Содержание

- 2. Moscow, 25th September 2008 Definition of Petrocurrency Petrocurrency is a convertible monetary unit of the state

- 3. Moscow, 25th September 2008 Two steps towards trading of Russian crude oil in rubles 1. To

- 4. Moscow, 25th September 2008 Positive sample: United States of America Average daily US statistics on crude

- 5. Moscow, 25th September 2008

- 6. Moscow, 25th September 2008 Email from the US Department of Energy on the 8th September 2008

- 7. Moscow, 25th September 2008 Two steps towards trading of Russian crude oil in rubles 2. To

- 8. Moscow, 25th September 2008 Conclusion It is necessary to make these two steps in establishing of

- 10. Скачать презентацию

Слайд 2Moscow, 25th September 2008

Definition of Petrocurrency

Petrocurrency is a convertible monetary unit of

Moscow, 25th September 2008

Definition of Petrocurrency

Petrocurrency is a convertible monetary unit of

Major world’s petrocurrencies:

Russian Ruble (RUB)

Canadian Dollar (CAD)

Norwegian Krone (NOK)

US Dollar (USD)

Kuwaiti Dinar (KWD)

Слайд 3Moscow, 25th September 2008

Two steps towards trading of Russian crude oil in

Moscow, 25th September 2008

Two steps towards trading of Russian crude oil in

1. To ban the export of crude oil of Russian origin.

Results:

The growth of Russian and foreign investments into Russian companies that refine and use crude oil with the goal to increase the income related with utilization of Russian energy sources inside Russia;

The development of Russian industrial production and internal markets, improving of job market;

The strengthening of Russian ruble, improving of buying power and living standards of Russian citizen;

The destruction of comprador bourgeoisie that prefers to develop export operations and to keep the national currency cheap.

Слайд 4Moscow, 25th September 2008

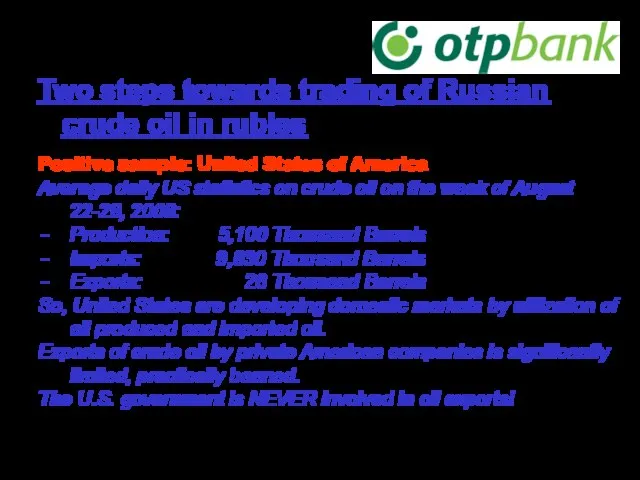

Positive sample: United States of America

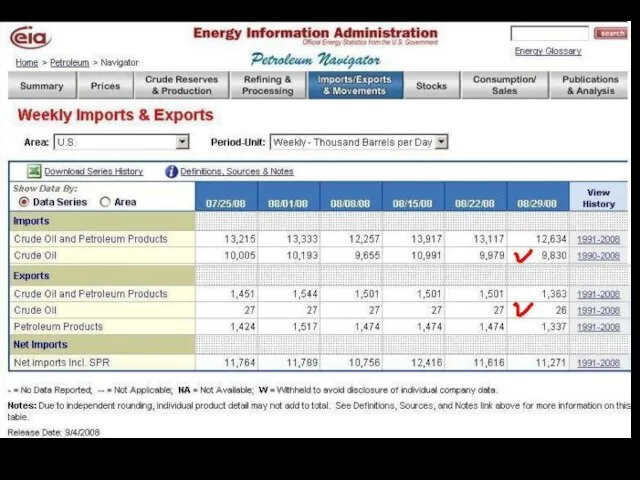

Average daily US statistics

Moscow, 25th September 2008

Positive sample: United States of America

Average daily US statistics

Production: 5,100 Thousand Barrels

Imports: 9,830 Thousand Barrels

Exports: 26 Thousand Barrels

So, United States are developing domestic markets by utilization of all produced and imported oil.

Exports of crude oil by private American companies is significantly limited, practically banned.

The U.S. government is NEVER involved in oil exports!

Two steps towards trading of Russian crude oil in rubles

Слайд 5Moscow, 25th September 2008

Moscow, 25th September 2008

Слайд 6Moscow, 25th September 2008

Email from the US Department of Energy on the

Moscow, 25th September 2008

Email from the US Department of Energy on the

Dear Mr. Suzdaltsev:

Thank you for your inquiry concerning U.S. crude oil exports.

There are restrictions on the export of domestically produced crude oil.

Crude oil exports are restricted to: (1) crude oil derived from fields under the State waters of Alaska's Cook Inlet; (2) Alaskan North Slope crude oil; (3) certain domestically produced crude oil destined for Canada; (4) shipments to U.S. territories; and (5) California crude oil to Pacific Rim countries. The U.S. government is not involved in oil exports.

