Содержание

- 2. EVALUATING ESTIMATES NPV> 0 PBP - as short as possible IRR - as high as possible

- 3. SCENARIO AND OTHER WHAT-IF ANALYSES Scenario analysis is the determination of what happens to NPV estimates

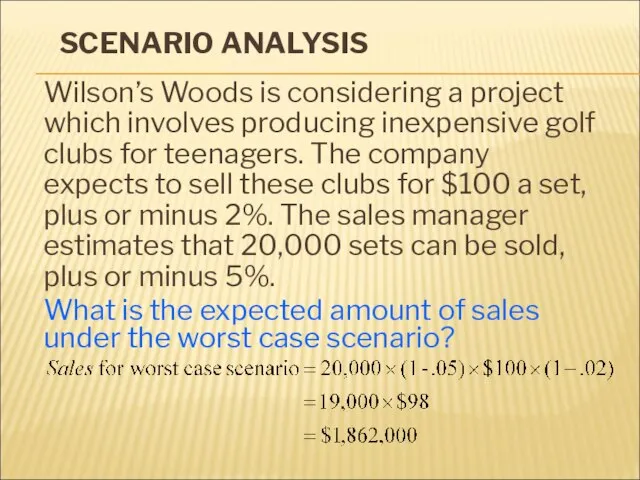

- 4. SCENARIO ANALYSIS Wilson’s Woods is considering a project which involves producing inexpensive golf clubs for teenagers.

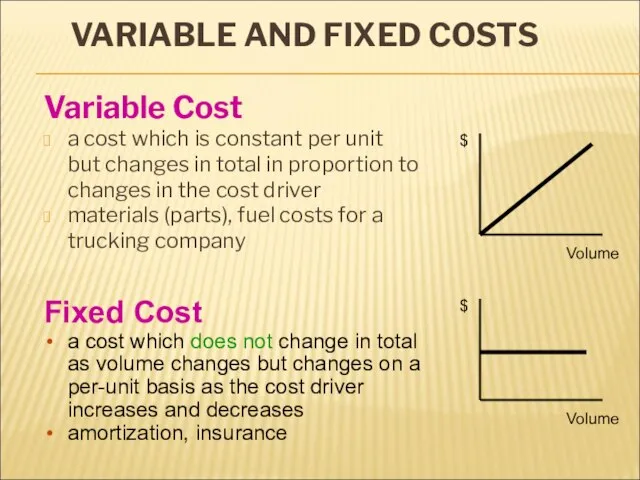

- 5. VARIABLE AND FIXED COSTS Variable Cost a cost which is constant per unit but changes in

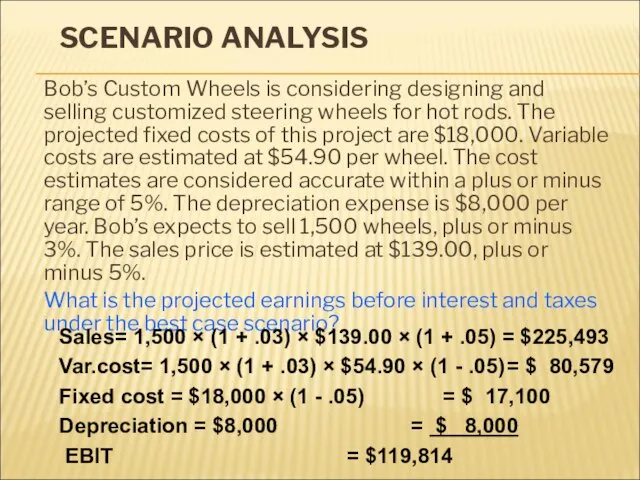

- 6. SCENARIO ANALYSIS Bob’s Custom Wheels is considering designing and selling customized steering wheels for hot rods.

