Содержание

- 2. Assumptions and Simplifications Use the Keynesian aggregate expenditures model Prices are fixed GDP = DI Begin

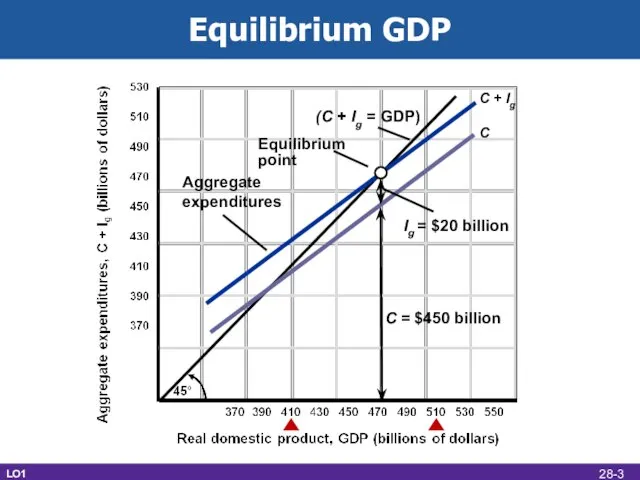

- 3. Equilibrium GDP C Ig = $20 billion Aggregate expenditures C = $450 billion C + Ig

- 4. Other Features of Equilibrium GDP Saving equals planned investment Saving is a leakage of spending Investment

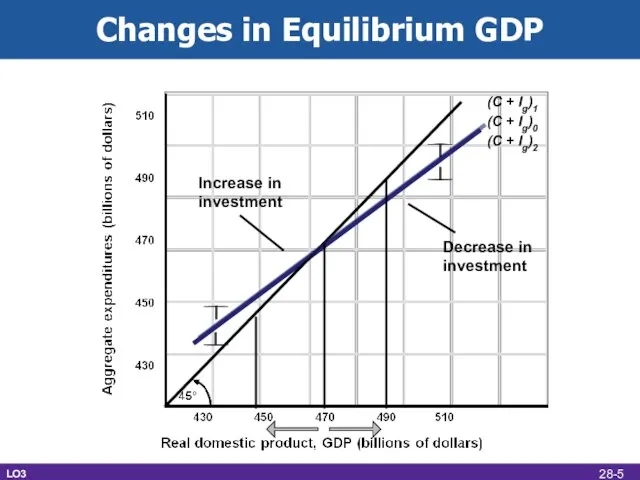

- 5. Changes in Equilibrium GDP Increase in investment (C + Ig)0 Decrease in investment (C + Ig)2

- 6. Adding International Trade Include net exports spending in aggregate expenditures Private, open economy Exports create production,

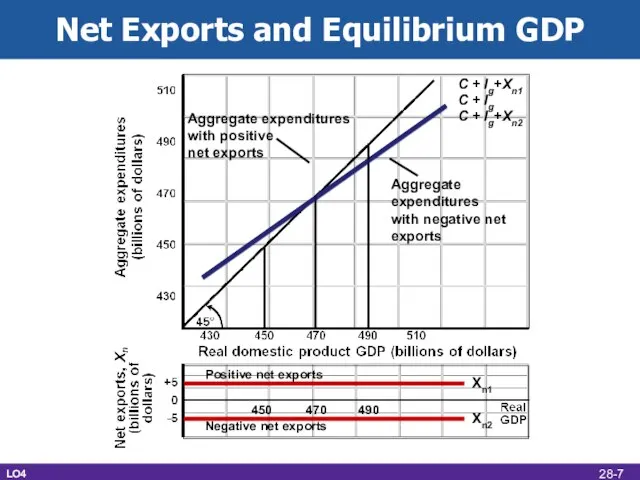

- 7. Net Exports and Equilibrium GDP Aggregate expenditures with positive net exports C + Ig Aggregate expenditures

- 8. International Economic Linkages Prosperity abroad Can increase U.S. exports Exchange rates Depreciate the dollar to increase

- 9. Adding the Public Sector Government purchases and equilibrium GDP Government spending is subject to the multiplier

