Содержание

- 2. Course objectives to give an introduction to corporate finance, providing a pre-requisite for Corporate Finance course

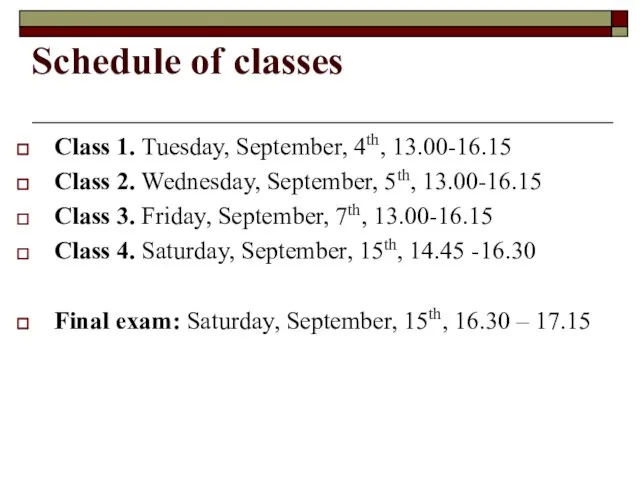

- 3. Schedule of classes Class 1. Tuesday, September, 4th, 13.00-16.15 Class 2. Wednesday, September, 5th, 13.00-16.15 Class

- 4. Individual consultation Friday, September, 7th, 16.30-17.30 (room TBA)

- 5. Course content Topic 1. Introduction to Finance. Overview of Сorporate Financial Decisions. Topic 2. Financial Statements

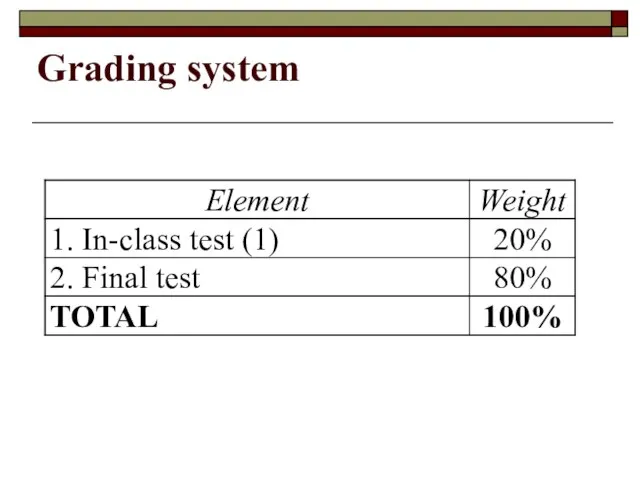

- 6. Grading system

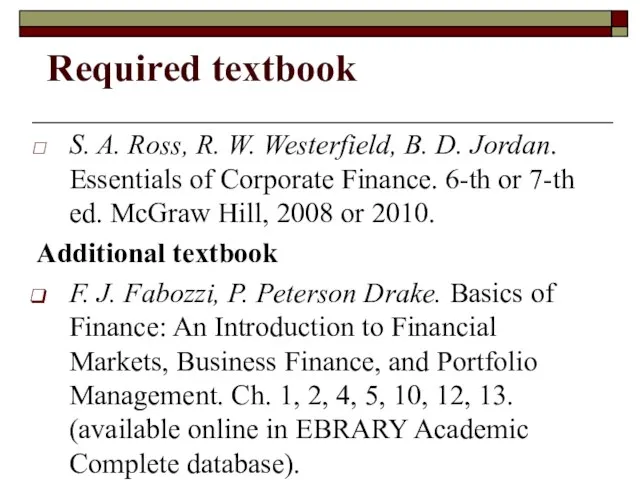

- 7. Required textbook S. A. Ross, R. W. Westerfield, B. D. Jordan. Essentials of Corporate Finance. 6-th

- 8. Introduction to Finance. Overview of Сorporate Financial Decisions. Topic 1

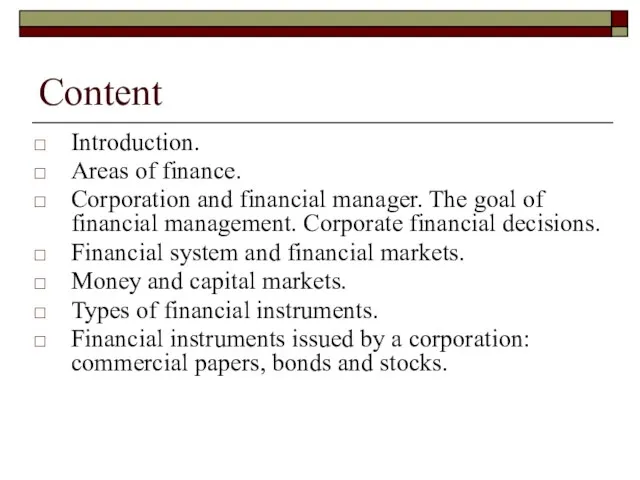

- 9. Content Introduction. Areas of finance. Corporation and financial manager. The goal of financial management. Corporate financial

