Содержание

- 2. What is Capital Budgeting (CB)? The process of identifying, analyzing, and selecting investment projects whose cash

- 3. The Capital Budgeting Process Generate investment proposals consistent with the firm’s strategic objectives. Estimate after-tax cash

- 4. The Capital Budgeting Process Select projects based on a value-maximizing acceptance criterion. Reevaluate implemented investment projects

- 5. Investment Project Proposals 1. New products or product modifications Replacement of existing equipment or buildings Real

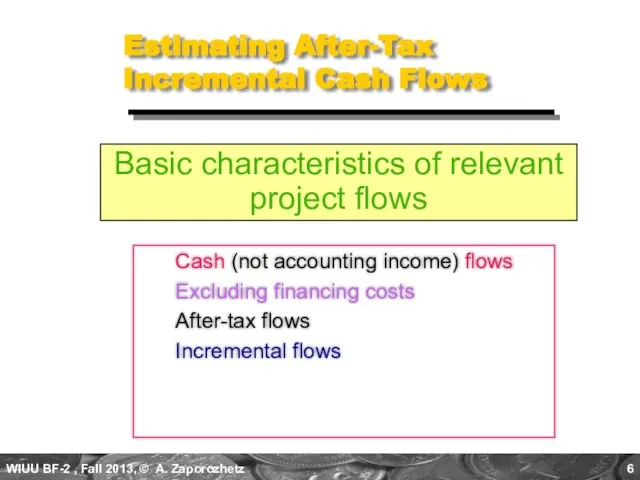

- 6. Estimating After-Tax Incremental Cash Flows Cash (not accounting income) flows Excluding financing costs After-tax flows Incremental

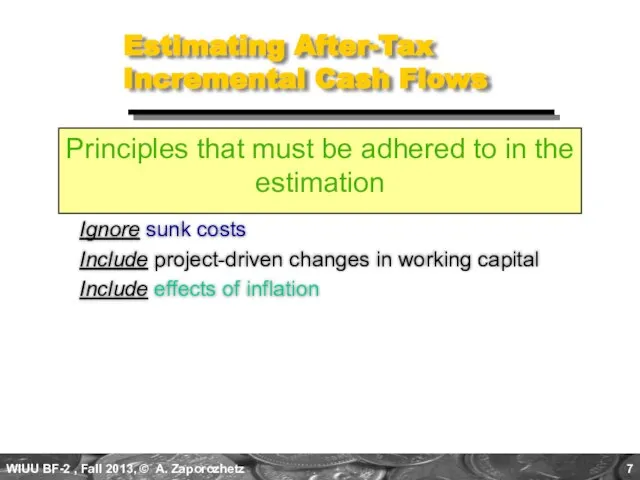

- 7. Estimating After-Tax Incremental Cash Flows Ignore sunk costs Include project-driven changes in working capital Include effects

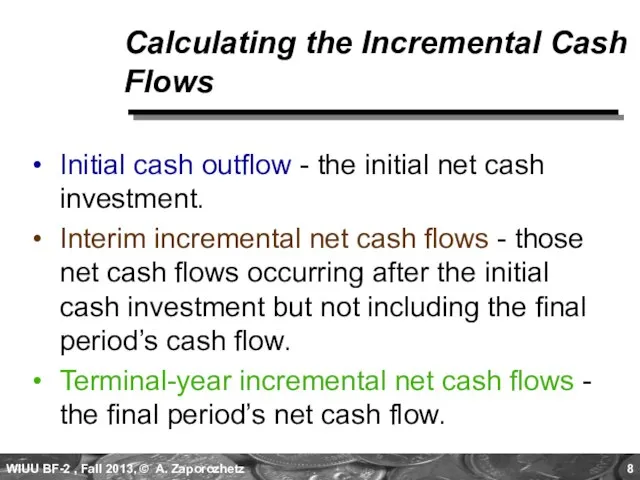

- 8. Calculating the Incremental Cash Flows Initial cash outflow - the initial net cash investment. Interim incremental

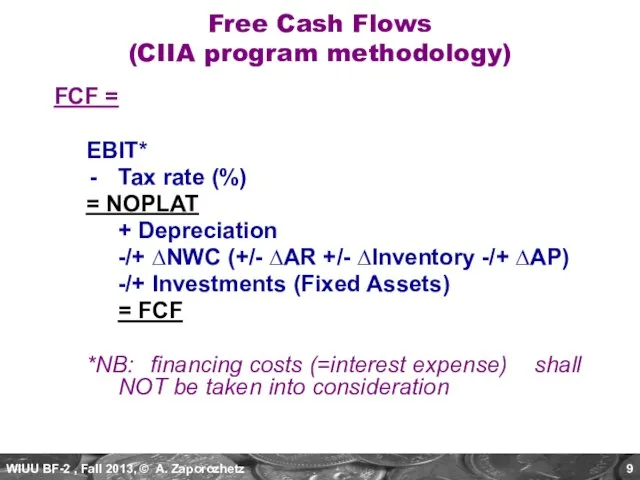

- 9. FCF = EBIT* Tax rate (%) = NOPLAT + Depreciation -/+ ∆NWC (+/- ∆AR +/- ∆Inventory

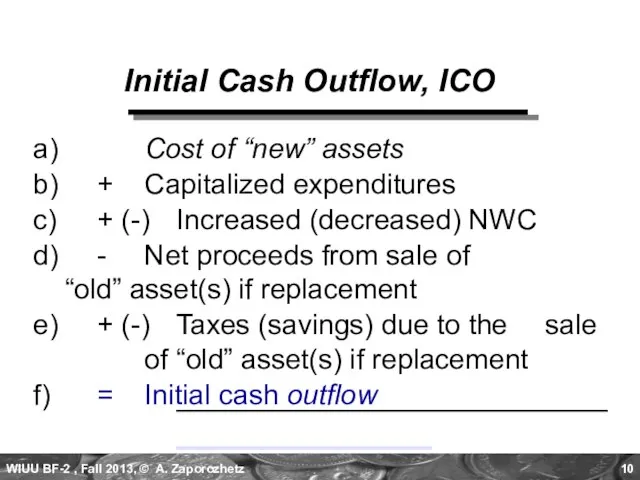

- 10. Initial Cash Outflow, ICO a) Cost of “new” assets b) + Capitalized expenditures c) + (-)

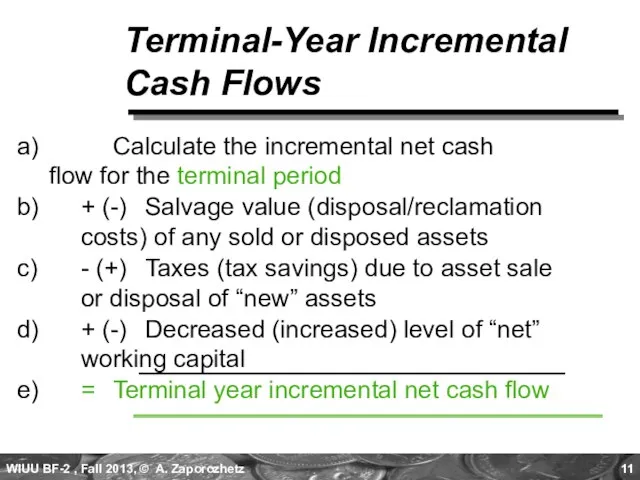

- 11. Terminal-Year Incremental Cash Flows a) Calculate the incremental net cash flow for the terminal period b)

