Слайд 2Plan:

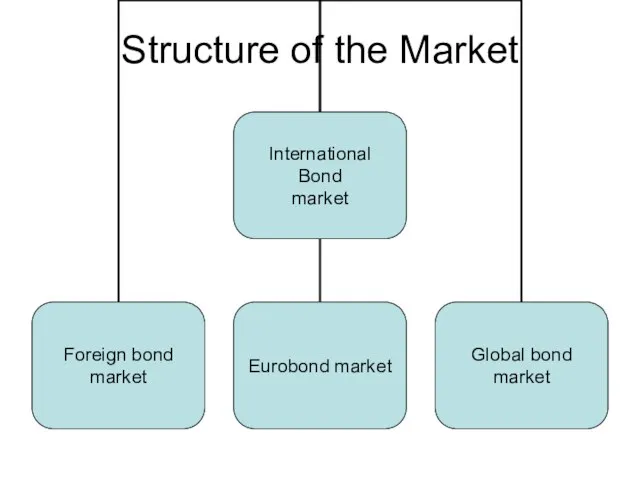

Structure of the Market

Types of Instruments

Bonds credit ratings

Eurobond market practice

http://www.eurobonds.info/

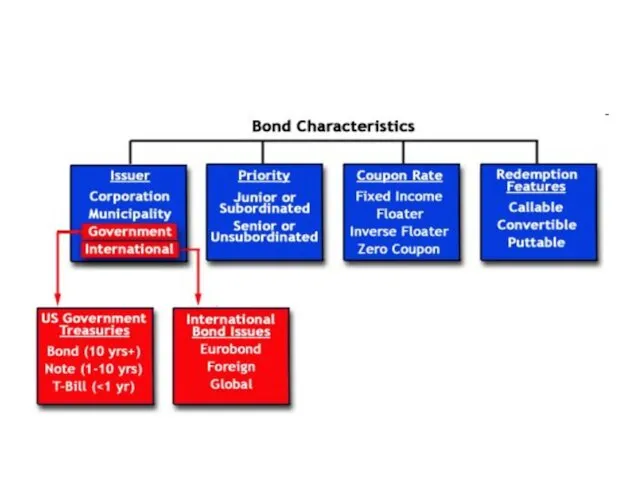

Слайд 4Priority

The priority of the bond is a determiner of the probability

that the issuer will pay you back your money.

The priority indicates your place in line should the company default on payments.

If you hold an unsubordinated (senior) security and the company defaults, you will be first in line to receive payment from the liquidation of its assets.

On the other hand, if you own a subordinated (junior) debt security, you will get paid out only after the senior debt holders have received their share.

Слайд 5Redemption Features

Callable, or a redeemable bond features gives a bond issuer the

right, but not the obligation, to redeem his issue of bonds before the bond's maturity.

The issuer, however, must pay the bond holders a premium.

Two subcategories of these types of bonds:

American callable bonds

European callable bonds.

American callable bonds can be called by the issuer any time after the call protection period.

European callable bonds can be called by the issuer only on pre-specified dates

Слайд 6Redemption Features

The optimal time for issuers to call their bonds is when

the prevailing interest rate is lower than the coupon rate they are paying on the bonds. After calling its bonds, the company could refinance its debt by reissuing bonds at a lower coupon rate.

Слайд 7Redemption Features

Convertible bonds give bondholders the right but not the obligation to

convert their bonds into a predetermined number of shares at predetermined dates prior to the bond's maturity. Of course, this only applies to corporate bonds.

Puttable bonds give bondholders the right but not the obligation to sell their bonds back to the issuer at a predetermined price and date.

These bonds generally protect investors from interest rate risk. If prevailing bond prices are lower than the exercise par of the bond, resulting from interest rates being higher than the bond's coupon rate, it is optimal for investors to sell their bonds back to the issuer and reinvest their money at a higher interest rate.

Слайд 9Foreign bond

A foreign bond - a bond that is issued in a

domestic market by a foreign entity, in the domestic market's currency.

An example is a German MNC issuing dollar-denominated bonds to U.S. investors.

Слайд 10Foreign bonds

Foreign bonds are regulated by the domestic market authorities and are

usually given nicknames that refer to the domestic market in which they are being offered.

Since investors in foreign bonds are usually the residents of the domestic country, investors find them attractive because they can add foreign content to their portfolios without the added exchange rate exposure.

Foreign bonds must meet the security regulations of the country in which they are issued.

Слайд 11Foreign bonds

Yankee Bond - A bond denominated in U.S. dollars that is

publicly issued in the U.S. by foreign banks and corporations. According to the Securities Act of 1933, these bonds must first be registered with the Securities and Exchange Commission (SEC) before they can be sold. Yankee bonds are often issued in tranches and each offering can be as large as $1 billion.

Bulldog Bond - a sterling denominated bond that is issued in London by a company that is not British.

