Слайд 2Lecture 5

Evolution of Trade Theories

Mercantilism

Absolute Advantage

Comparative Advantage

Factor proportion Trade

International Product Cycle

New

Trade Theory

National Competitive Advantage

Слайд 3Factor proportions theory

Heckscher (1919) - Olin (1933) Theory

Export goods that intensively use

factor endowments which are locally abundant

Corollary: import goods made from locally scarce factors

Note: Factor endowments can be impacted by government policy - minimum wage

Patterns of trade are determined by differences in factor endowments - not productivity

Remember, focus on relative advantage, not absolute advantage

Слайд 4Factor proportions theory

… trade theory holding that countries produce and export those

goods that require resources (factors) that are abundant (and thus cheapest) and import those goods that require resources that are in short supply

Example:

Australia – lot of land and a small population (relative to its size)

So what should it export and import?

Слайд 5Factor Proportions Trade Theory

Considers Two Factors of Production

Labor

Capital

Слайд 6Factor proportions theory

The Assumptions

There are two nations (1&2), two commodities (X&Y), two

factors of production (labor & capital).

Used to illustrate the theory in a two-dimensional figure.

Both nations use the same technology in production.

Means both nations have access to and use the same general production techniques.

Commodity X is labor intensive and Y is capital intensive in both nations.

Means the labor-capital ratio (L/K) is higher for X than Y in both nations at the same relative factor prices.

Слайд 7Factor proportions theory

Both commodities are produced under constant returns to scale in

both nations.

Means that increasing the amount of L and K will increase output in the same proportion

There is incomplete specialization in production in both nations.

Means that even with free trade both nations continue to produce both commodities. This implies neither nation is very small.

Tastes are equal in both nations.

Means demand preferences are identical in both nations. When relative prices are equal in the two nations, both consume X&Y in the same proportion.

Слайд 8Factor proportions theory

There is perfect competition in both commodities and factor markets

in both nations.

Means that producers, consumers, and traders of X&Y in both nations are each too small to affect prices of commodities. Also, in the L-R commodity prices equal their costs, leaving no economic profit.

There is perfect factor mobility within each nation but no international factor mobility.

Means K&L are free to move from areas and industries of lower earnings to those of higher earnings until earnings are the same in all areas, uses and industries of the nation. International differences in earnings persist due to zero international factor mobility in the absence of international trade.

Слайд 9Factor proportions theory

There are no transportation costs, tariffs, or other obstructions to

the free flow of international trade.

Means specialization in production proceeds until relative (and absolute) commodity prices are the same in both nations with trade. If transportation costs and tariffs were allowed, specialization would proceed only until prices differed by no more than the costs and tariffs on each until of the commodity traded.

Слайд 10Factor proportions theory

All resources are fully employed in both nations.

Means there

are no unemployed resources in either nation.

International trade between the two nations is balanced.

Means that the total value of each nation’s exports equals the total value of the nation’s imports.

Слайд 11Factor Proportions Trade Theory

A country that is relatively labor abundant (capital abundant)

should specialize in the production and export of that product which is relatively labor intensive (capital intensive)

Слайд 12The Theory Contains Four Core Propositions

Factor endowments and trade patterns

Factor price equalization

Distribution

of income

Factor growth and output patterns

Слайд 13The Factor-Proportions Theory

EXAMPLE:

U.S. (capital abundant) has comparative advantage in the production

of machines (capital intensive).

India (labor abundant) has comparative advantage in production of cloth (labor intensive).

Слайд 14The Factor-Proportions Theory

Factor-proportions theorem

A country will have a comparative advantage (disadvantage) and

export (import) goods whose production intensively uses its relatively abundant (scarce) factor of production.

Слайд 15The Factor-Proportions Theory

The U.S. imports goods from countries where labor in the

abundant factor.

The U.S. exports goods that are capital intensive.

Gains from trade are realized when a country exports goods based on its comparative advantage and imports goods based on comparative disadvantage.

