Содержание

- 2. How long-run growth can be measured by the increase in real GDP per capita, how this

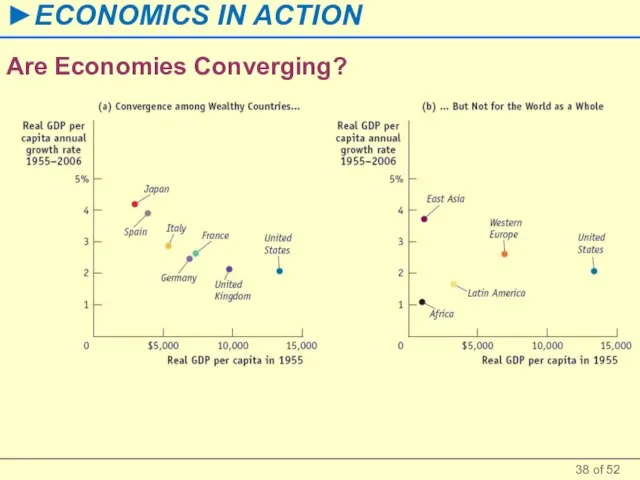

- 3. How growth has varied among several important regions of the world and why the convergence hypothesis

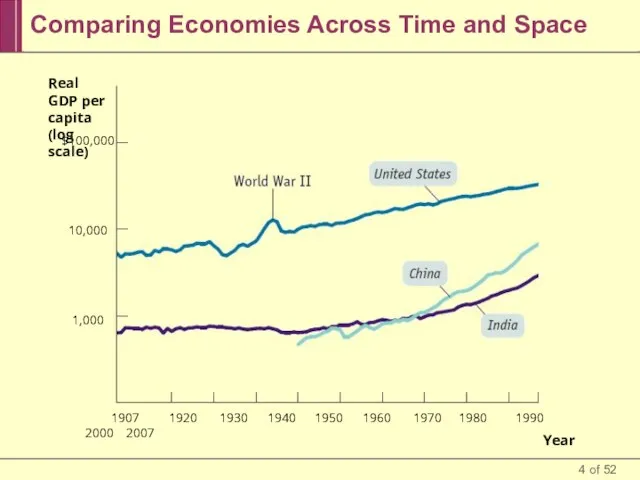

- 4. Comparing Economies Across Time and Space Real GDP per capita (log scale) $100,000 10,000 1,000 1907

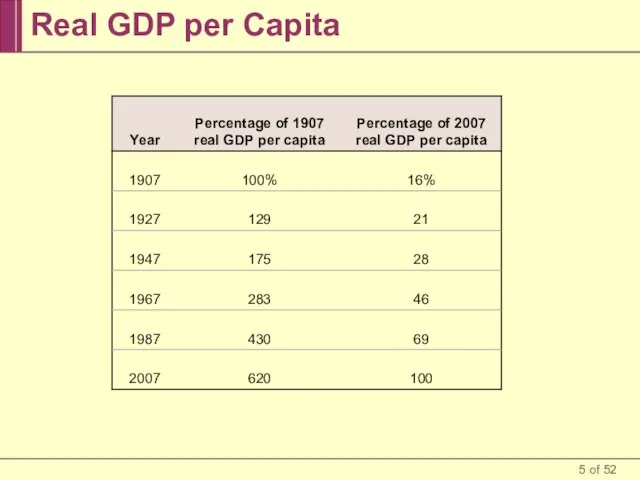

- 5. Real GDP per Capita

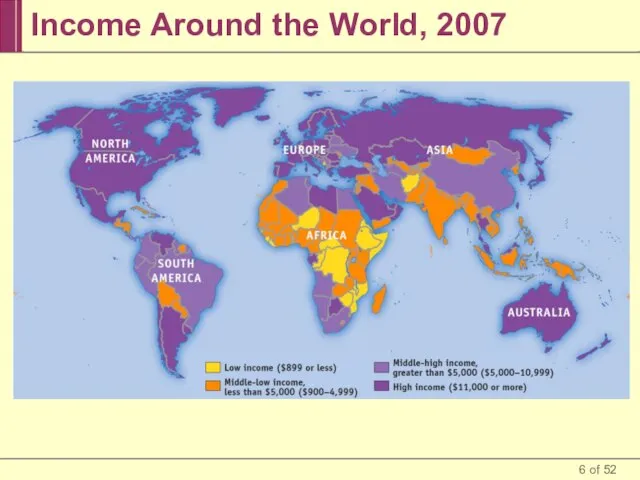

- 6. Income Around the World, 2007

- 7. Change in levels versus rate of change When studying economic growth, it’s vitally important to understand

