Содержание

- 2. Lecture 3. Bond Valuation

- 3. Definition of Bond Terminology & Characteristics of Bonds Bond Valuation Premium Bonds vs Discount Bonds Yield

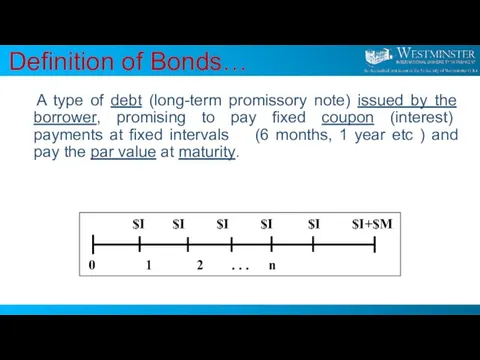

- 4. A type of debt (long-term promissory note) issued by the borrower, promising to pay fixed coupon

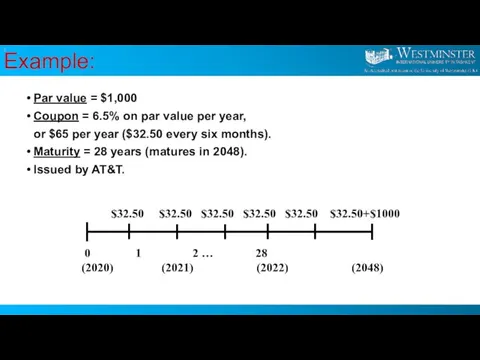

- 5. Par value = $1,000 Coupon = 6.5% on par value per year, or $65 per year

- 6. Bonds

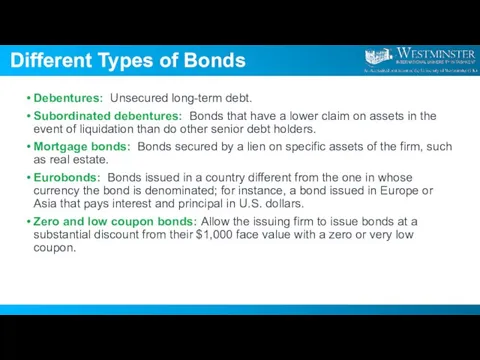

- 7. Different Types of Bonds Debentures: Unsecured long-term debt. Subordinated debentures: Bonds that have a lower claim

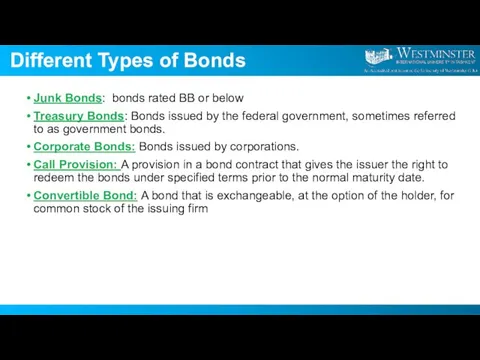

- 8. Different Types of Bonds Junk Bonds: bonds rated BB or below Treasury Bonds: Bonds issued by

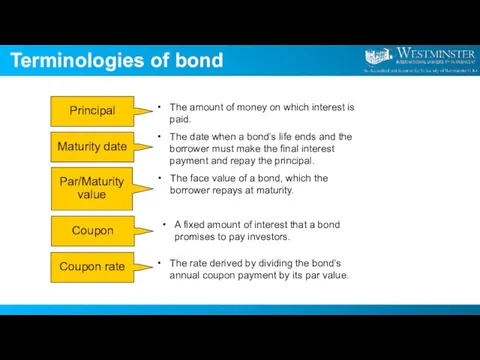

- 9. Terminologies of bond

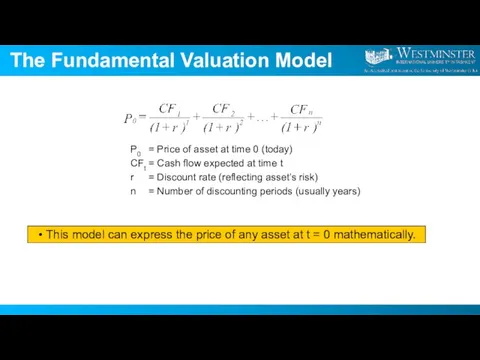

- 10. The Fundamental Valuation Model This model can express the price of any asset at t =

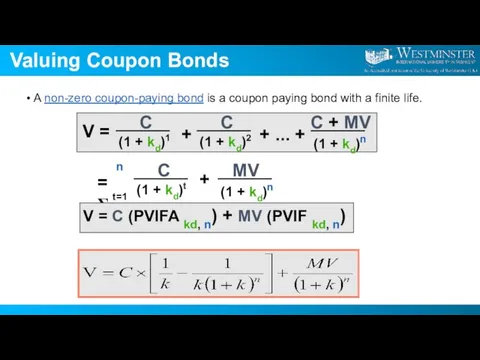

- 11. Valuing Coupon Bonds A non-zero coupon-paying bond is a coupon paying bond with a finite life.

