Содержание

- 2. Contents Balance sheet statement and its managerial applications; Income statement and its managerial applications; The concept

- 3. Balance Sheet reflects the financial position of a firm By “financial position” we mean: Assets Liabilities

- 4. Liabilities are obligations of the entity to outside parties (“creditors”): Result from past transactions (purchase through

- 5. Characteristics of Balance Sheet There is a relationship between balance sheet elements: Assets = Liabilities +

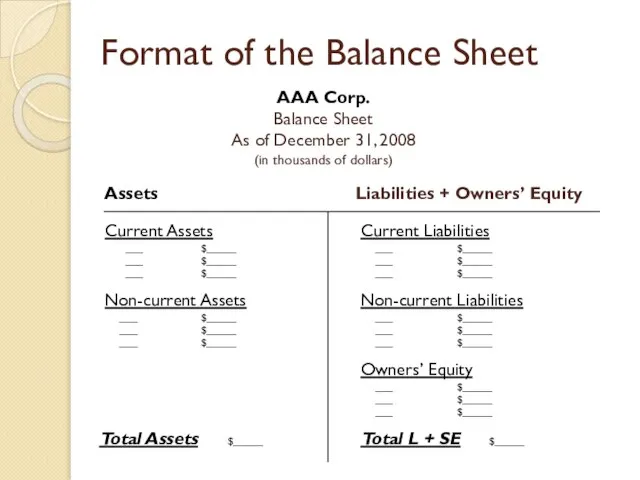

- 6. Format of the Balance Sheet AAA Corp. Balance Sheet As of December 31, 2008 (in thousands

- 7. Exercise 1 Prepare a balance sheet for AAA Corp. as of December 31, 2008, based on

- 8. What can be derived from the Balance Sheet 1) The proportion of current assets to current

- 9. Liquidity The term “liquidity” has at least two meanings: asset liquidity - ease and speed with

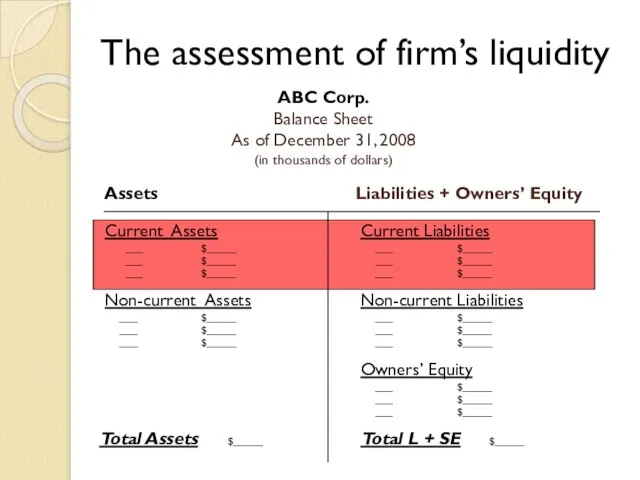

- 10. The assessment of firm’s liquidity ABC Corp. Balance Sheet As of December 31, 2008 (in thousands

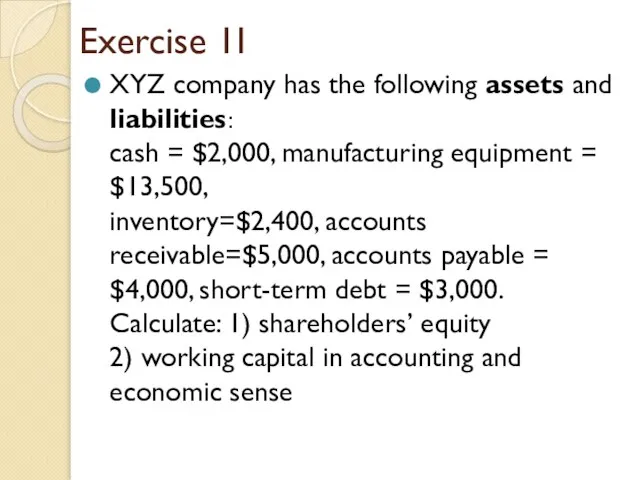

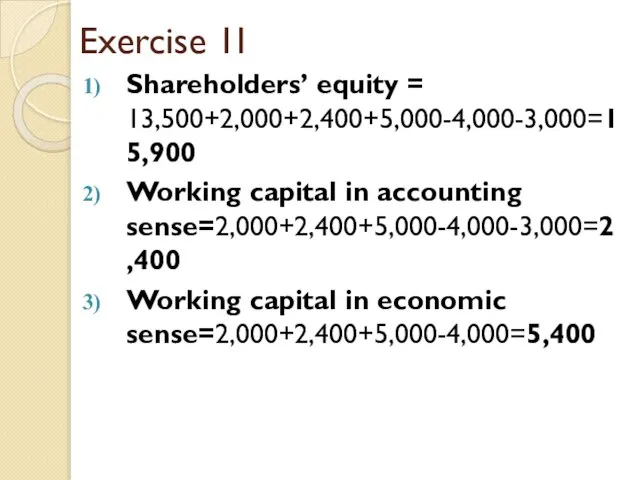

- 11. Exercise 1I XYZ company has the following assets and liabilities: cash = $2,000, manufacturing equipment =

