Содержание

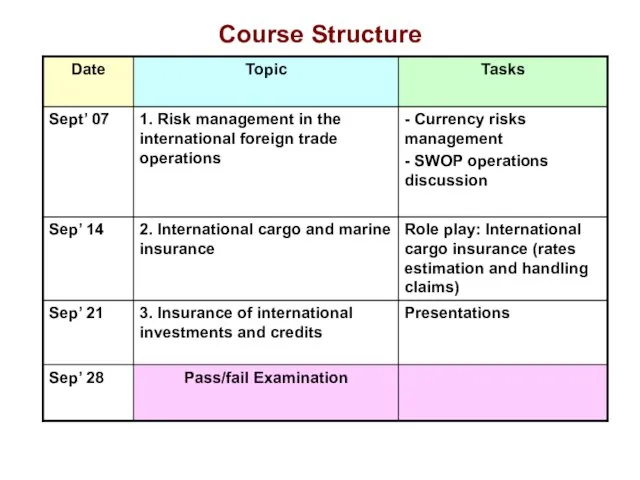

- 2. Course Structure

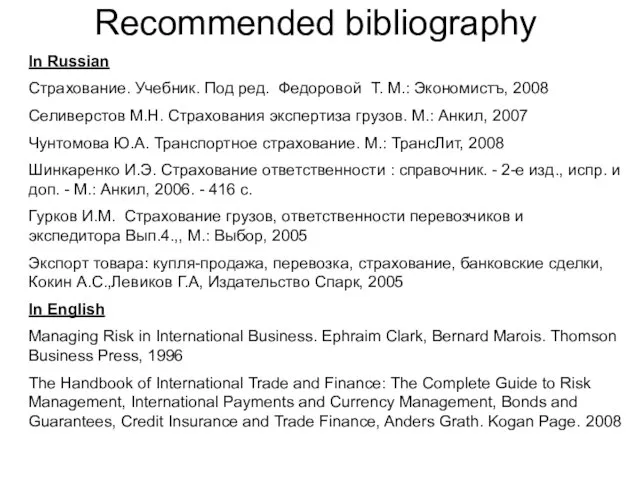

- 3. Recommended bibliography In Russian Страхование. Учебник. Под ред. Федоровой Т. М.: Экономистъ, 2008 Селиверстов М.Н. Страхования

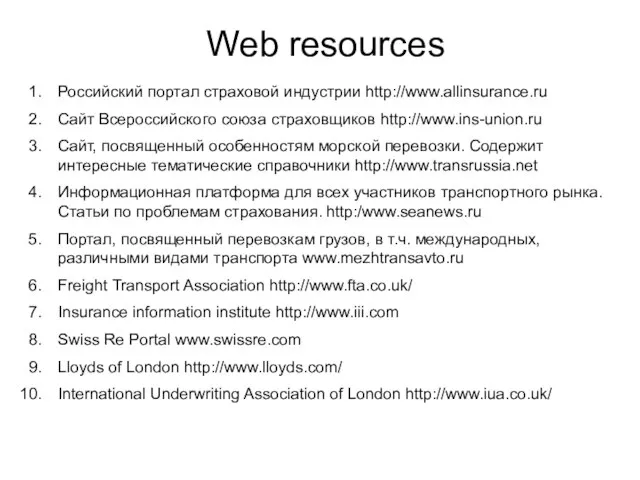

- 4. Web resources Российский портал страховой индустрии http://www.allinsurance.ru Сайт Всероссийского союза страховщиков http://www.ins-union.ru Сайт, посвященный особенностям морской

- 5. 1. Risk management in the international foreign trade operations

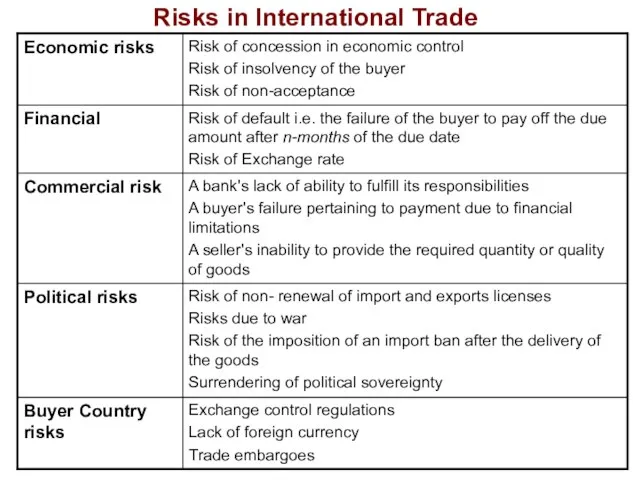

- 6. Risks in International Trade

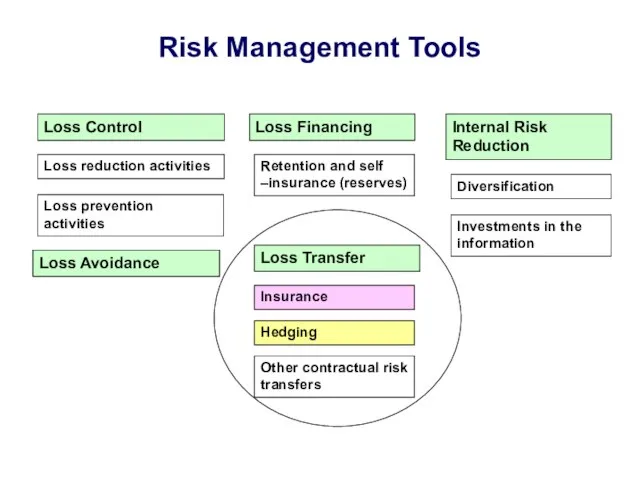

- 7. Risk Management Tools Loss Control Loss Financing Internal Risk Reduction Loss reduction activities Loss prevention activities

- 8. Most popular risk management instruments A documentary letter of credit offers the best protection for overseas

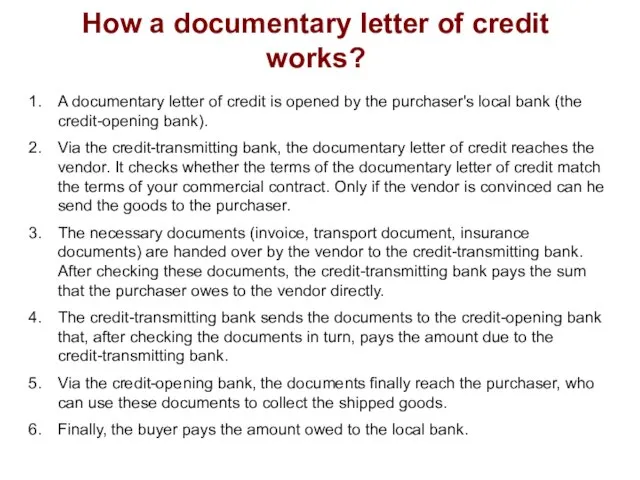

- 9. How a documentary letter of credit works? A documentary letter of credit is opened by the

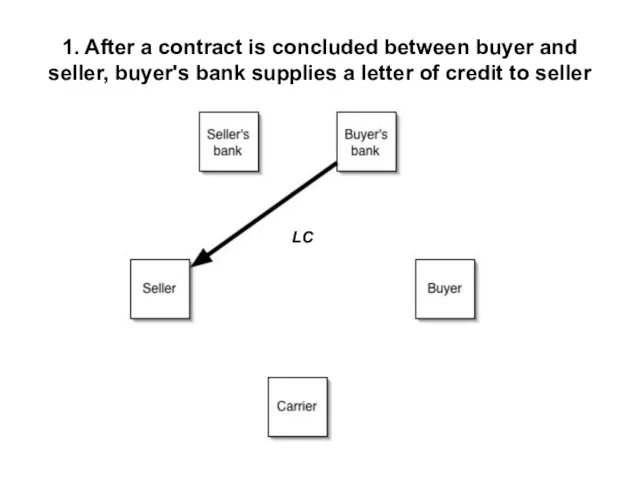

- 10. 1. After a contract is concluded between buyer and seller, buyer's bank supplies a letter of

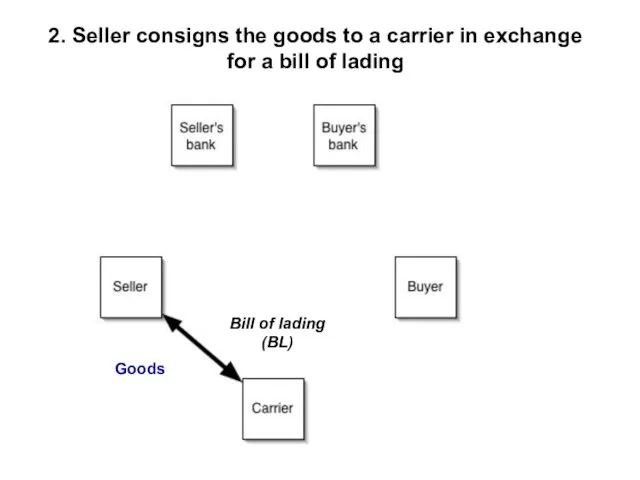

- 11. 2. Seller consigns the goods to a carrier in exchange for a bill of lading Goods

- 12. Seller put bill of lading for payment from buyer's bank. Buyer's bank exchanges bill of lading

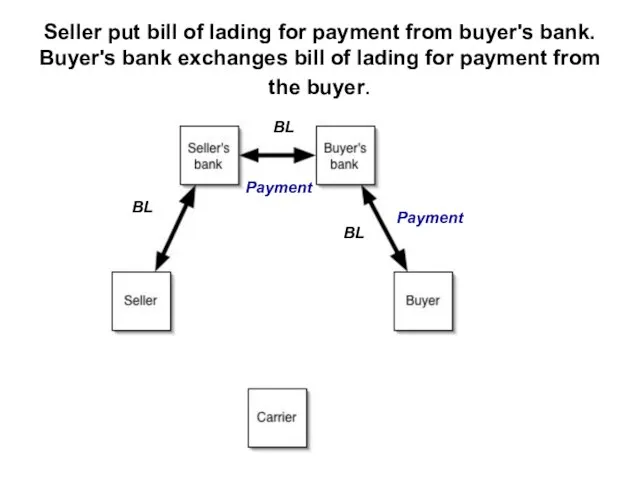

- 13. Buyer provides bill of lading to carrier and takes delivery of goods Goods BL

