Содержание

- 2. The Costs of Taxation How do taxes affect the economic well-being of market participants?

- 3. The Costs of Taxation It does not matter whether a tax on a good is levied

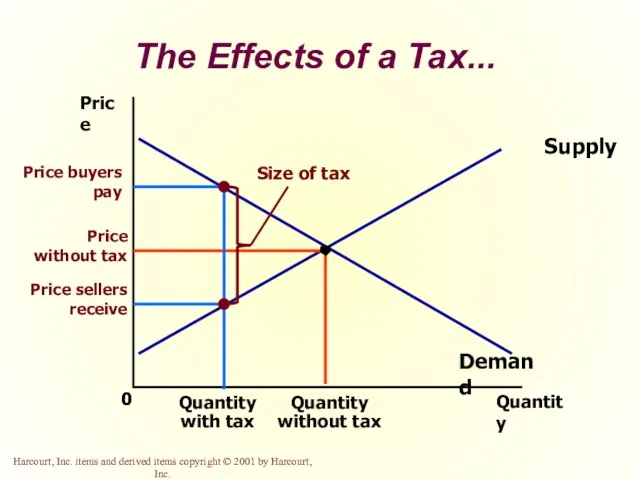

- 4. The Effects of a Tax... Price 0 Quantity Supply Demand

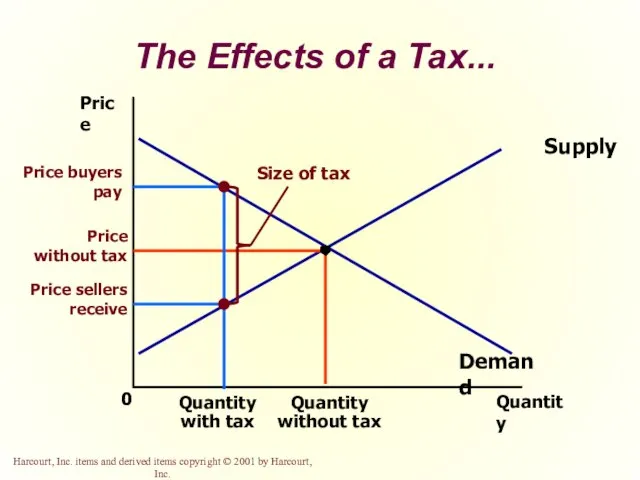

- 5. The Effects of a Tax A tax places a wedge between the price buyers pay and

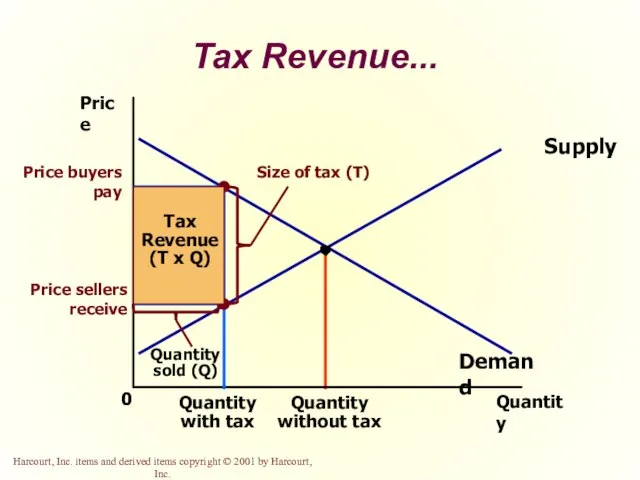

- 6. Tax Revenue T = the size of the tax Q = the quantity of the good

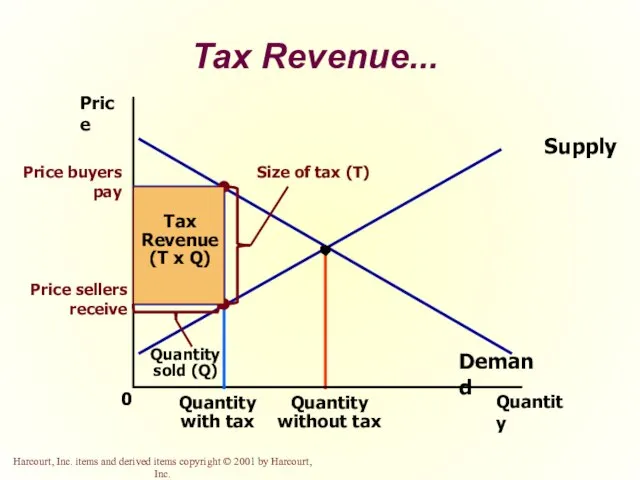

- 7. Tax Revenue... Price 0 Quantity Quantity without tax Supply Demand Price sellers receive Quantity with tax