- 10. Origin of the word “finance” Two versions: medieval Latin language (XIII-XIV centuries) contained words finatio, financia

- 11. Finance: evolution of meaning XVIII century – mid-XX century – “finance” meant funds of the state;

- 12. What is finance? Finance can be defined as the art and science of managing money [Gitman,

- 13. Main areas of finance Public Corporate or business Personal .

- 14. Basic types of business organization Sole proprietorship Partnership general partnership limited partnership Corporation .

- 15. Basic types of business organization: sole proprietorship Strengths: Easy to create Owner receives all profits Low

- 16. Basic types of business organization: partnership Strengths: Easy and inexpensive to form Weaknesses: Owners (general partners)

- 17. Characteristics of corporation Separate legal entity The shareholders have a limited liability for the business debts

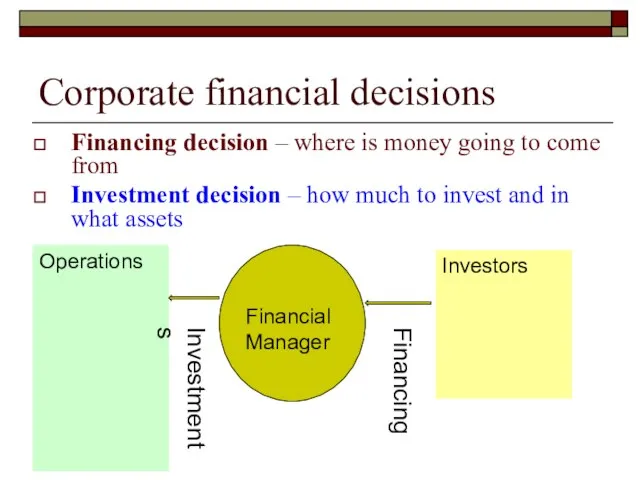

- 18. Corporate financial decisions Financing decision – where is money going to come from Investment decision –

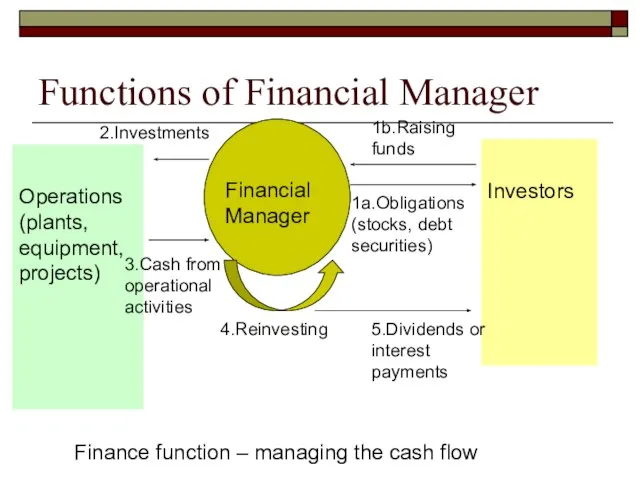

- 19. Functions of Financial Manager Operations (plants, equipment, projects) Financial Manager Investors 1b.Raising funds 2.Investments 3.Cash from

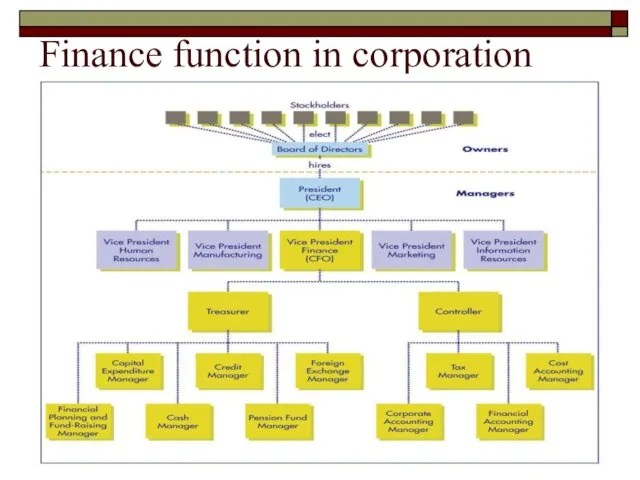

- 20. Finance function in corporation .

