Содержание

- 2. Introduction 1 A financial statement provides an accounting-based picture of a firm’s financial position. An annual

- 3. Introduction 2 Reports are used by accountants as a picture of past financial performance. Finance professionals

- 4. Balance Sheet The balance sheet reports firm’s assets, liabilities and equity at a point in time.

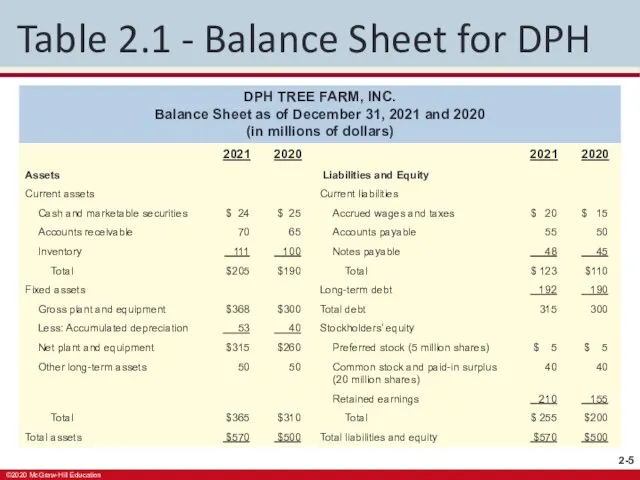

- 5. Table 2.1 - Balance Sheet for DPH DPH TREE FARM, INC. Balance Sheet as of December

- 6. Assets Current assets normally convert to cash within one year. For example, cash and marketable securities,

- 7. Liabilities Liabilities are funds provided to the firm by lenders. Current liabilities constitute the firm’s obligations

- 8. Stockholders’ Equity Stockholders’ equity is the difference between a firm’s total assets and total liabilities. Preferred

- 9. Managing the Balance Sheet Managers must monitor a number of issues underlying items reported on their

- 10. Accounting Method for Fixed Asset Depreciation Managers can choose the accounting method they use to record

- 11. Net Working Capital Net Working Capital = Current assets − Current liabilities Net working capital is

- 12. Liquidity 1 Liquidity refers to two dimensions. Ease with which the firm can convert an asset

- 13. Liquidity 2 Liquidity is double-edged sword. The good? The more liquid assets a firm holds, the

- 14. Debt versus Equity Financing Financial leverage refers to the extent to which a firm chooses to

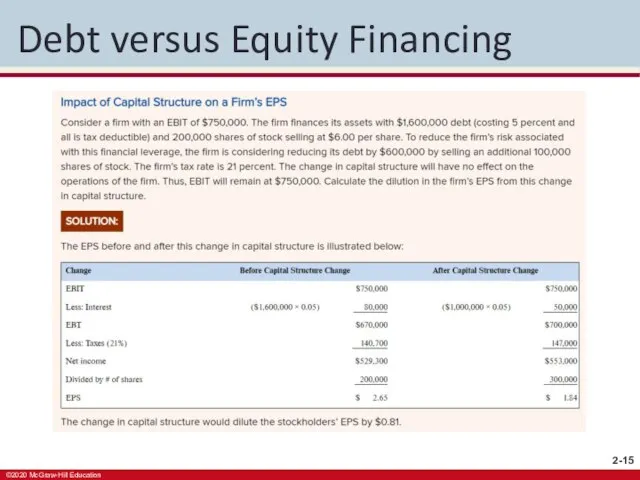

- 15. Debt versus Equity Financing

- 16. Book Value versus Market Value In many cases, book values differ widely from market values. The

- 17. Income Statement The income statement shows the total revenues that a firm earns and the total