Слайд 12Foreign bonds

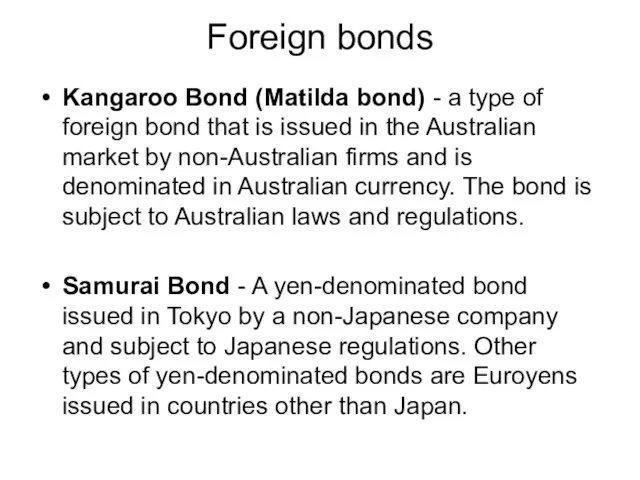

Kangaroo Bond (Matilda bond) - a type of foreign bond that

is issued in the Australian market by non-Australian firms and is denominated in Australian currency. The bond is subject to Australian laws and regulations.

Samurai Bond - A yen-denominated bond issued in Tokyo by a non-Japanese company and subject to Japanese regulations. Other types of yen-denominated bonds are Euroyens issued in countries other than Japan.

Слайд 13Foreign bonds

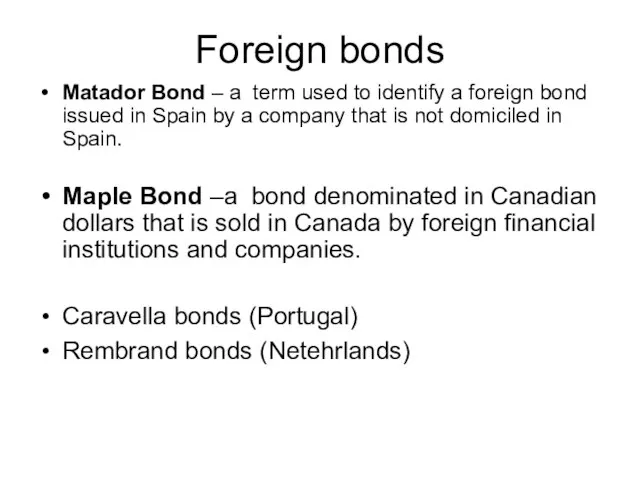

Matador Bond – a term used to identify a foreign bond

issued in Spain by a company that is not domiciled in Spain.

Maple Bond –a bond denominated in Canadian dollars that is sold in Canada by foreign financial institutions and companies.

Caravella bonds (Portugal)

Rembrand bonds (Netehrlands)

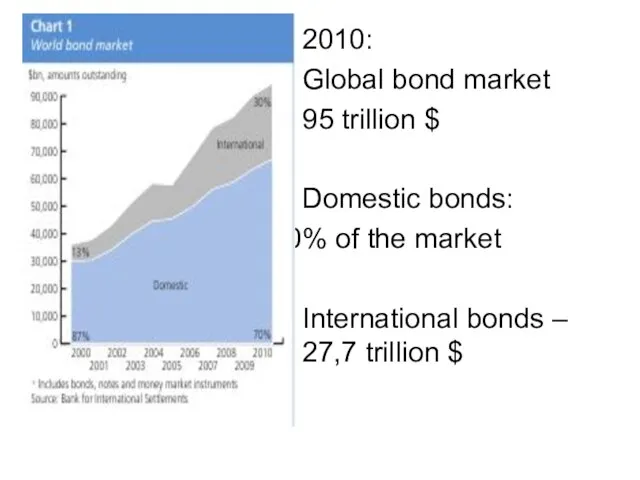

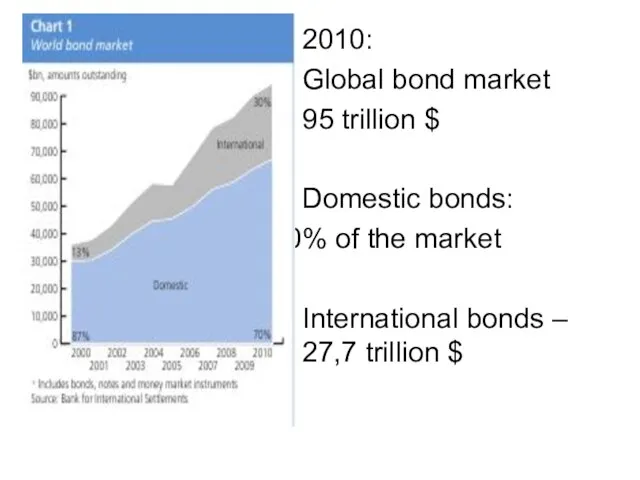

Слайд 142010:

Global bond market

95 trillion $

Domestic bonds:

% of the market

International bonds –

27,7 trillion $

Слайд 16Eurobonds

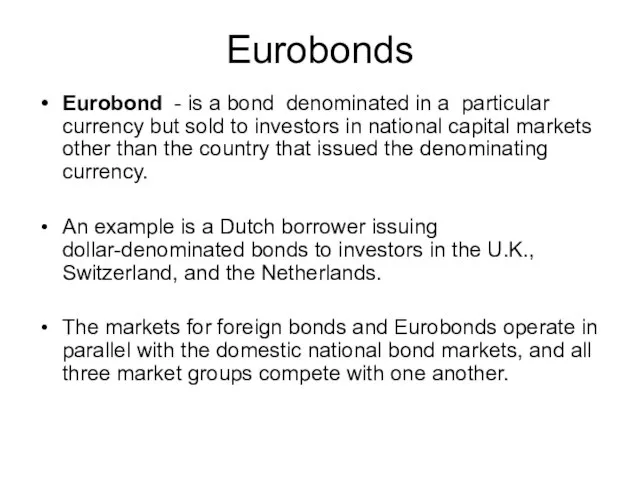

Eurobond - is a bond denominated in a particular currency but sold

to investors in national capital markets other than the country that issued the denominating currency.