Слайд 16Factor endowments and trade patterns

Natural resource version:

USA is relatively well endowed with

land. Therefore USA exports farm (land-intensive) products. Singapore is relatively well endowed with marine traffic locational resources. Therefore, Singapore exports shipping, marine insurance, ship repair plus many derivative services.

Слайд 17Factor endowments & trade patterns

Developed resource version:

Japan, USA, France & Germany are

relatively well endowed, after histories

of much investment, with non-human

productive resources or capital.

Therefore, they export capital-intensive

manufactured goods.

Слайд 18Factor endowments & trade patterns

Do they? France and USA are the

world’s

two biggest exporters of agricultural

products. Land intensive?

Leontief (Nobel laureate) discovered (1960s)

after extensive data crunching that the USA

exports labor intensive goods; to Japan?

To China? To Luxembourg? To India?

Слайд 19Factor endowments & trade patterns

Try to explain that one.

Maybe US

labor is (was) human capital

intensive. US endowment of capital

intensive labor is (was) relatively large by

international standards.

Hence, labor intensive exports were really human capital intensive. Try that one on the shop floor at Toyota City!

Слайд 20Factor Endowments

Although land, capital and highly skilled

labor may be relatively

abundant in the

United States & other developed countries,

labor in general is relatively scarce.

This has many implications with respect to trade policy, income distribution and other

matters.

Слайд 21Factor price equalization

Labor:

Through intense global competition,

wages and the return to capital

tend to

equalize across trading nations. Is this

true? Are your wages determined in

Bangladesh? Are low-skilled US workers

vulnerable? Many who were on the streets

of Seattle & Honolulu think so.

Слайд 22Factor Price Equalization & Productivity

A useful abstraction: visualize a worker as

an embodiment

of natural and acquired

skills or sources of productivity. The skills

are heterogeneous; some are highly

competitive internationally, others are

company or geographically specific.

Globalization transforms the specific into

global, but the transformation is incomplete.

Слайд 23Factor Price Equalization & Productivity

High tech skills tend to be global

and to

correlate with mobility.

Medium and low tech skills tend to be more local and less mobile.

However, a major exception may

be many low tech skills in the First World

which are highly substitutable for skills

that exist widely in the Third World.

Слайд 24Factor Price Equalization & Productivity

Due to opportunity differentials, low-skill

labor in the

First World embodies, on average, a greater concentration of skill units than that embodied in Third World labor.

If this is true, wages of low-skilled labor will remain higher in the First World, even if

global competition forces relative

equalization.

Слайд 25Factor price equalization

Capital:

Heavy investment in a country, whether

by its own residents or

through foreign

direct investment (FDI) leads to falling

returns. Resulting excess capacity in Asian

countries caused falling returns & inability

to pay off loans. Asia ceased to be a

better investment than developed countries.

Слайд 26Trade & income distribution

Free trade:

Land is abundant in USA, scarce in JPN.

Free

trade enables USA to share its land

globally, in an environment in which land

is not so abundant. Hence, US farm income

rises. However, US abundance swamps

JPN’s scarcity causing JPN’s farm income

to fall.

Слайд 27Trade & income distribution

Protection:

Protection of JPN’s agricultural sector

creates a local monopoly, free

of USA’s

abundant competition and raises JPN’s

farm income (lowers USA’s income).

Of course, JPN’s consumers pay more.

Farmers and related industries win;

consumers & others lose.

Слайд 28Trade & income distribution

Industrial products:

JPN’s automobiles & consumer electronic

products and USA’s software,

hardware &

entertainment output are produced by

industries relatively well endowed with

key inputs. Owners of these key inputs

profit from globalization if exporters, but

lose if importers.

Слайд 29Factor growth & output

The down side:

In a small country, world goods prices

are

set by large, global markets. Hence,

if, for example, population (labor force)

rises, labor-intensive industries will

grow and capital-intensive industries

will shrink.