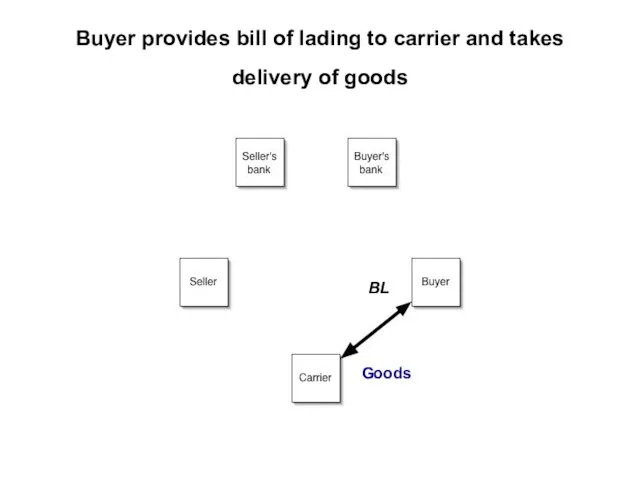

- 14. Exchange rate exposure You make forward purchases of foreign currencies and wish to protect yourself against

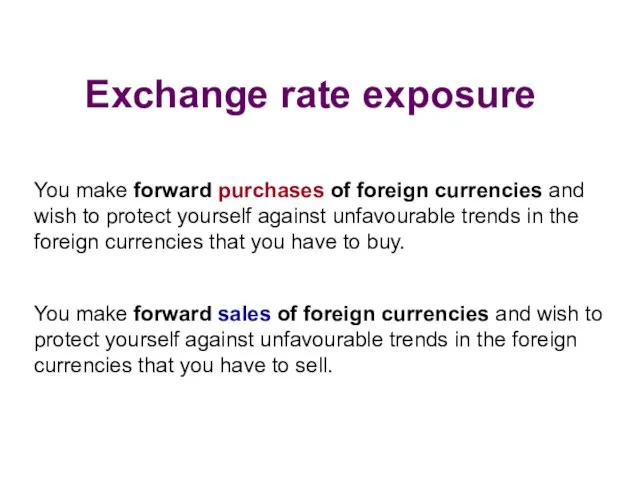

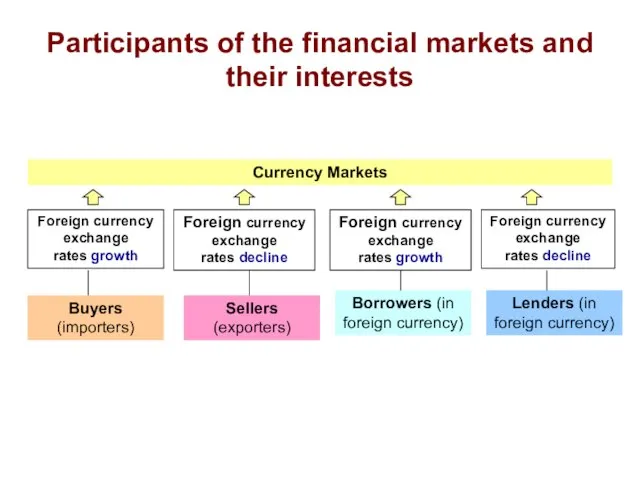

- 15. Participants of the financial markets and their interests

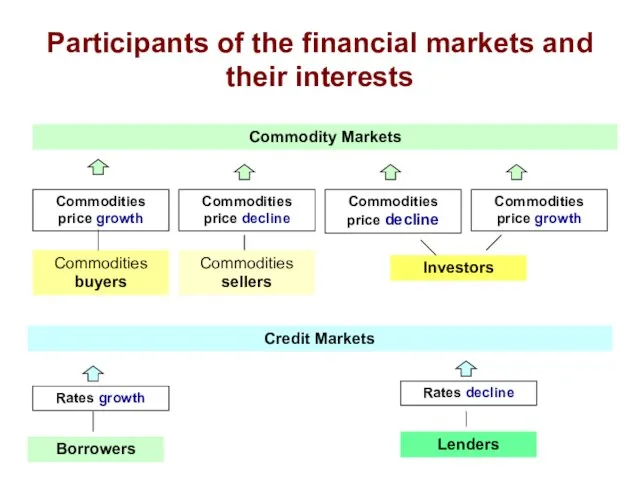

- 16. Participants of the financial markets and their interests Commodity Markets Commodities price growth Commodities price decline

- 17. Currency appreciations and depreciations Previous Exchange Rate (X): Currency A/ Currency B Current Exchange Rate (Y):

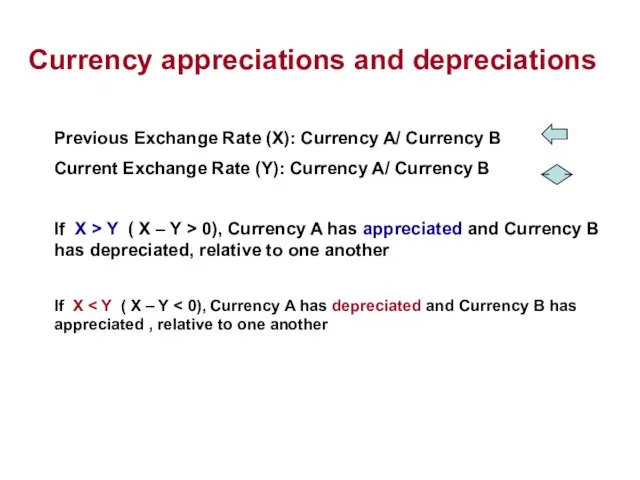

- 18. Foreign currency exchange rate risks Translation risks Arising from the ownership of operating companies outside the

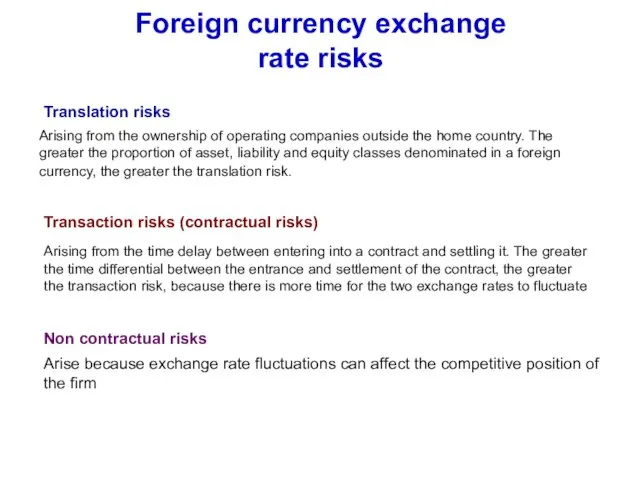

- 19. Minimizing contractual risks Example: UK based company buys property in USA for $ 440 mln. Payment

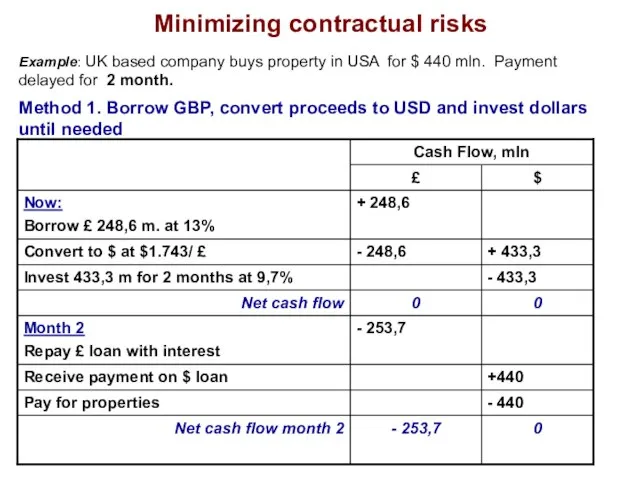

- 20. Minimizing contractual risks Method 2. Buy dollars forward Cost of hedging = Forward rate – Expected

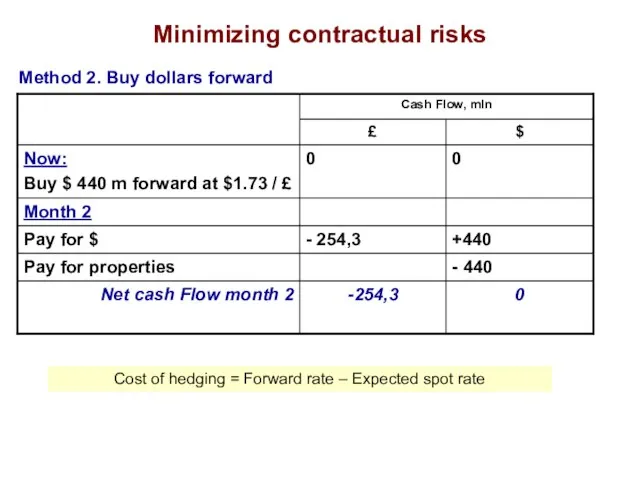

- 21. Currency forward contracts and rates $0,0655

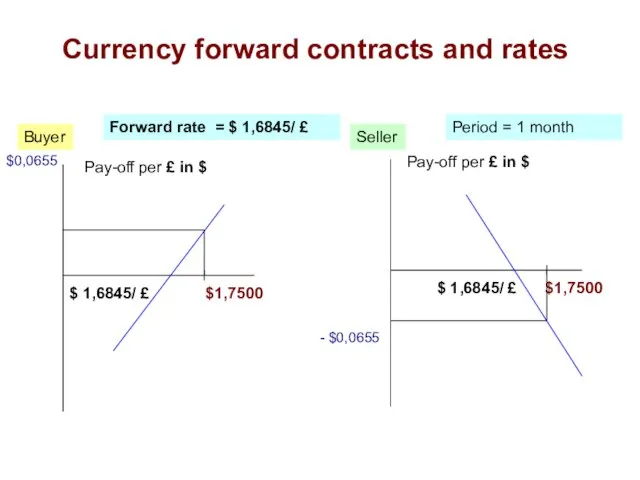

- 22. Forward premium Fair Forward Exchange Rate = Spot rate * (1+ R for) / (1+R home)

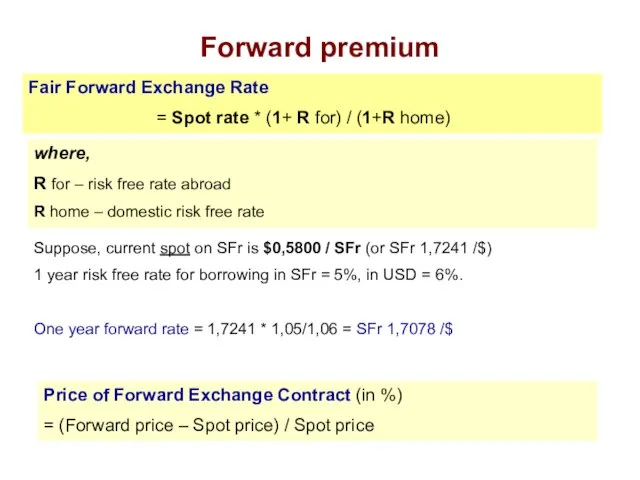

- 23. Hedging with currency forward contracts UK company expects to receive SFr 10 mln in 90 days

