Слайд 2The structure of the financial market:

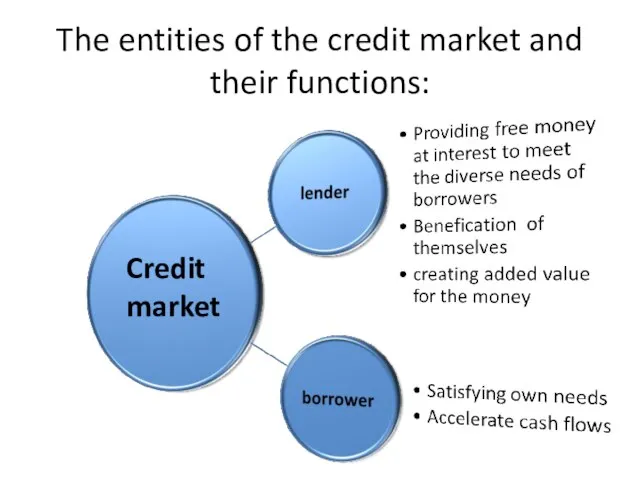

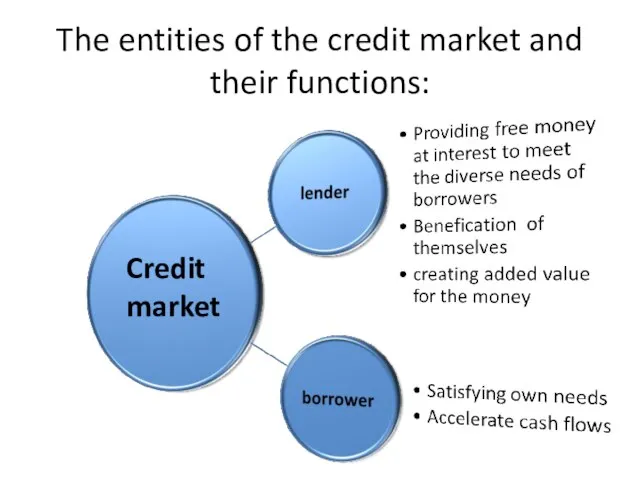

Слайд 3The entities of the credit market and their functions:

