Содержание

- 2. INTRODUCTION

- 3. FINANCIAL MODEL OF A COMPANY

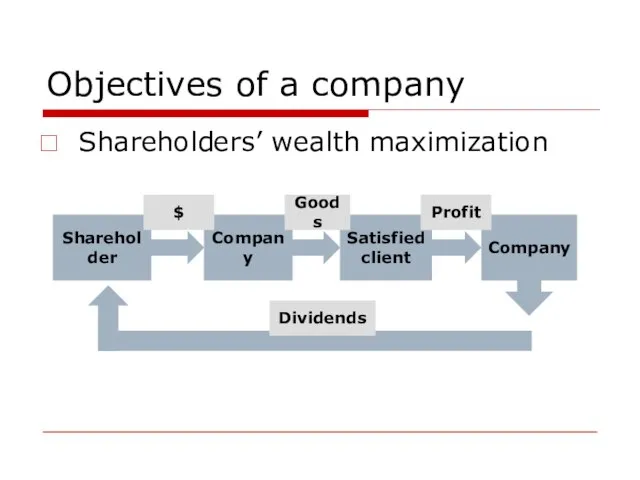

- 4. Objectives of a company Shareholders’ wealth maximization

- 5. Objectives of a company Stakeholders’ income increase: Shareholders Employees Managers Suppliers Clients Society

- 6. Functions of a financial manager Activity spheres of a financial manager: Strategic management – general objectives

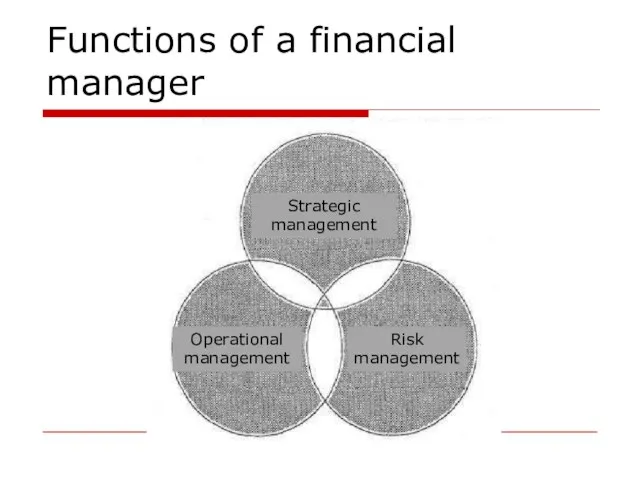

- 7. Functions of a financial manager

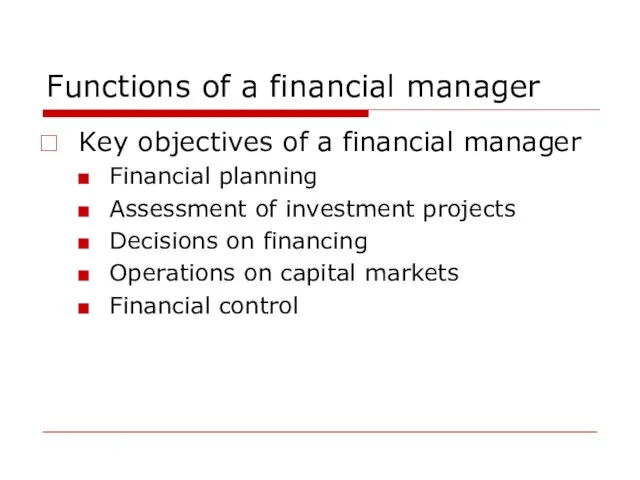

- 8. Functions of a financial manager Key objectives of a financial manager Financial planning Assessment of investment

- 9. Financial structure of the company Financial structure is a hierarchical system of financial responsibility centres (FRC)

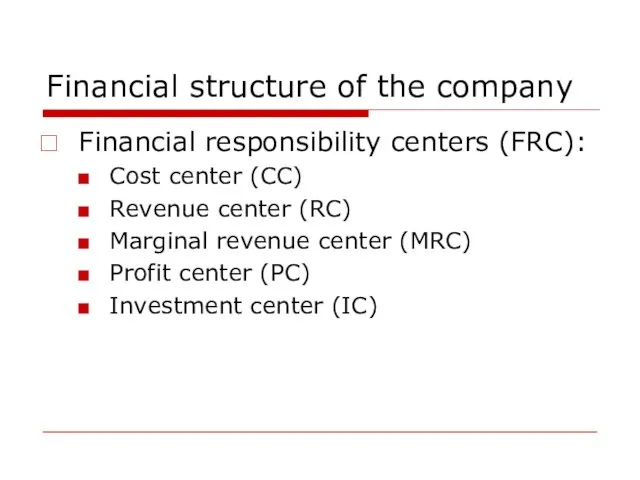

- 10. Financial structure of the company Financial responsibility centers (FRC): Cost center (CC) Revenue center (RC) Marginal

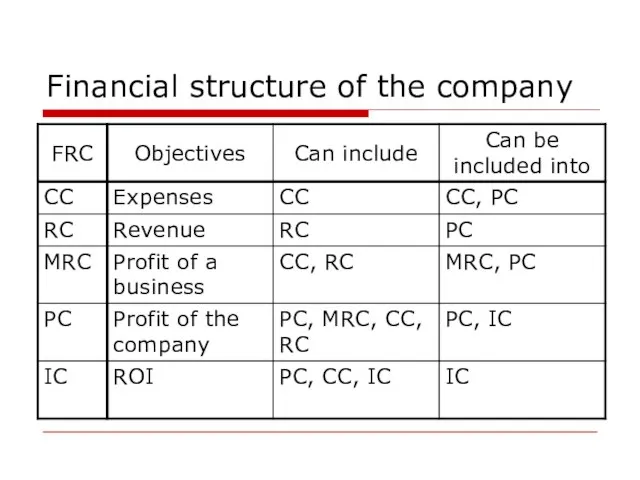

- 11. Financial structure of the company

- 12. Financial structure of the company How to from a financial structure: Organizational approach Process approach Define

- 13. Organizational approach An organizational structure is a mainly hierarchical concept of subordination of entities that collaborate