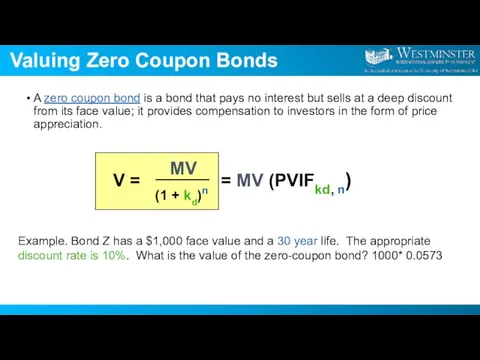

- 12. Valuing Zero Coupon Bonds A zero coupon bond is a bond that pays no interest but

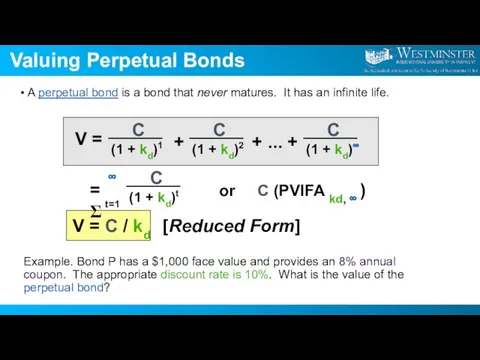

- 13. Valuing Perpetual Bonds A perpetual bond is a bond that never matures. It has an infinite

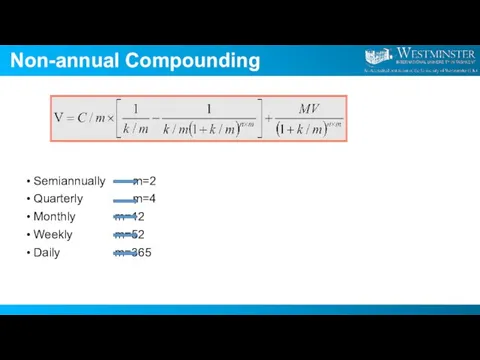

- 14. Non-annual Compounding Semiannually m=2 Quarterly m=4 Monthly m=12 Weekly m=52 Daily m=365

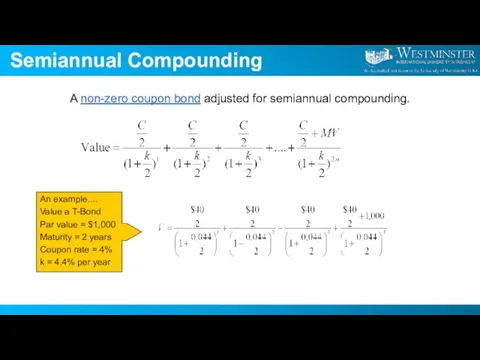

- 15. Semiannual Compounding A non-zero coupon bond adjusted for semiannual compounding. An example.... Value a T-Bond Par

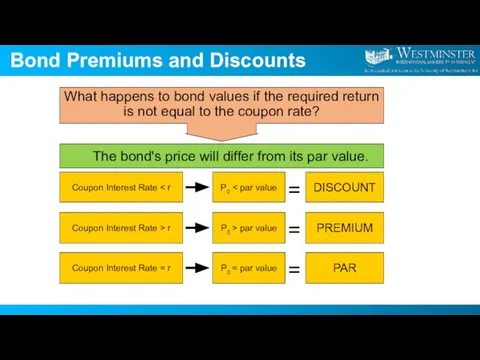

- 16. Bond Premiums and Discounts What happens to bond values if the required return is not equal