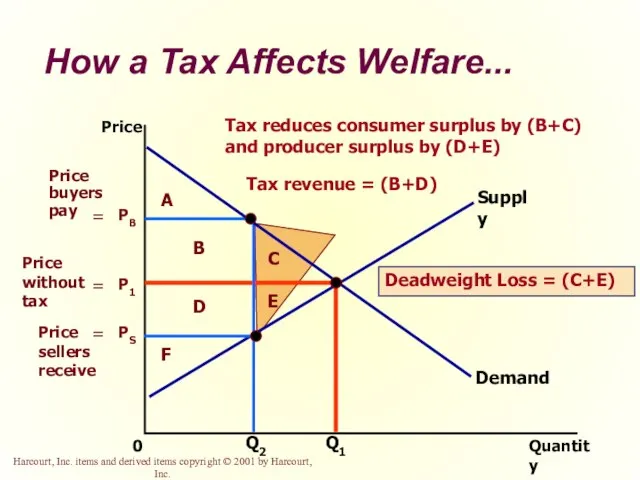

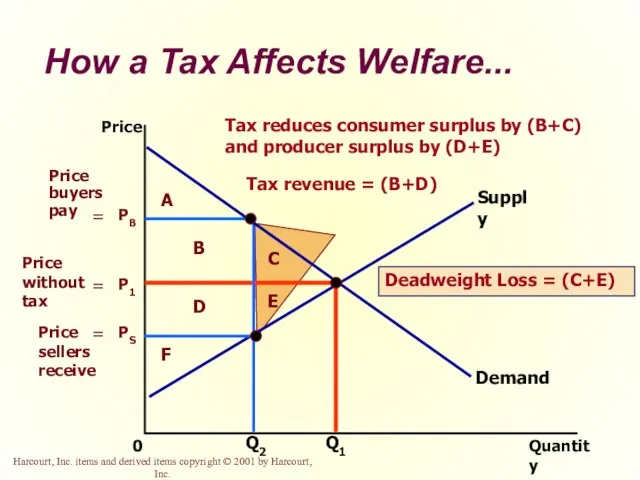

- 8. How a Tax Affects Welfare... Quantity 0 Price Demand Supply Q1 Q2 Tax reduces consumer surplus

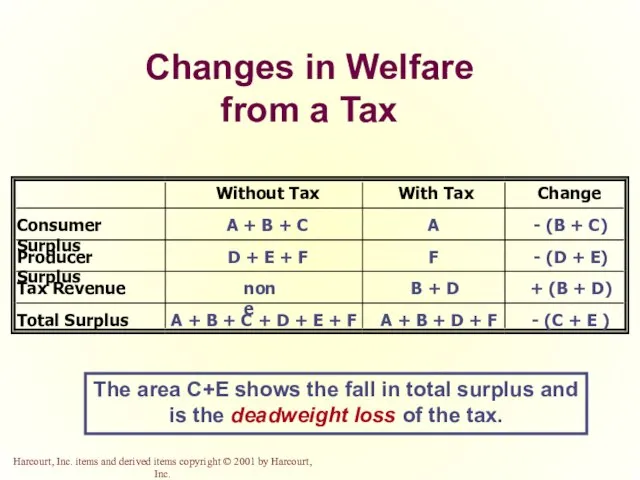

- 9. Changes in Welfare from a Tax Without Tax With Tax Change Consumer Surplus A + B

- 10. How a Tax Affects Welfare The change in total welfare includes: The change in consumer surplus,

- 11. Deadweight Losses and the Gains from Trade Taxes cause deadweight losses because they prevent buyers and

