Слайд 3Macroeconomics

Themes of Lectures

Capitalism, money, banking and monetary policy (Lecture #1)

Determination of

GDP under the fixed price level (by the Keynesian Cross model and by the IS-LM model) (Lecture #2)

Determination of GDP under the flexible price level (by the AD-AS model) (Lectures ##3-4)

Business Cycles (Financial Instability Hypothesis etc.) (Lecture #5)

Unemployment (Shapiro – Stiglitz model) (Lecture #6)

Growth (Solow model and Post-Solow models) (Lectures ##7-8)

Слайд 4Macroeconomics

Themes of Classes

Calculation of GDP by 3 Methods (Class #1)

Keynesian Cross

model (Class #2)

Deposit/Money Multiplier (Class #3)

The IS-LM model (Class #5)

Solow Model (Class #8)

Слайд 5Macroeconomics

Lecture 1.

Capitalism, money, banking and monetary policy

Слайд 6What is Capitalism?

This is the special economic system analyzed by Macroeconomics!

Features of

Capitalism include:

Private property

Market exchange

Capitalist firm as the main productive unit

Competition

Fixed capital and advanced technologies

- The special role of Money!

Слайд 7What is Money?

Money is what money does!

That is: any asset performing all

functions of money is money

Money has three functions in the economy:

Medium of exchange

Unit of account

Store of value

Слайд 8In other words: Money is…

Money is the set of assets in the

economy that people regularly use to buy goods and services from other people.

The market capitalist economy is monetary economy! Almost all transactions and almost all business are based on use of money!

Слайд 9The brief history of money

First, there was barter

Then, there was commodity money

This money takes the form of a commodity with intrinsic value.

Examples: Gold, silver, cigarettes.

Finally there was fiat money is used as money because of government decree.

It does not have intrinsic value, it has value because of decree.

Examples: Coins, paper money, check deposits.

Слайд 10The types of contemporary money

Currency is the paper bills and coins in

the hands of the public.

Demand deposits are balances in bank accounts that depositors can access on demand by writing a check.

Time deposits are balances in bank accounts that depositors can access only after a certain period. In other words, a time deposit is an interest-bearing bank account that has a pre-set date of maturity

Слайд 11The story about monetary aggregates

Monetary Aggregates are broad categories that measure the

money supply in an economy.

M0: Currency.

M1: All of M0, plus demand deposits.

M2: All of M1, plus small time deposits.

M3: All of M2, plus large time deposits.

Statisticians usually take into account M2, economists in their macroeconomic models usually assume that money is M1.

Слайд 12The simplest structure of contemporary money supply

The money supply equals currency plus

demand (checking account) deposits:

M = C + D

Since the money supply includes deposits, the banking system plays an important role.

Слайд 13Some basic concepts of Banking

Reserves (R ): the portion of deposits that

banks have not lent.

To a bank, liabilities include deposits, assets include reserves and outstanding loans

100 percent reserve banking: a system in which banks hold all deposits as reserves.

Fractional reserve banking:

a system in which banks hold a fraction of their deposits as reserves.

The contemporary capitalist economy is based on fractional reserve banking!

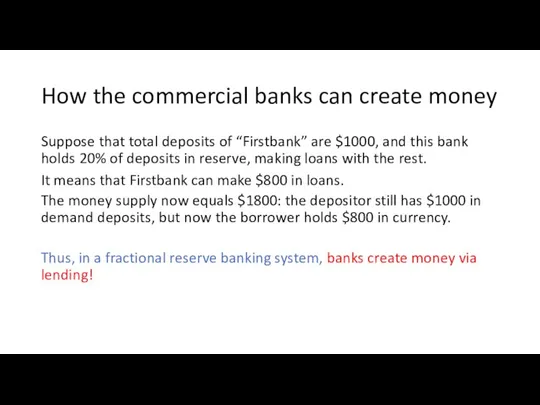

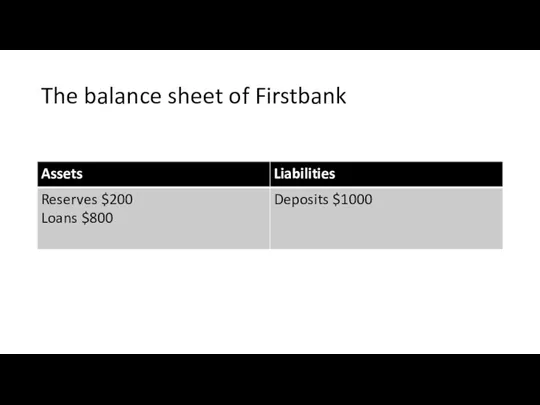

Слайд 14How the commercial banks can create money

Suppose that total deposits of “Firstbank”

