Содержание

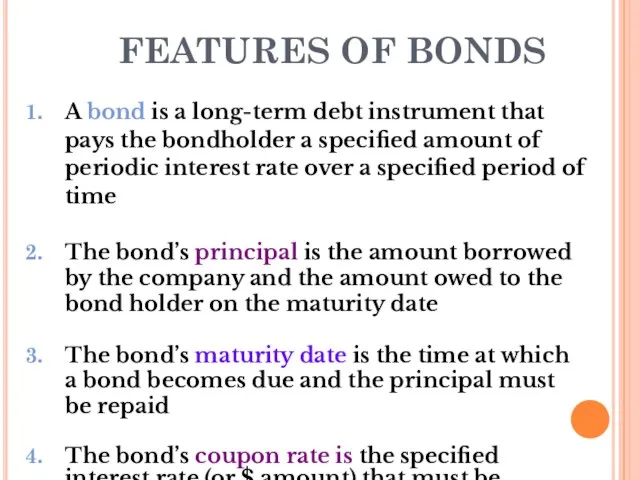

- 2. FEATURES OF BONDS A bond is a long-term debt instrument that pays the bondholder a specified

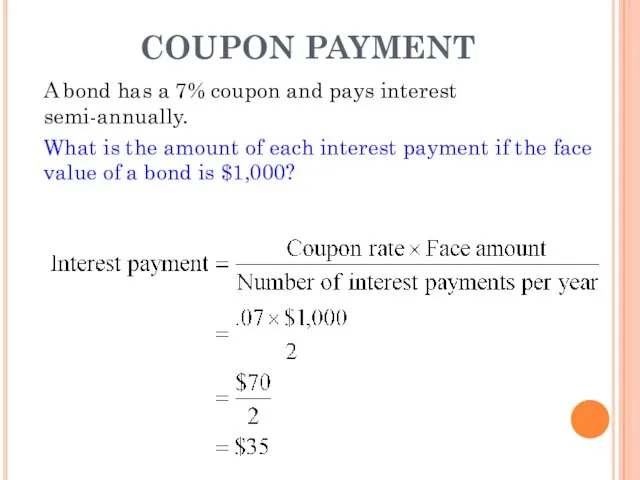

- 3. COUPON PAYMENT A bond has a 7% coupon and pays interest semi-annually. What is the amount

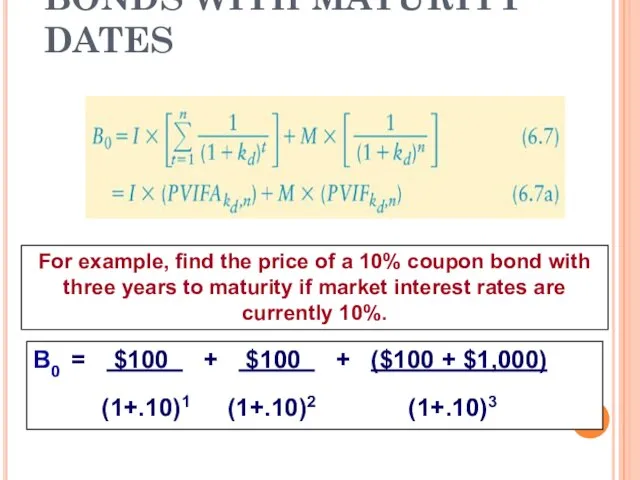

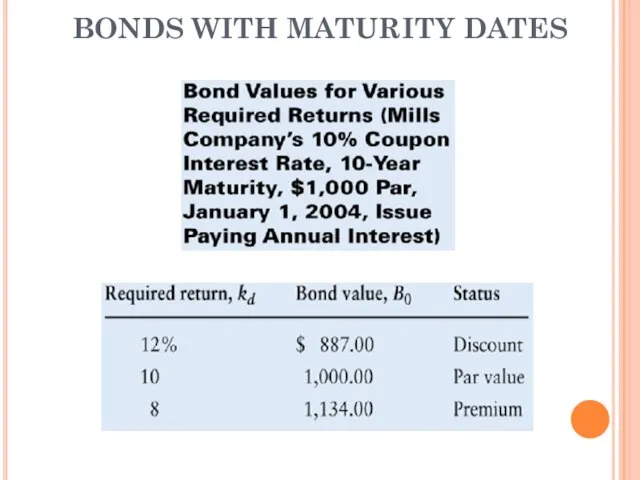

- 4. BONDS WITH MATURITY DATES For example, find the price of a 10% coupon bond with three

