Содержание

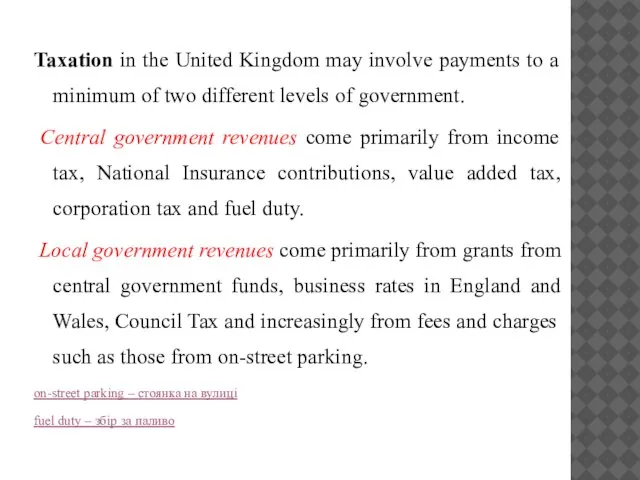

- 2. Taxation in the United Kingdom may involve payments to a minimum of two different levels of

- 3. THE TAX YEAR The tax year in the UK, which applies to income tax and other

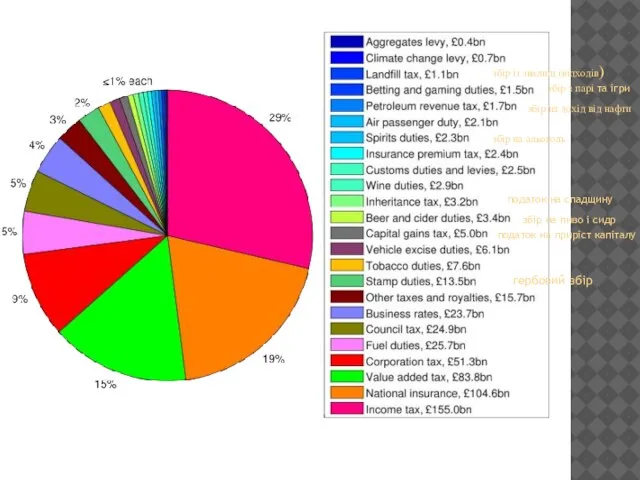

- 4. гербовий збір податок на приріст капіталу збір на пиво і сидр податок на спадщину збір на

- 5. INCOME TAX Income tax forms the single largest source of revenues collected by the government. Each

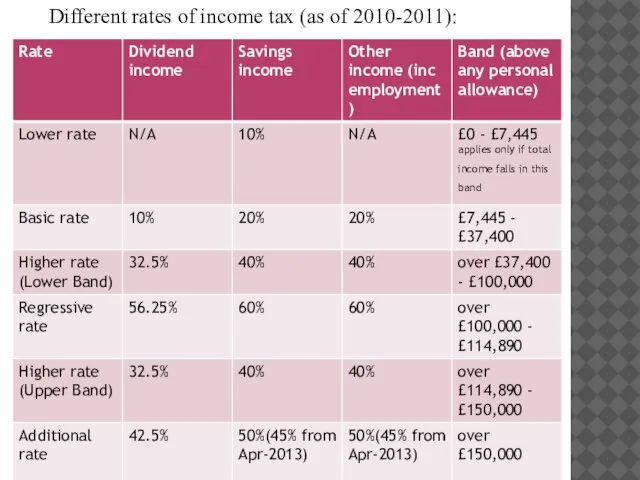

- 6. Different rates of income tax (as of 2010-2011):

- 7. NATIONAL INSURANCE CONTRIBUTIONS The second largest source of government revenues is National Insurance contributions (NICs). NICs

