Слайд 2Agenda

Key foreign regulatory issues faced by Russian companies

Russian FSFM regulation of GDR

issuance

Слайд 3History of limitations on GDR programmes

For the past 10 years FSFM

has been:

consistently reducing the ceiling for GDR offerings by Russian companies

2001: Permission requirement and 75% threshold introduced

2003: 75% threshold reduced to 40%

2006: 40% threshold reduced to 35% and 70/30 rule introduced

2008: 35% threshold reduced to 30%, lower thresholds of 25% and 5% introduced for strategic companies, 70/30 rule preserved

vigorously criticising offshore offerings of Russian businesses

Слайд 4June 2009 Amendments

Came into effect on 1 January 2010

Further reduced the

ceiling for GDR offerings

Applicable ceiling depends on:

existing level of Russian listing; and

whether a company is a strategic subsoil company

Imposed additional compliance requirements on Russian companies

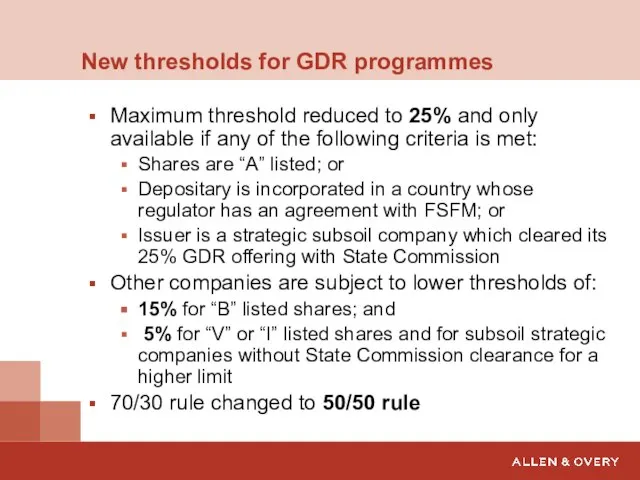

Слайд 5New thresholds for GDR programmes

Maximum threshold reduced to 25% and only available

if any of the following criteria is met:

Shares are “A” listed; or

Depositary is incorporated in a country whose regulator has an agreement with FSFM; or

Issuer is a strategic subsoil company which cleared its 25% GDR offering with State Commission

Other companies are subject to lower thresholds of:

15% for “B” listed shares; and

5% for “V” or “I” listed shares and for subsoil strategic companies without State Commission clearance for a higher limit

70/30 rule changed to 50/50 rule

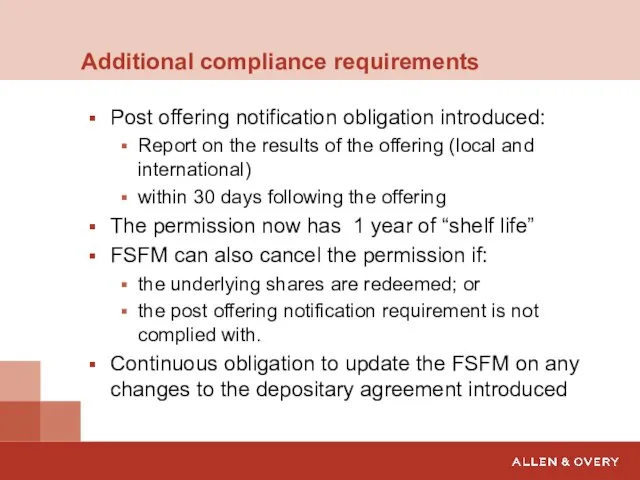

Слайд 6Additional compliance requirements

Post offering notification obligation introduced:

Report on the results of the

offering (local and international)

within 30 days following the offering

The permission now has 1 year of “shelf life”

FSFM can also cancel the permission if:

the underlying shares are redeemed; or

the post offering notification requirement is not complied with.

