Содержание

- 2. What do we already know about financial statements (FS)? FS are intended for external users. FS

- 3. The objective of general purpose FS is to provide information about the financial position, financial performance,

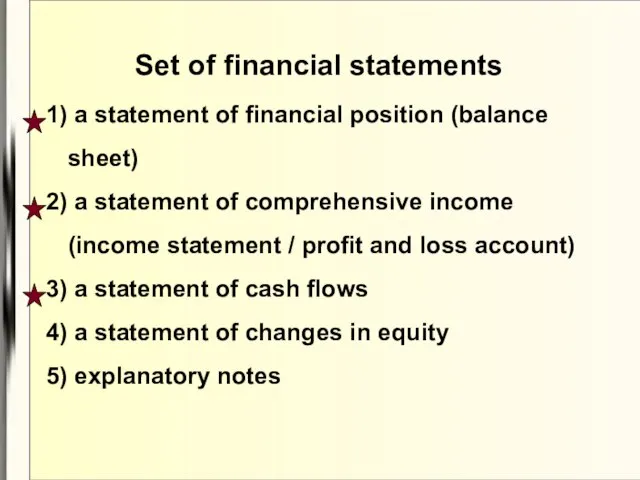

- 4. Set of financial statements 1) a statement of financial position (balance sheet) 2) a statement of

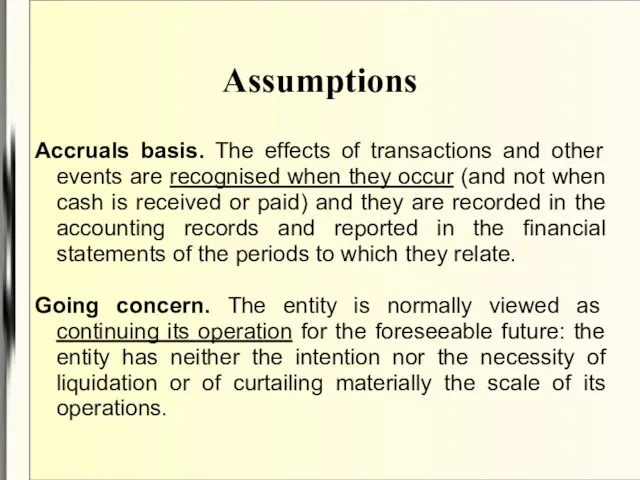

- 5. Assumptions Accruals basis. The effects of transactions and other events are recognised when they occur (and

- 6. Qualitative characteristics Fundamental characteristics Relevance. Information influences the economic decisions of users and has predicative and

- 7. The Balance Sheet The Statement of Financial Position (SOFP)

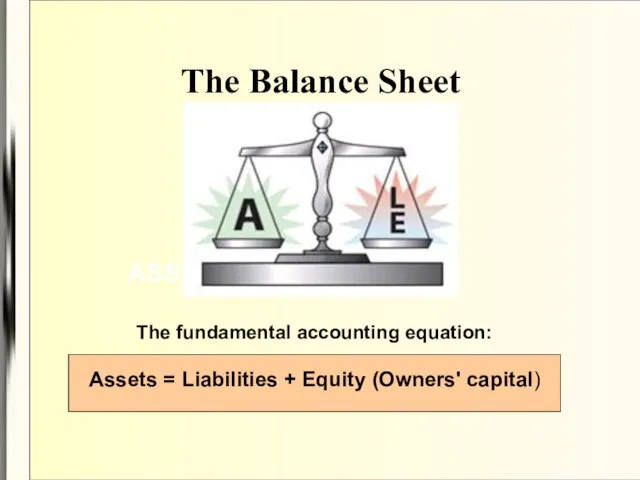

- 8. The Balance Sheet ASSETS The fundamental accounting equation: Assets = Liabilities + Equity (Owners' capital)

- 9. What is an asset? something that we own cash furniture vehicles inventory equipment land