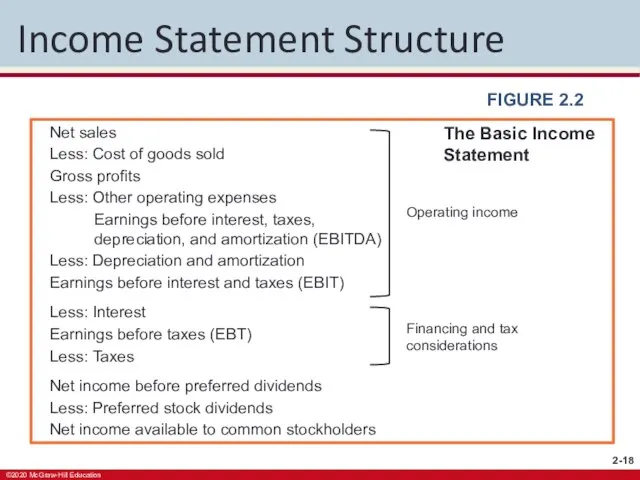

- 18. Income Statement Structure FIGURE 2.2 The Basic Income Statement Net sales Less: Cost of goods sold

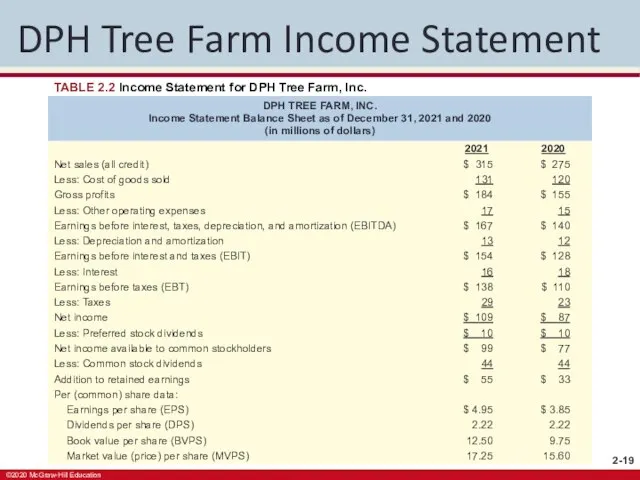

- 19. DPH Tree Farm Income Statement TABLE 2.2 Income Statement for DPH Tree Farm, Inc. DPH TREE

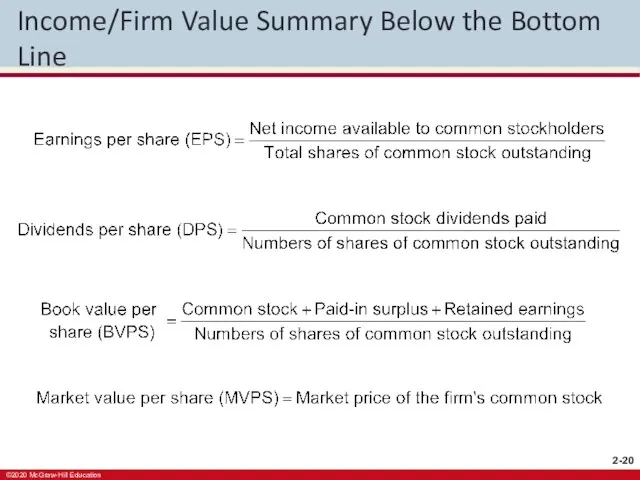

- 20. Income/Firm Value Summary Below the Bottom Line

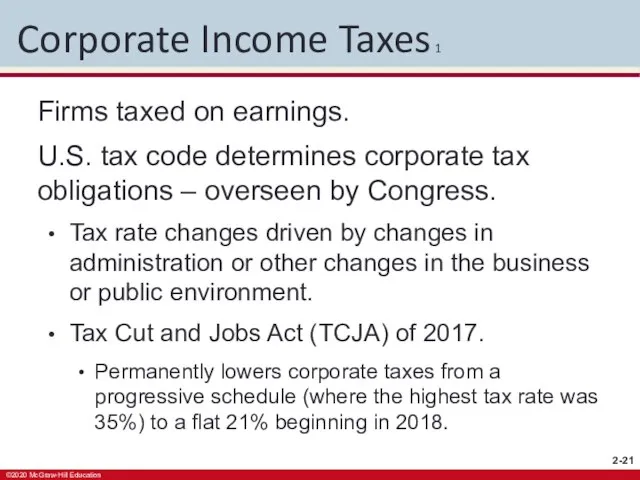

- 21. Corporate Income Taxes 1 Firms taxed on earnings. U.S. tax code determines corporate tax obligations –