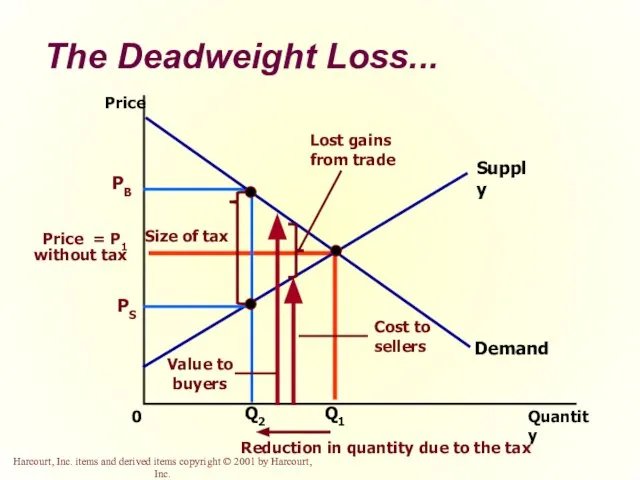

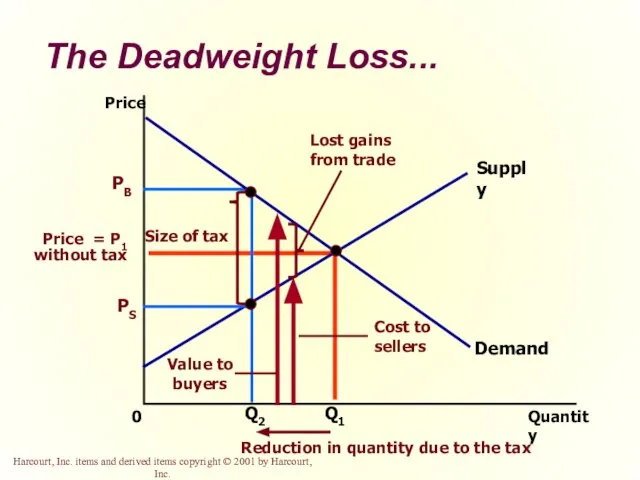

- 12. The Deadweight Loss... Quantity 0 Price Demand Supply Q1 PB Price = P1 without tax PS

- 13. Determinants of Deadweight Loss What determines whether the deadweight loss from a tax is large or