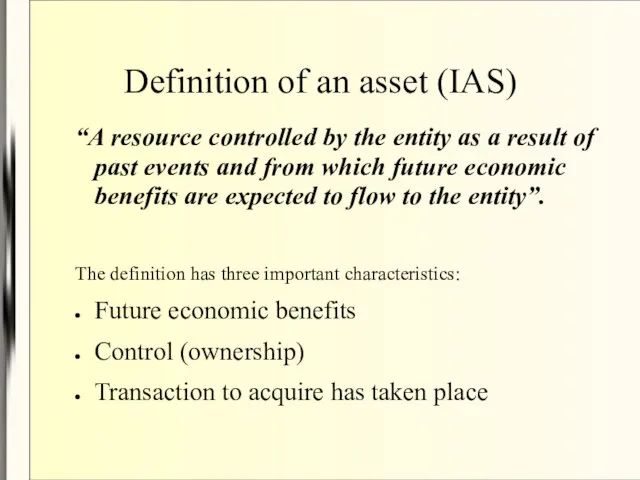

- 10. Definition of an asset (IAS) “A resource controlled by the entity as a result of past

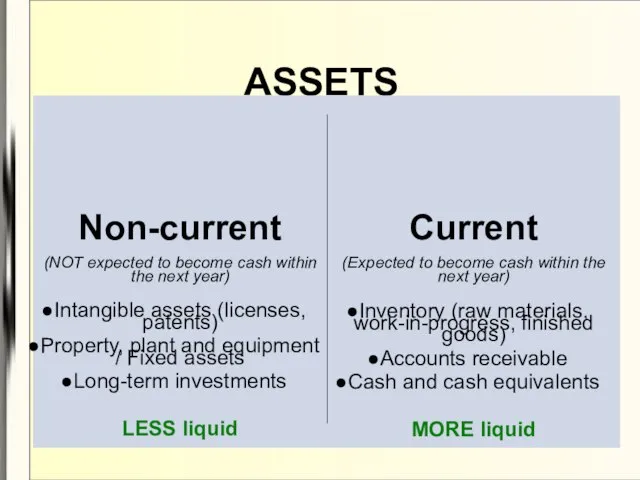

- 11. ASSETS

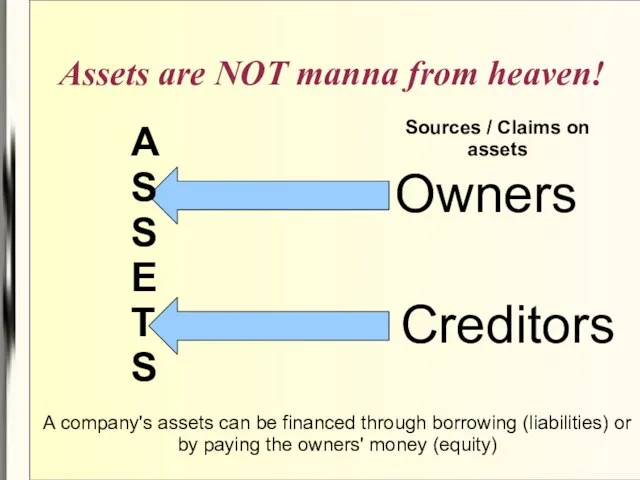

- 12. Assets are NOT manna from heaven! Sources / Claims on assets Owners Creditors A company's assets

- 13. What is a liability? something that we owe to banks to staff to the government to

