Слайд 2Sources of Research Agenda

Finance

Agency theory – investigation of different corporate governance practices

and firm performance

Law

Management

Firm life cycle

Stakeholder analysis

Слайд 3Research

Effectiveness may be based on a number of different dimensions of corporate

governance, ranging from monitoring and control over managerial discretion to promoting corporate entrepreneurship and innovation.

Regulating managerial power

Слайд 4Research

Board characteristics and composition

Resource dependency approach

Transaction costs theory

Role and effects of

independence of non- executive directors

Codes of best practice

Internal and external control mechanisms

Слайд 5Research

Board processes

Effects of duality of CEO role

Stewardship theory

Executive compensation

Managerial stock

ownership and performance

Слайд 6La Porta et al. 1998

Manuscript Type: Empirical and Conceptual

Research Question/Issue: Do differences

in legal protections of investors explain why firms are financed and owned so differently in different countries? Does a country’s membership in one of the two principle legal families affect the corporate governance mechanisms?

Слайд 7La Porta et al. 1998

Why do Italian companies rarely go public?

Why does

Germany have such a small stock market but also maintain very large and powerful banks ?

Why is the voting premium small in Sweden and the United States, and much larger in Italy and Israel

Why were Russian stocks nearly worthless immediately after

privatization—by some estimates 100 times cheaper than Western

stocks backed by comparable assets—and why did Russian companies have virtually no access to external finance ?

Why is ownership of large American and British companies so widely dispersed?

Слайд 8La Porta et al. 1998

Unit of analysis – country; generalized to legal

family

Methods – statistical analysis of investor protection; student t-test

Слайд 9La Porta et al. 1998

Independent Variables

Country

Legal Family

Dependent variables

Shareholder rights

Creditor rights

Enforcement

Ownership

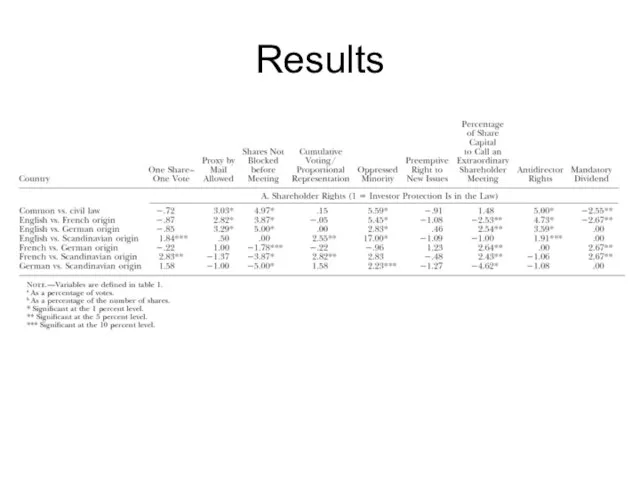

Слайд 11La Porta et al. 1998

Research Findings/Results: The results show that common-law countries

generally have the strongest, and French civil- law countries the weakest, legal protections of investors, with German- and Scandinavian-civil-law countries located in the middle. Also found that concentration of ownership of shares in the largest public companies is negatively related to investor protections, consistent with the hypothesis that small, diversified shareholders are unlikely to be important in countries that fail to protect their rights

Слайд 12Shleifer and Vishny 1997

Agency problem

Contracts

Managerial Discretion

Incentive Contracts

Evidence on agency problem – does

it exist?

How to solve?

Слайд 13Shleifer and Vishny 1997

Finance without governance – reputation

Legal Enforcement of Rights

Large Investors

Takeovers

Large

Creditors

Слайд 14Shleifer and Vishny 1997

Debt versus equity choice

LBO

Cooperatives and State ownership

Слайд 15La Porta et al. 1999

Studied ownership structures of large corporations in 27

wealthy economies to identify the ultimate controlling shareholders of these firms.

Found that except in economies with very good shareholder protection, relatively few of these firms are widely held, in contrast to Berle and Means’s image of ownership of the modern corporation.

Rather, these firms are typically controlled by families or the State.

Equity control by financial institutions is far less common.

The controlling shareholders typically have power over firms significantly in excess of their cash flow rights, primarily through the use of pyramids and participation in management.