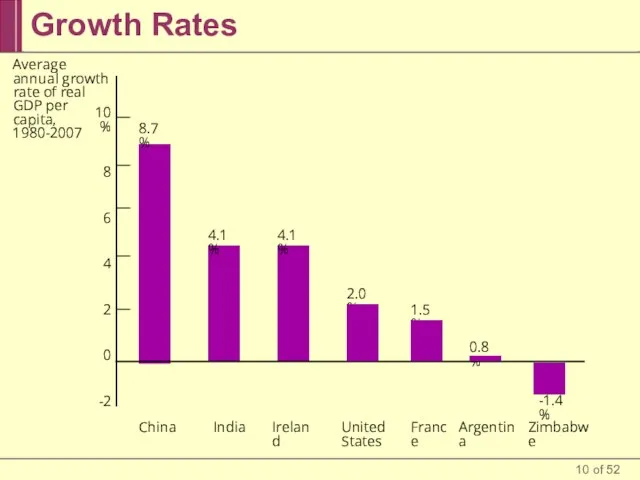

- 8. Growth Rates How did the United States manage to produce over six times more per person

- 9. Growth Rates The Rule of 70 tells us that the time it takes a variable that

- 10. Growth Rates United States 10% 8 6 4 2 0 -2 Average annual growth rate of

- 11. India Takes Off India achieved independence from Great Britain in 1947, becoming the world’s most populous

- 12. The Luck of the Irish In the nineteenth century, Ireland was desperately poor. Even as late

- 13. The Sources of Long-Run Growth Labor productivity, often referred to simply as productivity, is output per

- 14. Accounting for Growth: The Aggregate Production Function The aggregate production function is a hypothetical function that

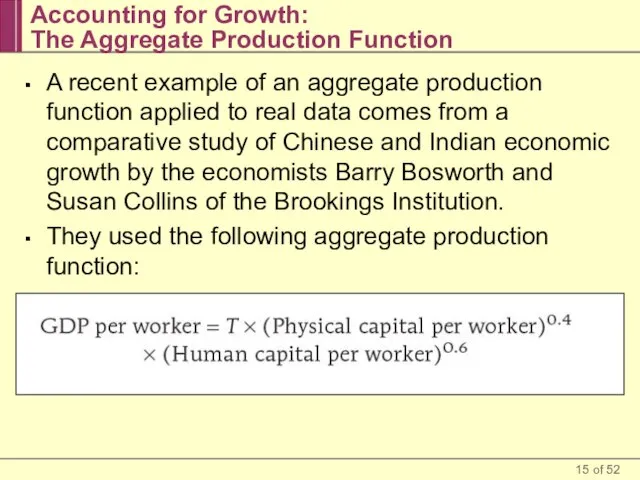

- 15. Accounting for Growth: The Aggregate Production Function A recent example of an aggregate production function applied

- 16. Accounting for Growth: The Aggregate Production Function Using this function, they tried to explain why China

- 17. Diminishing Returns to Physical Capital An aggregate production function exhibits diminishing returns to physical capital when,