An example is a Dutch borrower issuing dollar-denominated bonds to investors in the U.K., Switzerland, and the Netherlands.

The markets for foreign bonds and Eurobonds operate in parallel with the domestic national bond markets, and all three market groups compete with one another.

Слайд 17Eurobonds

Eurobonds are known by the currency in which they are denominated, for

example:

U.S. dollar Eurobonds,

yen Eurobonds,

Swiss franc Eurobonds,

Eurodollar bonds,

Euroyen bonds,

EuroSF bonds.

Слайд 18Bearer Bonds and Registered Bonds

With a bearer bond, possession is evidence

of ownership. The issuer does not keep any records indicating who is the current owner of a bond.

With registered bonds, the owner’s name is on the bond and it is also recorded by the issuer, or else the owner’s name is assigned to a bond serial number recorded by the issuer.

When a registered bond is sold, a new bond certificate is issued with the new owner’s name, or the new owner’s name is assigned to the bond serial number.

Слайд 19 Eurobonds are usually bearer bonds.

U.S. security regulations require Yankee bonds and

U.S. corporate bonds sold to U.S. citizens to be registered.

Bearer bonds are very attractive to investors desiring privacy and anonymity. One reason for this is that they enable tax evasion. Consequently, investors will generally accept a lower yield on bearer bonds than on registered bonds of comparable terms, making them a less costly source of funds for the issuer to service.

Слайд 20Recent changes in U.S. security regulations

Rule 415, which the SEC instituted in

1982 to allow shelf registration.

Shelf registration allows an issuer to preregister a securities issue, and then shelve the securities for later sale when financing is actually needed.

Shelf registration has thus eliminated the time delay in bringing a foreign bond issue to market in the United States, but it has not eliminated the information disclosure that many foreign borrowers find too expensive and/or objectionable.

Слайд 21Global Bonds

A global bond issue is a very large international bond

offering by a single borrower that is simultaneously sold in North America, Europe, and Asia. Global bonds follow the registration requirements of domestic bonds, but have the fee structure of Eurobonds.

Unlike eurobonds, global bonds can be issued in the same currency as the country of issuance. For example, a global bond could be both issued in the United States and denominated in U.S. dollars.

Global bond offerings enlarge the borrower’s opportunities for financing at reduced costs. Purchasers, mainly institutional investors to date, desire the increased liquidity of the issues and have been willing to accept lower yields.

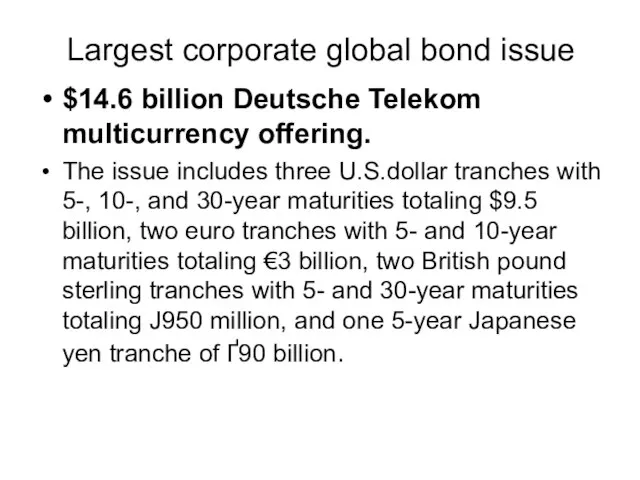

Слайд 22Largest corporate global bond issue

$14.6 billion Deutsche Telekom multicurrency offering.

The

issue includes three U.S.dollar tranches with 5-, 10-, and 30-year maturities totaling $9.5 billion, two euro tranches with 5- and 10-year maturities totaling €3 billion, two British pound sterling tranches with 5- and 30-year maturities totaling Ј950 million, and one 5-year Japanese yen tranche of Ґ90 billion.

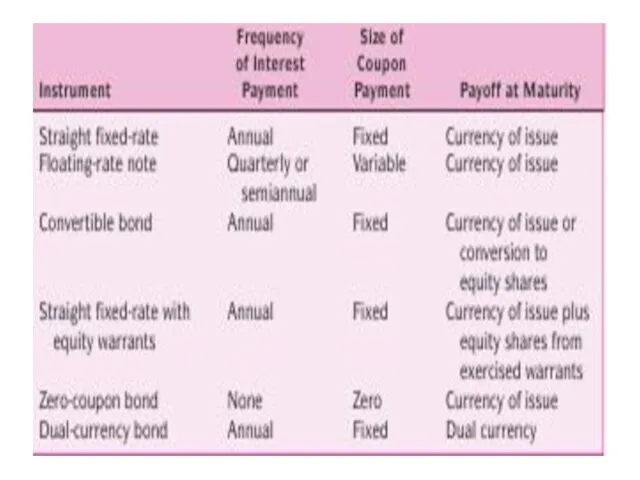

Слайд 24Types of instruments

Straight Fixed-Rate Issues

Zero-Coupon Bonds

Euro-Medium-Term Notes

Floating-Rate

Notes

Equity-Related Bonds

Dual-Currency Bonds

Слайд 25Straight fixed-rate bond

Straight fixed-rate bond issues have a designated maturity date

at which the principal of the bond issue is promised to be repaid.