- 7. SENSITIVITY ANALYSIS Sensitivity analysis is a “what-if” technique that examines how a result will change if

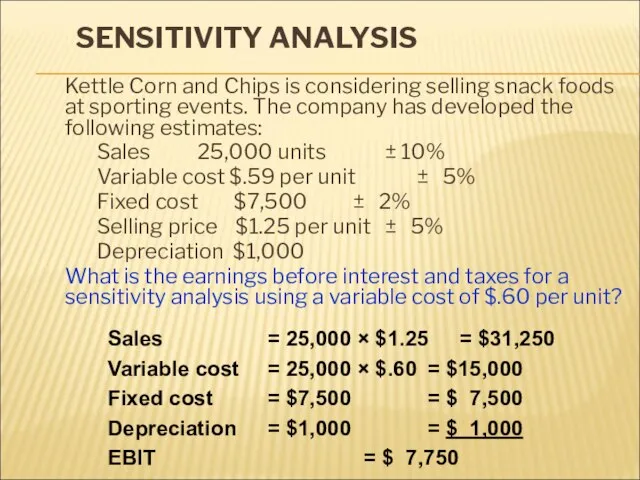

- 8. SENSITIVITY ANALYSIS Kettle Corn and Chips is considering selling snack foods at sporting events. The company

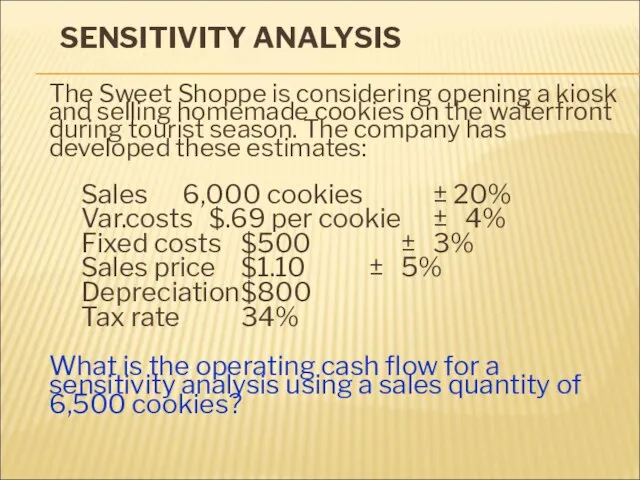

- 9. SENSITIVITY ANALYSIS The Sweet Shoppe is considering opening a kiosk and selling homemade cookies on the

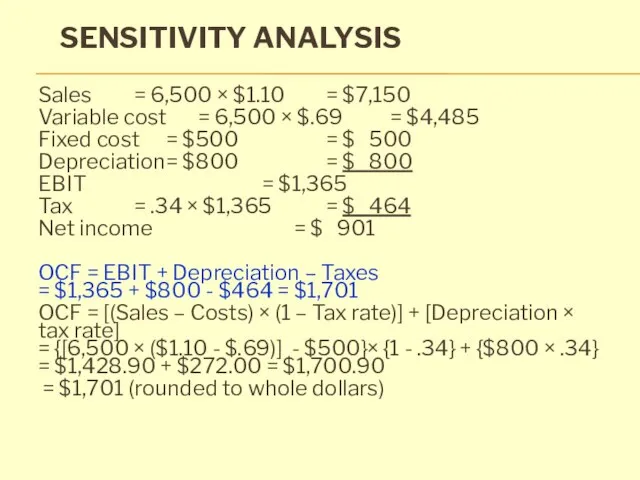

- 10. SENSITIVITY ANALYSIS Sales = 6,500 × $1.10 = $7,150 Variable cost = 6,500 × $.69 =

