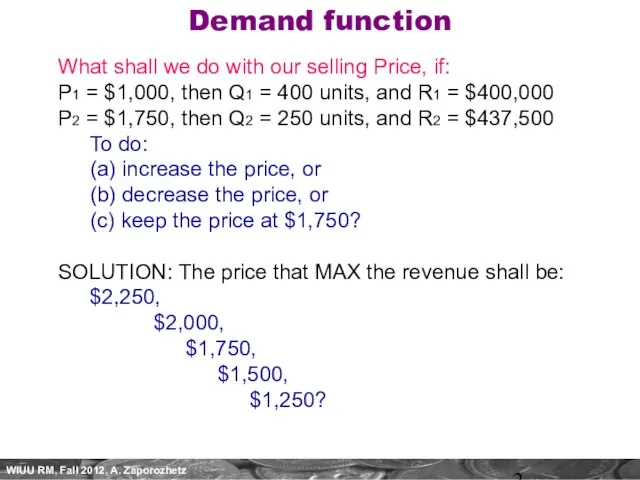

Слайд 2Demand function

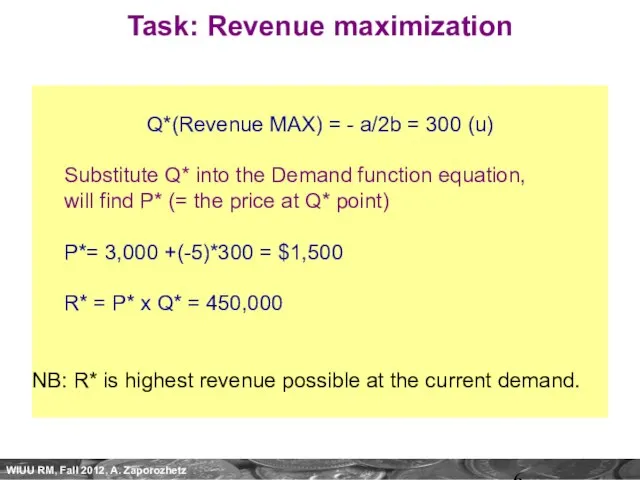

What shall we do with our selling Price, if:

P1 =

$1,000, then Q1 = 400 units, and R1 = $400,000

P2 = $1,750, then Q2 = 250 units, and R2 = $437,500

To do:

(a) increase the price, or

(b) decrease the price, or

(c) keep the price at $1,750?

SOLUTION: The price that MAX the revenue shall be: $2,250,

$2,000,

$1,750,

$1,500,

$1,250?

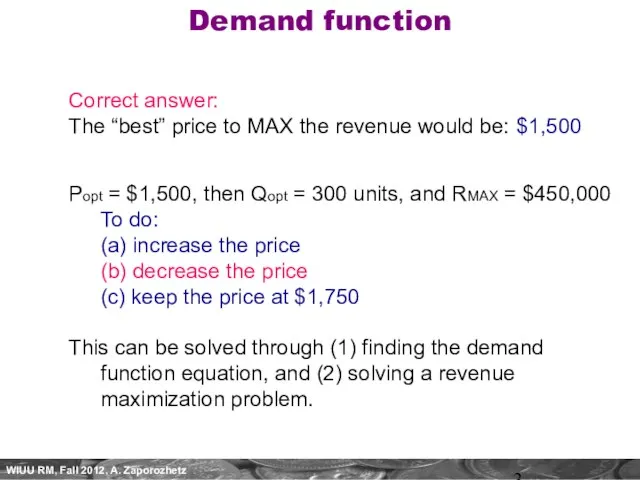

Слайд 3Demand function

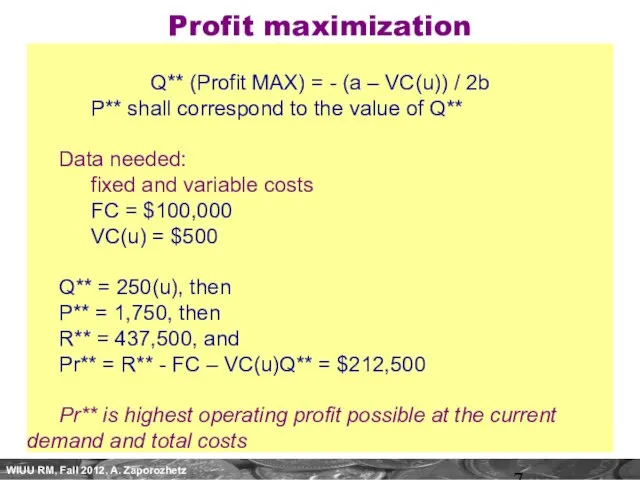

Correct answer:

The “best” price to MAX the revenue would be:

$1,500

Popt = $1,500, then Qopt = 300 units, and RMAX = $450,000

To do:

(a) increase the price

(b) decrease the price

(c) keep the price at $1,750

This can be solved through (1) finding the demand function equation, and (2) solving a revenue maximization problem.