Credit market

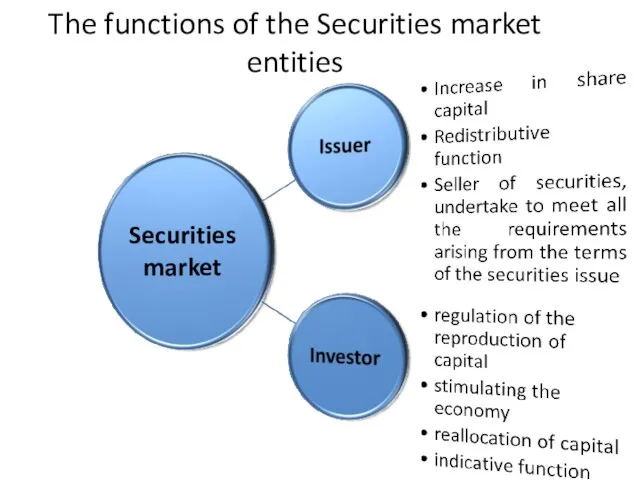

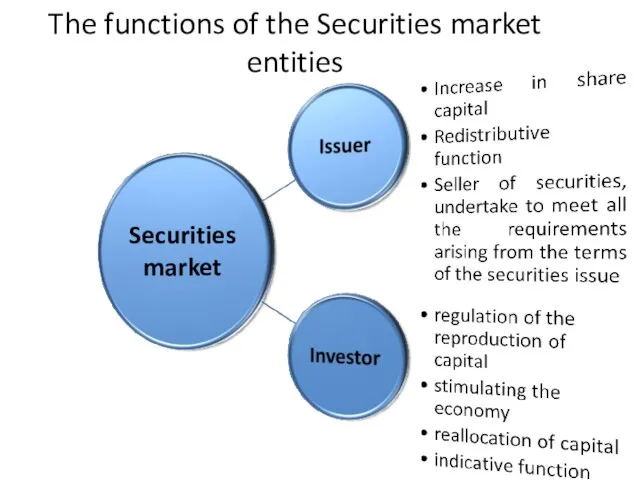

Слайд 4The functions of the Securities market entities

Securities market

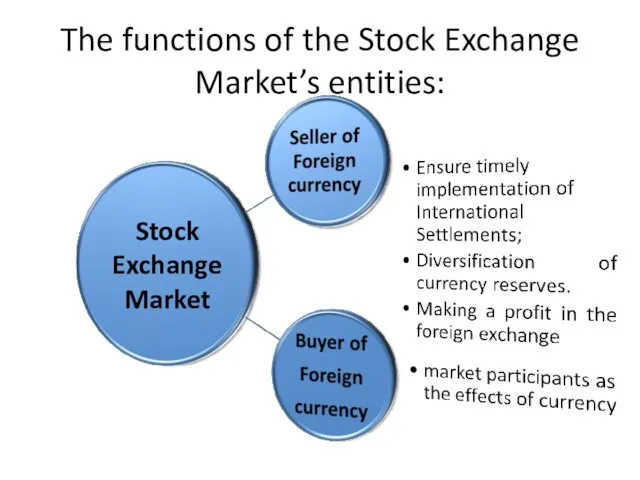

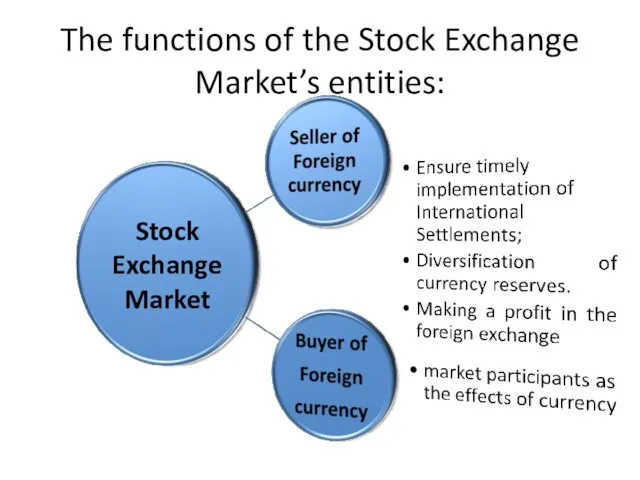

Слайд 5The functions of the Stock Exchange Market’s entities:

Stock

Exchange

Market

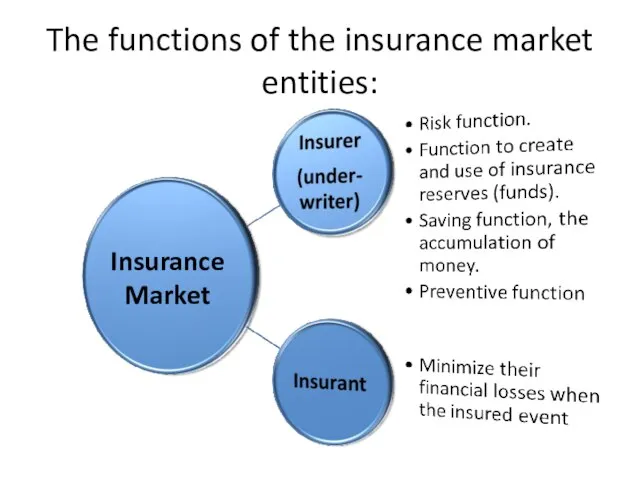

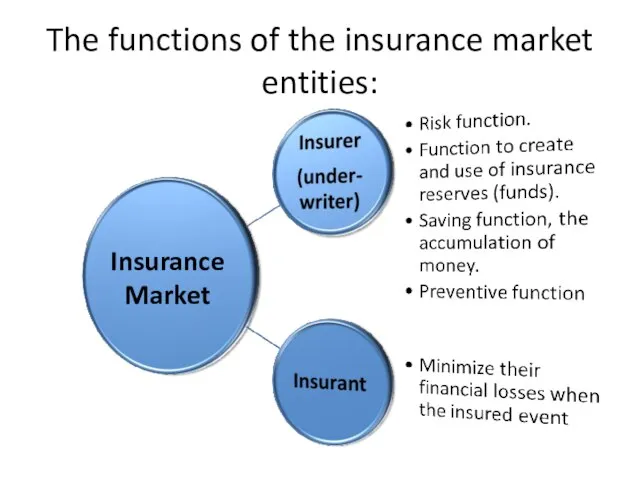

Слайд 6The functions of the insurance market entities:

Insurance

Market

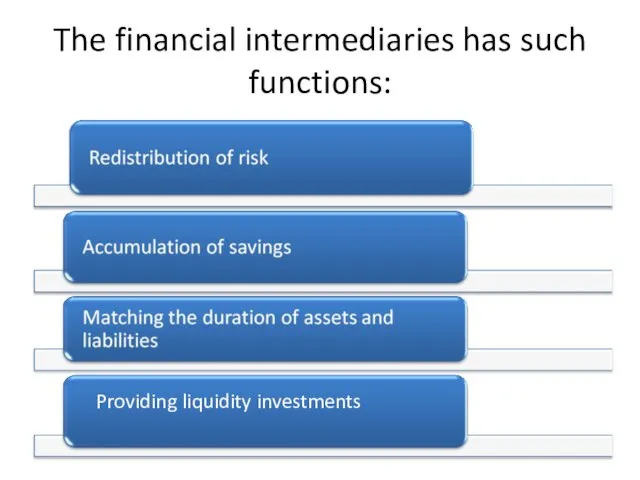

Слайд 7The financial intermediaries has such functions:

Providing liquidity investments

Слайд 8Accumulation of savings:

Financial institutions can decide objectively existing contradictions between the small

size of household savings and the needs of manufacturers in large volumes of investment. The direct involvement of small investors to firms generally do not benefit by having associated with considerable costs. Financial intermediaries, accumulating a small savings, greatly increase the efficiency of the investment process.

Слайд 9Redistribution of risk:

Equally important function of financial institutions pooling and redistribution of

risk in the economy. First, due to the accumulation of large amounts of financial resources, the mediators are able to reduce the investment risk for the individual economic actors. Second, financial institutions have the ability to trade risk, spread risk from more prone to less risk-averse economic agents, thereby increasing the well-being and of one and the other, that is, qualitatively improving the efficiency of investment.

Слайд 10Matching the duration of assets and liabilities.

In the absence of financial institutions,

it is difficult to solve the contradiction between the propensity of investors to short-term (more liquid) investments and the needs of manufacturers in attracting financing for long periods of time to carry out its investment programs. Financial institutions, accumulating a large amount of financial resources, even if the majority of these obligations is short, have the possibility of buying long-term assets. Thus, due to the scale of its activities, the mediators help to reduce the gap between supply and demand in the markets for financial assets with varying durations.

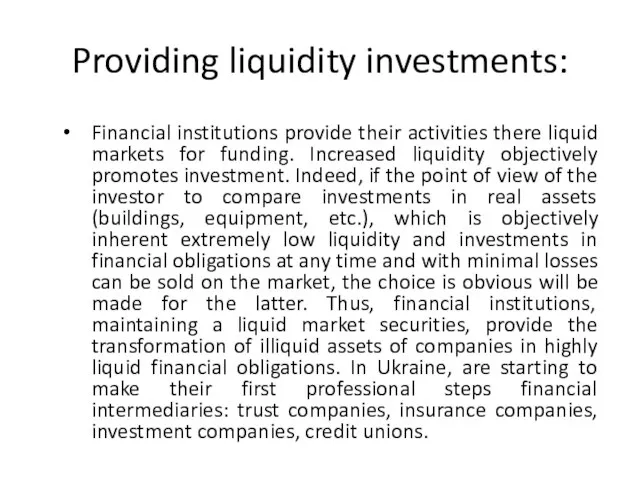

Слайд 11Providing liquidity investments:

Financial institutions provide their activities there liquid markets for funding.