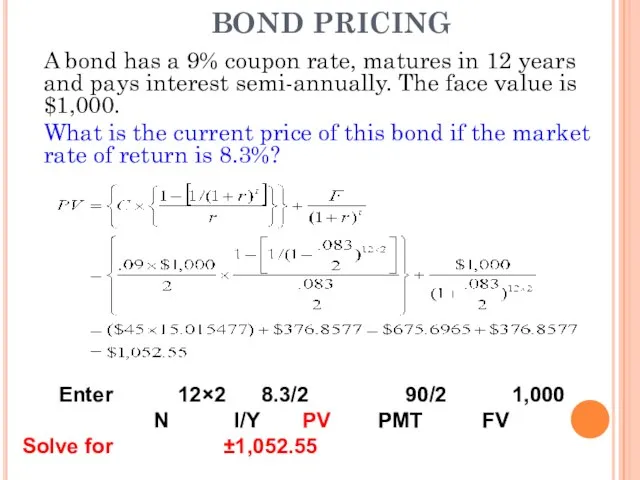

- 5. BOND PRICING A bond has a 9% coupon rate, matures in 12 years and pays interest

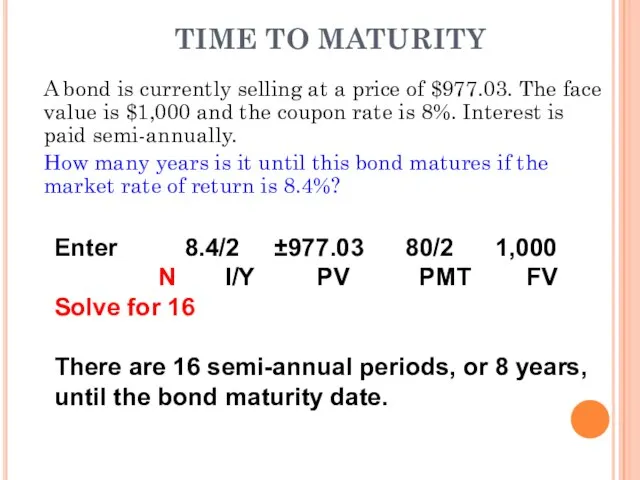

- 6. TIME TO MATURITY A bond is currently selling at a price of $977.03. The face value

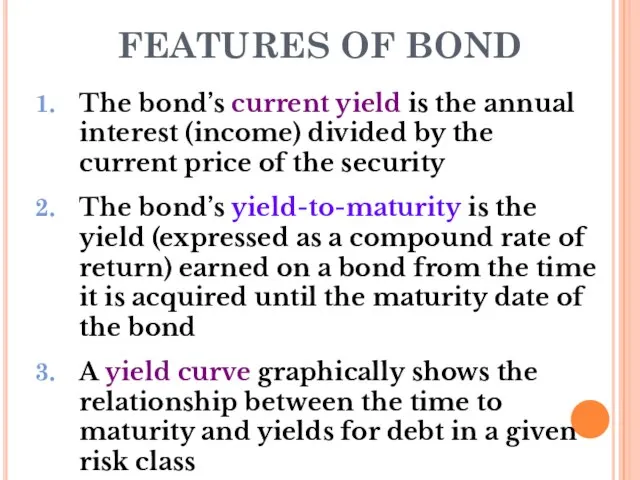

- 7. FEATURES OF BOND The bond’s current yield is the annual interest (income) divided by the current