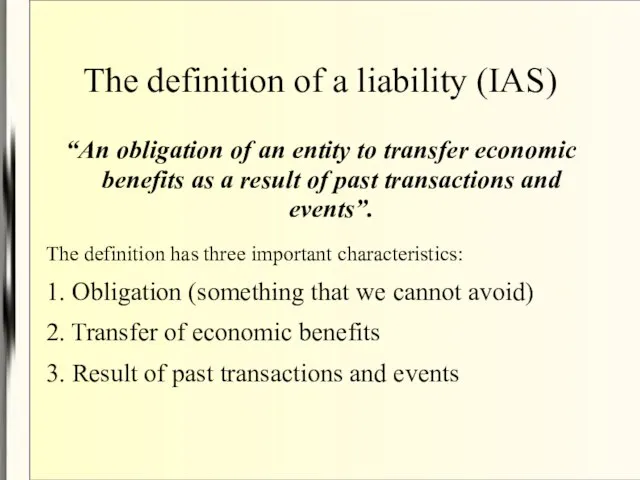

- 14. The definition of a liability (IAS) “An obligation of an entity to transfer economic benefits as

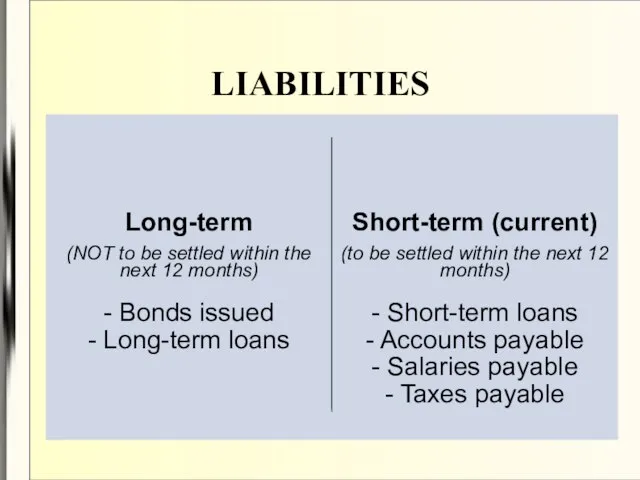

- 15. LIABILITIES

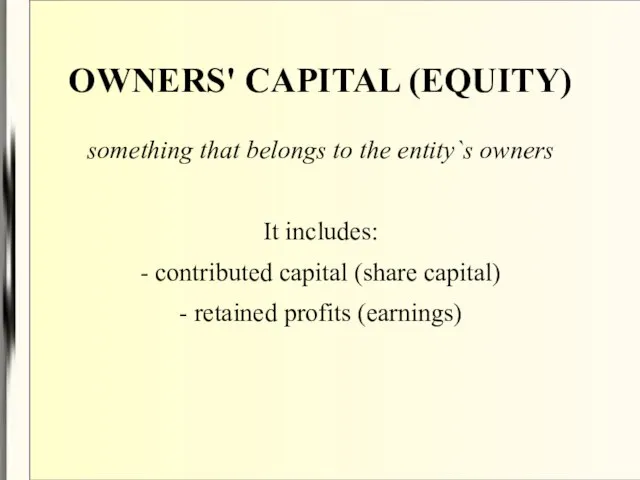

- 16. OWNERS' CAPITAL (EQUITY) something that belongs to the entity`s owners It includes: - contributed capital (share

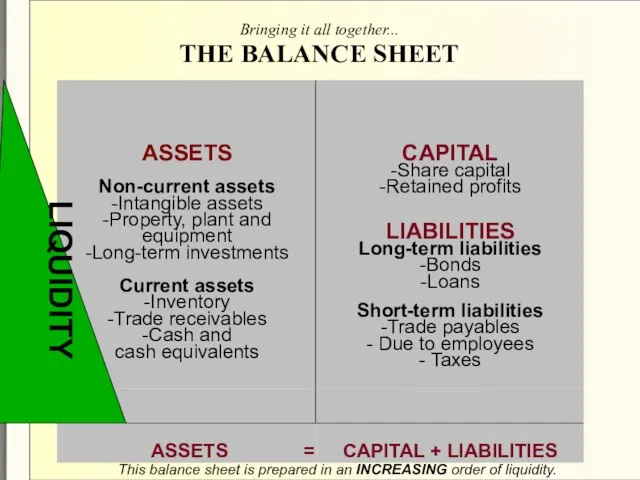

- 17. Bringing it all together... THE BALANCE SHEET This balance sheet is prepared in an INCREASING order