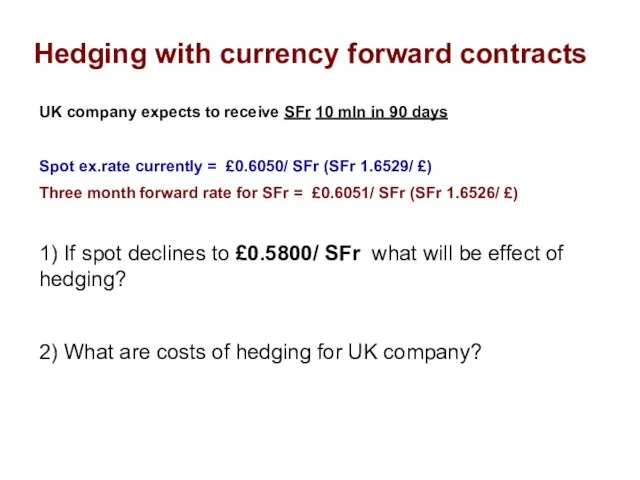

- 24. SWAPS & Interest rate risks SWAPS – arrangement by two counterparties to exchange one stream of

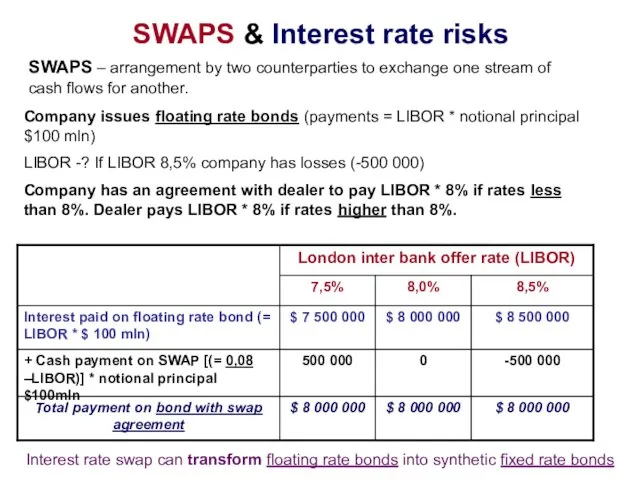

- 25. Fixed for floating swaps Notional principal = $ 10 mln Semi annual net CF for fixed

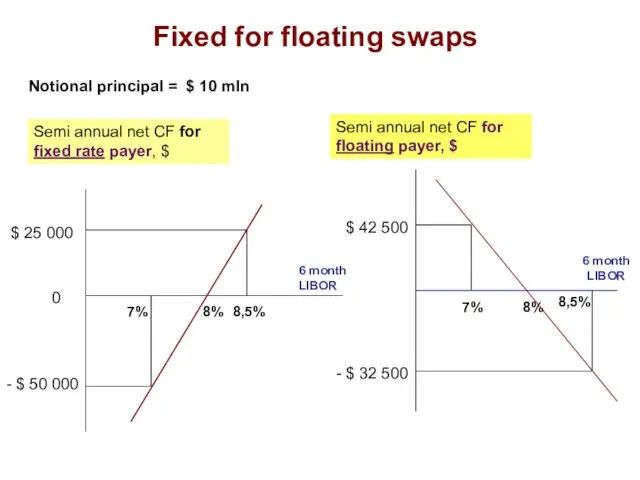

- 26. Example of currency swap US based company A is going to invest in Germany in EURO

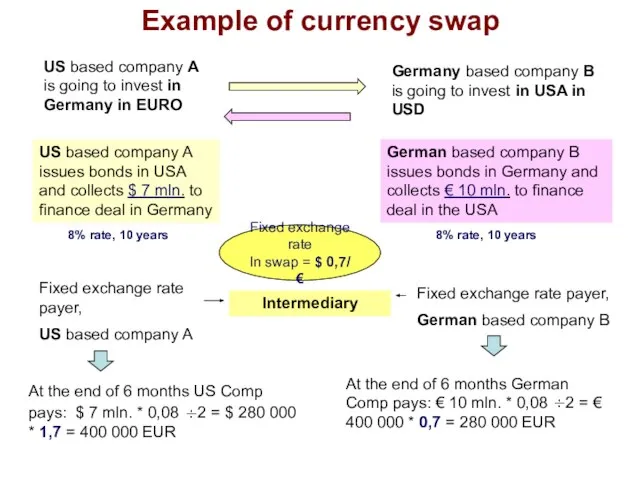

- 27. Risk Hedging, Risk Management and Value

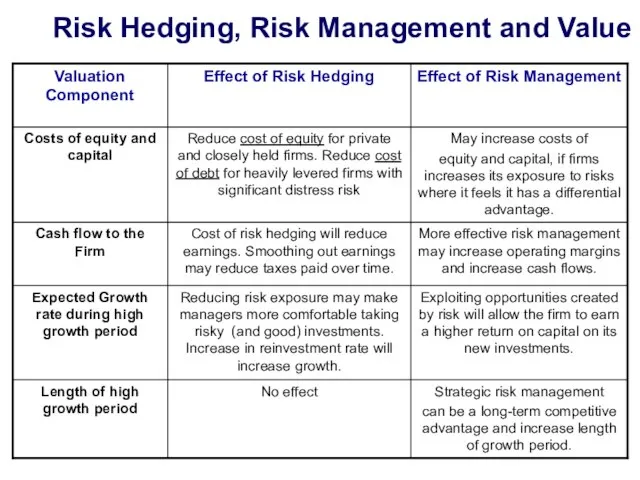

- 28. 2. International cargo and marine insurance

- 29. Plan of the lecture Structure of insurance programs Forms of insurance agreements International Cargo Clauses Carrier’s

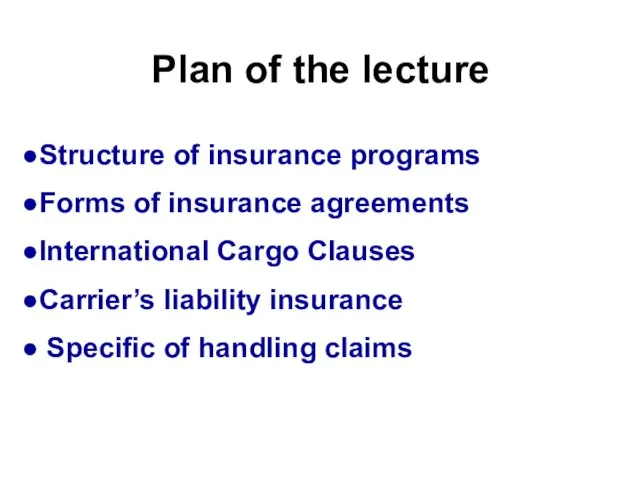

- 30. Insurance programs for foreign trade organizations INSURABLE RISKS Hull Cargo Carrier’s Liability Damage, total destruction or

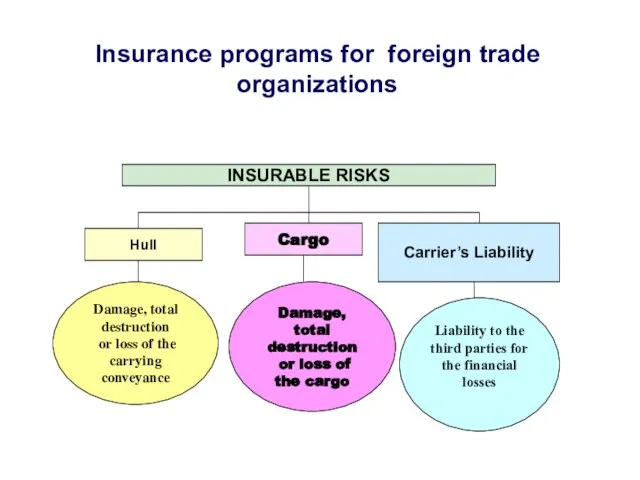

- 31. Who are interested in transportation of cargo insurance? Importers, buying on FOB & CPT conditions Exporters,

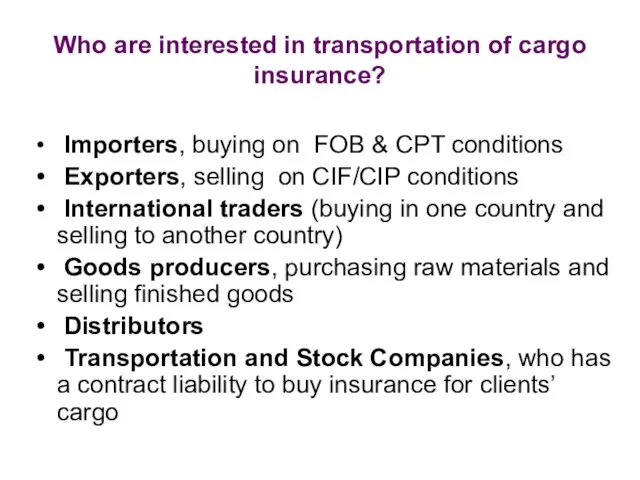

- 32. Forms of insurance agreements

- 33. Single insurance policy / Разовый полис страхования Valid for one shipping Valid for a period from

- 34. Open cover / Генеральный полис (договор) страхования Applicable when: Is issued once by the insurer under

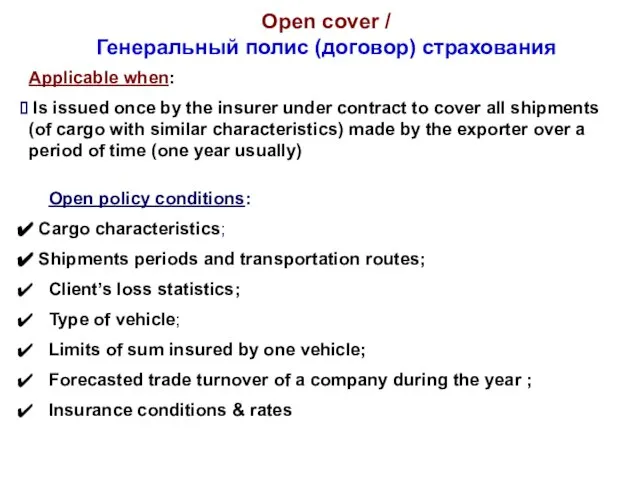

- 35. Open cover Client Insurer 1. Specification of main conditions of insurance agreement 2. Signing the open

