Содержание

Слайд 2Investment case

3. A company with best in class operational standards and

Investment case

3. A company with best in class operational standards and

a focus on best manufacturing practices

A culture of continuous improvement

Highly motivated workforce

Digital strategy to attain operational excellence and safety

Large-scale improvements in operational efficiency

An experienced management team, world-class experts

Industry leadership in profitability and free cash flow generation

Average profitability of about 50%, 2х higher than the industry average

A robust free cash flow generation through the cycle, cash returned to shareholders

4. a transparent financial policy and industry highest credit ratings

0.4х net debt / EBITDA in 2020

Investment-grade ratings from all the key rating agencies

TOP3 the most creditworthy companies in Russia according to S&P Global Ratings

5. Focus on shareholder returns

Leadership among global rough diamond producers as regards growth of total shareholder return since 2013

Up to 100% of cash flow paid as dividends semi-annually

Average dividend yield at 11%

6. Sustainable business with high-quality corporate governance practices

Compliance with high corporate governance standards as a strategic priority

The National Corporate Governance Rating confirmed at 8 (Advanced Corporate Governance Practices) by the Russian Institute of Directors in 2020

Adherence to sustainability principles and international standards of corporate social responsibility: ALROSA features in the ratings of MSCI ESG, Sustainalytics, CDP, S&P Global CSA, FTSE4Good and WWF Russia, and contributes towards the United Nations Sustainable Development Goals

A culture of continuous improvement

Highly motivated workforce

Digital strategy to attain operational excellence and safety

Large-scale improvements in operational efficiency

An experienced management team, world-class experts

Industry leadership in profitability and free cash flow generation

Average profitability of about 50%, 2х higher than the industry average

A robust free cash flow generation through the cycle, cash returned to shareholders

4. a transparent financial policy and industry highest credit ratings

0.4х net debt / EBITDA in 2020

Investment-grade ratings from all the key rating agencies

TOP3 the most creditworthy companies in Russia according to S&P Global Ratings

5. Focus on shareholder returns

Leadership among global rough diamond producers as regards growth of total shareholder return since 2013

Up to 100% of cash flow paid as dividends semi-annually

Average dividend yield at 11%

6. Sustainable business with high-quality corporate governance practices

Compliance with high corporate governance standards as a strategic priority

The National Corporate Governance Rating confirmed at 8 (Advanced Corporate Governance Practices) by the Russian Institute of Directors in 2020

Adherence to sustainability principles and international standards of corporate social responsibility: ALROSA features in the ratings of MSCI ESG, Sustainalytics, CDP, S&P Global CSA, FTSE4Good and WWF Russia, and contributes towards the United Nations Sustainable Development Goals

- Предыдущая

Лекция_5_Технические средстваСледующая -

Жизнедеятельность клетки, её деление и рост Enviromental problems

Enviromental problems  Зигмунд Фрейд

Зигмунд Фрейд Малое и среднее предпринимательство России

Малое и среднее предпринимательство России Народные ремёсла, ремёсла родного края

Народные ремёсла, ремёсла родного края ВПО, KPI ЦА и KPI ТО, ЕРП ФАС России

ВПО, KPI ЦА и KPI ТО, ЕРП ФАС России Ультразвук

Ультразвук Орифлейм

Орифлейм Лекция 10

Лекция 10 Дистанційне навчання

Дистанційне навчання Административно-процессуальное право

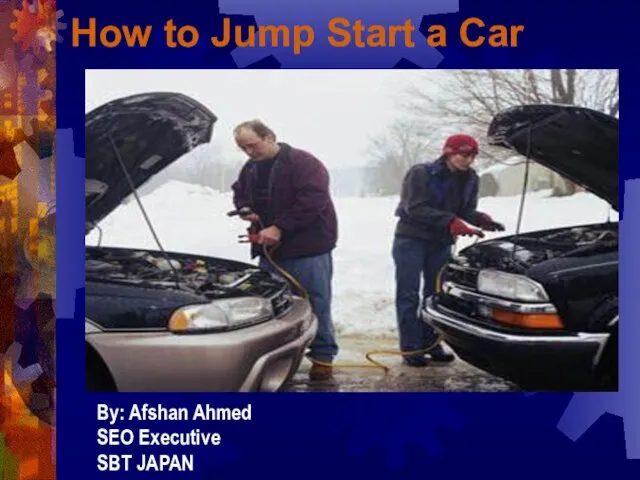

Административно-процессуальное право How to Jump Start a Car

How to Jump Start a Car Gelios. Возможности без ограничений

Gelios. Возможности без ограничений Разрушенные и восстановленные храмы. Церковь Вознесения. Христова в Орлецах

Разрушенные и восстановленные храмы. Церковь Вознесения. Христова в Орлецах Агентство интернет-рекламы Media stars Кто мы? Мы осуществляем полный комплекс услуг по эффективной реализации рекламных кампаний в Ин

Агентство интернет-рекламы Media stars Кто мы? Мы осуществляем полный комплекс услуг по эффективной реализации рекламных кампаний в Ин Презентация на тему Общая характеристика класса Птиц

Презентация на тему Общая характеристика класса Птиц  Использование социальных сетей для проумошена проектовManaging Partner SMM Group | Business PeopleВита Кравчук

Использование социальных сетей для проумошена проектовManaging Partner SMM Group | Business PeopleВита Кравчук Информация. Кодирование информации

Информация. Кодирование информации Модель компьютинга эксперимента АТЛАС

Модель компьютинга эксперимента АТЛАС Биологическая газета «Жизнь»

Биологическая газета «Жизнь» Презентация на тему Человеческие расы

Презентация на тему Человеческие расы  How healthy are your habits

How healthy are your habits Самым дорогим мамам 8 «б» посвящается… Мама! Самое прекрасное слово на Земле. Это первое слово, которое произносит человек, и оно зв

Самым дорогим мамам 8 «б» посвящается… Мама! Самое прекрасное слово на Земле. Это первое слово, которое произносит человек, и оно зв Стыд и совесть

Стыд и совесть Доклад Дания

Доклад Дания Профилактика эмоционального выгорания огранизационные

Профилактика эмоционального выгорания огранизационные Сценарий счастья

Сценарий счастья паттерны, домены, семейства … или что, где и как искать?

паттерны, домены, семейства … или что, где и как искать? Проект внедрения (лого)

Проект внедрения (лого)