Содержание

- 2. Content: Fixed Assets: general description, structure and classification Evaluation of Fixed Assets Deterioration and Amortization of

- 3. Legislative Acts: Clauses of The Accounting Standard #7 “Fixed Assets” (The Ministry`s of Finance of Ukraine

- 4. Fixed Capital Business Capital – The money, property, and other valuables which collectively represent the wealth

- 5. Fixed Capital Fixed Capital – Amount of business Capital, invested in all its Fixed Assets. Non-current

- 6. According to The Accounting Standard №7 Fixed assets – tangible assets, which are used in business

- 7. The Group of Fixed Assets Group of Fixed Assets – is a sum-total of single-type technical

- 8. Fixed Assets can be classified by the following signs - 1: Participation in Business Activity: Production

- 9. Fixed Assets can be classified by the following signs - 2: By purposes: Land, Capital costs

- 10. Fixed Assets can be classified by the following signs - 3: By Property: Private, Involved (f.e.,

- 11. Fixed Assets can be classified by the following signs - 4: By Amortization charge rate for

- 12. Fixed Assets are evaluated by: Original cost; Revaluation cost; Fair value; Book value; Residual value; Net

- 13. Original cost The total costs, associated with the purchase of an asset, for accounting purposes.

- 14. Original cost includes: The money business pays to suppliers or contractors for obtaining of the fixed

- 15. Revaluation cost: The cost of fixed assets after the process of reappraisal.

- 16. Indexing of Fixed Assets: Business has a right to apply annual indexing of the fixed assets

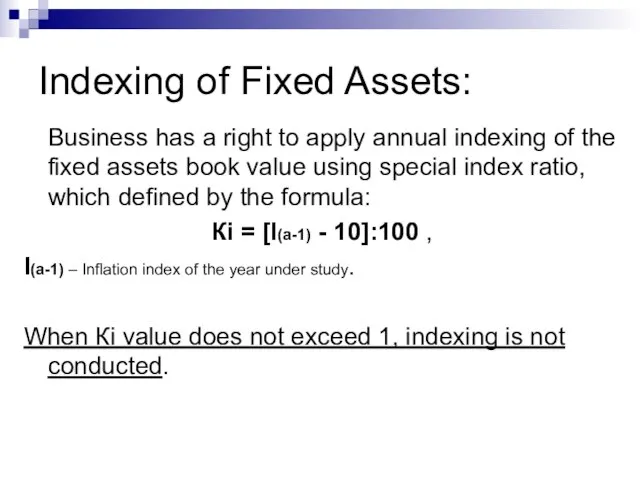

- 17. Fair Value: Rational and unbiased estimate of the potential market price of asset, taking into account

- 18. Book value: Can also be defined as deterioration adjustment, using formula Vb = Vo – Det.,

- 19. Net liquidation value: Responds to the fair value of assets excluding prospective sale costs.

- 20. Salvage value: the remaining value of an asset after it has been fully depreciated. It is

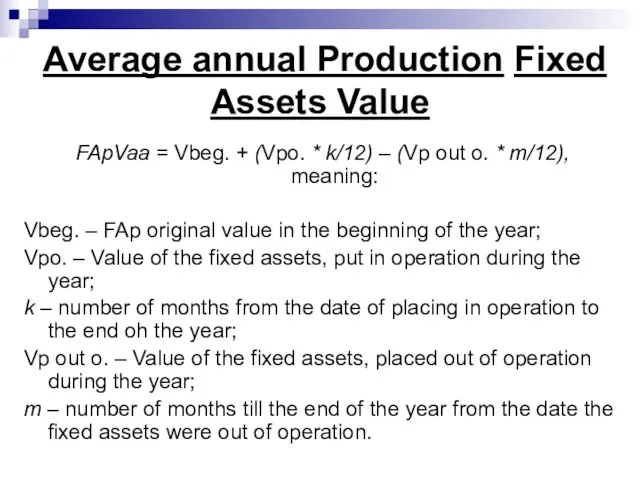

- 21. Average annual Production Fixed Assets Value FApVaa = Vbeg. + (Vpo. * k/12) – (Vp out

- 22. Deterioration and Obsolescence Deterioration – gradual loss of consumer value by non-tangible assets during operation. Obsolescence

- 23. According to the Accounting Standard №7: Depreciation – systematic amortized value of non-tangible assets carry-forward during

- 24. Object of Depreciation Object of Depreciation includes the value of fixed assets (except value of lands

- 25. Useful life of Assets Useful life of Assets – is an expected period of time, during

- 26. When defining the term of Assets` Useful life consideration must be given to: Expected using of

- 27. Useful life`s Term (Exploitation) of an Object Useful life`s Term (Exploitation) of the Fixed Assets is