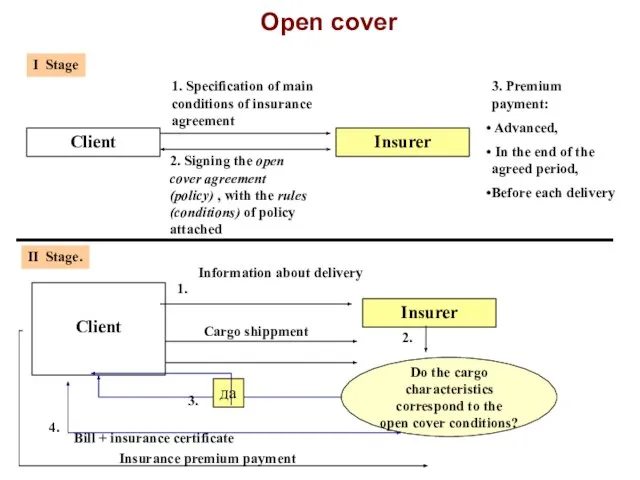

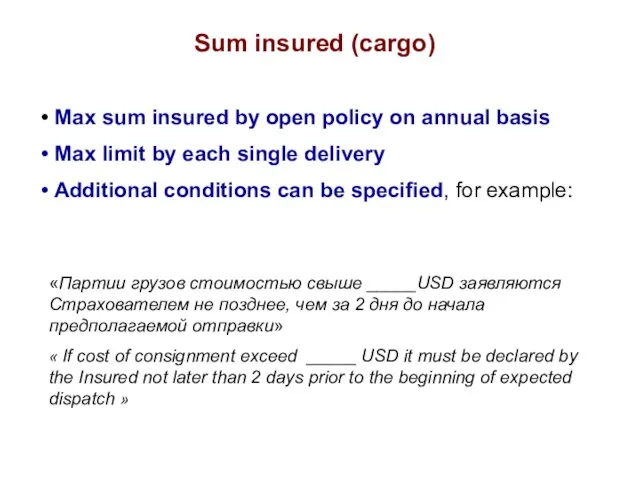

- 36. Sum insured (cargo) Max sum insured by open policy on annual basis Max limit by each

- 37. Open cover (frequent deliveries) Client Insurer During the month: Cargo shipments Акцепт (Страховой сертификат) / Issue

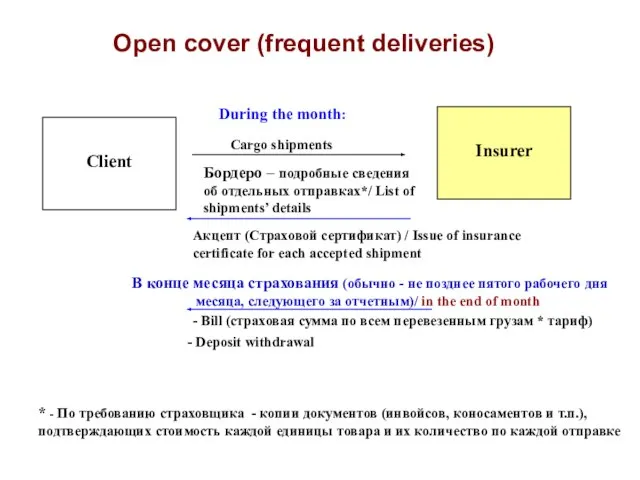

- 38. Open cover Advantages: - decreasing the administrative costs all the shipments automatically insured for 1 year

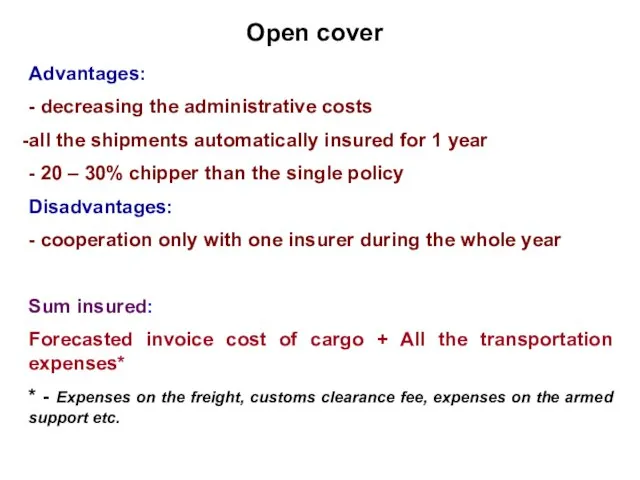

- 39. What factors influence on the amount of the insurance rate and cost of insurance? Insurance Conditions

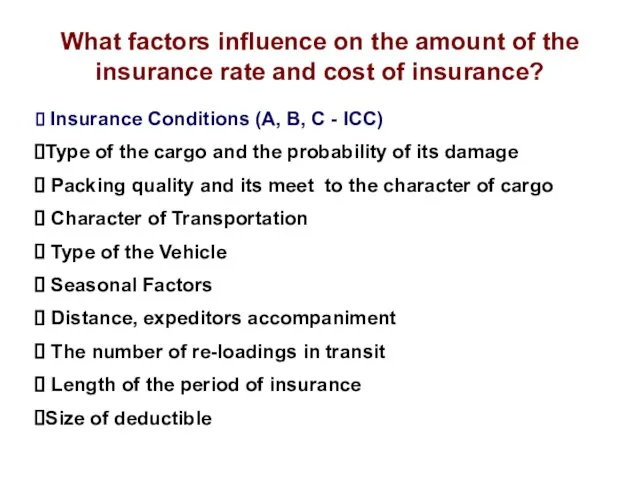

- 40. International Cargo Clauses (ICC)

- 41. A, B, C Clauses of ICC - Institute Cargo Clauses (Institute of London Undewriters) С =

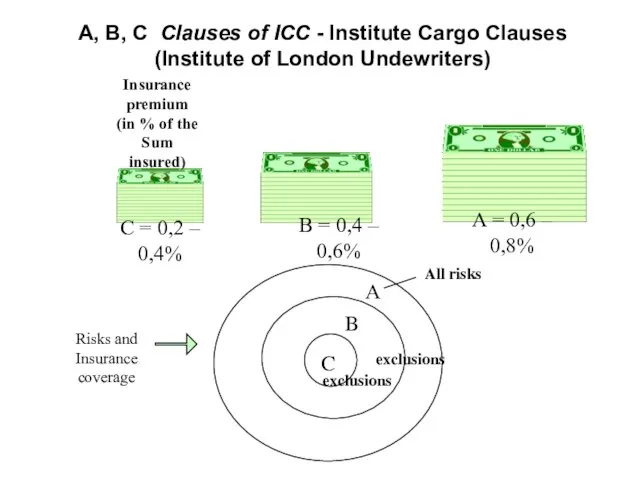

- 42. Cargo insurance conditions Clauses cover all risks of loss of or damage (All risks) Clauses cover

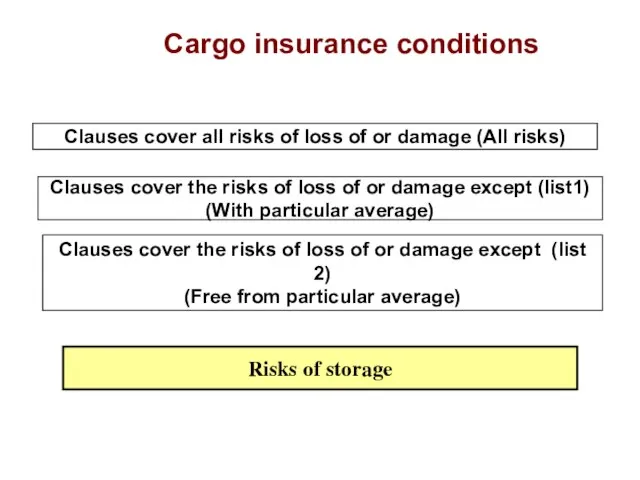

- 43. Cargo insurance conditions All risks (A) Damage, total destruction or loss of the whole cargo or

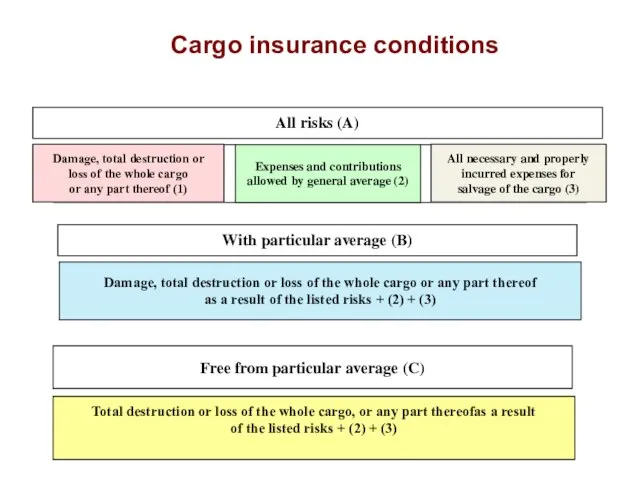

- 44. Comparative analysis of ICC coverages

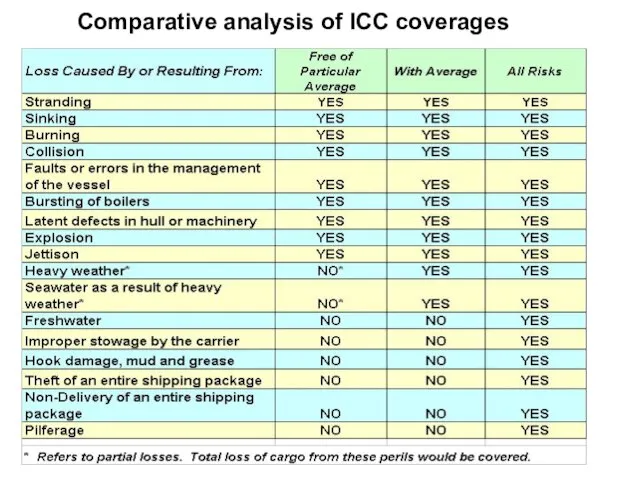

- 45. Carrier’s liability insurance

- 46. Insurance of liability for international transportation organizations Responsibility to cargo damage (including insurance within the limits