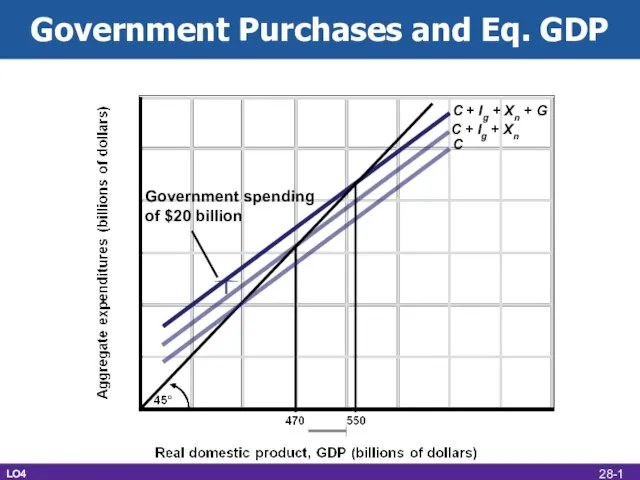

- 10. Government Purchases and Eq. GDP C Government spending of $20 billion C + Ig + Xn

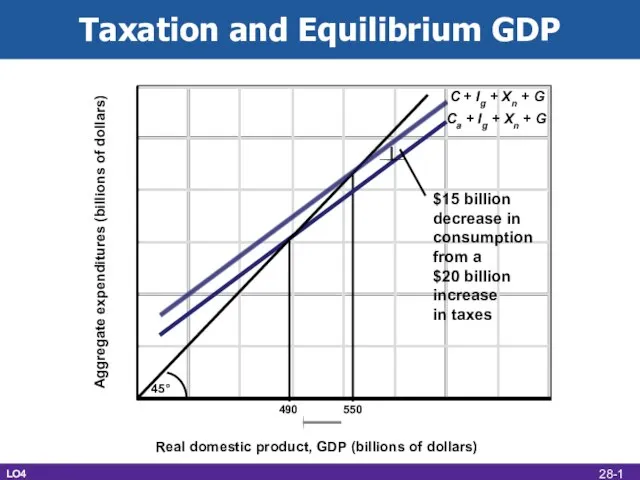

- 11. Taxation and Equilibrium GDP $15 billion decrease in consumption from a $20 billion increase in taxes

- 12. Equilibrium versus Full-Employment Recessionary expenditure gap Insufficient aggregate spending Spending below full-employment GDP Increase G and/or

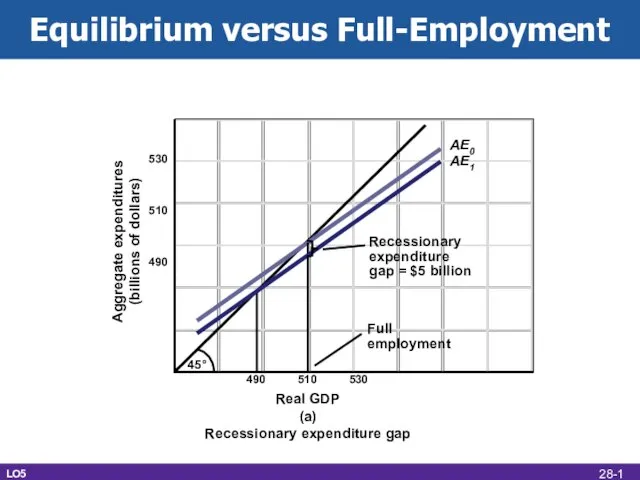

- 13. Equilibrium versus Full-Employment AE0 AE1 Full employment Recessionary expenditure gap = $5 billion LO5 28-

- 15. Скачать презентацию

Реализация проекта «Кто не умеет говорить, тот карьеры не сделает» (Повышение речевой компетенции учащихся как основа их успешно

Реализация проекта «Кто не умеет говорить, тот карьеры не сделает» (Повышение речевой компетенции учащихся как основа их успешно Внешняя политика Ивана Грозного (10 класс)

Внешняя политика Ивана Грозного (10 класс) «Союз волшебных звуков, чувств и дум»в «Пушкиниане» Нади Рушевой

