Слайд 2Roadmap

The Efficient Market Hypothesis

Stronger Version of Efficient Market Hypothesis

Evidence on the Efficient

Market Hypothesis

Evidence Against Market Efficiency

Behavioural Finance

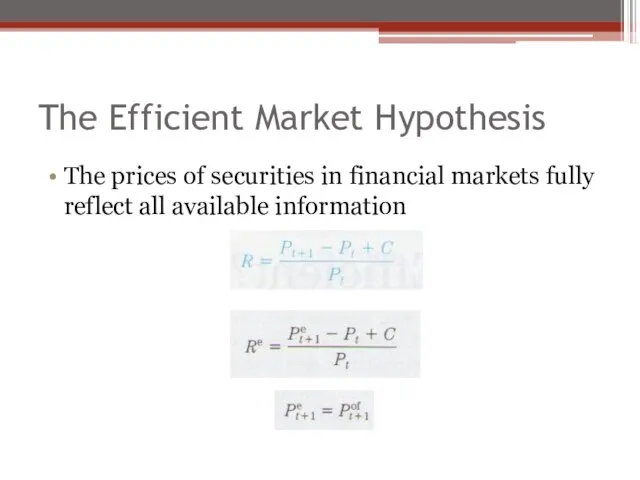

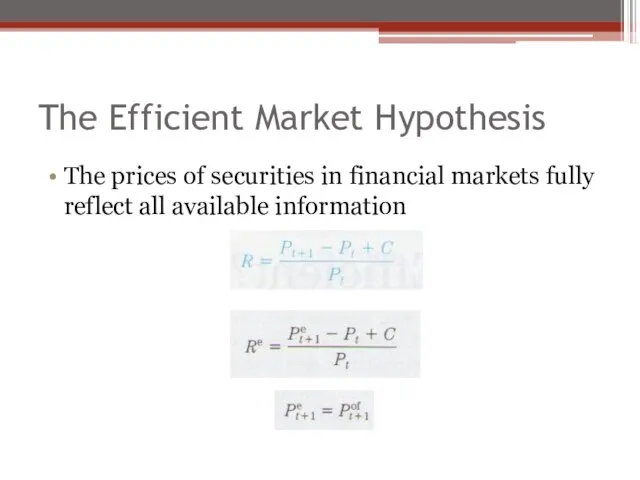

Слайд 3The Efficient Market Hypothesis

The prices of securities in financial markets fully reflect

all available information

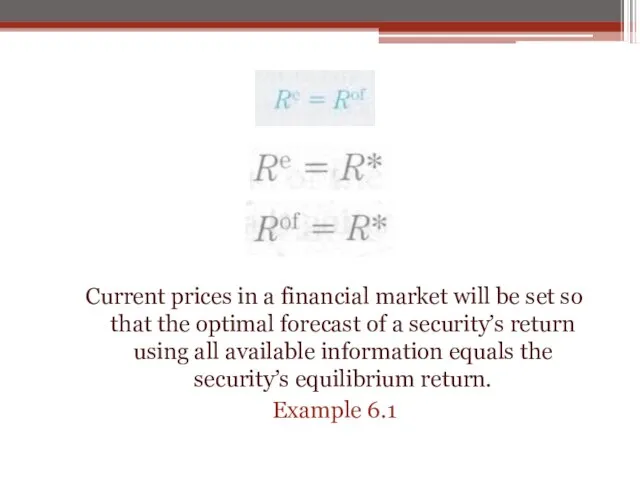

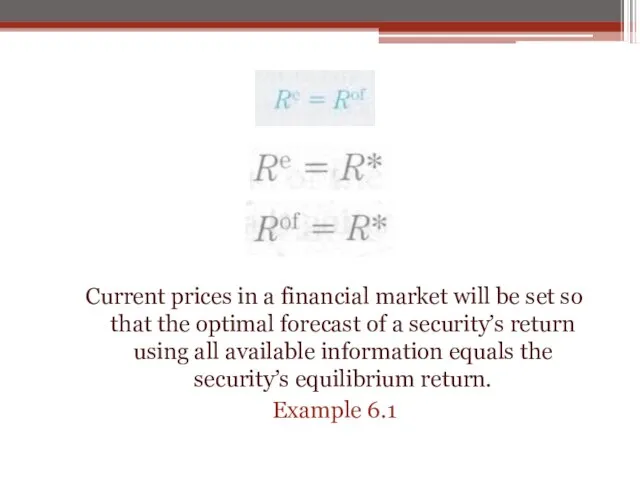

Слайд 4

Current prices in a financial market will be set so that the

optimal forecast of a security’s return using all available information equals the security’s equilibrium return.