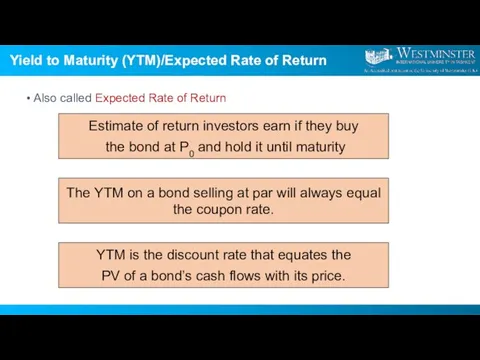

- 17. Yield to Maturity (YTM)/Expected Rate of Return Also called Expected Rate of Return Estimate of return

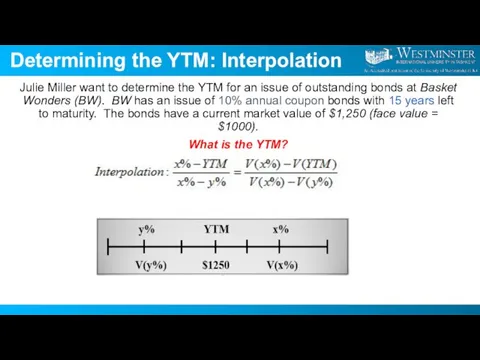

- 18. Determining the YTM: Interpolation Julie Miller want to determine the YTM for an issue of outstanding

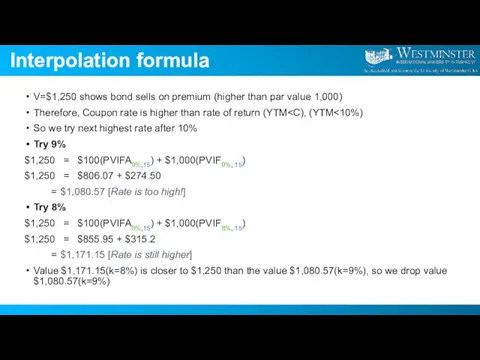

- 19. Interpolation formula V=$1,250 shows bond sells on premium (higher than par value 1,000) Therefore, Coupon rate

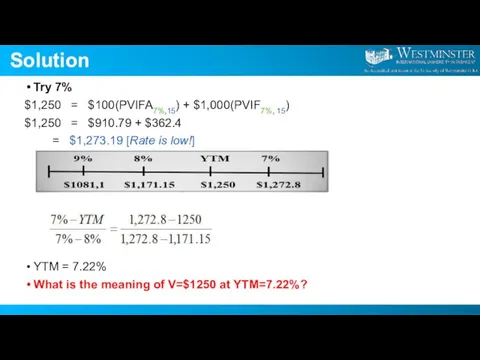

- 20. Solution Try 7% $1,250 = $100(PVIFA7%,15) + $1,000(PVIF7%, 15) $1,250 = $910.79 + $362.4 = $1,273.19

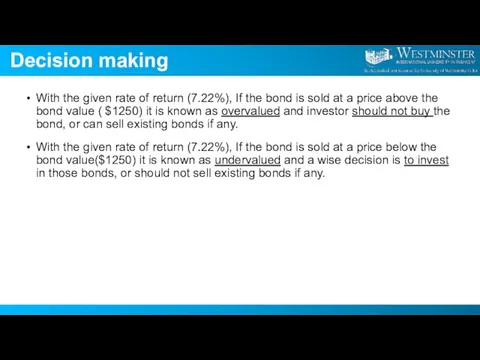

- 21. Decision making With the given rate of return (7.22%), If the bond is sold at a

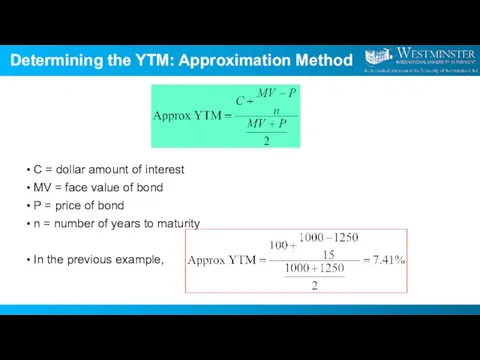

- 22. Determining the YTM: Approximation Method C = dollar amount of interest MV = face value of

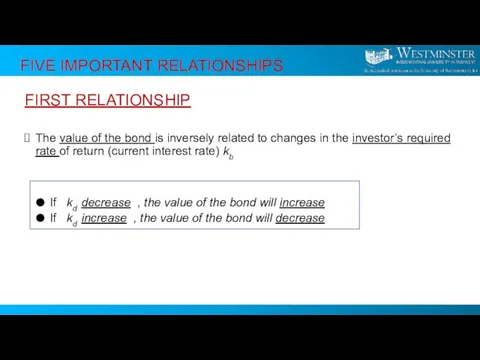

- 23. FIRST RELATIONSHIP The value of the bond is inversely related to changes in the investor’s required

