Слайд 2Building Users

Differentiated by Users/Tenants

Major Institutional/Professional

Occupied by banks, insurance companies, professionals, corporate headquarters

General

Commercial

Smaller buildings, accessible to workers and markets

Parking is important, tenants are sales oriented

Medical and/or Dental

Generally located near hospitals

Слайд 3Building Users

Differentiated by Users/Tenants

Quasi-industrial

may be located in industrial parks

flex and/or research and

development

Pure industrial

part of a manufacturing operation

Government and/or Education

Слайд 4Building Terms

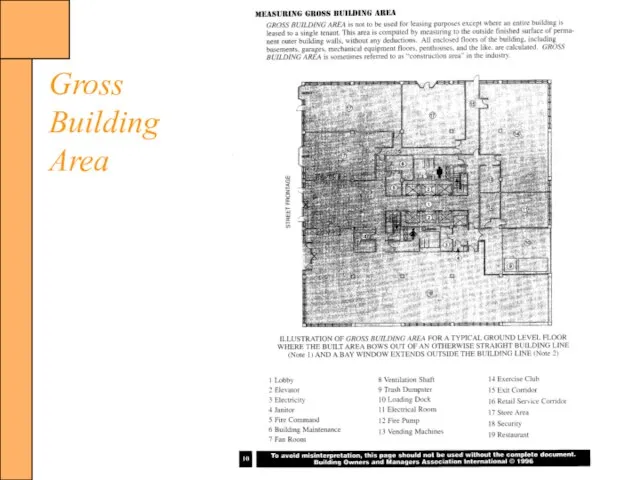

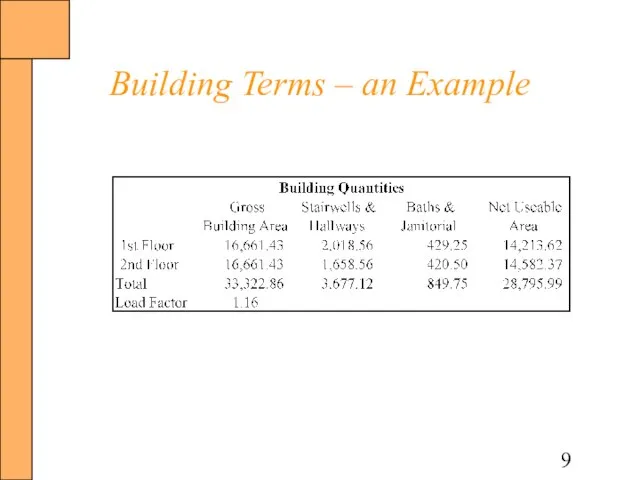

Gross Building Area (GBA)

Total area of the building in square feet

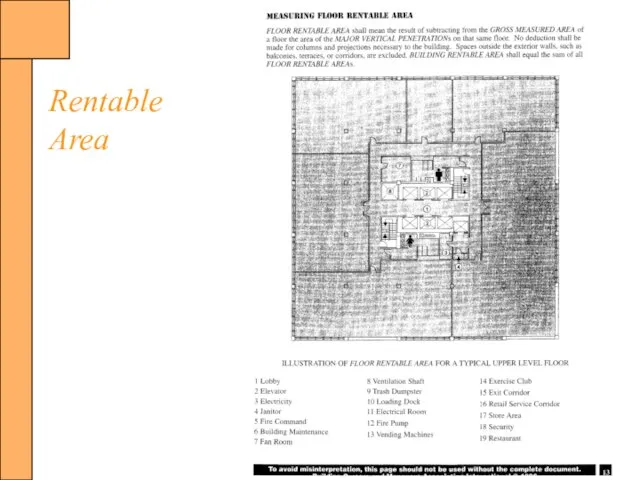

Rentable

Area

Usually considered the tenant’s pro rata share of the entire building.

Excludes elements of the building that penetrate through the floor

Слайд 5Building Terms

Rented Area

Amount of space under lease in a building

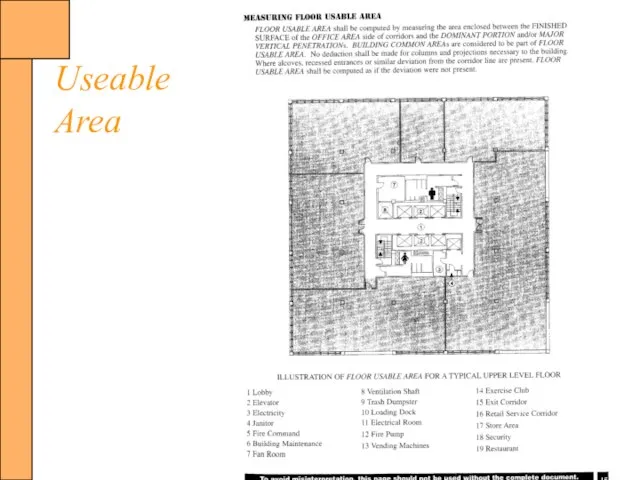

Net Occupied Space

(Useable)

Area within the building occupied by the tenant(s)

Efficiency ratio

Rentable area divided by gross building area

Store Area

Number of square feet in ground floor store area

Слайд 10Building Types

Trophy

highest quality building, one-of-a-kind

unique architectural design

outstanding location

Class A

excellent location and access

good

quality materials and workmanship

good to excellent condition

Слайд 11Building Types

Class B

good location and good construction

may suffer from physical deterioration and

some form of functional obsolescence

Class C

Older (15 to 25 years), may not meet current codes

may suffer from physical deterioration and some form of functional obsolescence

Rehab

older vacant or poorly occupied that if rehabbed could become Class A

Слайд 12General Concepts and Terms

Analysis of Competition

should recognize differences between building types

segmentation of

supply by building classification

Office Space per Employee

norms change from market area to market area, and even between submarket areas within the same general market

generally average is 175 to 200 sq. ft. per employee

Слайд 14Market Analysis: the Six Steps

Step 1: Define the Product

(property productivity analysis)

Step 2:

Define Users of the Property

(market delineation)

Step 3: Forecast Demand Factors

Step 4: Inventory and Forecast Competitive Supply

Step 5: Analyze and Interaction of Supply and Demand

(residual demand study)

Step 6: Forecast Subject Capture

Слайд 15Step 1: Define the Product

Property Productivity Analysis

Identify the type of Office Building

tenants

and construction quality

Analyze the site and the building

rate the subject in relation to the typical competition and/or industry standards

Analyze the location

rate the node to other competitive nodes within the metropolitan area. Consider linkages and direction of urban growth.

analyze the characteristics of the subject’s location within it’s node.