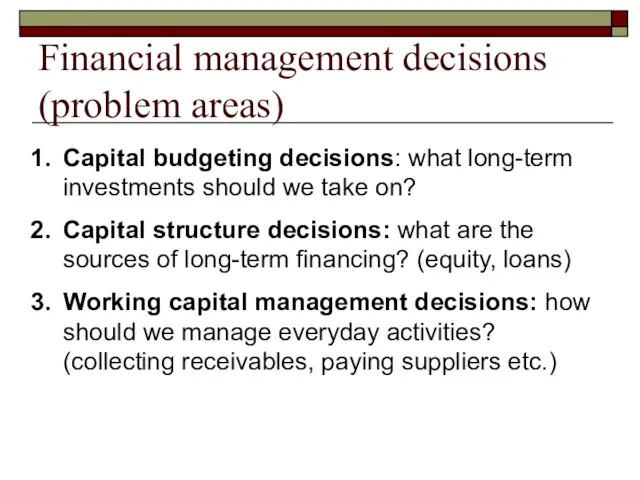

- 21. Financial management decisions (problem areas) Capital budgeting decisions: what long-term investments should we take on? Capital

- 22. What is the goal of financial management?

- 23. The goal of financial management Maximizing shareholder’s wealth Maximizing stock prices

- 24. Objectives for financial manager Maximizing earnings and earnings growth Maximizing return on assets and return on

- 25. Financing decisions

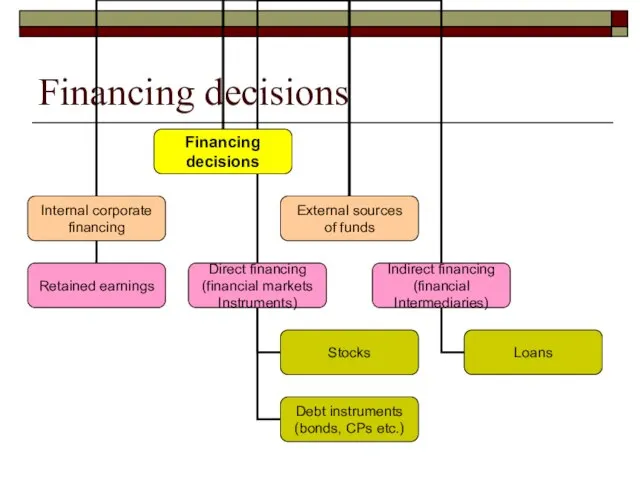

- 26. Financial markets The main goal of financial markets: Take savings from those who do not wish

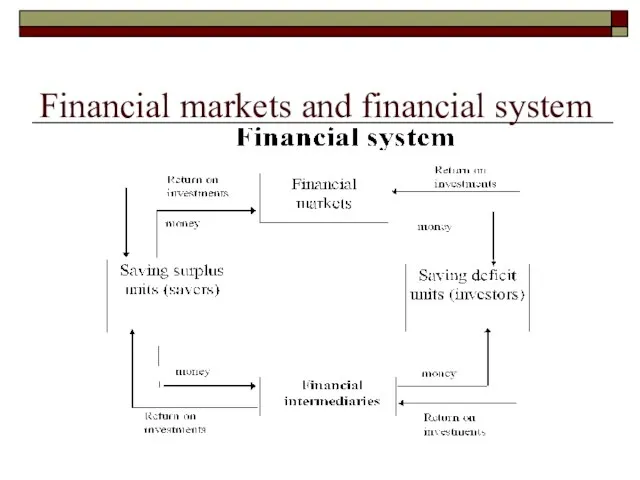

- 27. Financial markets and financial system

- 28. The example of financial intermediary work: the case of commercial bank Deposits Loans Commercial bank Kd