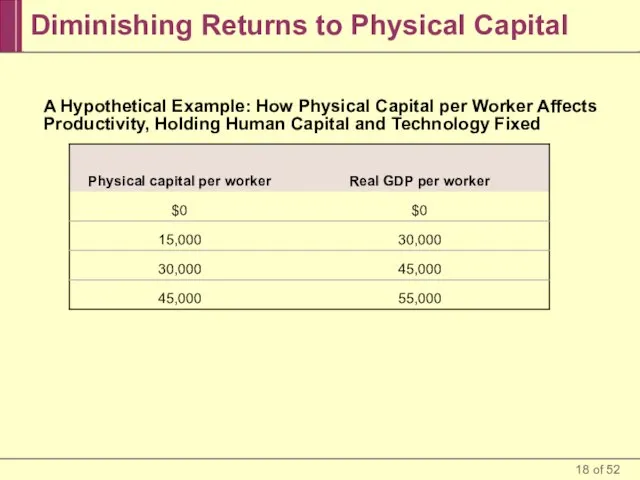

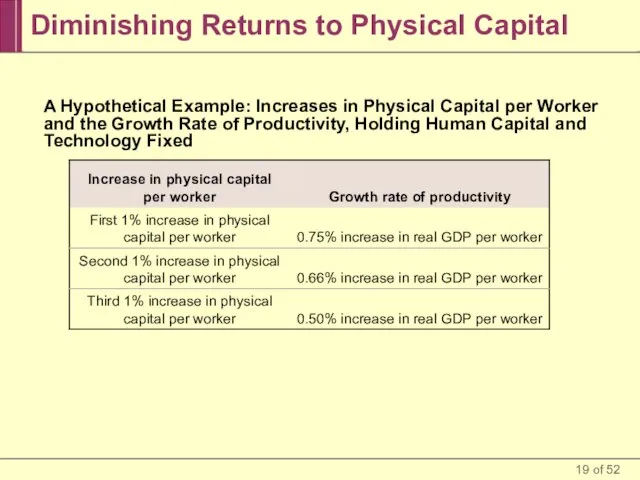

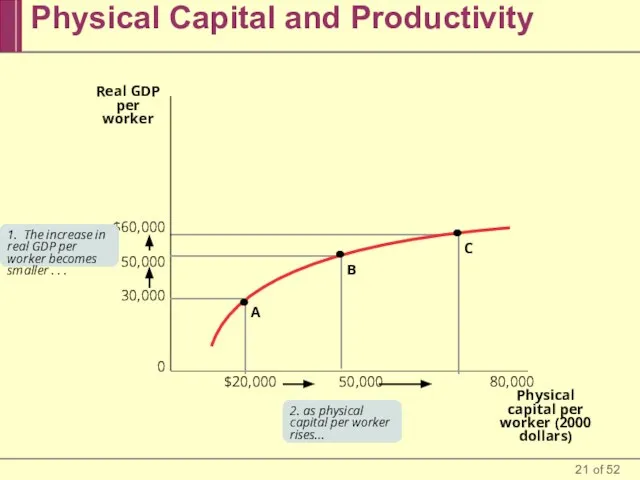

- 18. Diminishing Returns to Physical Capital A Hypothetical Example: How Physical Capital per Worker Affects Productivity, Holding

- 19. Diminishing Returns to Physical Capital A Hypothetical Example: Increases in Physical Capital per Worker and the

- 20. The Wal-Mart Effect After 20 years of being sluggish, U.S. productivity growth accelerated sharply (grew at

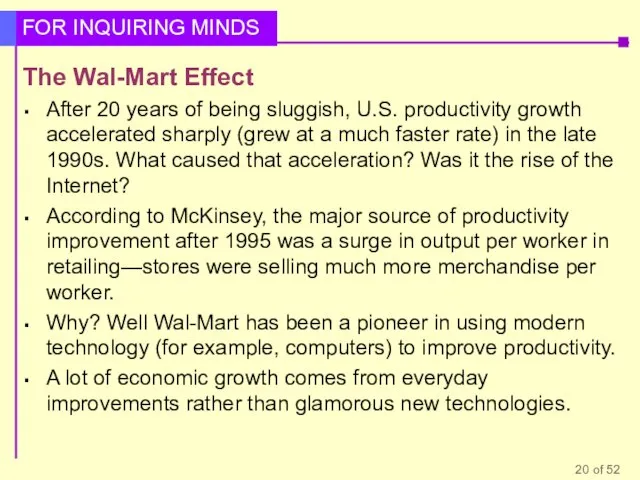

- 21. Physical Capital and Productivity $60,000 50,000 30,000 0 Real GDP per worker $20,000 50,000 80,000 Physical

- 22. It May Be Diminished … But It’s Still Positive Diminishing returns to physical capital is an