Dual Underwriting, представитель эмиссионного консорциума-объединения андеррайтеров

Dual Underwriting, представитель эмиссионного консорциума-объединения андеррайтеров Коммерческие банки в схемах и мемах

Коммерческие банки в схемах и мемах Мониторинг воспитательного процесса

Мониторинг воспитательного процесса Протеины

Протеины Изучение генетического контроля устойчивости зерновых культур к болезням (на примере листовой ржавчины пшеницы)

Изучение генетического контроля устойчивости зерновых культур к болезням (на примере листовой ржавчины пшеницы) Бихевиоризм

Бихевиоризм Достопримечальности Киева

Достопримечальности Киева Лекция 10

Лекция 10 Жизнь и творчество Василия Андреевича Жуковского

Жизнь и творчество Василия Андреевича Жуковского Центр психолого-медико-социального сопровождения №2

Центр психолого-медико-социального сопровождения №2 Воздушная геодезия, г. Вологда

Воздушная геодезия, г. Вологда Макет заголовка. Скоро в продаже!!!

Макет заголовка. Скоро в продаже!!! Любовь и брак в высказываниях и афоризмах

Любовь и брак в высказываниях и афоризмах Область определения и область значения показательной, логарифмической и степенной функций

Область определения и область значения показательной, логарифмической и степенной функций Исследование формообразования при фрезоточении многогранных профильных поверхностей

Исследование формообразования при фрезоточении многогранных профильных поверхностей Презентация на тему Четные и нечетные функции

Презентация на тему Четные и нечетные функции  Битва за серебряный столб (игра)

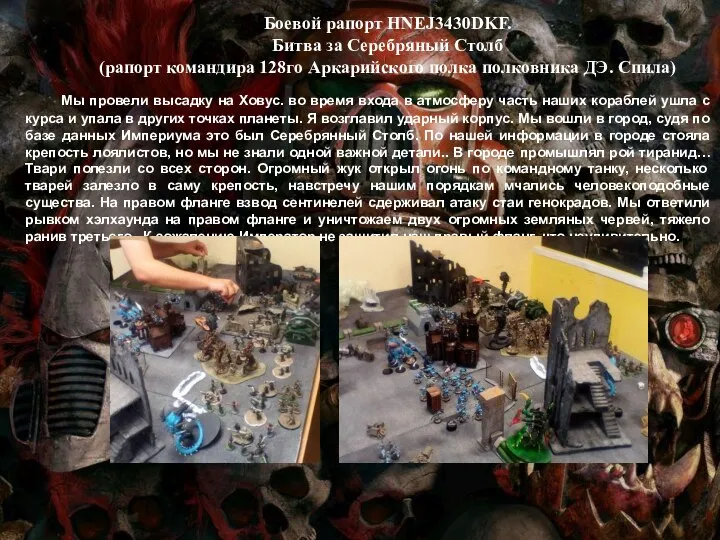

Битва за серебряный столб (игра) Клеточные технологии в лечении социально-значимых заболеваний

Клеточные технологии в лечении социально-значимых заболеваний Презентация на тему Юридическая клиника РГСУ

Презентация на тему Юридическая клиника РГСУ  Северная Команда по Координации и Быстрой Оценке ( ККБО – REACT )

