Слайд 2Home assignment

Civil Code,

Chapter 3, articles 128-1 – 139-1.

Statute “On

Securities Market”.

(Закон РК «О рынке ценных бумаг»)

Please see these Statutes on the L-Drive, folder “Acts”

Слайд 3Plan

Financial Instruments

Derivatives

Shares

Bonds

Слайд 4Financial Instruments

Financial Instruments:

Money

Securities

Derivatives

Слайд 5Derivatives

Derivative financial Instrument:

Swap

Option

Futures

Forward

Слайд 6Derivatives

SWAP – is a derivative financial instrument where counterparties exchange cash

flows.

Cash flows to be exchanged are based on interest rates, currencies, equities, commodities, other base/underlying assets.

Cash flows are calculated over notional principal amount fixed in the agreement.

Notional amount is usually not exchanged between counterparties

Types of swaps: interest rate swaps, currency swaps, credit swaps, commodity swaps, equity swaps, other.

Слайд 7Derivatives

SWAP: example

Party A swaps 1 000 USD at LIBOR +

0.03% against

1 000 USD (S&P to the 1 000 USD notional).

Term is 1 year

In 1 year LIBOR is 5.97%, S&P increased 10%

Party A will pay to Party B: 1000 * (5.97%+.03%) = 60 000

Party B will pay to party A: 5%* 1000 = 50 000

What if S&P falls at 5%

Then Party A will pay additional 50 000 to Party B

Слайд 8Derivatives

Option – is a contract which gives the buyer (the owner) the right, but

not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date. The seller has the corresponding obligation to fulfill the transaction – that is to sell or buy – if the buyer (owner) "exercises" the option.

Call option – the right to buy

Put option – the right to sell

Слайд 9Derivatives

Option: example

You buys a call option (a right to buy):

Underlying asset

– 1000 barrels of oil

Strike price – 115 USD per barrel

Exercise day – in three months

Today price of oil – 113 USD

Will you exercise your option in 3 month if:

Price - 113

Price - 118

Слайд 10Derivatives

Futures – is a standardized contract between two parties to buy or

sell a specified asset of standardized quantity and quality for a price agreed upon today (the futures price) with delivery and payment occurring at a specified future date, the delivery date. The contracts are negotiated at a futures exchange, which acts as an intermediary between the two parties.

Unlike an option, both parties of a futures contract must fulfill the contract on the delivery date.

The seller delivers the underlying asset to the buyer, or, if it is a cash-settled futures contract, then cash is transferred from the futures trader who sustained a loss to the one who made a profit.

To exit the commitment prior to the settlement date, the holder of a futures position can close out its contract obligations by taking the opposite position on another futures contract on the same asset and settlement date.

Слайд 11Derivatives

Forward – is a non-standardized contract between two parties to buy

or to sell an asset at a specified future time at a price agreed upon today

Unlike futures, forward contracts are concluded on OTC market

Underlying assets of a deal are not standardized

Слайд 12Securities

Equity - stock

Bonds

Stock represents the residual assets of the

company that would be due to stockholders after discharge of debt

Common vs preferred

Dividends

Management of a company

HIPAK Kinetic 2400 AF / 2600 AF

HIPAK Kinetic 2400 AF / 2600 AF Прыжок в длину с места

Прыжок в длину с места МКОУ «Приреченская основная общеобразовательная школа Верхнемамонского муниципального района Воронежской области»ЛАГЕРЬ С

МКОУ «Приреченская основная общеобразовательная школа Верхнемамонского муниципального района Воронежской области»ЛАГЕРЬ С  Презентация без названия

Презентация без названия Disaster

Disaster Экзаменационный стресс

Экзаменационный стресс 1

1 Святой праведный старец Феодор Томский

Святой праведный старец Феодор Томский Современное потребление

Современное потребление  Изменение экономической конъюнктуры и эволюция маркетинговых концепций на примере ВТБ24

Изменение экономической конъюнктуры и эволюция маркетинговых концепций на примере ВТБ24 Характер философского знания и задачи философии

Характер философского знания и задачи философии Агентство Соединенных Штатов по Международному Развитию Винрок Интернэшнл

Агентство Соединенных Штатов по Международному Развитию Винрок Интернэшнл Источники права в Грузии

Источники права в Грузии Презентация кабинета химии

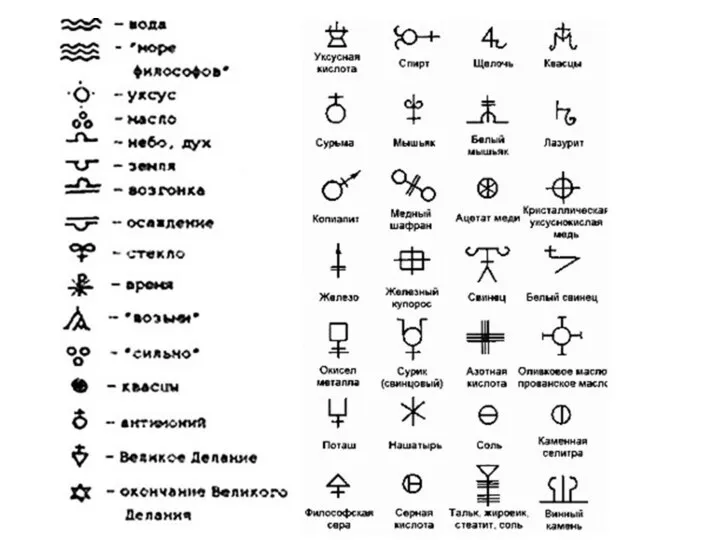

Презентация кабинета химии 5 ПСХЭ символы

5 ПСХЭ символы Ослабление влияния помех на аудиоаппаратуру сетевыми фильтрами

Ослабление влияния помех на аудиоаппаратуру сетевыми фильтрами Презентация на тему Отряд Вши

Презентация на тему Отряд Вши  Круглый стол «Социальная активность молодежи в реальном и виртуальном социальном пространстве».

Круглый стол «Социальная активность молодежи в реальном и виртуальном социальном пространстве». Эффект лотоса

Эффект лотоса Гибридизация

Гибридизация Паукообразные 2 класс

Паукообразные 2 класс Нагрузочное тестирование Описание услуг

Нагрузочное тестирование Описание услуг Проектная деятельность

Проектная деятельность Презентация на тему Буллинг

Презентация на тему Буллинг Happy Holidays

Happy Holidays Нейропсихология продаж

Нейропсихология продаж Презентация на тему Как жили на Руси

Презентация на тему Как жили на Руси Вирусы и антивирусы

Вирусы и антивирусы