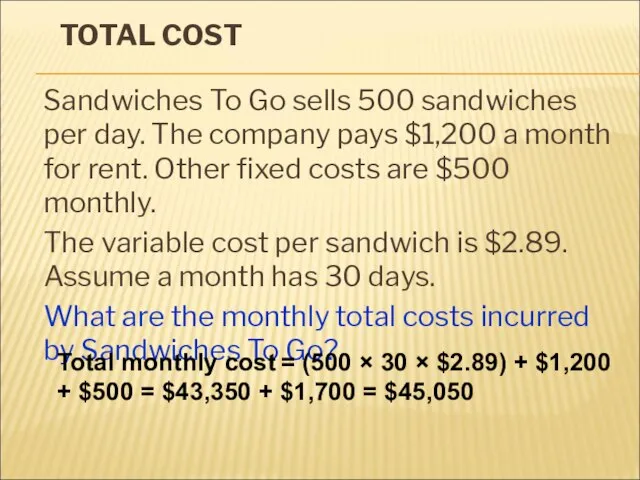

- 11. TOTAL COST Sandwiches To Go sells 500 sandwiches per day. The company pays $1,200 a month

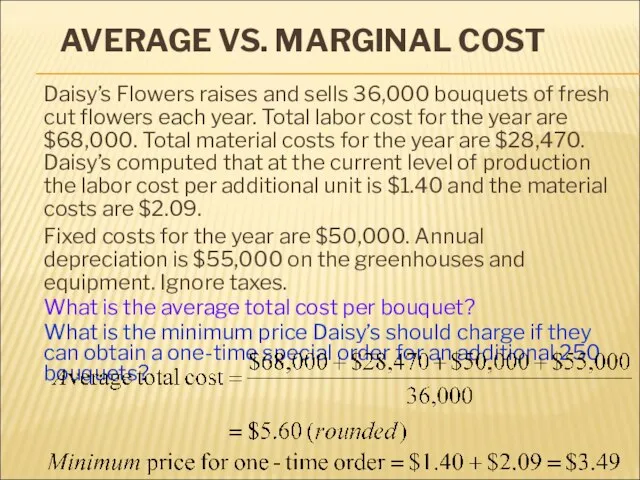

- 12. AVERAGE VS. MARGINAL COST Daisy’s Flowers raises and sells 36,000 bouquets of fresh cut flowers each

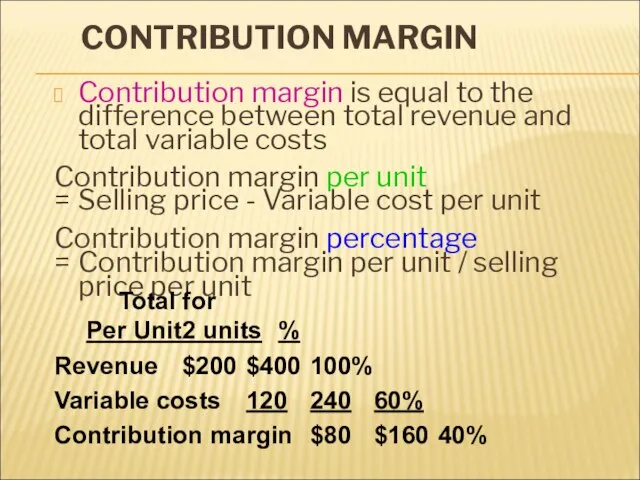

- 13. CONTRIBUTION MARGIN Contribution margin is equal to the difference between total revenue and total variable costs

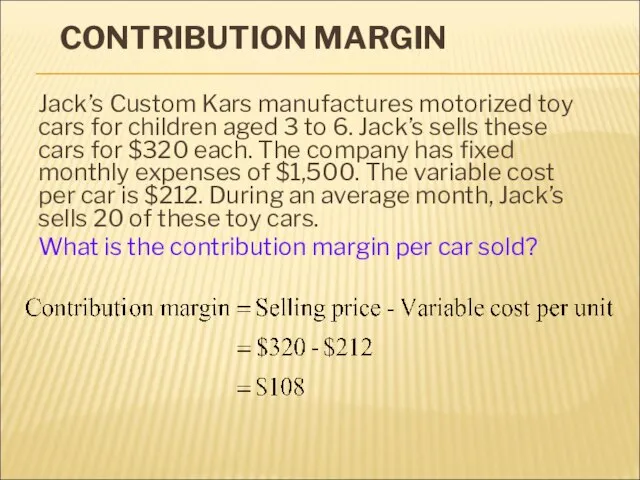

- 14. CONTRIBUTION MARGIN Jack’s Custom Kars manufactures motorized toy cars for children aged 3 to 6. Jack’s