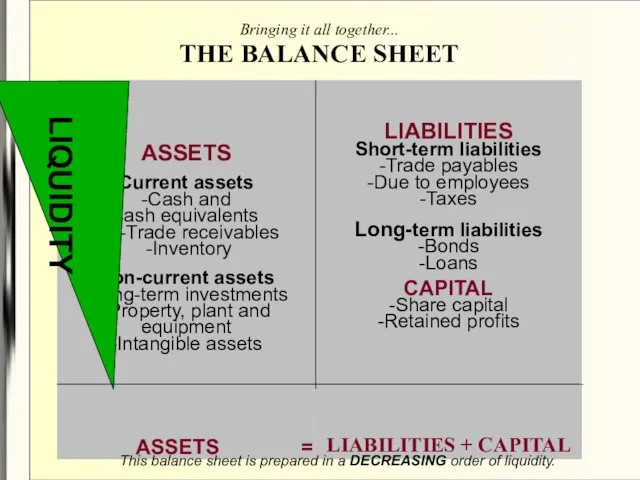

- 18. Bringing it all together... THE BALANCE SHEET This balance sheet is prepared in a DECREASING order

- 19. A balance sheet is a snapshot of a company at a moment in time . It

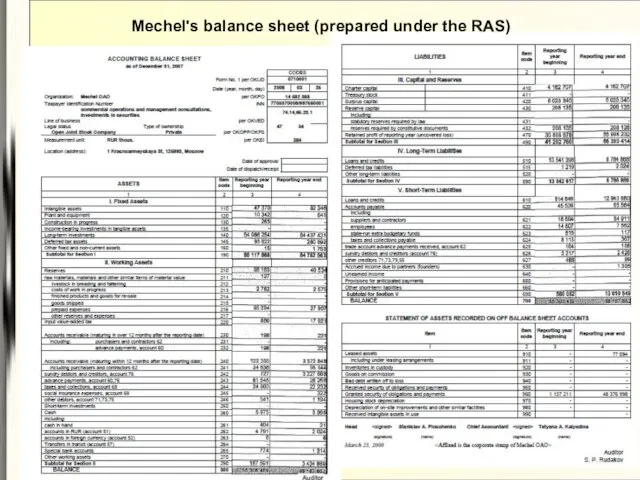

- 20. Mechel's balance sheet (prepared under the RAS))

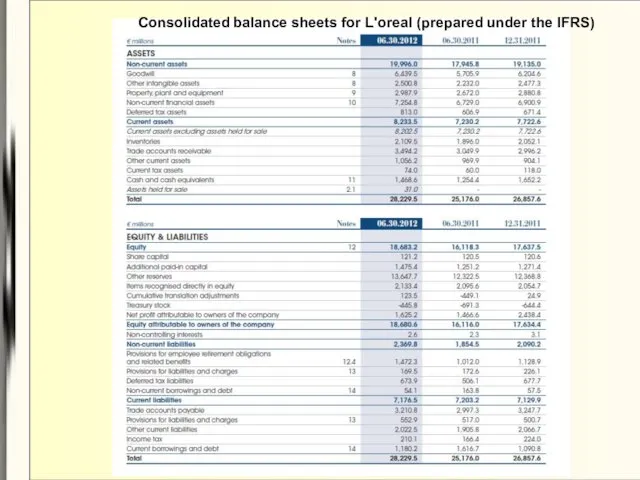

- 21. Consolidated balance sheets for L'oreal (prepared under the IFRS)

- 22. No matter what transactions a company enters into the equation assets = liabilities + capital is

- 23. Explain how the transactions will affect the balance sheet: Transaction 1 Costas has decided to set