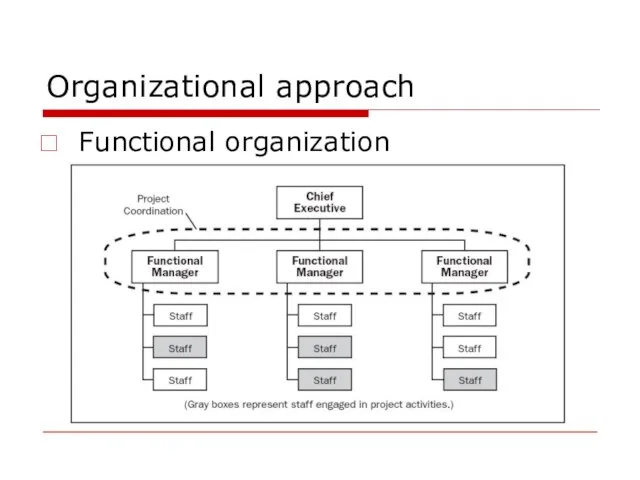

- 14. Organizational approach Functional organization

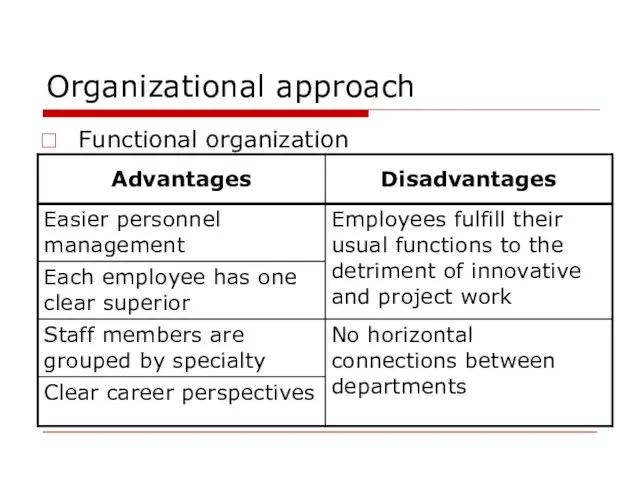

- 15. Organizational approach Functional organization

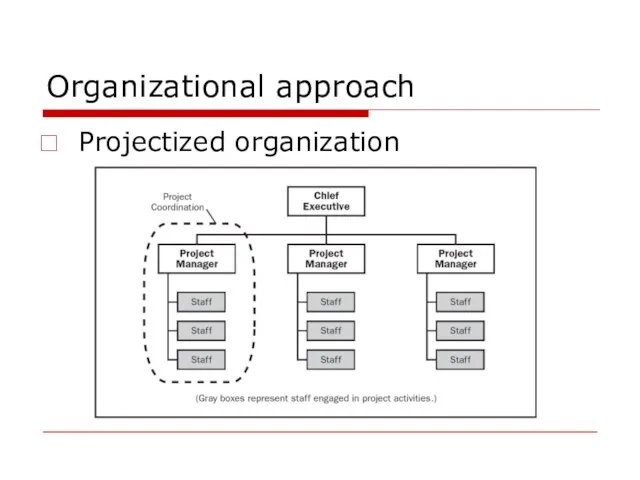

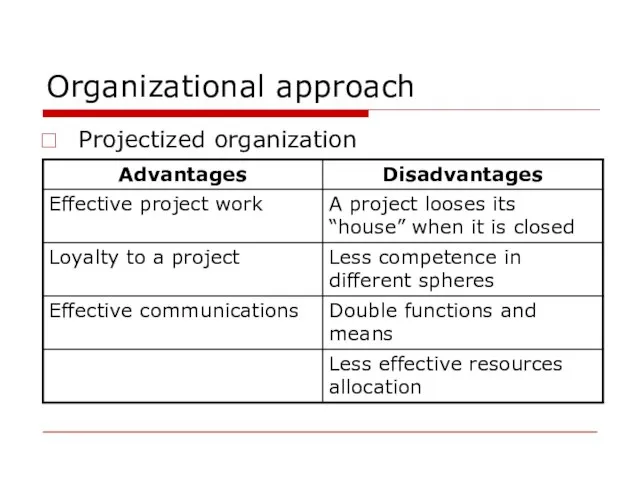

- 16. Organizational approach Projectized organization

- 17. Organizational approach Projectized organization

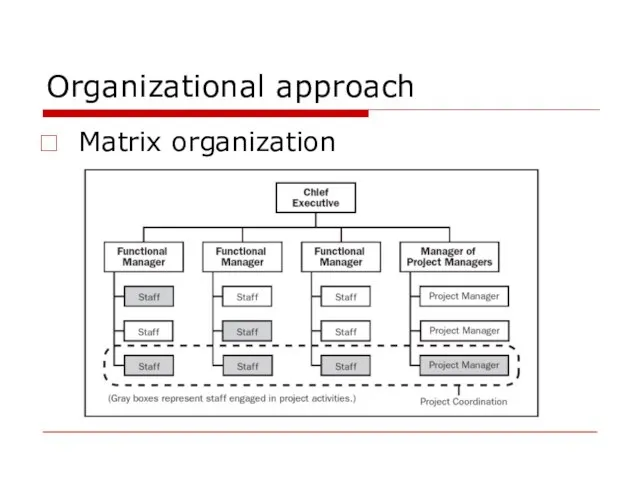

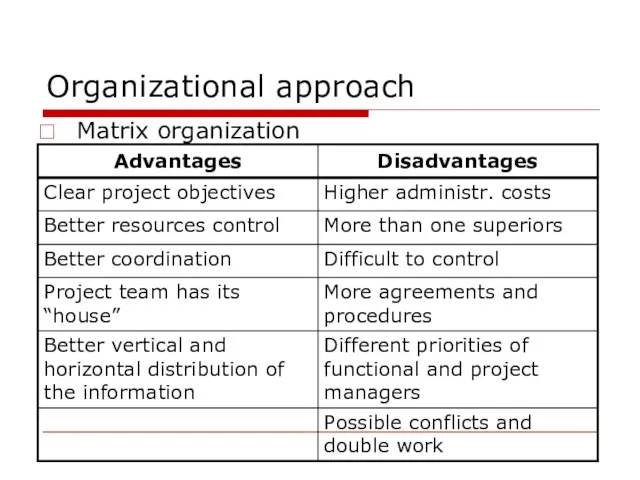

- 18. Organizational approach Matrix organization

- 19. Organizational approach Matrix organization

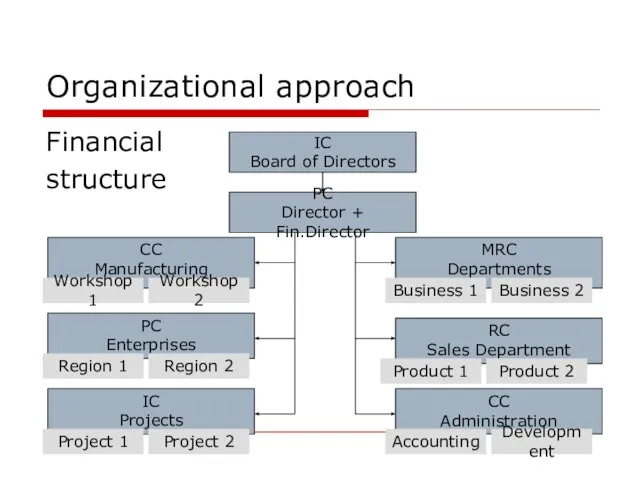

- 20. Organizational approach Financial structure PC Director + Fin.Director CC Manufacturing Workshop 1 Workshop 2 PC Enterprises

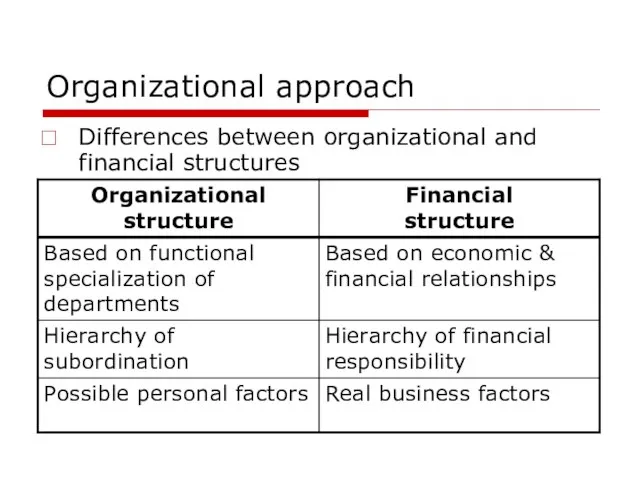

- 21. Organizational approach Differences between organizational and financial structures

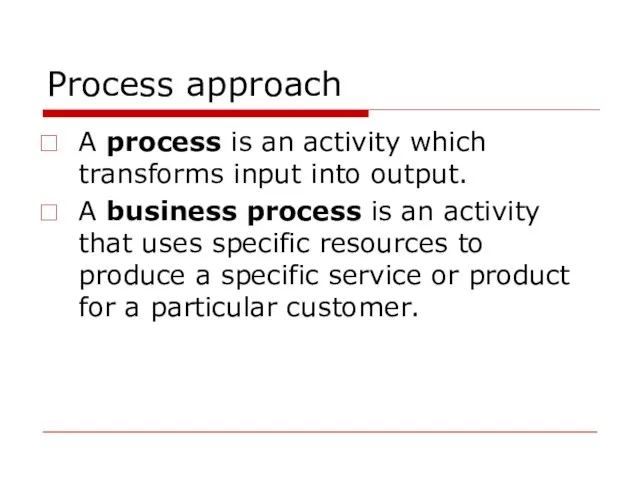

- 22. Process approach A process is an activity which transforms input into output. A business process is

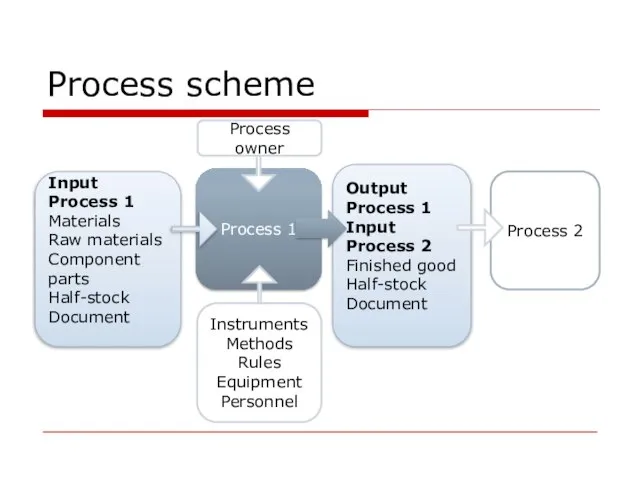

- 23. Process scheme

- 24. Process approach Business-process types: Main Supporting Development Corporate management

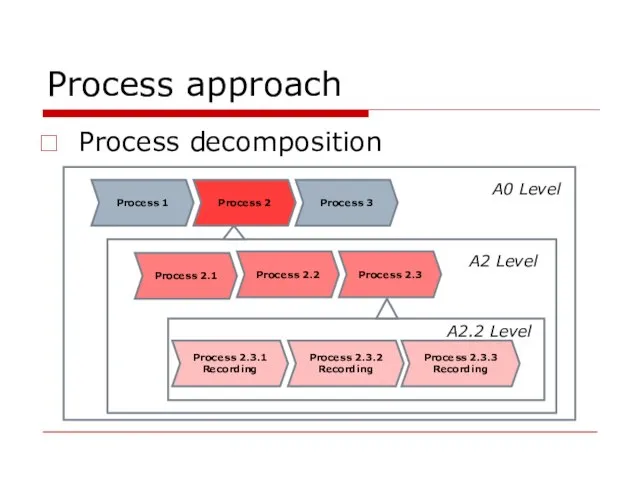

- 25. Process approach Process decomposition Process 1 Process 2 Process 3 Process 2.1 Process 2.2 Process 2.3

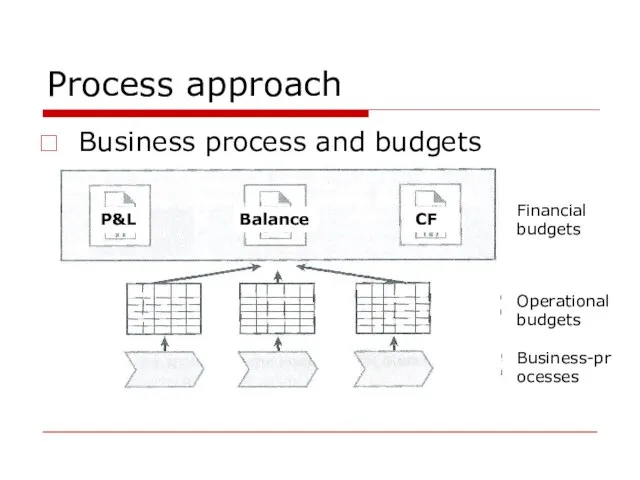

- 26. Process approach Business process and budgets P&L Balance CF Financial budgets Operational budgets Business-processes

- 27. BASIC PRINCIPLES OF FINANCIAL MANAGEMENT

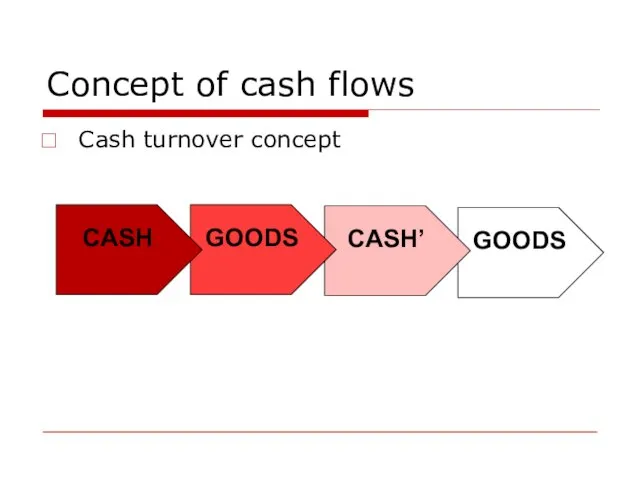

- 28. Concept of cash flows Cash turnover concept

- 29. Concept of cash flows Cash flow - the movement of cash into or out of a

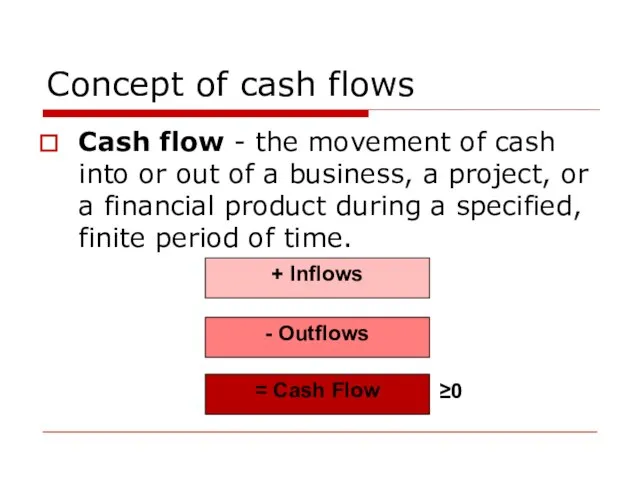

- 30. Relationship between risk & profit Nothing ventured, nothing gained Britain’s Special Air Service motto: Who dares,