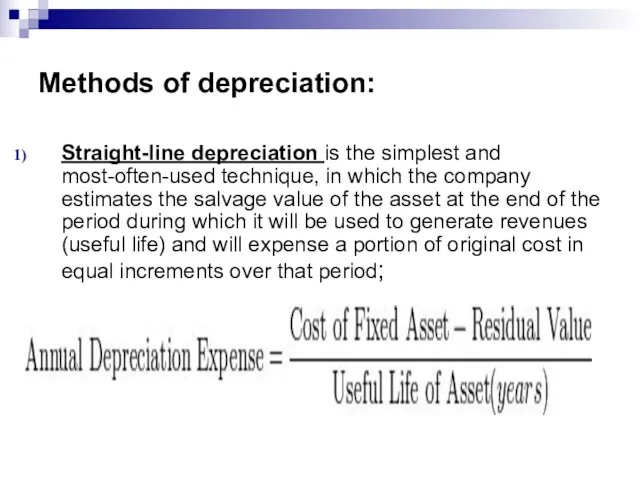

- 28. Methods of depreciation: Straight-line depreciation is the simplest and most-often-used technique, in which the company estimates

- 29. Straight-line depreciation Book value at the beginning of the first year of depreciation is the original

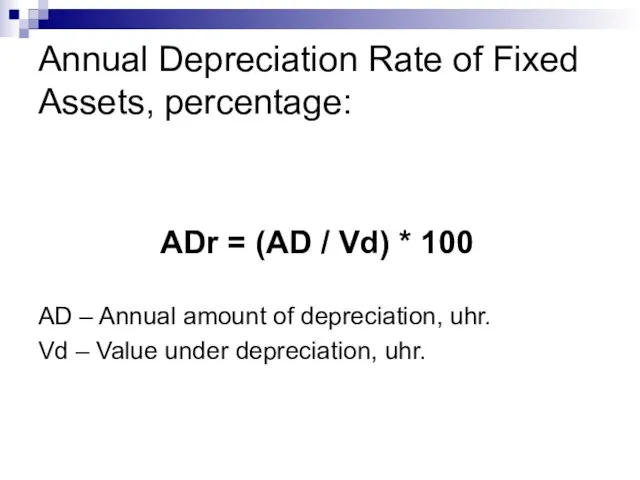

- 30. Annual Depreciation Rate of Fixed Assets, percentage: ADr = (AD / Vd) * 100 AD –

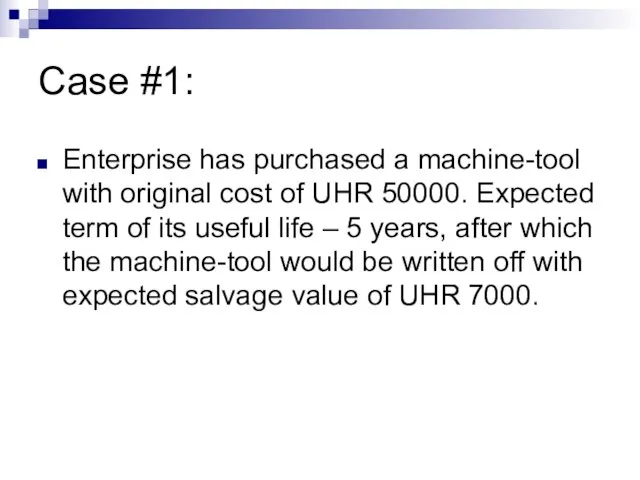

- 31. Case #1: Enterprise has purchased a machine-tool with original cost of UHR 50000. Expected term of