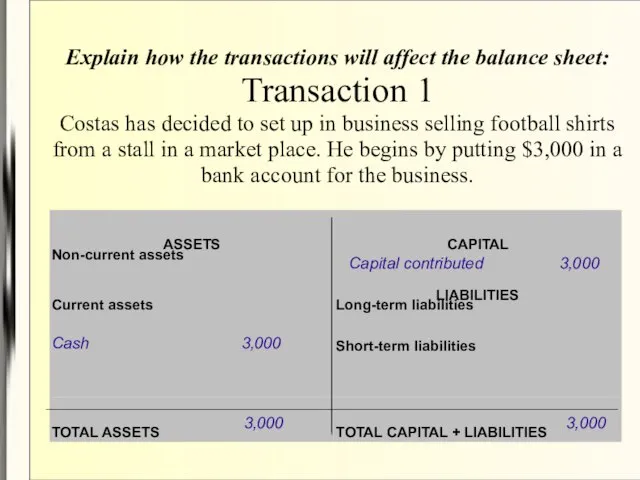

- 24. Transaction 2 Costas then obtains a 5-year loan of $4,000 from his brother. Cash 3,000 Capital

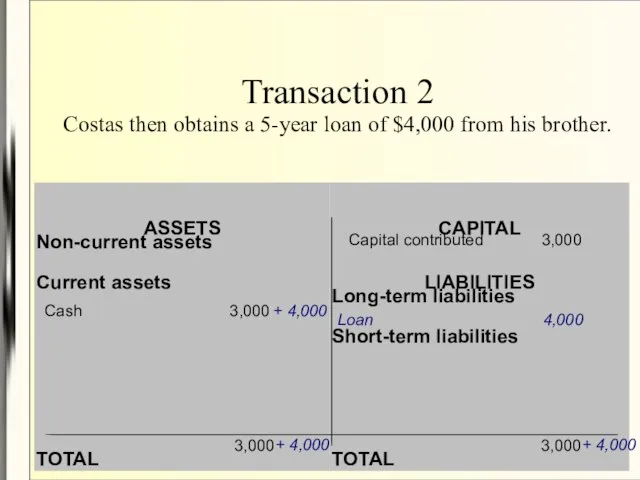

- 25. Transaction 3 Costas then purchases a market stall and pays $2,000 in cash. Cash 7,000 Capital