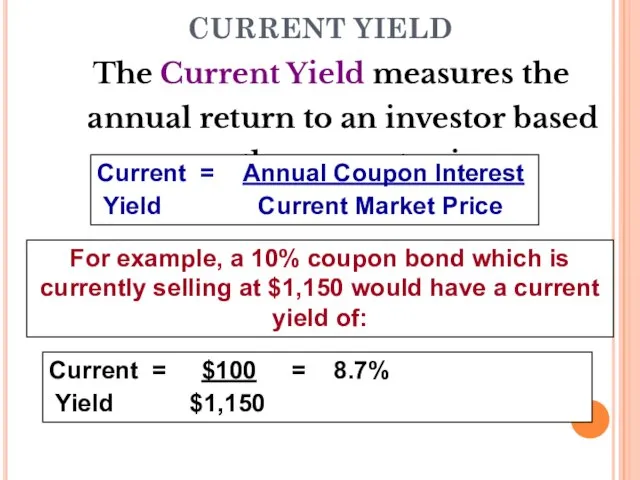

- 8. CURRENT YIELD The Current Yield measures the annual return to an investor based on the current

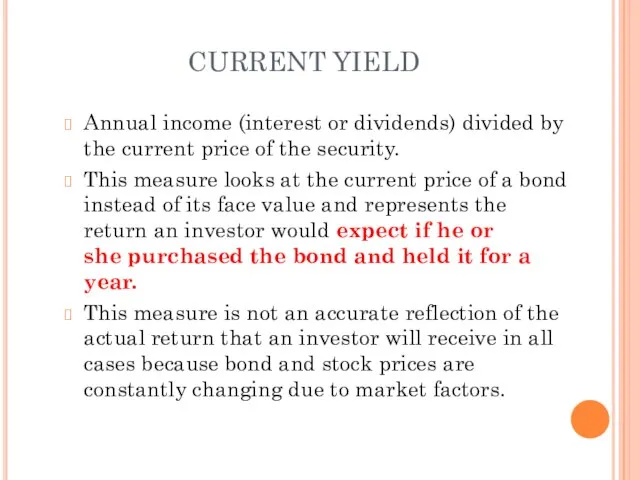

- 9. CURRENT YIELD Annual income (interest or dividends) divided by the current price of the security. This

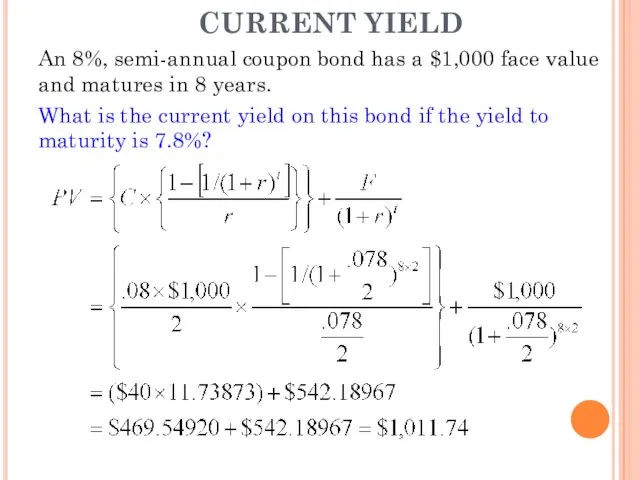

- 10. CURRENT YIELD An 8%, semi-annual coupon bond has a $1,000 face value and matures in 8

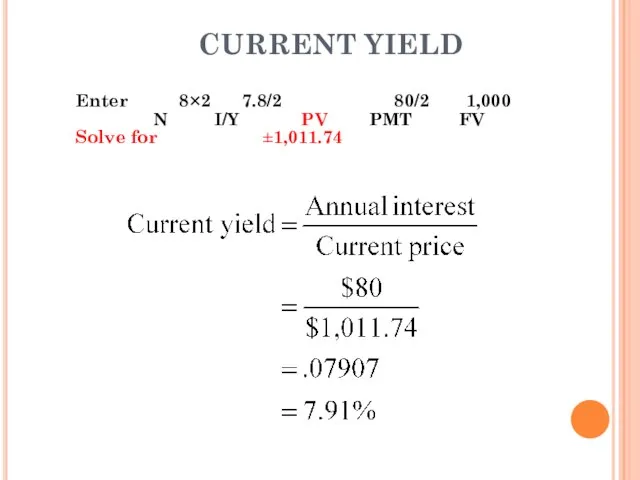

- 11. CURRENT YIELD Enter 8×2 7.8/2 80/2 1,000 N I/Y PV PMT FV Solve for ±1,011.74