are $1000, and this bank holds 20% of deposits in reserve, making loans with the rest.

It means that Firstbank can make $800 in loans.

The money supply now equals $1800: the depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency.

Thus, in a fractional reserve banking system, banks create money via lending!

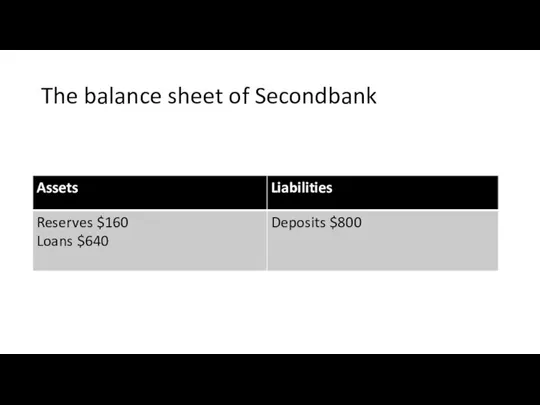

Слайд 16The story continues…

Suppose the borrower deposits the $800 in Secondbank.

But then Secondbank

will loan 80% of this deposit

Слайд 18The next stage of this story…

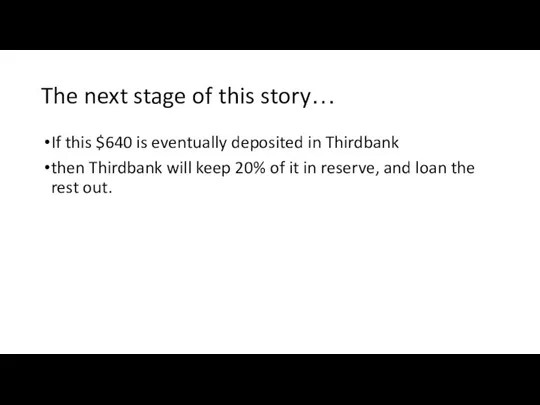

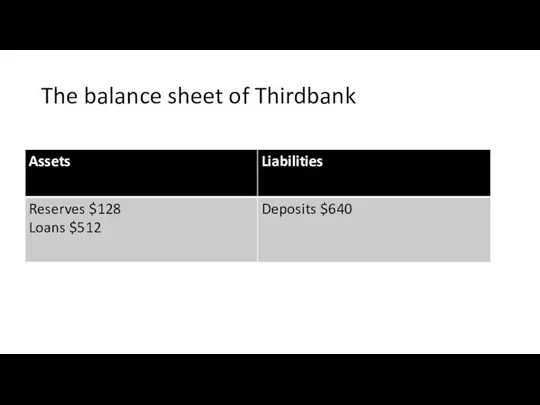

If this $640 is eventually deposited in

Thirdbank

then Thirdbank will keep 20% of it in reserve, and loan the rest out.