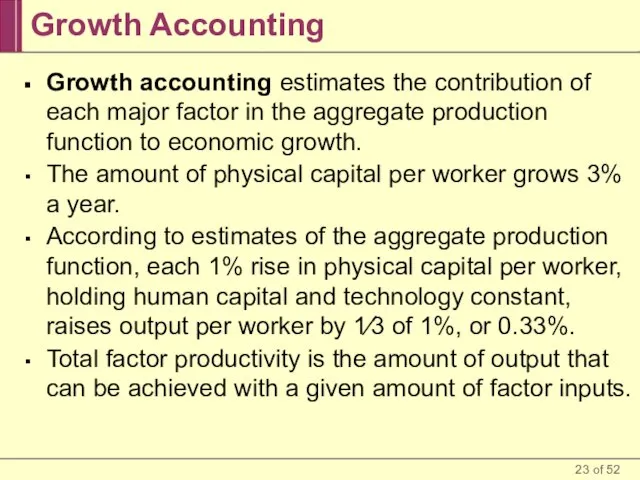

- 23. Growth Accounting Growth accounting estimates the contribution of each major factor in the aggregate production function

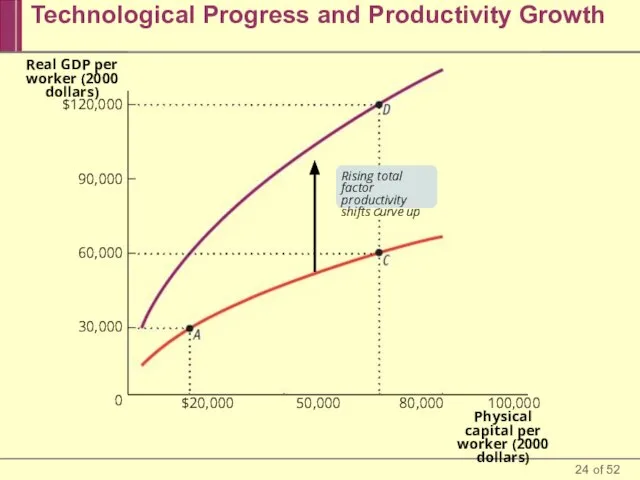

- 24. Technological Progress and Productivity Growth $120,000 90,000 60,000 30,000 0 Real GDP per worker (2000 dollars)

- 25. What about Natural Resources? In contrast to earlier times, in the modern world, natural resources are

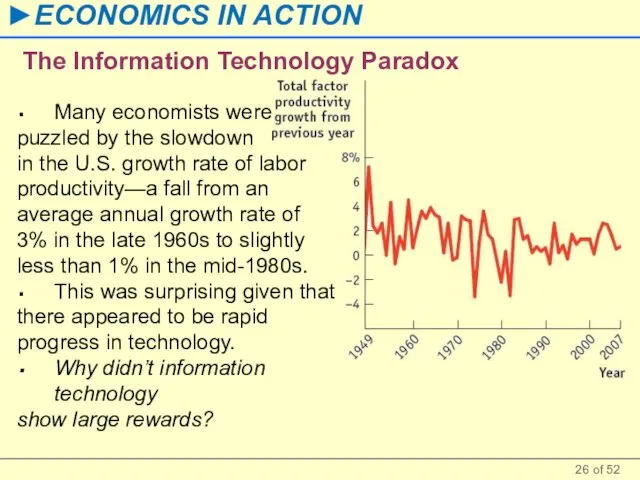

- 26. The Information Technology Paradox Many economists were puzzled by the slowdown in the U.S. growth rate

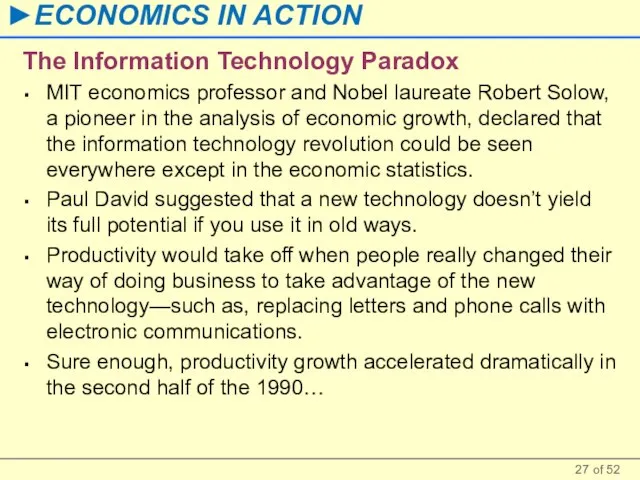

- 27. The Information Technology Paradox MIT economics professor and Nobel laureate Robert Solow, a pioneer in the

- 28. Why Growth Rates Differ A number of factors influence differences among countries in their growth rates.