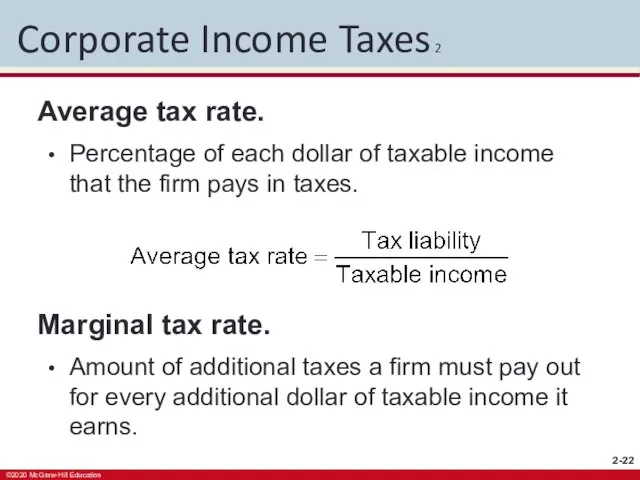

- 22. Corporate Income Taxes 2 Average tax rate. Percentage of each dollar of taxable income that the

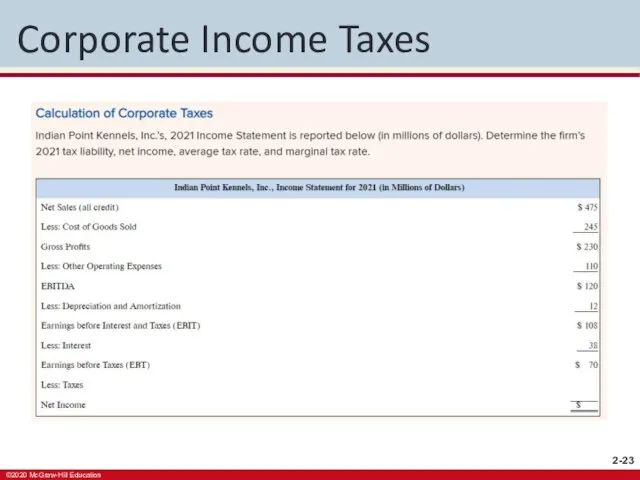

- 23. Corporate Income Taxes

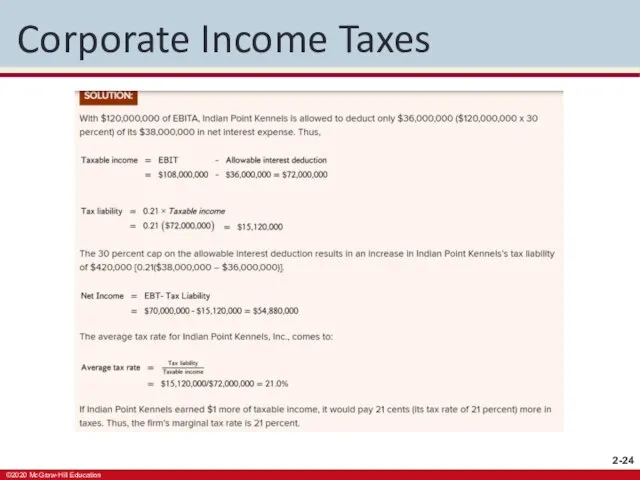

- 24. Corporate Income Taxes

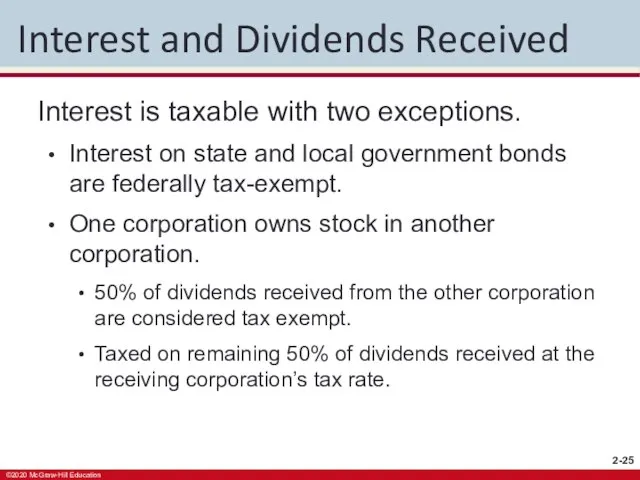

- 25. Interest and Dividends Received Interest is taxable with two exceptions. Interest on state and local government

- 26. Interest and Dividends Paid Interest payments appear on the income statement as an expense item. They

- 27. Statement of Cash Flows The statement of cash flows is a financial statement that shows firm’s

- 28. GAAP Accounting Principles Company accountants use GAAP principles to prepare firm income statements. Revenue recognition and