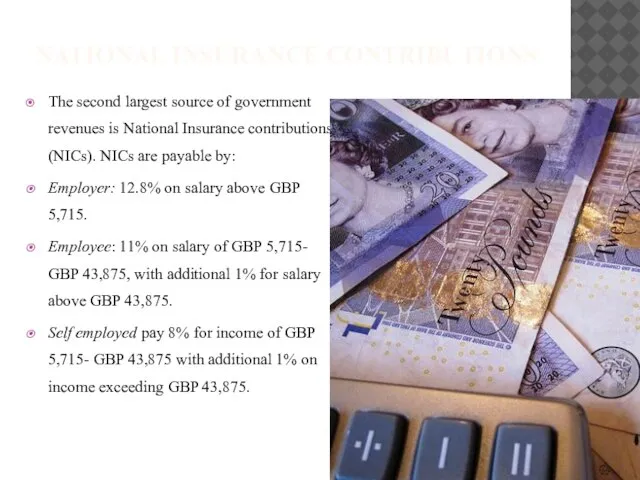

- 8. VALUE ADDED TAX On 4 January 2011 VAT was raised from 17, 5% to 20% The

- 9. CORPORATION TAX Corporation tax forms the fourth-largest source of government revenue (after income, NIC, and VAT).

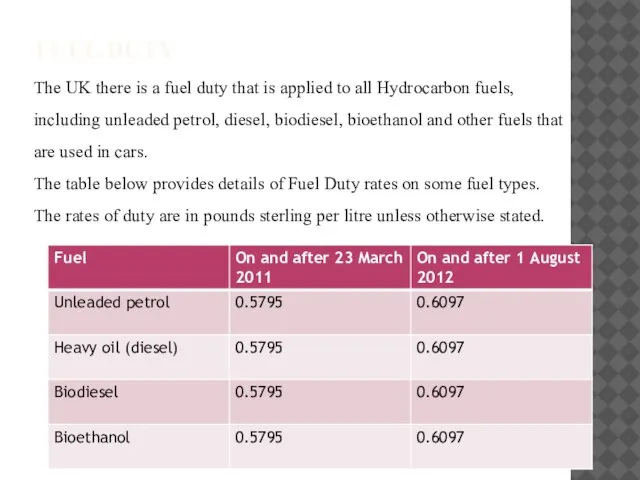

- 10. FUEL DUTY The UK there is a fuel duty that is applied to all Hydrocarbon fuels,

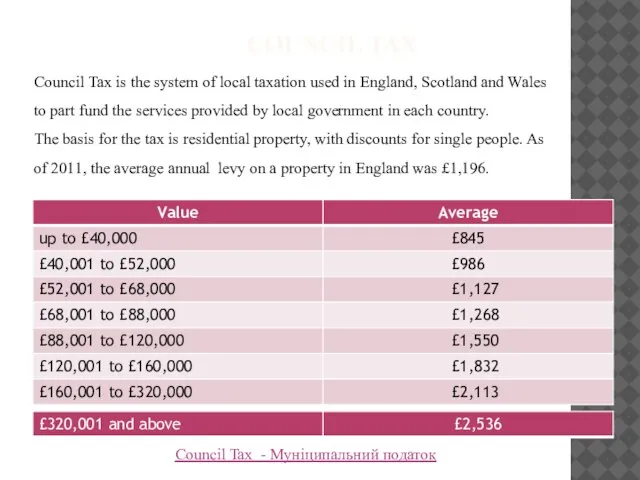

- 11. COUNCIL TAX Council Tax is the system of local taxation used in England, Scotland and Wales

- 12. CLIMATE CHANGE LEVY The climate change levy (CCL) is a tax on energy delivered to non-domestic

- 14. Скачать презентацию

Евстафьев А.И. Начальник отдела консалтинга ООО “Южная Юридическая Консалтинговая Компания”, САРН Максимов Д.В. Финансовый дире

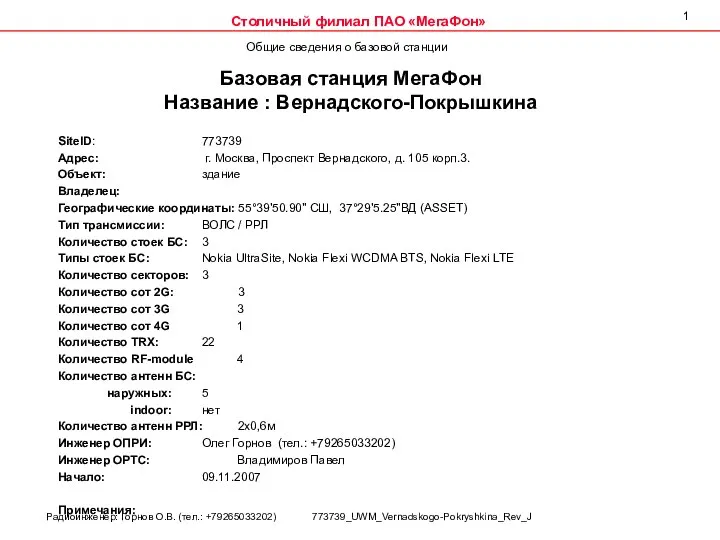

Евстафьев А.И. Начальник отдела консалтинга ООО “Южная Юридическая Консалтинговая Компания”, САРН Максимов Д.В. Финансовый дире Базовая станция МегаФон