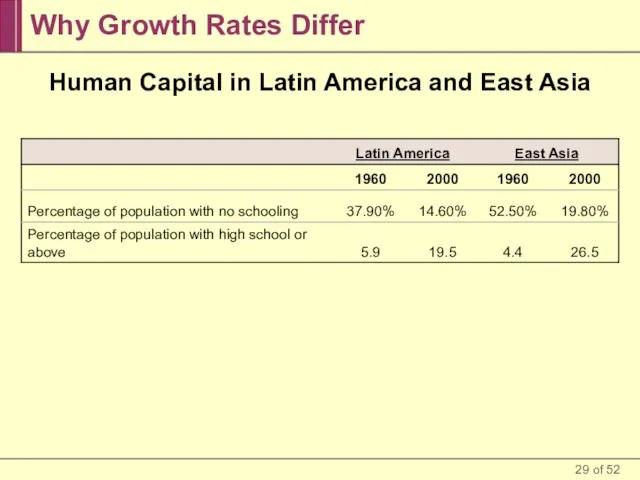

- 29. Why Growth Rates Differ Human Capital in Latin America and East Asia

- 30. Inventing R&D Thomas Edison is best known as the inventor of the light bulb and the

- 31. The Role of Government in Promoting Economic Growth Political stability and protection of property rights are

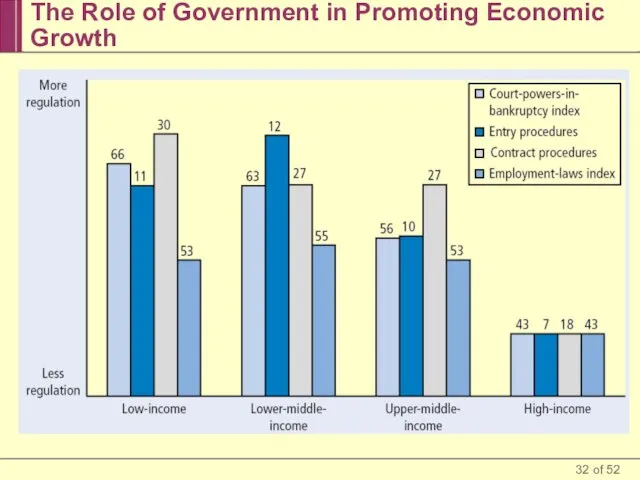

- 32. The Role of Government in Promoting Economic Growth

- 33. The Brazilian Breadbasket In recent years, Brazil’s economy has made a strong showing, especially in agriculture.

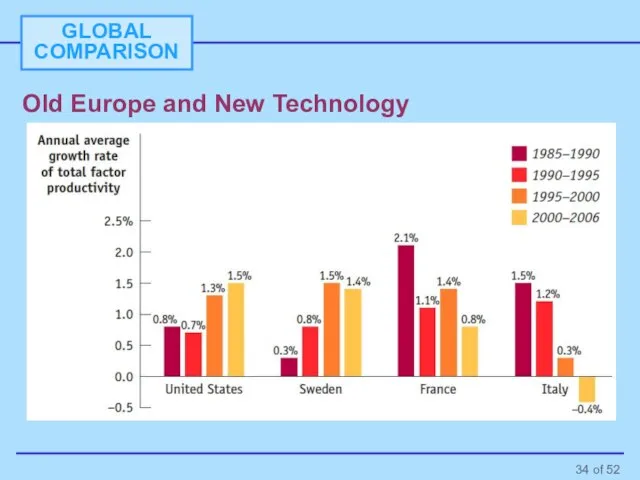

- 34. Old Europe and New Technology

- 35. Success, Disappointment, and Failure Real GDP per capita (log scale) 1960 1970 1980 1990 2000 2007

