Слайд 2First text here

Second text here

Third text here

Why do you need to regularly

count the total volume of sales made? This is a very important indicator that can demonstrate an increase in total sales.

So the businessman or salesman, accountant, can be seen on the counting results as the company grew, or, on the contrary, sales have fallen.

Слайд 3First text here

Second text here

Third text here

The owner of the business can

be counted on the results of the sales to see if the business is successful in his business or has a problem with trade and something needs to be taken so as not to have to close the failing company.

Слайд 4Net and gross sales

Sales volume is gross and net. Consider first of

all need to gross profit.

Слайд 5GROSS - is the total amount of sales, which is done for

a certain period of time. These accrued and sales that have been made on credit in a certain period. Evaluate all sales should be at full price, ie the price, respectively, specified in the counting invoices. All prices that have been made to customers during this period, it is not necessary to take into account. Also, it does not include the amount of purchases that have been returned by buyers, sold at a lower price products and other amendments to the sales.

Слайд 6NET SALES REPRESENTS - the same total volume, only because it is

necessary to subtract all the benefits and discounts that the company has made to its customers. Also, do not forget to subtract from the gross amount of the total amount of the goods that buyers returned.

It is net of all sales clearly shows the effectiveness of the trade and gives forecasts for the company's development in the future.

Слайд 7Calculation Formula

There are several formulas that are used for various calculations:

Gross formula

is as follows: From the total revenue for a particular period subtracted the sum value of all goods sold or services.

To calculate losses and gains, that is, the implementation is carried out the following calculation: From the gross profit margin deducted costs. What is the cost? These are expenses that were spent for management and commerce.

Слайд 8Loss before tax and profit: From the sales profits subtract or add

to it revenues and operating expenses. To all added or subtracted costs is implemented.

For the calculation of net income or loss is necessary: take the revenue and cost of goods costs (they include selling and administrative expenses) and minus other costs and taxes.

To calculate the total income should be: From the proceeds take the purchase price of the goods (services)

Слайд 9INCOME

Income - money or goods received by the State, person or entity

as a result of any activity for a certain period of time

Income - any cash inflow or receipt of material assets that have monetary value, without debt growth. Often used the phrase "net income" represents the difference between the total, gross income and expenses.

The income does not include amounts received in the duty collected on behalf of third parties, such as taxes. When mediation income ratio is the amount of commission, rather than the gross cash flow.

آموزش سواد رسانه ای – درس سوم

آموزش سواد رسانه ای – درس سوم Раскрытие скобок. Линейные уравнения. Повторение

Раскрытие скобок. Линейные уравнения. Повторение История Древнего Рима (МХК 10 класс)

История Древнего Рима (МХК 10 класс) МОДУЛЬНАЯ

МОДУЛЬНАЯ Лучшие инструменты для сведения звука (саундпродюссинг)

Лучшие инструменты для сведения звука (саундпродюссинг) Деловые документы (автобиография, заявление, резюме )

Деловые документы (автобиография, заявление, резюме ) MixMarket.BIZ

MixMarket.BIZ Практика-Инфекции-3 (Бактериальные)

Практика-Инфекции-3 (Бактериальные) природные условия

природные условия Презентация на тему Правописание сочетаний Чк чн

Презентация на тему Правописание сочетаний Чк чн Реконструкция системы водоснабжения п. Гирей, Краснодарского края

Реконструкция системы водоснабжения п. Гирей, Краснодарского края Правила проведения банных процедур

Правила проведения банных процедур Лексические нормы

Лексические нормы Организация общения дошкольников в повседневной жизни и разнообразных видах деятельности

Организация общения дошкольников в повседневной жизни и разнообразных видах деятельности Натюрморт в графике. ИЗО. 6 класс

Натюрморт в графике. ИЗО. 6 класс Каким ты видишь мир?

Каким ты видишь мир? Завоевание Римом Италии 5 класс

Завоевание Римом Италии 5 класс Как продавать продукцию IEK® в розницу: формула успеха

Как продавать продукцию IEK® в розницу: формула успеха Мини-волейбол

Мини-волейбол Подача питательной воды в парогенератор при запроектной аварии

Подача питательной воды в парогенератор при запроектной аварии Мы дарим впечатления, которые хочется хранить всю жизнь!

Мы дарим впечатления, которые хочется хранить всю жизнь! Алгоритм выбора профессии. Занятие 15

Алгоритм выбора профессии. Занятие 15 Crisis del Salitre

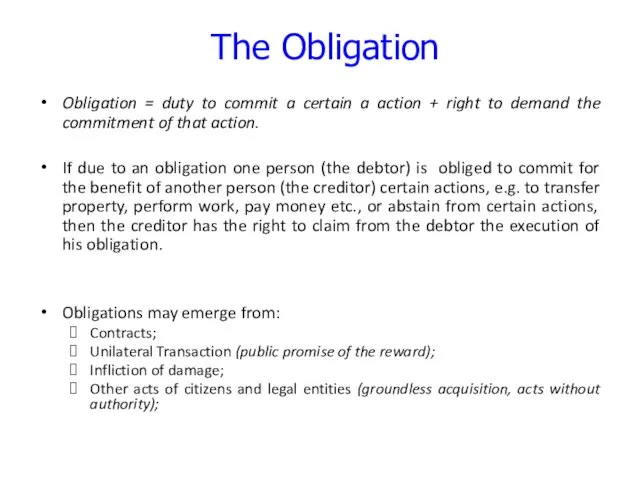

Crisis del Salitre The obligation

The obligation  Презентация на тему Что надо знать про жевательную резинку

Презентация на тему Что надо знать про жевательную резинку Анализ сайта Развитие ребёнка

Анализ сайта Развитие ребёнка Производственный комплекс АГАМА

Производственный комплекс АГАМА Современное состояние, перспективы развития общин КМНС. - презентация

Современное состояние, перспективы развития общин КМНС. - презентация