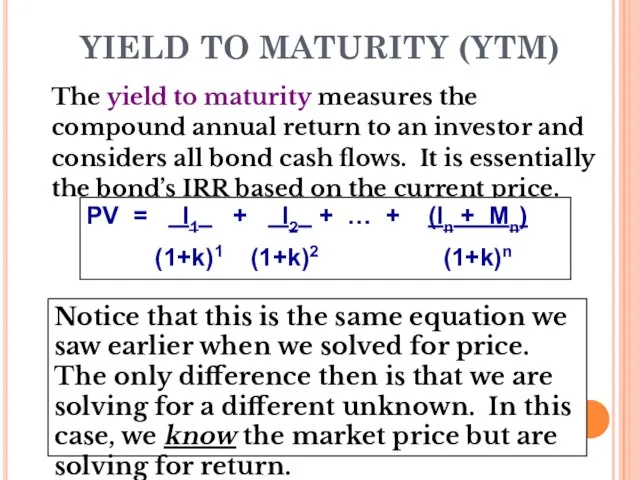

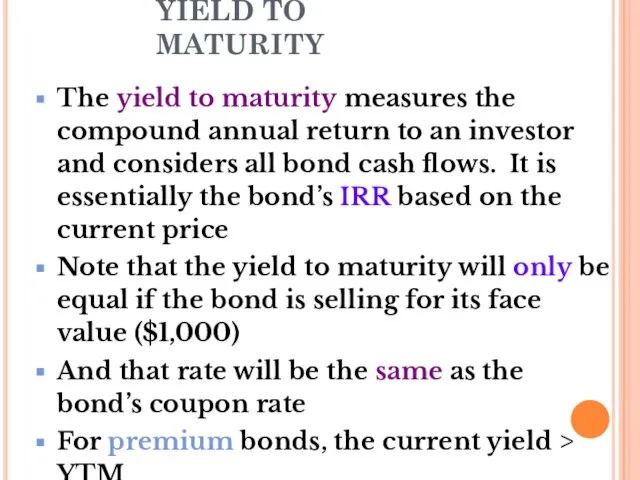

- 12. YIELD TO MATURITY (YTM) The yield to maturity measures the compound annual return to an investor

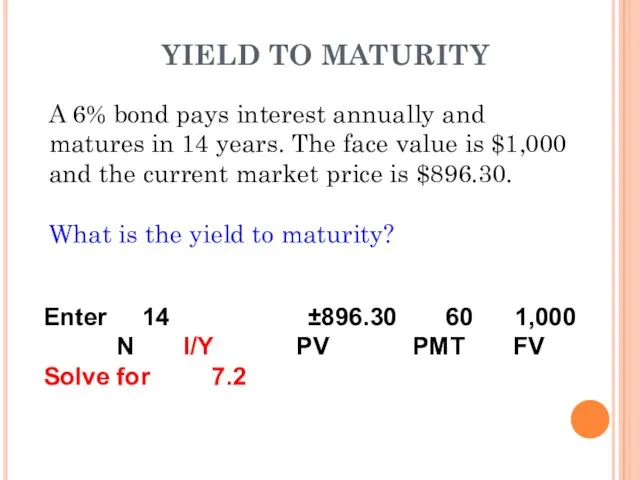

- 13. YIELD TO MATURITY A 6% bond pays interest annually and matures in 14 years. The face