Example 6.1

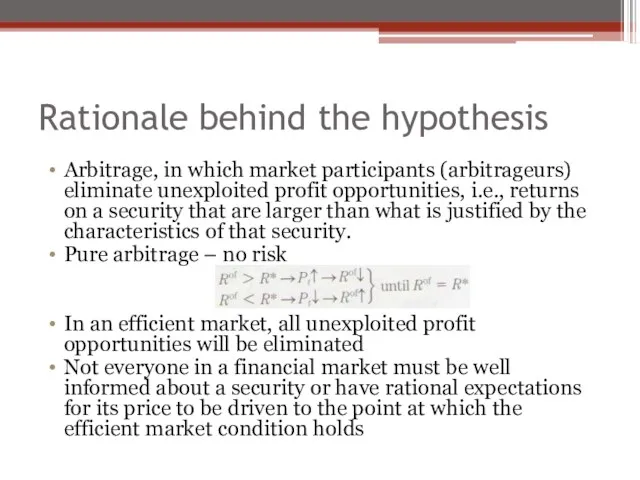

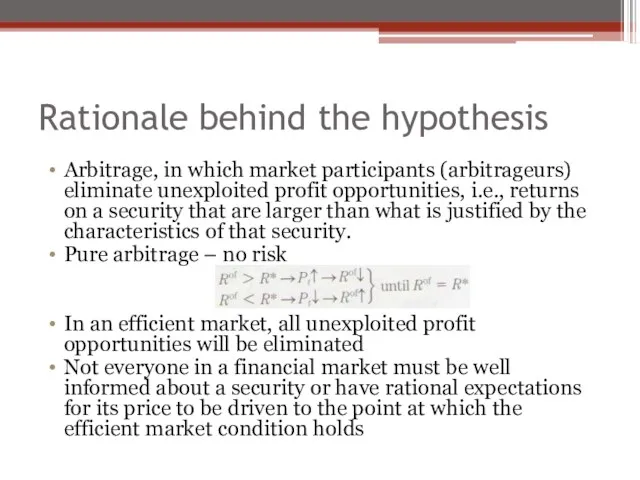

Слайд 5Rationale behind the hypothesis

Arbitrage, in which market participants (arbitrageurs) eliminate unexploited profit

opportunities, i.e., returns on a security that are larger than what is justified by the characteristics of that security.

Pure arbitrage – no risk

In an efficient market, all unexploited profit opportunities will be eliminated

Not everyone in a financial market must be well informed about a security or have rational expectations for its price to be driven to the point at which the efficient market condition holds

Слайд 6Stronger Version of the Efficient Market Hypothesis

Not only do scientists define an

efficient market as one in which expectations are optimal forecasts using all available information, but they also add the condition that an efficient market is one in which prices reflect the true fundamental value of securities.

In an eff. Market prices are always correct and reflect market fundamentals

Слайд 7Implications of the above

In an eff. market one investment is as good

as any other because the securities prices are always correct

A security’s price reflect all available information about the intrinsic value of the security

Security prices can be used by managers of both financial and non-financial firms to assess their cost of capital accurately and hence that security prices can be used to help them make the correct decisions about whether a specific investment is worth making or not

Слайд 8Evidence on the Efficient Market Hypothesis

Evidence in favour of Market Efficiency

Performance of

investment analysts and mutual funds

One implication is that you cannot beat the market

“Investment Dartboard”

Mutual funds did not beat the market

Conclusion: having performed well in the past does not indicate that an investment adviser or a mutual fund will perform well in the future.

Слайд 9Evidence on the Efficient Market Hypothesis

Do stock prices reflect publically available information?

Favourable

stock announcements do not, on average, cause stock price to rise

Random-walk behaviour of stock prices

Future changes on stock prices should, for all practical purposes, be unpredictable

Technical analysis-popular technique to predict stock prices

Слайд 10Evidence Against Market Efficiency

Small firm effect

Due to rebalancing of portfolios by institutional

investors, low liquidity of small-firm stocks, large information costs in valuing small firm, etc

January Effect

Inconsistent with random walk beahaviour

Market overreaction

Pricing errors are corrected slowly to news announcements

Investor can earn abnormally high returns

Слайд 11Evidence Against Market Efficiency

Excessive volatility

Fluctuations in stock prices may be much greater

than is warranted by fluctuations in their fundamental value.

Robert Shiller, fluctuations in S&P 500 could not be justified by the subsequent fluctuations in dividends of the stocks making up index.

Mean reversion

Stocks with low return today tend to have high returns in the future, vice versa

Not a random walk

Слайд 12Evidence Against Market Efficiency

New information is not always immediately incorporated into stock

prices

On average stock prices continue to rise for some time after the announcement of unexpectedly high profits and they continue to fall after surprisingly low profit announcement

Слайд 13Overview of the Evidence on the EMH

How valuable are publishable reports by

Investment Advisors?