Слайд 20Finding the total money supply

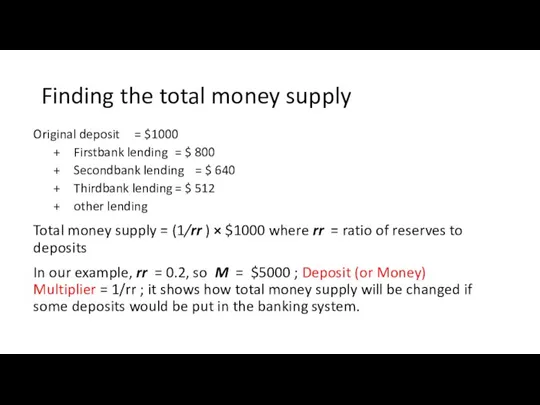

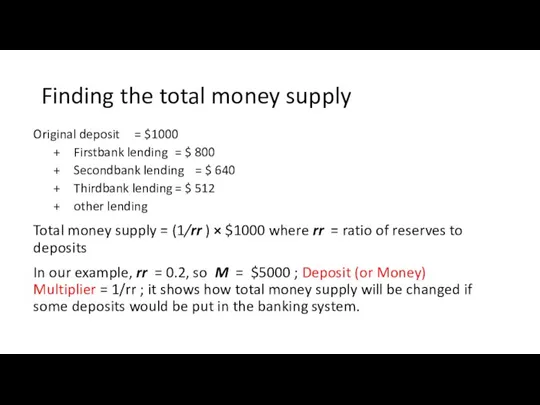

Original deposit = $1000

+ Firstbank lending = $ 800

+

Secondbank lending = $ 640

+ Thirdbank lending = $ 512

+ other lending

Total money supply = (1/rr ) × $1000 where rr = ratio of reserves to deposits

In our example, rr = 0.2, so M = $5000 ; Deposit (or Money) Multiplier = 1/rr ; it shows how total money supply will be changed if some deposits would be put in the banking system.

Слайд 21Some important conclusions about the role of banks in the money-creating process

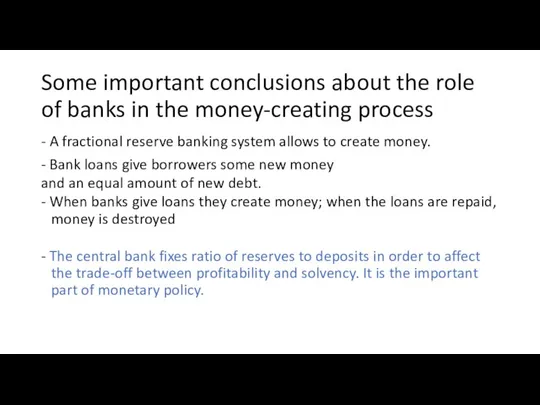

-

A fractional reserve banking system allows to create money.

- Bank loans give borrowers some new money

and an equal amount of new debt.

- When banks give loans they create money; when the loans are repaid, money is destroyed

- The central bank fixes ratio of reserves to deposits in order to affect the trade-off between profitability and solvency. It is the important part of monetary policy.

Слайд 22What is monetary policy?

Monetary policy is policy adopted by the monetary authority of

a nation to control either the interest rate or the money supply in order to affect – via aggregate demand – the important macroeconomic variables like real GDP, inflation rate etc.

Monetary policy should be distinguished from fiscal policy that tries to affect real GDP via taxation, government spending and government borrowing.

Слайд 23Monetary policy can be expansionary or restrictive

Monetary policy is expansionary if the

central bank tries – via instruments of monetary policy – increase aggregate demand and real GDP.

Monetary policy is restrictive if the central bank tries – via instruments of monetary policy – decrease aggregate demand and the price level/the inflation rate.

Слайд 24The main instruments of monetary policy

Reserve requirements.

Discount rate/base rate

Open market operations

Слайд 25Reserve requirements

The reserve requirement is regulation that sets the minimum amount of reserves that

must be held by a commercial bank.

The minimum reserve is generally determined by the central bank to be no less than a specified percentage of the amount of deposit liabilities the commercial bank owes to its customers.

The commercial bank's reserves normally consist of cash owned by the bank and stored physically in the bank vault (vault cash), plus the amount of the commercial bank's balance in that bank's account with the central bank.

Слайд 26The discount rate/base rate

The discount rate/base rate is price of borrowing money

from the central bank by commercial banks, usually on a short-term basis.

Usually the discount rate sets the “floor” for market short-term interest rate set by the commercial banks for their borrowers.

Слайд 27Open market operations

Open market operations are an activity by a central bank to give (or

take) liquidity in its currency to (or from) a bank or a group of banks.

The central bank can either buy or sell government bonds in the open market (this is where the name was historically derived from) or, in what is now mostly the preferred solution, enter into secured lending transaction with a commercial bank.