Слайд 17Location Analysis

Often reflects its convenience to office workers, support facilities and executive

housing areas

Office node where the subject property is located is analyzed for its linkages and position in the urban growth pattern

comparing subject’s node to competitive office nodes

direction and rate of urban growth

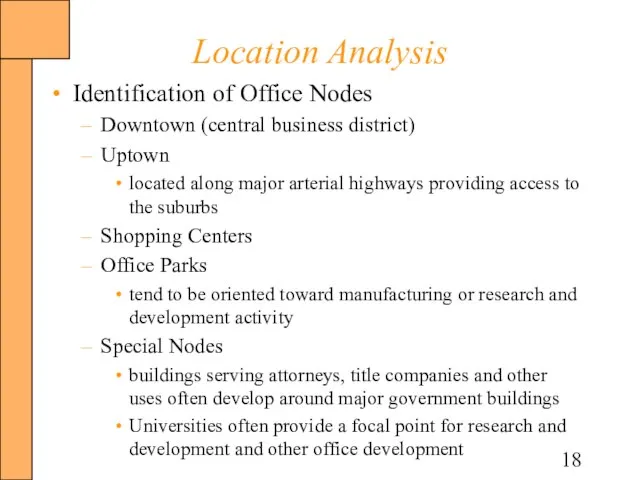

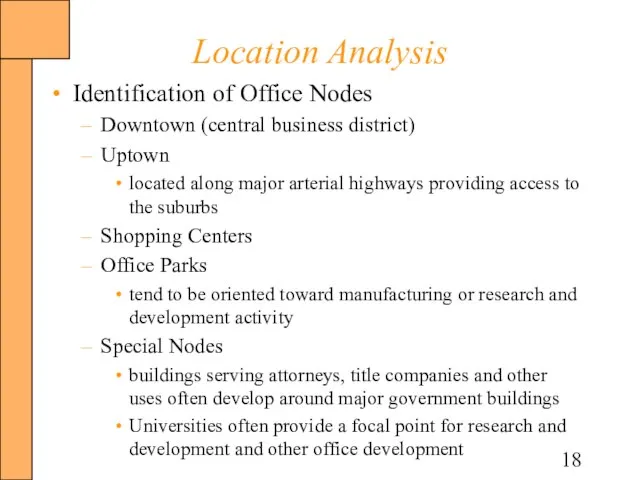

Слайд 18Location Analysis

Identification of Office Nodes

Downtown (central business district)

Uptown

located along major arterial highways

providing access to the suburbs

Shopping Centers

Office Parks

tend to be oriented toward manufacturing or research and development activity

Special Nodes

buildings serving attorneys, title companies and other uses often develop around major government buildings

Universities often provide a focal point for research and development and other office development

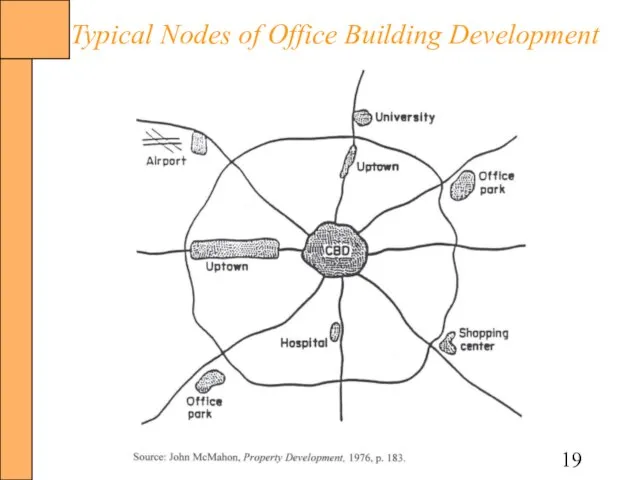

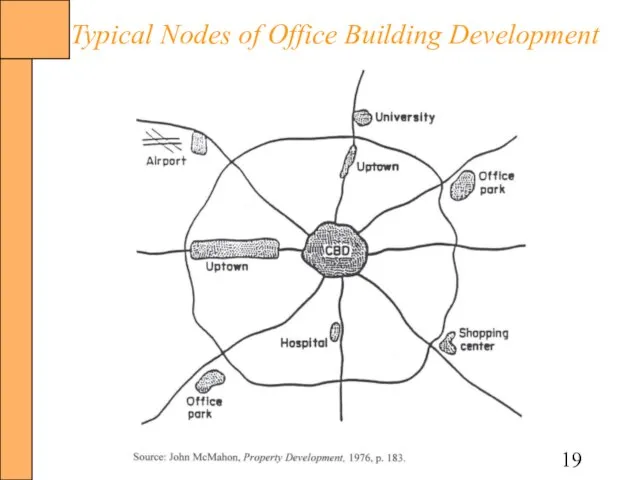

Слайд 19Typical Nodes of Office Building Development

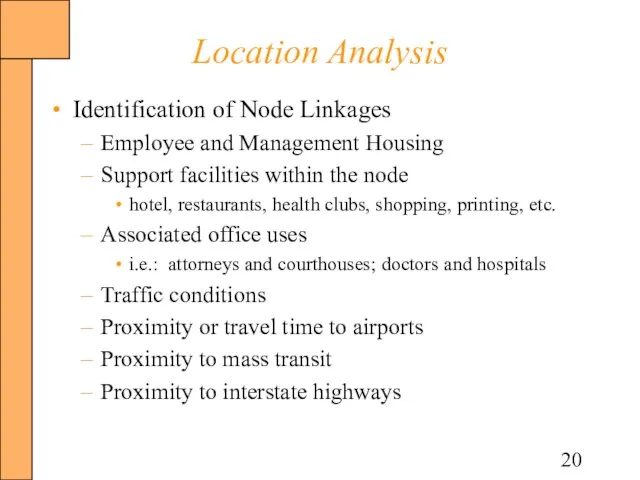

Слайд 20Location Analysis

Identification of Node Linkages

Employee and Management Housing

Support facilities within the node

hotel,

restaurants, health clubs, shopping, printing, etc.

