Слайд 2Plan for our presentation:

*Tell about the author

*Tell about the book

*Interesting parts of

the book we liked

*Recommendations and advices

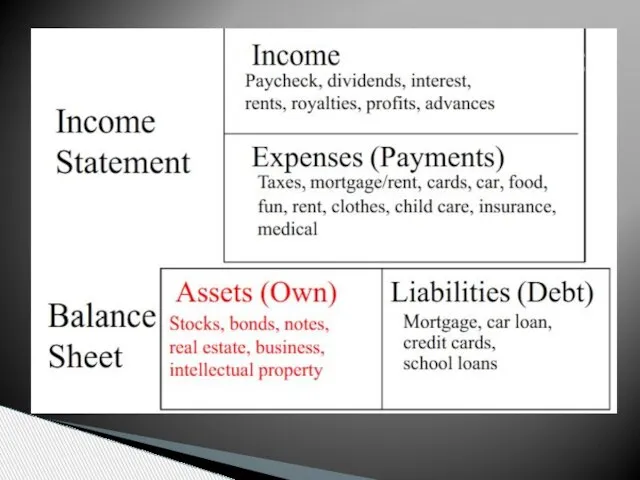

Слайд 5So what’s the difference between them?

Слайд 6Lesson1

The rich don’t work for money

Lesson2

Master Financial Literacy

Слайд 8There are five reasons that people don’t grow assets and become financially

independent:

*Fear - of losing money

*Cynicism - don’t let doubts paralyze

*Laziness - busy people are often the most lazy

*Bad Habits - our lives reflect our habits

*Arrogance - arrogance + ego = ignorance

Слайд 9You must know the difference between an

asset and a liability and buy

assets:

1.The rich buy assets but the poor and middleclass buy liabilities they think are assets.

2.The cash flow pattern of an asset is from

Assets to Income.

3.The cash flow pattern of a liability is from Liabilities to Expense.

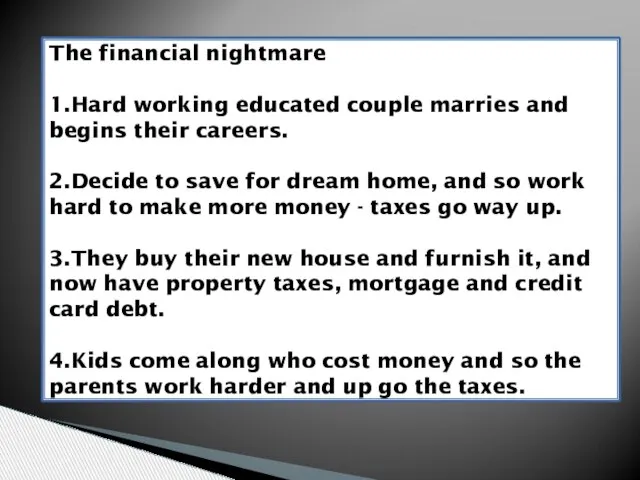

Слайд 10The financial nightmare

1.Hard working educated couple marries and begins their careers.

2.Decide to save

for dream home, and so work hard to make more money - taxes go way up.

3.They buy their new house and furnish it, and now have property taxes, mortgage and credit card debt.

4.Kids come along who cost money and so the parents work harder and up go the taxes.

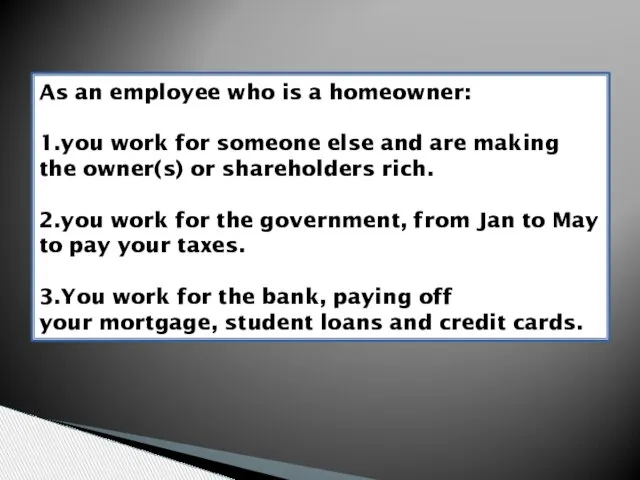

Слайд 11As an employee who is a homeowner:

1.you work for someone else and

are making the owner(s) or shareholders rich.

2.you work for the government, from Jan to May to pay your taxes.

3.You work for the bank, paying off your mortgage, student loans and credit cards.