- 29. Sources and Uses of Cash 1 An activity that increases cash is a cash source. Increasing

- 30. Sources and Uses of Cash 2 Four categories are used to separate cash flows on the

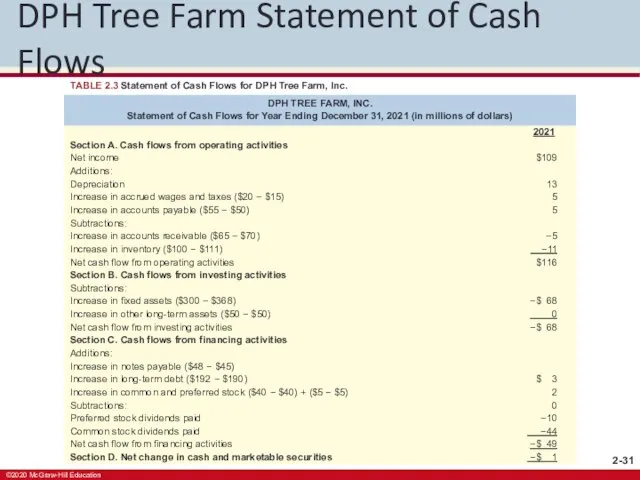

- 31. DPH Tree Farm Statement of Cash Flows TABLE 2.3 Statement of Cash Flows for DPH Tree

- 32. Cash Flows from Operations Cash flows that are the direct result of the production and sale

- 33. Cash Flows from Investing Activities Cash flows associated with the purchase or sale of fixed or

- 34. Cash Flows from Financing Activities Cash flows from financing activities result from debt and equity financing

- 35. Net Change in Cash and Marketable Securities The sum of the cash flows from operations, investing

- 36. Free Cash Flow 1 Free cash flows is the cash actually available for distribution to the