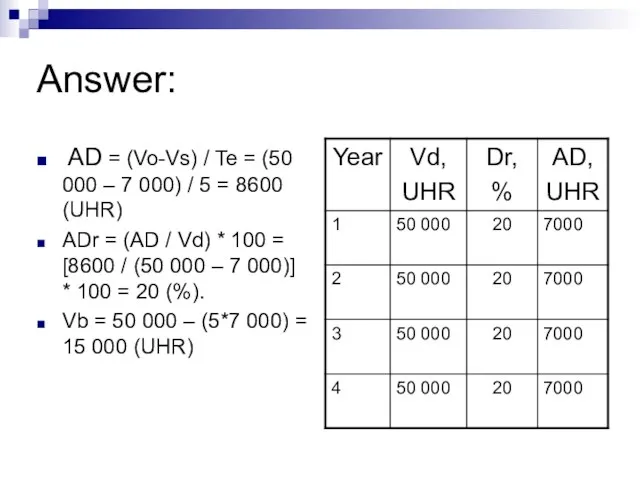

- 32. Answer: AD = (Vo-Vs) / Te = (50 000 – 7 000) / 5 = 8600

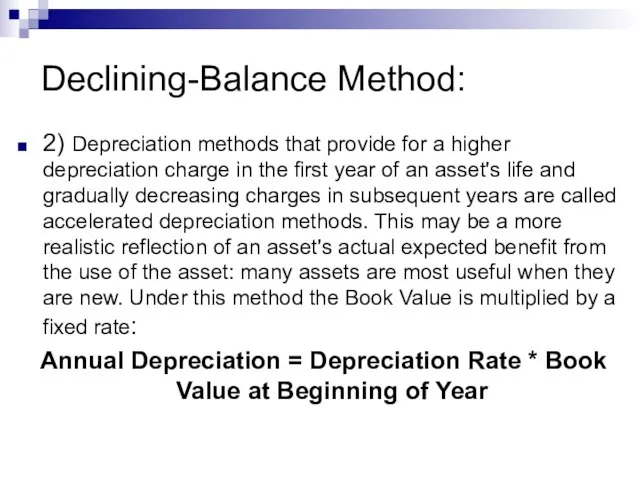

- 33. Declining-Balance Method: 2) Depreciation methods that provide for a higher depreciation charge in the first year

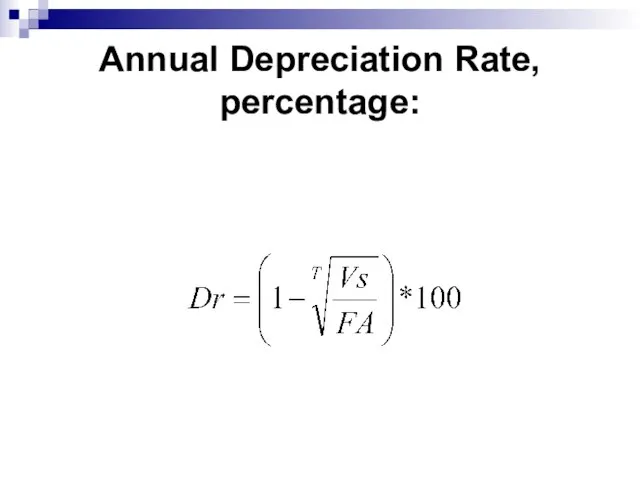

- 34. Annual Depreciation Rate, percentage:

- 35. Case #2

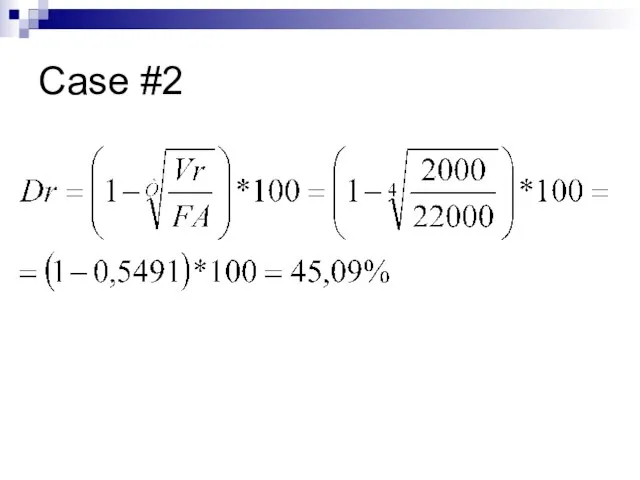

- 36. Annual Amount of Depreciation`s Calculation by the Declining-Balance Method, example of the machine-tool:

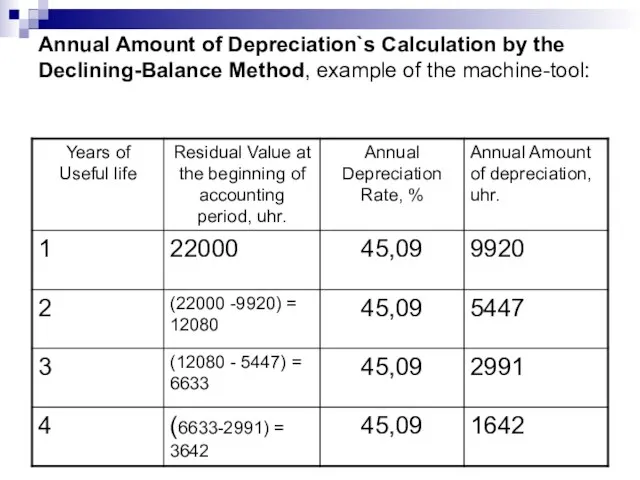

- 37. Salvage value of the Machine-tool after the period of its useful life: Vr = 3642 –

