Содержание

- 2. Plan of lection 1. Definition of income and cost 2. Classification of costs 3. Price and

- 3. 1 The earning of net income, or profits, is a major goal of almost every business

- 4. Since business managers and economists use the word profits in somewhat different senses, accountants prefer to

- 5. To determine net income, it is necessary to measure for a given time period (1) the

- 6. Revenue is the price of goods sold and services rendered during a given accounting period. Business

- 7. Expenses are the cost of the goods and services used up in the process of earning

- 8. Cost – Variable costs A variable cost increases and decreases directly and proportionately with changes in

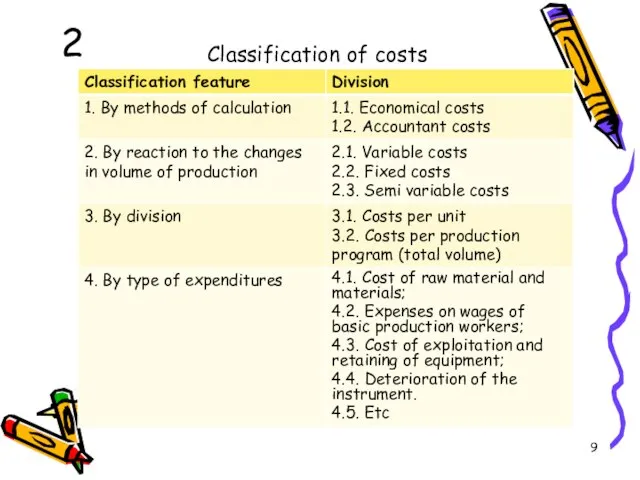

- 9. Classification of costs 2

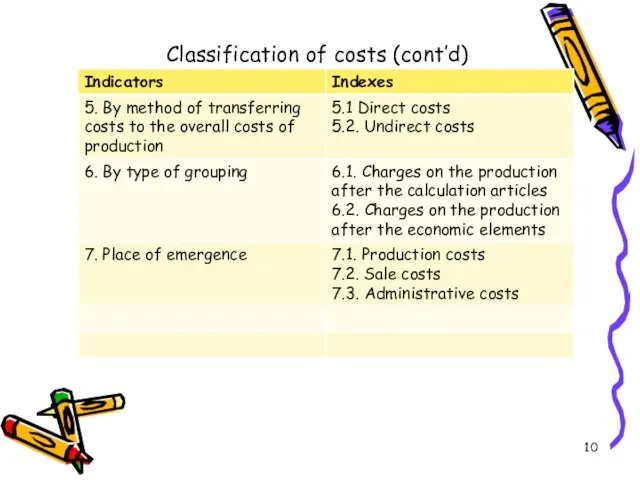

- 10. Classification of costs (cont’d)

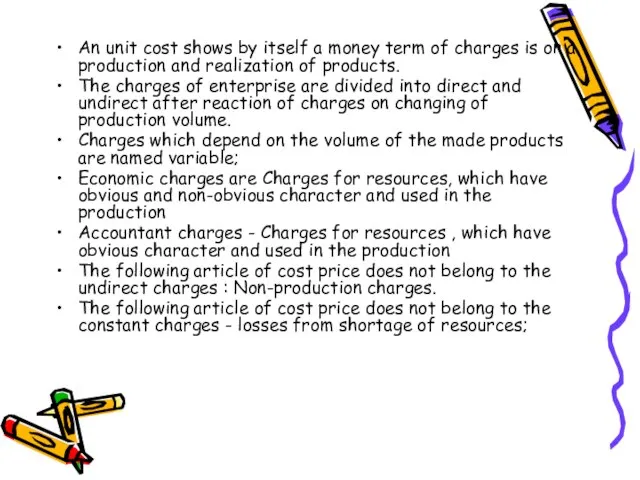

- 11. An unit cost shows by itself a money term of charges is on a production and