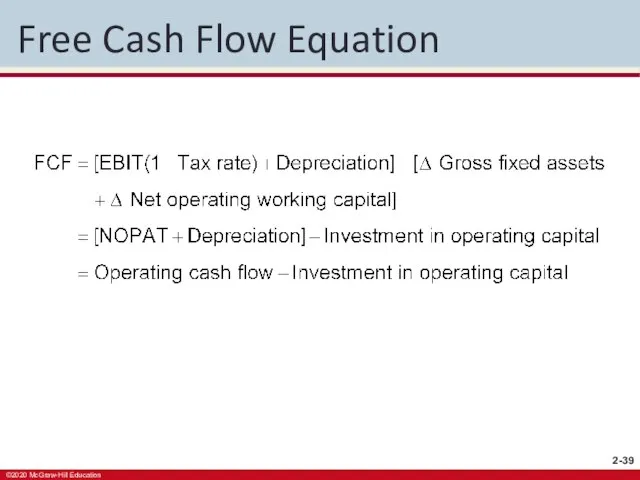

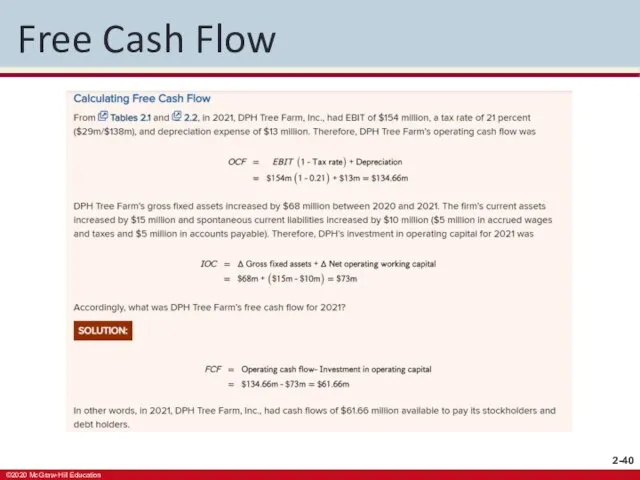

- 37. Free Cash Flow 2 Firms generate operating cash flow (OCF) after they have paid necessary operating

- 38. Free Cash Flow 3 Firms with positive free cash flow (FCF) have funds available for distribution

- 39. Free Cash Flow Equation

- 40. Free Cash Flow

- 41. Statement of Retained Earnings The statement of retained earnings reconciles net income earned during a given

- 42. Cautions in Interpreting Financial Statements GAAP standards required for financial statements. Firms can use earnings management

- 44. Скачать презентацию

Расчет административно- бытовых, подсобных и технических помещений

Расчет административно- бытовых, подсобных и технических помещений Анализ и совершенствование рекламной деятельности гостиничного предприятия

Анализ и совершенствование рекламной деятельности гостиничного предприятия Классические виды дизайна

Классические виды дизайна Графика

Графика Новогодний натюрморт

Новогодний натюрморт Санитарно-гигиенические требования к механической и термической обработке: Живой и солёной рыбы

Санитарно-гигиенические требования к механической и термической обработке: Живой и солёной рыбы Постимпрессионизм

Постимпрессионизм Третий ежегодный конкурс «Корпоративный донор России»

Третий ежегодный конкурс «Корпоративный донор России» Работа над сжатым изложением

Работа над сжатым изложением  Постройки Древней Руси

Постройки Древней Руси Держава Александра Македонского

Держава Александра Македонского Презентация на тему Комплемент

Презентация на тему Комплемент  Презентация ЭМИ-211 Орлова А.В.

Презентация ЭМИ-211 Орлова А.В. Правописание суффиксов -чик- и -щик-

Правописание суффиксов -чик- и -щик- Параллельные вычисления

Параллельные вычисления Англия во второй половине XIX в

Англия во второй половине XIX в Транспорт питательных веществ через мембрану

Транспорт питательных веществ через мембрану Описание системы работы

Описание системы работы Презентация на тему Чем опасна толпа

Презентация на тему Чем опасна толпа  Детский развивающий клуб «ЮЛА»

Детский развивающий клуб «ЮЛА» Школьное биологическое образование: проблемы структуры и содержания

Школьное биологическое образование: проблемы структуры и содержания Атеросклероз

Атеросклероз Многообразие земноводных

Многообразие земноводных Проект создания информационно-аналитического Интернет-портала регионального масс-медийного комплекса

Проект создания информационно-аналитического Интернет-портала регионального масс-медийного комплекса Изменения законодательства в сфере недвижимости в 2019 году

Изменения законодательства в сфере недвижимости в 2019 году Функции государства

Функции государства ЗАОр НП Конфил. История и современность

ЗАОр НП Конфил. История и современность Презентация на тему Рентгеновские излучения и применение их в медицине

Презентация на тему Рентгеновские излучения и применение их в медицине