- 38. Method of the Book Value Accelerated decrease: 3) Method of the Book Value Accelerated decrease, which

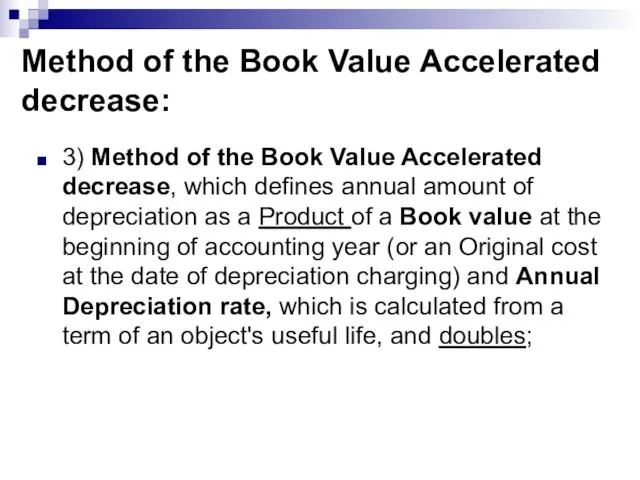

- 39. Method of the Book Value Accelerated decrease: Annual Depreciation Rate (Dr): Dr = (100 / T

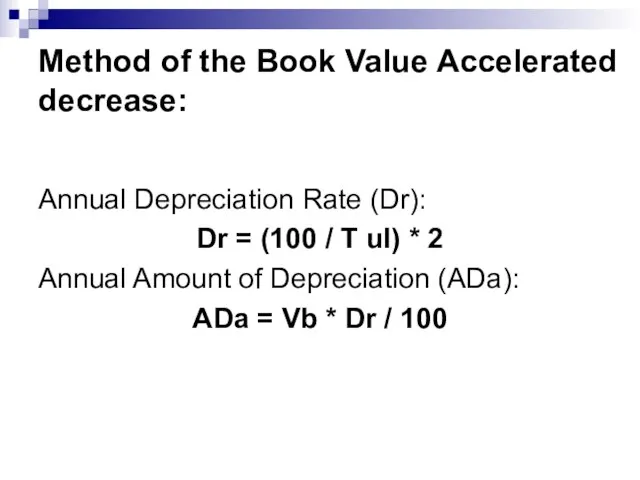

- 40. Case #3: Dr = (100 / Т ul) * 2 = =(100 / 4) * 2

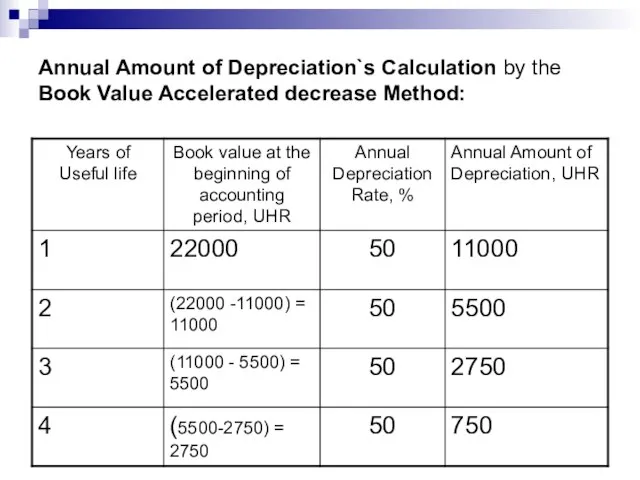

- 41. Annual Amount of Depreciation`s Calculation by the Book Value Accelerated decrease Method:

- 42. Machine-tool Salvage Value after Useful life`s completion: Vs = 2750-750 = 2000 UHR

- 43. Sum-of-Years' Digits Method: 4) Sum-of-Years' Digits is a depreciation method that results in a more accelerated

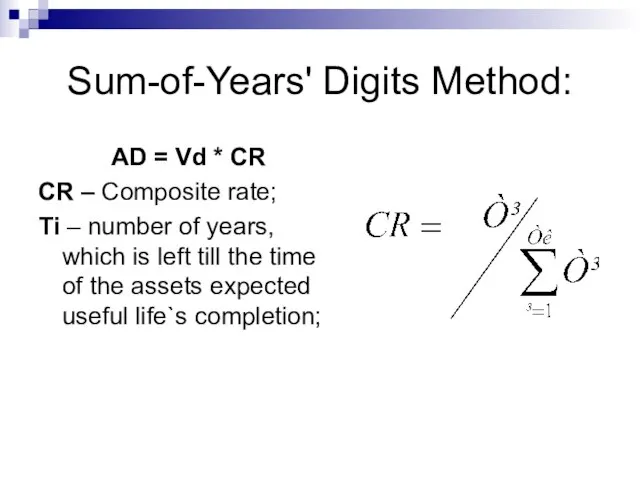

- 44. Sum-of-Years' Digits Method: AD = Vd * CR CR – Composite rate; Ті – number of