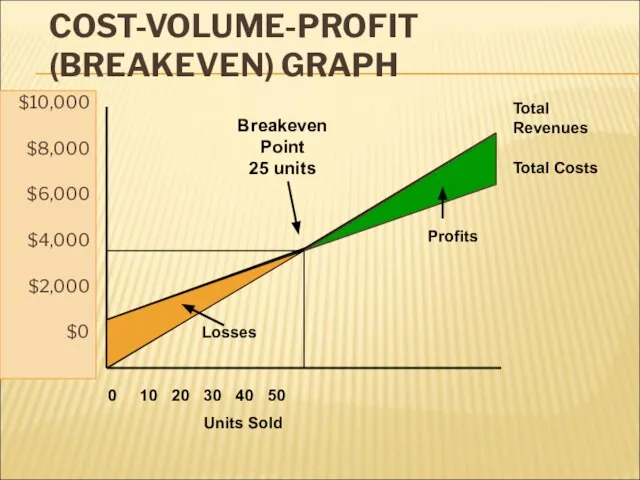

- 15. COST-VOLUME-PROFIT (BREAKEVEN) GRAPH $10,000 $8,000 $6,000 $4,000 $2,000 $0 0 10 20 30 40 50 Units

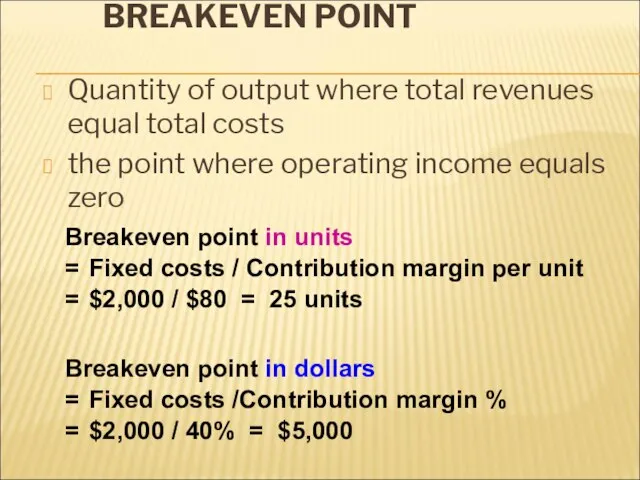

- 16. BREAKEVEN POINT Quantity of output where total revenues equal total costs the point where operating income

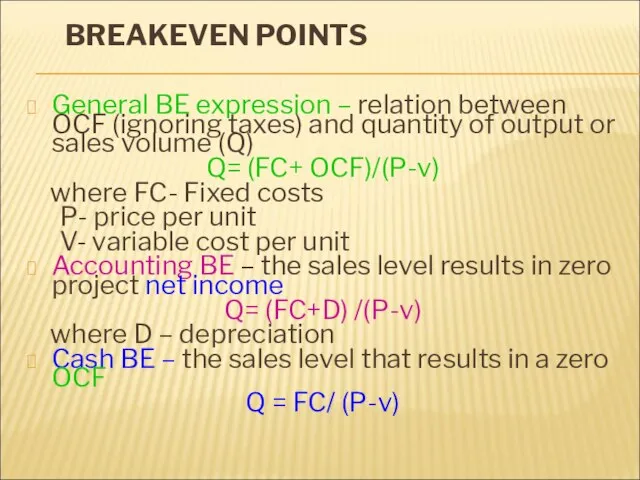

- 17. BREAKEVEN POINTS General BE expression – relation between OCF (ignoring taxes) and quantity of output or