Базовая станция МегаФон Матюшевский Дом культуры приглашение в дни весенних праздников

Матюшевский Дом культуры приглашение в дни весенних праздников Бизнес инсайт. Саша Лонго. Как стать человеком-магнитом

Бизнес инсайт. Саша Лонго. Как стать человеком-магнитом Полевые транзисторы. Самостоятельная работа

Полевые транзисторы. Самостоятельная работа МОНИТОРЫ

МОНИТОРЫ Важнейшие географические открытия. Марко Поло и его путешествия.

Важнейшие географические открытия. Марко Поло и его путешествия. Уголовно - правовые отношения

Уголовно - правовые отношения Создание базы знаний по флоре Байкальской Сибири

Создание базы знаний по флоре Байкальской Сибири Наброски и зарисовки архитектурных строений и их элементов. Пленэр

Наброски и зарисовки архитектурных строений и их элементов. Пленэр Кому нужен ВСД. Комплексная транспортная система Санкт-Петербурга

Кому нужен ВСД. Комплексная транспортная система Санкт-Петербурга Традиции празднования Рождества в США

Традиции празднования Рождества в США Время любви - весна

Время любви - весна Презентация на тему ХАМЕЛЕОНЫ

Презентация на тему ХАМЕЛЕОНЫ  Formy prac florystycznych

Formy prac florystycznych Традиции семьи для квеста

Традиции семьи для квеста Как выполнить чертёж Брусок /стойка/. 10, 11 класс

Как выполнить чертёж Брусок /стойка/. 10, 11 класс Правовые символы

Правовые символы ОАО «РУСДЖАМ КИРИШИ»

ОАО «РУСДЖАМ КИРИШИ» 732 Вот год пришёл к кончине

732 Вот год пришёл к кончине Русская культура в конце XIII- начале XIV веков

Русская культура в конце XIII- начале XIV веков Порядок назначения и выплаты пособий семьям с детьми в РФ

Порядок назначения и выплаты пособий семьям с детьми в РФ КЕЙС. СТРАТЕГИЯ РОСТА

КЕЙС. СТРАТЕГИЯ РОСТА Я буду конструктором, проектировщиком или архитектором – детские мечты в реальность

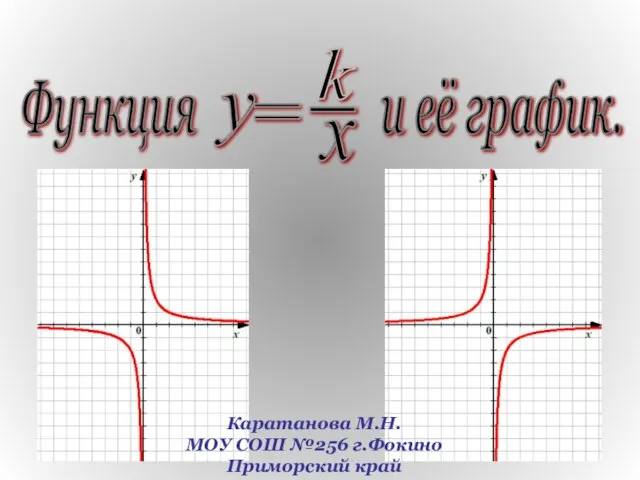

Я буду конструктором, проектировщиком или архитектором – детские мечты в реальность Презентация на тему Функция и её график

Презентация на тему Функция и её график  ЖИВОПИСЬ 14 — 15 ВЕКОВ НА РУСИ

ЖИВОПИСЬ 14 — 15 ВЕКОВ НА РУСИ  #Pokupanda_Tomsk

#Pokupanda_Tomsk FEATURES OF DRUGS ACTION DURING PREGNANCY

FEATURES OF DRUGS ACTION DURING PREGNANCY