Слайд 2TWO-ROOM APARTMENT IN GERMANY

average cost € 300,000

good enough repair

favorable area

developed infrastructure

Слайд 3EXAMPLE OF SUCH AN APARTMENT

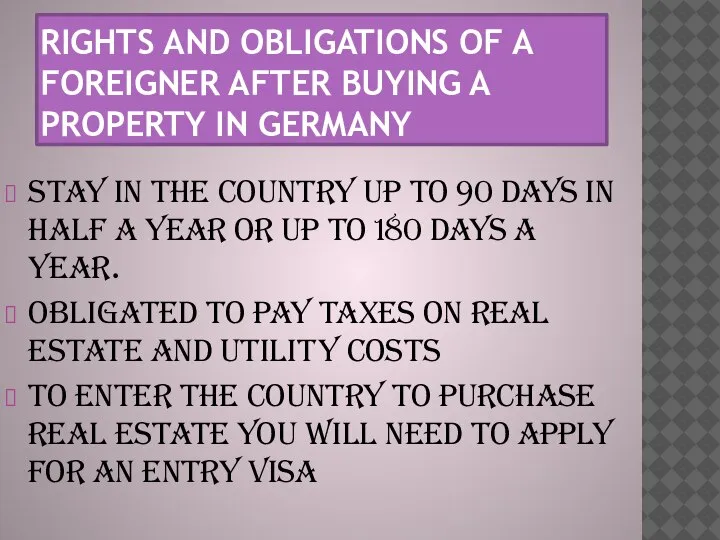

Слайд 4RIGHTS AND OBLIGATIONS OF A FOREIGNER AFTER BUYING A PROPERTY IN GERMANY

stay

in the country up to 90 days in half a year or up to 180 days a year.

obligated to pay taxes on real estate and utility costs

to enter the country to purchase real estate you will need to apply for an entry visa

Слайд 5REAL ESTATE TAXES IN GERMANY

The tax on the purchase of real estate

is 3.5-6.5% depending on the region

For notary services you will have to pay about 1-1.5% of the value of the object

realtor commission - 3.5–6% of the property value

Слайд 6

CAPABILITIES

If you plan to purchase an apartment for subsequent rental, then in

Berlin or Munich you can count on the profitability of this company about 4% per year. At the same time, in smaller cities, returns may be higher.

Слайд 7MORTGAGE TERMS

interest rate - from 3 to 5% per annum

down payment

- at least 40% of the market price of housing

loan term - from 5 to 40 years (standard term - 10 years)

Слайд 8GETTING A MORTGAGE

1 step - Analysis of offers from banks

2 step -

Collection and preparation of documentation

3 step - Opening a bank account and replenishing it

4 step - The conclusion of the contract.

Линейная алгебра

Линейная алгебра Основные институты общества. Тема 1.9

Основные институты общества. Тема 1.9 Фовизм как историческое художественное направление. Анри Матисс – один из самых ярких представителей фовизма

Фовизм как историческое художественное направление. Анри Матисс – один из самых ярких представителей фовизма «Мурманск-LNG»

«Мурманск-LNG» Игра "Что? Где? Когда?"

Игра "Что? Где? Когда?" "Своя игра" на английском языке

"Своя игра" на английском языке Рациональность макроагентов: кому приписывать функцию полезности? член-корр. РАН И.Г. Поспелов,ВЦ РАН, отдел математического моде

Рациональность макроагентов: кому приписывать функцию полезности? член-корр. РАН И.Г. Поспелов,ВЦ РАН, отдел математического моде Роль денег в нашей жизни