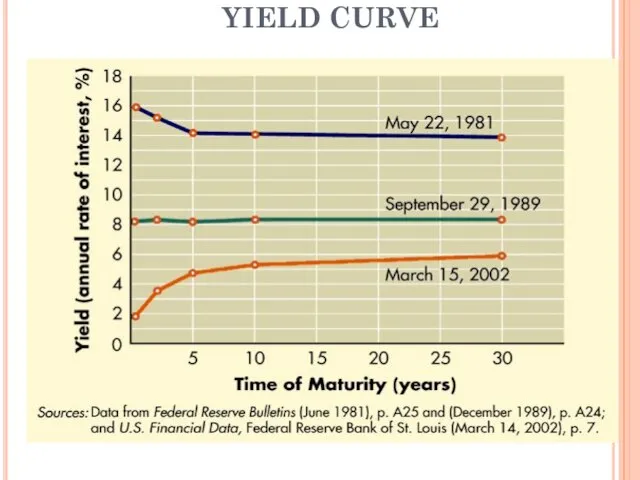

- 14. YIELD CURVE

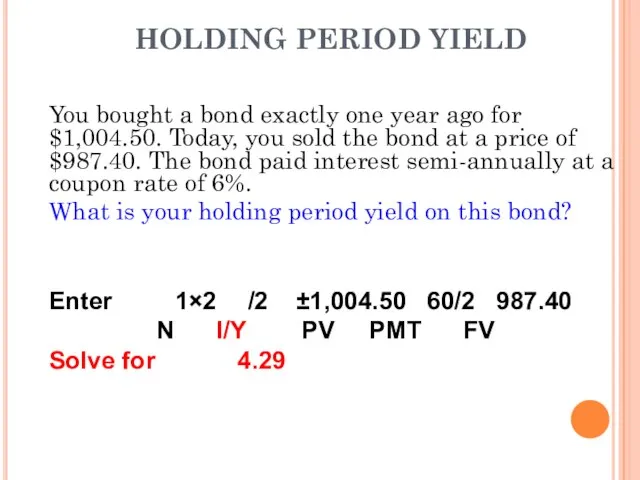

- 15. HOLDING PERIOD YIELD You bought a bond exactly one year ago for $1,004.50. Today, you sold

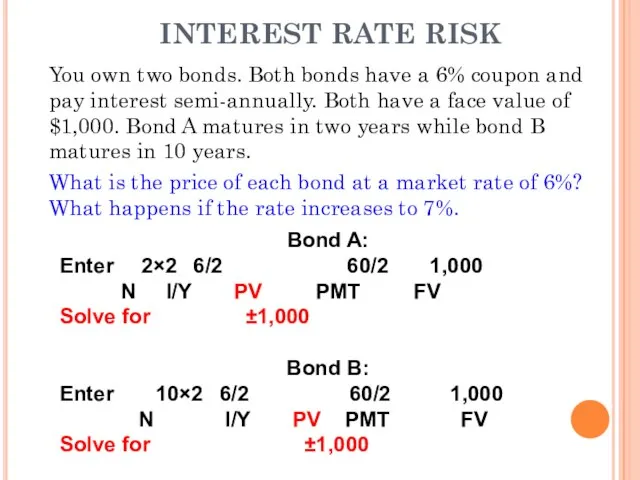

- 16. INTEREST RATE RISK You own two bonds. Both bonds have a 6% coupon and pay interest

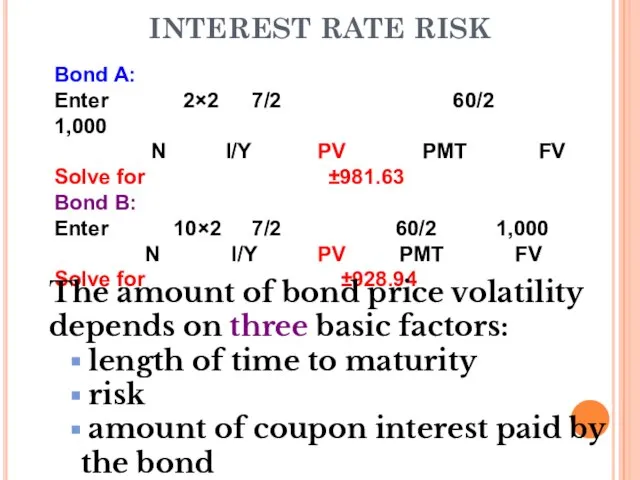

- 17. INTEREST RATE RISK Bond A: Enter 2×2 7/2 60/2 1,000 N I/Y PV PMT FV Solve

- 18. BONDS WITH MATURITY DATES

- 19. PRICE CONVERGES ON PAR AT MATURITY It is also important to note that a bond’s price