In other words, the central bank gives the money as a deposit for a defined period and synchronously takes an eligible asset as collateral.

Слайд 28If the central bank wants to make expansionary policy that it will

Soften

reserve requirements.

Reduce the discount rate/base rate

Buy government bonds by giving money to the commercial banks.

Слайд 29If the central bank wants to make restrictive policy that it will

Tighten

reserve requirements.

Increase the discount rate/base rate

Sell government bonds by taking money from the commercial banks.

Слайд 30Something about the demand for money

The effectiveness of monetary policy depends on

– other things being equal – changes in demand for money.

The demand for money is not quantity of money that is necessary for providing absolute happiness…

The demand for money is the quantity of money that people plan to hold. This quantity depends mainly on:

The price level

The interest rate

Real GDP

Financial innovations

Слайд 31The price level as a factor of the demand for money

A rise

in the price level increases the nominal quantity of money demanded but doesn’t change the real quantity of money that people plan to hold.

Nominal money is the amount of money measured in rubles/dollars/euros.

The quantity of nominal money demanded is proportional to the price level — a 10 percent rise in the price level increases the quantity of nominal money demanded by 10 percent.

Слайд 32The interest rate as a factor of the demand for money

The interest

rate is the opportunity cost of holding wealth in the form of money rather than an interest-bearing asset.

In other words, when people hold money, they lose interest income.

A rise in the interest rate decreases the quantity of money that people plan to hold.

Слайд 33The real GDP as a factor of the demand for money

The idea

is that people receive wages and salaries 1-2 times per month, but make expenditure almost every day.

Money holding allows to fill the “gap” in time between incomes and expenditures.

An increase in real GDP increases the volume of expenditure, which increases the quantity of real money that people plan to hold.

Слайд 34Financial innovations as a factor of the demand for money

Financial innovation that

lowers the cost of switching between money and interest-bearing assets decreases the quantity of money that people plan to hold.

For example, an expansion of financial markets or an emergence of new types of debit/credit cards will decrease the demand for money.

Слайд 35The money supply and the demand for money together

Economists usually prefer to

construct macroeconomic models in which:

The money supply does not depend on the interest rate – because the central bank is able to control the quantity of money in the economy – or the money supply positively depends on the interest rate because the commercial banks will increase loans (and create money) as the interest rates rises.

The demand for money negatively depends on the interest rate – because the interest rate is the opportunity cost of money holding.