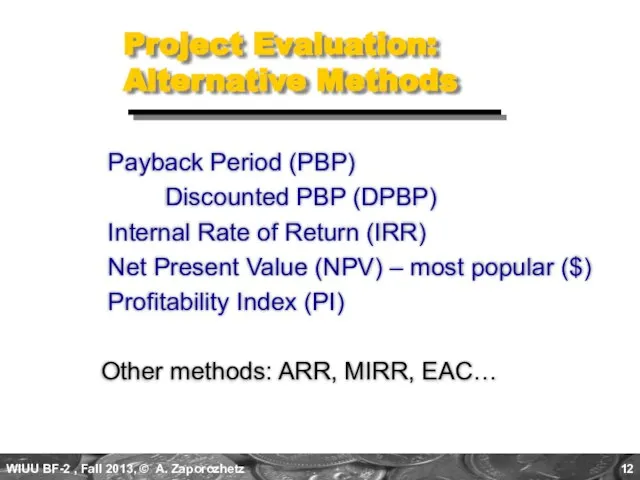

- 12. Project Evaluation: Alternative Methods Payback Period (PBP) Discounted PBP (DPBP) Internal Rate of Return (IRR) Net

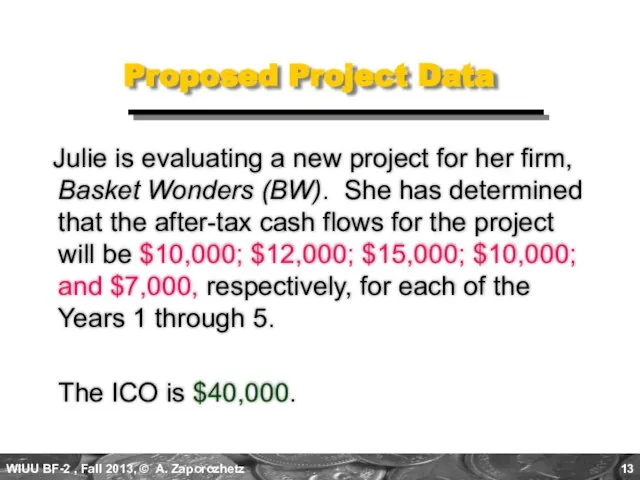

- 13. Proposed Project Data Julie is evaluating a new project for her firm, Basket Wonders (BW). She

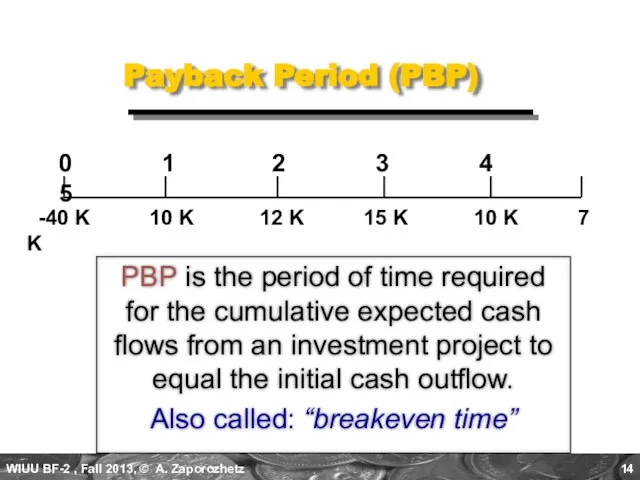

- 14. Payback Period (PBP) PBP is the period of time required for the cumulative expected cash flows

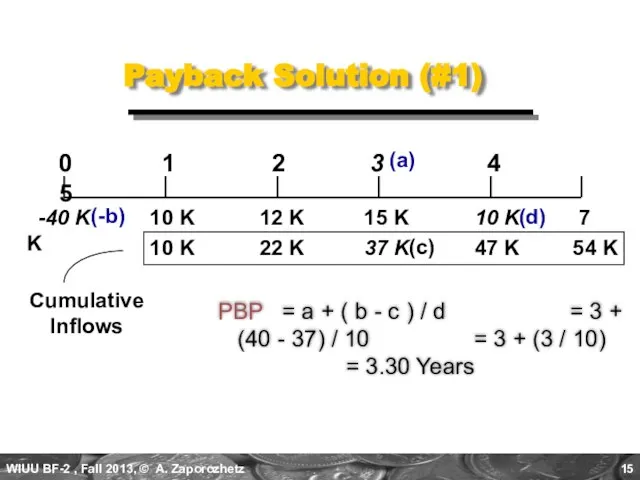

- 15. (c) 10 K 22 K 37 K 47 K 54 K Payback Solution (#1) PBP =

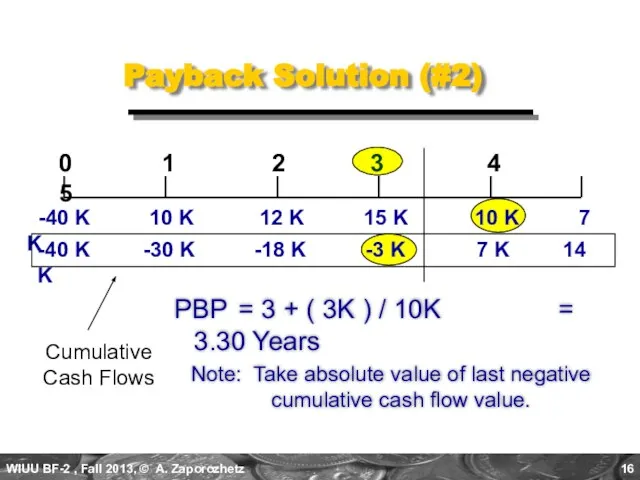

- 16. Payback Solution (#2) PBP = 3 + ( 3K ) / 10K = 3.30 Years Note:

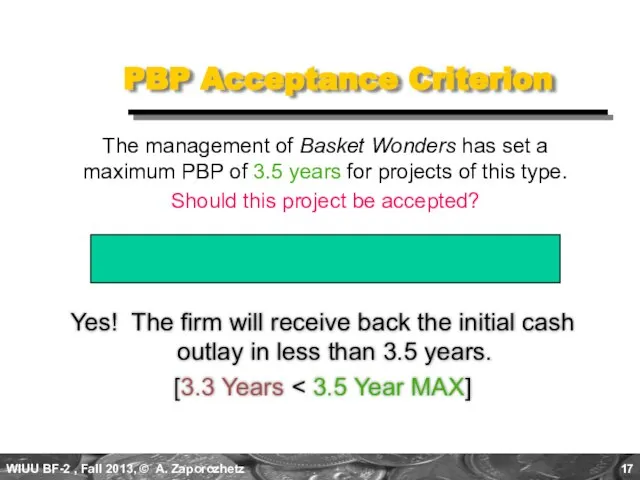

- 17. PBP Acceptance Criterion Yes! The firm will receive back the initial cash outlay in less than

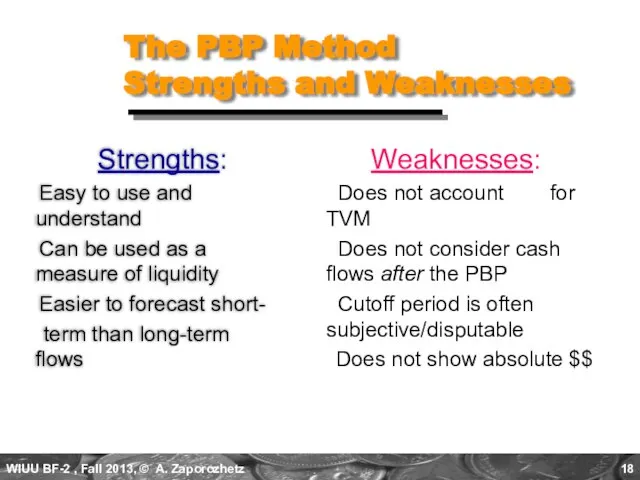

- 18. The PBP Method Strengths and Weaknesses Strengths: Easy to use and understand Can be used as

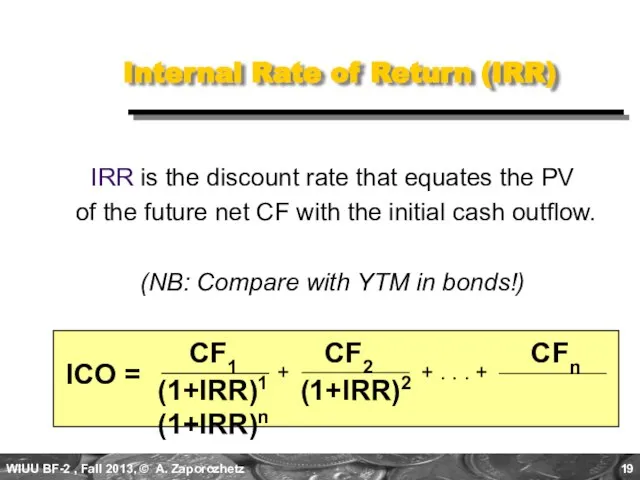

- 19. Internal Rate of Return (IRR) IRR is the discount rate that equates the PV of the