During the life of the bond, fixed coupon payments, which are a percentage of the face value, are paid as interest to the bondholders. In contrast to many domestic bonds, which make semiannual coupon payments, coupon interest on Eurobonds is typically paid annually. The reason is that the Eurobonds are usually bearer bonds, and annual coupon redemption is more convenient for the bondholders and less costly for the bond issuer because the bondholders are scattered geographically.

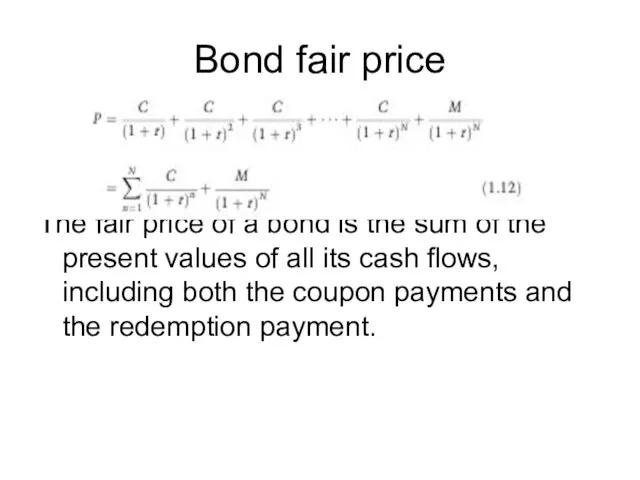

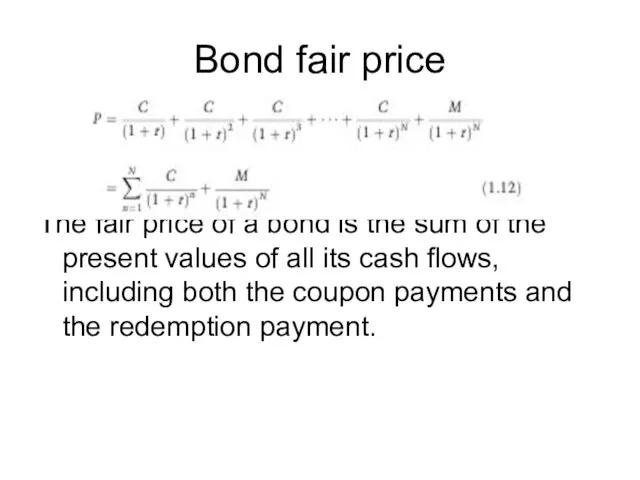

Слайд 26Bond fair price

The fair price of a bond is the sum of

the present values of all its cash flows, including both the coupon payments and the redemption payment.

Слайд 27where P = Bond’s fair price;

C = Annual coupon payment;

r = Discount

rate, or required yield;

N = Number of years to maturity, and so the number of interest periods for a bond paying an annual coupon;

M = Maturity payment, or par value, which is usually 100% of face value.

Слайд 28

Bond yield

Yield-to-maturity is the percentage rate of return assuming a bond is

held until maturity and interest payments are reinvested at the same nominal yield.

The yield on any investment is the discount rate that will make the present value of its cash flows equal its initial cost or price.

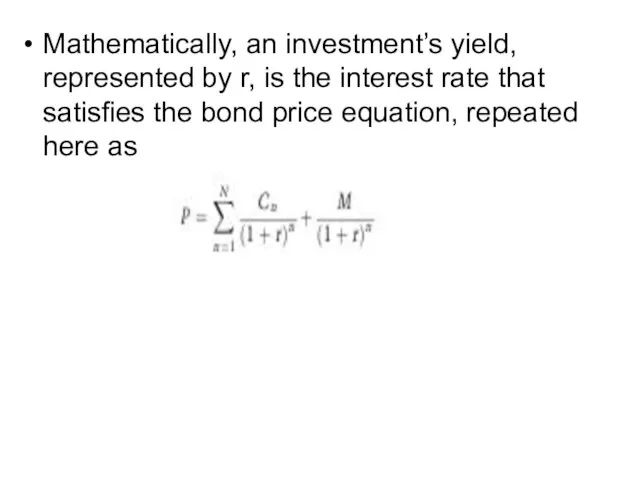

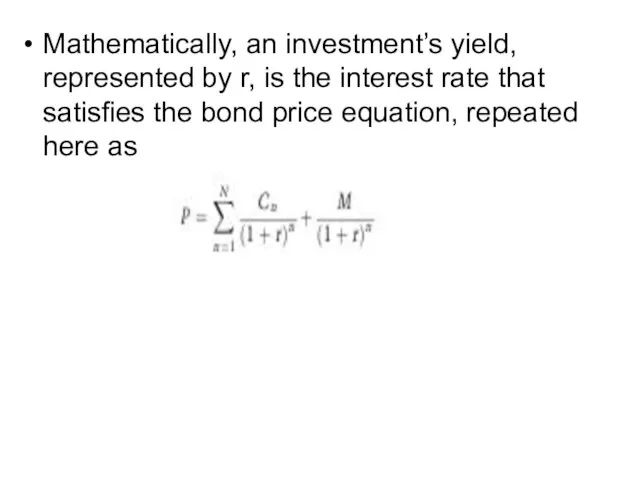

Слайд 29Mathematically, an investment’s yield, represented by r, is the interest rate that