- 31. ACCOUNTING SYSTEMS

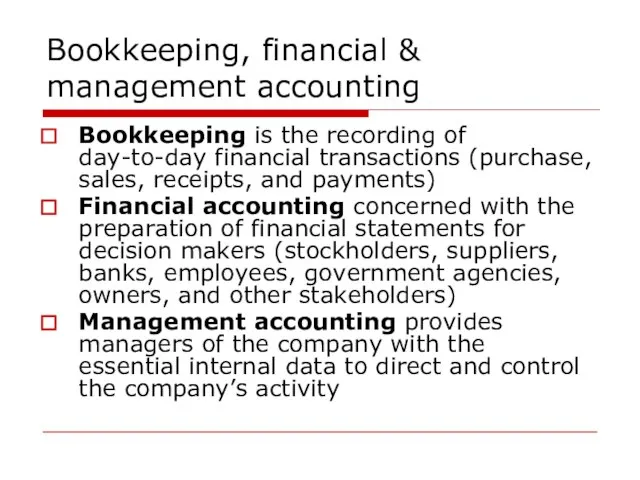

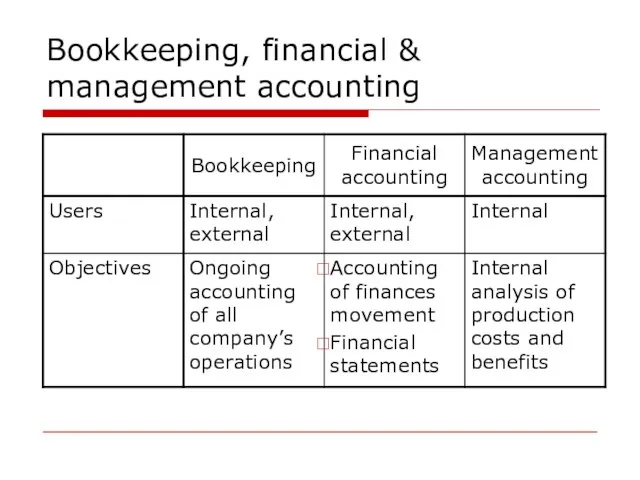

- 32. Bookkeeping, financial & management accounting Bookkeeping is the recording of day-to-day financial transactions (purchase, sales, receipts,

- 33. Bookkeeping, financial & management accounting

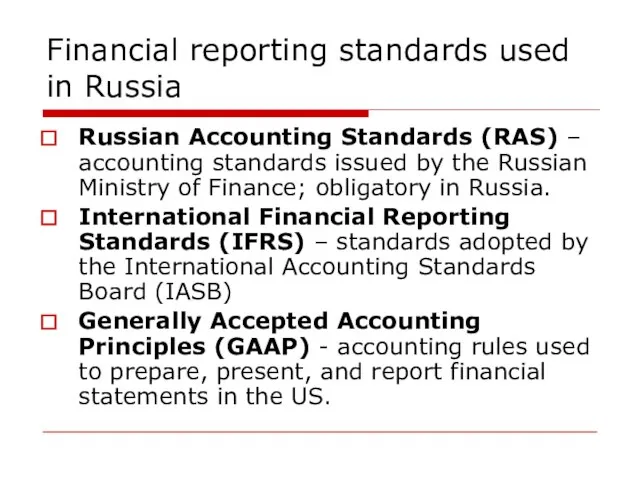

- 34. Financial reporting standards used in Russia Russian Accounting Standards (RAS) – accounting standards issued by the

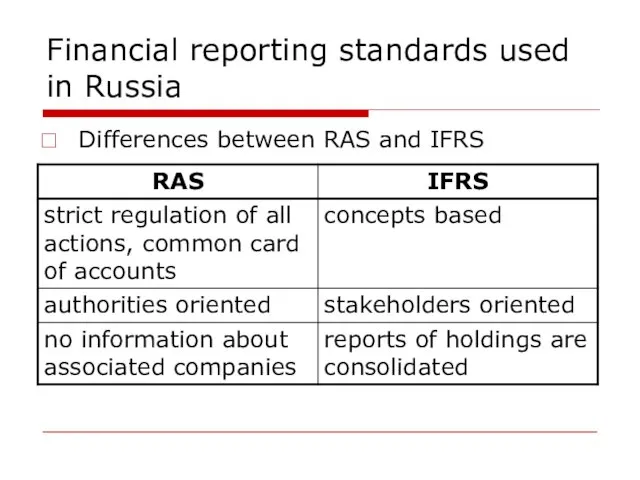

- 35. Financial reporting standards used in Russia Differences between RAS and IFRS

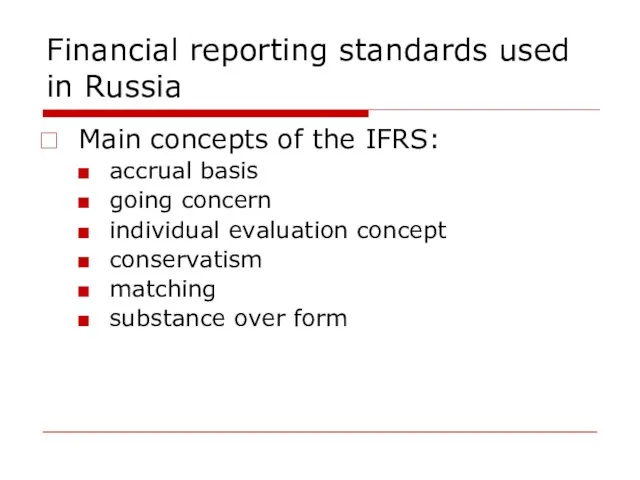

- 36. Financial reporting standards used in Russia Main concepts of the IFRS: accrual basis going concern individual

- 37. FINANCIAL STATEMENTS

- 38. Annual reports

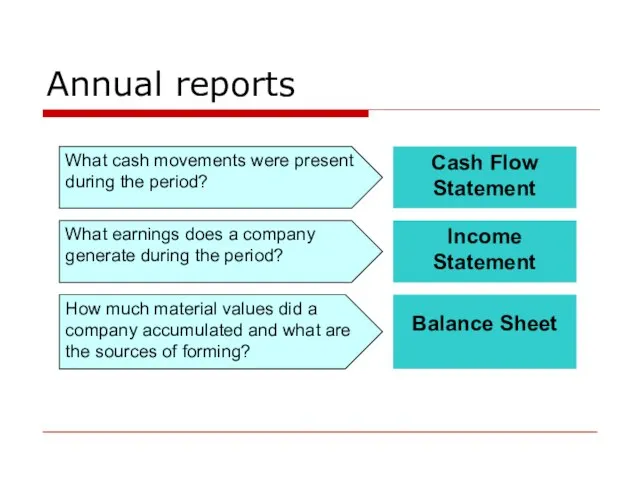

- 39. BALANCE SHEET

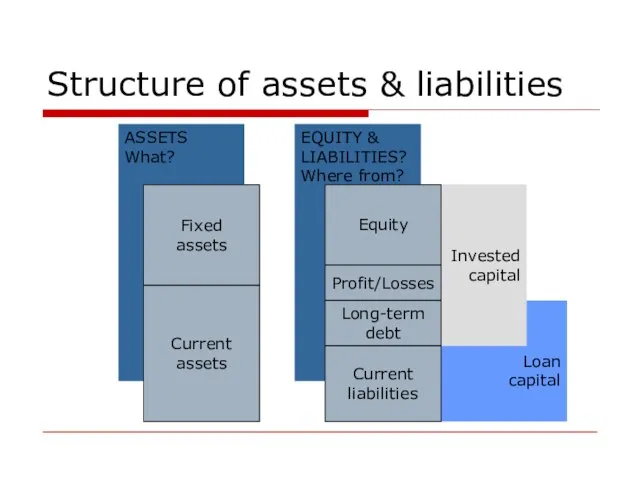

- 40. Loan capital Invested capital EQUITY & LIABILITIES? Where from? ASSETS What? Structure of assets & liabilities

- 41. Structure of assets & liabilities Balance equation Total Assets = Total Liabilities & Equity = FA

- 42. Structure of assets & liabilities Fixed assets: land plant & equipment transport long-term financial investments license

- 43. Structure of assets & liabilities Current assets: cash inventories work-in-process accounts receivable short-term financial investments pre-paid

- 44. Structure of assets & liabilities Equity: shareholders’ equity retained earnings additional capital reserves

- 45. Structure of assets & liabilities Loan capital: long-term liabilities (longer than 12 months) short-term liabilities loans