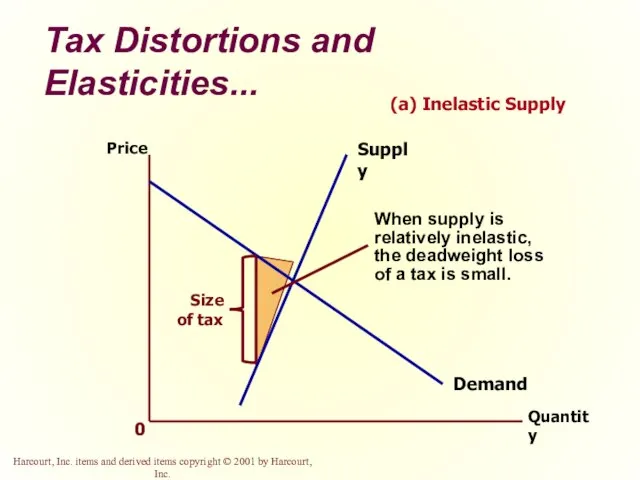

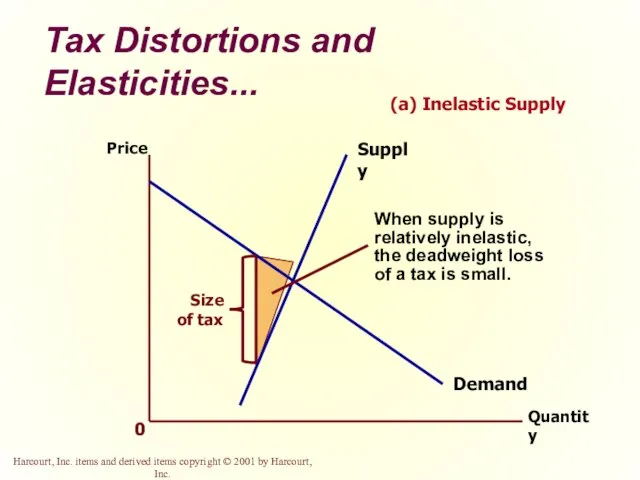

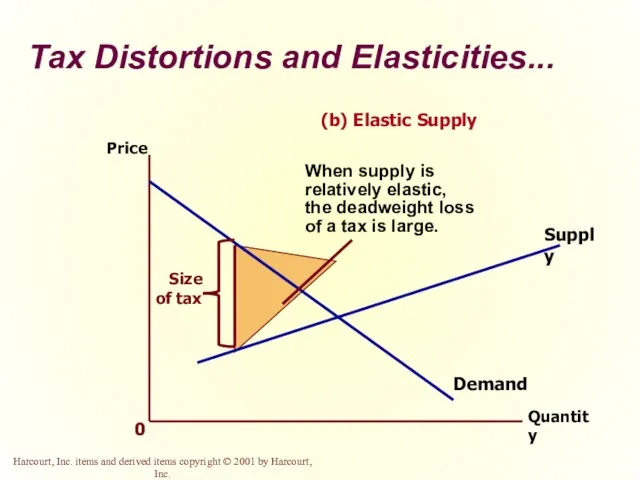

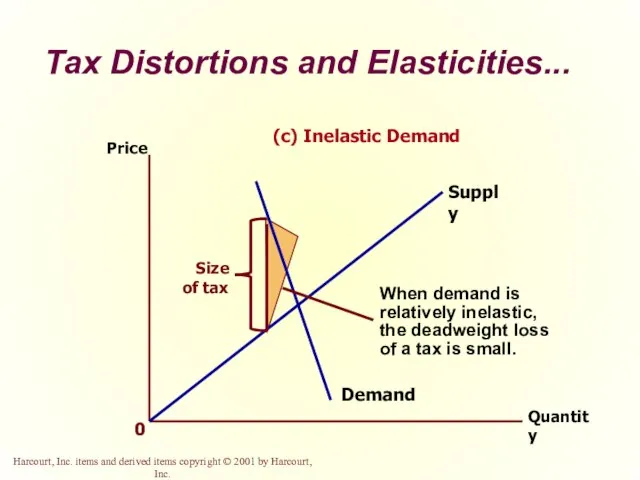

- 14. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (a) Inelastic Supply

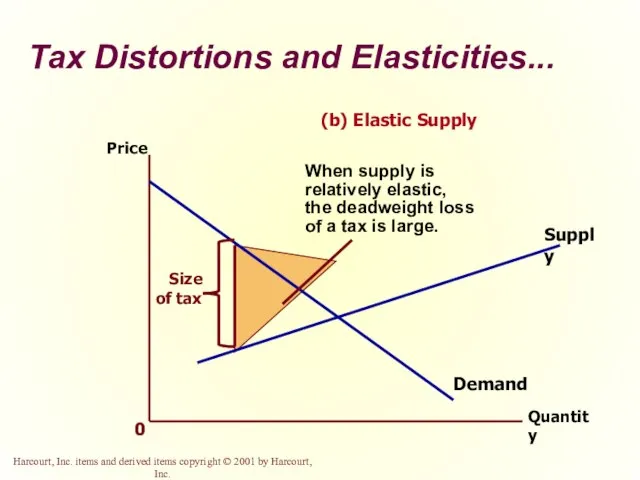

- 15. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (b) Elastic Supply

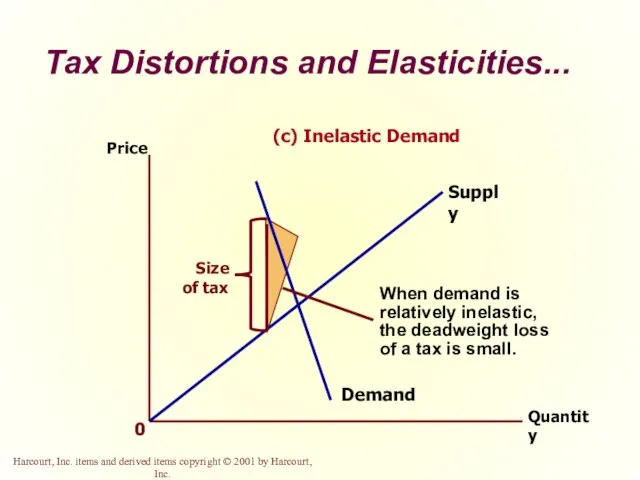

- 16. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (c) Inelastic Demand

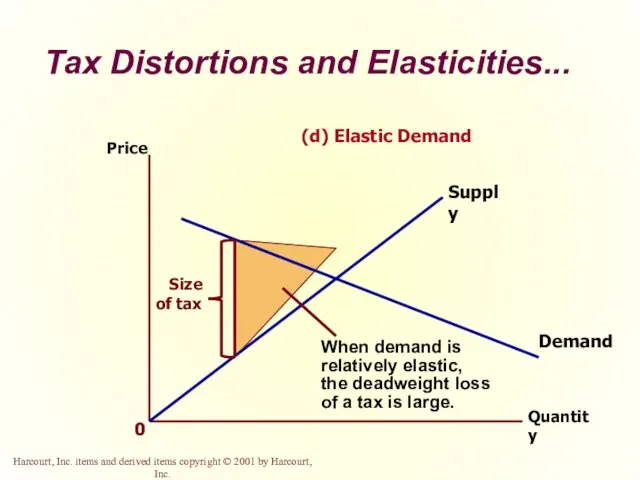

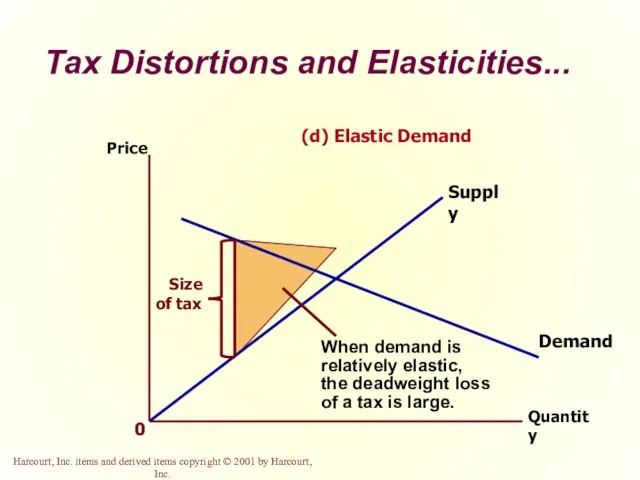

- 17. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (d) Elastic Demand