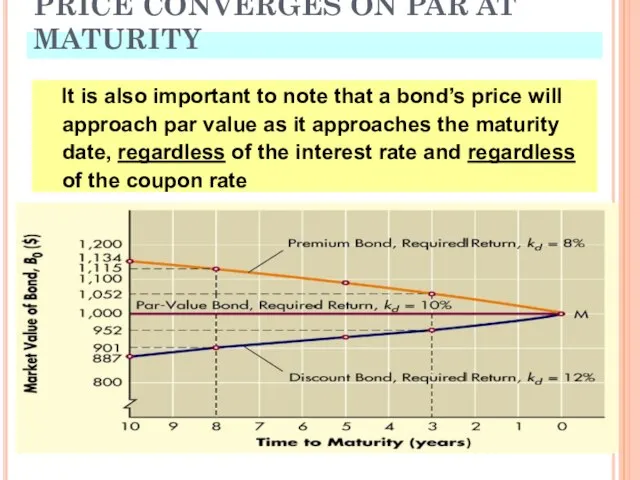

- 20. YIELD TO MATURITY The yield to maturity measures the compound annual return to an investor and

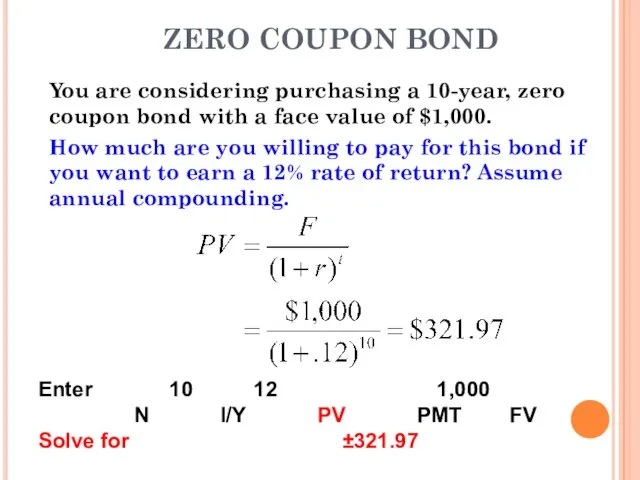

- 21. ZERO COUPON BOND You are considering purchasing a 10-year, zero coupon bond with a face value

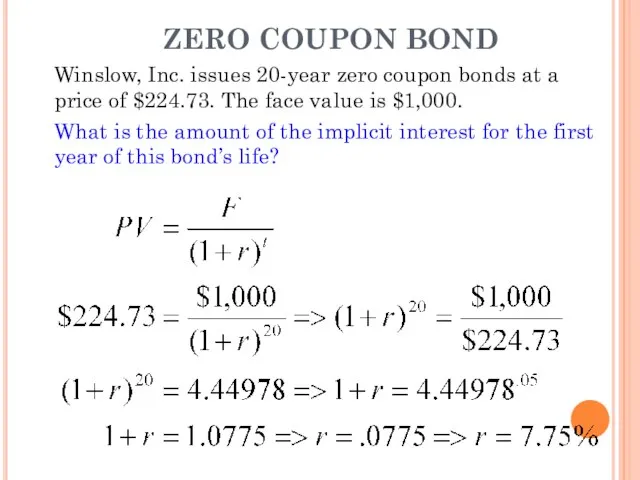

- 22. ZERO COUPON BOND Winslow, Inc. issues 20-year zero coupon bonds at a price of $224.73. The

