Содержание

- 2. Is the banking system in Russia fully developed? Bank services in Russia: theory and fact. Do

- 3. The differences lie in the limitations for the private sector and in prolonging bank operations for

- 4. Banks are the most important link in the world of money.

- 5. Almost everyone in the world uses or has used banking services.

- 6. All banking services can be divided into specific and nonspecific services. Specific services include:

- 7. Deposit operations are the operations of placing clients’ money into the bank on deposit. While keeping

- 8. Credit operations are the operations of giving loans to bank clients and receiving, in exchange interest

- 9. Banks are the biggest center of credit.

- 10. Payment operations by banks can be fulfilled in cash or in transfer payments. Banks can open

- 11. All other services are included in non-traditional services. There are many of them, such as: intermediary

- 12. In the situation of shortage, banks have had to decide how to raise their money supply.

- 13. The Russian banking system:

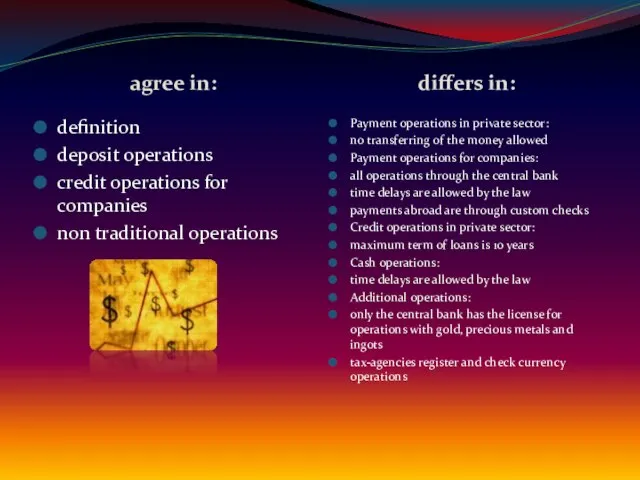

- 14. agree in: differs in: definition deposit operations credit operations for companies non traditional operations Payment operations

- 15. The Russian money institute is called a banking system, so it has to conform to the

- 16. The government should review its banking laws if it really wants to see a stable economy

- 18. Скачать презентацию

Компьютерная зависимость

Компьютерная зависимость Форум сельской молодежи Центрального Федерального округа

Форум сельской молодежи Центрального Федерального округа Участникам ЕГЭ-2011

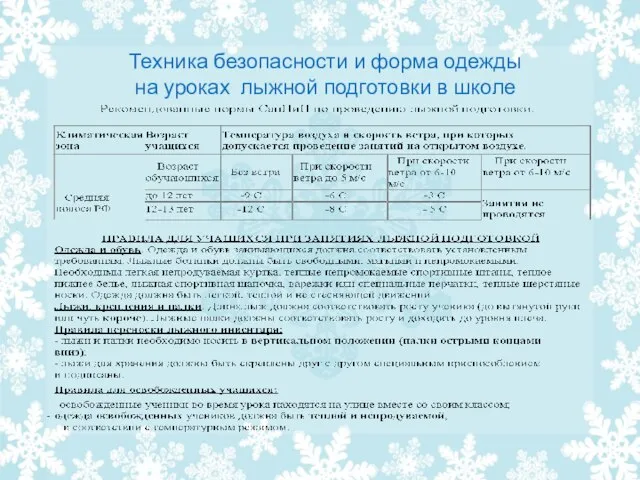

Участникам ЕГЭ-2011 Техника безопасности и форма одежды на уроках лыжной подготовки в школе

Техника безопасности и форма одежды на уроках лыжной подготовки в школе Наблюдения за погодой природные явления Сила и направление ветра Урок-обобщение

Наблюдения за погодой природные явления Сила и направление ветра Урок-обобщение Гражданская война И Иностранная интервенция