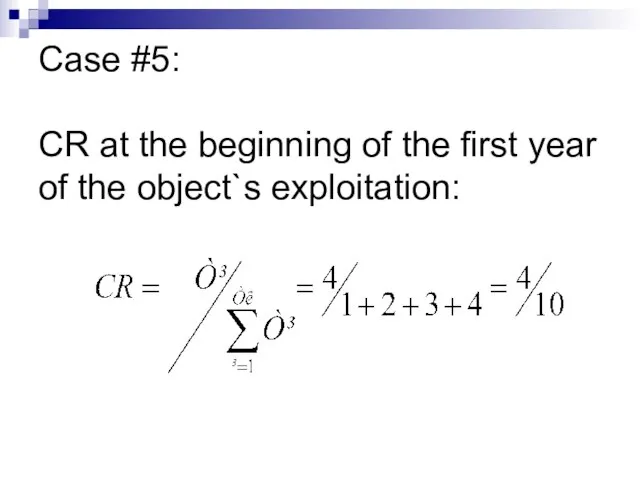

- 45. Case #5: CR at the beginning of the first year of the object`s exploitation:

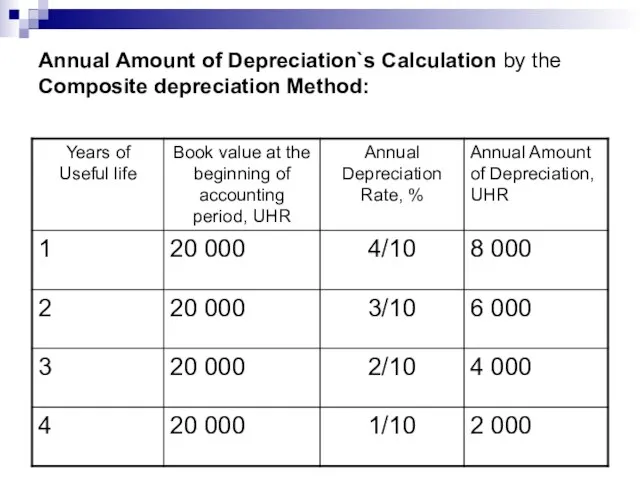

- 46. Annual Amount of Depreciation`s Calculation by the Composite depreciation Method:

- 47. Machine-tool Salvage Value after Useful life`s completion: Vs = 22 000 – (8000+6000+4000+2000) = 2000 (UHR)

- 48. Units-of-Production Depreciation Method: 5) Under this method, useful life of the asset is expressed in terms

- 49. Units-of-Production Depreciation Method: Monthly (annual) amount of depreciation: DA = TPe * DRp TPe – annual

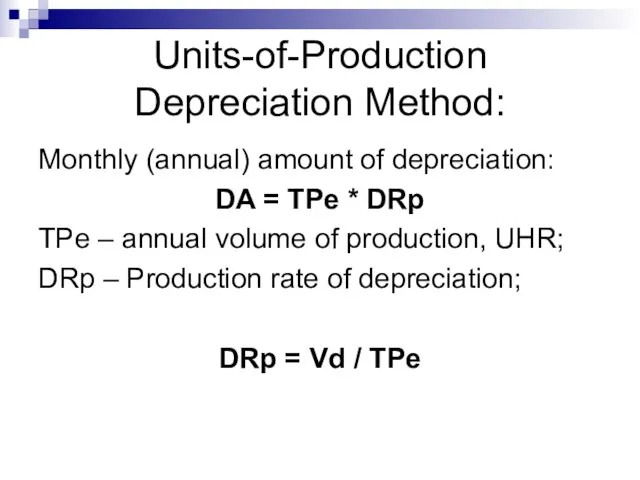

- 50. Case #6: Let`s apply Units-of-Production Depreciation Method in order to calculate depreciation charges by the years