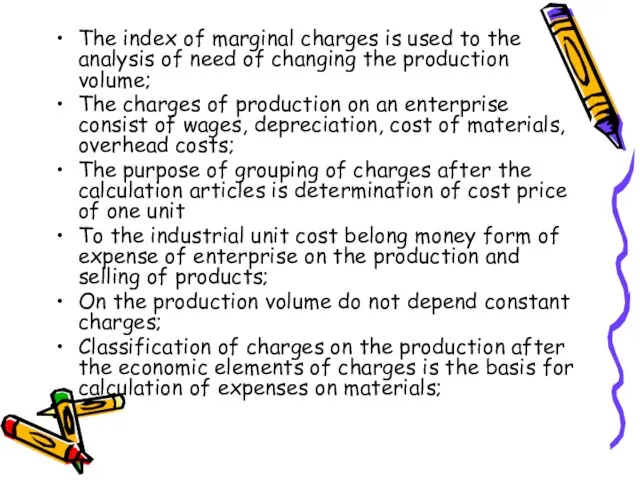

- 12. The index of marginal charges is used to the analysis of need of changing the production

- 13. 3 Price – it is money expression of cost of commodity Functions of price : Signalling

- 14. Signaling function Prices perform a signaling function – they adjust to demonstrate where resources are required,

- 15. Transmission of preferences Through their choices consumers send information to producers about the changing nature of

- 16. Stimulative function of price - rational use of the limited resources., instrumental in scientific and technical

- 17. Pricing – it is the process of establishment and putting of prices and tariffs, later their

- 18. Factors, which influence on price making process: Positioning - How are you positioning your product in

- 19. Pricing strategies Short-term profit maximization - This approach is common in companies that are bootstrapping, as

- 20. Maximize profit margin - This strategy is most appropriate when the number of sales is either

- 21. Methods of pricing : method of estimation of consumer cost; method of receipt of specified norm

- 22. Psychological pricing - Ultimately, you must take into consideration the consumer's perception of your price, figuring

- 23. Cost-plus pricing - Set the price at your production cost, including both cost of goods and

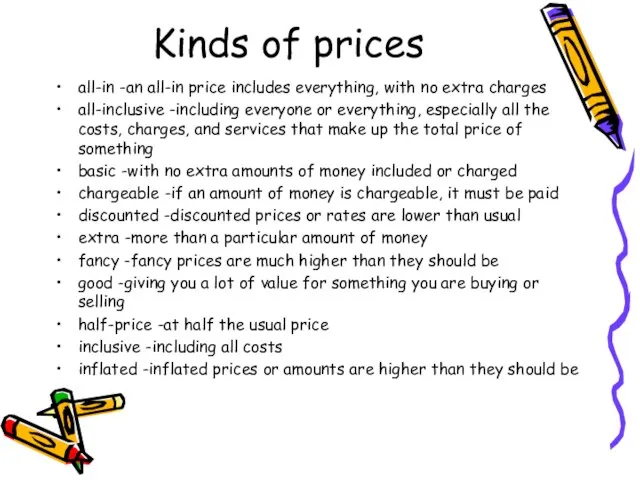

- 24. Kinds of prices all-in -an all-in price includes everything, with no extra charges all-inclusive -including everyone

- 25. introductory -an introductory offer or price is a low price that is intended to encourage people

- 26. To the production prices belong: wholesale; of asqusition; estimate; Calculation (self-cost) planned The lower limit of

- 27. Cost-Volume-Profit Analysis Examines the behaviour of total revenues, total costs, and operating income as changes occur