- 24. FIVE IMPORTANT RELATIONSHIPS SECOND RELATIONSHIP The market value (Po) will be less than the par value

- 25. FIVE IMPORTANT RELATIONSHIPS THIRD RELATIONSHIP As the maturity approaches, the market value of the bond approaches

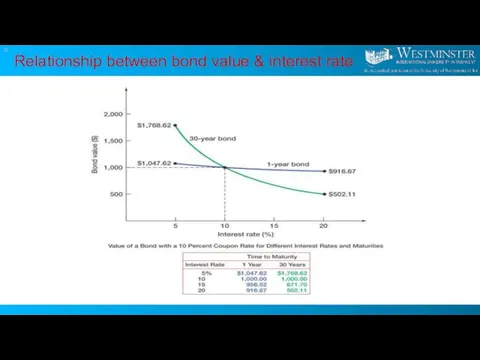

- 26. Relationship between bond value & interest rate

- 27. FIVE IMPORTANT RELATIONSHIPS FIFTH RELATIONSHIP The sensitivity of a bond’s value to changing - depends on:

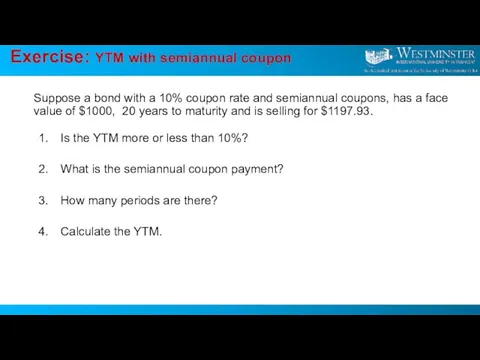

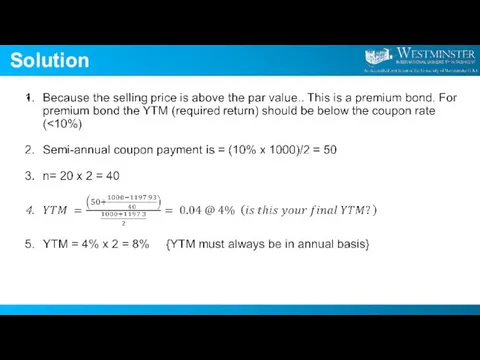

- 28. Exercise: YTM with semiannual coupon Suppose a bond with a 10% coupon rate and semiannual coupons,