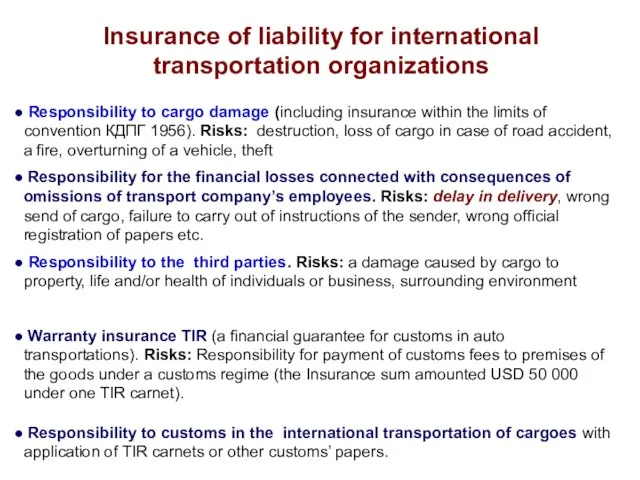

- 47. Claim cover limitations (cargo damage) * - The SDR is an international reserve asset, created by

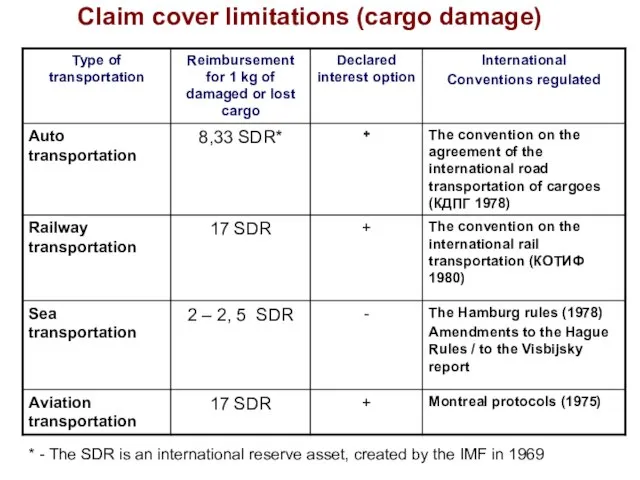

- 48. Special Drawing Rights (SDR) Valuation It is calculated as the sum of specific amounts of the

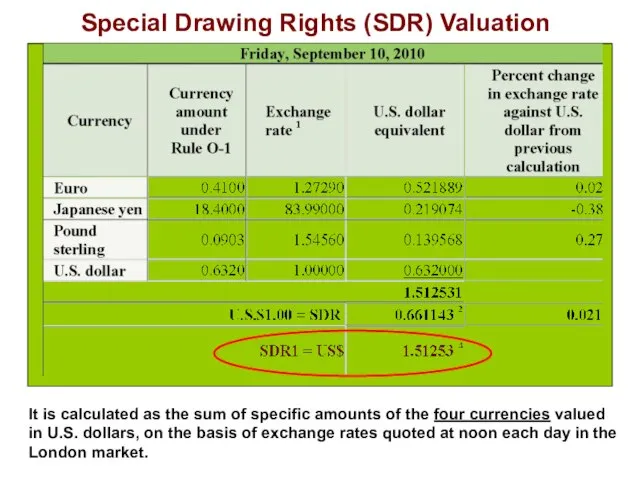

- 49. Specific of handling claims

- 50. Handling of claims What are the steps if the losses took place ?

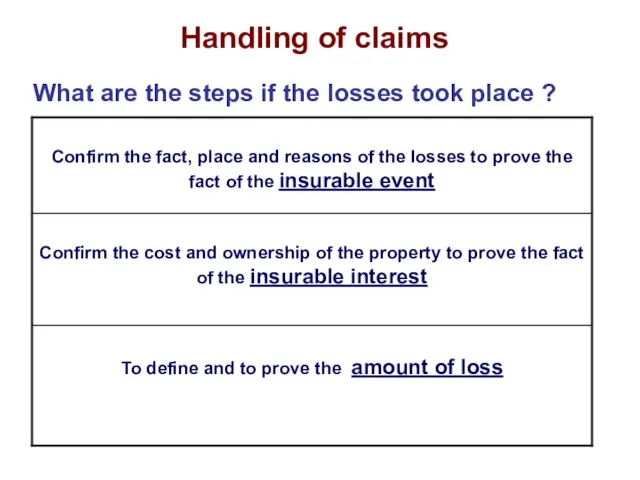

- 51. The process of handling the claims Damage Insured info Written Notice of Loss Carrier Survey/ inspection

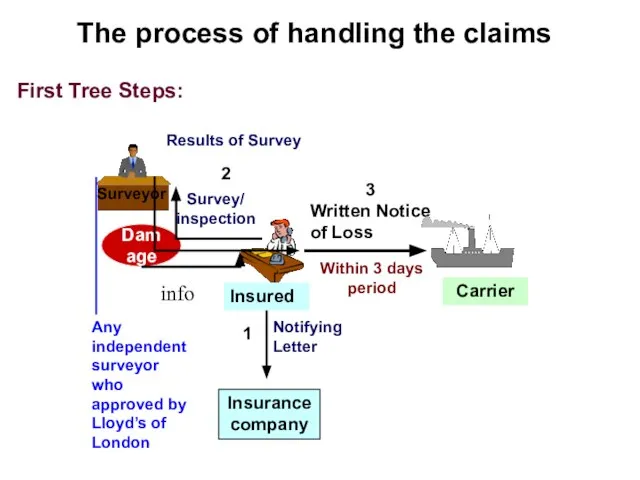

- 52. Who else involved in claim producing process? Surveyor Adjuster Defines: Fact of damage Amount of loss

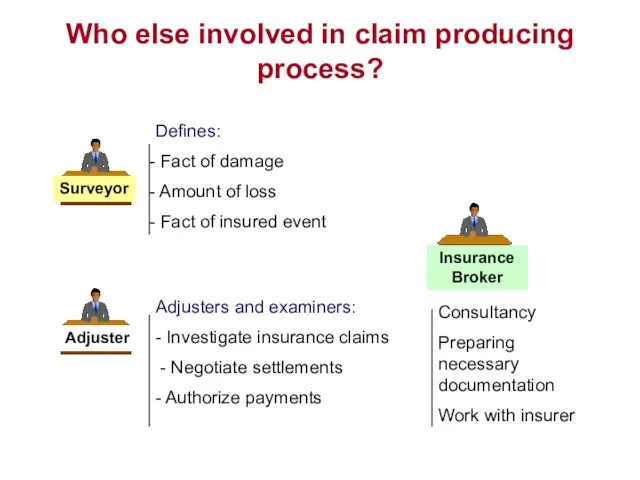

- 53. What documents are included in the claim to insurance company? Proof of ownership of cargo Survey

- 54. Survey report is one of the most important documents for insurer A survey should contain the

- 55. Generally the following documents will be required to settle a claim 1. Proof of Insurance: Declaration

- 56. Cases when insurers don’t respond to the clients When claims have to be sent to the

- 57. 3. Insurance of international credits and investments

- 58. Country risks classification Political risks are related either to the country of a foreign buyer or

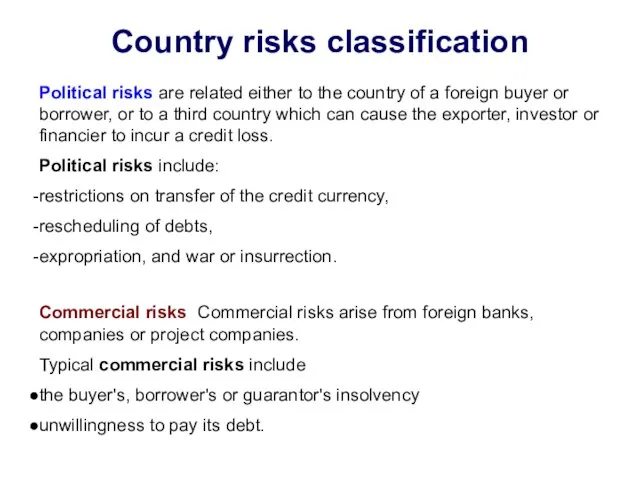

- 59. Political risks Political risk may materialise as the consequence of a long course of events, or

- 60. Political risks classification

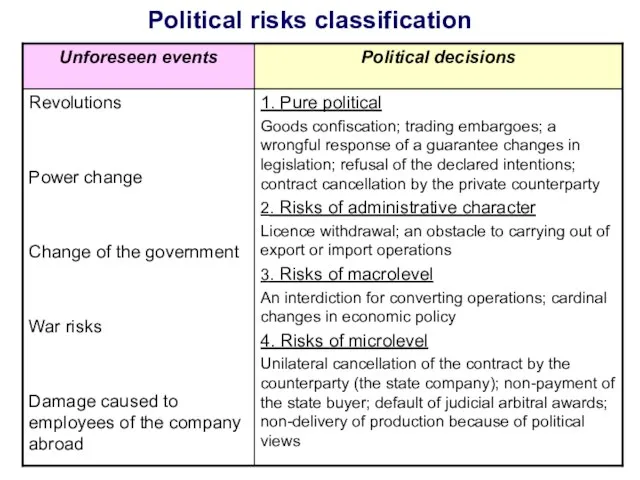

- 61. Risk management for political risks Internal techniques: Decreasing overall risk exposure (choice of country or trade

- 62. Commercial risks Financial risk assumed by a seller when extending credit without any collateral or recourse.

- 63. Guarantees offered to exporter in the export/import operations Credit Risk Guarantee provides the exporter with cover