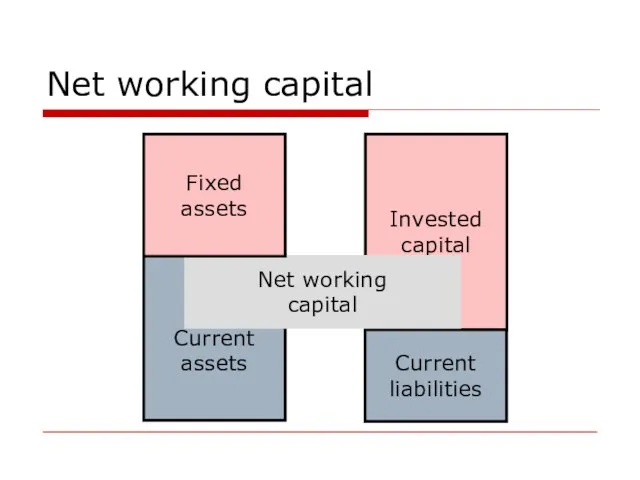

- 46. Net working capital Invested capital Current assets Current liabilities Net working capital Fixed assets

- 47. Net working capital NWC = CA – CL = IC – FA Represents operating liquidity available

- 48. INCOME STATEMENT

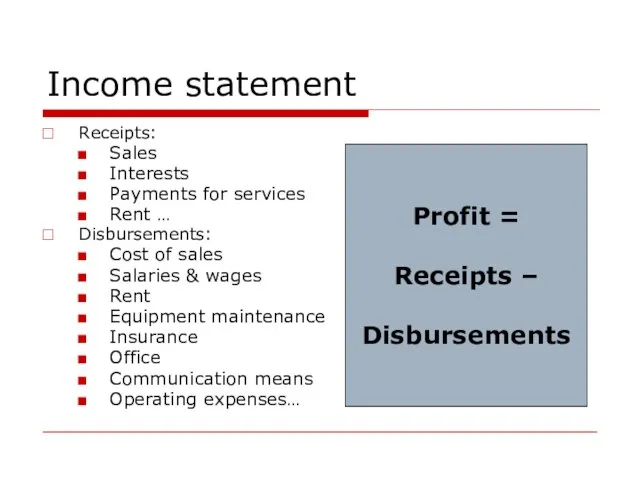

- 49. Income statement Receipts: Sales Interests Payments for services Rent … Disbursements: Cost of sales Salaries &

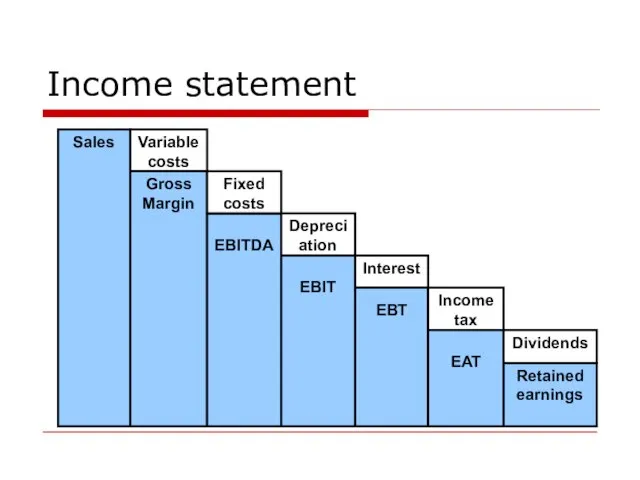

- 50. Income statement

- 51. Balance sheet & income statement

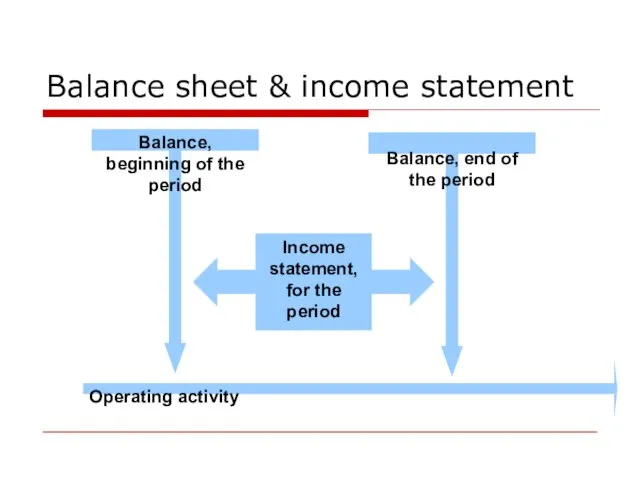

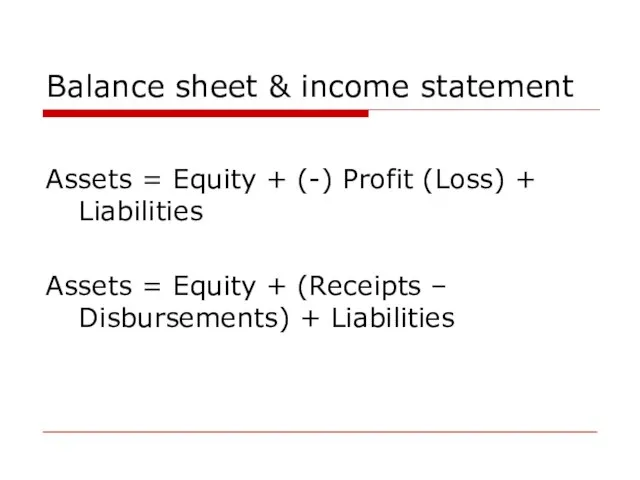

- 52. Balance sheet & income statement Assets = Equity + (-) Profit (Loss) + Liabilities Assets =

- 53. STATEMENT OF CASH FLOWS

- 54. Cash flow statement Operating activities: Cash received from customers Cash paid to suppliers and employees Operating

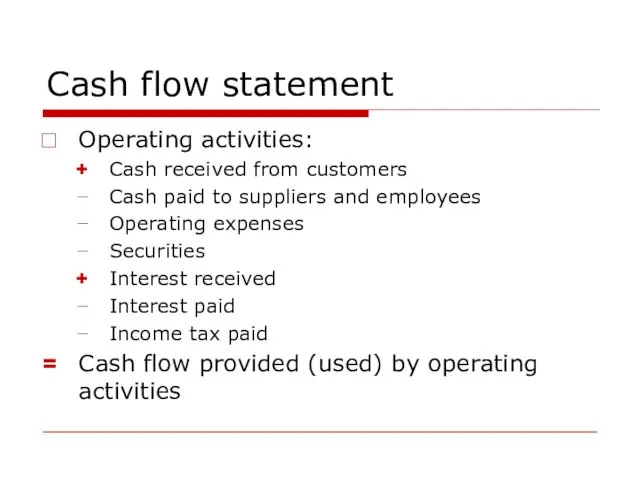

- 55. Cash flow statement Investing activities Proceeds from sales of assets Capital expenditures Shares acquisition Proceeds from

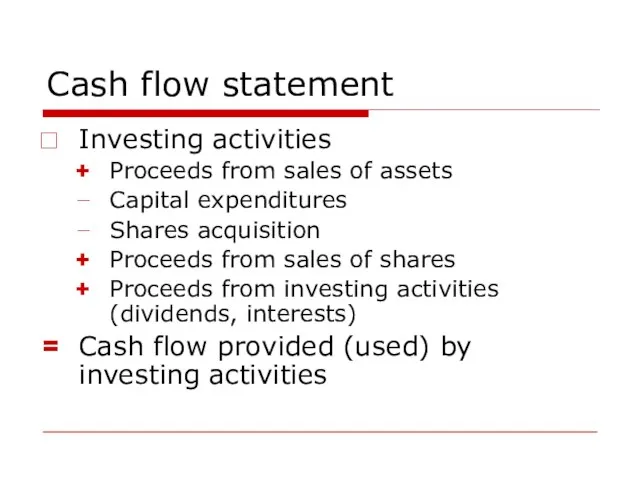

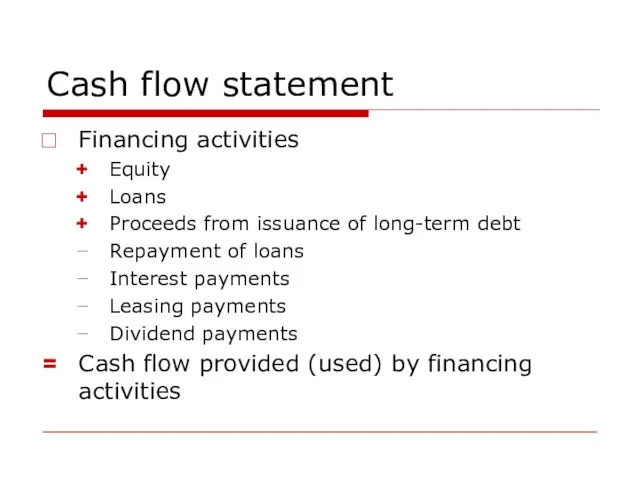

- 56. Cash flow statement Financing activities Equity Loans Proceeds from issuance of long-term debt Repayment of loans

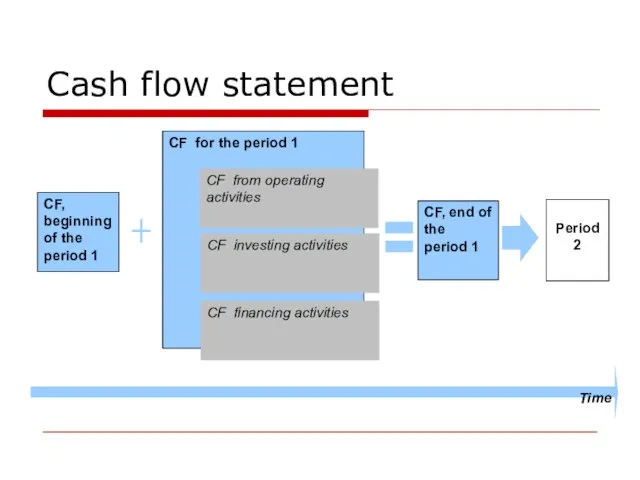

- 57. Cash flow statement

- 58. Cash flow statement Methods of representing cash flows from operating activities: Direct - all the inflows

- 59. Cash flow statement Steps of the indirect method: Add back noncash expenses, primarily depreciation / Subtract

- 60. Cash flow statement Signs for adjustments (indirect method) ? Current assets ? Current liabilities Noncash earnings

- 61. Cash flow statement Differences between EAT and CF: ? EAT show economic effectiveness of sales, don’t

- 62. FINANCIAL ANALYSIS

- 63. BASIC PRINCIPLES

- 64. Financial ratios A financial ratio is a relationship that indicates something about a firm’s activities and