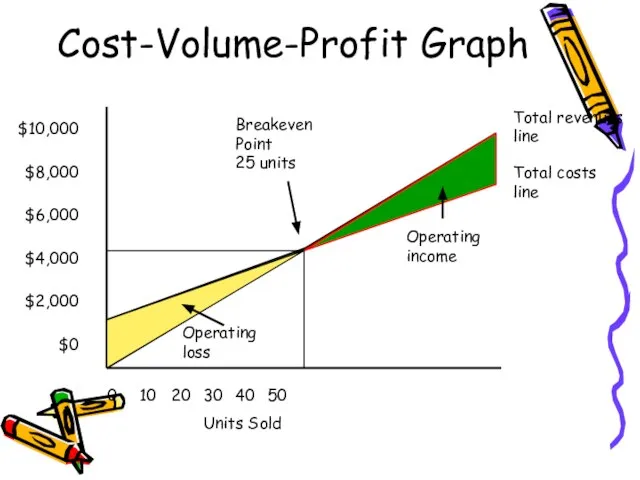

- 28. The resulting break-even formula for composite unit sales is: Break-even point in composite units Fixed costs

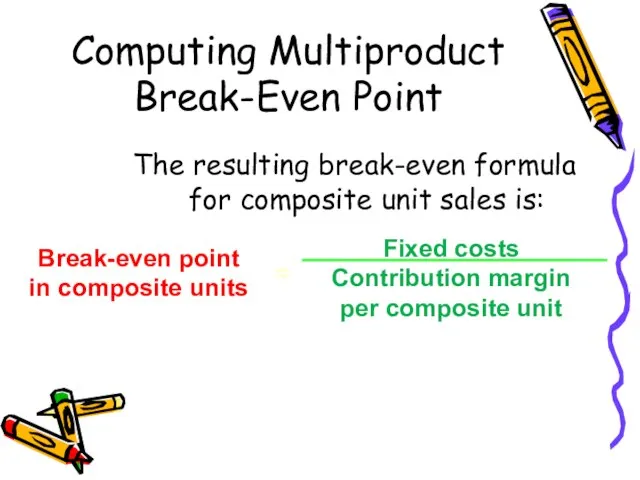

- 29. Contribution Margin Contribution margin is equal to the difference between total revenue and total variable costs

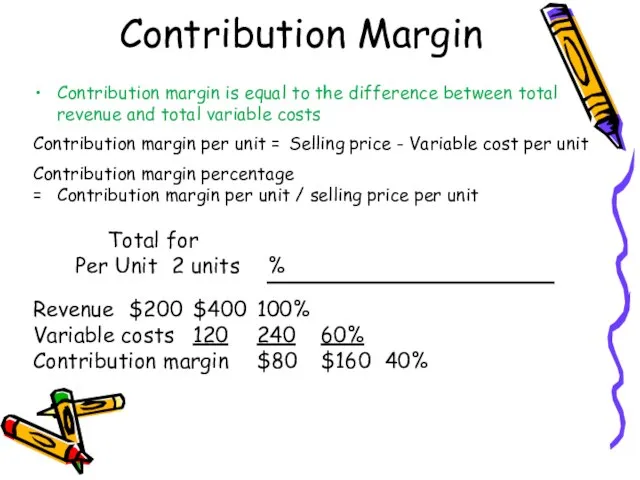

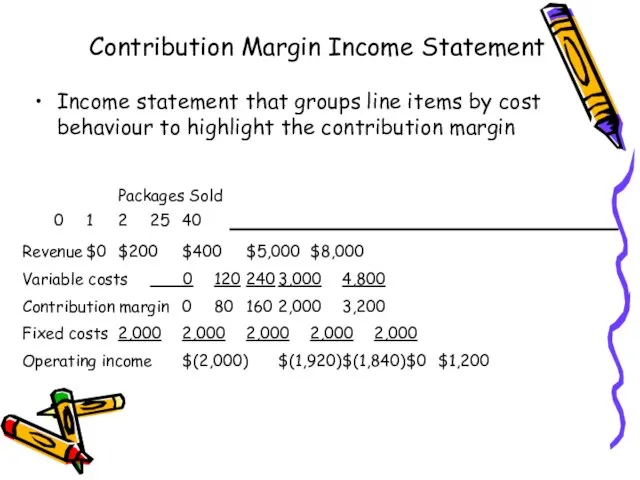

- 30. Contribution Margin Income Statement Packages Sold 0 1 2 25 40 Revenue $0 $200 $400 $5,000