- 29. Solution

- 31. Скачать презентацию

Соотношения между сторонами и углами в прямоугольном треугольнике

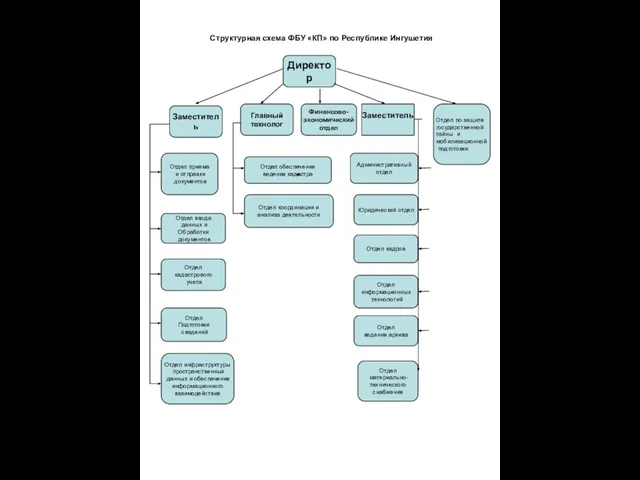

Соотношения между сторонами и углами в прямоугольном треугольнике Директор

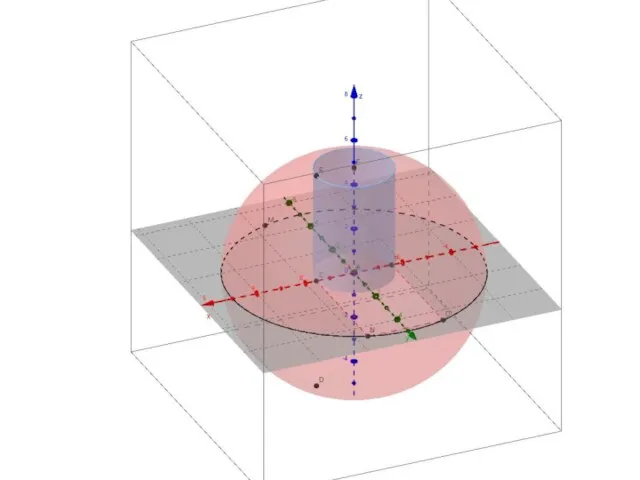

Директор Шар с 3 осями

Шар с 3 осями ОРУЖИЕ ПОБЕДЫ

ОРУЖИЕ ПОБЕДЫ Методы обучения и воспитания

Методы обучения и воспитания Реформирование охраны труда в России - переход к управлению профессиональными рисками в системе управления охраной труда

Реформирование охраны труда в России - переход к управлению профессиональными рисками в системе управления охраной труда Футуризм и Супрематизм, в живописи

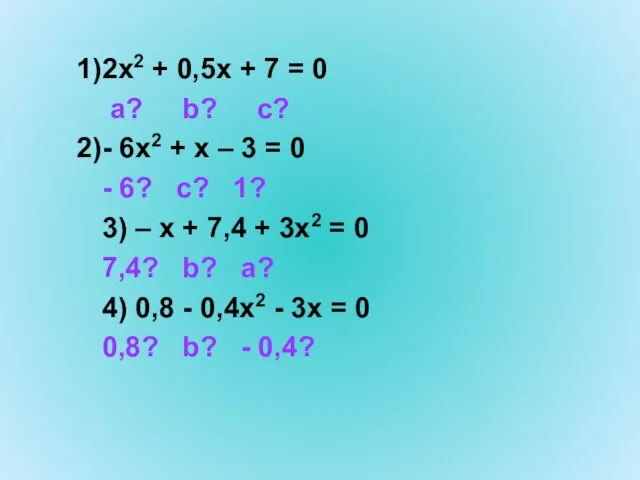

Футуризм и Супрематизм, в живописи 2х2 + 0,5х + 7 = 0 а? b? с? - 6х2 + х – 3 = 0 - 6? с? 1? 3) – х + 7,4 + 3х2 = 0 7,4? b? а? 4) 0,8 - 0,4х2 - 3х = 0 0,8? b? - 0,4?

2х2 + 0,5х + 7 = 0 а? b? с? - 6х2 + х – 3 = 0 - 6? с? 1? 3) – х + 7,4 + 3х2 = 0 7,4? b? а? 4) 0,8 - 0,4х2 - 3х = 0 0,8? b? - 0,4? ТЕПЛОВИЙ БАЛАНС

ТЕПЛОВИЙ БАЛАНС Краны пролётного типа

Краны пролётного типа Web-аналітика: 3 найважливіші цифри

Web-аналітика: 3 найважливіші цифри преза

преза Конституция Российской Федерации. Что такое Конституция?

Конституция Российской Федерации. Что такое Конституция? Виды и формы бизнеса

Виды и формы бизнеса CRI/CRIN

CRI/CRIN Презентация Microsoft PowerPoint

Презентация Microsoft PowerPoint Энергетика и ожирение

Энергетика и ожирение ВИЧ И ПРАВА ЧЕЛОВЕКА

ВИЧ И ПРАВА ЧЕЛОВЕКА Летний читательский чемпионат в Волгоградской областной детской библиотеке

Летний читательский чемпионат в Волгоградской областной детской библиотеке Напишите мне письмо!

Напишите мне письмо! Финансовая грамотность в информационно – библиотечной среде

Финансовая грамотность в информационно – библиотечной среде Презентация на тему Причуды истории (психоактивные вещества)

Презентация на тему Причуды истории (психоактивные вещества) БОЛЬШИЕ ДЕНЬГИ В ВАШЕЙ ЖИЗНИ, СЕТЕВОЙ МАРКЕТИНГ

БОЛЬШИЕ ДЕНЬГИ В ВАШЕЙ ЖИЗНИ, СЕТЕВОЙ МАРКЕТИНГ Использование ассоциаций на уроке немецкого

Использование ассоциаций на уроке немецкого Развитие телекоммуникационной инфраструктуры сферы образования (ТИСО)

Развитие телекоммуникационной инфраструктуры сферы образования (ТИСО) А.С.ПушкинПеснь о вещем Олеге

А.С.ПушкинПеснь о вещем Олеге My land

My land Твардовский "Рассказ танкиста" 5 класс

Твардовский "Рассказ танкиста" 5 класс