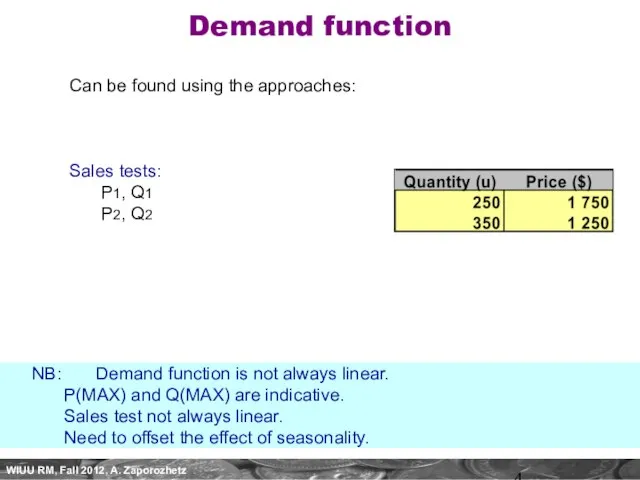

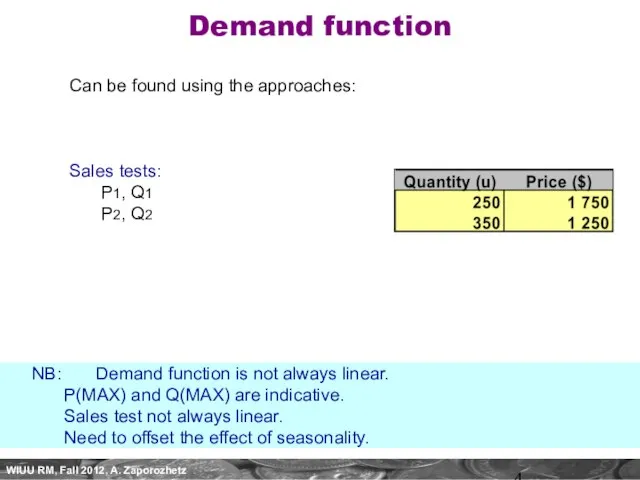

Слайд 4Demand function

Can be found using the approaches:

Sales tests:

P1, Q1

P2, Q2

NB: Demand

function is not always linear.

P(MAX) and Q(MAX) are indicative.

Sales test not always linear.

Need to offset the effect of seasonality.

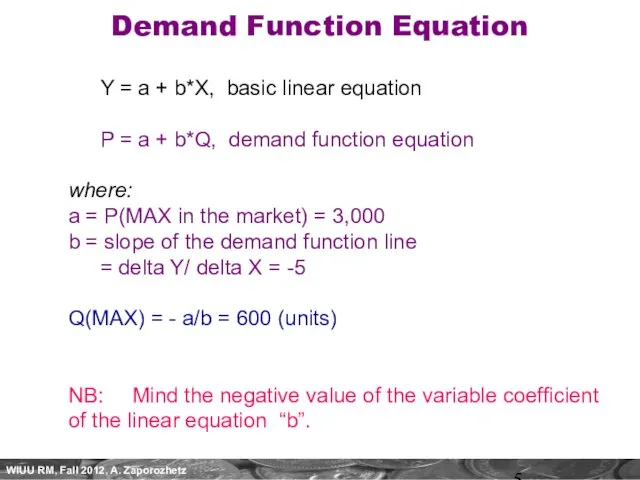

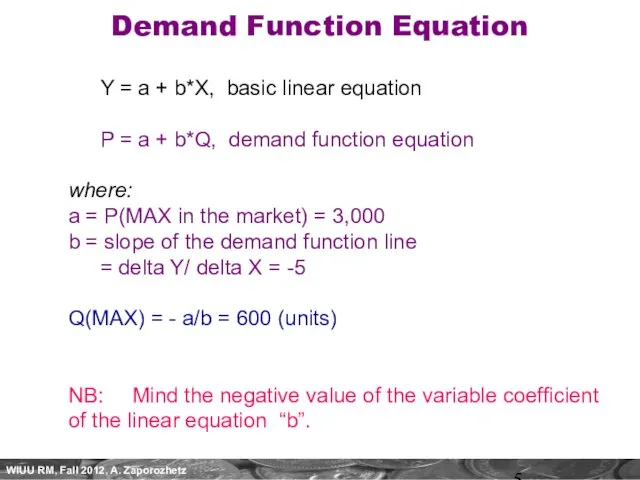

Слайд 5Demand Function Equation

Y = a + b*X, basic linear equation

P = a

+ b*Q, demand function equation

where:

a = P(MAX in the market) = 3,000

b = slope of the demand function line

= delta Y/ delta X = -5

Q(MAX) = - a/b = 600 (units)

NB: Mind the negative value of the variable coefficient of the linear equation “b”.