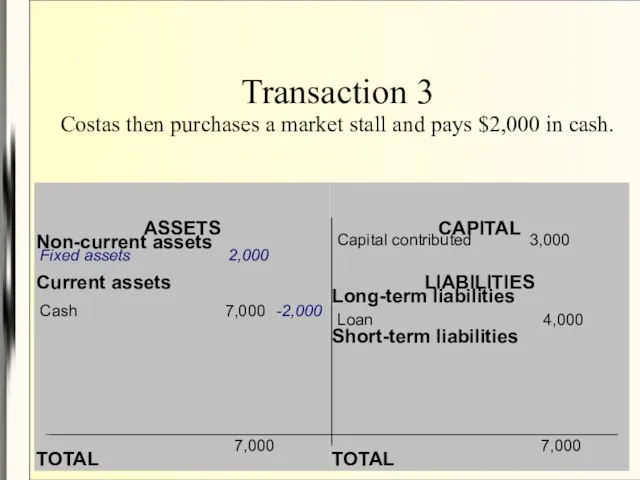

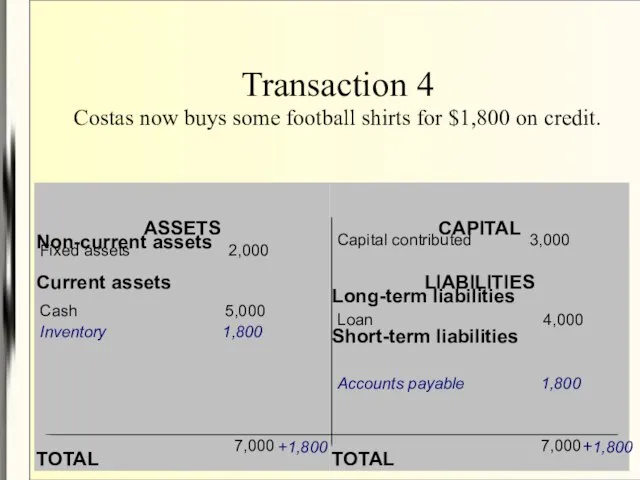

- 26. Transaction 4 Costas now buys some football shirts for $1,800 on credit. Cash 5,000 Capital contributed

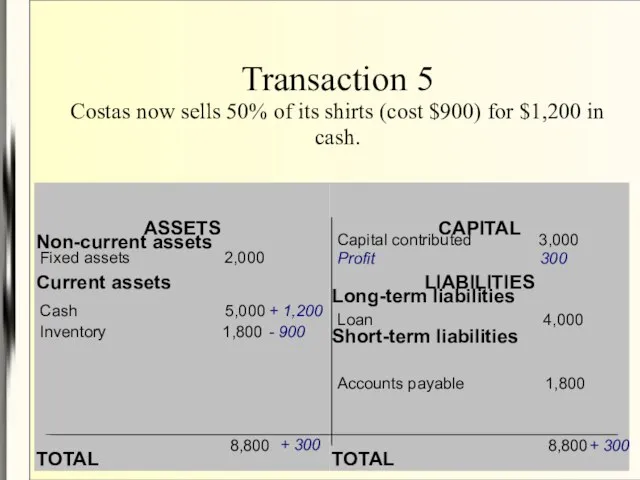

- 27. Transaction 5 Costas now sells 50% of its shirts (cost $900) for $1,200 in cash. Cash

- 28. Things to remember... Internally generated intangibles (expertise of the staff, the reputation of the business) are