- 31. I. Common Cost Behavior Patterns Variable Costs Fixed Costs Discretionary versus Committed Fixed Costs Mixed Costs

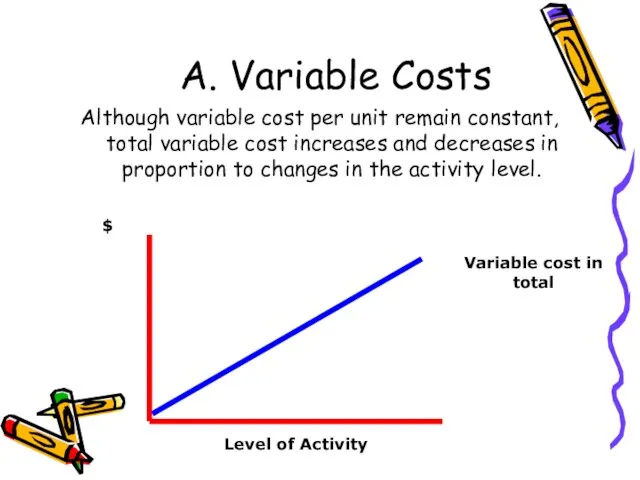

- 32. A. Variable Costs Although variable cost per unit remain constant, total variable cost increases and decreases

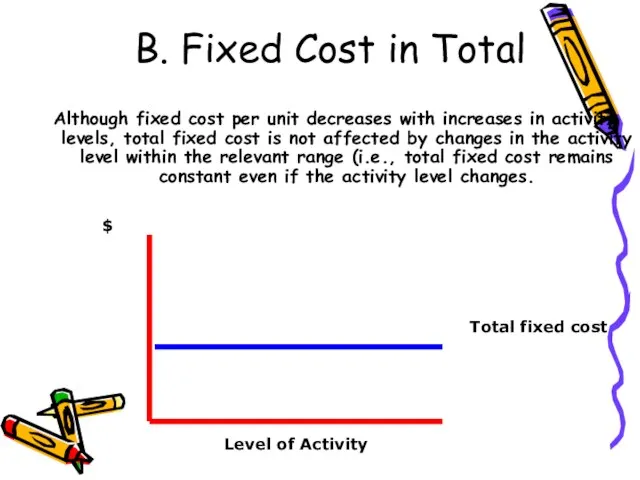

- 33. B. Fixed Cost in Total Although fixed cost per unit decreases with increases in activity levels,

- 34. C. Discretionary versus Committed Fixed Costs Committed Fixed Costs Examples include rent, depreciation, insurance. Two key

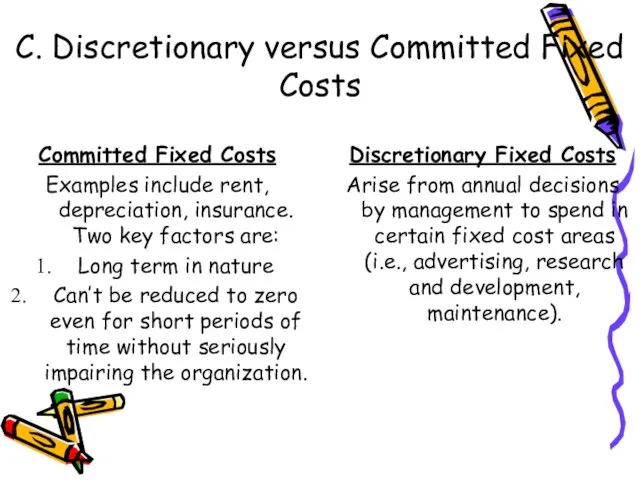

- 35. D. Mixed Cost A mixed cost has both a variable and a fixed component. $ Level