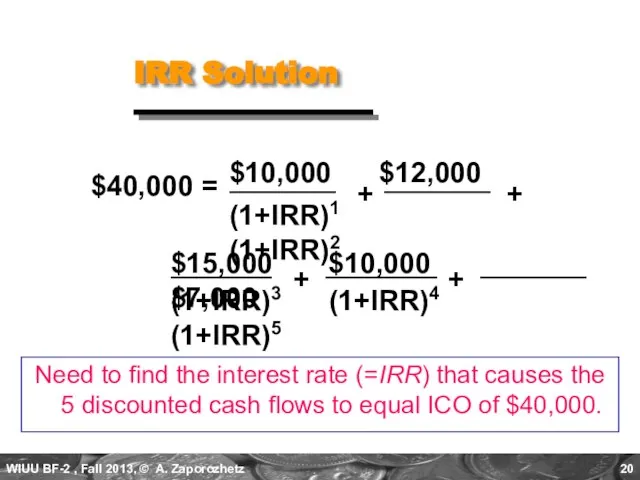

- 20. $15,000 $10,000 $7,000 IRR Solution $10,000 $12,000 (1+IRR)1 (1+IRR)2 Need to find the interest rate (=IRR)

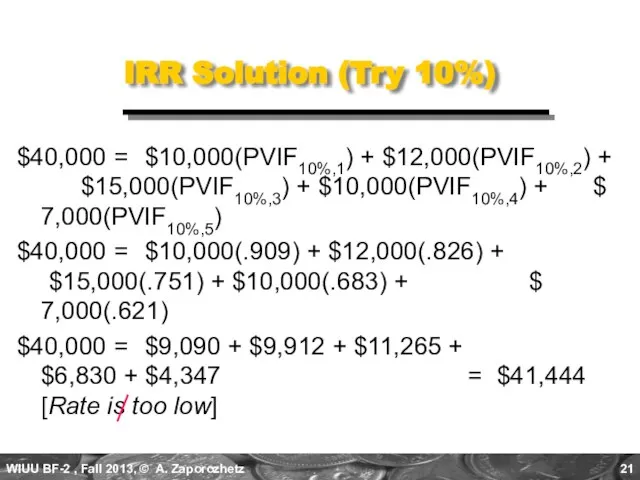

- 21. IRR Solution (Try 10%) $40,000 = $10,000(PVIF10%,1) + $12,000(PVIF10%,2) + $15,000(PVIF10%,3) + $10,000(PVIF10%,4) + $ 7,000(PVIF10%,5)

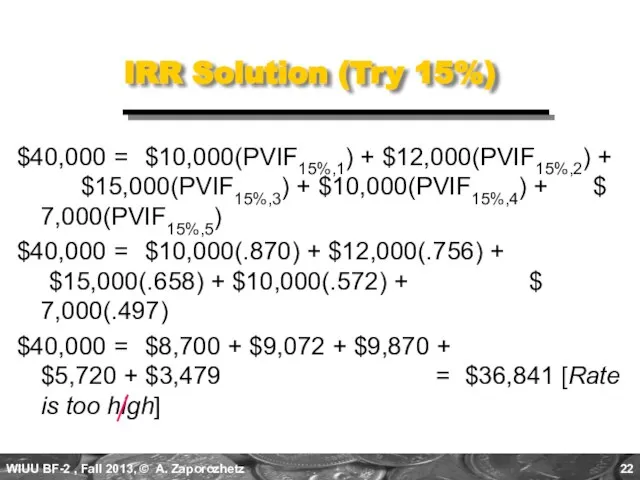

- 22. IRR Solution (Try 15%) $40,000 = $10,000(PVIF15%,1) + $12,000(PVIF15%,2) + $15,000(PVIF15%,3) + $10,000(PVIF15%,4) + $ 7,000(PVIF15%,5)

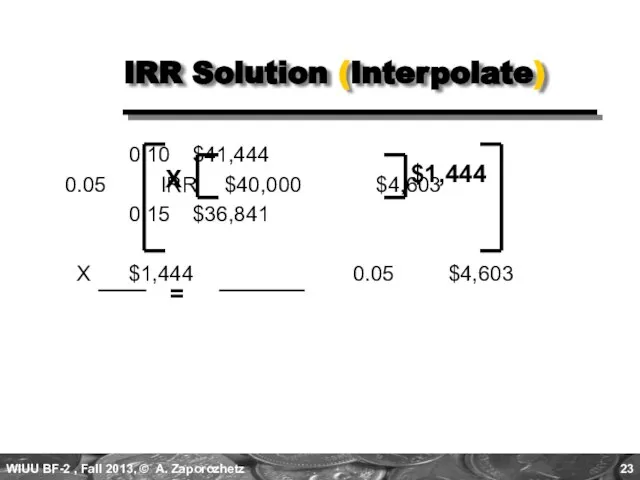

- 23. 0.10 $41,444 0.05 IRR $40,000 $4,603 0.15 $36,841 X $1,444 0.05 $4,603 IRR Solution (Interpolate) $1,444

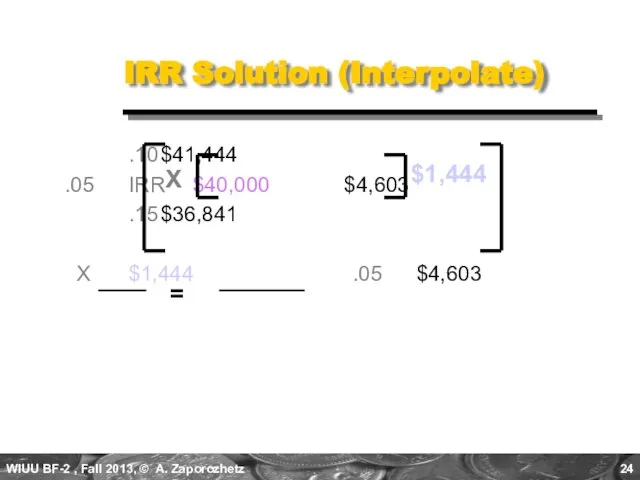

- 24. .10 $41,444 .05 IRR $40,000 $4,603 .15 $36,841 X $1,444 .05 $4,603 IRR Solution (Interpolate) $1,444

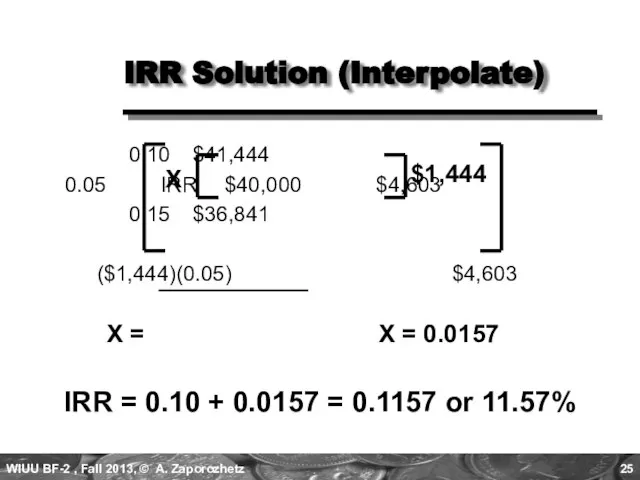

- 25. 0.10 $41,444 0.05 IRR $40,000 $4,603 0.15 $36,841 ($1,444)(0.05) $4,603 IRR Solution (Interpolate) $1,444 X X