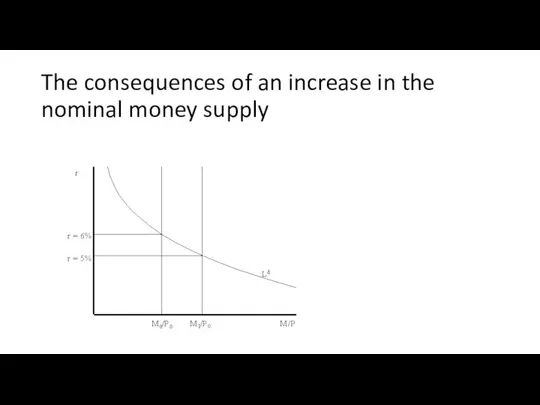

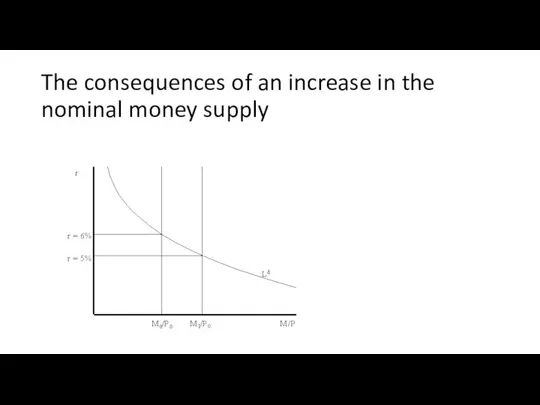

Слайд 37The consequences of an increase in the nominal money supply

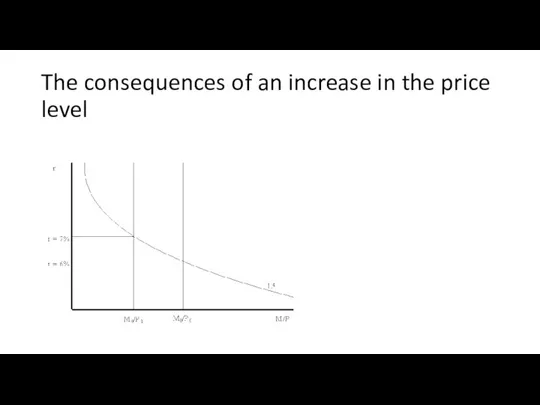

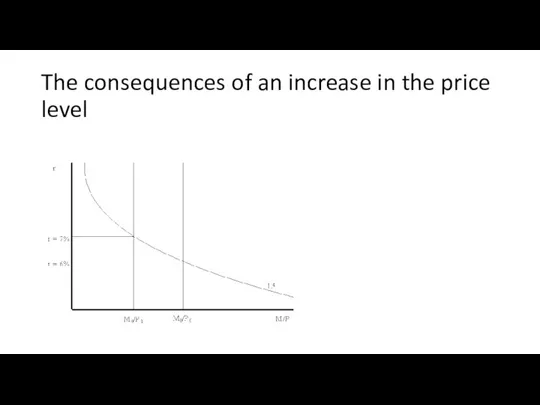

Слайд 38The consequences of an increase in the price level

тема проекта: «МУДРОСТЬ ВЕКОВ»

тема проекта: «МУДРОСТЬ ВЕКОВ» Применение первого закона термодинамики к изопроцессам

Применение первого закона термодинамики к изопроцессам Эволюция управленческой мысли

Эволюция управленческой мысли Святая великомученица Екатерина

Святая великомученица Екатерина Всероссийская олимпиада школьников по предметам (школьный,муниципальный, краевой этапы)2011 – 2012 учебный год

Всероссийская олимпиада школьников по предметам (школьный,муниципальный, краевой этапы)2011 – 2012 учебный год Проект Развитие реальных компетенций в выдуманных мирах

Проект Развитие реальных компетенций в выдуманных мирах Что изображают на глобусе и карте?

Что изображают на глобусе и карте? Презентация на тему Россия в начале 21 века

Презентация на тему Россия в начале 21 века  Биография Ивана Алексеевича Бунина

Биография Ивана Алексеевича Бунина Проект PANDA

Проект PANDA Архитектура и дизайн

Архитектура и дизайн Прогрессии

Прогрессии Базовые технологии развития зрительного восприятия детей с нарушением зрения.

Базовые технологии развития зрительного восприятия детей с нарушением зрения. Кичигинский горно-обогатительный комбинат Кварц

Кичигинский горно-обогатительный комбинат Кварц Наше путешествие в Абхазию-страну солнца

Наше путешествие в Абхазию-страну солнца Собрание отела продаж

Собрание отела продаж Права и обязанности участников дорожного движения

Права и обязанности участников дорожного движения История о том как драйвер в поход ходил

История о том как драйвер в поход ходил Русская народная резьба и роспись по дереву

Русская народная резьба и роспись по дереву Урок-консультация «Алканы»10 класс

Урок-консультация «Алканы»10 класс «Оnline» урок по биологии для учащихся и учителей общеобразовательных школ Республики Казахстан Хайдарова Жупар Уразбаевна, учит

«Оnline» урок по биологии для учащихся и учителей общеобразовательных школ Республики Казахстан Хайдарова Жупар Уразбаевна, учит Современное понимание педагогики развития

Современное понимание педагогики развития Мотивация. Потребности по Маслоу

Мотивация. Потребности по Маслоу Штокмановское газоконденсатное месторождение

Штокмановское газоконденсатное месторождение Презентация на тему Экологическая игра

Презентация на тему Экологическая игра  СПЕЦПРОЕКТ

СПЕЦПРОЕКТ "Полотно Победы"

"Полотно Победы" Картинка-миниатюрка

Картинка-миниатюрка