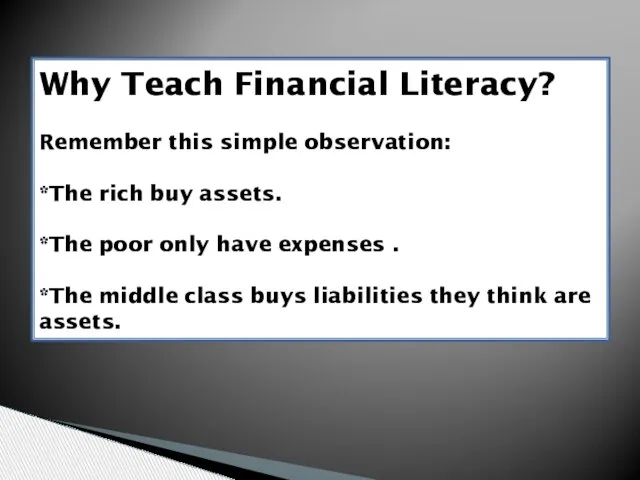

Слайд 12Why Teach Financial Literacy?

Remember this simple observation:

*The rich buy assets.

*The poor only have

expenses .

*The middle class buys liabilities they think are assets.

Леонид Ильич Брежнев не повлиял на распад СССР

Леонид Ильич Брежнев не повлиял на распад СССР Деятельностный подход

Деятельностный подход  Презентация на тему Болезни Земли

Презентация на тему Болезни Земли Математика 6 класс Тема: «Деление положительных и отрицательных чисел»

Математика 6 класс Тема: «Деление положительных и отрицательных чисел» Невозможные фигуры

Невозможные фигуры Характеристика и оформление меню со свободным выбором блюд

Характеристика и оформление меню со свободным выбором блюд Альтернативные источники энергии

Альтернативные источники энергии Презентация на тему Плавание

Презентация на тему Плавание 5

5 Internet Protocol Security (IPSec)

Internet Protocol Security (IPSec) Характеристика местоимения как части речи

Характеристика местоимения как части речи Латынь в повседневной жизни римлян

Латынь в повседневной жизни римлян Николай Алексеевич НЕКРАСОВ

Николай Алексеевич НЕКРАСОВ 4 классОкружающий мир.Растениеводство в нашем крае.

4 классОкружающий мир.Растениеводство в нашем крае. Супервайзер по развитию ключевых клиентов

Супервайзер по развитию ключевых клиентов Применение ВВ для добычи полезных ископаемых

Применение ВВ для добычи полезных ископаемых Что такое сделка. Общий обзор проблемы

Что такое сделка. Общий обзор проблемы День матери (открытки)

День матери (открытки) проф качест

проф качест Повышения качества знаний учащихся при обучении математике

Повышения качества знаний учащихся при обучении математике Культура России 4 класс

Культура России 4 класс Организация хранения данных с использованием системы eDocLib

Организация хранения данных с использованием системы eDocLib Koyusheva_Miroslava

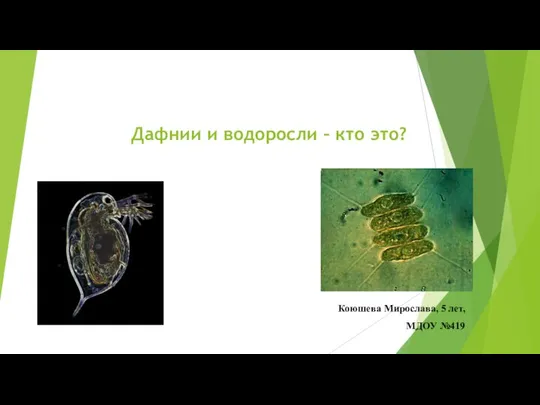

Koyusheva_Miroslava Любимое блюдо моей семьи

Любимое блюдо моей семьи Ирисы живописи

Ирисы живописи Героям десантникам Новороссийска посвящается

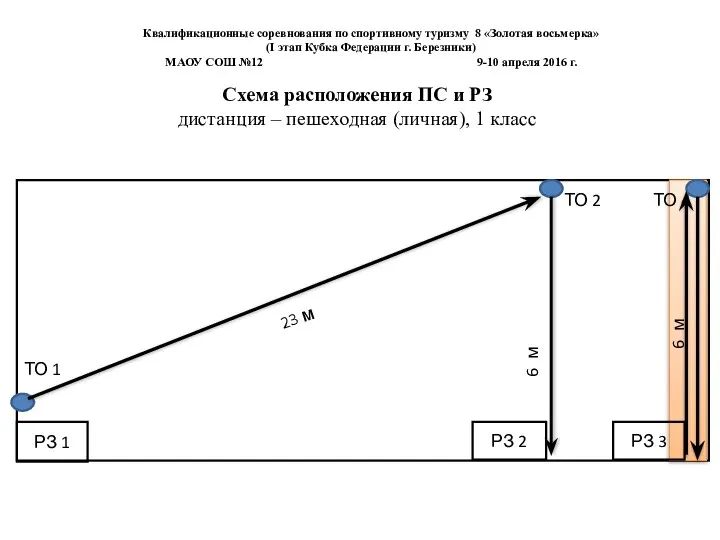

Героям десантникам Новороссийска посвящается Квалификационные соревнования по спортивному туризму Золотая восьмерка. Схемы

Квалификационные соревнования по спортивному туризму Золотая восьмерка. Схемы Крестецкая детская школа искусств

Крестецкая детская школа искусств