- 18. Determinants of Deadweight Loss The greater the elasticities of demand and supply: the larger will be

- 19. The Deadweight Loss Debate Some economists argue that labor taxes are highly distorting and believe that

- 20. The Deadweight Loss Debate Some examples of workers who may respond more to incentives: Workers who

- 21. Deadweight Loss and Tax Revenue as Taxes Vary With each increase in the tax rate, the

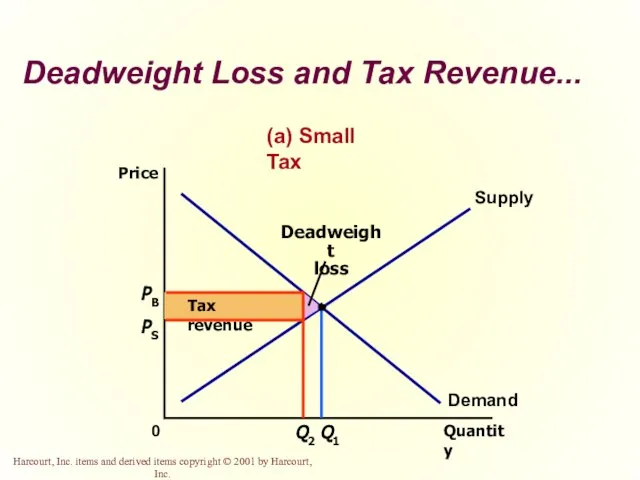

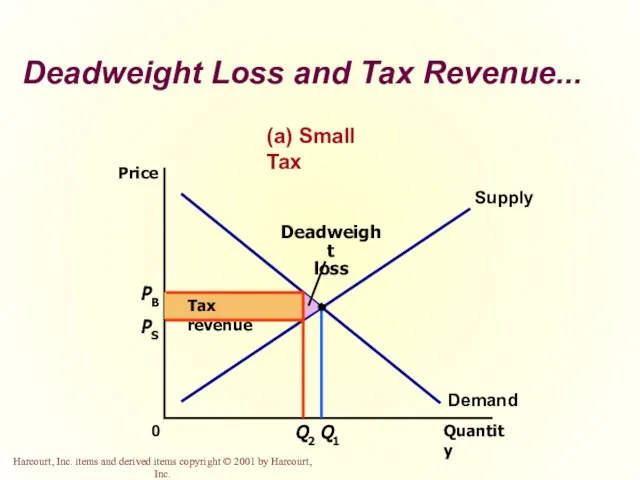

- 22. Deadweight Loss and Tax Revenue... PB Quantity Q2 0 Price Q1 Demand Supply PS (a) Small