satisfies the bond price equation, repeated here as

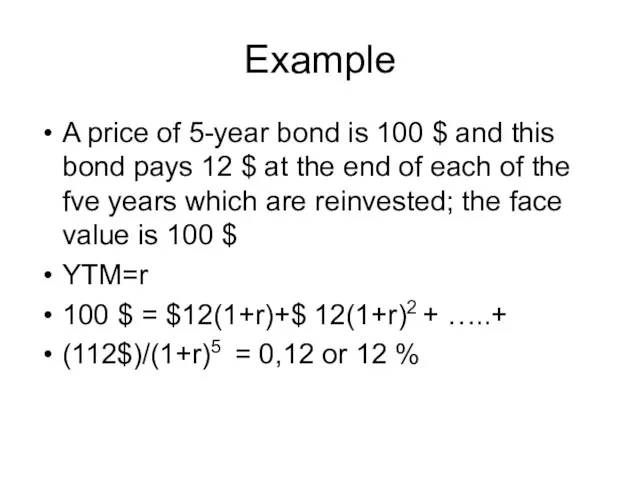

Слайд 30Example

A price of 5-year bond is 100 $ and this bond pays

12 $ at the end of each of the fve years which are reinvested; the face value is 100 $

YTM=r

100 $ = $12(1+r)+$ 12(1+r)2 + …..+

(112$)/(1+r)5 = 0,12 or 12 %

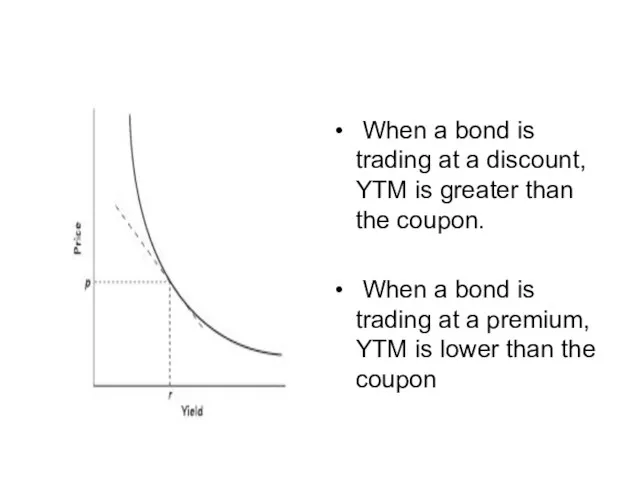

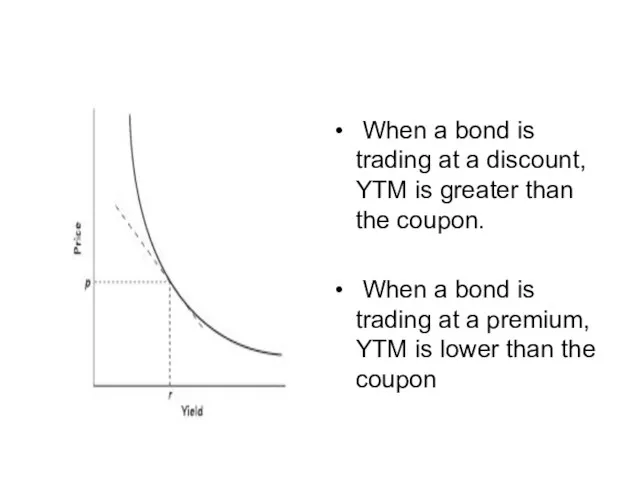

Слайд 31 When a bond is trading at a discount, YTM is greater

than the coupon.

When a bond is trading at a premium, YTM is lower than the coupon

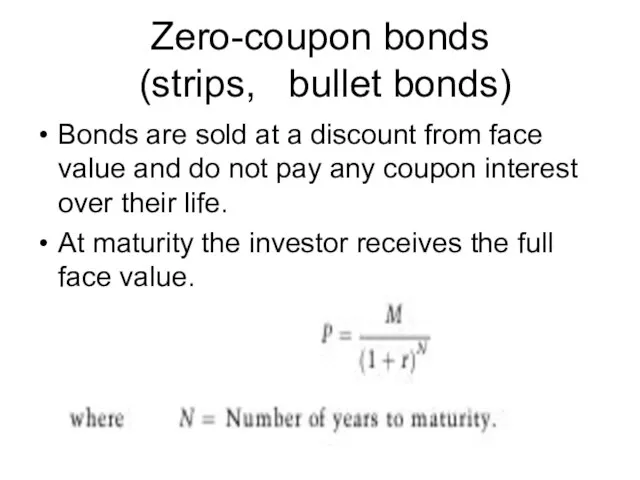

Слайд 32Zero-coupon bonds

(strips, bullet bonds)

Bonds are sold at a discount from face

value and do not pay any coupon interest over their life.

At maturity the investor receives the full face value.