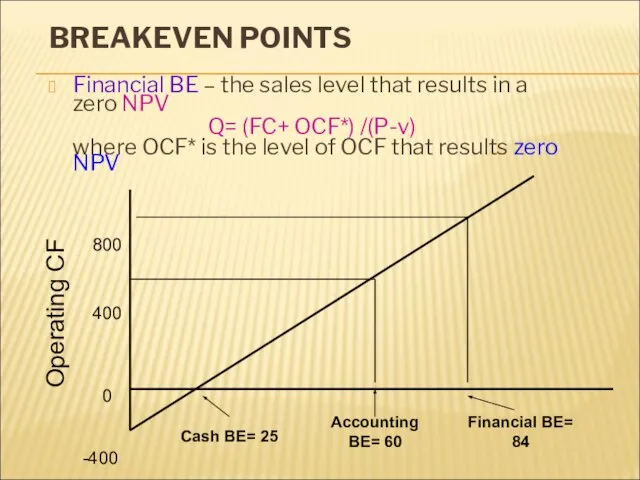

- 18. BREAKEVEN POINTS Financial BE – the sales level that results in a zero NPV Q= (FC+

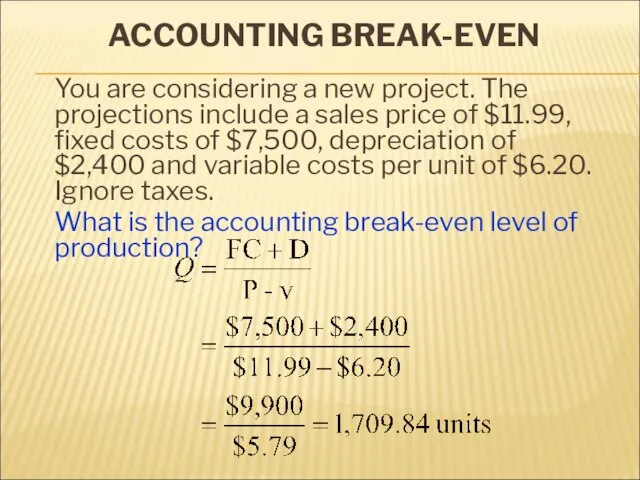

- 19. ACCOUNTING BREAK-EVEN You are considering a new project. The projections include a sales price of $11.99,

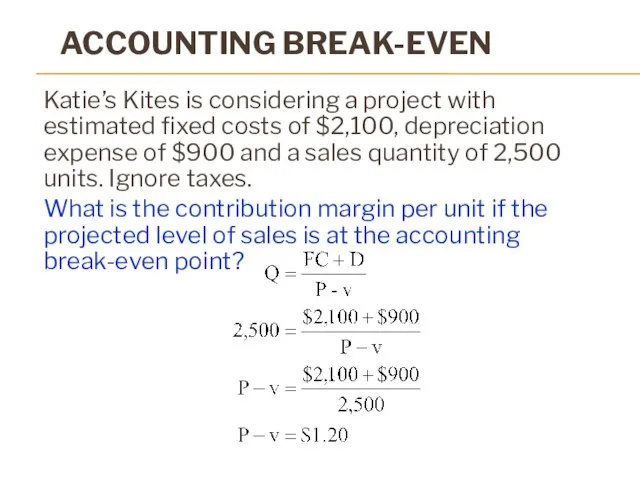

- 20. ACCOUNTING BREAK-EVEN Katie’s Kites is considering a project with estimated fixed costs of $2,100, depreciation expense

