Глава 18

Закон Божий. Глава 18 Презентация на тему СПИД - реальность или миф?

Презентация на тему СПИД - реальность или миф? Берегите книгу

Берегите книгу ФГОС общего образования - основа социокультурной модернизации России

ФГОС общего образования - основа социокультурной модернизации России Карточный бизнес: реалии и перспективы.

Карточный бизнес: реалии и перспективы.  Развитие лыжного спорта в Тобольском районе

Развитие лыжного спорта в Тобольском районе PHRASEOLOGY OF THE ENGLISH LANGUAGE

PHRASEOLOGY OF THE ENGLISH LANGUAGE  Лекция

Лекция Участие общественности в жизни образовательных учреждений

Участие общественности в жизни образовательных учреждений Оценка руководителей по результатам деятельности организации

Оценка руководителей по результатам деятельности организации КИНО КВИЗ

КИНО КВИЗ MadLib String Theory

MadLib String Theory 19.09-23.09

19.09-23.09 Куличная кампания 2019

Куличная кампания 2019 Автоматизация складского учета

Автоматизация складского учета Медикаменты

Медикаменты Романтизм в Английской живописи XIX века

Романтизм в Английской живописи XIX века Масленица. Русские традиции

Масленица. Русские традиции Презентация на тему Зинаида Евгеньевна Серебрякова 1884 – 1967

Презентация на тему Зинаида Евгеньевна Серебрякова 1884 – 1967