- 12. Exercise 1I Shareholders’ equity = 13,500+2,000+2,400+5,000-4,000-3,000=15,900 Working capital in accounting sense=2,000+2,400+5,000-4,000-3,000=2,400 Working capital in economic sense=2,000+2,400+5,000-4,000=5,400

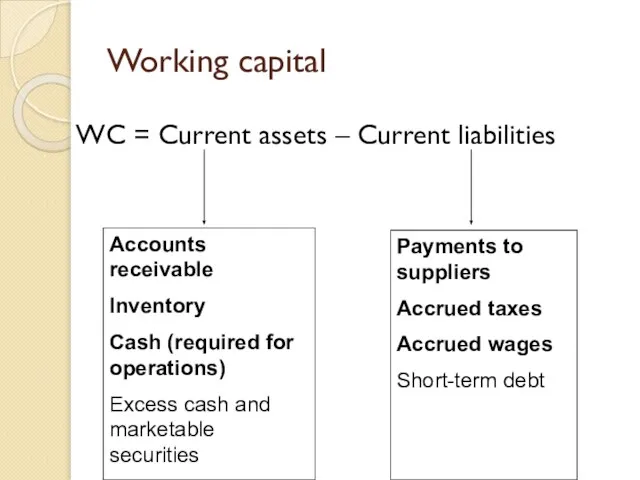

- 13. Working capital Working capital (WC) is a difference between firm’s current assets and current liabilities Working

- 14. Working capital WC = Current assets – Current liabilities Accounts receivable Inventory Cash (required for operations)

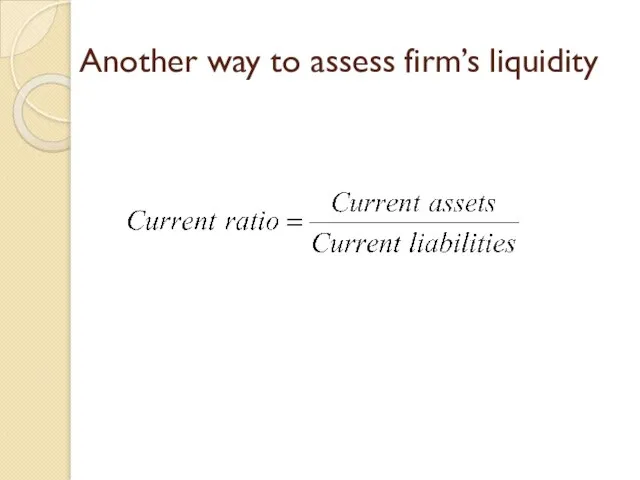

- 15. Another way to assess firm’s liquidity

- 16. What can be derived from the Balance Sheet 2) The proportion in which debt and equity

- 17. The income statement provides an assessment of firm’s performance over a particular period of time The