Continuous obligation to update the FSFM on any changes to the depositary agreement introduced

Lluvia

Lluvia Жужжалочка. Дидактическая игра для автоматизации звука Ж в словах

Жужжалочка. Дидактическая игра для автоматизации звука Ж в словах УД ПСИХОЛОГИЯ

УД ПСИХОЛОГИЯ Храмы России

Храмы России Оптическая микроскопия

Оптическая микроскопия Менеджмент

Менеджмент Кондитерский отдел

Кондитерский отдел Органы и службы стандартизации РФ

Органы и службы стандартизации РФ Вышел зайчик погулять Художник – В. Сергеев

Вышел зайчик погулять Художник – В. Сергеев Знакомство с точкой

Знакомство с точкой Состояние и задачи управления проектами в строительстве

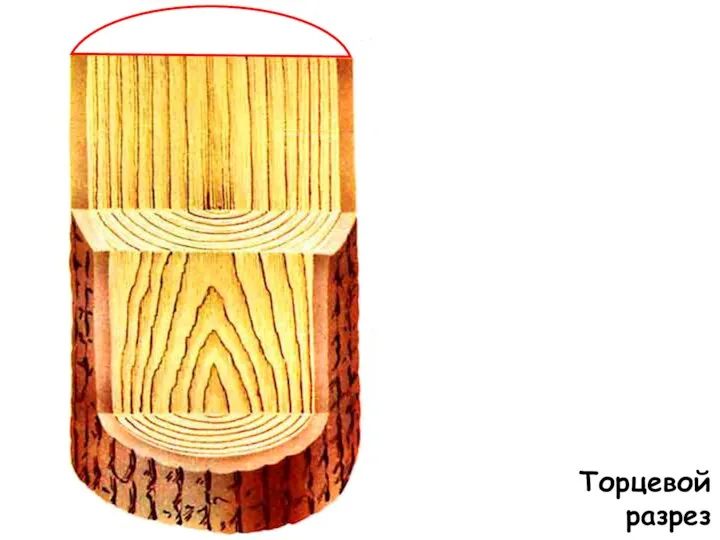

Состояние и задачи управления проектами в строительстве Торцевой разрез. Материаловедение

Торцевой разрез. Материаловедение чайные истории

чайные истории Шпаргалка юного покупателя

Шпаргалка юного покупателя Учебно-методический комплекс "Живая география" Живая география - учебно-методический комплекс, позволяющий использовать геоинфор

Учебно-методический комплекс "Живая география" Живая география - учебно-методический комплекс, позволяющий использовать геоинфор Классификация реакций

Классификация реакций Организация хранения документов Архивного фонда Российской Федерации и других архивных документов

Организация хранения документов Архивного фонда Российской Федерации и других архивных документов Трансляция – биосинтез белка на рибосоме

Трансляция – биосинтез белка на рибосоме Инновационный подход к жизни

Инновационный подход к жизни DaCoPAn Software Engineering Project - Система динамической визуализации событий работы протоколов при обмене данными между двумя сетевыми ЭВМ — D

DaCoPAn Software Engineering Project - Система динамической визуализации событий работы протоколов при обмене данными между двумя сетевыми ЭВМ — D Урок – размышление по рассказу К.Г. Паустовского «Телеграмма»

Урок – размышление по рассказу К.Г. Паустовского «Телеграмма» Путешествие в мир животных

Путешествие в мир животных СПАСИБО, АЗБУКА!

СПАСИБО, АЗБУКА! Rave Cosmology Today Dying, Death & Bardo . RC3.8

Rave Cosmology Today Dying, Death & Bardo . RC3.8 Основные закономерности развития информационного пространства

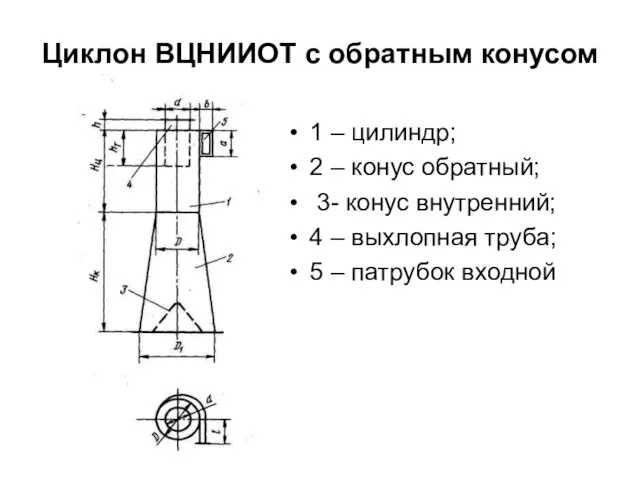

Основные закономерности развития информационного пространства Циклон ВЦНИИОТ с обратным конусом

Циклон ВЦНИИОТ с обратным конусом  Квантовые компьютеры

Квантовые компьютеры Разработать рекламную кампанию в стиле шоу для молодежного интернет-издания Пи-Пермь (бюджет студенческой редакции)

Разработать рекламную кампанию в стиле шоу для молодежного интернет-издания Пи-Пермь (бюджет студенческой редакции)