- 65. Financial ratios Successful financial ratio analysis: Requires only representative sample of possible ratios A financial ratio

- 66. Financial ratios Advantages of financial ratios: Possible to compare companies and projects of different sizes Just

- 67. Financial ratios Disadvantages of financial ratios: Strongly depend on accuracy of reports Don’t analyze absolute values

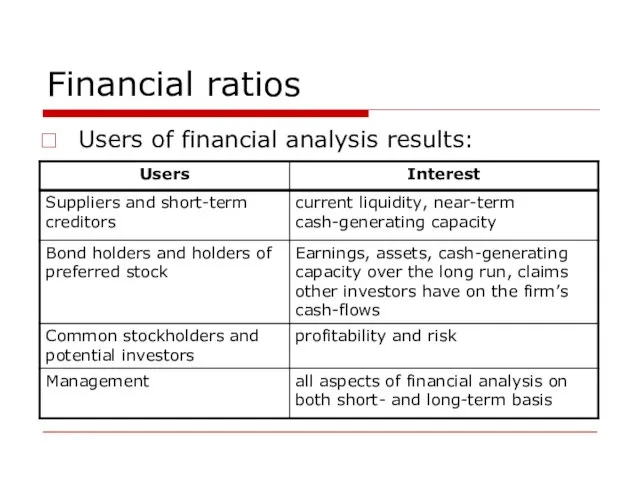

- 68. Financial ratios Users of financial analysis results:

- 69. FIVE GROUPS OF FINANCIAL RAIOS

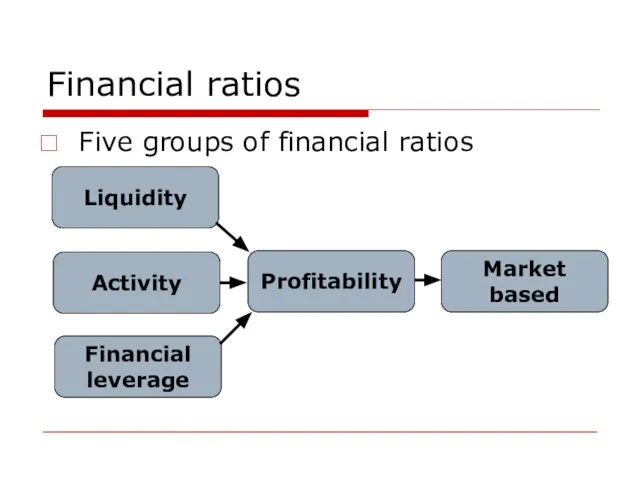

- 70. Financial ratios Five groups of financial ratios Profitability Liquidity Activity Financial leverage Market based

- 71. Liquidity ratios Liquidity ratios indicate a firm’s ability to meet short-term financial obligations. Current ratio=Current assets

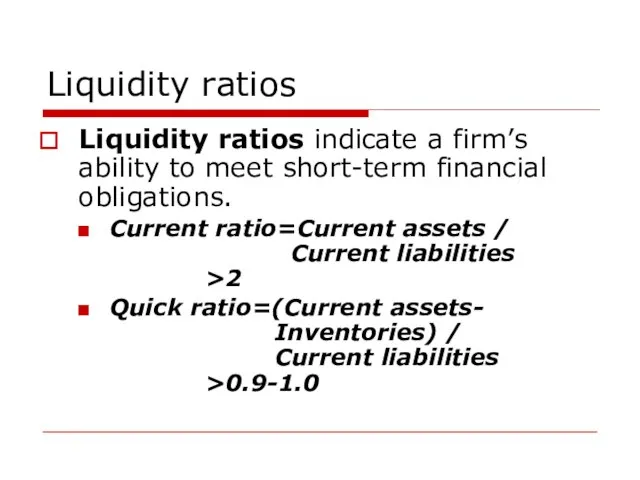

- 72. Liquidity ratios Aging schedule

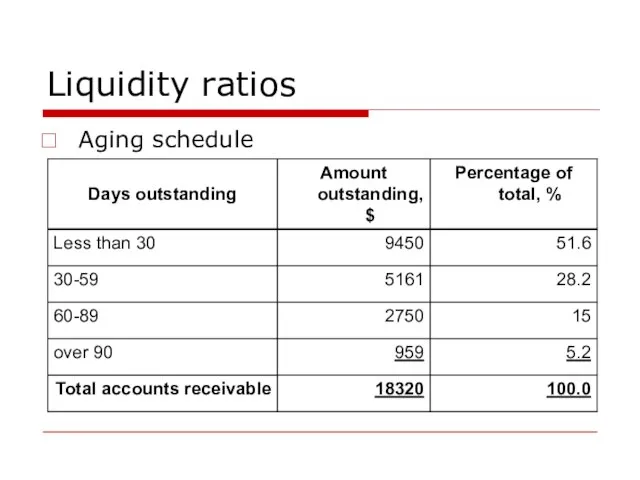

- 73. Activity ratios Activity ratios indicate how efficiently a firm is utilizing its assets to generate the

- 74. Activity ratios Average collection period = Accounts receivable/ (Annual credit sales/365) Inventory turnover = Costs of

- 75. Financial leverage ratios Financial leverage ratios measure the degree to which a firm is financing its

- 76. Financial leverage ratios Financial leverage rule: if the rate of return on equity exceed the cost

- 77. Profitability ratios Profitability ratios measure the total effectiveness of a company’s management in generating profits. Gross

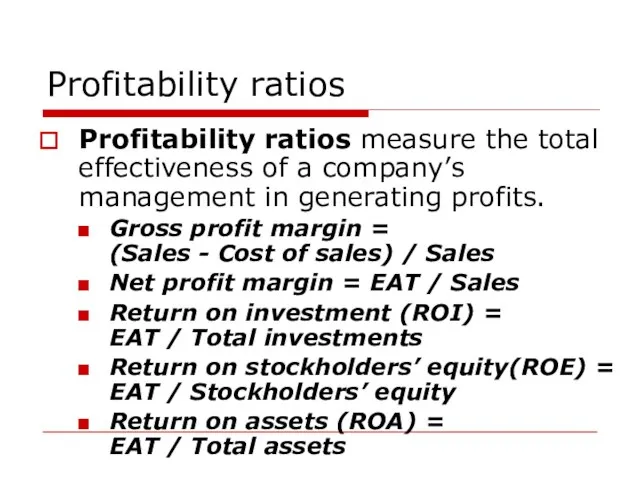

- 78. Market-based ratios Market-based ratios measure the market’s (investor’s) assessment of the risk and performance of a

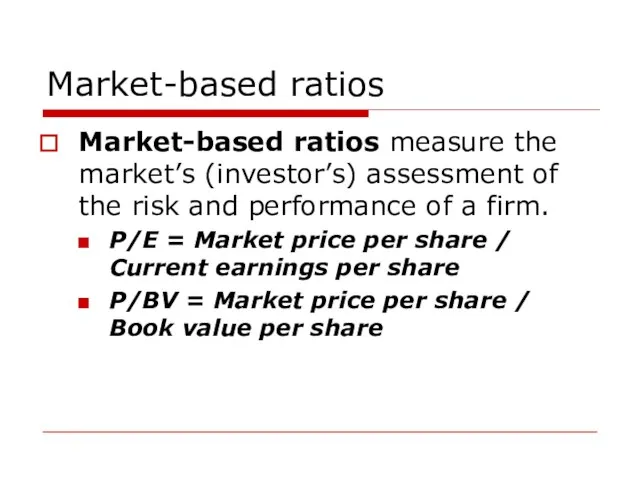

- 79. SOME METHODS OF FINANCIAL ANALYSIS

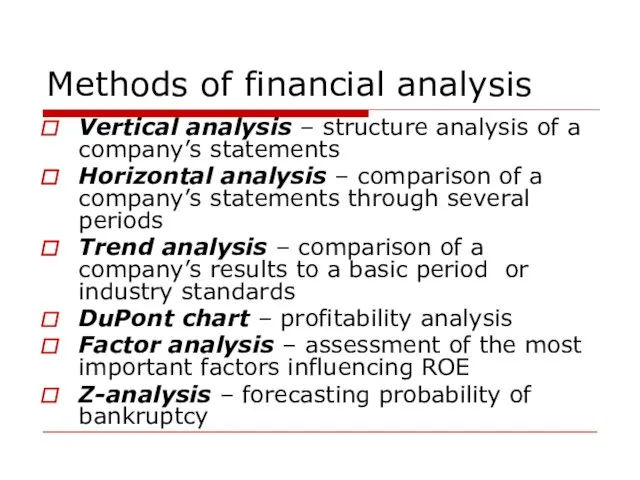

- 80. Methods of financial analysis Vertical analysis – structure analysis of a company’s statements Horizontal analysis –

- 81. Trend analysis Steps of the trend analysis: Choose a ratio Choose a basic period / find