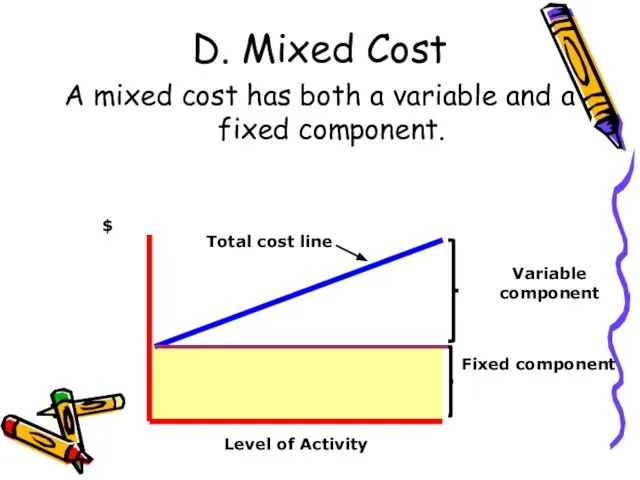

- 36. E. Step Costs Step costs are those costs that are fixed for a range of volume

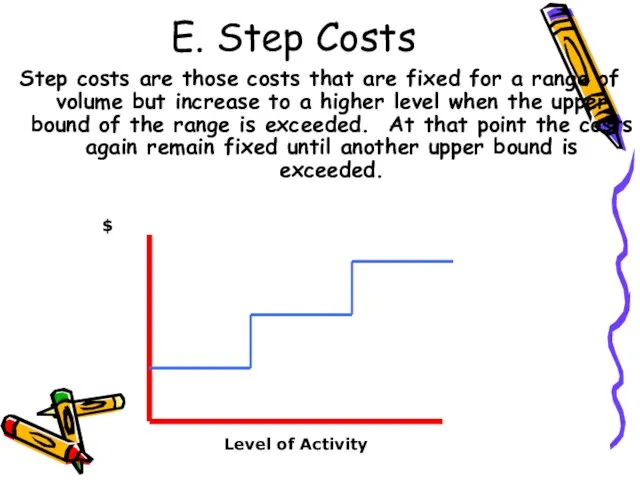

- 37. Breakeven Point Quantity of output where total revenues equal total costs Point where operating income equals

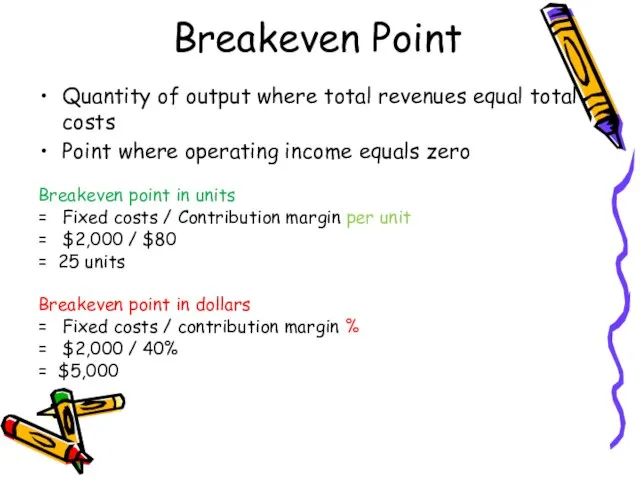

- 38. Cost-Volume-Profit Graph $10,000 $8,000 $6,000 $4,000 $2,000 $0 0 10 20 30 40 50 Units Sold