- 64. Biggest credit insurers/guarantee providers in Europe

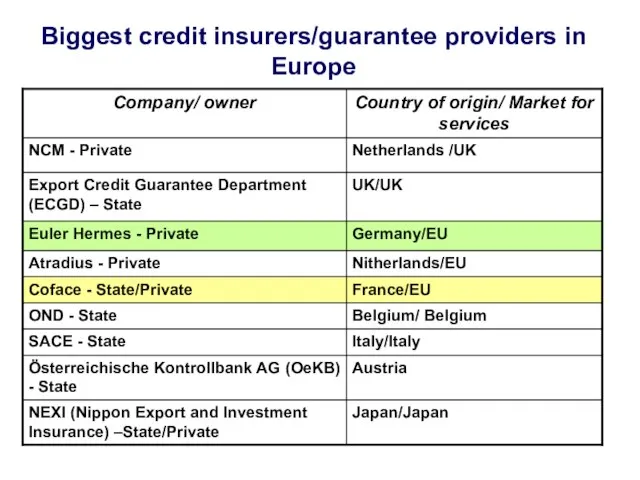

- 65. Coface

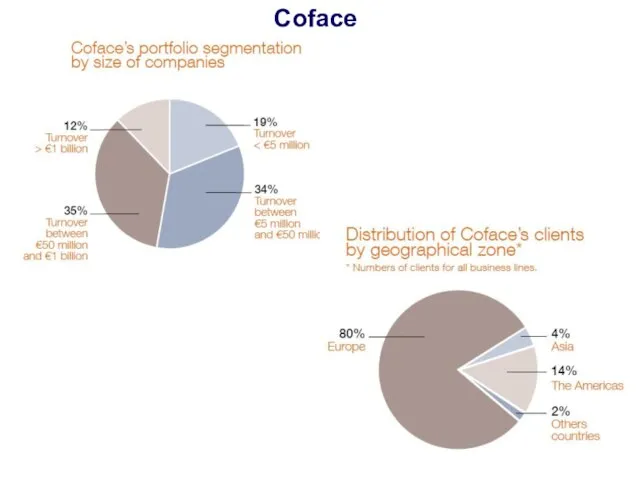

- 66. Euler Hermes Group

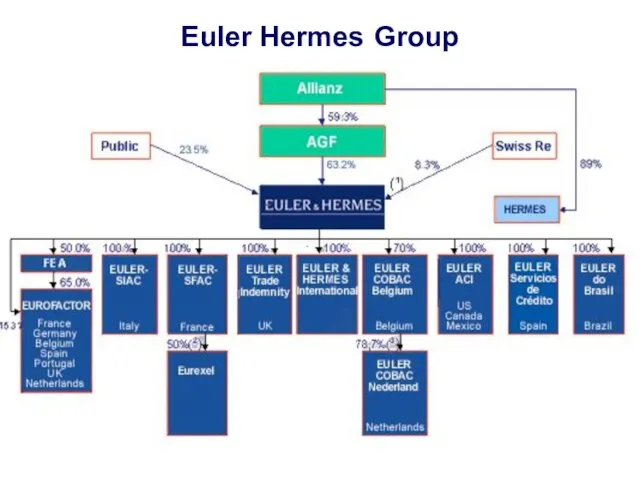

- 67. Guarantee Services Guarantees are issued for clients in respect of their contractual or statutory obligations to

- 68. Guarantee Premiums Short-term (repayment period less than 2 years) Buyer Credit and Credit Risk Guarantees usually

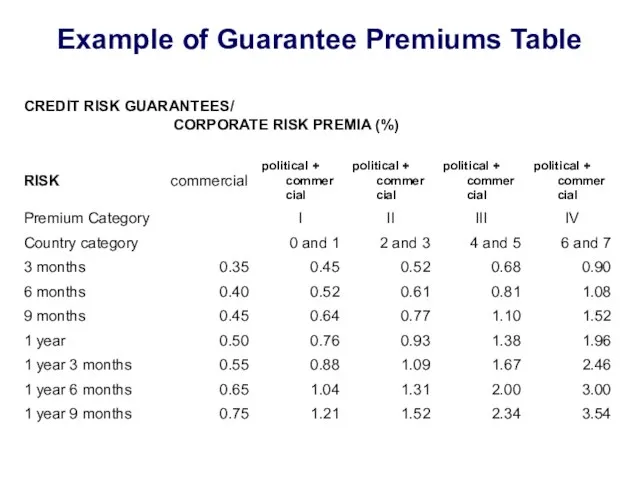

- 69. Example of Guarantee Premiums Table

- 70. Country Ratings Rating classification for credit guarantees’ rates: 0 : Advanced economy - no minimum premium

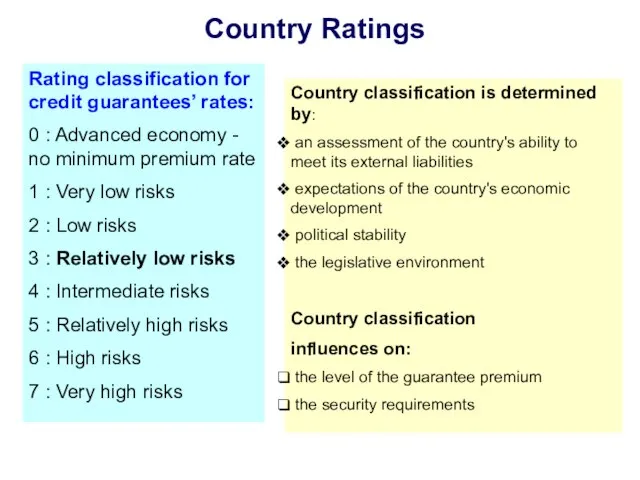

- 71. Credit rating agencies Business Environmental Risk Intelligence (BERI) Frost and Sullivan (Index WPRF – World Political

- 72. Credit Insurance

- 73. Structure of credit insurance market Private insurers State Insurance of commercial credits inside the countries Insurance

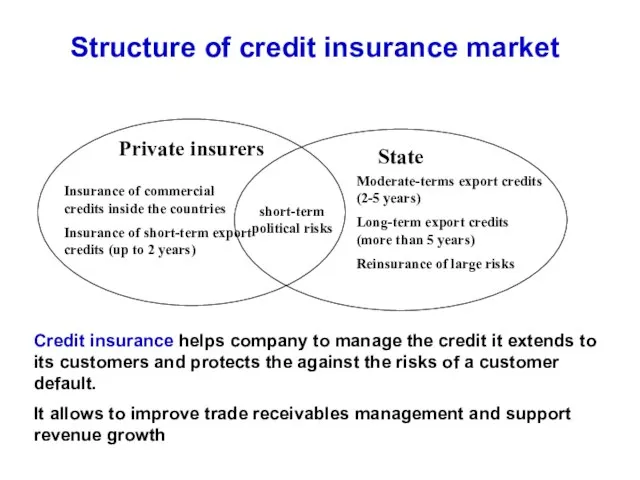

- 74. Capital concentration in the European credit insurance market

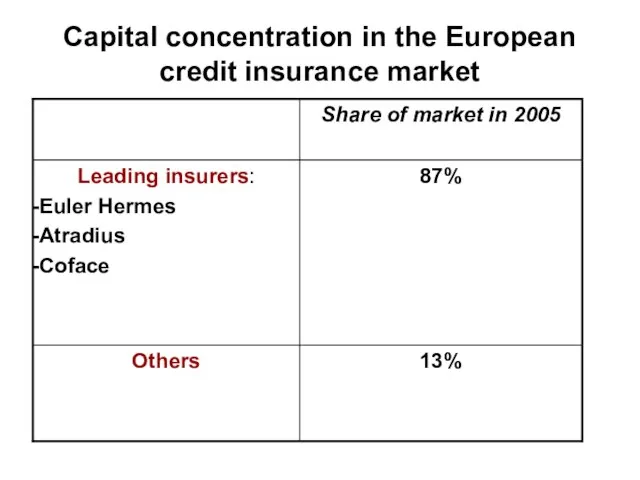

- 75. Commercial insurance companies, operating on the export credit insurance market Lloyds of London (Robert and Hiscox

- 76. Export credit scheme Risks considered by insurer: Unpaid maturities notified by one or more insureds Bankruptcy,

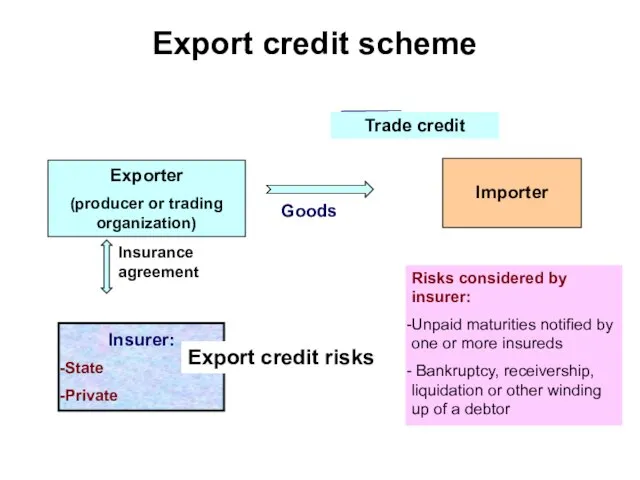

- 77. Types of credit insurance policies 1. Extraordinary coverage (specific coverage) Is used when the outstanding balances

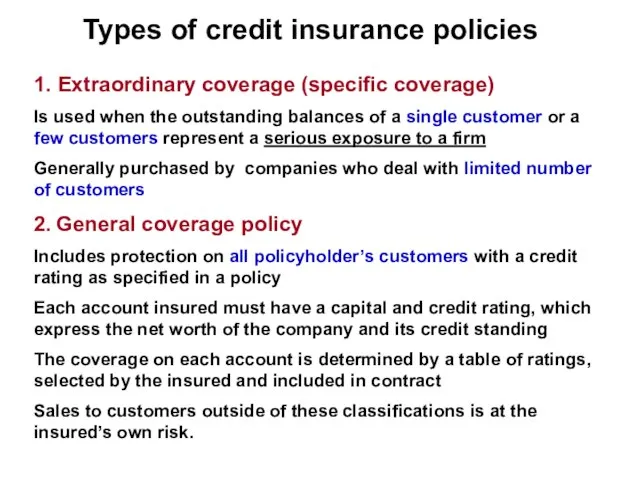

- 78. Stages of insurance

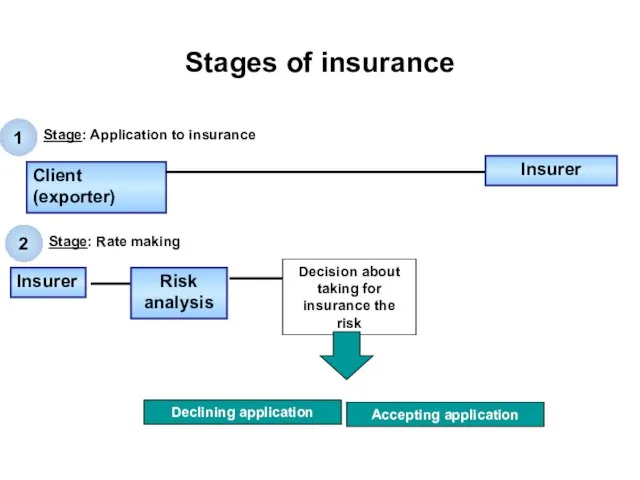

- 79. Factors, influencing on the decision about insurance

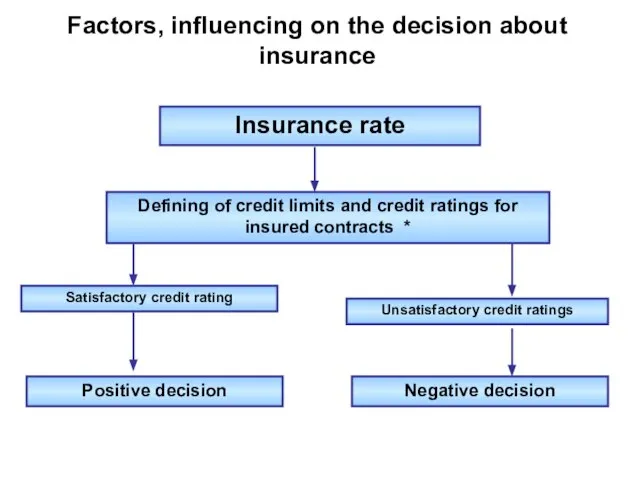

- 80. Credit limit 2 Credit limit 1 Credit limit 3 Credit limit 4 Buyer B Buyer А