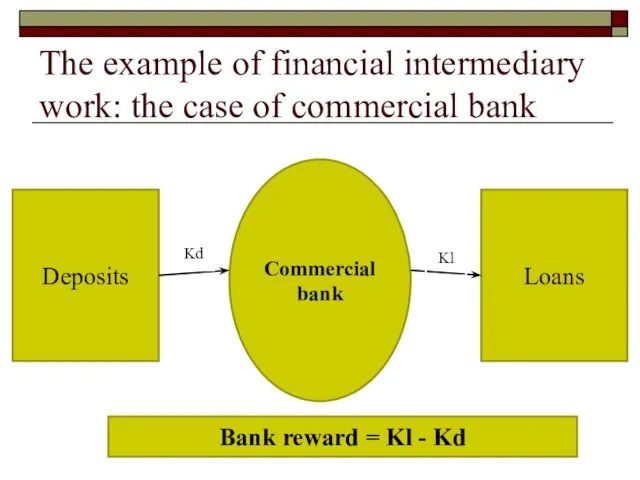

- 29. Financial markets

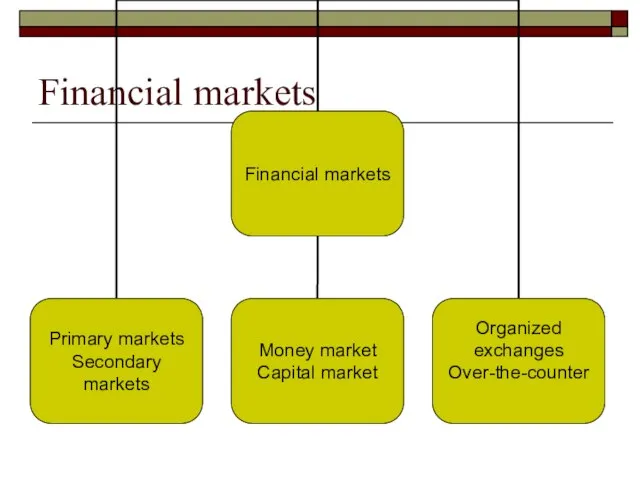

- 30. Primary and secondary markets Primary market – primary issues of securities are sold, allows governments, banks,

- 31. Money and capital markets Money markets – short-term assets (maturity less than 1 year) are traded:

- 32. Organized exchanges and over-the-counter Organized exchange – most of stocks, bonds and derivatives are traded. Has

- 33. Types of financial instruments

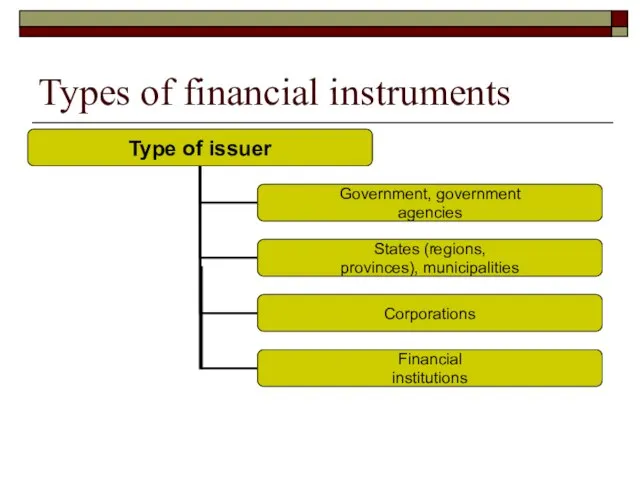

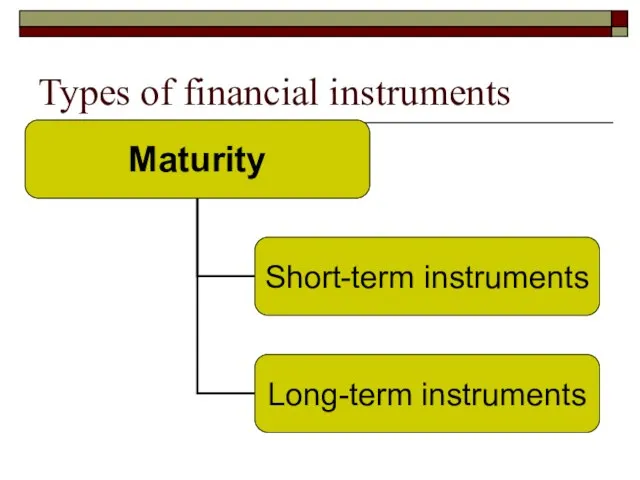

- 34. Types of financial instruments

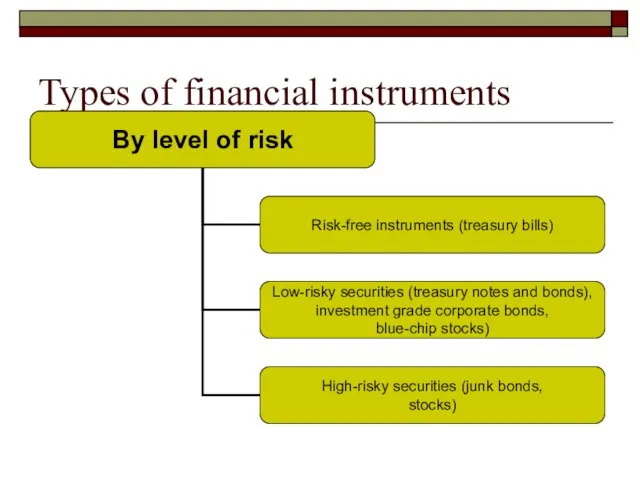

- 35. Types of financial instruments

- 36. Financial instruments issued by corporations: goals To finance operations To invest in new projects To expand