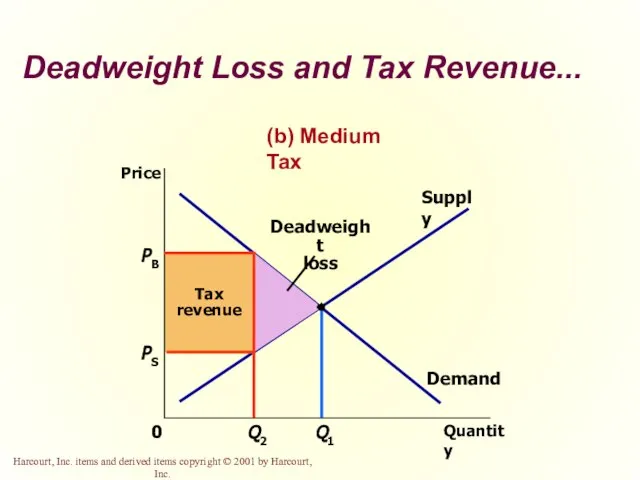

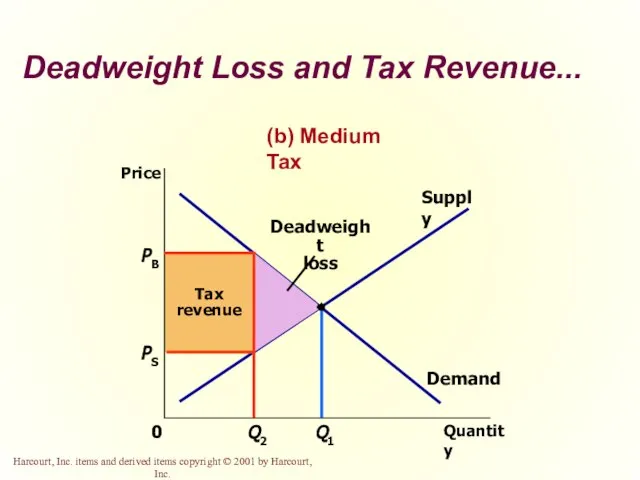

- 23. Demand Supply PB Quantity Q2 0 Price Q1 PS Deadweight Loss and Tax Revenue... (b) Medium

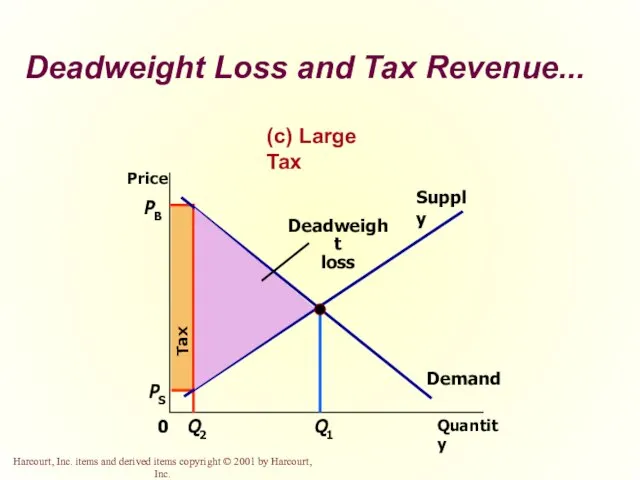

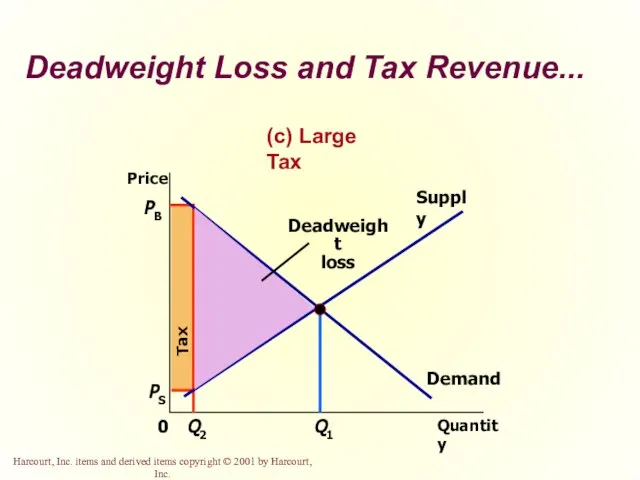

- 24. PB Quantity Q2 0 Price Q1 Demand Supply PS Deadweight Loss and Tax Revenue... (c) Large