Слайд 33 Calculate the price of a French government zero-coupon bond with precisely

5 years to maturity, with the required yield of

5.40%. Note that French government bonds pay coupon annually:

P = 100/ (1,054)5 = 76.877092

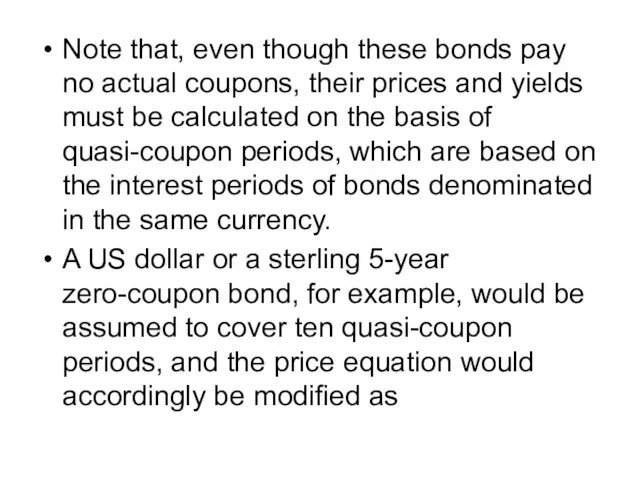

Слайд 34Note that, even though these bonds pay no actual coupons, their prices

and yields must be calculated on the basis of quasi-coupon periods, which are based on the interest periods of bonds denominated in the same currency.

A US dollar or a sterling 5-year zero-coupon bond, for example, would be assumed to cover ten quasi-coupon periods, and the price equation would accordingly be modified as

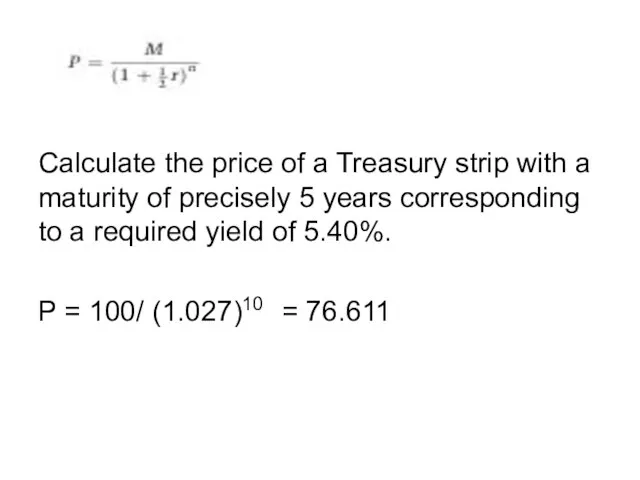

Слайд 35

Calculate the price of a Treasury strip with a maturity of precisely

5 years corresponding to a required yield of 5.40%.

P = 100/ (1.027)10 = 76.611

Слайд 36 Calculate the price of a Treasury strip with a maturity of

precisely 5 years corresponding to a required yield of 5.40%.

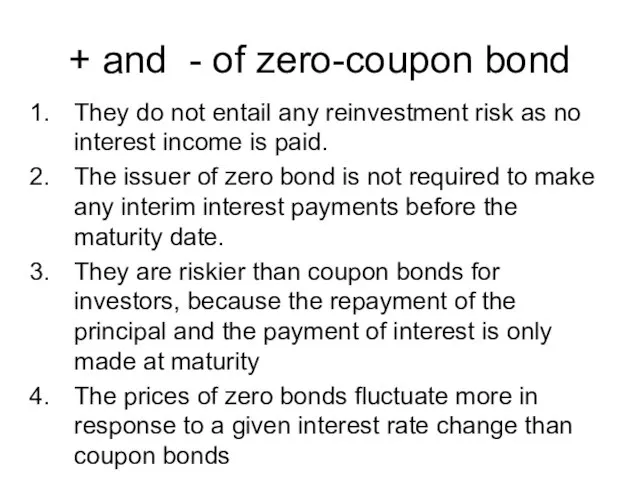

Слайд 37+ and - of zero-coupon bond

They do not entail any reinvestment risk

as no interest income is paid.

The issuer of zero bond is not required to make any interim interest payments before the maturity date.

They are riskier than coupon bonds for investors, because the repayment of the principal and the payment of interest is only made at maturity

The prices of zero bonds fluctuate more in response to a given interest rate change than coupon bonds

Слайд 38

Euro-Medium-Term Notes (Euro MTNs)

Euro-Medium-Term Notes (Euro MTNs) are (typically) fixed-rate notes issued

by a corporation with maturities ranging from less than a year to about 10 years. Like fixed-rate bonds, Euro-MTNs have a fixed maturity and pay coupon interest on periodic dates.

Unlike a bond issue, in which the entire issue is brought to market at once, a Euro-MTN issue is partially sold on a continuous basis through an issuance facility that allows the borrower to obtain funds only as needed on a flexible basis.

This feature is very attractive to issuers. Euro-MTNs have become a very popular means of raising medium-term funds since they were first introduced in 1986.

Слайд 39Euro-Medium-Term Notes (Euro MTNs)

EMTNs make it easier for issuers to enter into

foreign markets for capital.

With EMTNs, the issuer maintains a standardized document (known as a program) that can be transferred across all issues and has a great proportion of sales through a syndication of pre-selected buyers.

Слайд 40Floating-Rate Notes (FRNs)

A note with a variable interest rate. The adjustments to

the interest rate are usually made every six months and are tied to a certain money-market index. Also known as a "floater".

