Содержание

- 2. The Financial System The financial system consists of the group of institutions in the economy that

- 3. FINANCIAL INSTITUTIONS IN THE U.S. ECONOMY The financial system is made up of financial institutions that

- 4. FINANCIAL INSTITUTIONS IN THE U.S. ECONOMY Financial Markets Stock Market Bond Market Financial Intermediaries Banks Mutual

- 5. FINANCIAL INSTITUTIONS IN THE U.S. ECONOMY Financial markets are the institutions through which savers can directly

- 6. Financial Markets The Bond Market A bond is a certificate of indebtedness that specifies obligations of

- 7. Financial Markets The Stock Market Stock represents a claim to partial ownership in a firm and

- 8. Financial Markets The Stock Market Most newspaper stock tables provide the following information: Price (of a

- 9. Financial Intermediaries Financial intermediaries are financial institutions through which savers can indirectly provide funds to borrowers.

- 10. Financial Intermediaries Banks take deposits from people who want to save and use the deposits to

- 11. Financial Intermediaries Banks Banks help create a medium of exchange by allowing people to write checks

- 12. Financial Intermediaries Mutual Funds A mutual fund is an institution that sells shares to the public

- 13. Financial Intermediaries Other Financial Institutions Credit unions Pension funds Insurance companies Loan sharks

- 14. SAVING AND INVESTMENT IN THE NATIONAL INCOME ACCOUNTS Recall that GDP is both total income in

- 15. Some Important Identities Assume a closed economy – one that does not engage in international trade:

- 16. Some Important Identities Now, subtract C and G from both sides of the equation: Y –

- 17. Some Important Identities Substituting S for Y - C - G, the equation can be written

- 18. Some Important Identities National saving, or saving, is equal to: S = I S = Y

- 19. The Meaning of Saving and Investment National Saving National saving is the total income in the

- 20. The Meaning of Saving and Investment Public Saving Public saving is the amount of tax revenue

- 21. The Meaning of Saving and Investment Surplus and Deficit If T > G, the government runs

- 22. The Meaning of Saving and Investment For the economy as a whole, saving must be equal

- 23. THE MARKET FOR LOANABLE FUNDS Financial markets coordinate the economy’s saving and investment in the market

- 24. THE MARKET FOR LOANABLE FUNDS The market for loanable funds is the market in which those

- 25. THE MARKET FOR LOANABLE FUNDS Loanable funds refers to all income that people have chosen to

- 26. Supply and Demand for Loanable Funds The supply of loanable funds comes from people who have

- 27. Supply and Demand for Loanable Funds The interest rate is the price of the loan. It

- 28. Supply and Demand for Loanable Funds Financial markets work much like other markets in the economy.

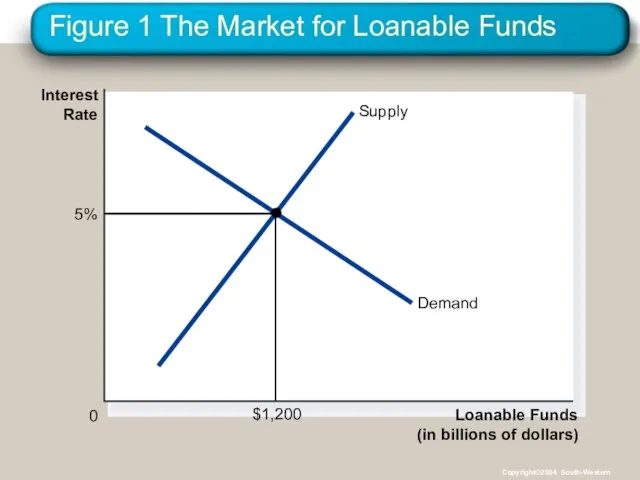

- 29. Figure 1 The Market for Loanable Funds Loanable Funds (in billions of dollars) 0 Interest Rate

- 30. Supply and Demand for Loanable Funds Government Policies That Affect Saving and Investment Taxes and saving

- 31. Policy 1: Saving Incentives Taxes on interest income substantially reduce the future payoff from current saving

- 32. Policy 1: Saving Incentives A tax decrease increases the incentive for households to save at any