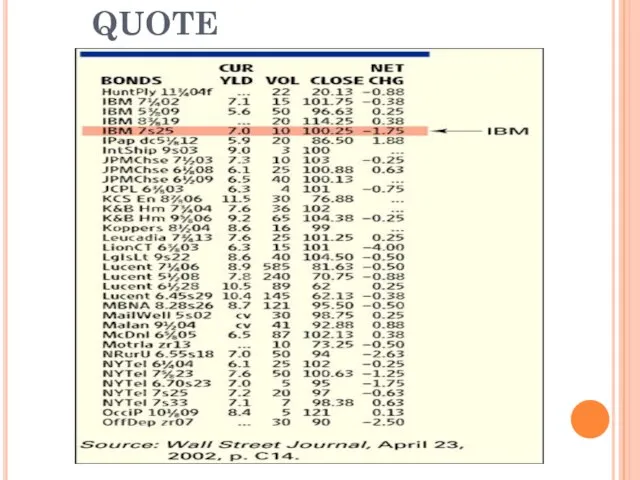

- 23. CORPORATE BOND QUOTE

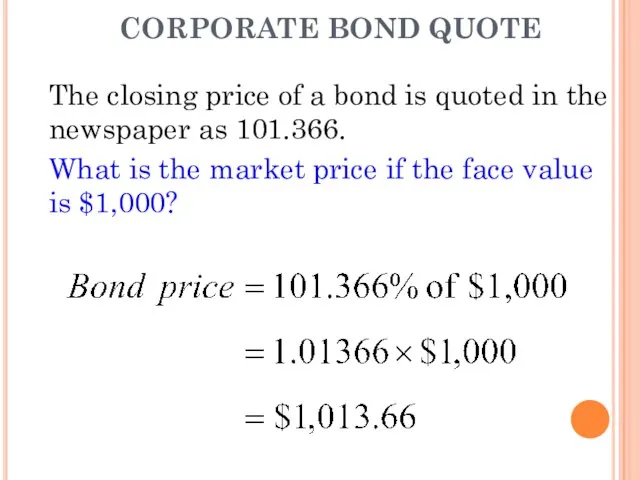

- 24. CORPORATE BOND QUOTE The closing price of a bond is quoted in the newspaper as 101.366.

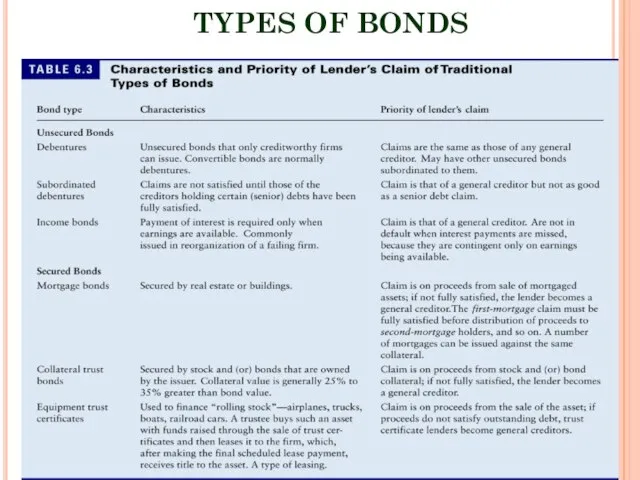

- 25. TYPES OF BONDS

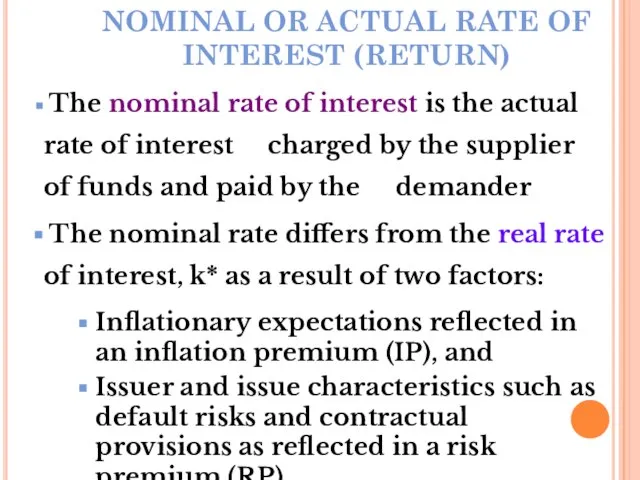

- 26. NOMINAL OR ACTUAL RATE OF INTEREST (RETURN) The nominal rate of interest is the actual rate

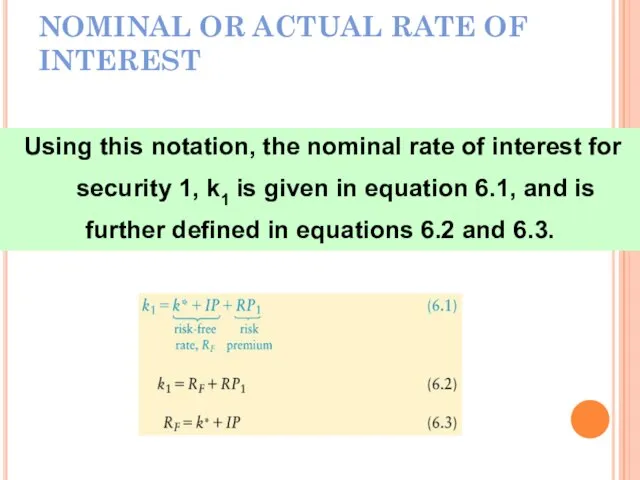

- 27. NOMINAL OR ACTUAL RATE OF INTEREST Using this notation, the nominal rate of interest for security