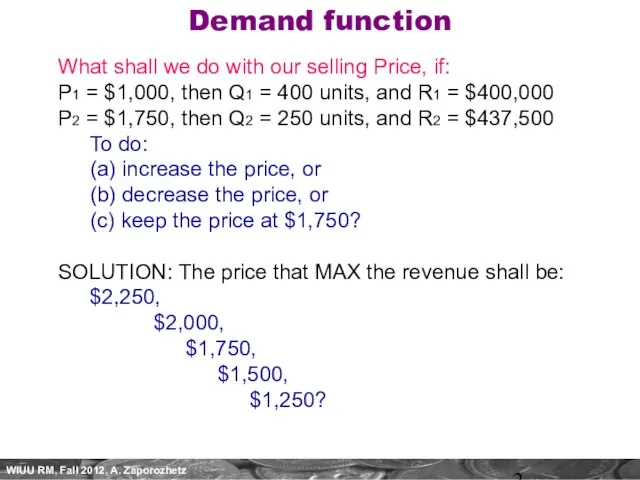

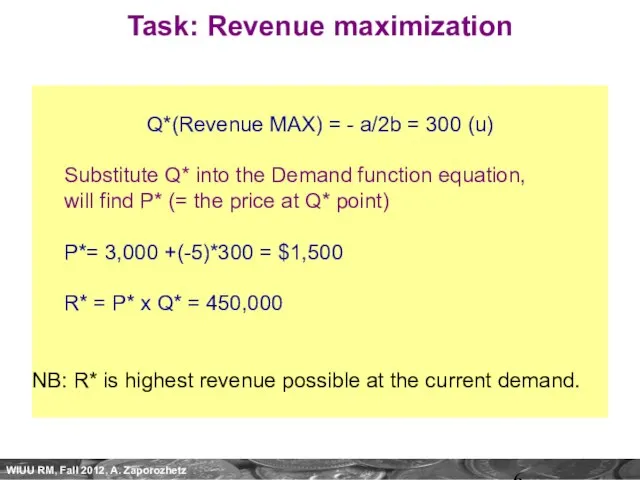

Слайд 6Task: Revenue maximization

Q*(Revenue MAX) = - a/2b = 300 (u)

Substitute Q* into

the Demand function equation,

will find P* (= the price at Q* point)

P*= 3,000 +(-5)*300 = $1,500

R* = P* x Q* = 450,000

NB: R* is highest revenue possible at the current demand.

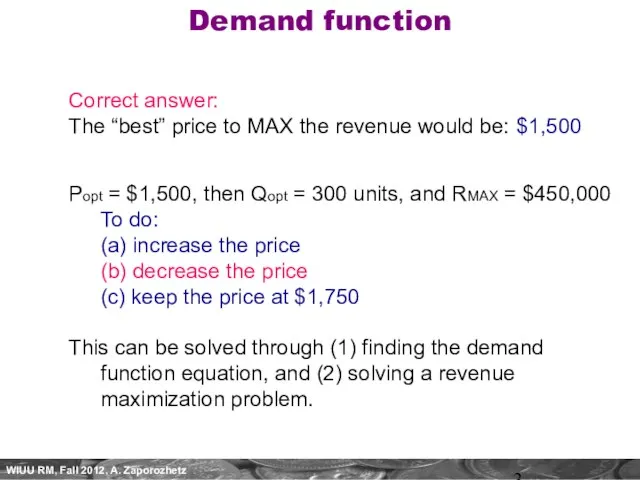

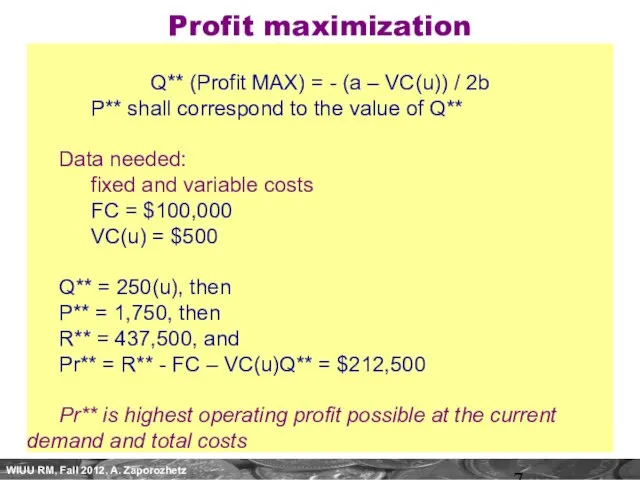

Слайд 7Profit maximization

Q** (Profit MAX) = - (a – VC(u)) / 2b

P** shall

correspond to the value of Q**

Data needed:

fixed and variable costs

FC = $100,000

VC(u) = $500

Q** = 250(u), then

P** = 1,750, then

R** = 437,500, and

Pr** = R** - FC – VC(u)Q** = $212,500

Pr** is highest operating profit possible at the current demand and total costs

Конкурентная стратегия

Конкурентная стратегия Экстрасенсорное общение

Экстрасенсорное общение Презентация без названия

Презентация без названия Дистанционный конкурс на лучший школьный инновационный проект «Инновации рождаются в школе» НП «Телешкола»

Дистанционный конкурс на лучший школьный инновационный проект «Инновации рождаются в школе» НП «Телешкола» Повторение понятий

Повторение понятий Михаил Врубель Ведь женщины

Михаил Врубель Ведь женщины Бережно ласкающий гель, обволакивающий аромат, заботливая мягкость. Что еще нужно, чтобы почувствовать легкость. Окунуться в мир б

Бережно ласкающий гель, обволакивающий аромат, заботливая мягкость. Что еще нужно, чтобы почувствовать легкость. Окунуться в мир б Базы данных EBSCO по бизнесу и экономике Андрей Соколов

Базы данных EBSCO по бизнесу и экономике Андрей Соколов Культура Древнего Египта

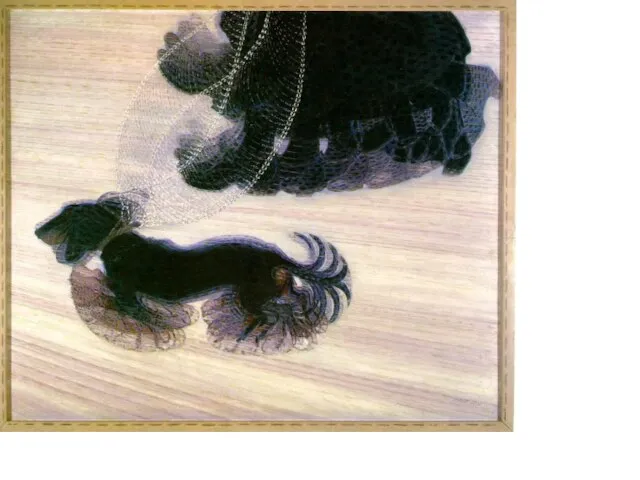

Культура Древнего Египта Путешествие в мир искусства

Путешествие в мир искусства Lektsia_1

Lektsia_1 Почему важно помнить героев, их подвиги

Почему важно помнить героев, их подвиги Литературное чтение

Литературное чтение Как подготовиться к ЭССЕ?

Как подготовиться к ЭССЕ? Акулы и человек

Акулы и человек Фильтры/кондиционеры охлаждающей жидкости

Фильтры/кондиционеры охлаждающей жидкости Портфолио методического объединения учителей информатики и ИКТ за 2011-2012 учебный год Руководитель МО – Заломина Е.Ю.

Портфолио методического объединения учителей информатики и ИКТ за 2011-2012 учебный год Руководитель МО – Заломина Е.Ю. Спинной мозг, структуры и функции

Спинной мозг, структуры и функции  Плавающие подсвечники

Плавающие подсвечники Проблема компенсации в специальной психологии

Проблема компенсации в специальной психологии Виктор Петрович Астафьев

Виктор Петрович Астафьев Презентация на тему Общие закономерности развития науки

Презентация на тему Общие закономерности развития науки  Презентация на тему Измерение пространства и времени

Презентация на тему Измерение пространства и времени Презентация на тему Простые вещества металлы 8 класс

Презентация на тему Простые вещества металлы 8 класс  Прибыль. Финансы и кредит

Прибыль. Финансы и кредит Международный день птиц

Международный день птиц Сертификация QA

Сертификация QA “Внутренний контроль качества образования. Поиск оптимальной модели. Опыт работы по организации внутришкольного контроля ”

“Внутренний контроль качества образования. Поиск оптимальной модели. Опыт работы по организации внутришкольного контроля ”