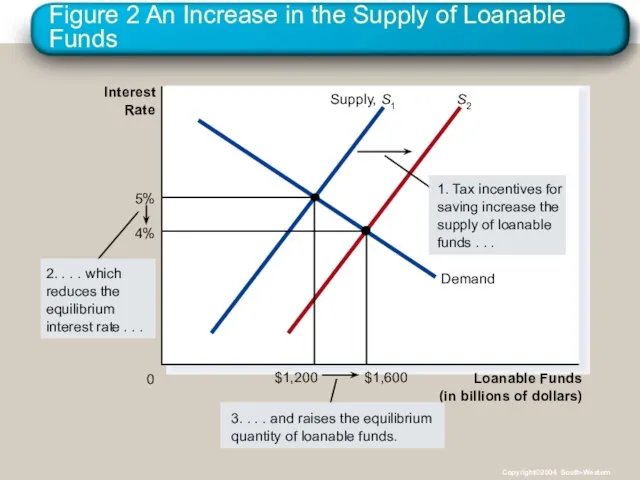

- 33. Figure 2 An Increase in the Supply of Loanable Funds Loanable Funds (in billions of dollars)

- 34. Policy 1: Saving Incentives If a change in tax law encourages greater saving, the result will

- 35. Policy 2: Investment Incentives An investment tax credit increases the incentive to borrow. Increases the demand

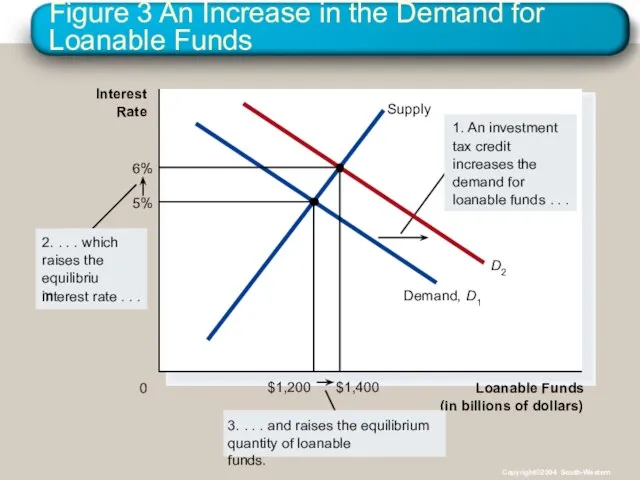

- 36. Policy 2: Investment Incentives If a change in tax laws encourages greater investment, the result will

- 37. Figure 3 An Increase in the Demand for Loanable Funds Loanable Funds (in billions of dollars)

- 38. Policy 3: Government Budget Deficits and Surpluses When the government spends more than it receives in

- 39. Policy 3: Government Budget Deficits and Surpluses Government borrowing to finance its budget deficit reduces the

- 40. Policy 3: Government Budget Deficits and Surpluses A budget deficit decreases the supply of loanable funds.

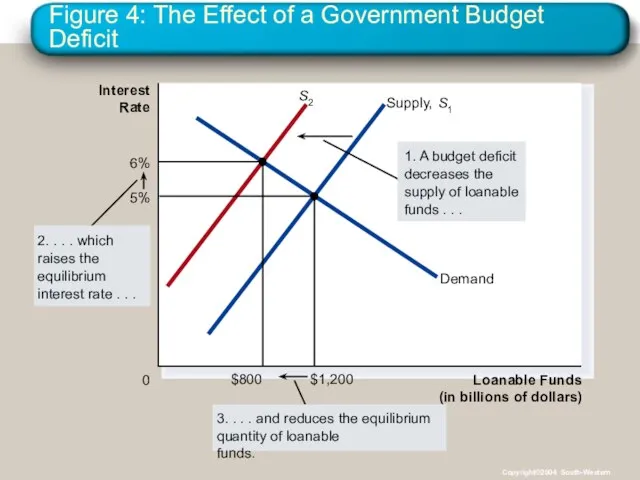

- 41. Figure 4: The Effect of a Government Budget Deficit Loanable Funds (in billions of dollars) 0

- 42. Policy 3: Government Budget Deficits and Surpluses When government reduces national saving by running a deficit,

- 43. Policy 3: Government Budget Deficits and Surpluses A budget surplus increases the supply of loanable funds,