Increased liquidity objectively promotes investment. Indeed, if the point of view of the investor to compare investments in real assets (buildings, equipment, etc.), which is objectively inherent extremely low liquidity and investments in financial obligations at any time and with minimal losses can be sold on the market, the choice is obvious will be made for the latter. Thus, financial institutions, maintaining a liquid market securities, provide the transformation of illiquid assets of companies in highly liquid financial obligations. In Ukraine, are starting to make their first professional steps financial intermediaries: trust companies, insurance companies, investment companies, credit unions.

Презентация на тему Родник

Презентация на тему Родник Система ценообразования стримеров

Система ценообразования стримеров Сочинение по картине Ивана Ивановича Шишкина Корабельная роща

Сочинение по картине Ивана Ивановича Шишкина Корабельная роща Быт и культура коренных народов Севера. 9 класс

Быт и культура коренных народов Севера. 9 класс Наши добрые дела

Наши добрые дела Технические средства и инженерно-технические системы обеспечения транспортной безопасности

Технические средства и инженерно-технические системы обеспечения транспортной безопасности  Экономика возобновляемой энергетики и ветроэнергетики

Экономика возобновляемой энергетики и ветроэнергетики Кинетика нелинейных процессов

Кинетика нелинейных процессов Презентация на тему Материальные и экономические трудности

Презентация на тему Материальные и экономические трудности Презентация на тему Устройства ввода информации

Презентация на тему Устройства ввода информации  Anne Bronte

Anne Bronte Основы алгоритмизации и программирования

Основы алгоритмизации и программирования Информационно-практический проектна тему:«Соблюдение Правил дорожного движения пешеходами».

Информационно-практический проектна тему:«Соблюдение Правил дорожного движения пешеходами». ЗАВИСИМОСТЬ МЕЖДУ СИНУСОМ, КОСИНУСОМ И ТАНГЕНСОМ ОДНОГО И ТОГО ЖЕ УГЛА

ЗАВИСИМОСТЬ МЕЖДУ СИНУСОМ, КОСИНУСОМ И ТАНГЕНСОМ ОДНОГО И ТОГО ЖЕ УГЛА Учет и хранение фондов музея образовательной организации

Учет и хранение фондов музея образовательной организации Ернест Хамингуей

Ернест Хамингуей  SMM. Галкина Любовь

SMM. Галкина Любовь Эскиз

Эскиз Привлечение инвестиций

Привлечение инвестиций Методика анализа и оценки степени риска

Методика анализа и оценки степени риска AMPHIBIANS BULLFROG CROAK EGG FROG GILLS GUNGLE LEGS LEOPARD METAMORPHOSIS POND TADPOLE

AMPHIBIANS BULLFROG CROAK EGG FROG GILLS GUNGLE LEGS LEOPARD METAMORPHOSIS POND TADPOLE лекция 7 тема 1

лекция 7 тема 1 36f368566b7b47859a7e1559c9c90b96 (1)

36f368566b7b47859a7e1559c9c90b96 (1) Готовность ребёнка к школе

Готовность ребёнка к школе Презентация на тему Откуда взялся сфетофор

Презентация на тему Откуда взялся сфетофор Способы двигательной деятельности

Способы двигательной деятельности Сведения о морфемике и словообразовании

Сведения о морфемике и словообразовании В институтах Евросоюза официально равноправно используются 24 языка

В институтах Евросоюза официально равноправно используются 24 языка