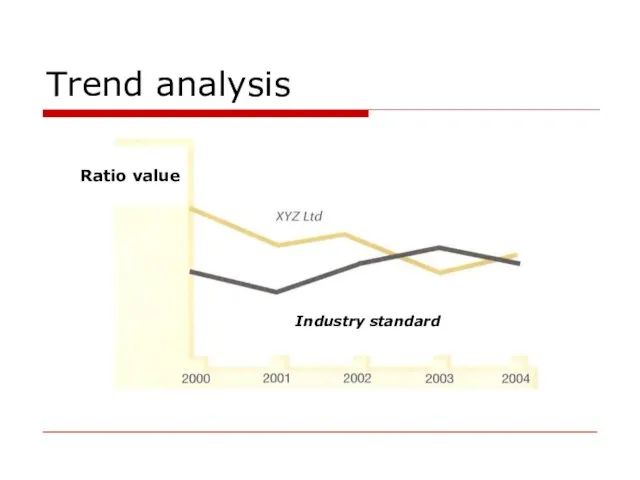

- 82. Trend analysis Ratio value Industry standard

- 83. DuPont Chart analysis ROI = NPM * TAT ROE = NPM * TAT * EM

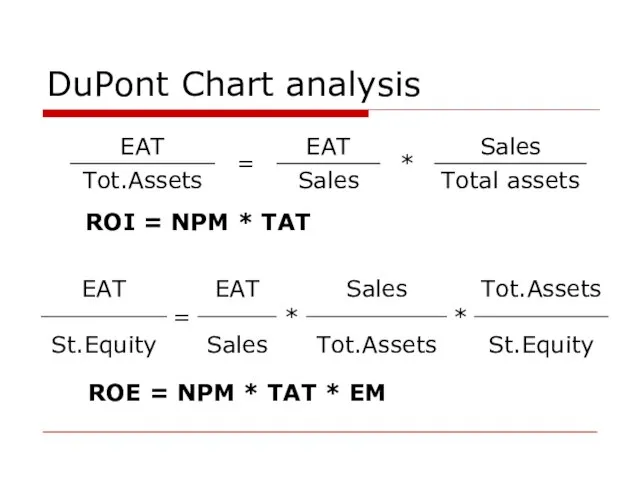

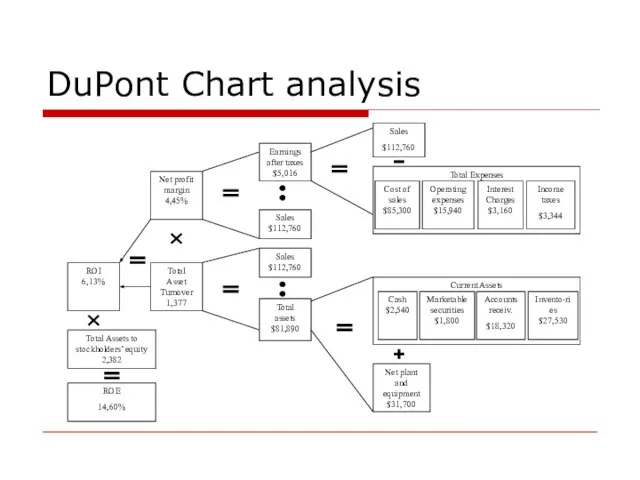

- 84. DuPont Chart analysis Net profit margin 4,45% Total Asset Turnover 1,377 Earnings after taxes $5,016 Sales

- 85. Factor analysis

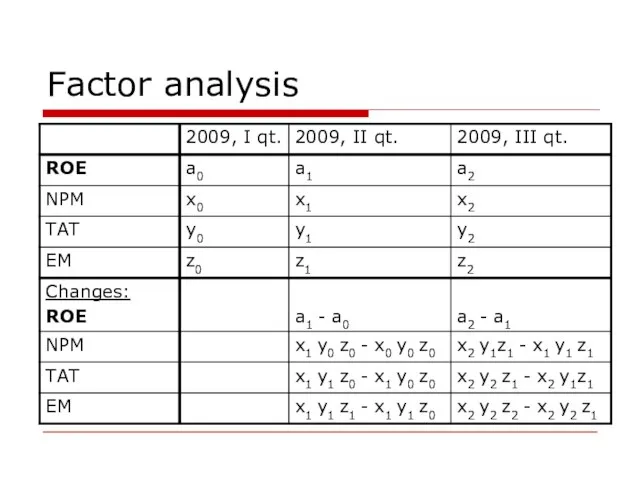

- 86. Factor analysis

- 87. Z-analysis

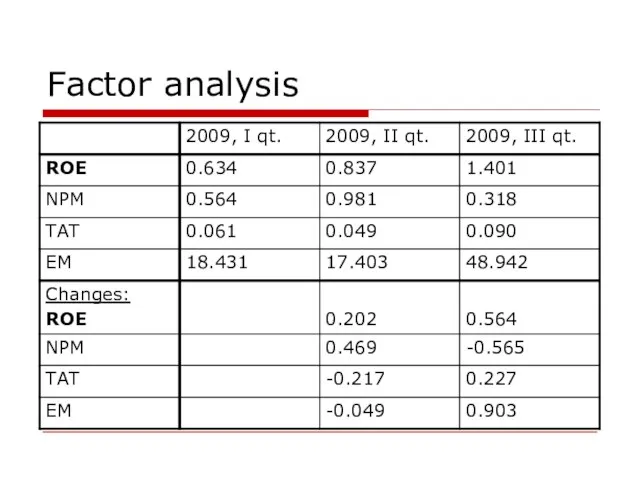

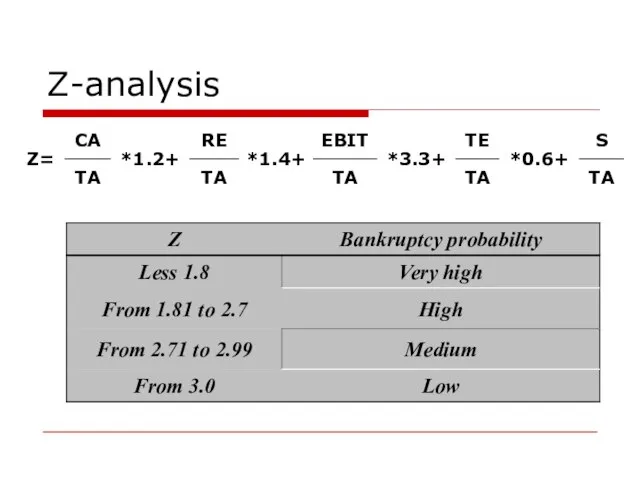

- 88. CASH FLOW MANAGEMENT

- 89. NET CASH FLOW

- 90. Cash as a company’s working capital

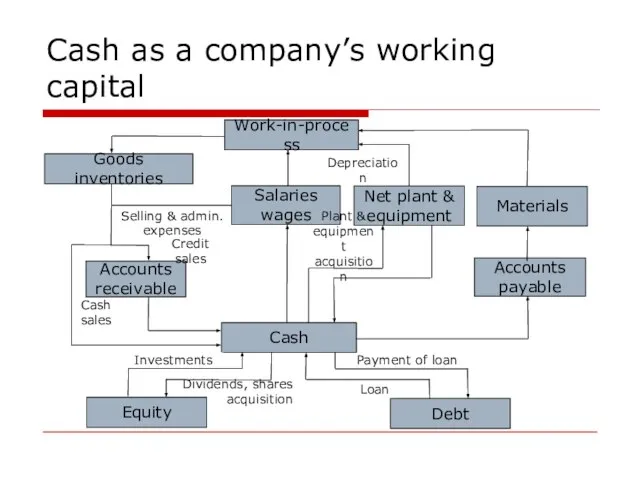

- 91. Cash as a company’s working capital Cash volume depends on: Production phase Sales Collection of accounts

- 92. Cash as a company’s working capital Control of a cash rest Cash rest, RUR External limit

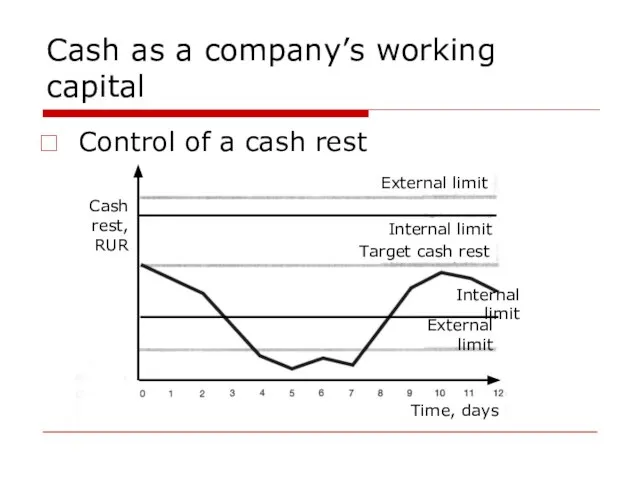

- 93. Cash as a company’s working capital Cash turnover cycle

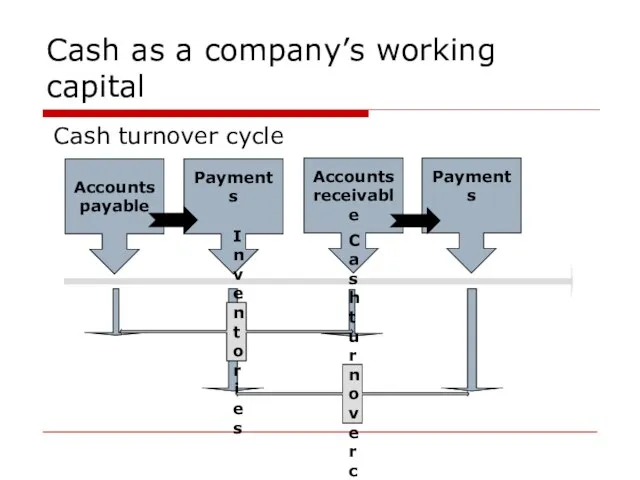

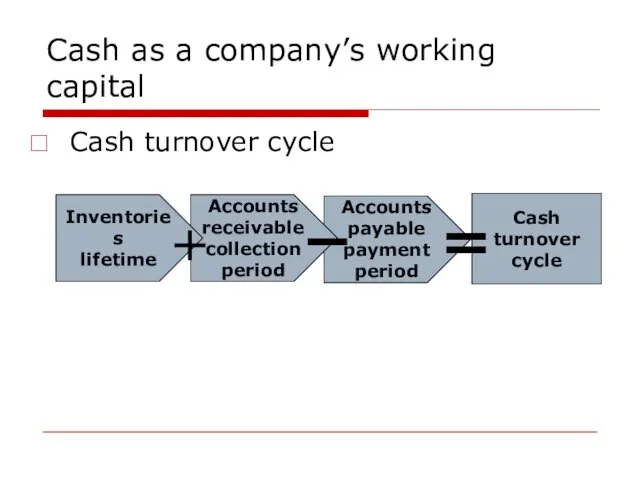

- 94. Accounts payable payment period Accounts receivable collection period Cash as a company’s working capital Cash turnover

- 95. Statement of cash sources & disbursements Cash sources Current assets reduction (excl. cash) Fixed assets reduction