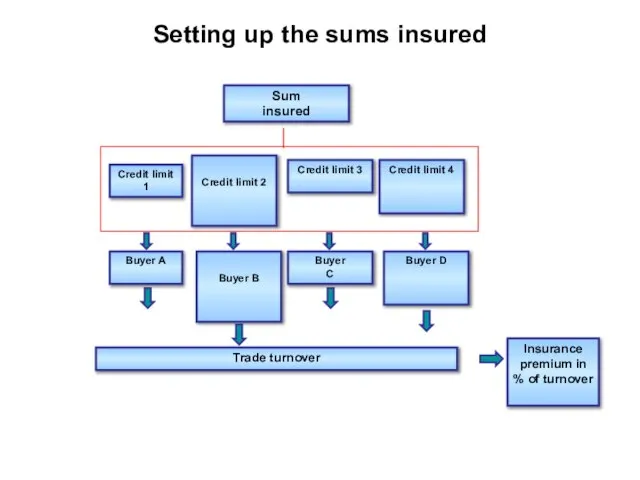

- 81. 3. Financial results became worse 4. Serious declining of financial position Buyer Monitoring of contractors enables

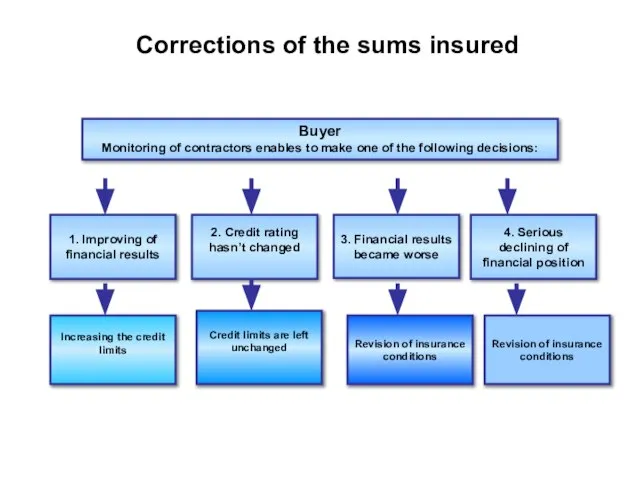

- 82. Risk analysis of credit portfolio and conditions of insurance Buyer Risk class (solvency, financial stability, ratio

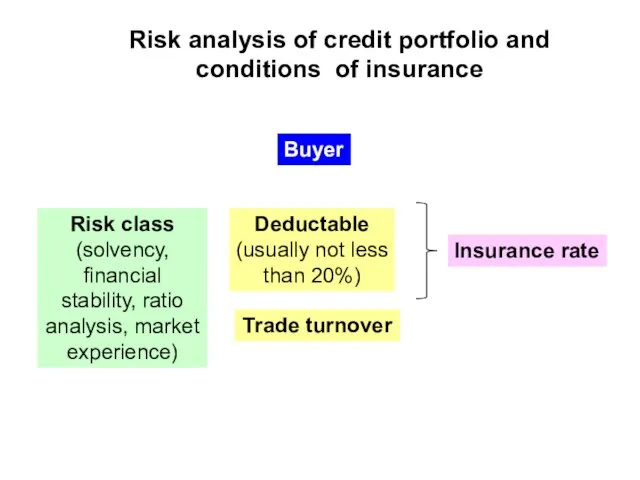

- 83. Amount of debt minus Sum that was partially paid Revenue from the sales of returned goods

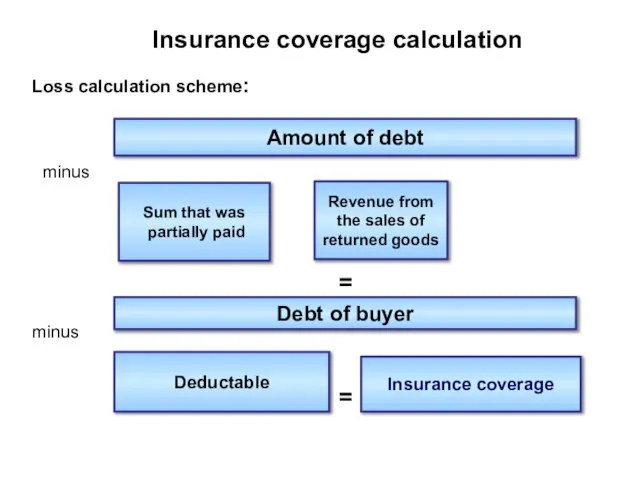

- 84. Example of coverage table (credit limits)

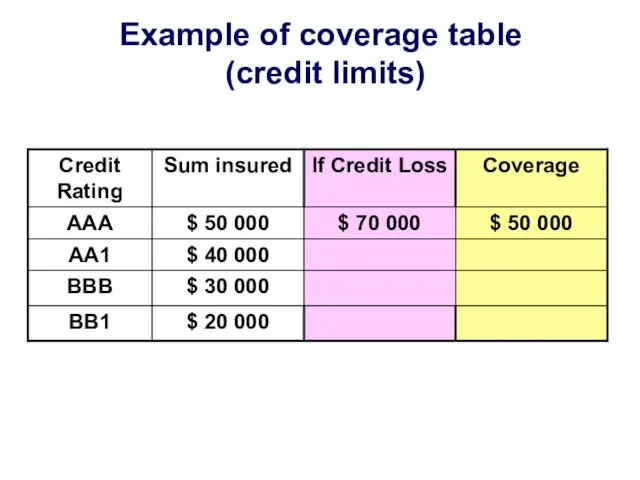

- 85. Coinsurance and Loss

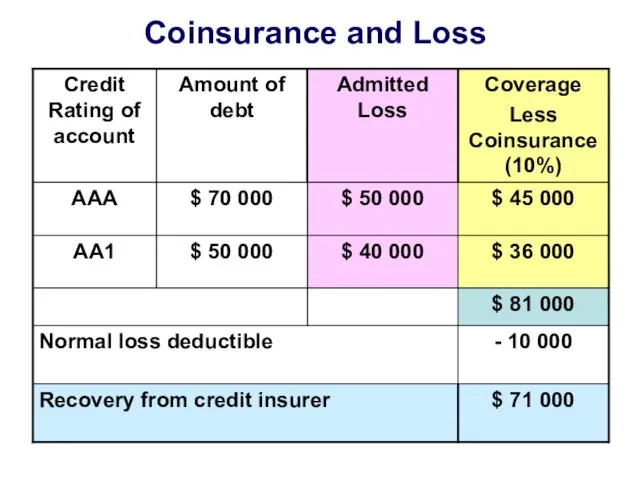

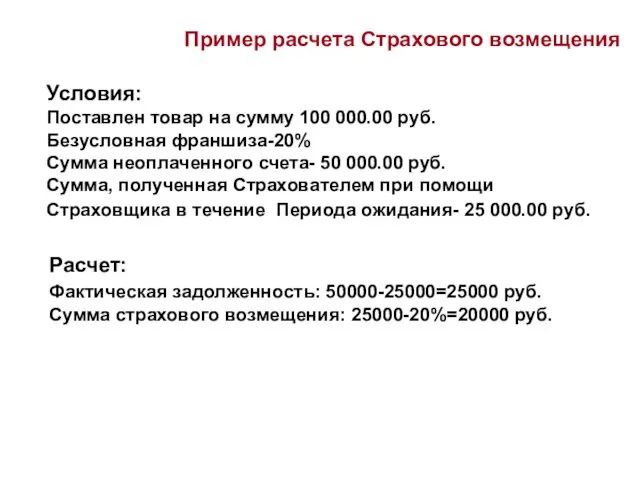

- 86. Условия: Поставлен товар на сумму 100 000.00 руб. Безусловная франшиза-20% Сумма неоплаченного счета- 50 000.00 руб.

- 87. Dynamics of payments’ delays index by branches of economics (Basis - 100) (chemical industry) (mechanical engineering

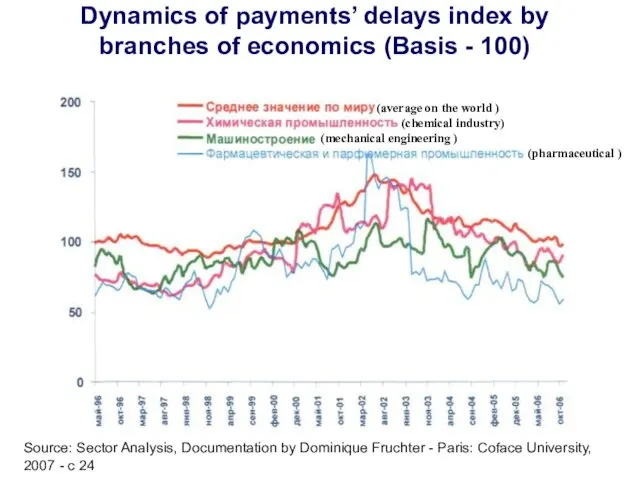

- 88. Dynamics of payments’ delays index by branches of economics (Basis - 100) (average on the world

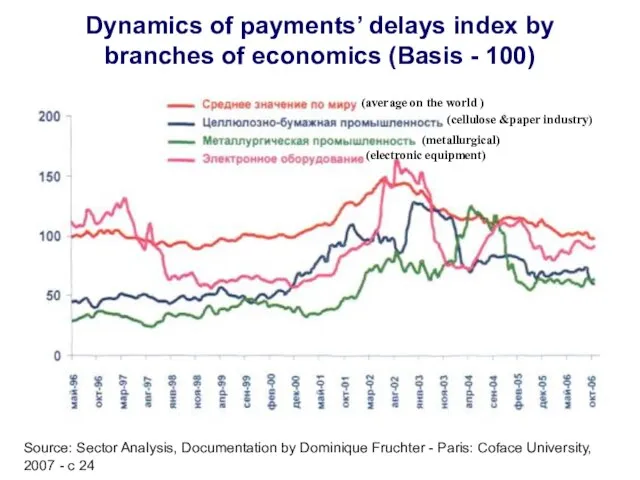

- 89. Branch risks by regions and the world countries (according to ratings of Coface) Source: Sector Analysis,