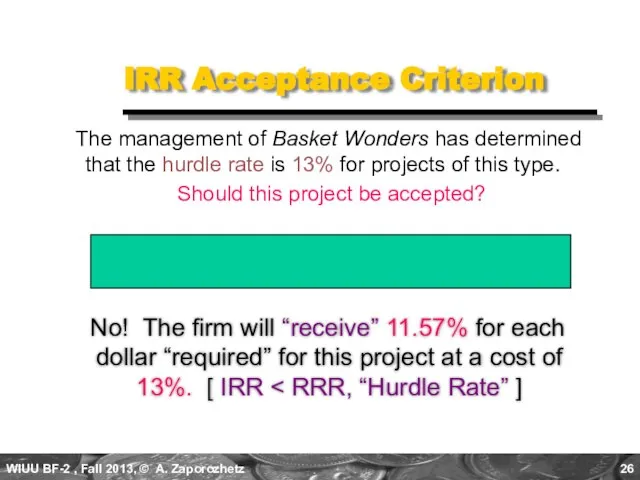

- 26. IRR Acceptance Criterion No! The firm will “receive” 11.57% for each dollar “required” for this project

- 27. IRR Strengths and Weaknesses Strengths: Accounts for TVM Considers all the cash flows Less subjectivity Weaknesses:

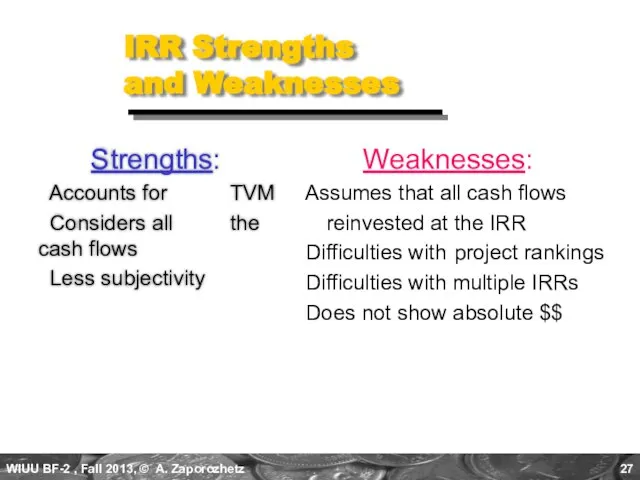

- 28. Net Present Value (NPV) NPV is the present value of an investment project’s net DCFs minus

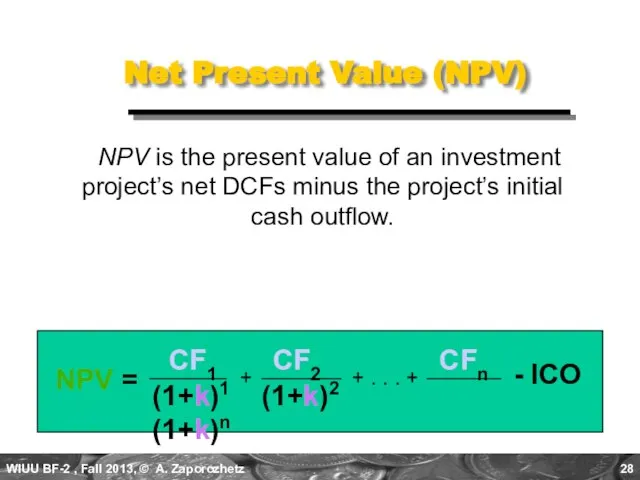

- 29. Basket Wonders has determined that the appropriate discount rate (k) for this project is 13%. $10,000

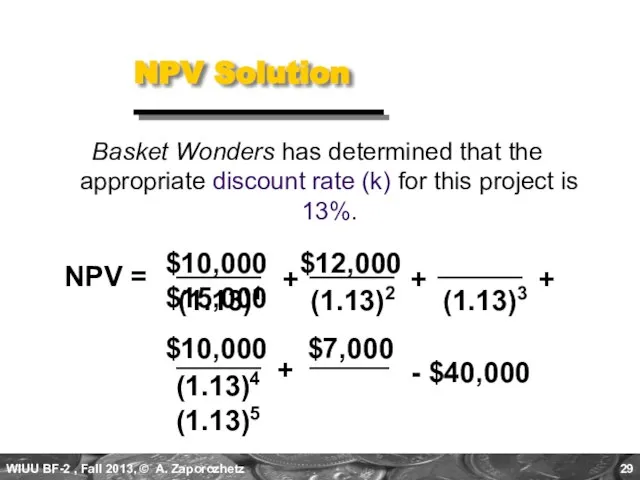

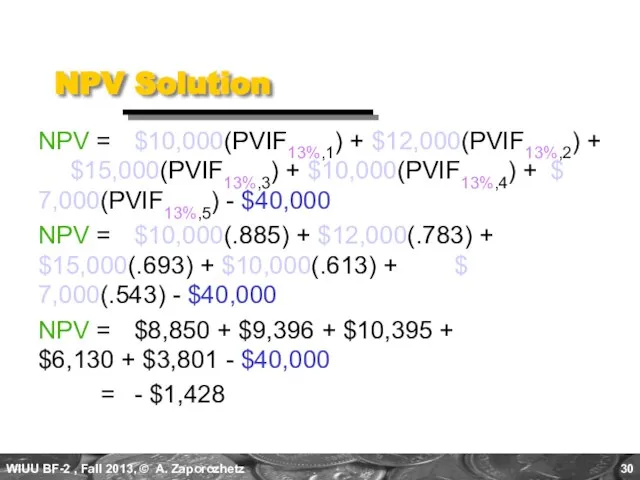

- 30. NPV Solution NPV = $10,000(PVIF13%,1) + $12,000(PVIF13%,2) + $15,000(PVIF13%,3) + $10,000(PVIF13%,4) + $ 7,000(PVIF13%,5) - $40,000

- 31. NPV Acceptance Criterion No! The NPV is negative. This means that the project is reducing shareholder

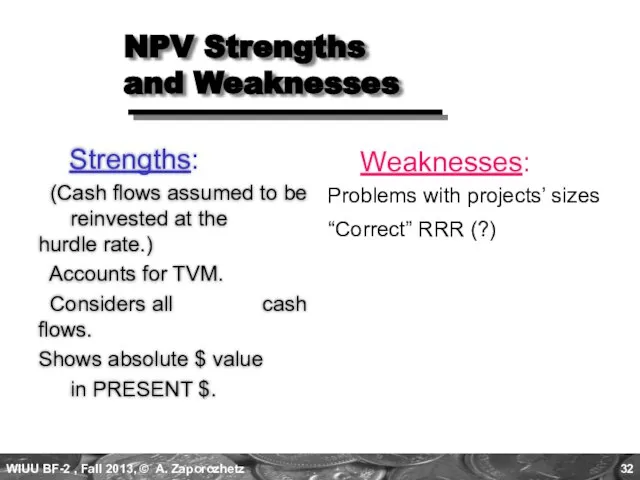

- 32. NPV Strengths and Weaknesses Strengths: (Cash flows assumed to be reinvested at the hurdle rate.) Accounts

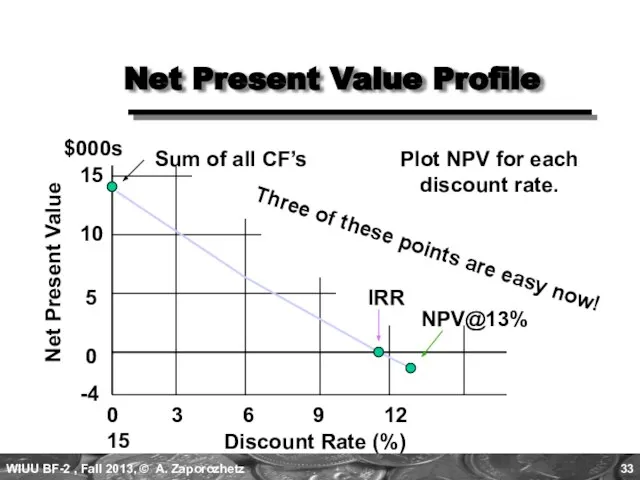

- 33. Net Present Value Profile Discount Rate (%) 0 3 6 9 12 15 IRR NPV@13% Sum

- 34. Profitability Index (PI) PI is the ratio of the present value of a project’s future net