- 30. Скачать презентацию

Площади многоугольников

Площади многоугольников Победа в Отечественной войне 1812 года

Победа в Отечественной войне 1812 года Правила поведения во время похода

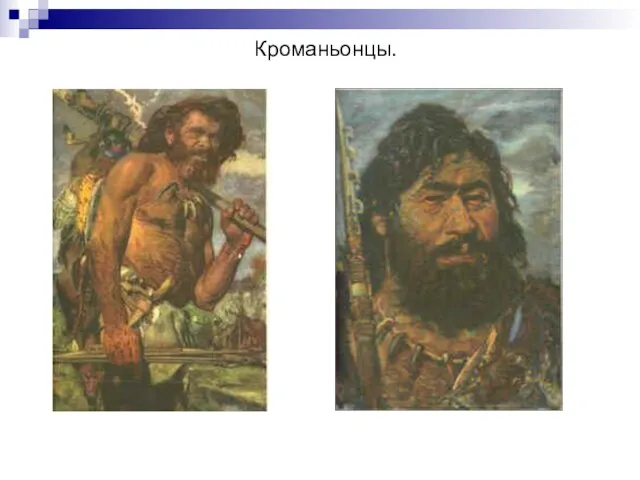

Правила поведения во время похода Кроманьонцы

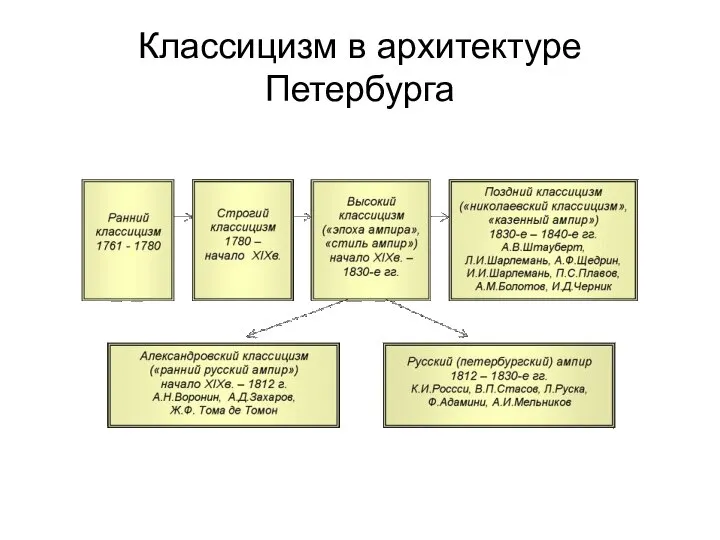

Кроманьонцы Классицизм в архитектуре Петербурга

Классицизм в архитектуре Петербурга The 10 most popular vehicles in history.

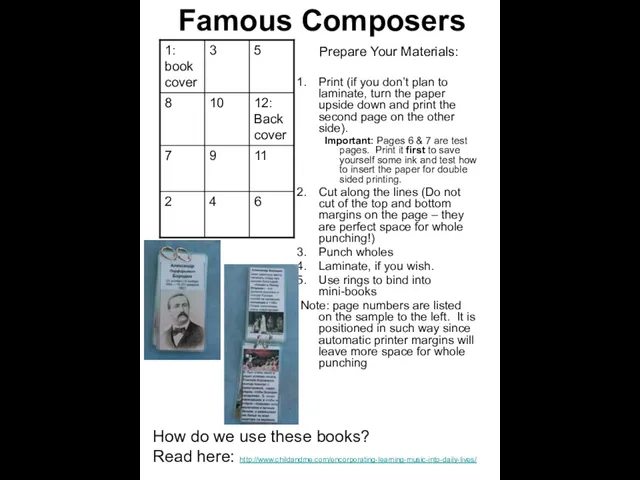

The 10 most popular vehicles in history. Famous Composers

Famous Composers Игра: "Калейдоскоп естественных наук"

Игра: "Калейдоскоп естественных наук" Работа с проволокой

Работа с проволокой Константин Бальмонт

Константин Бальмонт Раздел 6 изм. Замена лампочек

Раздел 6 изм. Замена лампочек 1

1 Виды партнерства и сотрудничества в предпринимательской деятельности

Виды партнерства и сотрудничества в предпринимательской деятельности Построение биссектрисы углагеометрия, 7 класс

Построение биссектрисы углагеометрия, 7 класс Мы во Вселенной

Мы во Вселенной Телеграфная связь

Телеграфная связь Proverbs and sayings

Proverbs and sayings Презентация на тему Режим дня дошкольника

Презентация на тему Режим дня дошкольника Виды туризма по способу передвижения. Краткая характеристика пешего и лыжного туризма

Виды туризма по способу передвижения. Краткая характеристика пешего и лыжного туризма Презентация на тему ПАДЕЖИ Знакомство с падежами имен существительных

Презентация на тему ПАДЕЖИ Знакомство с падежами имен существительных  Таврический дворец

Таврический дворец Жилой комплекс подворья Марфо-Мариинской обители в Севастополе

Жилой комплекс подворья Марфо-Мариинской обители в Севастополе Представление информации

Представление информации Наши зимние забавы

Наши зимние забавы Инновационные решения для распределительных сетей 6 - 35 кВ. ООО Оптиметрик, 2021

Инновационные решения для распределительных сетей 6 - 35 кВ. ООО Оптиметрик, 2021 Шаблон ПРЕЗЕНТАЦИИ к рубежной аттестации 1 курс ОПД-1

Шаблон ПРЕЗЕНТАЦИИ к рубежной аттестации 1 курс ОПД-1 Свойства текстильных волокон. 5 класс

Свойства текстильных волокон. 5 класс Презентация на тему Анализаторы органы чувств

Презентация на тему Анализаторы органы чувств