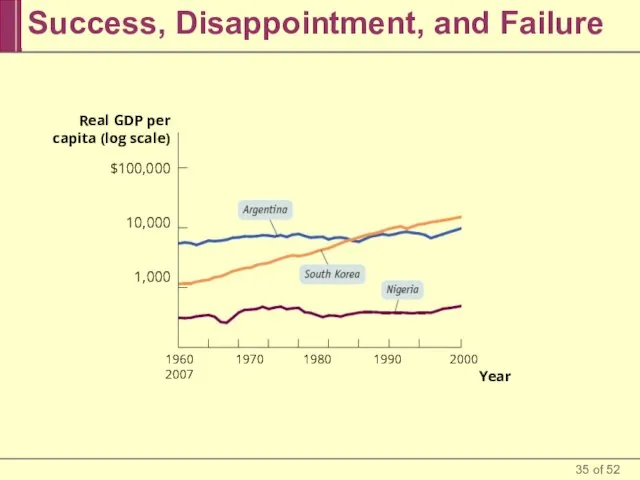

- 36. Success, Disappointment, and Failure The world economy contains examples of success and failure in the effort

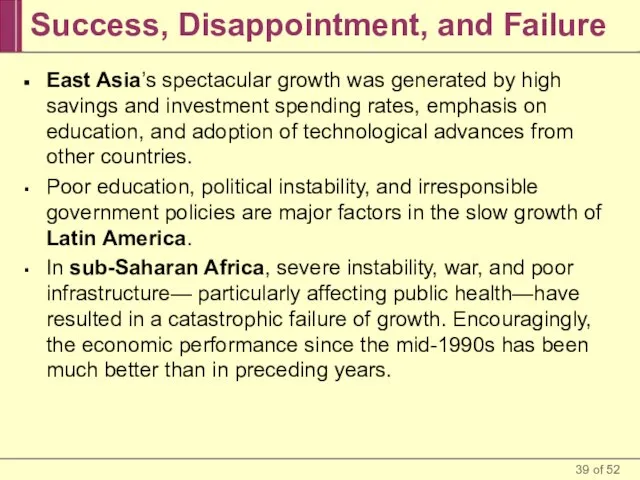

- 37. Success, Disappointment, and Failure The growth rates of economically advanced countries have converged, but not the

- 38. Are Economies Converging?

- 39. Success, Disappointment, and Failure East Asia’s spectacular growth was generated by high savings and investment spending

- 40. Is World Growth Sustainable? Long-run economic growth is sustainable if it can continue in the face

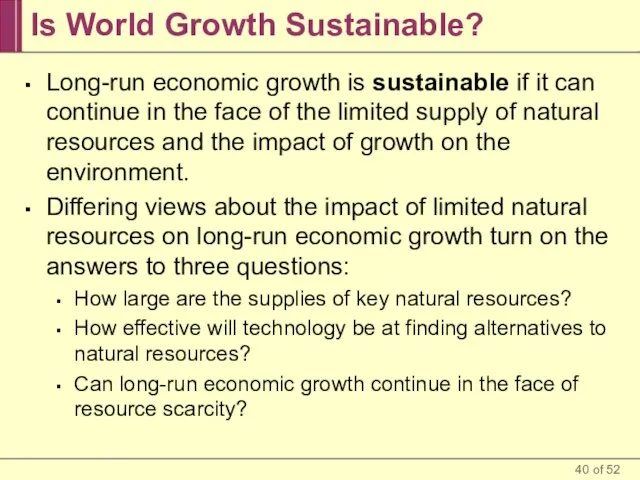

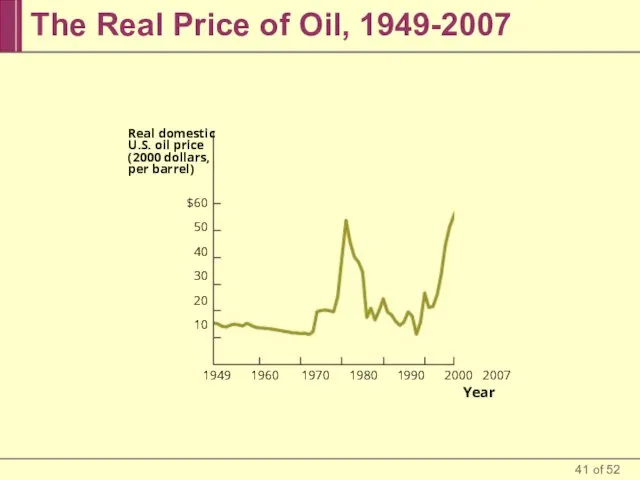

- 41. The Real Price of Oil, 1949-2007 Real domestic U.S. oil price (2000 dollars, per barrel) 1949

