Слайд 2FINANCIAL MARKETS AND

INTEREST RATES

Слайд 3Market Players

An investor / lender is an individual, company, government, or any

entity that owns more funds than it can use.

An issuer / borrower is an entity that has a need for capital.

Brokers and dealers are financial intermediaries, who purchase securities from issuers and sell them to investors

Слайд 4Securities

Debt security or bond – promises periodic payments of interest and/or principal

from a claim on the issuer's earnings

Equity or stock – promises a share in the ownership and profits of the issuer

Слайд 5Types of Financial Markets

Money markets trade short-term, marketable, liquid, low-risk debt securities

- "cash equivalents“

Capital markets trade in longer-term, more risky securities:

bond (or debt) markets,

equity markets,

derivative markets

Слайд 6INTEREST RATES

The stated or offered rate of

interest (r) reflects three factors:

Pure

rate of interest (r*)

Premium that reflects expected inflation (IP)

Premium for risk (RP)

r = r* + IP + RP

Слайд 7Pure Interest Rate

the rate for a risk-free security when no inflation is

expected

constantly changes over time, depending on economic conditions

Слайд 8Inflation

Investors build in an inflation premium to compensate for this loss of

value

the inflation premium is not constant; it is always changing based on investors' expectations of the future level of inflation

Слайд 9Risk

Counterparty (default) risk is the chance that the borrower will not be

able to pay the interest or pay off the principal of a loan.

Ratings companies identify and classify the creditworthiness of corporations and governments to determine how large the risk premium should be (AAA – CCC)

Слайд 10Risk

Liquidity risk – possible losses if there is no opportunity to buy

or to sell assets at the proposed volume for the proposed price due to bad market conditions

Слайд 11Risk

Interest rate risk - possible changes of asset value due to changes

of the interest rate:

As interest rates increase, bond prices decrease.

As interest rates decrease, bond prices increase.

Слайд 12Risk

Currency risk – possible changes of the assets value due to changes

of the currency exchange rate.

Operational risk – possible losses due to possible technical mistakes.

Business-event risk – possible losses due to force-mageure events, changes in legislation, etc.

Слайд 13Normal Yield Curve Theories

upward sloping yield curve is considered normal:

expectations theory,

the

market segmentation theory,

the liquidity preference theory

Слайд 14Expectations Theory

The yield curve reflects lenders' and borrowers' expectations of inflation

Changes in

these expectations cause changes in the shape of the yield curve

Слайд 15Market Segmentation Theory

The slope of the yield curve depends on supply /

demand conditions in the short-term and long-term markets

An upward sloping curve results from a large supply of funds in the short-term market relative to demand and a shortage of long-term funds.

A downward sloping curve indicates strong demand in the short-term market relative to the long-term market

Слайд 16Liquidity Preference Theory

long-term securities often yield more than short-term securities

Investors generally prefer

short-term securities, which are more liquid and less expensive to buy and sell. Investors require higher yield on long-term instruments to compensate for the higher cost

Слайд 17Liquidity Preference Theory

Borrowers dislike short-term debt because it exposes them to the

risk of having to roll over the debt or raise new principal under adverse conditions (such as a rise in rates). Borrowers will pay a higher rate for long-term debt than for short-term debt, all other factors being held constant.

BMW F90 VoLe

BMW F90 VoLe Система работы классного руководителяпо организации совместной деятельности школы и семьи через создание центров в классном к

Система работы классного руководителяпо организации совместной деятельности школы и семьи через создание центров в классном к Электрофизические свойства водородосодержащих доноров в субмикронных слоях кремния Магистерская диссертация Выполнил – м

Электрофизические свойства водородосодержащих доноров в субмикронных слоях кремния Магистерская диссертация Выполнил – м Юные инспектора движения

Юные инспектора движения POLYMER PROCESSING

POLYMER PROCESSING Презентация на тему Государственные границы России

Презентация на тему Государственные границы России  Цифровой блок разгрузки по частоте и напряжению типа БРЧН-100

Цифровой блок разгрузки по частоте и напряжению типа БРЧН-100 Сон и сновидения

Сон и сновидения Алгоритмы и их свойства

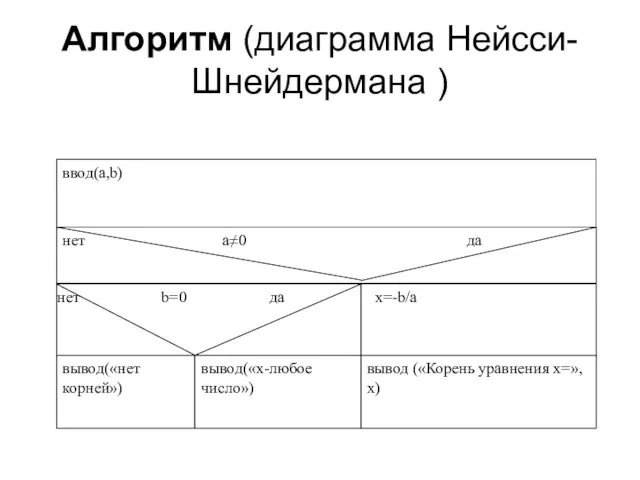

Алгоритмы и их свойства Огруппление мышления

Огруппление мышления Когда в сердце разгорается любовь

Когда в сердце разгорается любовь Лернейская гидра мифология

Лернейская гидра мифология Создание финансового плана

Создание финансового плана Памятники архитектуры в России

Памятники архитектуры в России Три мира в романе «Мастер и Маргарита»

Три мира в романе «Мастер и Маргарита» О результатах проведенного мониторинга наркоситуации в Удмуртской Республике в 2019 году

О результатах проведенного мониторинга наркоситуации в Удмуртской Республике в 2019 году Современные методы лечения и профилактики заболеваний парадонта у детей

Современные методы лечения и профилактики заболеваний парадонта у детей Первые киевские князья. Принятие христианства

Первые киевские князья. Принятие христианства Совместная деятельность с детьми средней группы по формированию правил дорожного движения и поведения на улице в средней группе

Совместная деятельность с детьми средней группы по формированию правил дорожного движения и поведения на улице в средней группе Основы административного права

Основы административного права Австралия

Австралия История становления избирательного права в России

История становления избирательного права в России НАНОТЕХНОЛОГИИ В БИОЛОГИИ И МЕДИЦИНЕ

НАНОТЕХНОЛОГИИ В БИОЛОГИИ И МЕДИЦИНЕ Презентация шаблон

Презентация шаблон Взаимодействие органов ГПН с государственной властью, местным самоуправлением и организациями пожарной безопасности (Тема № 9)

Взаимодействие органов ГПН с государственной властью, местным самоуправлением и организациями пожарной безопасности (Тема № 9) Презентация на тему Округление чисел

Презентация на тему Округление чисел Презентация разработана на основе методики Е. В. Заика «Упражнения для развития техники чтения» (1 класс)

Презентация разработана на основе методики Е. В. Заика «Упражнения для развития техники чтения» (1 класс) Вода Кыргызстана и ее воздействие на региональные отношения.

Вода Кыргызстана и ее воздействие на региональные отношения.