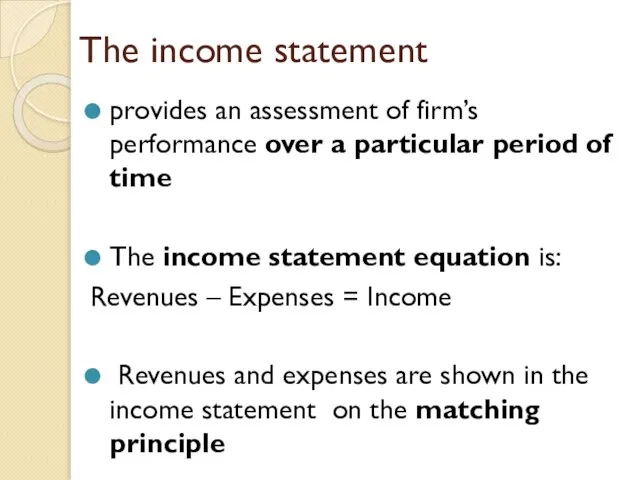

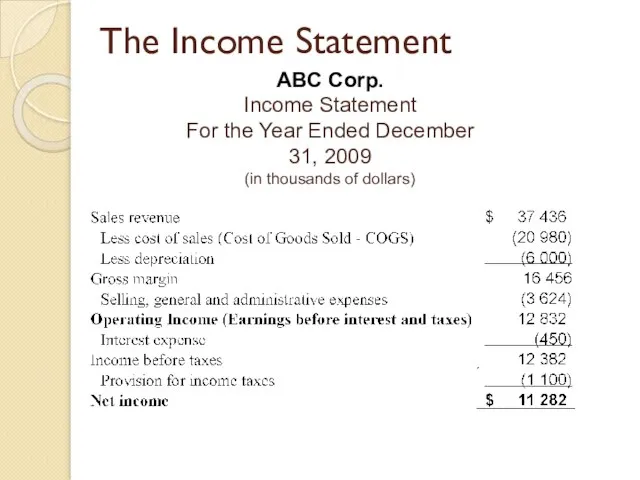

- 18. The Income Statement ABC Corp. Income Statement For the Year Ended December 31, 2009 (in thousands

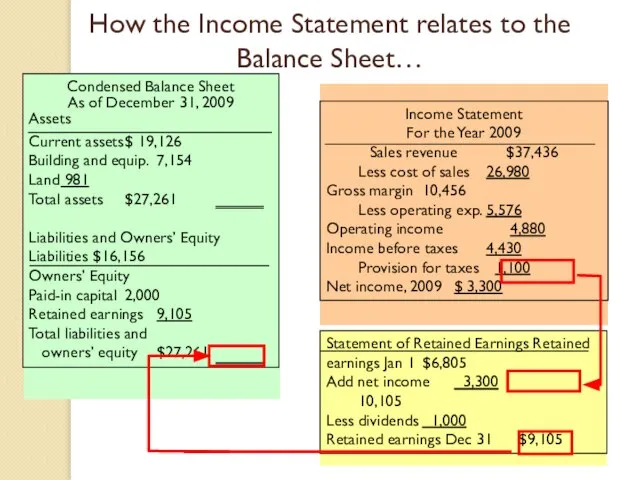

- 19. How the Income Statement relates to the Balance Sheet…

- 20. Accounting income and cash flow basically, they are not the same thing The main reasons why

- 21. Сash flow from assets (free cash flow) It’s the cash flow generated by the company which

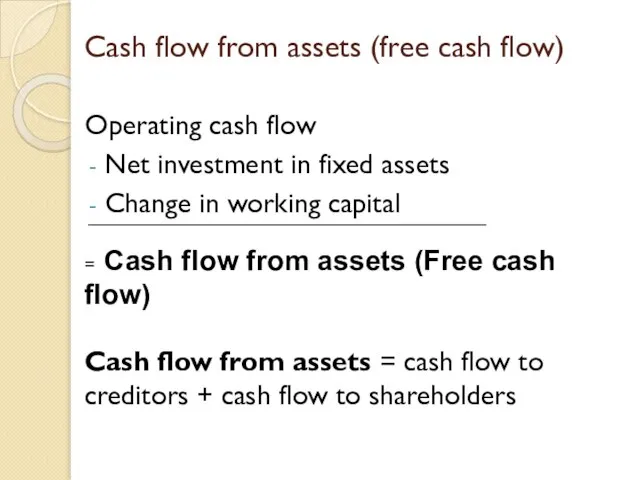

- 22. Cash flow from assets (free cash flow) Operating cash flow Net investment in fixed assets Change

- 23. Operating cash flow Sales Cost of goods sold Depreciation Selling, General and Administrative expenses = Operating

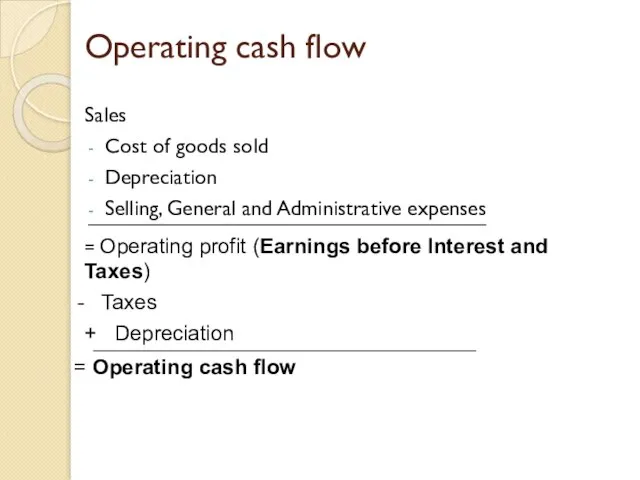

- 24. Net investment in fixed assets Ending net fixed assets Beginning net fixed assets + Depreciation =