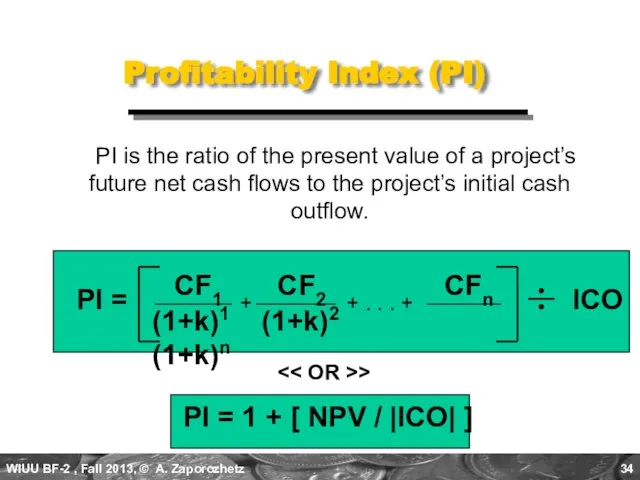

- 35. PI Acceptance Criterion No! The PI is less than 1.00. This means that the project is

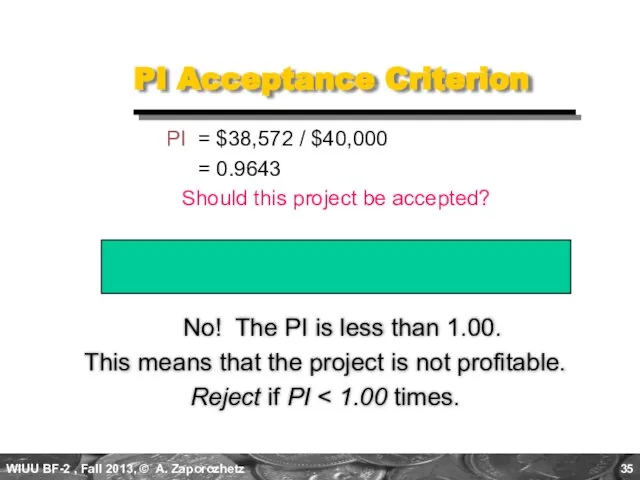

- 36. PI Strengths and Weaknesses Strengths: Same as NPV Allows for comparison of different scale and lifetime

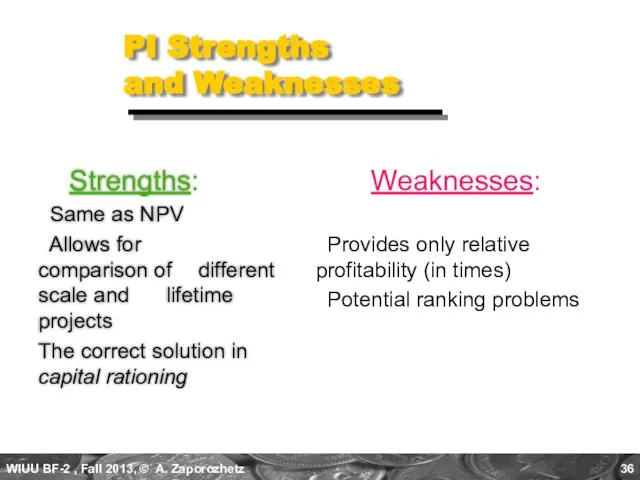

- 37. Evaluation Summary Basket Wonders Independent Project

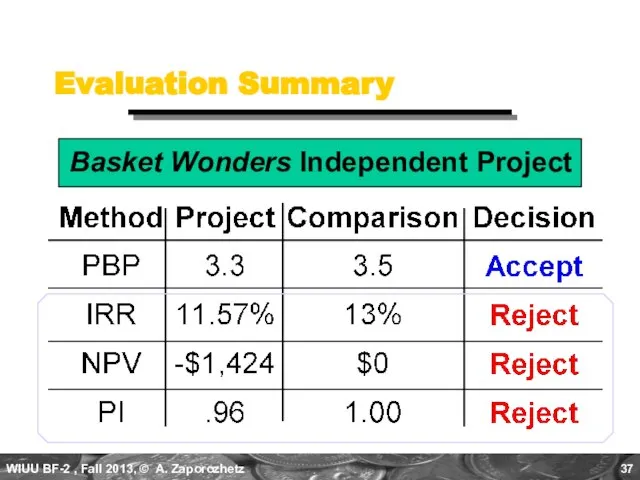

- 38. Other Project Relationships Mutually Exclusive - A project whose acceptance precludes the acceptance of one or

- 39. Potential Problems Under Mutual Exclusivity A. Scale of Investment B. Cash-flow Pattern C. Project Life Ranking

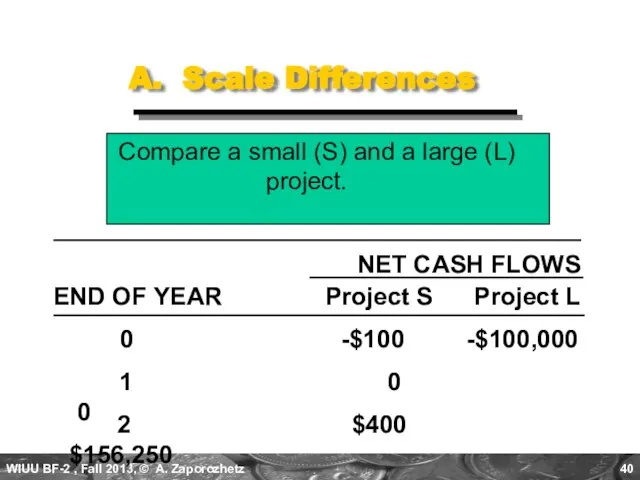

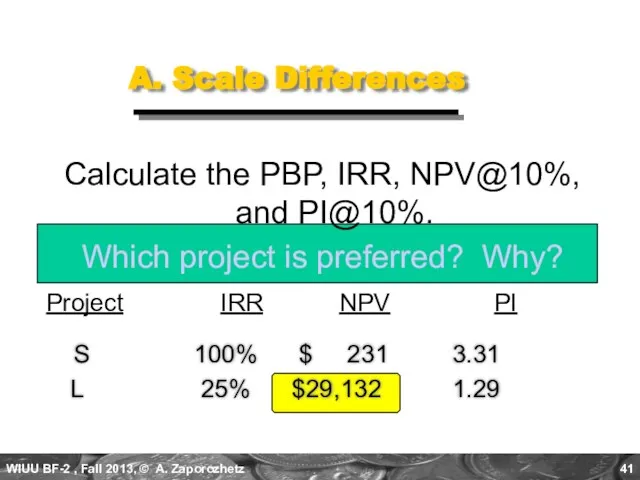

- 40. A. Scale Differences Compare a small (S) and a large (L) project. NET CASH FLOWS Project

- 41. A. Scale Differences Calculate the PBP, IRR, NPV@10%, and PI@10%. Which project is preferred? Why? Project

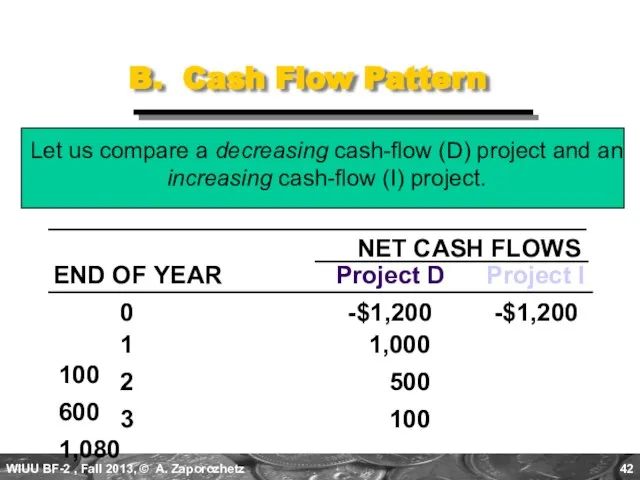

- 42. B. Cash Flow Pattern Let us compare a decreasing cash-flow (D) project and an increasing cash-flow