- 42. U.S. Oil Consumption and Growth over Time Oil consumption (thousands of barrels per day) 1949 1960

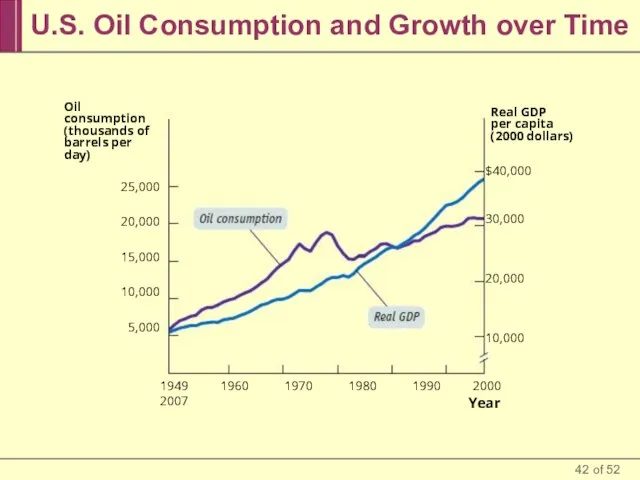

- 43. Economic Growth and the Environment The limits to growth arising from environmental degradation are more difficult

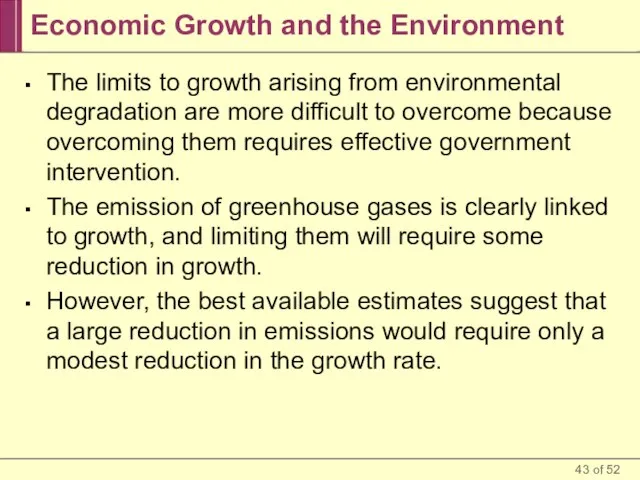

- 44. Climate Change and Growth Carbon dioxide emissions (million metric tons) 1980 1985 1990 1995 2000 2005

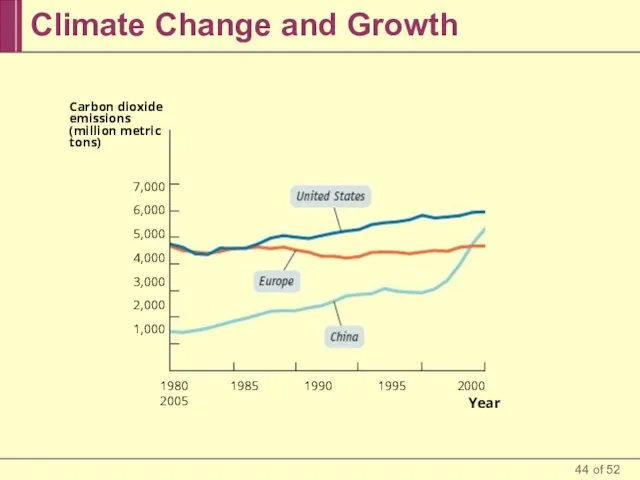

- 45. Economic Growth and the Environment There is broad consensus that government action to address climate change

- 46. Growth is measured as changes in real GDP per capita in order to eliminate the effects

- 47. The key to long-run economic growth is rising labor productivity, or just productivity, which is output

- 48. The large differences in countries’ growth rates are largely due to differences in their rates of

- 49. The world economy contains examples of success and failure in the effort to achieve long-run economic

- 50. Economists generally believe that environmental degradation poses a greater problem for whether long-run economic growth is

- 51. There is broad consensus that government action to address climate change and greenhouse gases should be

- 53. Скачать презентацию

Соединение боковых срезов пижамной сорочки запошивочным швом

Соединение боковых срезов пижамной сорочки запошивочным швом 3.Классификация проектов