Associated office uses

i.e.: attorneys and courthouses; doctors and hospitals

Traffic conditions

Proximity or travel time to airports

Proximity to mass transit

Proximity to interstate highways

Слайд 22Location Analysis

Land Use considerations

Reputation of the area

Nuisances in the area

Traffic conditions adjacent

to the site

One way streets

Curb cuts and median cuts

Pedestrian access to and from major support facilities

Parking availability and access

Natural amenities

view

beaches, lakes, etc.

Size and tenant mix

office clusters are based on the idea of face to face contact

Слайд 23Location Analysis

Citywide growth analysis

Procedure for analysis

map current major urban centers and housing

areas

map current and committed roads, transit systems, airports, and other transportation facilities expected in the next 5 to 15 years

project and map any major land use expansion anticipated in the next 1 to 10 years

map the growth forecast for 10 to 20 years

locate the subject property within the present and forecast land use patterns

Questions to consider

where has office growth occurred in the past five years?

where are the largest residential and retail growth areas?

Слайд 24Step 2: Define the Users of the Property

Market Delineation

Specify the market of

possible property users

the tenants in the building

the clientele the tenants will draw

most office space does not have a contiguous market area, generally broad metropolitan area, or sub-area

tenants and clientele will vary with the character of the cluster or node.

Слайд 25Step 3: Forecast Demand Factors

Inferred (trend) methods

general employment growth (decline) trends

general secondary

data that reports total market occupancy and absorption

general trends in rents and/or sales

Fundamental methods

Forecast work force occupying office space

Estimate the size of the work force occupying space in the subject’s class of office building

Estimate the requisite space per office worker

Calculate demand for the specific class of office space

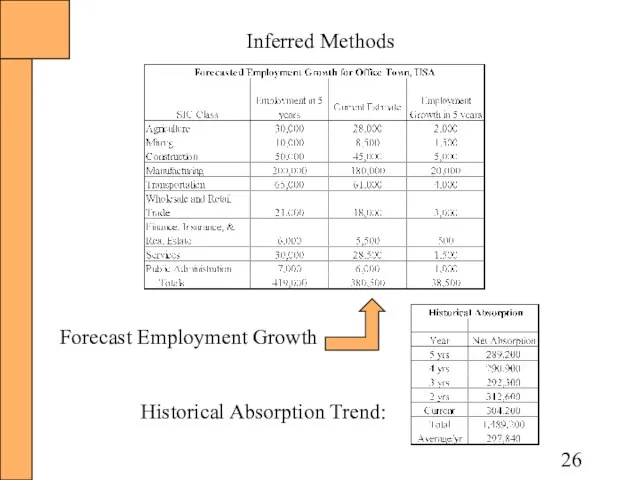

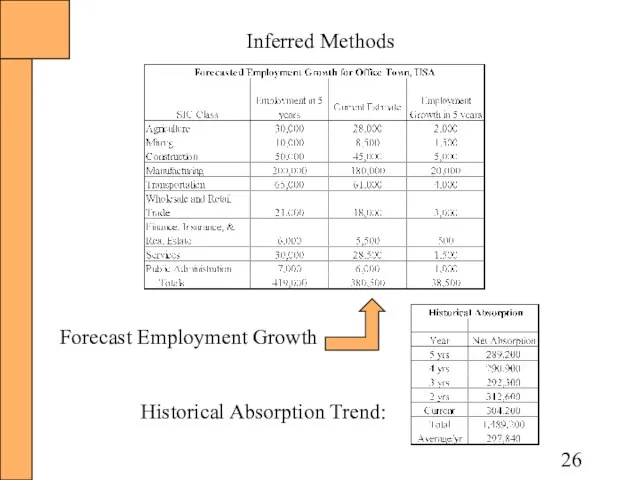

Слайд 26Inferred Methods

Historical Absorption Trend:

Forecast Employment Growth

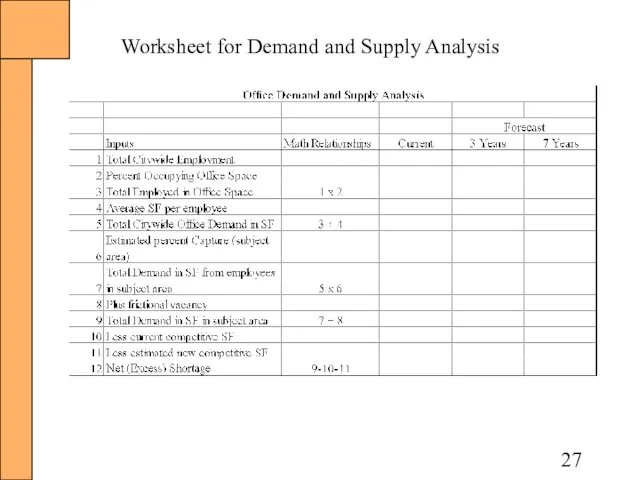

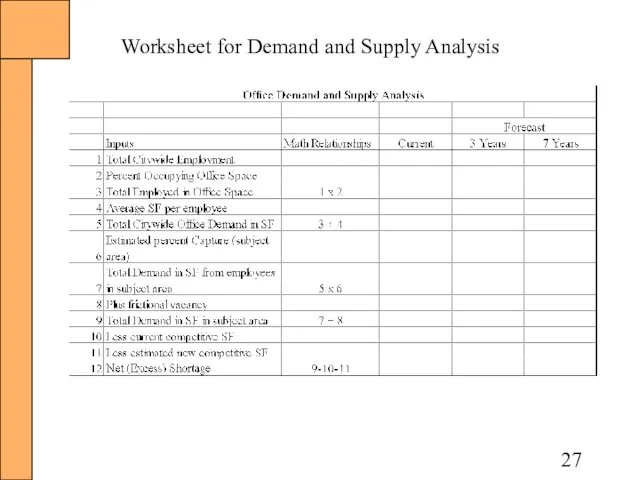

Слайд 27Worksheet for Demand and Supply Analysis

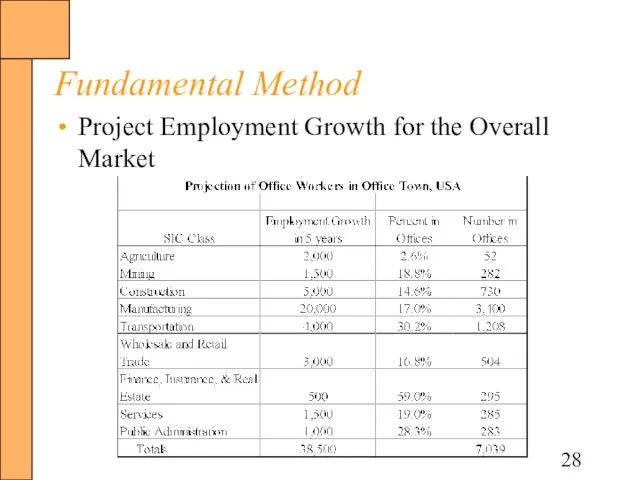

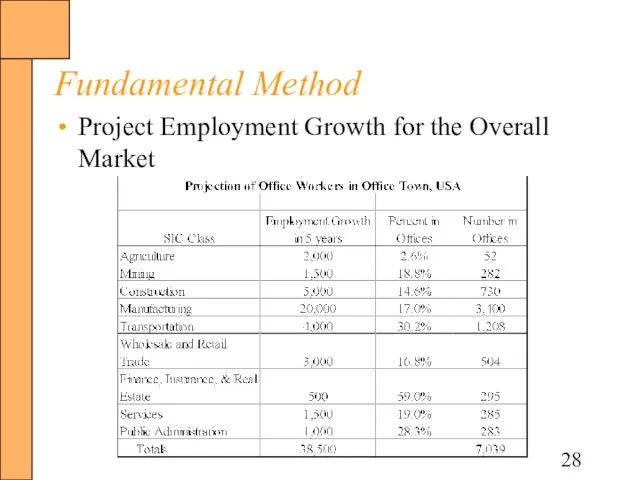

Слайд 28Fundamental Method

Project Employment Growth for the Overall Market

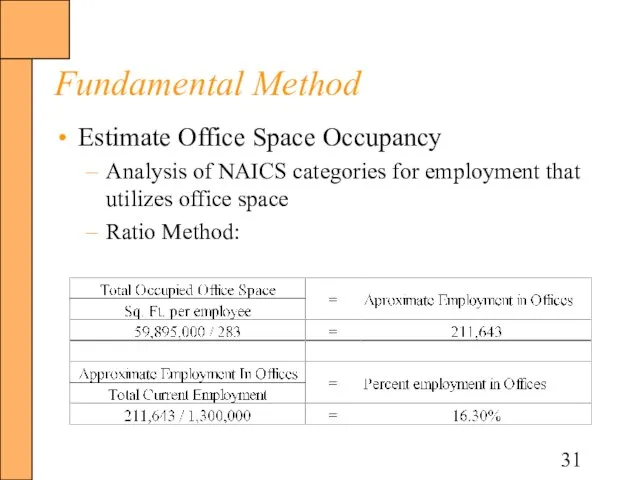

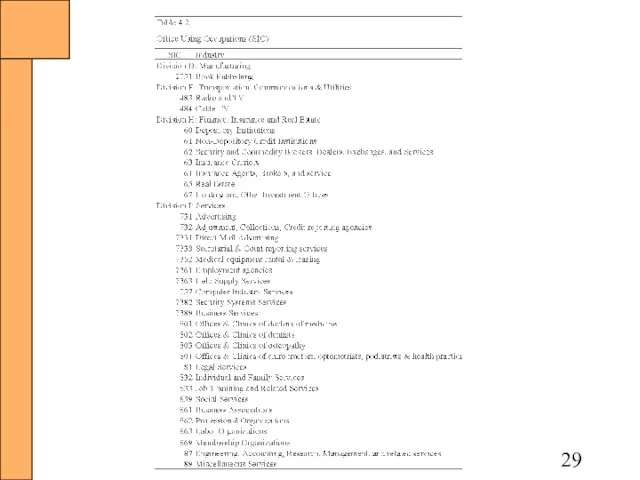

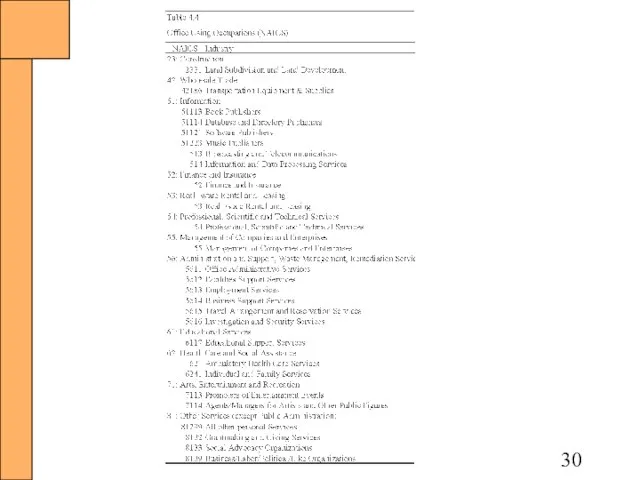

Слайд 31Fundamental Method

Estimate Office Space Occupancy

Analysis of NAICS categories for employment that utilizes

office space

Ratio Method:

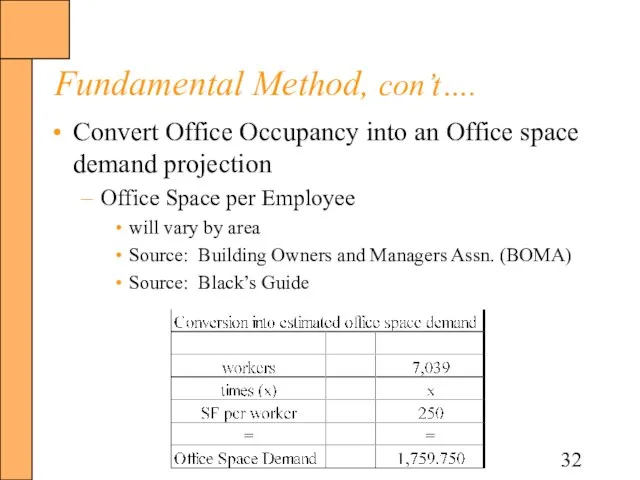

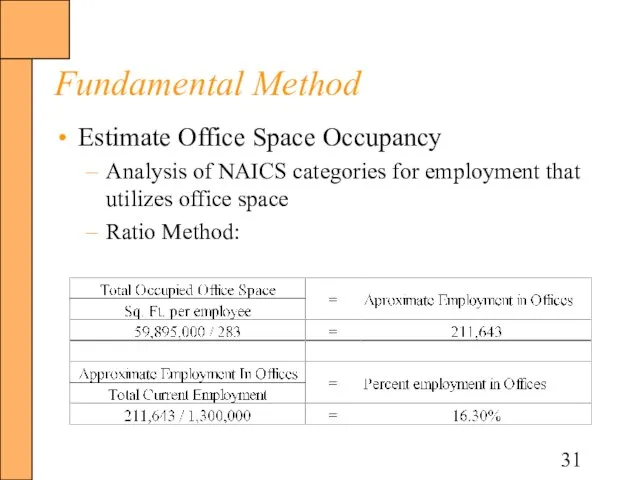

Слайд 32Fundamental Method, con’t….

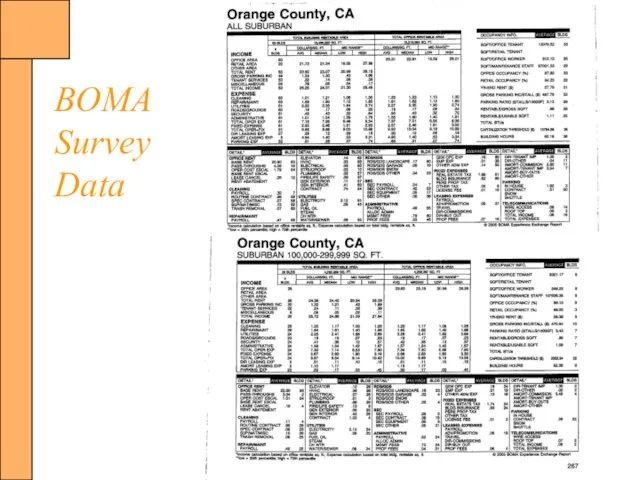

Convert Office Occupancy into an Office space demand projection

Office Space

per Employee

will vary by area

Source: Building Owners and Managers Assn. (BOMA)

Source: Black’s Guide

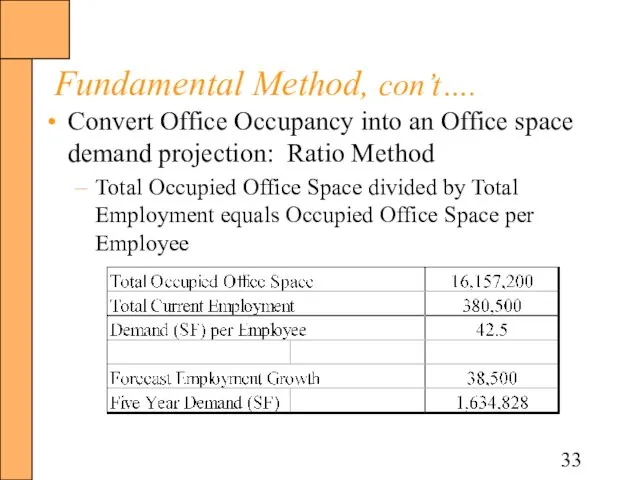

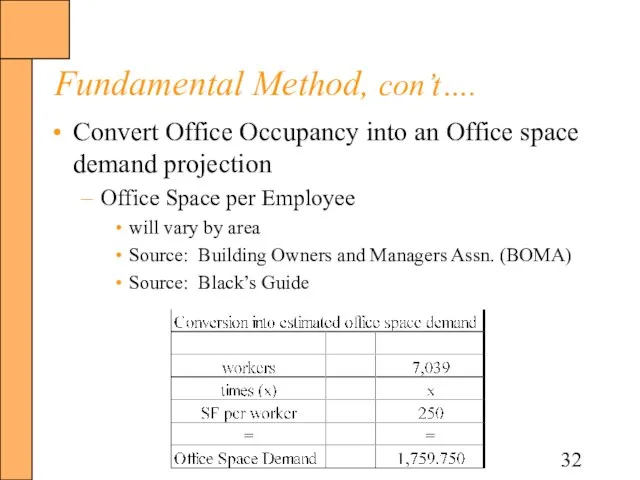

Слайд 33Fundamental Method, con’t….

Convert Office Occupancy into an Office space demand projection: Ratio

Method

Total Occupied Office Space divided by Total Employment equals Occupied Office Space per Employee

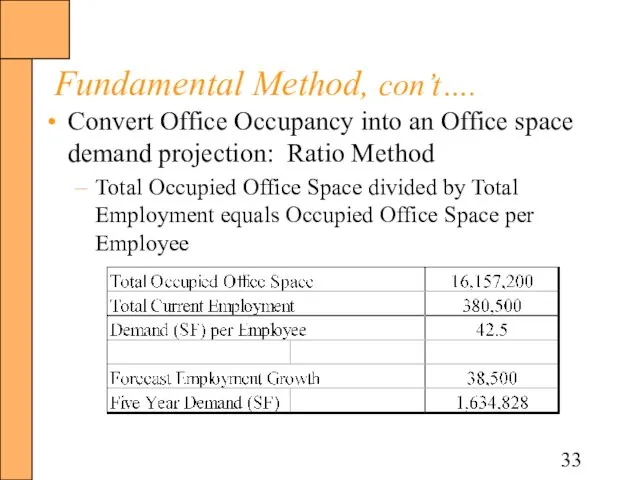

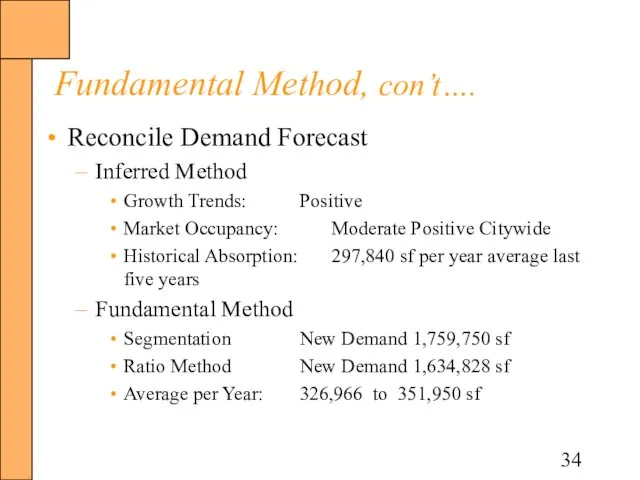

Слайд 34Fundamental Method, con’t….