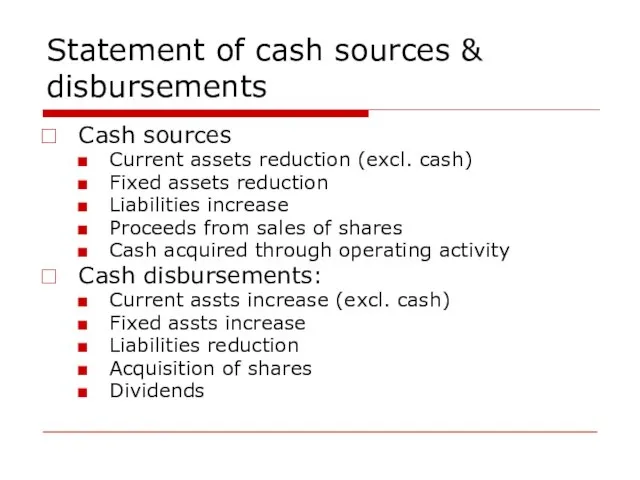

- 96. Depreciation Depreciation norm depends on: Initial Lifetime: Technical Effective Rest cost Method of depreciation: Straight line

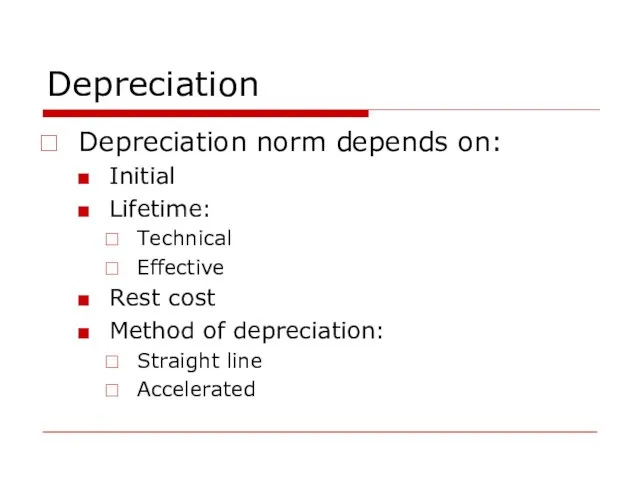

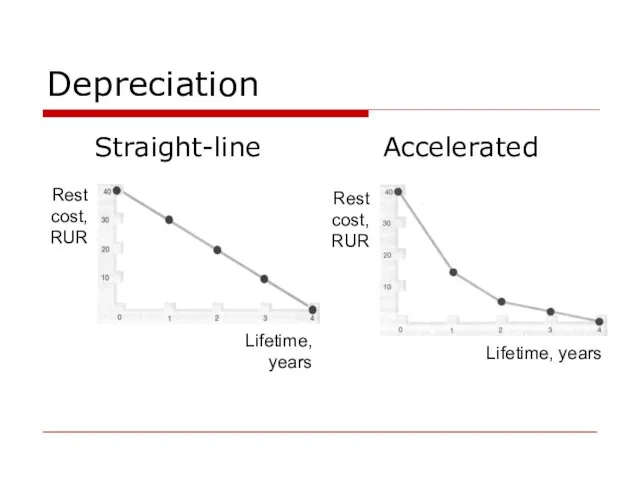

- 97. Depreciation Straight-line Accelerated

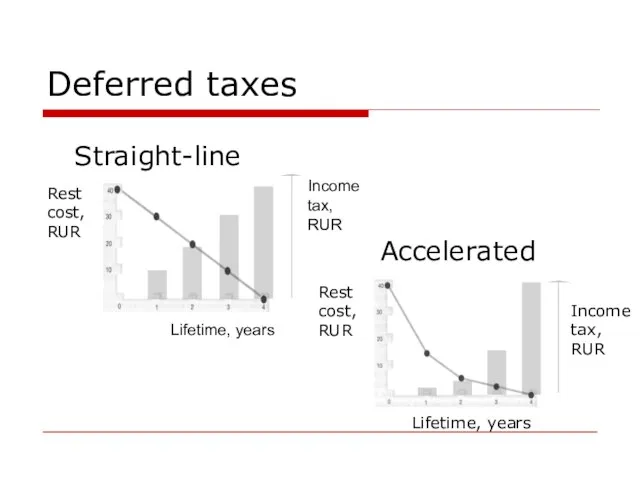

- 98. Deferred taxes Straight-line Accelerated

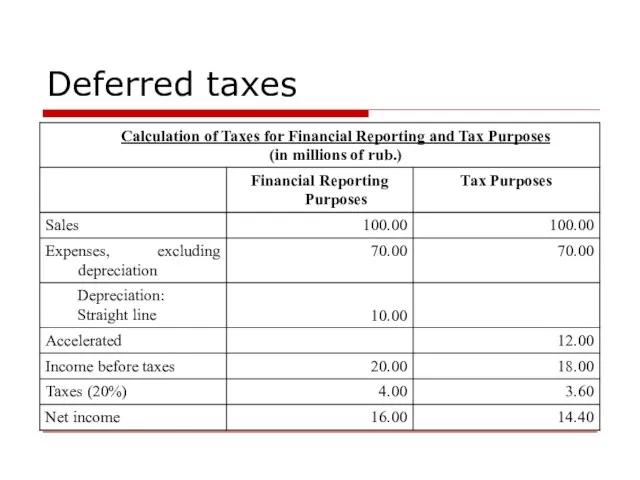

- 99. Deferred taxes

- 100. CASH FLOW FORECASTING

- 101. Forecasting of financial statements 5 steps: Define basic data for forecasting: external income tax rate interest

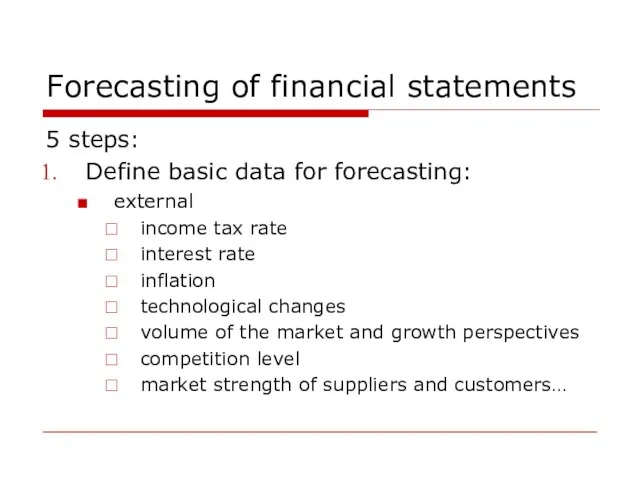

- 102. Forecasting of financial statements internal: investments policy external financing policy accounting policy dividend policy planned profitability

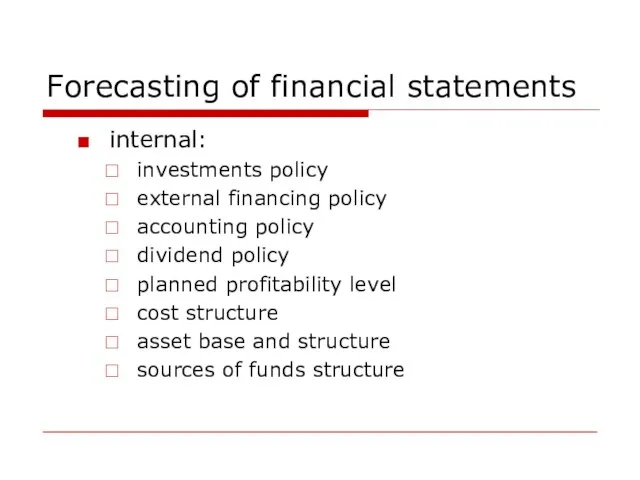

- 103. Forecasting of financial statements Forecast the volume of sales bottom-up forecasting statistics analysis marketing analysis Forecast

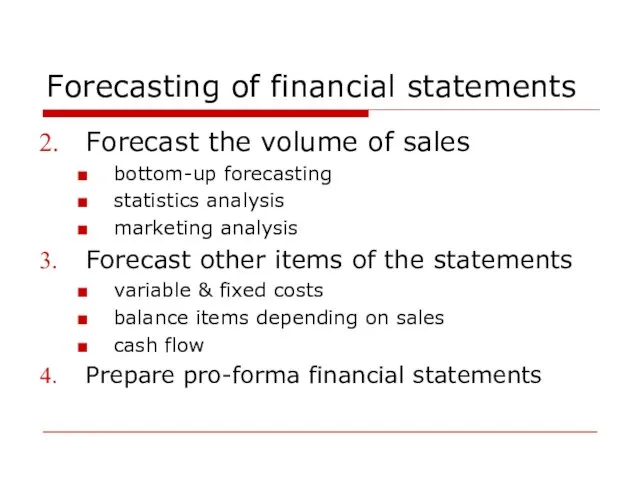

- 104. Forecasting of financial statements Analysis of pro forma financial statements Cash flows Additional financing & sources

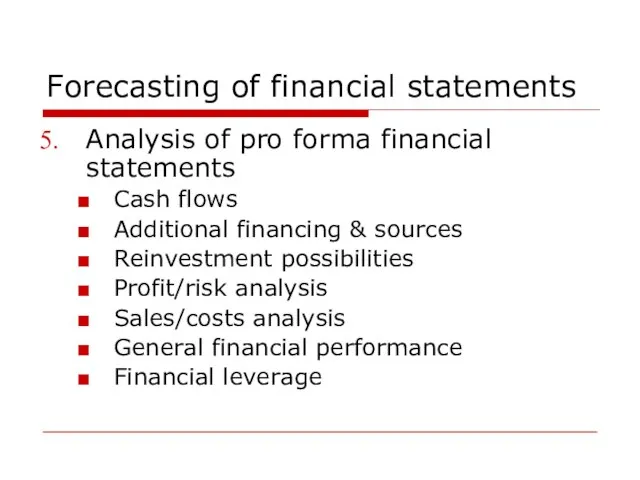

- 105. Percentage of sales forecasting method The percentage of sales forecasting method: permits a company to forecast

- 106. Percentage of sales forecasting method Internal net cash provided = Forecasted CF - Dividends