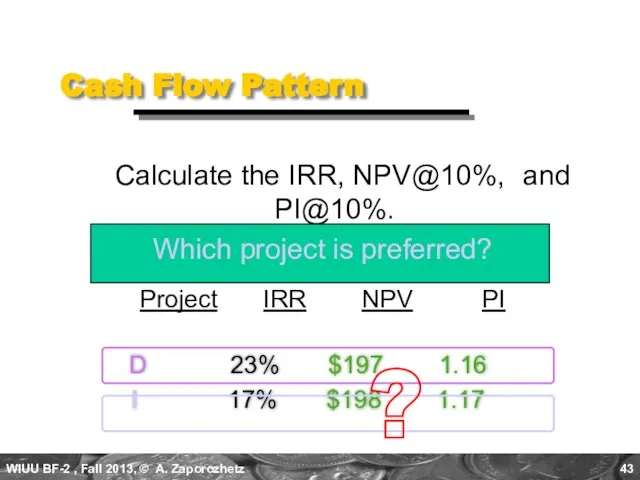

- 43. D 23% $197 1.16 I 17% $198 1.17 Cash Flow Pattern Calculate the IRR, NPV@10%, and

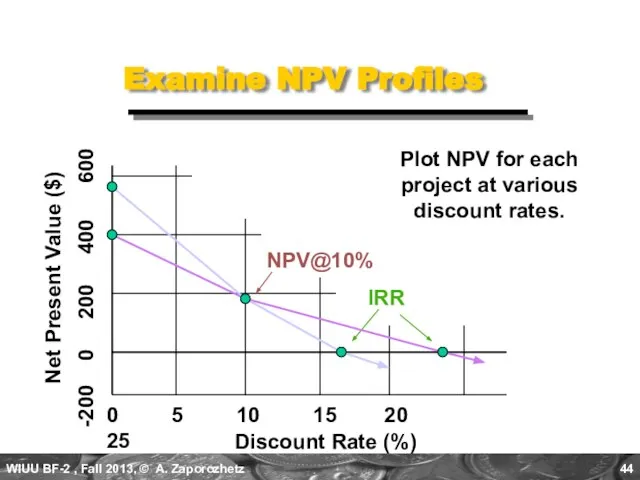

- 44. Examine NPV Profiles Discount Rate (%) 0 5 10 15 20 25 -200 0 200 400

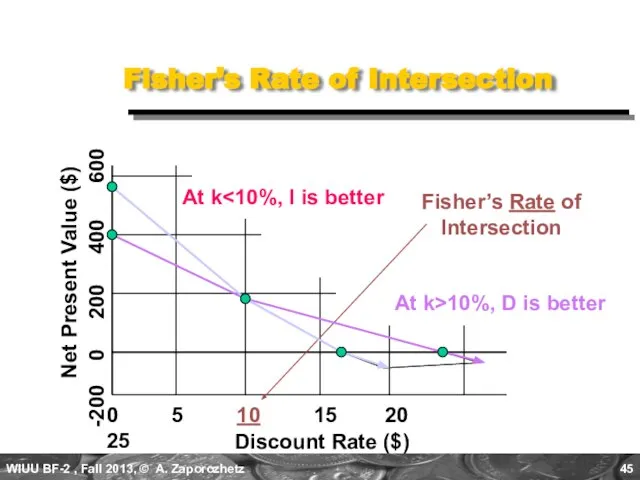

- 45. Fisher’s Rate of Intersection Discount Rate ($) 0 5 10 15 20 25 -200 0 200

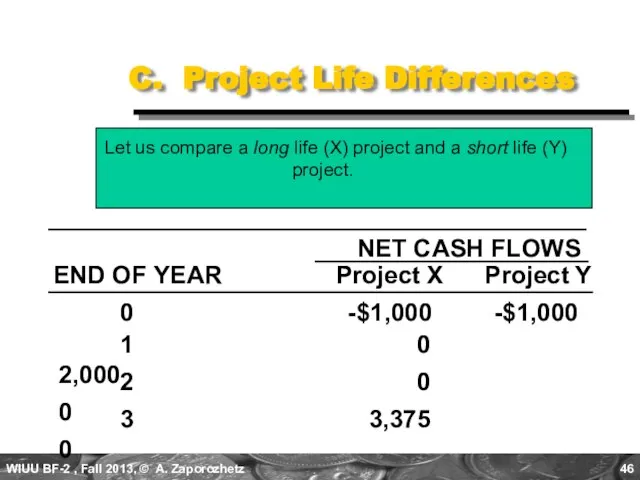

- 46. C. Project Life Differences Let us compare a long life (X) project and a short life

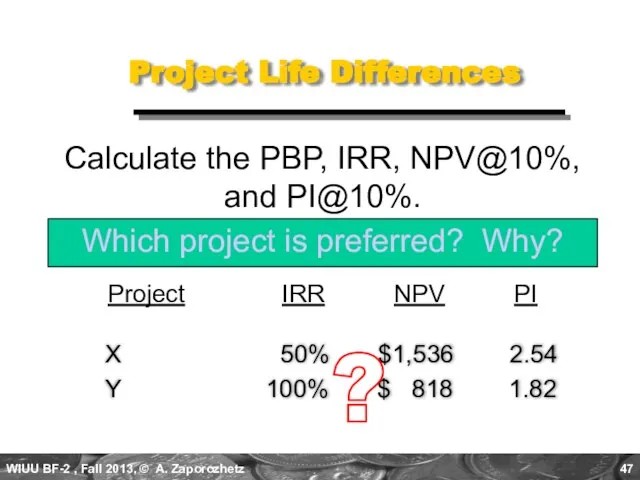

- 47. X 50% $1,536 2.54 Y 100% $ 818 1.82 Project Life Differences Calculate the PBP, IRR,

- 48. Another Way to Look at Things 1. Adjust cash flows to a common terminal year if

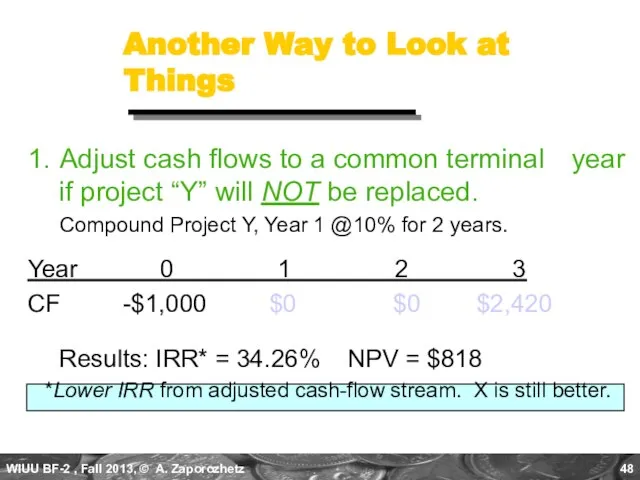

- 49. Replacing Projects with Identical Projects 2. Use Replacement Chain Approach (Appendix B) when project “Y” will

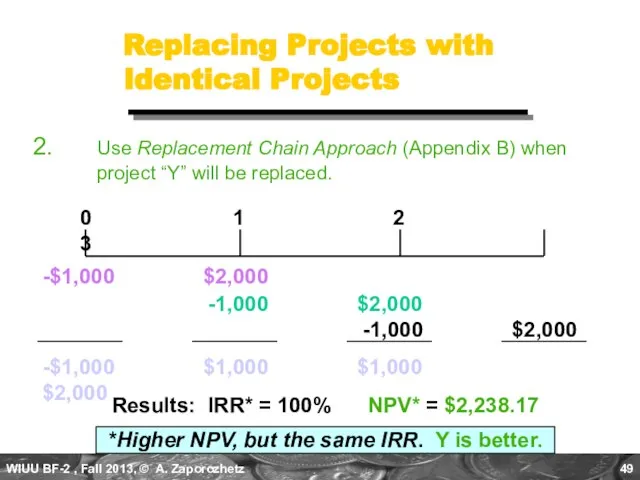

- 50. Capital Rationing Capital Rationing occurs when a constraint (or budget ceiling) is placed on the total

