Слайд 2CONTENT:

Objective and Scope

Recognition and Measurement of Exploration and Evaluation Assets

Impairment

Disclosure

Слайд 3IFRS 6 – Objective and

Scope

IFRS 6 is limited to the accounting

for and reporting of costs associated only with the exploration and evaluation of mineral resources. These activities are defined as:

- the search for mineral resources…after the entity has obtained legal rights to explore in a specific area, and

- the determination of the technical feasibility and commercial viability of extracting the mineral resource.

Слайд 4IFRS 6 – Objective and Scope

IFRS 6 is an interim measure pending

completion of a major project on extractive activities.

Permits continuation of accounting policies used prior to adoption of IFRS

Accounting policies may be inconsistent with IFRS Framework

Слайд 5IFRS 6 – Recognition and Measurement of Exploration and Evaluation Assets

Recognition:

Companies use

a variety of methods to account for exploration and evaluation activities, from expensing all related costs to fully capitalizing them

Therefore, exploration and evaluation assets are defined in terms of the policy each company chooses

Слайд 6IFRS 6 – Recognition and Measurement of Exploration and Evaluation Assets

Exploration and

evaluation assets are recognized at cost

Examples of costs that may be capitalized:

- Cost of exploration rights, geological studies, exploratory drilling and sampling, and evaluating technical and commercial viability of extraction

Слайд 7IFRS 6 – Recognition and Measurement of Exploration and Evaluation Assets

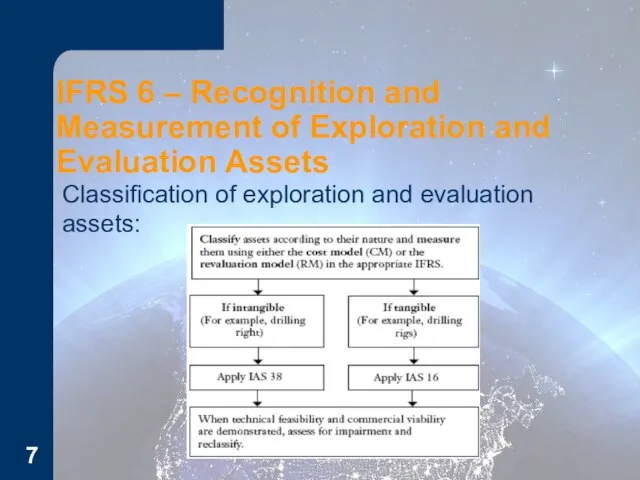

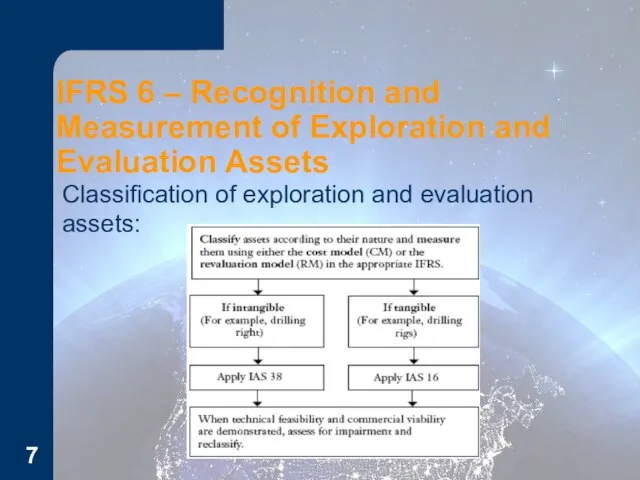

Classification of

exploration and evaluation assets:

Слайд 8IFRS 6 - Impairment

Impaired? When facts and circumstances suggest that carrying amount

> recoverable amount. Consider:

the right to explore expires and is not expected to be renewed

no other substantial expenditures are planned for exploration or evaluation in the area

the entity decides to stop exploration and evaluation activities because viable quantities have not been found in the area

although development is likely, the costs capitalized as exploration and evaluation assets exceed the amounts that are likely to be recovered

Impairment losses are taken to profit or loss – may be reversed

Слайд 9IFRS 6 - Disclosure

Disclosure objective: to identify and explain amounts recognized in

the financial statements that result from exploration and evaluation activities

If classified as PP&E, use IAS 16

If classified as intangible asset, use IAS 38

Слайд 10IFRS 6 - Disclosure

Minimum disclosure:

Accounting policies for exploration and evaluation expenditures and

their capitalization as assets

The amount of assets, liabilities, income, expense, and operating and investing cash flows from exploration and evaluation activities

Станковая скульптура: бюст

Станковая скульптура: бюст Отчёт директората цифрового телевидения Alma tv за период с 13 по 19 Октября 2017г

Отчёт директората цифрового телевидения Alma tv за период с 13 по 19 Октября 2017г Системный подход на благо людей и природы

Системный подход на благо людей и природы Живете

Живете Этико-правовые проблемы конца жизни человека

Этико-правовые проблемы конца жизни человека ПРИЧИНЫ ВОЗНИКНОВЕНИЯ ПОЖАРОВ В ЖИЛЫХ И ОБЩЕСТВЕННЫХ ЗДАНИЯХ.

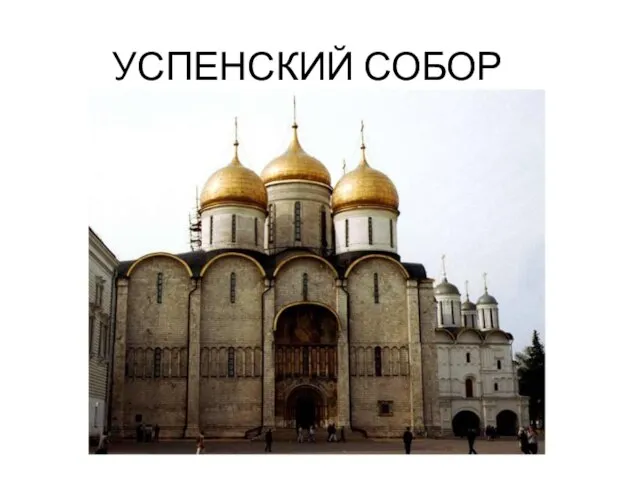

ПРИЧИНЫ ВОЗНИКНОВЕНИЯ ПОЖАРОВ В ЖИЛЫХ И ОБЩЕСТВЕННЫХ ЗДАНИЯХ. УСПЕНСКИЙ СОБОР

УСПЕНСКИЙ СОБОР Опале листя: користь чи шкода

Опале листя: користь чи шкода Государственное управление в области природопользования и охраны окружающей среды

Государственное управление в области природопользования и охраны окружающей среды Магнитная гидродинамика солнечных явлений

Магнитная гидродинамика солнечных явлений Пишем проект!

Пишем проект! Этапы речевого развития

Этапы речевого развития Растения Чувашской республики

Растения Чувашской республики Эффективность стратегии диверсификации на российском рынке(эмпирическое исследование)

Эффективность стратегии диверсификации на российском рынке(эмпирическое исследование) Стресс и пути его преодоления

Стресс и пути его преодоления Интерактивные формы и методы в преподавании русского языка и литературы. Тема: Групповые формы работы на уроках русского языка и л

Интерактивные формы и методы в преподавании русского языка и литературы. Тема: Групповые формы работы на уроках русского языка и л Западный и Восточный типы культуры

Западный и Восточный типы культуры Упражнение Настроение

Упражнение Настроение Выполняй правила безопасности на дороге!

Выполняй правила безопасности на дороге! Тихонова Тамара Вячеславовна учитель истории и обществознания ГОУ лицей № 150

Тихонова Тамара Вячеславовна учитель истории и обществознания ГОУ лицей № 150 ОРКиСЭ

ОРКиСЭ Непревзойденные преимущества систем T2Red + T2Reflecta

Непревзойденные преимущества систем T2Red + T2Reflecta Модели данных

Модели данных  Модель организации внеурочной деятельности на основе краткосрочных курсов

Модель организации внеурочной деятельности на основе краткосрочных курсов История развития системы железнодорожной автоматики, применяемые на железнодорожном транспорте (АТМ) в России

История развития системы железнодорожной автоматики, применяемые на железнодорожном транспорте (АТМ) в России Высокоранговые и Низкопримативные правят миром

Высокоранговые и Низкопримативные правят миром Ртуть

Ртуть Презентация на тему: клавиатура.Авторы: Суханов Г.

Презентация на тему: клавиатура.Авторы: Суханов Г.