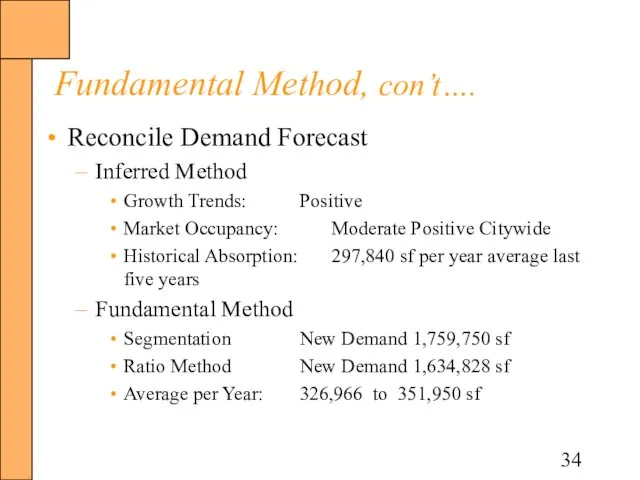

Reconcile Demand Forecast

Inferred Method

Growth Trends: Positive

Market Occupancy: Moderate Positive Citywide

Historical Absorption: 297,840 sf

per year average last five years

Fundamental Method

Segmentation New Demand 1,759,750 sf

Ratio Method New Demand 1,634,828 sf

Average per Year: 326,966 to 351,950 sf

Слайд 35Step 4: Inventory and Forecast Competitive Supply

Inventory the current competitive office space

within the subject’s building class

Inventory the competitive buildings under construction

Forecast the amount of space expected from proposed competitive buildings

Estimate the amount of space anticipated for demolitions, renovations, and conversions

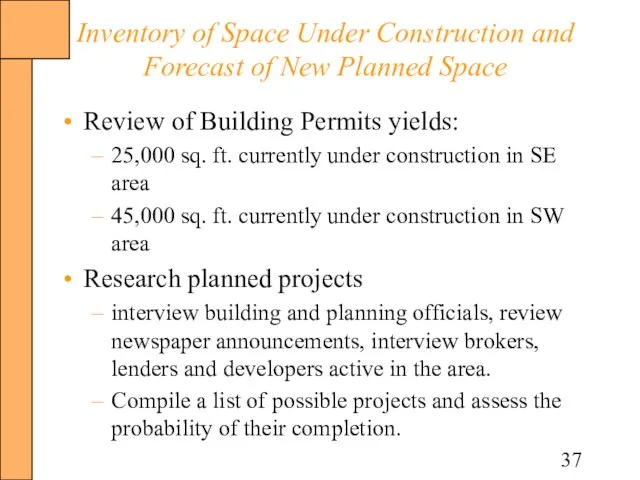

Слайд 37Inventory of Space Under Construction and Forecast of New Planned Space

Review of

Building Permits yields:

25,000 sq. ft. currently under construction in SE area

45,000 sq. ft. currently under construction in SW area

Research planned projects

interview building and planning officials, review newspaper announcements, interview brokers, lenders and developers active in the area.

Compile a list of possible projects and assess the probability of their completion.

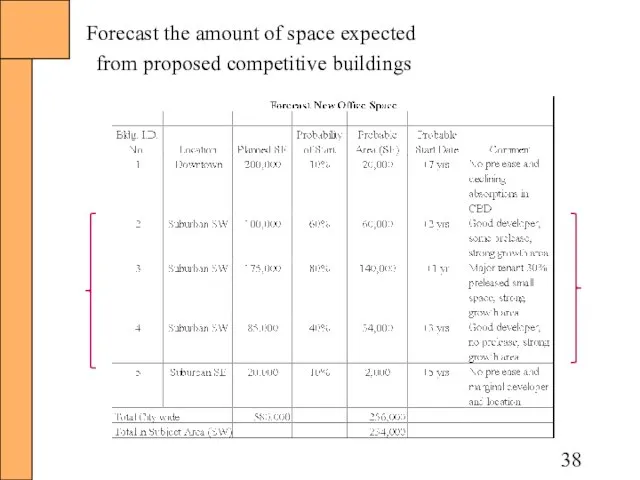

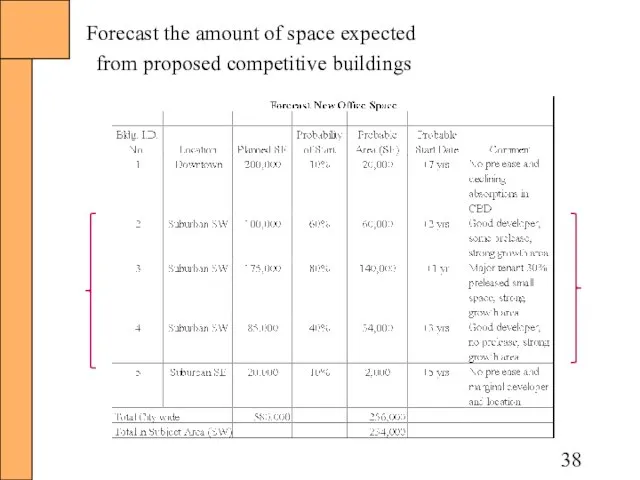

Слайд 38Forecast the amount of space expected

from proposed competitive buildings

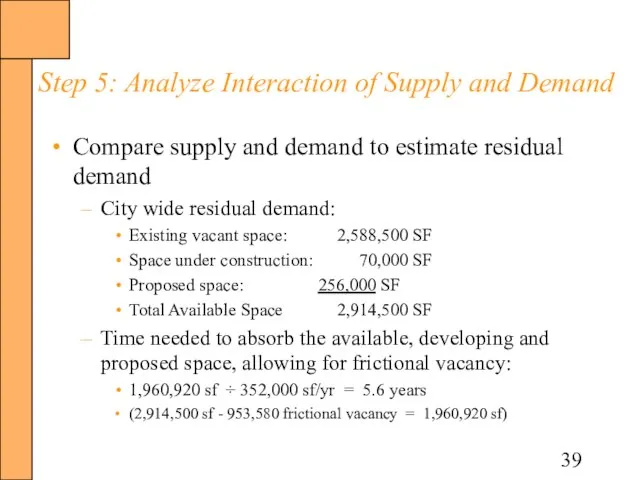

Слайд 39Step 5: Analyze Interaction of Supply and Demand

Compare supply and demand to

estimate residual demand

City wide residual demand:

Existing vacant space: 2,588,500 SF

Space under construction: 70,000 SF

Proposed space: 256,000 SF

Total Available Space 2,914,500 SF

Time needed to absorb the available, developing and proposed space, allowing for frictional vacancy:

1,960,920 sf ÷ 352,000 sf/yr = 5.6 years

(2,914,500 sf - 953,580 frictional vacancy = 1,960,920 sf)

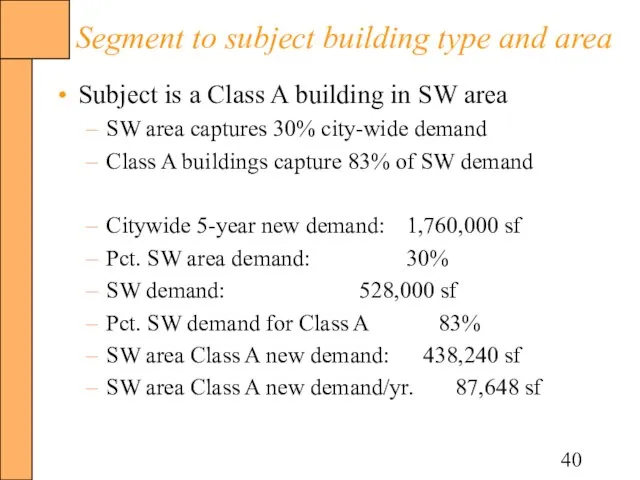

Слайд 40Segment to subject building type and area

Subject is a Class A building

in SW area

SW area captures 30% city-wide demand

Class A buildings capture 83% of SW demand

Citywide 5-year new demand: 1,760,000 sf

Pct. SW area demand: 30%

SW demand: 528,000 sf

Pct. SW demand for Class A 83%

SW area Class A new demand: 438,240 sf

SW area Class A new demand/yr. 87,648 sf

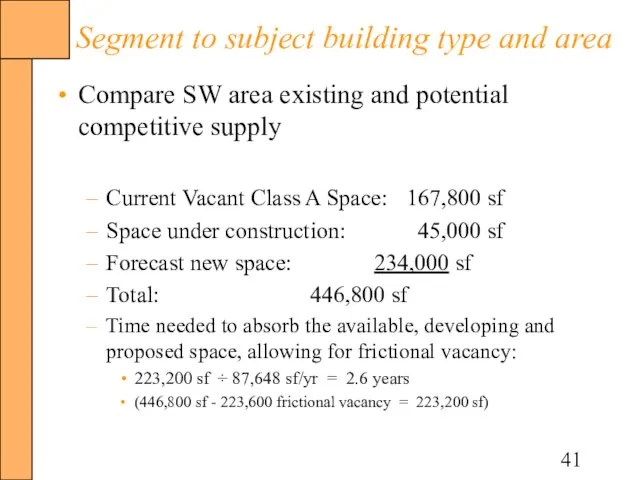

Слайд 41Segment to subject building type and area

Compare SW area existing and potential

competitive supply

Current Vacant Class A Space: 167,800 sf

Space under construction: 45,000 sf

Forecast new space: 234,000 sf

Total: 446,800 sf

Time needed to absorb the available, developing and proposed space, allowing for frictional vacancy:

223,200 sf ÷ 87,648 sf/yr = 2.6 years

(446,800 sf - 223,600 frictional vacancy = 223,200 sf)

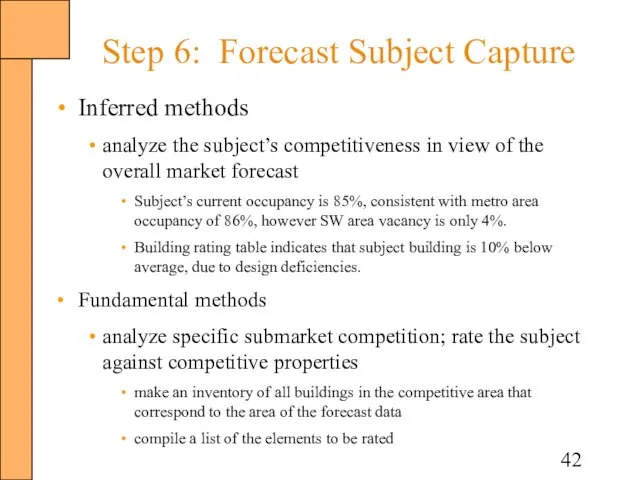

Слайд 42Step 6: Forecast Subject Capture

Inferred methods

analyze the subject’s competitiveness in view of

the overall market forecast

Subject’s current occupancy is 85%, consistent with metro area occupancy of 86%, however SW area vacancy is only 4%.

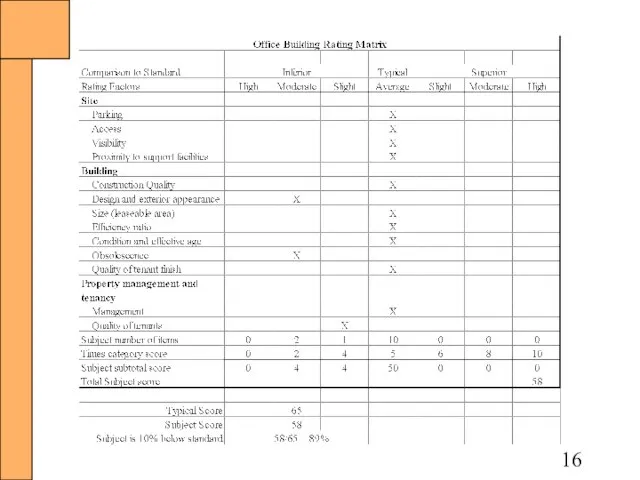

Building rating table indicates that subject building is 10% below average, due to design deficiencies.