We cannot expect to earn abnormally high return, a greater than the equilibrium return

Human investment advisors in San Francisco do not on average even outperform an orangutan!

A person who has done well regularly in the past cannot guarantee that he or she will do well in the future

Слайд 14Overview of the Evidence on the EMH

Should you be skeptical of hot

tips?

If this is new information and you get it first…

Do stock prices always rise when there is a good news?

A puzzling phenomenon: when good news is announced, the price of the stock frequently does not rise.

Stock prices will respond to announcements only when the information being announced is new and unexpected

Prices reflect publically available information

Sometimes a stock price declines when good news is announced. Why?

Слайд 15Overview of the Evidence on the EMH

Efficient market prescription for an investor

Hot

tips, investment advisors, technical analysis cannot help the investor to outperform market (because judgment is based on publically available information)

“buy and hold” strategy – fewer brokerage commission paid

Invest in no-load mutual fund

Воскресение Христово (Пасха)

Воскресение Христово (Пасха) Выполнили: студентки группы 41Д Артеменко Анастасия Журавлева Ирина Руководитель Банникова В.Г.

Выполнили: студентки группы 41Д Артеменко Анастасия Журавлева Ирина Руководитель Банникова В.Г. Операционные среды, системы и оболочки

Операционные среды, системы и оболочки Разработка установки для создания тонких пленок методом ионного наслаивания

Разработка установки для создания тонких пленок методом ионного наслаивания Исторические личности в повести А.С.Пушкина «Капитанская дочка»

Исторические личности в повести А.С.Пушкина «Капитанская дочка» Определения и свойства алгоритмов

Определения и свойства алгоритмов Презентация на тему Ферменты. Витамины. Гормоны

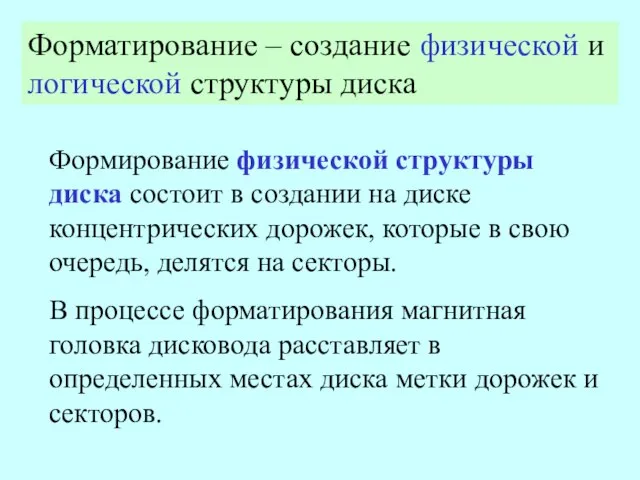

Презентация на тему Ферменты. Витамины. Гормоны Форматирование создание физической и логической структуры диска

Форматирование создание физической и логической структуры диска Тренажёр по краеведению. Мир природы.Полезные ископаемые.

Тренажёр по краеведению. Мир природы.Полезные ископаемые. Решение линейных уравнений

Решение линейных уравнений www.it-izhevsk.ru

www.it-izhevsk.ru  Задачи принцессы Турандот

Задачи принцессы Турандот Польза и вред компьютера

Польза и вред компьютера Обучающая площадка

Обучающая площадка Культура Кубани в 20-е годы

Культура Кубани в 20-е годы Презентация на тему О правах - играя

Презентация на тему О правах - играя Сведения об использовании цифровых технологий и производстве связанных с ними товаров и услуг

Сведения об использовании цифровых технологий и производстве связанных с ними товаров и услуг Брестский государственный профессионально-технический колледж торговли

Брестский государственный профессионально-технический колледж торговли Pros and Cons of Different Media

Pros and Cons of Different Media 20141003_viktorina_po_kraevedeniyu_1_chast

20141003_viktorina_po_kraevedeniyu_1_chast Декоративно-прикладное искусство. Часть 1

Декоративно-прикладное искусство. Часть 1 Искусство и духовная жизнь

Искусство и духовная жизнь Аверьянов В.Н. – первый заместитель министра здравоохранения Оренбургской области

Аверьянов В.Н. – первый заместитель министра здравоохранения Оренбургской области Кредитный портфель по розничному бизнесу филиала Челябинский

Кредитный портфель по розничному бизнесу филиала Челябинский От иконоскопа до плазмы

От иконоскопа до плазмы Школьная форма от компании Алфавит, цвет синий

Школьная форма от компании Алфавит, цвет синий Самовыражение в цвете

Самовыражение в цвете Информационно-консультационный центр поддержки СМиСБ при АОП РБ 243-38-37, 264-62-90

Информационно-консультационный центр поддержки СМиСБ при АОП РБ 243-38-37, 264-62-90