- 51. Case #6: Са = Vd / TP = (22 000 - 2000) / 10 000 =

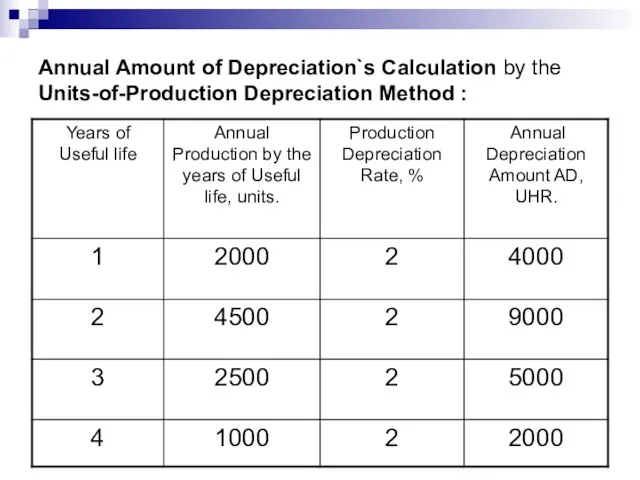

- 52. Annual Amount of Depreciation`s Calculation by the Units-of-Production Depreciation Method :

- 53. Machine-tool Salvage Value after Useful life`s completion: Vs = 22 000 – (4000+9000+5000+2000) = 2000 (uhr)

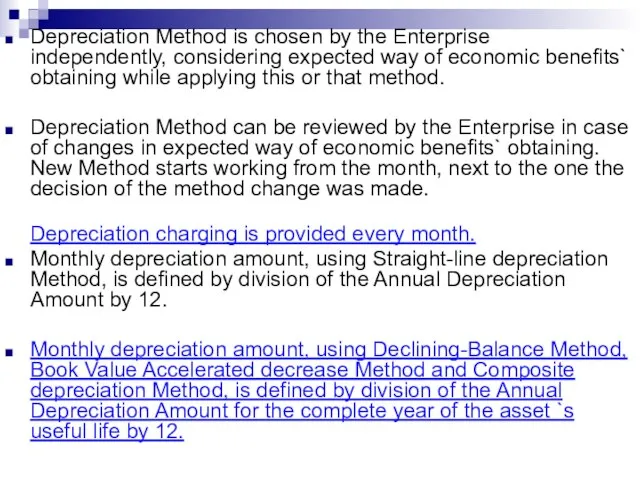

- 54. Depreciation Method is chosen by the Enterprise independently, considering expected way of economic benefits` obtaining while

- 55. Fixed Assets Depreciation Method, which is used in Fiscal Accounting: Depreciation Amount is calculated quarterly, using

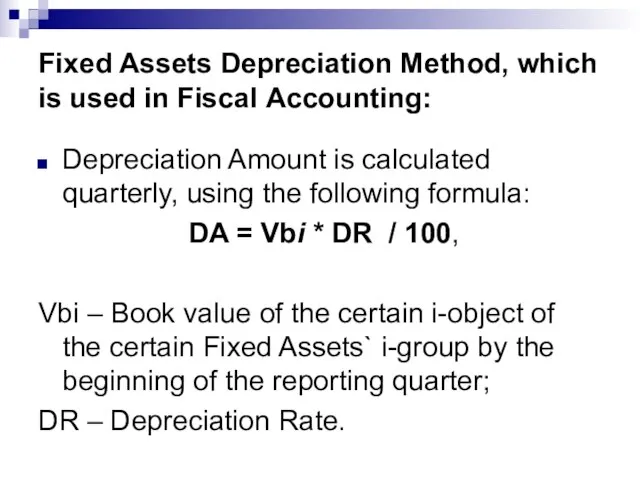

- 56. Book Value of the Fixed Assets` Group (of the certain object in Fixed Assets` Group #1)

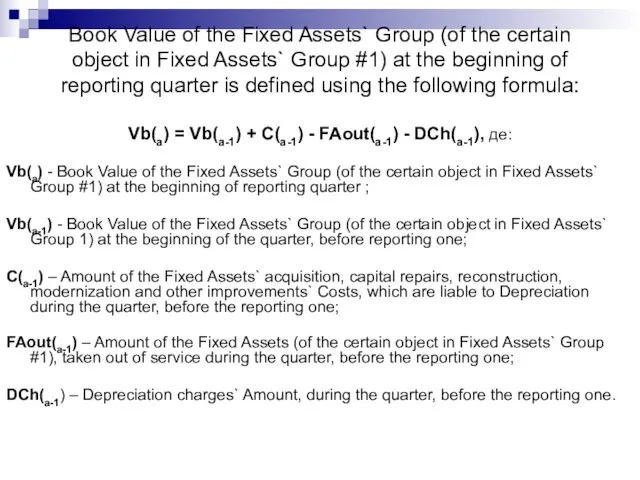

- 57. Fixed Assets Depreciation`s Rates, according to the Fiscal Legislation, percentage to the FA`s book value:

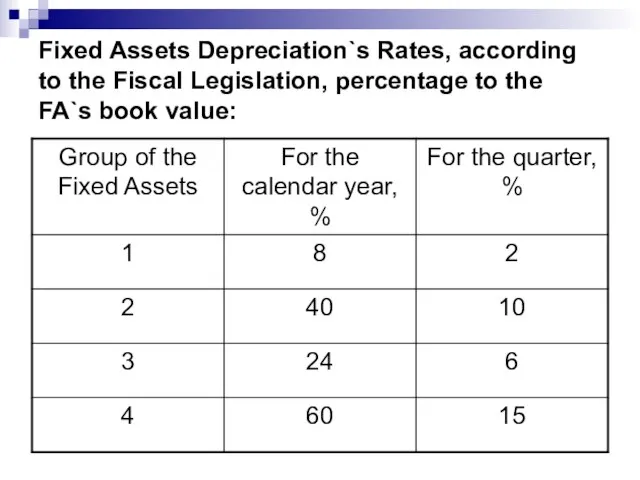

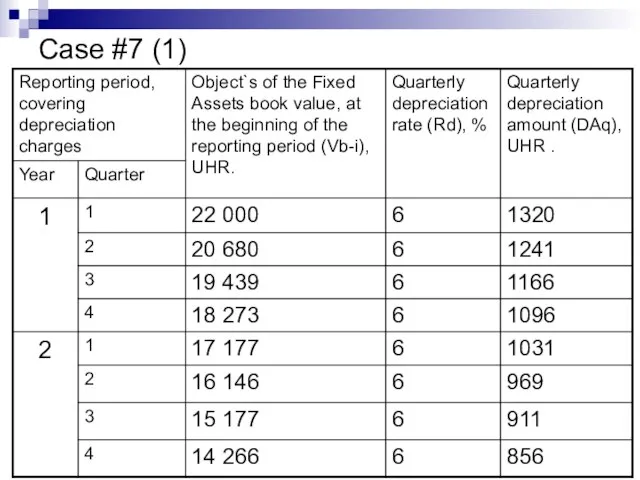

- 58. Case #7 (1)

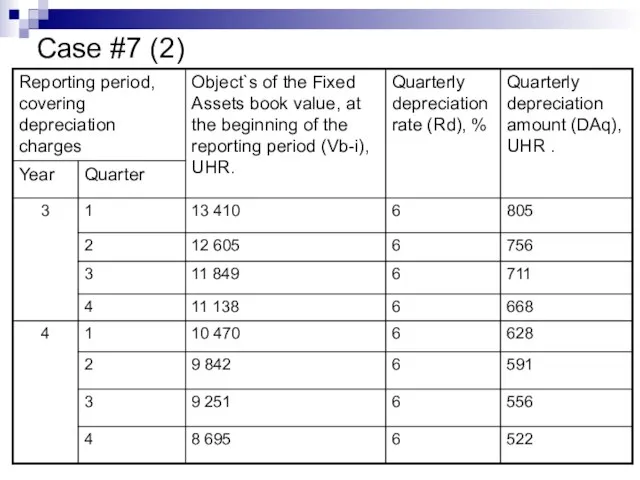

- 59. Case #7 (2)

- 60. Case #7 (3) Machine-tool`s Book Value by the end of the 4th year of its exploitation

- 61. 4. Indicators of Fixed Assets` provision, condition and efficiency

- 62. Indicators of provision with the Fixed Assets: Capital intensity indicator (uhr/uhr): CI = FAva / Q

- 63. Indicators of provision with the Fixed Assets: Level of labor mechanization Indicator: LM = FAva /

- 64. Indicators of provision with the Fixed Assets: Real value of the fixed productive assets is reflected

- 65. Indicators of the fixed assets` condition estimation: Deterioration Ratio: Dr = Da / Vo Da –

- 66. Indicators of the fixed assets` condition estimation: Fixed assets` Adaptability Ratio: Ar = Da / Vo

- 67. Indicators of the fixed assets` condition estimation: Fixed assets Renewal Ratio: Rr = V rep.per. /

- 68. Indicators of the fixed assets` condition estimation: Fixed assets Dropout Ratio: Dr = V d-o /

- 69. Fixed Assets` Efficiency estimation Indicators: Capital productivity of the fixed assets: CP = Q / FAva

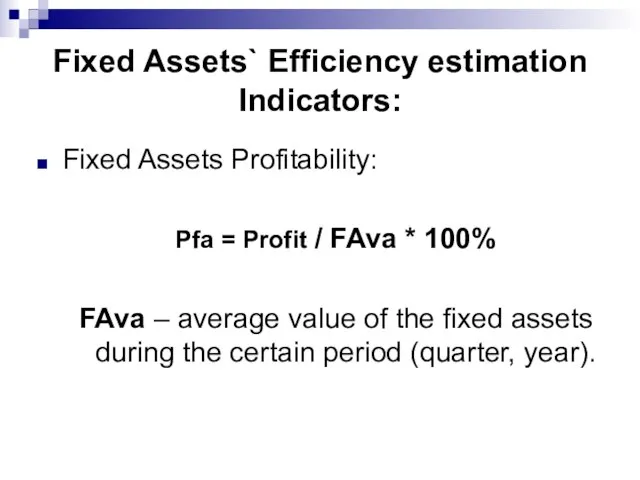

- 70. Fixed Assets` Efficiency estimation Indicators: Fixed Assets Profitability: Pfa = Profit / FAva * 100% FAva