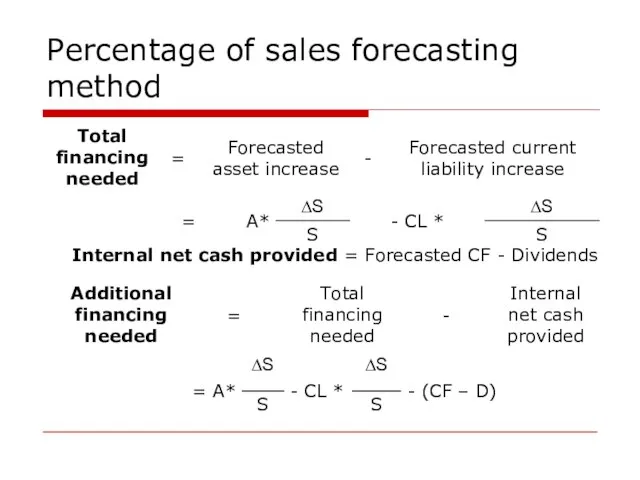

- 107. Percentage of sales forecasting method To support the sales increase the management of the company has

- 108. Budgeting Five steps in preparing a budget

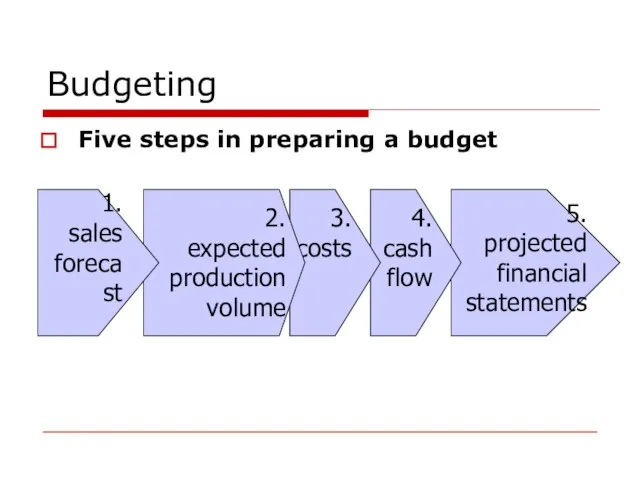

- 109. COSTS PLANNING

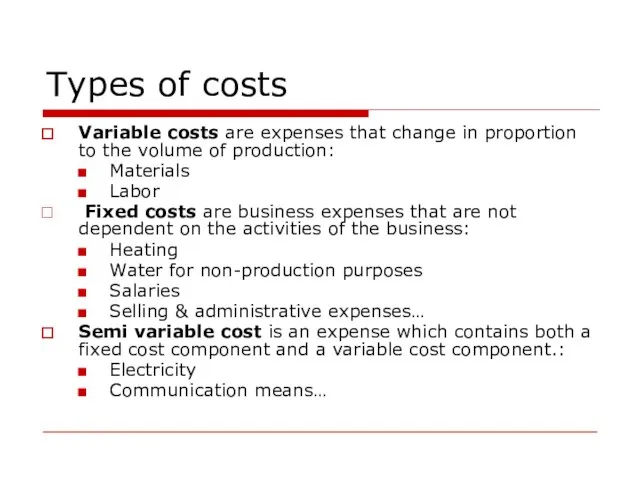

- 110. Types of costs Variable costs are expenses that change in proportion to the volume of production:

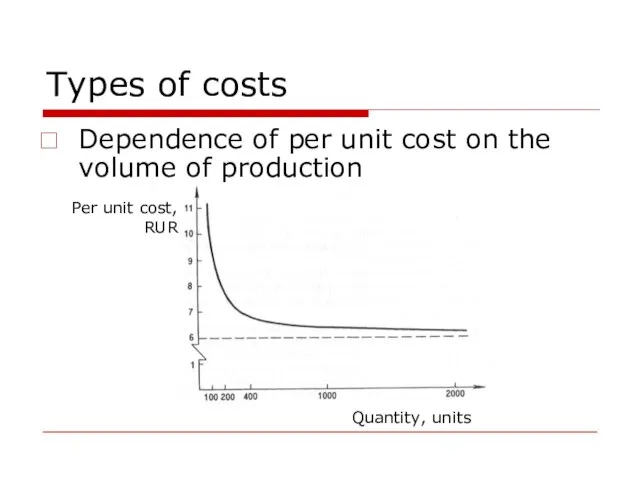

- 111. Types of costs Dependence of per unit cost on the volume of production Per unit cost,

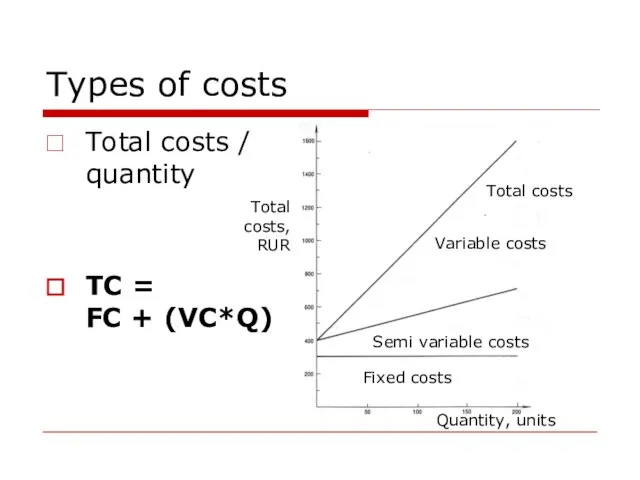

- 112. Types of costs Total costs / quantity TC = FC + (VC*Q) Total costs, RUR Quantity,

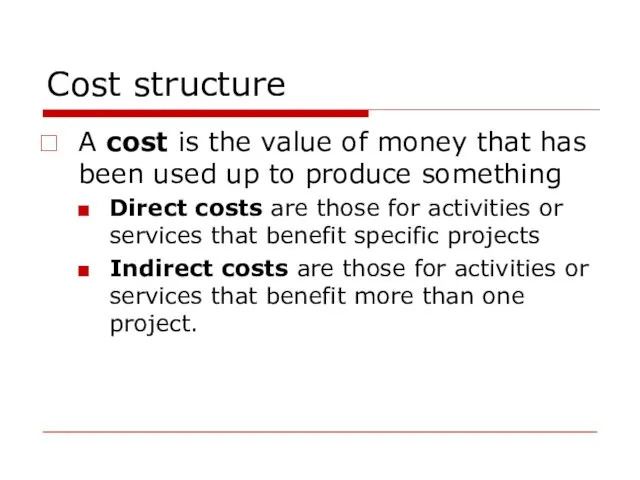

- 113. Cost structure A cost is the value of money that has been used up to produce

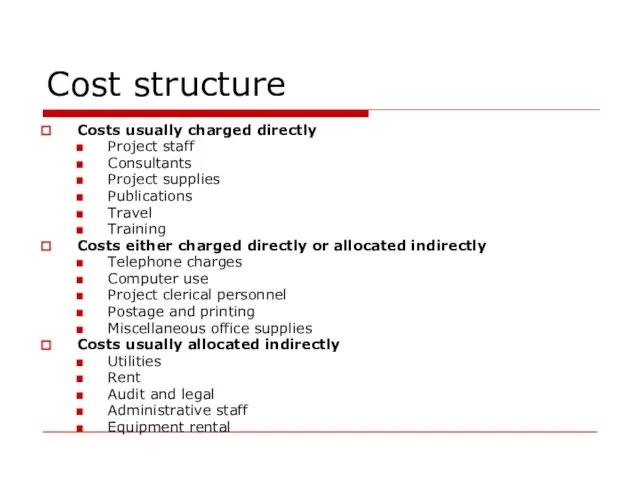

- 114. Cost structure Costs usually charged directly Project staff Consultants Project supplies Publications Travel Training Costs either

- 116. Скачать презентацию

Графический диктант №1

Графический диктант №1 ESPRESSO STILE ITALIANO

ESPRESSO STILE ITALIANO Правополушарные дети

Правополушарные дети Уход за растениями

Уход за растениями Мозаика с металлическим контуром

Мозаика с металлическим контуром Обратная пропорциональность

Обратная пропорциональность МОУ «Красноярская основная общеобразовательная школа» Зырянского района. Учитель математики: Кудинова Ирина Николаевна.

МОУ «Красноярская основная общеобразовательная школа» Зырянского района. Учитель математики: Кудинова Ирина Николаевна. Презентация на тему Виды связи в словосочетаниях

Презентация на тему Виды связи в словосочетаниях ВКР: Маркетинг инноваций в организации социальной сферы

ВКР: Маркетинг инноваций в организации социальной сферы Распределительные устройства и подстанции напряжением выше 1 кВ

Распределительные устройства и подстанции напряжением выше 1 кВ Экскурсия по Алтайскому краю

Экскурсия по Алтайскому краю Электроподвижной состав

Электроподвижной состав Презентация на тему Все дети любят рисовать

Презентация на тему Все дети любят рисовать Презентация на тему Тундра 4 класс

Презентация на тему Тундра 4 класс МОСКВА – ОБЩЕЭКОНОМИЧЕСКИЕ ПОКАЗАТЕЛИ

МОСКВА – ОБЩЕЭКОНОМИЧЕСКИЕ ПОКАЗАТЕЛИ С ДНЁМ РОЖДЕНИЯ МОЯ ЛЮБИМАЯ МАМА!

С ДНЁМ РОЖДЕНИЯ МОЯ ЛЮБИМАЯ МАМА! РЕНТГЕНОВСКАЯ ТОМОГРАФИЯ

РЕНТГЕНОВСКАЯ ТОМОГРАФИЯ Коммуникационное сопровождение российских компаний при выходе на международные рынки

Коммуникационное сопровождение российских компаний при выходе на международные рынки Словообразование

Словообразование Техническое обеспечение работы с документами, учёт и хранение документов и дел в правоохранительных органах

Техническое обеспечение работы с документами, учёт и хранение документов и дел в правоохранительных органах Устный счет в пределах 10

Устный счет в пределах 10 Тест по теме «Трудные времена на Русской земле»

Тест по теме «Трудные времена на Русской земле» Видео/Аудио Домофон Dom.ru

Видео/Аудио Домофон Dom.ru День Святого Патрика

День Святого Патрика Оптимизация планирования ИВП БПЛА в Российской Федерации

Оптимизация планирования ИВП БПЛА в Российской Федерации Превращения сплавов в твёрдом состоянии (вторичная кристаллизация)

Превращения сплавов в твёрдом состоянии (вторичная кристаллизация) Пингвины

Пингвины Демографическая ситуация России

Демографическая ситуация России