Роль денег в нашей жизни Презентация на тему Картинный словарь. Овощи

Презентация на тему Картинный словарь. Овощи  Классификация стилей

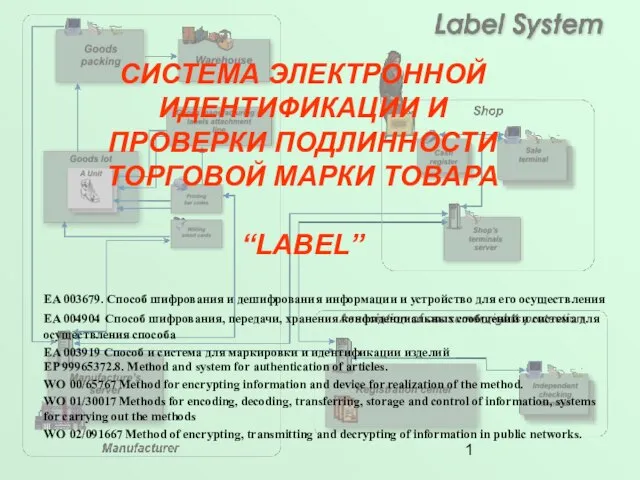

Классификация стилей СИСТЕМА ЭЛЕКТРОННОЙ ИДЕНТИФИКАЦИИ И ПРОВЕРКИ ПОДЛИННОСТИ ТОРГОВОЙ МАРКИ ТОВАРА “LABEL”

СИСТЕМА ЭЛЕКТРОННОЙ ИДЕНТИФИКАЦИИ И ПРОВЕРКИ ПОДЛИННОСТИ ТОРГОВОЙ МАРКИ ТОВАРА “LABEL” Подгруппа кислорода

Подгруппа кислорода Презентация проектно- исследовательской работы.

Презентация проектно- исследовательской работы. Культура Византии VI – XI века

Культура Византии VI – XI века Презентация на тему Как человек использует свойства воздуха

Презентация на тему Как человек использует свойства воздуха  Большой маркетингв малом бизнесеКак мы завоевали рынок

Большой маркетингв малом бизнесеКак мы завоевали рынок Типы менеджмента и особенности принятия управленческого решения

Типы менеджмента и особенности принятия управленческого решения Презентация на тему Земноводные

Презентация на тему Земноводные Гении эпохи Возрождения

Гении эпохи Возрождения Энергоменеджмент. Правовое сопровождение энергетической деятельности Организации. Взаимодействие по эксплуатации электрическ

Энергоменеджмент. Правовое сопровождение энергетической деятельности Организации. Взаимодействие по эксплуатации электрическ ЦЕНЫ НИЖЕ!

ЦЕНЫ НИЖЕ! Ночной клуб. Танцевальный зал до 120 посадочных мест. Караоке зал до 80 посадочных мест. Архангельск

Ночной клуб. Танцевальный зал до 120 посадочных мест. Караоке зал до 80 посадочных мест. Архангельск Постэмбриональное развитие

Постэмбриональное развитие Специалист по сопровождению системы КонсультантПлюс

Специалист по сопровождению системы КонсультантПлюс Правила безопасного поведения на воде

Правила безопасного поведения на воде Мастер-классы «Грант Гезар»

Мастер-классы «Грант Гезар» Презентация

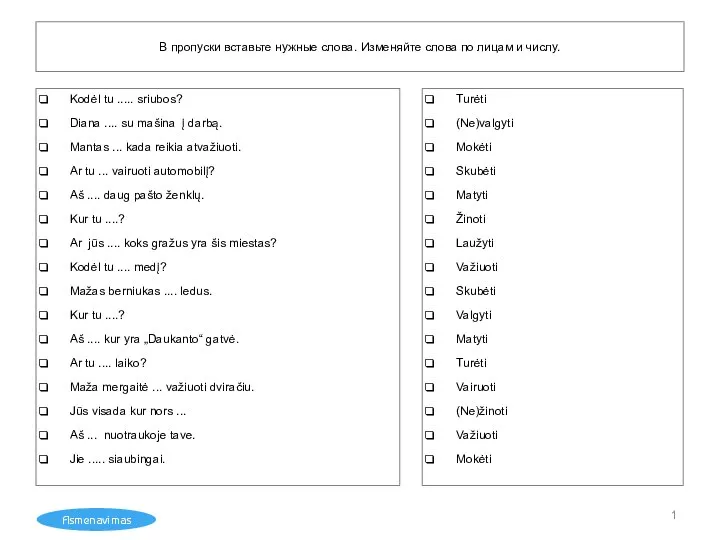

Презентация Asmenavimas uzduotys

Asmenavimas uzduotys