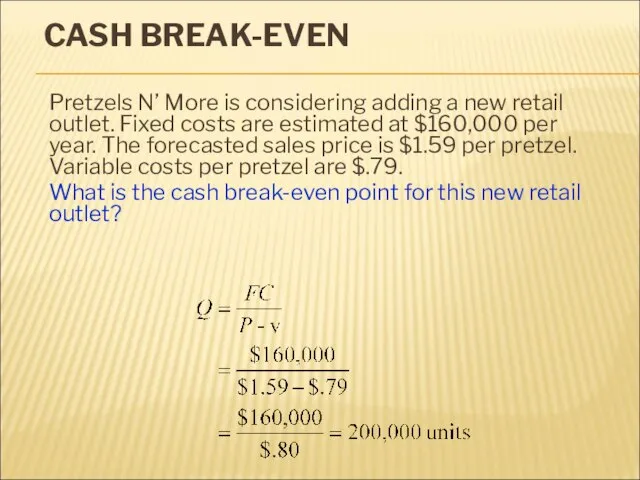

- 21. CASH BREAK-EVEN Pretzels N’ More is considering adding a new retail outlet. Fixed costs are estimated

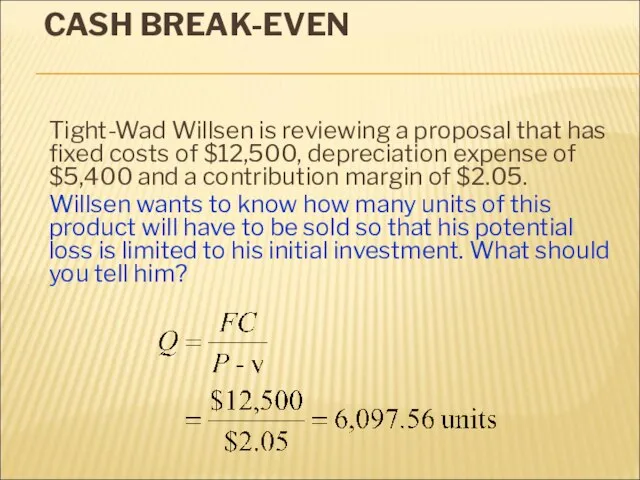

- 22. CASH BREAK-EVEN Tight-Wad Willsen is reviewing a proposal that has fixed costs of $12,500, depreciation expense

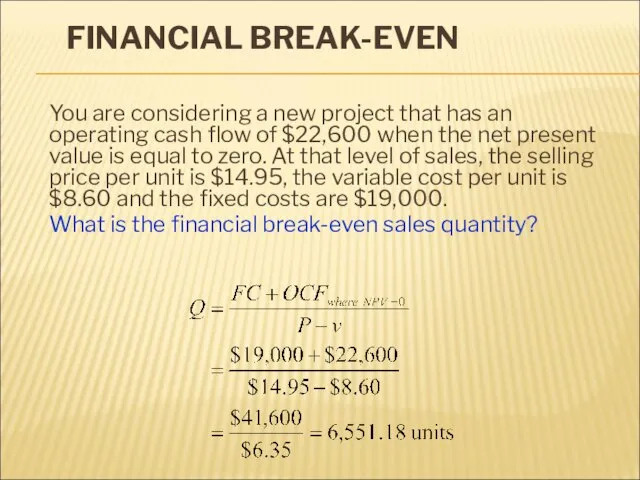

- 23. FINANCIAL BREAK-EVEN You are considering a new project that has an operating cash flow of $22,600