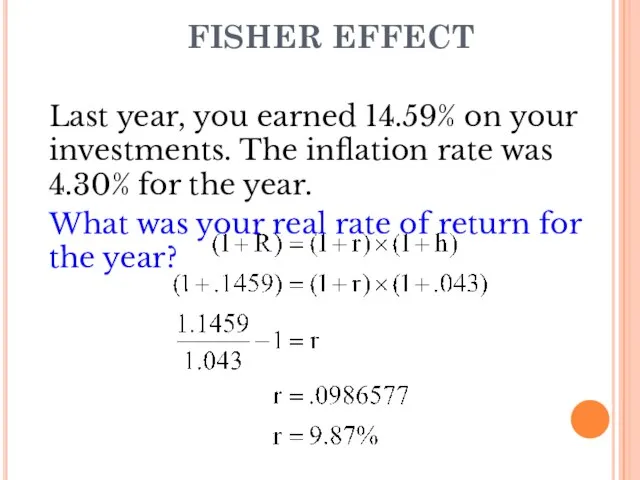

- 28. FISHER EFFECT Last year, you earned 14.59% on your investments. The inflation rate was 4.30% for

- 30. Скачать презентацию

Полиграфия

Полиграфия Омонимы. 2 класс

Омонимы. 2 класс Говорящий хомяк. Всегда поднимет настроение

Говорящий хомяк. Всегда поднимет настроение Презентация на тему Мясо птицы

Презентация на тему Мясо птицы  Технология изготовления изделий

Технология изготовления изделий Cодержание и основные задачи современного документационного обеспечения управления

Cодержание и основные задачи современного документационного обеспечения управления Криптовалюта first-coin

Криптовалюта first-coin Защита цифрового контента в кабельных сетях Примеры «Облачных» решений Conax в Восточной ЕвропеДни кабельного телевидения Украины

Защита цифрового контента в кабельных сетях Примеры «Облачных» решений Conax в Восточной ЕвропеДни кабельного телевидения Украины Энергетика, автоматика и системы коммуникаций

Энергетика, автоматика и системы коммуникаций Презентация на тему Микроорганизмы

Презентация на тему Микроорганизмы Гражданское право. 9 кл

Гражданское право. 9 кл Работа должна доставлять удовольствие!

Работа должна доставлять удовольствие! Видеоролики в instagram

Видеоролики в instagram «Состояние, актуальные проблемы и перспективы развития системы образования города Снежинска»

«Состояние, актуальные проблемы и перспективы развития системы образования города Снежинска» Центр детского развития Семицветик

Центр детского развития Семицветик Снеговик: история происхождения. Значение

Снеговик: история происхождения. Значение Процентные расчеты на каждый день

Процентные расчеты на каждый день Формирование положительного образа региона

Формирование положительного образа региона Кто придумал первую ракету?

Кто придумал первую ракету? Презентация на тему: Уроки литературы 11 класс ПЬЕСА М.ГОРЬКОГО «НА ДНЕ». ОСОБЕННОСТИ ЖАНРА И КОНФЛИКТА

Презентация на тему: Уроки литературы 11 класс ПЬЕСА М.ГОРЬКОГО «НА ДНЕ». ОСОБЕННОСТИ ЖАНРА И КОНФЛИКТА Merry christmas and happy new year

Merry christmas and happy new year Ведущие идеи построения региональной модели сопровождении одаренных детей

Ведущие идеи построения региональной модели сопровождении одаренных детей Варианты нормальной анатомии головного мозга на МР изображении

Варианты нормальной анатомии головного мозга на МР изображении Частые и популярные вопросы, а также помощь новичку.

Частые и популярные вопросы, а также помощь новичку. Развитие жизни в палеозойской эре

Развитие жизни в палеозойской эре Развитие жизни на Земле

Развитие жизни на Земле Ашан Скай мол

Ашан Скай мол Отчет по результатам диагностики адаптации учащихся 1 классов

Отчет по результатам диагностики адаптации учащихся 1 классов