These protect investors against a rise in interest rates (which have an inverse relationship with bond prices), but also carry lower yields than fixed notes of the same maturity.

Слайд 41FRNs

Additional features have been added to FRNs, including floors (the coupon

cannot fall below a specified minimum rate), caps (the coupon cannot rise above a maximum rate) and callability.

Слайд 42Equity-related Bonds

There are two types of equity-related bonds:

convertible bonds

bonds

with equity Bonds warrants.

A convertible bond issue allows the investor to exchange the bond for a predetermined number of equity shares of the issuer.

The floor-value of a convertible bond is its straight fixed-rate bond value. Convertibles usually sell at a premium above the larger of their straight debt value and their conversion value. Additionally, investors are usually willing to accept a lower coupon rate of interest than the comparable straight fixed coupon bond rate because they find the conversion feature attractive.

Слайд 43Equity-related Bonds

Bonds with equity warrants can be viewed as straight fixed-rate bonds

with the addition of a call option (or warrant) feature.

The warrant entitles the bondholder to purchase a certain number of equity shares in the issuer at a prestated price over a predetermined period of time.

Слайд 44Dual-currency bonds

A dual-currency bond is a straight fixed-rate bond issued in one

currency, say, Swiss francs, that pays coupon interest in that same currency. At maturity, the principal is repaid in another currency, say, U.S. dollars.

Coupon interest is frequently at a higher rate than comparable straight fixed-rate bonds. The amount of the dollar principal repayment at maturity is set at inception; frequently, the amount allows for some appreciation in the exchange rate of the stronger currency.

From the investor’s perspective, a dual-currency bond includes a long-term forward contract. If the dollar appreciates over the life of the bond, the principal repayment will be worth more than a return of principal in Swiss francs.

Слайд 47International Bond Market Credit Ratings

Fitch IBCA,

Moody’s Investors Service,

Standard &

Poor’s (S&P)

www.fitchibca.com

www.moodys.com

www.standardandpoors.com

Слайд 48These three credit-rating organizations classify bond issues into categories based upon the

creditworthiness of the borrower.

The ratings are based on an analysis of current information regarding the ikelihood of default and the specifics of the debt obligation.

The ratings only reflect creditworthiness and not exchange rate uncertainty.

Слайд 49Moody’s

bonds are rated into nine categories, from Aaa, Aa, A, Baa, and

Ba down to C. rating service.

Information Ratings of Aaa to Baa are known as investment grade ratings. These issues are judged to have any speculative elements; interest payments and principal safety appear adequate can be found here.

The future prospects of lower-rated issues cannot be considered as well assured.

Within each of the nine categories, Moody’s has three numeric modifiers, 1, 2, or 3, to place an issue, respectively, at the upper, middle, or lower end of the category.

Слайд 50International Bond Market Indexes

Emerging market bonds

J.P. Morgan Emerging Markets Bond Index (EMBI)

J.P. Morgan Government Bond Index

Domestic Government Indices,

European Monetary Union Government Bond Index (EMU)

Слайд 51Standard & Poor’s

Bonds are rated into 11 categories, from AAA, AA, A,

BBB,and BB down to D and CI

Categories AAAto BBB are investment grade ratings.

Category D is reserved for bond issues that are presently in default, and the payment of interest and/or the repayment of principal is in arrears.

Category CI is reserved for income bonds on which no income is being paid.

Ratings for Categories AA to CCC may be modified with a plus (+) or minus (-) to reflect the relative standing of an issue to others in the category.

Fitch uses ratings symbols and definitions similar to S&P’s.

Слайд 53Eurobond market makers and dealers are members of the International Securities Market

Association (ISMA), a self-regulatory body based in Zurich.

Two major clearing systems, Euroclear and Clearstream International, have been established to handle most Eurobond trades.

Euroclear Clearance System is based in Brussels and is operated by Euroclear Bank.

Clearstream, located in Luxembourg, was established in 2000 through a merger of Deutsche Bцrse Clearing and Cedel International, two other clearing firms.

Слайд 54Euroclear

Euroclear settles domestic and international securities transactions, covering bonds, equities, derivatives and

investment funds. Euroclear provides securities services to financial institutions located in more than 90 countries.

In addition to its role as an International Central Securities Depository (ICSD), Euroclear also acts as the Central Securities Depository (CSD) for Belgian, Dutch, Finnish, French, Irish, Swedish and UK securities. Euroclear also owns EMXCo, the UK's leading provider of investment-fund order routing, and Xtrakter, owner of the TRAX trading matching and reporting system.

Euroclear is the largest international central securities depository in the world.

Слайд 55Supervision

Incorporated in Belgium, Euroclear SA/NV is subject to the supervision of the

Belgium Banking, Finance and Insurance Commission (CBFA).

In accordance with Article 8 of its Organic Law, the National Bank of Belgium (NBB) also has oversight of Euroclear SA/NV.

Euroclear plc is authorised as a service company by the Financial Services Authority in the United Kingdom. Each of the Euroclear CSDs are regulated by the relevant authorities within their respective home countries.

Слайд 56Each clearing system has a group of depository banks that physically store

bond certificates.

Members of system hold cash and bond accounts.

When a transaction is conducted, electronical book entries are made that transfer book ownership of the bond certificates from the seller to the buyer and transfer funds from the purchaser’s cash account to the seller’s.

Physical transfer of the bonds seldom takes place.