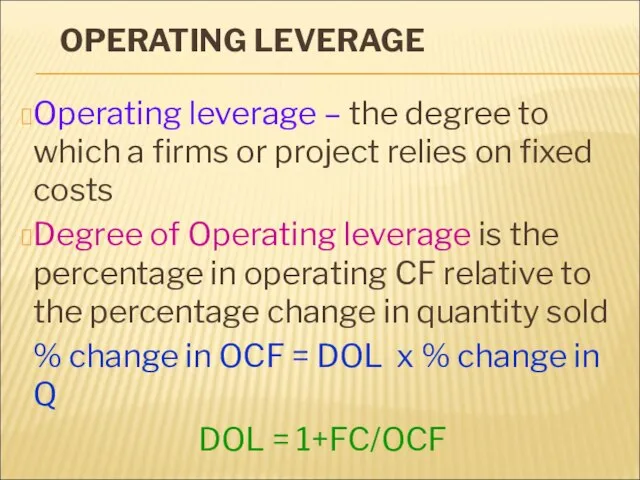

- 24. OPERATING LEVERAGE Operating leverage – the degree to which a firms or project relies on fixed

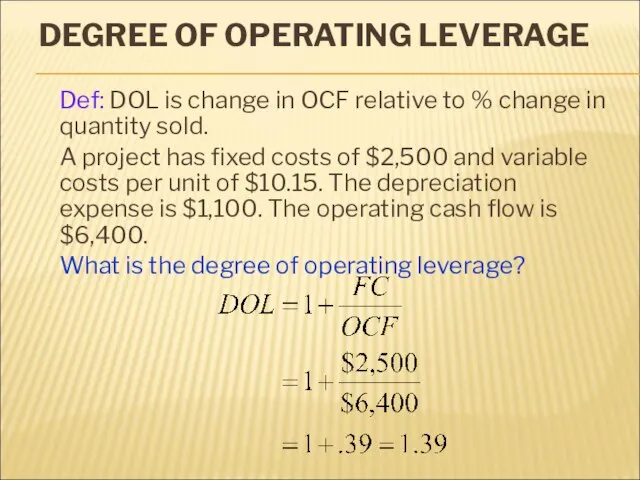

- 25. DEGREE OF OPERATING LEVERAGE Def: DOL is change in OCF relative to % change in quantity

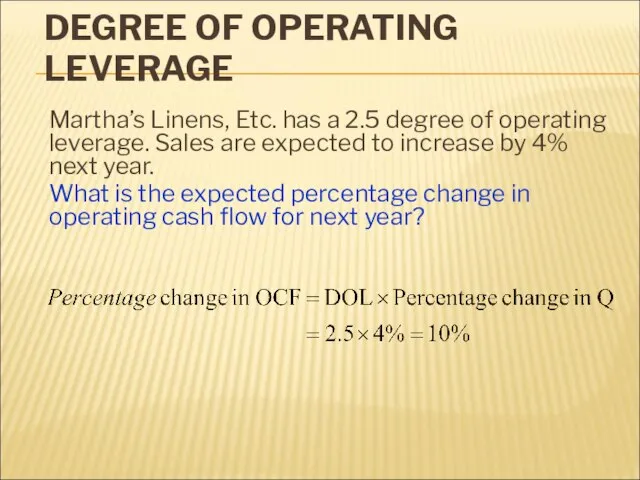

- 26. DEGREE OF OPERATING LEVERAGE Martha’s Linens, Etc. has a 2.5 degree of operating leverage. Sales are