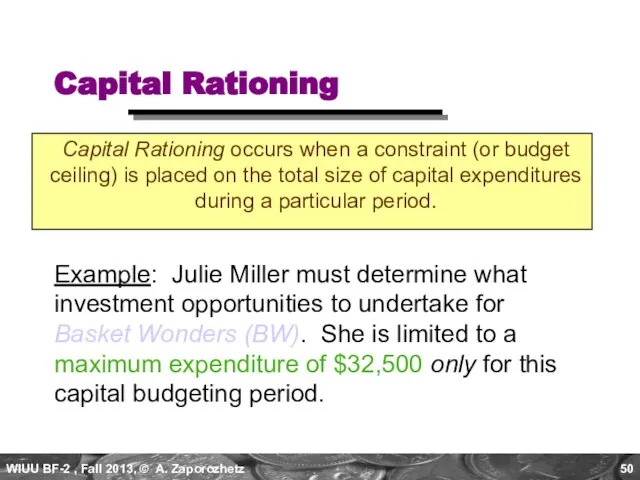

- 51. Available Projects for BW Project ICO,$ IRR,% NPV,$ PI A $ 500 18 50 1.10 B

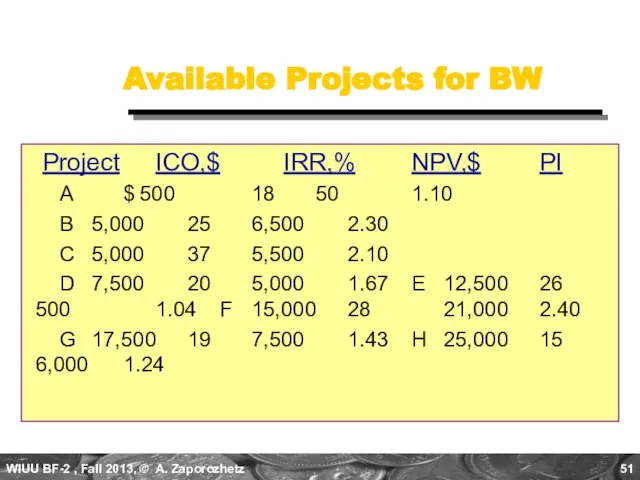

- 52. Choosing by IRRs for BW Project ICO IRR NPV PI C $5,000 37% $5,500 2.10 F

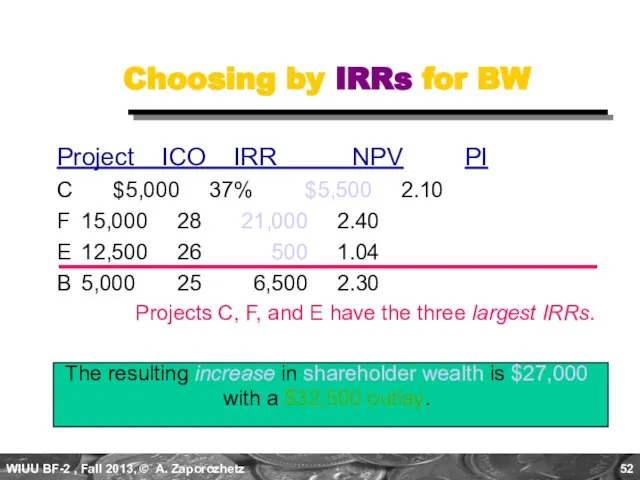

- 53. Choosing by NPVs for BW Project ICO IRR NPV PI F $15,000 28% $21,000 2.40 G

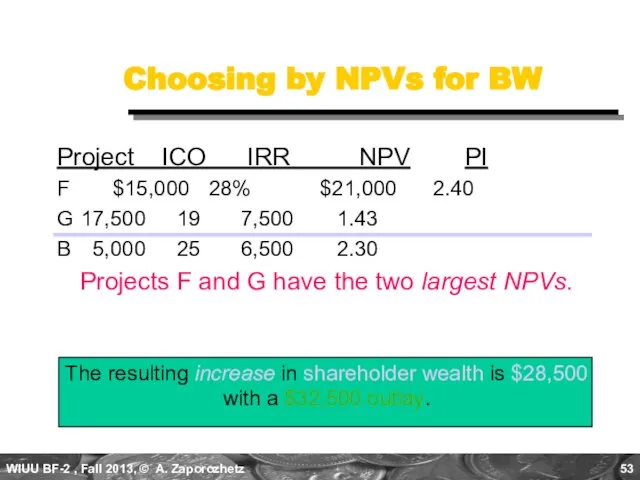

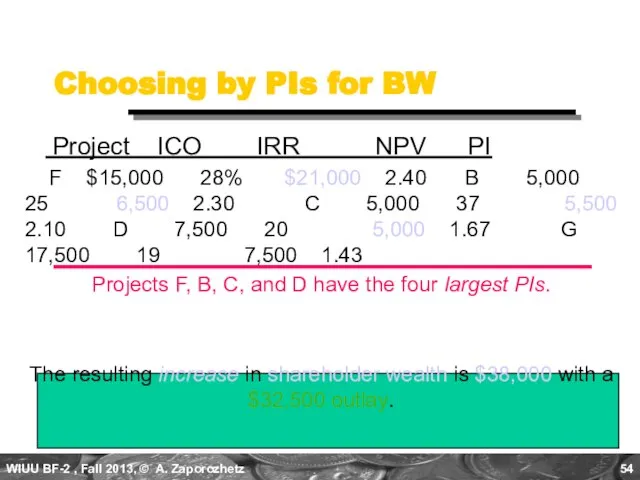

- 54. Choosing by PIs for BW Project ICO IRR NPV PI F $15,000 28% $21,000 2.40 B

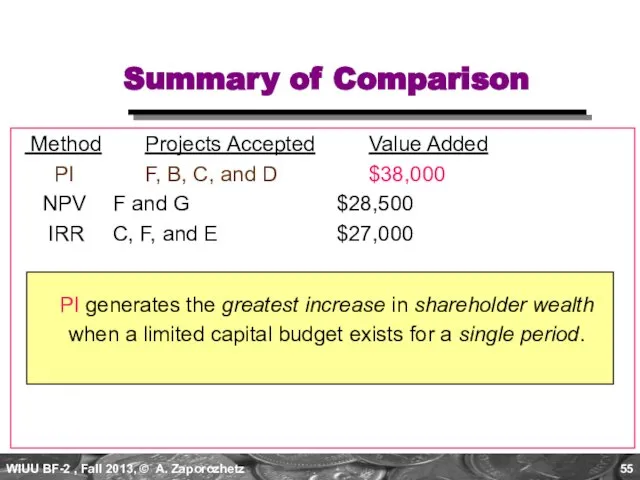

- 55. Summary of Comparison Method Projects Accepted Value Added PI F, B, C, and D $38,000 NPV

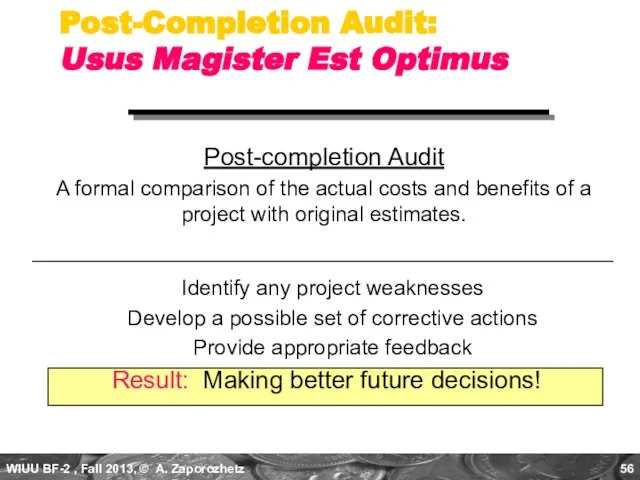

- 56. Post-Completion Audit: Usus Magister Est Optimus Post-completion Audit A formal comparison of the actual costs and