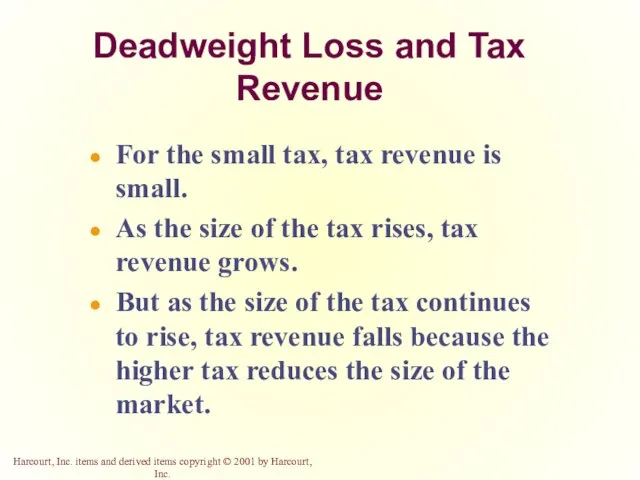

- 25. Deadweight Loss and Tax Revenue For the small tax, tax revenue is small. As the size

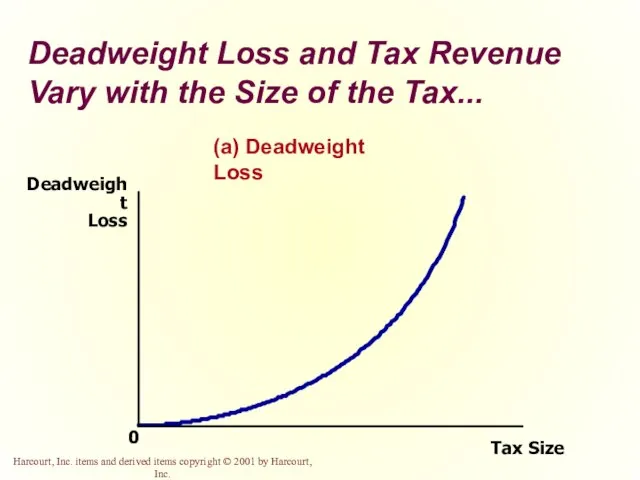

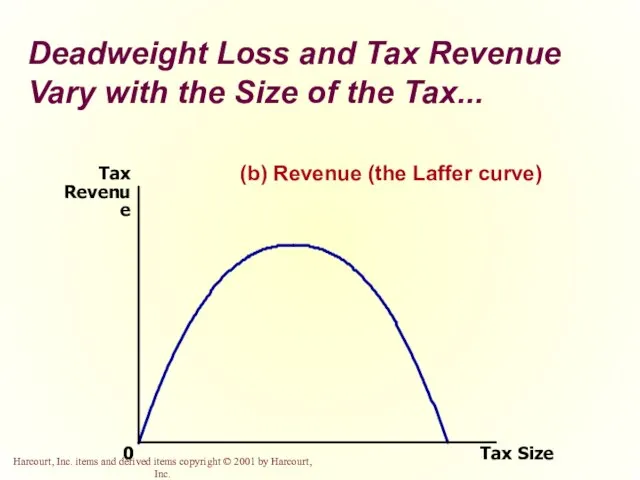

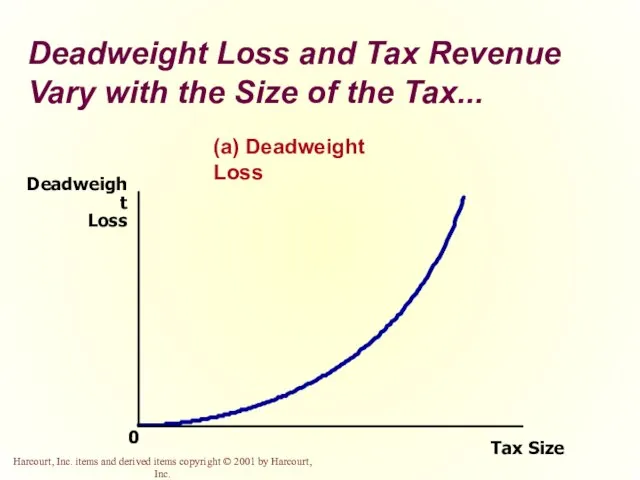

- 26. Deadweight Loss and Tax Revenue Vary with the Size of the Tax... (a) Deadweight Loss Deadweight

- 27. Deadweight Loss and Tax Revenue Vary with the Size of the Tax... (b) Revenue (the Laffer

- 28. Deadweight Loss and Tax Revenue Vary with the Size of the Tax As the size of

- 29. The Laffer Curve and Supply-Side Economics The Laffer curve depicts the relationship between tax rates and

- 30. Summary A tax on a good reduces the welfare of buyers and sellers of the good.