«Союз волшебных звуков, чувств и дум»в «Пушкиниане» Нади Рушевой Презентация

Презентация Английские, французские, немецкие народные песенки

Английские, французские, немецкие народные песенки Сложение и вычитание в пределах 100

Сложение и вычитание в пределах 100 Prezentatsia_9B

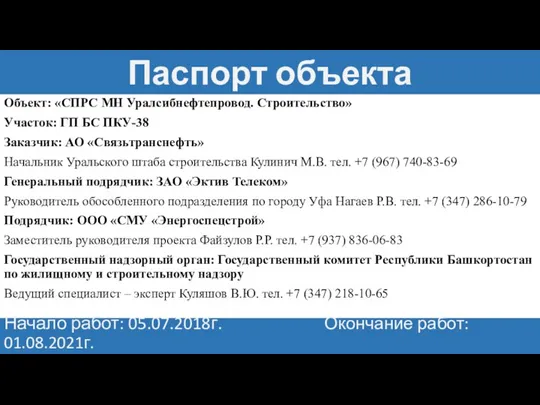

Prezentatsia_9B Паспорт объекта

Паспорт объекта ИТОГИ 2006 ГОДА.ГОД ЛИКВИДАЦИИ

ИТОГИ 2006 ГОДА.ГОД ЛИКВИДАЦИИ Презентация на тему Родительская любовь и стили родительского поведения

Презентация на тему Родительская любовь и стили родительского поведения Отдых в Daima biz

Отдых в Daima biz Засушлевые зоны умеренного пояса. Степи

Засушлевые зоны умеренного пояса. Степи Азбука архитектуры

Азбука архитектуры «Профессия:вчера, сегодня, завтра»

«Профессия:вчера, сегодня, завтра» Аминокислоты, белки

Аминокислоты, белки Гибкость и ловкость. Круговой метод тренировки для развития основных групп мышц с предметами

Гибкость и ловкость. Круговой метод тренировки для развития основных групп мышц с предметами Презентация на тему Все работы хороши

Презентация на тему Все работы хороши  КРИМИНОЛОГИЯ

КРИМИНОЛОГИЯ Мишин В.В

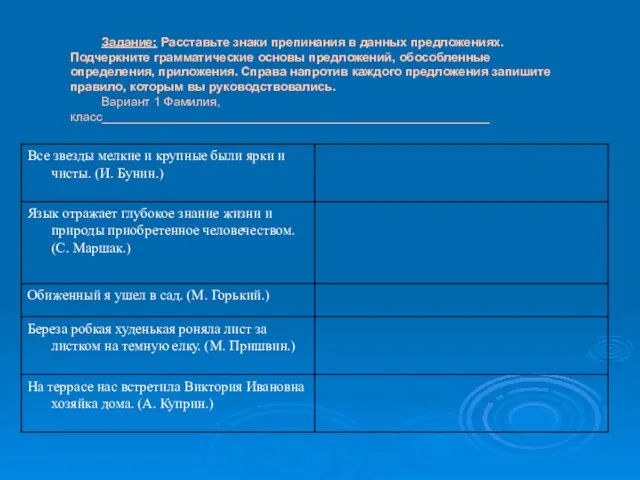

Мишин В.В Задание: Расставьте знаки препинания в данных предложениях. Подчеркните грамматические основы предложений, обособленные определ

Задание: Расставьте знаки препинания в данных предложениях. Подчеркните грамматические основы предложений, обособленные определ Динамика DDoS-атак в России

Динамика DDoS-атак в России Презентация на тему Интеллектуальная разминка

Презентация на тему Интеллектуальная разминка  КИТАЙСКАЯ ЖИВОПИСЬ И КАЛЛИГРАФИЯ

КИТАЙСКАЯ ЖИВОПИСЬ И КАЛЛИГРАФИЯ Система образования в Китае

Система образования в Китае Презентация ИС1-21 Марк Израйлев 21.10.2022

Презентация ИС1-21 Марк Израйлев 21.10.2022 Особенности древних цивилизаций. Цивилизации Древнего Востока

Особенности древних цивилизаций. Цивилизации Древнего Востока Презентация на тему Стратегия Казахстан - 2050

Презентация на тему Стратегия Казахстан - 2050  Взамод АГ

Взамод АГ