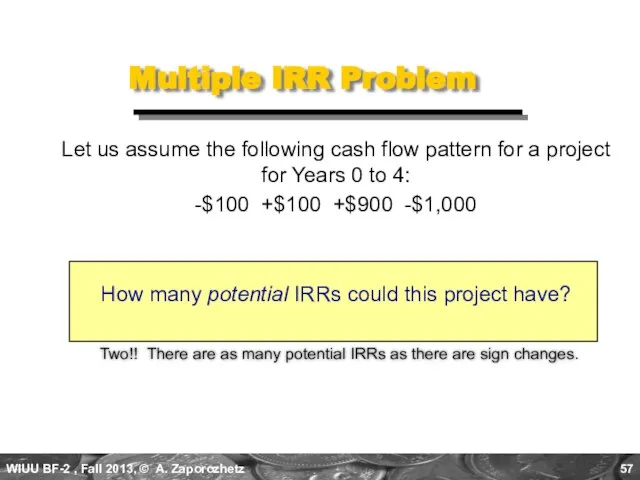

- 57. Multiple IRR Problem Two!! There are as many potential IRRs as there are sign changes. Let

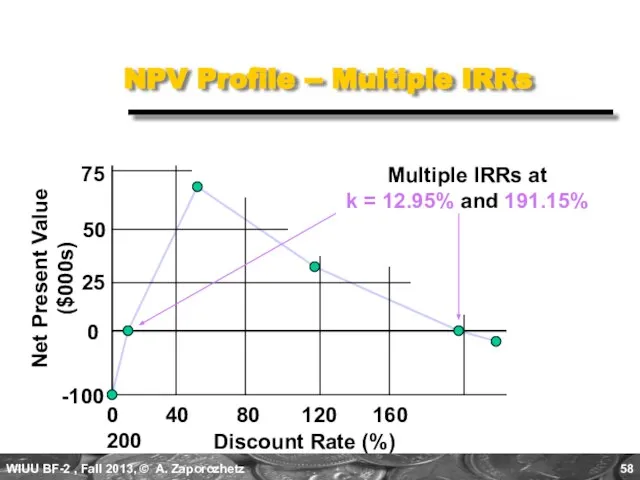

- 58. NPV Profile -- Multiple IRRs Discount Rate (%) 0 40 80 120 160 200 Net Present

- 60. Скачать презентацию

Инфраструктурные инвестиции

Инфраструктурные инвестиции Културен туризъм: международен маркетинг Бележки към кръглата маса организирана от ПП ГЕРБ Асеновград, 23.06.09

Културен туризъм: международен маркетинг Бележки към кръглата маса организирана от ПП ГЕРБ Асеновград, 23.06.09 Pos материалы гербион

Pos материалы гербион Презентация на тему Неофициальные символы России

Презентация на тему Неофициальные символы России CPA launches FOD

CPA launches FOD Методы и приборы разрушающего контроля, применяемые при обследовании

Методы и приборы разрушающего контроля, применяемые при обследовании ЖИЗНЬ И БЫТ В СРЕДНЕВЕКОВОМ ЗАМКЕ

ЖИЗНЬ И БЫТ В СРЕДНЕВЕКОВОМ ЗАМКЕ Презентация компании MOST Marketing«Франчайзинговый пакет: как разработать,чтобы привлечь франчайзи»

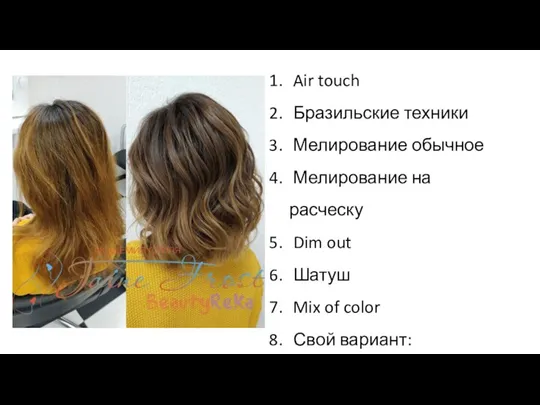

Презентация компании MOST Marketing«Франчайзинговый пакет: как разработать,чтобы привлечь франчайзи» Колористика при окрашивании волос. Тест

Колористика при окрашивании волос. Тест Предложение по летнему корпоративному отдыху на стадионе «Труд» (пос. «Старая Купавна»)

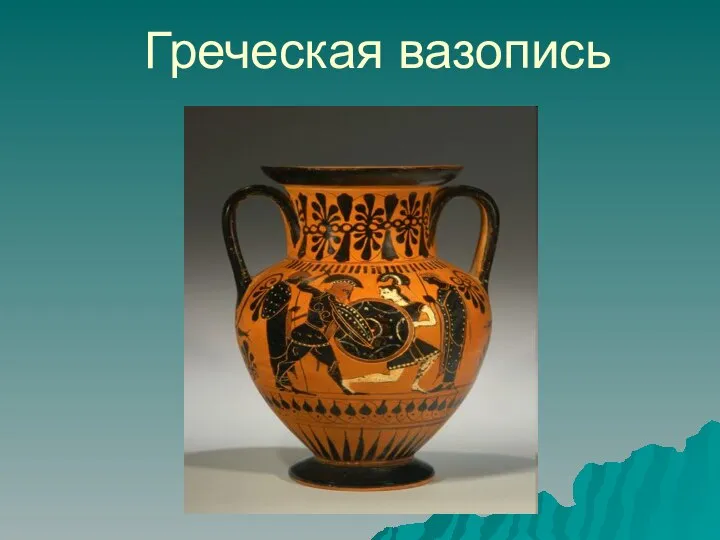

Предложение по летнему корпоративному отдыху на стадионе «Труд» (пос. «Старая Купавна») Греческая вазопись

Греческая вазопись Холод в нефтянной промышленности

Холод в нефтянной промышленности Урок-путешествие по разделу «Были-небылицы». Оценка достижений

Урок-путешествие по разделу «Были-небылицы». Оценка достижений LobbyWorks

LobbyWorks Самоиндукция

Самоиндукция Correct сommunication. Правильное общение

Correct сommunication. Правильное общение Тема: «Положение человека в системе животного мира. Эволюция гоминид».

Тема: «Положение человека в системе животного мира. Эволюция гоминид». Презентация на тему Выживание в природных условиях после аварии

Презентация на тему Выживание в природных условиях после аварии  ангелы

ангелы Интеллектуально-познавательная игра

Интеллектуально-познавательная игра Анализ применимости ПИК «СтОФ» для массовой оценки стоимости движимого имущества Тевелева Оксана Валерьевна тел: (499) 724-15-14, 8(903)208-

Анализ применимости ПИК «СтОФ» для массовой оценки стоимости движимого имущества Тевелева Оксана Валерьевна тел: (499) 724-15-14, 8(903)208- Fruit and vegetables

Fruit and vegetables Ты подвиг совершил во имя жизни на земле

Ты подвиг совершил во имя жизни на земле Обязательства из односторонних сделок и из действий в чужом интересе. Обязательства из договоров, не подлежащие судебной защите

Обязательства из односторонних сделок и из действий в чужом интересе. Обязательства из договоров, не подлежащие судебной защите ТВ - тюнеры

ТВ - тюнеры Применение программного комплекса CorPos (FORCE Technology Norway AS) для диагностики и прогнозирования коррозии на внутренних стенках газопров

Применение программного комплекса CorPos (FORCE Technology Norway AS) для диагностики и прогнозирования коррозии на внутренних стенках газопров Евгений Замятин

Евгений Замятин Characteristic of grain mass

Characteristic of grain mass