- 31. Summary The fall in total surplus – the sum of consumer surplus, producer surplus, and tax

- 32. Summary Taxes have a deadweight loss because they cause buyers to consume less and sellers to

- 33. Summary As a tax grows larger, it distorts incentives more, and its deadweight loss grows larger.

- 35. The Effects of a Tax... Price 0 Quantity Supply Demand

- 36. Tax Revenue... Price 0 Quantity Quantity without tax Supply Demand Price sellers receive Quantity with tax

- 37. How a Tax Affects Welfare... Quantity 0 Price Demand Supply Q1 Q2 Tax reduces consumer surplus

- 38. The Deadweight Loss... Quantity 0 Price Demand Supply Q1 PB Price = P1 without tax PS

- 39. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (a) Inelastic Supply

- 40. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (b) Elastic Supply

- 41. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (c) Inelastic Demand

- 42. Tax Distortions and Elasticities... Quantity Price Demand Supply 0 (d) Elastic Demand

- 43. Deadweight Loss and Tax Revenue... PB Quantity Q2 0 Price Q1 Demand Supply PS (a) Small

- 44. Demand Supply PB Quantity Q2 0 Price Q1 PS Deadweight Loss and Tax Revenue... (b) Medium

- 45. PB Quantity Q2 0 Price Q1 Demand Supply PS Deadweight Loss and Tax Revenue... (c) Large

- 46. Deadweight Loss and Tax Revenue Vary with the Size of the Tax... (a) Deadweight Loss Deadweight

- 48. Скачать презентацию

Под небом Парижа

Под небом Парижа Мир зверей в русской фразеологии

Мир зверей в русской фразеологии Гипертекстовая технология

Гипертекстовая технология  Асайзар коно

Асайзар коно Австралия – уникальный материк

Австралия – уникальный материк Бизнес-старт. Способы определения поставщиков: электронный аукцион. Порядок организации и участия

Бизнес-старт. Способы определения поставщиков: электронный аукцион. Порядок организации и участия ИССЛЕДОВАТЕЛЬСКАЯ РАБОТА«Использование ИКТ при анализе и контроле знаний учащихсяпо изобразительному искусству»

ИССЛЕДОВАТЕЛЬСКАЯ РАБОТА«Использование ИКТ при анализе и контроле знаний учащихсяпо изобразительному искусству» VLM TechnologiesПрезентацияКомпании

VLM TechnologiesПрезентацияКомпании Транспорт России

Транспорт России Дружба детей России

Дружба детей России КОНЦЕПЦИЯ СТРАТЕГИИ РАЗВИТИЯКАЛИНИНГРАДСКОЙ ОБЛАСТИ

КОНЦЕПЦИЯ СТРАТЕГИИ РАЗВИТИЯКАЛИНИНГРАДСКОЙ ОБЛАСТИ Презентация на тему Петр III

Презентация на тему Петр III  Дополнительные сервисы

Дополнительные сервисы 2_5325812936562711869

2_5325812936562711869 Гражданские правоотношения

Гражданские правоотношения X Infotech offers

X Infotech offers Ёлочные игрушки Российских фабрик

Ёлочные игрушки Российских фабрик Моя деревенька (фотографии и иллюстрации)

Моя деревенька (фотографии и иллюстрации) Мир динозавров

Мир динозавров Структура целей организации

Структура целей организации ПОЭТИЧЕСКОЕ СЛОВО А.С. ПУШКИНА

ПОЭТИЧЕСКОЕ СЛОВО А.С. ПУШКИНА Биоиндикаторы

Биоиндикаторы Что такое дисграфия?

Что такое дисграфия? Проект линии по выработке булки ярославской сдобной

Проект линии по выработке булки ярославской сдобной Меню японской кухни

Меню японской кухни Презентация на тему Положительные и отрицательные числа

Презентация на тему Положительные и отрицательные числа МОУ СОШ №43 Адлерского района г. Сочи 2006-07 учебный год

МОУ СОШ №43 Адлерского района г. Сочи 2006-07 учебный год Презентация на тему Плазма Электрический ток в плазме

Презентация на тему Плазма Электрический ток в плазме