- 37. Commercial paper – short-term debt with maturity of not more than 270 days Issued by larger,

- 38. Corporate bond – long-term debt security, promising a bondholder interest payments on a regular basis and

- 39. Zero-coupon corporate bonds Bonds that pay face value at maturity and no payment until then Sell

- 40. Corporate bonds Secured debt (mortgage debt) – secured by specific assets Debentures - unsecured debt. Backed

- 41. Financial instruments issued by corporations: common stocks The common stockholders are the owners of the corporation’s

- 42. Common stockholders are called the residual claimants of the firm Stockholders have only limited liabilities Financial

- 43. Hybrid securities: has characteristics of debt and equity Have face value, predetermined periodical (dividend) payments with

- 45. Скачать презентацию

Характеристика історичної особи. Сандро Боттічелі

Характеристика історичної особи. Сандро Боттічелі OBZh_9A

OBZh_9A ТРАНСПОРТНАЯ ЛОГИСТИКА

ТРАНСПОРТНАЯ ЛОГИСТИКА  Современный русский язык и культура речи: практический курс

Современный русский язык и культура речи: практический курс ПРАВА ЧЕЛОВЕКА

ПРАВА ЧЕЛОВЕКА Основы теории всеобщего управления качеством (tqm) Принципы tqm

Основы теории всеобщего управления качеством (tqm) Принципы tqm Тема урока: Социальный проект

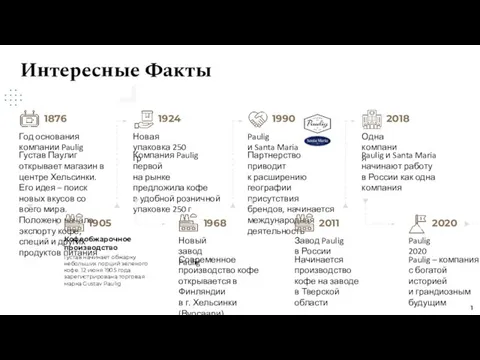

Тема урока: Социальный проект Интересные факты компании Paulig

Интересные факты компании Paulig Все различны – все равны

Все различны – все равны ОБЩЕСТВЕННЫЙ ПРОГРЕСС

ОБЩЕСТВЕННЫЙ ПРОГРЕСС Оскорбления в сети

Оскорбления в сети Social Ecology Sustainable Development Lecture III Sustainable

Social Ecology Sustainable Development Lecture III Sustainable Игра «Крестики - нолики»

Игра «Крестики - нолики» Языковой центр Speak Up

Языковой центр Speak Up Поправки к Конституции РФ

Поправки к Конституции РФ Нет наркомании

Нет наркомании Комплексная оценка эффективности системы образования Бурятии как ресурс развития региона

Комплексная оценка эффективности системы образования Бурятии как ресурс развития региона Хищные растения

Хищные растения Представление числовой информации с помощью систем счисления

Представление числовой информации с помощью систем счисления Ключові зміни в спрощеній системі оподаткування у 2011 році та особливості роботи з 72 КВЕДом

Ключові зміни в спрощеній системі оподаткування у 2011 році та особливості роботи з 72 КВЕДом Тенденции реформирования системы обеспечения безопасности труда на основе менеджмента рисков

Тенденции реформирования системы обеспечения безопасности труда на основе менеджмента рисков By Dr. Steven Williams

By Dr. Steven Williams "Умники и умницы"

"Умники и умницы" Подготовка к научному проекту

Подготовка к научному проекту  Привет, Весна!

Привет, Весна! Предложение фирмы «Проектика» по производству и поставке торгового оборудования Рязань 2012 Россия, 390029, г.Рязань, ул.Чкалова, 68А Тел

Предложение фирмы «Проектика» по производству и поставке торгового оборудования Рязань 2012 Россия, 390029, г.Рязань, ул.Чкалова, 68А Тел Справочно-правовые системы

Справочно-правовые системы Т

Т