Слайд 16Yermack 1996

Smaller boards of directors are more efficient than larger boards

Theory

Large boards

have higher monitoring costs

Larger groups are less able to reach agreement and thus take no tough decisions

Model: Tobin’s Q will vary inversely with board size

Слайд 17Jensen 1993

Claims that since 1973 technological, political, regulatory, and economic forces have

been changing the worldwide economy in a fashion comparable to the changes experienced during the nineteenth century Industrial Revolution.

During the 1970s and 1980s indicate corporate internal control systems have failed to deal effectively with these changes

Слайд 18Jensen 1993

IC systems have failed to require managers to make decisions to

properly manage the efficient and capacity of their companies

Misspending in R&D as example

Высокий рейтинг успеваемости. Победы на олимпиадах и конкурсах. Высокая социальная активность. Победа в творческих конкурсах. Исс

Высокий рейтинг успеваемости. Победы на олимпиадах и конкурсах. Высокая социальная активность. Победа в творческих конкурсах. Исс Термическая обработка. Отжиг

Термическая обработка. Отжиг Структура организации современных Вооруженных Сил

Структура организации современных Вооруженных Сил Кавказ

Кавказ Институт правового положения личности в римском праве

Институт правового положения личности в римском праве Использование здоровьесберегающих технологий в психологическом сопровождении учащихся групп особого внимания в условиях школьн

Использование здоровьесберегающих технологий в психологическом сопровождении учащихся групп особого внимания в условиях школьн Особенности управления командой как человеческим ресурсом. Тема 2

Особенности управления командой как человеческим ресурсом. Тема 2 Не кури!

Не кури! Образование и наука

Образование и наука Моя самая любимая книга

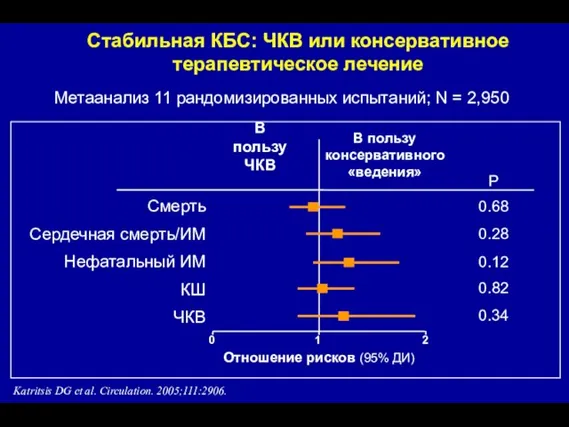

Моя самая любимая книга Стабильная КБС: ЧКВ или консервативноетерапевтическое лечение

Стабильная КБС: ЧКВ или консервативноетерапевтическое лечение Практическое применение данных о цитировании в российских университетах и научных организациях

Практическое применение данных о цитировании в российских университетах и научных организациях Презентация на тему winter зима

Презентация на тему winter зима Внешнеполитические связи России с Европой и Азией в конце -XVI в. - начале XVII в

Внешнеполитические связи России с Европой и Азией в конце -XVI в. - начале XVII в КОНФИГУРАЦИЯ ДЛЯ ПРЕДПРИЯТИЙАГРОПРОМЫШЛЕННОГО КОМПЛЕКСА

КОНФИГУРАЦИЯ ДЛЯ ПРЕДПРИЯТИЙАГРОПРОМЫШЛЕННОГО КОМПЛЕКСА Природопользование и устойчивое развитие

Природопользование и устойчивое развитие Пищевые добавки

Пищевые добавки Архитектура NET приложений

Архитектура NET приложений Политический анализ и политическое прогнозирование

Политический анализ и политическое прогнозирование  Организационные структуры маркетинговых служб предприятий питания

Организационные структуры маркетинговых служб предприятий питания Презентация на тему Saint-Petersbourg

Презентация на тему Saint-Petersbourg Велосипедные походы и безопасность туристов

Велосипедные походы и безопасность туристов Коррупция. Викторина

Коррупция. Викторина Борьба с пылью в подготовительном забое

Борьба с пылью в подготовительном забое Конституция РК 1995 года, как основной закон государства

Конституция РК 1995 года, как основной закон государства Виртуальный музей. Российское движение школьников

Виртуальный музей. Российское движение школьников Особливості ЗНО - 2021

Особливості ЗНО - 2021 Главы из книги пророка Осии

Главы из книги пророка Осии