Гражданская война И Иностранная интервенция Save the Earth

Save the Earth Миграция нефти и газа в земной коре

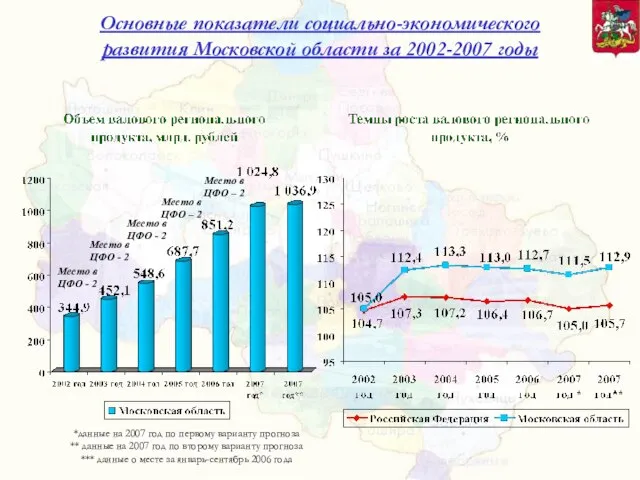

Миграция нефти и газа в земной коре  Основные показатели социально-экономического развития Московской области за 2002-2007 годы

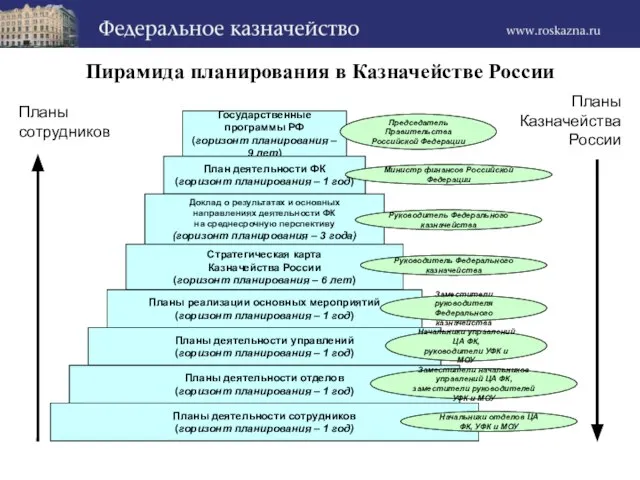

Основные показатели социально-экономического развития Московской области за 2002-2007 годы Пирамида планирования в Казначействе России

Пирамида планирования в Казначействе России Исследовательская работа по теме:Экологические проблемы олимпиады в Сочи и пути их решения

Исследовательская работа по теме:Экологические проблемы олимпиады в Сочи и пути их решения «Заглядинская средняя общеобразовательная школа»

«Заглядинская средняя общеобразовательная школа» Классический дарвинизм

Классический дарвинизм Социологические исследования как источник информированного принятия решения в области реализации прав ребенка

Социологические исследования как источник информированного принятия решения в области реализации прав ребенка DTX Series CableAnalyzer™

DTX Series CableAnalyzer™ « Сколько весит здоровье ученика?» Составили: ученики 3-б класса Руководитель: Просвирнина Н.П учитель начальных классов МОУ-СОШ№2

« Сколько весит здоровье ученика?» Составили: ученики 3-б класса Руководитель: Просвирнина Н.П учитель начальных классов МОУ-СОШ№2 Презентация на тему Рождество обычаи и традиции

Презентация на тему Рождество обычаи и традиции Спортивно-оздоровительный клуб Аздобромир Пермь

Спортивно-оздоровительный клуб Аздобромир Пермь Market Equilibrium

Market Equilibrium Презентация по вкусовым товарам.

Презентация по вкусовым товарам. Предложение по проведению медиакампании для номинантов «Национальной Цифровой премии» «Золотой» пакет

Предложение по проведению медиакампании для номинантов «Национальной Цифровой премии» «Золотой» пакет Рембрандт Ван Рейн

Рембрандт Ван Рейн Выразительные возможности аппликации _Осенний листопад_. (2)

Выразительные возможности аппликации _Осенний листопад_. (2) Правописание безударных окончаний имен прилагательных единственного числа

Правописание безударных окончаний имен прилагательных единственного числа Никита Дубенцов1

Никита Дубенцов1 «ТЕХНОЛОГИЯ ПРОФЕССИОНАЛЬНОЙ КАРЬЕРЫ. ЭФФЕКТИВНОЕ ПОВЕДЕНИЕ НА РЫНКЕ ТРУДА»

«ТЕХНОЛОГИЯ ПРОФЕССИОНАЛЬНОЙ КАРЬЕРЫ. ЭФФЕКТИВНОЕ ПОВЕДЕНИЕ НА РЫНКЕ ТРУДА» Сказочный образ

Сказочный образ Діяльність НЕФКО в Україні. - презентация

Діяльність НЕФКО в Україні. - презентация