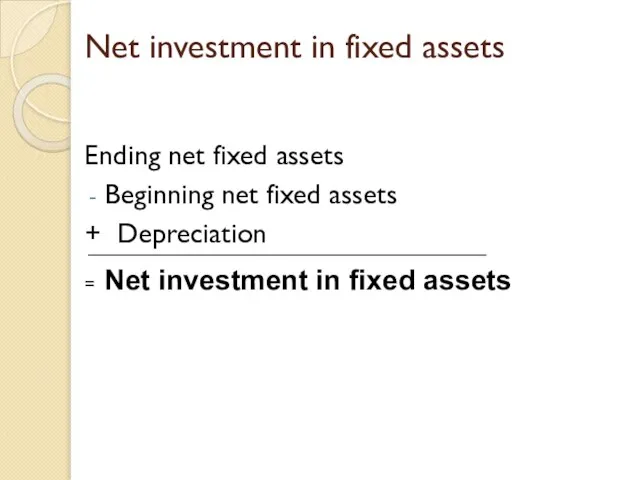

- 25. Changes in working capital Ending working capital Beginning working capital = Change in working capital

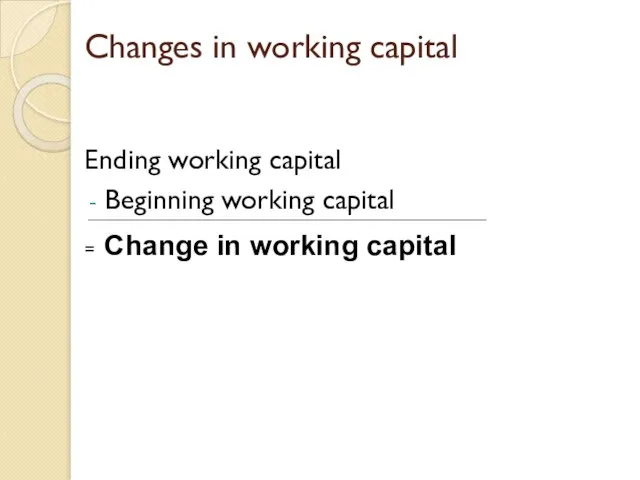

- 26. Cash flow to creditors Interest paid New net borrowing = Cash flow to creditors

- 28. Скачать презентацию

Урок 18

Урок 18 SoftInform Search Technology

SoftInform Search Technology 1 занятие курса Юный учёный. Плюсы заниматься наукой

1 занятие курса Юный учёный. Плюсы заниматься наукой Витраж. Сюжеты витражей

Витраж. Сюжеты витражей Дифференциация обучения как возможность индивидуализации обучения в условиях одного класса

Дифференциация обучения как возможность индивидуализации обучения в условиях одного класса Оперативная память

Оперативная память 600 шагов. Ролики мечты

600 шагов. Ролики мечты История культурологии

История культурологии Декоративные куклы

Декоративные куклы Куклы из ниток

Куклы из ниток Современный урок в начальной школе

Современный урок в начальной школе Презентация на тему З.Е.Серебряковой «За обедом»

Презентация на тему З.Е.Серебряковой «За обедом» Брачный договор

Брачный договор Who wants to live forever

Who wants to live forever  Квалификационная практика

Квалификационная практика Виды Теплопередачи ( Теплообмена )

Виды Теплопередачи ( Теплообмена ) Суффиксы

Суффиксы Презентация на тему Значимость портфолио для современного школьника

Презентация на тему Значимость портфолио для современного школьника Страх и пути его преодоления

Страх и пути его преодоления Заморочки из бочки

Заморочки из бочки Khudozhestvennye_vozmozhnosti_v_Adobe_Photoshop

Khudozhestvennye_vozmozhnosti_v_Adobe_Photoshop Seven Wonders of the World

Seven Wonders of the World  Һаулыҡ-ҙур байлыҡ

Һаулыҡ-ҙур байлыҡ Гражданская оборона России

Гражданская оборона России Вопросы профилактики суицидального проведения несовершеннолетних (теория)

Вопросы профилактики суицидального проведения несовершеннолетних (теория) Dinamika_i_struktura_nasilstvennoy_prestupnosti_v_Rossii

Dinamika_i_struktura_nasilstvennoy_prestupnosti_v_Rossii Технология разработки внутренних стандартов предприятия сервиса

Технология разработки внутренних стандартов предприятия сервиса Профессия Нефтяник

Профессия Нефтяник