- 44. Figure 5 The U.S. Government Debt Percent of GDP 1790 1810 1830 1850 1870 1890 1910

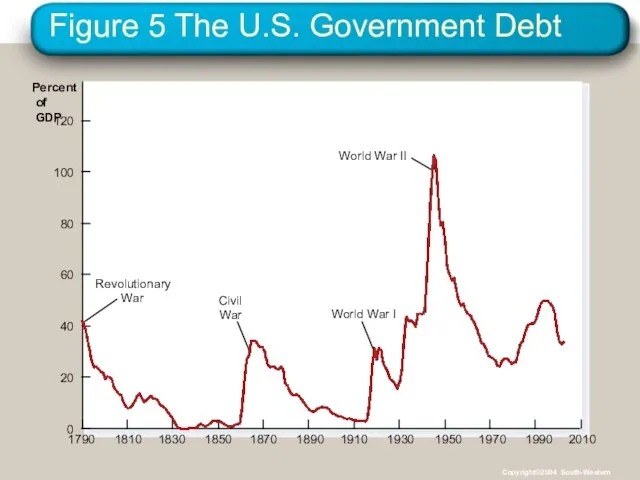

- 45. Summary The U.S. financial system is made up of financial institutions such as the bond market,

- 46. Summary National income accounting identities reveal some important relationships among macroeconomic variables. In particular, in a

- 47. Summary The interest rate is determined by the supply and demand for loanable funds. The supply

- 49. Скачать презентацию

Управление запасами на предприятиях – участниках цепей поставок

Управление запасами на предприятиях – участниках цепей поставок Проект Школьный

Проект Школьный Молтен

Молтен Бизнес-проект. Производство резиновой крошки

Бизнес-проект. Производство резиновой крошки Матурым, поздравляю тебя с Нашим днём!

Матурым, поздравляю тебя с Нашим днём! Источники питания для сварки

Источники питания для сварки ROBOT MOEЙ MEЧТЫ

ROBOT MOEЙ MEЧТЫ Современные подходы в организации деятельности по развитию кадрового потенциала сотрудников

Современные подходы в организации деятельности по развитию кадрового потенциала сотрудников  Эластичность

Эластичность Презентация на тему Australia

Презентация на тему Australia Составление конструктивно-технологической характеристики узла самолёта

Составление конструктивно-технологической характеристики узла самолёта 1

1 Что такое дисциплина (7 класс)

Что такое дисциплина (7 класс) ОСВ-сообщество 2020 – 2027

ОСВ-сообщество 2020 – 2027 Источники поступления средств в семейный бюджет

Источники поступления средств в семейный бюджет Михаил Евграфович Салтыков-Щедрин Сведения о жизни и творчестве писателя

Михаил Евграфович Салтыков-Щедрин Сведения о жизни и творчестве писателя Автоматизация РЭИ 2020

Автоматизация РЭИ 2020 Презентация на тему Правописание Ча-ща, чу-щу

Презентация на тему Правописание Ча-ща, чу-щу Санкции – новые возможности

Санкции – новые возможности Подошва Надежда Валентиновна Старший преподаватель кафедры прикладной математики Филиала Московского Государственного Открыто

Подошва Надежда Валентиновна Старший преподаватель кафедры прикладной математики Филиала Московского Государственного Открыто History of England:From the Romans to Normans

History of England:From the Romans to Normans Русская кухня

Русская кухня Игра «Звездный марафон»

Игра «Звездный марафон» Слоганы для ювелирной сети гипермаркетов Sunlight

Слоганы для ювелирной сети гипермаркетов Sunlight Функции правосознания

Функции правосознания Modernism in litirature

Modernism in litirature  Катастрофы

Катастрофы Исследовательская работа ученицы 3 класса МОУ СОШ №1 ЛОРАЙ ЕЛЕНЫ на тему «ВЫРАЩИВАНИЕ МОЖЖЕВЕЛЬНИКА В УСЛОВИЯХ ТУЛЬСКОЙ

Исследовательская работа ученицы 3 класса МОУ СОШ №1 ЛОРАЙ ЕЛЕНЫ на тему «ВЫРАЩИВАНИЕ МОЖЖЕВЕЛЬНИКА В УСЛОВИЯХ ТУЛЬСКОЙ