- 72. Скачать презентацию

Золотарь. Повышение уровня работоспособности

Золотарь. Повышение уровня работоспособности Формирование гендерной принадлежности детей дошкольного возраста

Формирование гендерной принадлежности детей дошкольного возраста Склонение имен существительных в упражнениях

Склонение имен существительных в упражнениях Обработка фрезерованием

Обработка фрезерованием Презентация на тему Финансы и кредит Денежная система

Презентация на тему Финансы и кредит Денежная система  Система применения минеральных удобрений под посев озимой пшеницы урожая 2013 года

Система применения минеральных удобрений под посев озимой пшеницы урожая 2013 года Презентация на тему Слово о полку Игореве

Презентация на тему Слово о полку Игореве  ПРОВОДЯЩИЕ ПОЛИМЕРЫ

ПРОВОДЯЩИЕ ПОЛИМЕРЫ Die vier Kerzen

Die vier Kerzen Презентация на тему Саранча

Презентация на тему Саранча  Толықтауыш

Толықтауыш Особенности радиоактивного заражения при авариях на АЭС

Особенности радиоактивного заражения при авариях на АЭС Транспортно-экспедиционная деятельность на автомобильном транспорте. Контейнерные перевозки

Транспортно-экспедиционная деятельность на автомобильном транспорте. Контейнерные перевозки Проведение ГИА-9 в 2012 году

Проведение ГИА-9 в 2012 году Презентация на тему Преподавание истории и обществознания в условиях открытой информационно-образовательной среды

Презентация на тему Преподавание истории и обществознания в условиях открытой информационно-образовательной среды Русский язык будет жить. Язык в эпоху Интернета

Русский язык будет жить. Язык в эпоху Интернета Веселые моменты школьной жизни

Веселые моменты школьной жизни С днём рождения!

С днём рождения! Урок-соревнование в 3 классе Тема: «Wir kennen Deutsch super – ich kenne Deutsch am besten!»

Урок-соревнование в 3 классе Тема: «Wir kennen Deutsch super – ich kenne Deutsch am besten!» Презентация на тему Города воинской славы

Презентация на тему Города воинской славы  Бизнес-планирование. Бассейн

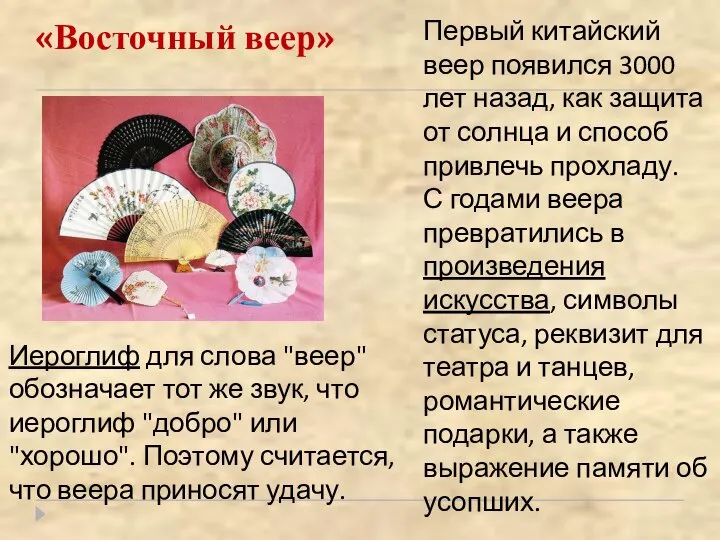

Бизнес-планирование. Бассейн Восточный веер

Восточный веер Lection2

Lection2 Сохранение психологического здоровья учащихся

Сохранение психологического здоровья учащихся Social network

Social network Роль ШМО естественно – математического цикла в работе со слабоуспевающими учащимися

Роль ШМО естественно – математического цикла в работе со слабоуспевающими учащимися Урок литературы в 11 классе Учитель русского языка и литературы Бокова Лидия Александровна

Урок литературы в 11 классе Учитель русского языка и литературы Бокова Лидия Александровна Прыжки в высоту с разбега способом перешагивание. 5 класс

Прыжки в высоту с разбега способом перешагивание. 5 класс