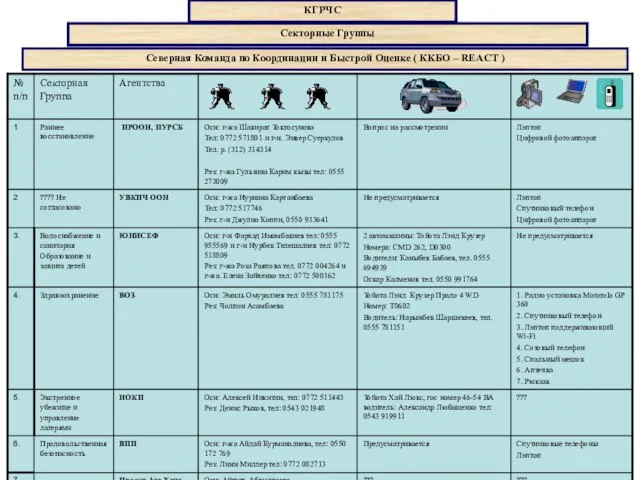

Северная Команда по Координации и Быстрой Оценке ( ККБО – REACT ) Синь России

Синь России РЕЗУЛЬТАТЫ РАБОТЫПОДСИСТЕМЫ «ВЕДЕНИЯ»

РЕЗУЛЬТАТЫ РАБОТЫПОДСИСТЕМЫ «ВЕДЕНИЯ» Компетенции финансового директора в формировании стратегии управления бизнесом

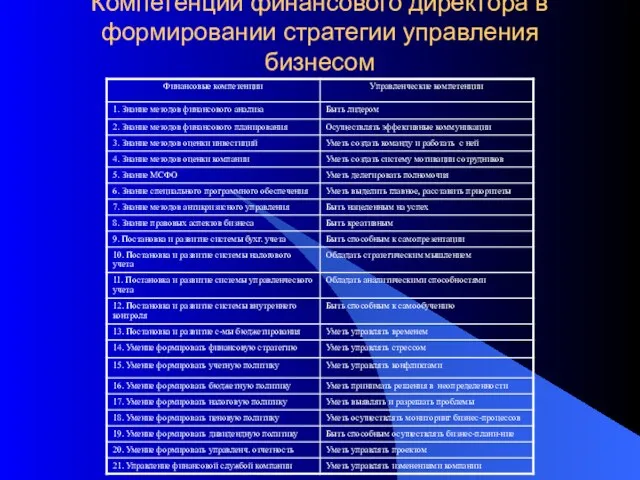

Компетенции финансового директора в формировании стратегии управления бизнесом Политические партии и движения, их роль в общественной жизни

Политические партии и движения, их роль в общественной жизни Лекция_1,2,3,4

Лекция_1,2,3,4 СЕРГЕЙ МИХАЙЛОВ.БАСНЯ. ЩЕНОК и ЗМЕЯ

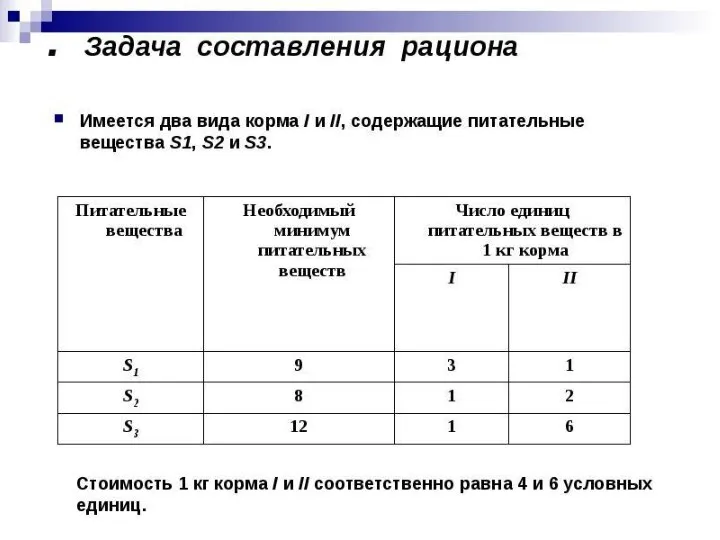

СЕРГЕЙ МИХАЙЛОВ.БАСНЯ. ЩЕНОК и ЗМЕЯ Zadacha_sostavlenia_ratsiona (1)

Zadacha_sostavlenia_ratsiona (1) Проект по созданию бренда ювелирных изделий Shine Jewellery

Проект по созданию бренда ювелирных изделий Shine Jewellery