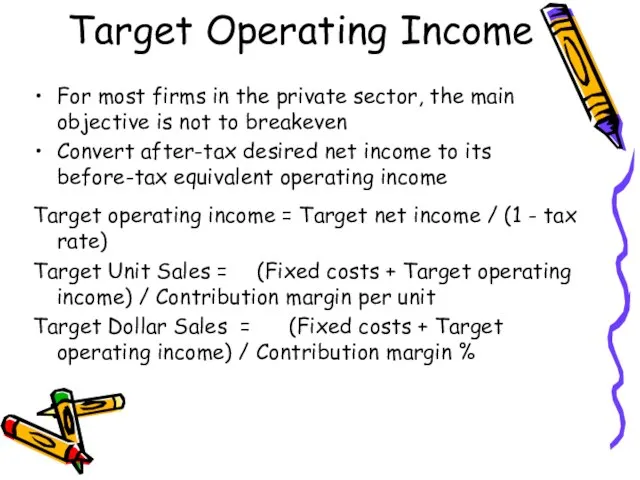

- 39. Target Operating Income For most firms in the private sector, the main objective is not to

- 41. Скачать презентацию

Политические режимы

Политические режимы Тройникова Софья автор.

Тройникова Софья автор. Приостановление полномочий судьи и отставки судьи

Приостановление полномочий судьи и отставки судьи Административные правоотношения

Административные правоотношения Экология и культура -будущее России

Экология и культура -будущее России Рынок труда и заработная плата

Рынок труда и заработная плата КОМПЬЮТЕР И ВИДЕОКАМЕРА КАК ИНСТРУМЕНТЫ ОБУЧЕНИЯ ФИЗИКЕ

КОМПЬЮТЕР И ВИДЕОКАМЕРА КАК ИНСТРУМЕНТЫ ОБУЧЕНИЯ ФИЗИКЕ Саба районы Шынар авылы

Саба районы Шынар авылы Презентация на тему Уголовное право. Уголовный процесс

Презентация на тему Уголовное право. Уголовный процесс Новые технологии при тестоведении

Новые технологии при тестоведении ЮГОРСКИЙ ГОСУДАРСТВЕННЫЙУНИВЕРСИТЕТ

ЮГОРСКИЙ ГОСУДАРСТВЕННЫЙУНИВЕРСИТЕТ «Музыка и движение»

«Музыка и движение» ОЦЕНКА КАЧЕСТВА АНАЛЬГЕТИКОВ НЕКОТОРЫХ ПРОИЗВОДИТЕЛЕЙ

ОЦЕНКА КАЧЕСТВА АНАЛЬГЕТИКОВ НЕКОТОРЫХ ПРОИЗВОДИТЕЛЕЙ ДОБРОКАЧЕСТВЕННЫЕ ОПУХОЛИ ЖЕНСКИХ ПОЛОВЫХ ОРГАНОВ (лекция)

ДОБРОКАЧЕСТВЕННЫЕ ОПУХОЛИ ЖЕНСКИХ ПОЛОВЫХ ОРГАНОВ (лекция) Программа курса Семейная фотография

Программа курса Семейная фотография Охрана здоровья и безопасностьИТОГИ 2008 годаОАО «АрселорМиттал Кривой Рог», Украина

Охрана здоровья и безопасностьИТОГИ 2008 годаОАО «АрселорМиттал Кривой Рог», Украина Что такое вредные привычки и каковы причины их возникновения и последствия?

Что такое вредные привычки и каковы причины их возникновения и последствия? Кома

Кома  Презентация на тему Биография и творчество Чингиза Айтматова (1928 – 2008)

Презентация на тему Биография и творчество Чингиза Айтматова (1928 – 2008) Презентация на тему Периметр и площадь прямоугольника

Презентация на тему Периметр и площадь прямоугольника увтро

увтро Economic and Political unification

Economic and Political unification  Авторитет государственной власти

Авторитет государственной власти Провешивание прямой на местности

Провешивание прямой на местности Использование УМК в современной начальной школе. Федеральный перечень учебников

Использование УМК в современной начальной школе. Федеральный перечень учебников proekt_TTU (1)

proekt_TTU (1) Проект.pptx презентация ШЭПР

Проект.pptx презентация ШЭПР Беспроводное устройство управления элементами системы “Умный дом”

Беспроводное устройство управления элементами системы “Умный дом”