Слайд 57 (1) The clearing systems will finance up to 90 percent of

the inventory that a Eurobond market maker has deposited within the system.

(2) the clearing systems will assist in the distribution of a new bond issue. The clearing systems will take physical possession of the newly printed bond certificates in the depository, collect subscription payments from the purchasers, and record ownership of the bonds.

(3) The clearing systems will also distribute coupon payments. The borrower pays to the clearing system the coupon interest due on the portion of the issue held in the depository, which in turn credits the appropriate amounts to the bond owners’cash accounts.

Слайд 58Issuers of eurobond

Domotechnika

Donbass Resources

Donbassenergo

Donetsk City

Donetsktelekom

Dongorbank

Donsnab-service

Слайд 59International portfolio strategies

1. Benchmark selection

2. Bond market selection

3.Sector selection/credit selection

4.Currency management

Слайд 60Benchmark selection

The benchmark is some bond index.

What types of issuers should be

included?

If corporates are included, do we put a threshold on their credit quality? Should we include debt from emerging countries?

Do we include all currencies/countries or do we restrict the benchmark to major ones?

Do we allow all maturities (or e.g. only bonds with long maturity

Слайд 61Bond market selection

Take into account currency and interest rate forecast and volatility.

Economic

fundamentals:

monetary and fiscal policy;

public spending;

current and forecast public indebtedness

inflationary pressures

BOP

International comparison of the real yields

National productivity and competitiveness

Political factors

Моё настроение

Моё настроение Моё хобби

Моё хобби 1© Copyright 2011 EMC Corporation. All rights reserved. Источники инноваций в программных проектах Вячеслав Нестеров Software Project Management Conference. - презентация

1© Copyright 2011 EMC Corporation. All rights reserved. Источники инноваций в программных проектах Вячеслав Нестеров Software Project Management Conference. - презентация Коллекция Воображариум

Коллекция Воображариум Електронні таблиці Сортування і фільтрація даних

Електронні таблиці Сортування і фільтрація даних Филиал ТИУ в г. Нижневартовске

Филиал ТИУ в г. Нижневартовске «Обо мне много толковали, разбирая кое-какие мои стороны, но главного существа моего не определили. Его слышал один только Пушкин. О

«Обо мне много толковали, разбирая кое-какие мои стороны, но главного существа моего не определили. Его слышал один только Пушкин. О Разборка технологического маршрута ремонта автомобильного диска из алюминиевого сплава

Разборка технологического маршрута ремонта автомобильного диска из алюминиевого сплава Компьютерное математическое моделирование

Компьютерное математическое моделирование Гражданское право

Гражданское право Технические и идейные особенности творчества Билла Виолы

Технические и идейные особенности творчества Билла Виолы Конституция Российской Федерации.

Конституция Российской Федерации. Перчатки нашего производства

Перчатки нашего производства Активная защита. Описание программы страхования Риски

Активная защита. Описание программы страхования Риски Презентация на тему ЭТАПЫ РАЗВИТИЯ МИРОВОЙ ВАЛЮТНОЙ СИСТЕМЫ

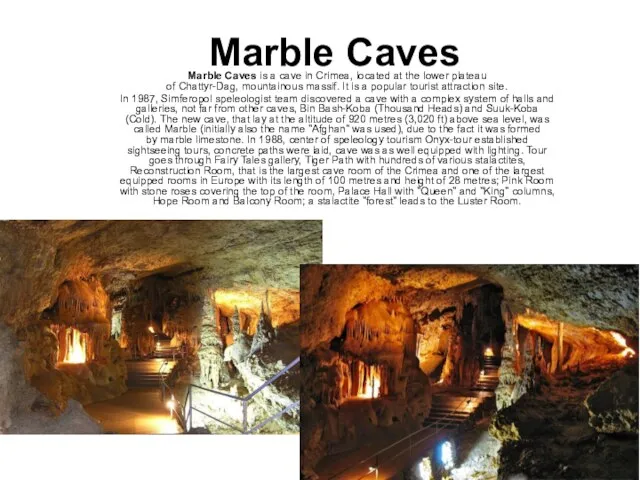

Презентация на тему ЭТАПЫ РАЗВИТИЯ МИРОВОЙ ВАЛЮТНОЙ СИСТЕМЫ  Marble Caves

Marble Caves  Жизнь и творчество Дениса Ивановича Фонвизина

Жизнь и творчество Дениса Ивановича Фонвизина Проект частного сада с применением колористических приёмов создания садов в природной зоне Подмосковья

Проект частного сада с применением колористических приёмов создания садов в природной зоне Подмосковья Использование деятельного подхода в ОД при формировании ОБЖ

Использование деятельного подхода в ОД при формировании ОБЖ Тормозная конференция доклад ДПМВЗрег Иванов А.С

Тормозная конференция доклад ДПМВЗрег Иванов А.С Презентация на тему Постэмбриональное развитие

Презентация на тему Постэмбриональное развитие  Уважаемые партнеры!!!

Уважаемые партнеры!!! Гидравлическая классификация

Гидравлическая классификация Единый государственный экзамен – проблемы и решения

Единый государственный экзамен – проблемы и решения Не шути, дружок, с огнём!

Не шути, дружок, с огнём! XX век Век космонавтики

XX век Век космонавтики Презентация на тему По грибы

Презентация на тему По грибы  Speaking and writing

Speaking and writing