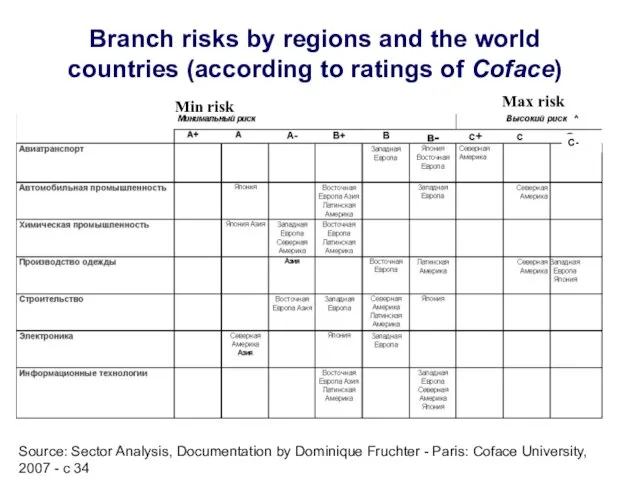

- 90. International investments’ insurance agencies Multilateral Investments Guaranteeing Agency (MIGA) - a member of the World Bank

- 91. Functions of MIGA Political risks insured: Currency transfer restriction Expropriation War and civil disturbance Breach of

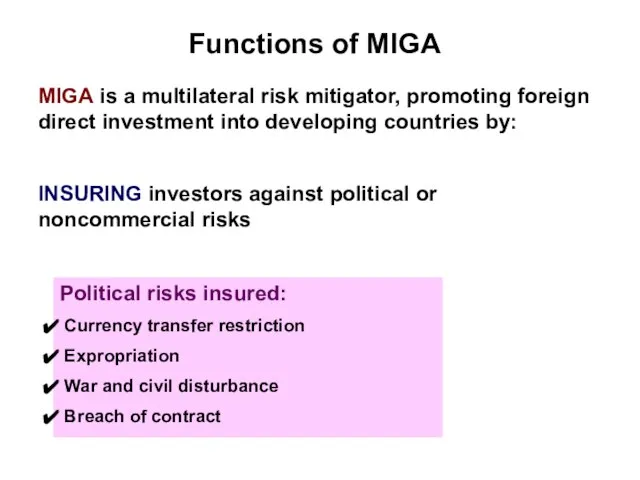

- 92. Who eligible for MIGA’s Guarantee Coverage? New cross-border investments originating in any MIGA member country, destined

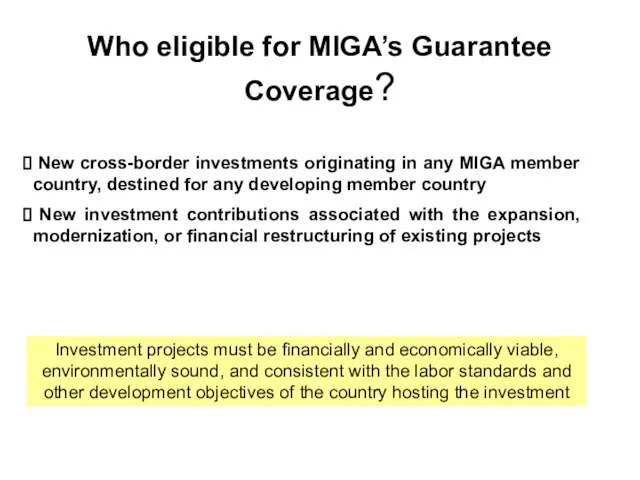

- 93. MIGA's Reinsurance Partners (1)

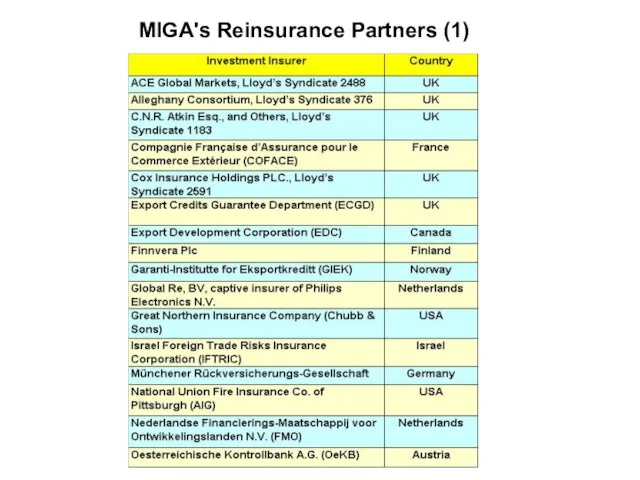

- 94. MIGA's Reinsurance Partners (2)

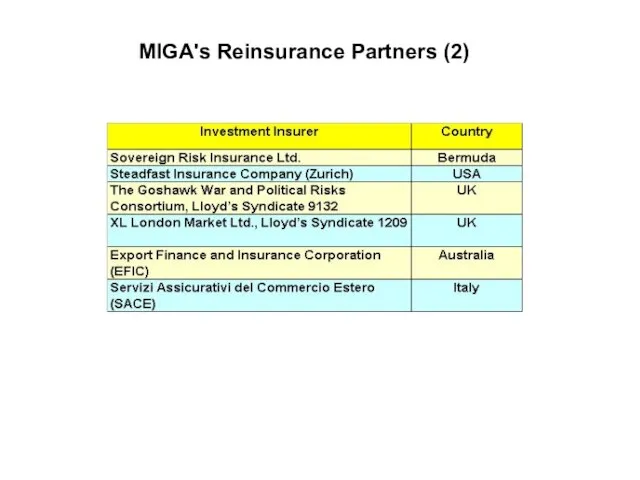

- 95. Currency transfer restriction Coverage protects against: losses arising from an investor's inability to convert local currency

- 96. Expropriation Coverage offers protection against: loss of the insured investment as a result of acts by

- 97. Breach of contract Coverage protects against: Losses arising from the host government's breach or repudiation of

- 99. Скачать презентацию

Станковая скульптура: бюст

Станковая скульптура: бюст Отчёт директората цифрового телевидения Alma tv за период с 13 по 19 Октября 2017г

Отчёт директората цифрового телевидения Alma tv за период с 13 по 19 Октября 2017г Системный подход на благо людей и природы

Системный подход на благо людей и природы Живете

Живете Этико-правовые проблемы конца жизни человека

Этико-правовые проблемы конца жизни человека ПРИЧИНЫ ВОЗНИКНОВЕНИЯ ПОЖАРОВ В ЖИЛЫХ И ОБЩЕСТВЕННЫХ ЗДАНИЯХ.

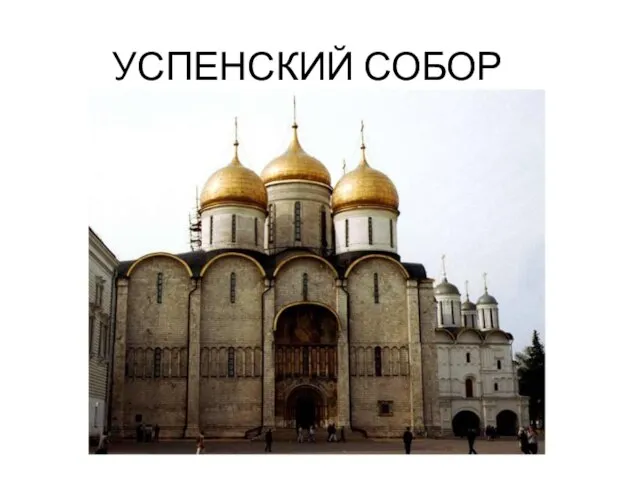

ПРИЧИНЫ ВОЗНИКНОВЕНИЯ ПОЖАРОВ В ЖИЛЫХ И ОБЩЕСТВЕННЫХ ЗДАНИЯХ. УСПЕНСКИЙ СОБОР

УСПЕНСКИЙ СОБОР Опале листя: користь чи шкода

Опале листя: користь чи шкода Государственное управление в области природопользования и охраны окружающей среды

Государственное управление в области природопользования и охраны окружающей среды Магнитная гидродинамика солнечных явлений

Магнитная гидродинамика солнечных явлений Пишем проект!

Пишем проект! Этапы речевого развития

Этапы речевого развития Растения Чувашской республики

Растения Чувашской республики Эффективность стратегии диверсификации на российском рынке(эмпирическое исследование)

Эффективность стратегии диверсификации на российском рынке(эмпирическое исследование) Стресс и пути его преодоления

Стресс и пути его преодоления Интерактивные формы и методы в преподавании русского языка и литературы. Тема: Групповые формы работы на уроках русского языка и л

Интерактивные формы и методы в преподавании русского языка и литературы. Тема: Групповые формы работы на уроках русского языка и л Западный и Восточный типы культуры

Западный и Восточный типы культуры Упражнение Настроение

Упражнение Настроение Выполняй правила безопасности на дороге!

Выполняй правила безопасности на дороге! Тихонова Тамара Вячеславовна учитель истории и обществознания ГОУ лицей № 150

Тихонова Тамара Вячеславовна учитель истории и обществознания ГОУ лицей № 150 ОРКиСЭ

ОРКиСЭ Непревзойденные преимущества систем T2Red + T2Reflecta

Непревзойденные преимущества систем T2Red + T2Reflecta Модели данных

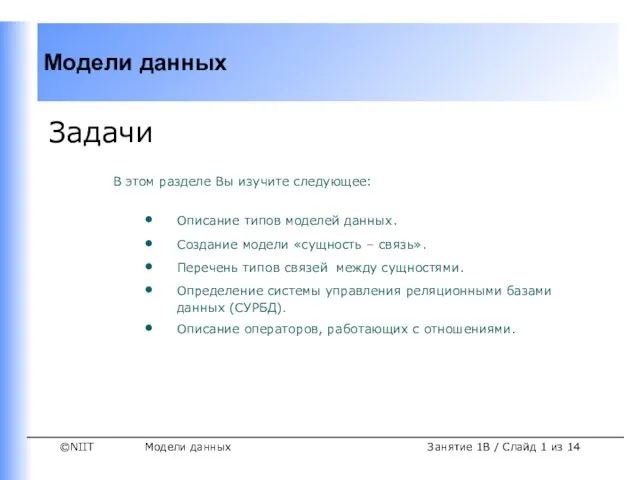

Модели данных  Модель организации внеурочной деятельности на основе краткосрочных курсов

Модель организации внеурочной деятельности на основе краткосрочных курсов История развития системы железнодорожной автоматики, применяемые на железнодорожном транспорте (АТМ) в России

История развития системы железнодорожной автоматики, применяемые на железнодорожном транспорте (АТМ) в России Высокоранговые и Низкопримативные правят миром

Высокоранговые и Низкопримативные правят миром Ртуть

Ртуть Презентация на тему: клавиатура.Авторы: Суханов Г.

Презентация на тему: клавиатура.Авторы: Суханов Г.