Fundamental methods

analyze specific submarket competition; rate the subject against competitive properties

make an inventory of all buildings in the competitive area that correspond to the area of the forecast data

compile a list of the elements to be rated

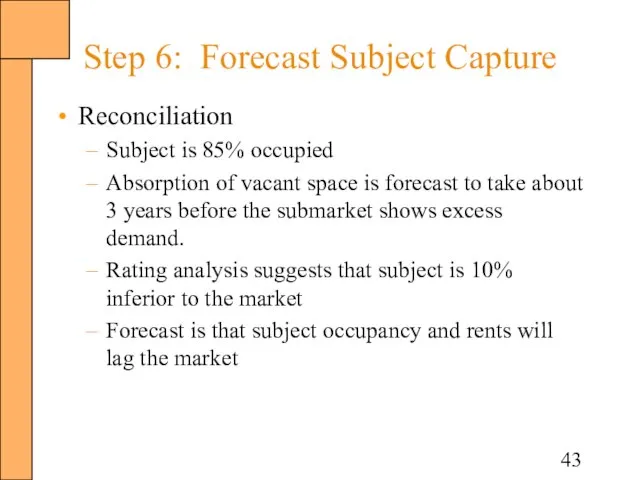

Слайд 43Step 6: Forecast Subject Capture

Reconciliation

Subject is 85% occupied

Absorption of vacant space is

forecast to take about 3 years before the submarket shows excess demand.

Rating analysis suggests that subject is 10% inferior to the market

Forecast is that subject occupancy and rents will lag the market

К тайнам нашего языка

К тайнам нашего языка Perfect Vision Gallery

Perfect Vision Gallery Управление конфликтом

Управление конфликтом Мой милый маг, моя Мария, - Мечтам мерцающий маяк. Мятежны марева морские, Мой милый маг, моя Мария, Молчаньем манит мутный мрак … Мне

Мой милый маг, моя Мария, - Мечтам мерцающий маяк. Мятежны марева морские, Мой милый маг, моя Мария, Молчаньем манит мутный мрак … Мне РАБОЧАЯ ПРОГРАММАКОМПЛЕКСНОГО УЧЕБНОГО КУРСА 4 КЛАССА «ОСНОВЫ РЕЛИГИОЗНЫХ КУЛЬТУР И СВЕТСКОЙ ЭТИКИ»(НАЧАЛЬНОЕ ОБЩЕЕ ОБРАЗОВАНИ

РАБОЧАЯ ПРОГРАММАКОМПЛЕКСНОГО УЧЕБНОГО КУРСА 4 КЛАССА «ОСНОВЫ РЕЛИГИОЗНЫХ КУЛЬТУР И СВЕТСКОЙ ЭТИКИ»(НАЧАЛЬНОЕ ОБЩЕЕ ОБРАЗОВАНИ GPS

GPS Интернет-банк. Инструкция по оформлению кредитов

Интернет-банк. Инструкция по оформлению кредитов Балет С.С. Прокофьева Ромео и Джульетта

Балет С.С. Прокофьева Ромео и Джульетта Spotlight 5 Starter Ур 4 отр предл

Spotlight 5 Starter Ур 4 отр предл Химические предприятия Саратовской области

Химические предприятия Саратовской области Создание контраста в рекламе

Создание контраста в рекламе Защита творческих проектов

Защита творческих проектов Животные леса

Животные леса Развитие жизни в период позднего палеозоя

Развитие жизни в период позднего палеозоя Опубликование итогов голосования и результатов референдума

Опубликование итогов голосования и результатов референдума Отчёт по воспитательной работе

Отчёт по воспитательной работе Презентация на тему Угарный газ

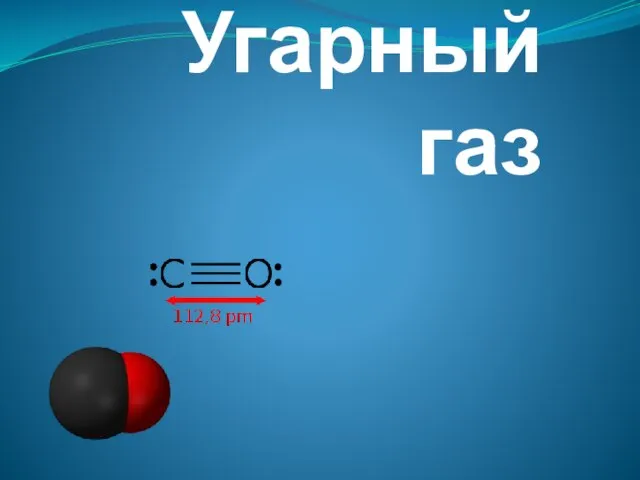

Презентация на тему Угарный газ  Синтез искусств в архитектуре. Витраж

Синтез искусств в архитектуре. Витраж Нормативное и учебно-методическое обеспечение нового ФГОС по технологии третьего поколения – 2021

Нормативное и учебно-методическое обеспечение нового ФГОС по технологии третьего поколения – 2021 Конкурс знатоков права

Конкурс знатоков права Засоби навчання

Засоби навчання Презентация О Петербурге

Презентация О Петербурге 9_3_Ravnouskorennoe_dvizhenie

9_3_Ravnouskorennoe_dvizhenie New Life - живи по-новому

New Life - живи по-новому Организация работы ЦОКО ТОИПКРО в период подготовки и проведения ЕГЭ

Организация работы ЦОКО ТОИПКРО в период подготовки и проведения ЕГЭ Отыскание части от целого и целого по его части

Отыскание части от целого и целого по его части СЕМЁН ДЕЖНЁВ

СЕМЁН ДЕЖНЁВ Дар созидания. Эстетическое формирование искусством окружающей среды

Дар созидания. Эстетическое формирование искусством окружающей среды