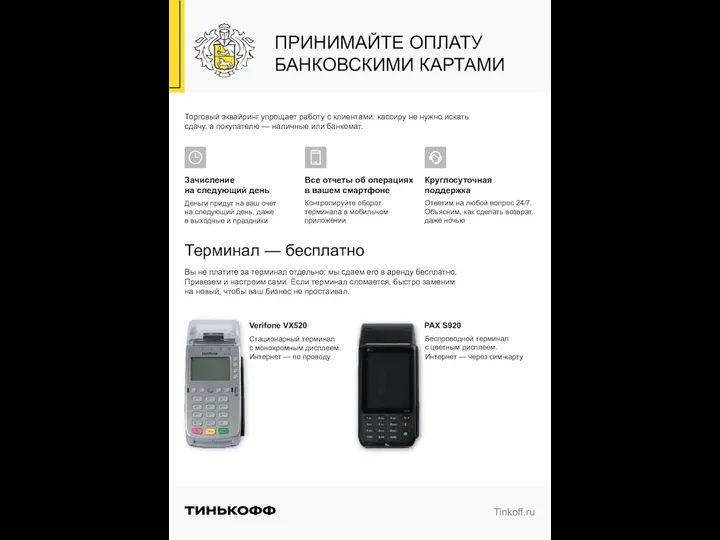

3.Классификация проектов Онлайн кассы

Онлайн кассы Презентация на тему Спартанская и Афинская системы обучения и воспитания в Древней Греции

Презентация на тему Спартанская и Афинская системы обучения и воспитания в Древней Греции  Примеры тоталитарных режимов

Примеры тоталитарных режимов Инновационная экономика и технологическое предпринимательство

Инновационная экономика и технологическое предпринимательство Практические аспекты мониторинга программ

Практические аспекты мониторинга программ Question1

Question1 ЭУП «Основы правовых знаний»

ЭУП «Основы правовых знаний» Аппарат для приготовления и продажи кислородных коктейлей. Создание вендинговой сети.

Аппарат для приготовления и продажи кислородных коктейлей. Создание вендинговой сети. 1

1 The National Gallery

The National Gallery Заседание рабочей группы по подготовке к введению комплексного учебного курса «Основы религиозных культур и светской этики» в о

Заседание рабочей группы по подготовке к введению комплексного учебного курса «Основы религиозных культур и светской этики» в о Открытый Кубок Донецкой области по маунтенбайку-2011

Открытый Кубок Донецкой области по маунтенбайку-2011 Презентация на тему Колебательный контур

Презентация на тему Колебательный контур Начало Первой мировой войны. Роль Восточного фронта в войне

Начало Первой мировой войны. Роль Восточного фронта в войне Sh_Mimi_Mishki_memori_avt_v_kontse_slova_Ch3

Sh_Mimi_Mishki_memori_avt_v_kontse_slova_Ch3 Презентация на тему Эвакуация населения

Презентация на тему Эвакуация населения  Проблема снижения уровня тревожности детей на занятиях физическим воспитанием

Проблема снижения уровня тревожности детей на занятиях физическим воспитанием Презентация на тему Этапы коррекционно-педагогической деятельности и коррекционные дневники

Презентация на тему Этапы коррекционно-педагогической деятельности и коррекционные дневники Понятия групповой психотерапии. История

Понятия групповой психотерапии. История Государственная (итоговая) аттестация выпускников 9-х классов

Государственная (итоговая) аттестация выпускников 9-х классов Кедровые орешки«Лесные Угодья»

Кедровые орешки«Лесные Угодья» Окно

Окно Технологическая платформа «Малая распределенная энергетика»

Технологическая платформа «Малая распределенная энергетика» Что такое эмблемы

Что такое эмблемы Локомотивные технические средства регулирования и обеспечения безопасности движения поездов КЛУБ и КЛУБ-У. При организации движе

Локомотивные технические средства регулирования и обеспечения безопасности движения поездов КЛУБ и КЛУБ-У. При организации движе Тема 1. Энергия и энергоэффективность в мире труда и профессии Услуги с помощью энергии, виды энергии, энергоэффективность Мате

Тема 1. Энергия и энергоэффективность в мире труда и профессии Услуги с помощью энергии, виды энергии, энергоэффективность Мате