- 28. Скачать презентацию

Олимпийские игры в Греции 5 класс

Олимпийские игры в Греции 5 класс Поколение ЭВМ

Поколение ЭВМ ИКТ в системе работы с одаренными детьми

ИКТ в системе работы с одаренными детьми Histoire de Disneyland Paris

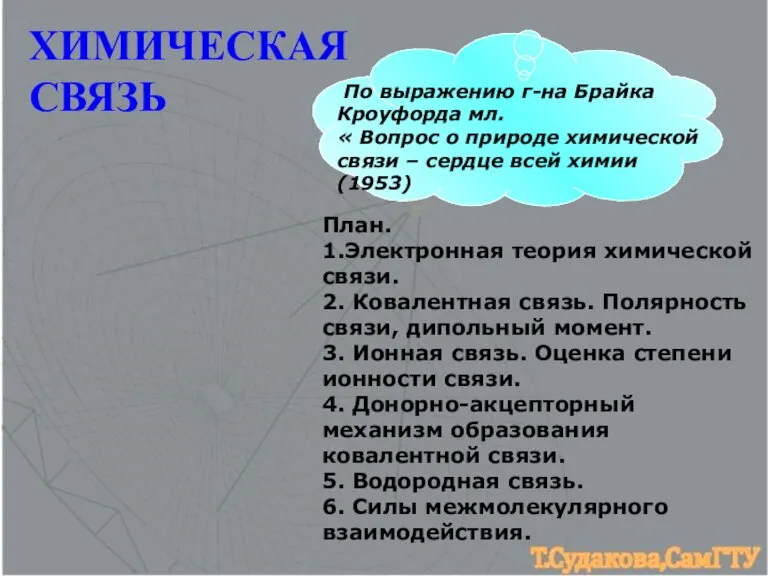

Histoire de Disneyland Paris Химическая связь

Химическая связь Вещное право в МЧП. Тема 8

Вещное право в МЧП. Тема 8 Где получить профессию финансиста?

Где получить профессию финансиста? Презентация на тему Уругвай

Презентация на тему Уругвай Презентация без названия

Презентация без названия Модели данных

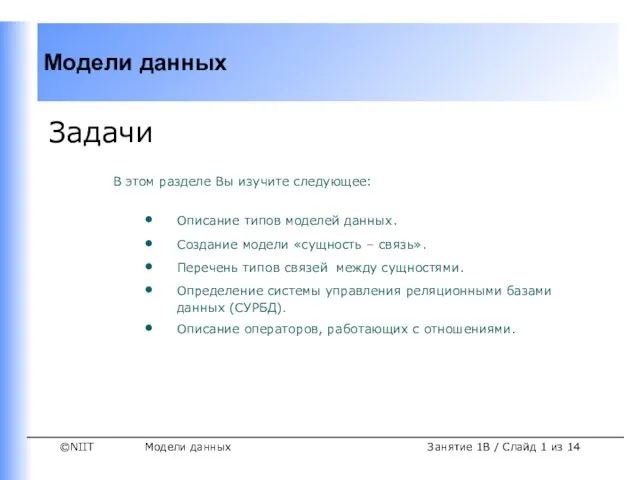

Модели данных  Письмо заглавной буквы Ж

Письмо заглавной буквы Ж Повторение изученного

Повторение изученного Музеи искусства. Картина-пейзаж

Музеи искусства. Картина-пейзаж Две стратегии повышения эффективности контекстной рекламы Андрей Лебедев , Зураб Полосин, интернет-маркетологи департамента Ин

Две стратегии повышения эффективности контекстной рекламы Андрей Лебедев , Зураб Полосин, интернет-маркетологи департамента Ин Презентация на тему Социальный прогресс и развитие общества 8 КЛАСС

Презентация на тему Социальный прогресс и развитие общества 8 КЛАСС Презентация на тему Причастие как часть речи (7 класс)

Презентация на тему Причастие как часть речи (7 класс) Деньги Money

Деньги Money Презентация на тему Начало Реформации в Европе

Презентация на тему Начало Реформации в Европе  Презентация на тему Архитектура классицизма в России МХК 11 класс

Презентация на тему Архитектура классицизма в России МХК 11 класс  Налогообложение и социальная политика РФ.

Налогообложение и социальная политика РФ. Групповая дифференциация и лидерство

Групповая дифференциация и лидерство Теория цвета

Теория цвета Гуморальная регуляция автономных функций

Гуморальная регуляция автономных функций Презентація

Презентація Порахуй з Вовком!

Порахуй з Вовком! Производство Наноструктурированного пенобетона

Производство Наноструктурированного пенобетона Система защиты труб от замерзания

Система защиты труб от замерзания Презентация на тему Развитие связной речи у дошкольников Советы родителям

Презентация на тему Развитие связной речи у дошкольников Советы родителям