Within the Export Administration Regulations Database (http://www.access.gpo.gov/bis/ear/ear_data.html), you can find information on restrictions on crude oil exports and the exceptions to those restrictions in Part 754 - Short Supply Controls at: http://www.access.gpo.gov/bis/ear/pdf/754.pdf

Currently, all of the crude oil exported from the U.S. goes to Canada.

You can find data on U.S. crude oil exports by country of origin at: http://tonto.eia.doe.gov/dnav/pet/pet_move_expc_a_EPC0_EEX_mbbl_m.htm

I hope this information helps. Please contact us again if you need further assistance with energy data or statistics.

Jonathan Cogan

Energy Information Administration, (202) 586-8719, [email protected]

Слайд 7Moscow, 25th September 2008

Two steps towards trading of Russian crude oil in

Moscow, 25th September 2008

Two steps towards trading of Russian crude oil in

2. To make Russian ruble a major settlement currency for all domestic, export or import commodity deals made by people and companies – the residents of Russian Federation.

Results:

The growth of usage of Russian ruble as settlement currency around the world;

The growth of Russian ruble FX trading on financial markets;

Simplification of international settlements and increasing of profitability of Russian companies due to the elimination of expenses for currencies’ conversion;

Ruble strengthening to the level of reserve currency.

Слайд 8Moscow, 25th September 2008

Conclusion

It is necessary to make these two steps in

Moscow, 25th September 2008

Conclusion

It is necessary to make these two steps in

It will also provide the basis for achieving of the goal of Russian President Dmitry Medvedev to establish the Russian ruble as reserve currency.

Необходимость отмены запретов на пропуск трафика

Необходимость отмены запретов на пропуск трафика «100 ЛЕТ СО ДНЯ РОЖДЕНИЯ СЕРГЕЯ ПАВЛОВИЧА КОРОЛЕВА»

«100 ЛЕТ СО ДНЯ РОЖДЕНИЯ СЕРГЕЯ ПАВЛОВИЧА КОРОЛЕВА» День Святого Патрика

День Святого Патрика Действие электрического тока на человека

Действие электрического тока на человека Ребусворд

Ребусворд Переходный возраст: Особенности контакта с подростками

Переходный возраст: Особенности контакта с подростками ПетрГУ Историко-филологический факультет 1979 – 1984 г.г

ПетрГУ Историко-филологический факультет 1979 – 1984 г.г Конституция. Интерактивный тренажёр

Конституция. Интерактивный тренажёр Brand Online 2009_Касперович Евгений_ Tvigle Media Брендированный видео-контент, как нестандартная форма интеграции в лицензионное video: Как не р

Brand Online 2009_Касперович Евгений_ Tvigle Media Брендированный видео-контент, как нестандартная форма интеграции в лицензионное video: Как не р Королева пчел

Королева пчел The International Structure of Words

The International Structure of Words Символика в романе Ф.И. Достоевского «Преступление и наказание»

Символика в романе Ф.И. Достоевского «Преступление и наказание» Эмоционально-чувственные процессы: страх и ужас

Эмоционально-чувственные процессы: страх и ужас Презентация на тему Сравнение: Коран и Библия

Презентация на тему Сравнение: Коран и Библия Товары и услуги, подлежащие обязательной сертификации

Товары и услуги, подлежащие обязательной сертификации Организация перевозок и грузовой работы на транспорте

Организация перевозок и грузовой работы на транспорте РОССИЙСКИЙ РЫНОК ПЕЧАТНЫХ CМИ: оценка текущей ситуации и перспектив развития на 2010 год пятая волна мониторинга: январь – апрель 20

РОССИЙСКИЙ РЫНОК ПЕЧАТНЫХ CМИ: оценка текущей ситуации и перспектив развития на 2010 год пятая волна мониторинга: январь – апрель 20 Перекачка высоковязких и высокозастывающих нефтей

Перекачка высоковязких и высокозастывающих нефтей Победитель фотоконкурса В объективе: Многодетная семья

Победитель фотоконкурса В объективе: Многодетная семья Экраны 4 октября

Экраны 4 октября Порядок организации оздоровления и отдыха детей города Перми в 2011 году

Порядок организации оздоровления и отдыха детей города Перми в 2011 году Россия - Родина моя

Россия - Родина моя Интенсивная технология производства диаммонийфосфата

Интенсивная технология производства диаммонийфосфата «210 лет со дня рождения А. С. Пушкина

«210 лет со дня рождения А. С. Пушкина Макеевой А.С."

Макеевой А.С." Wide Range of UPVC Windows & Doors

Wide Range of UPVC Windows & Doors Всероссийская студенческая фармацевтическая олимпиада (ВСФО)

Всероссийская студенческая фармацевтическая олимпиада (ВСФО) Поручение Президента РФ

Поручение Президента РФ