Слайд 3Lecture Outline

The Money Markets Defined

The Purpose of Money Markets

Who Participates in

Money Markets?

Money Market Instruments

Comparing Money Market Securities

Слайд 4The Money Markets Defined

The term “money market” is a misnomer. Money (currency)

is not actually traded in the money markets.

The securities in the money market are short term with high liquidity; therefore, they are close to being money.

Money Markets Defined

Usually sold in large denominations ($1,000,000 or more)

Low default risk

Mature in one year or less from their issue date, although most mature in less than 120 days

Слайд 5Why Do We Need Money Markets?

The banking industry should handle the needs

for short-term funding

Banks have an information advantage.

Banks, however, are heavily regulated, which creates a distinct cost advantage for money markets over banks.

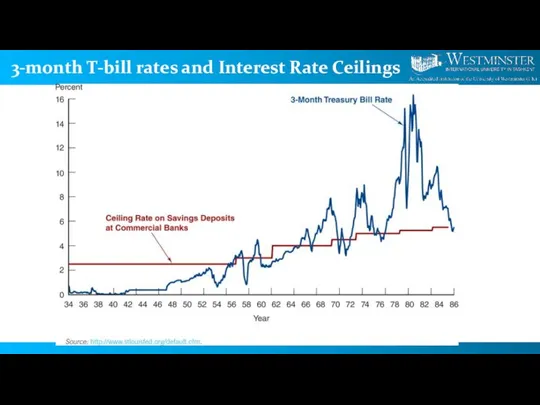

Слайд 6Cost Advantages of Money Markets

Reserve requirements create additional expense for banks that

money markets do not have

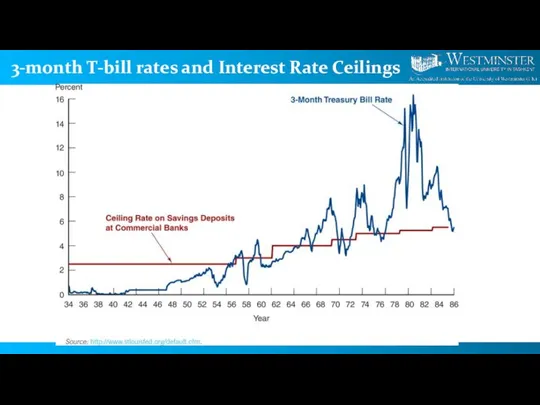

Regulations on the level of interest banks could offer depositors lead to a significant growth in money markets, especially in the 1970s and 1980s.

When interest rates rose, depositors moved their money from banks to money markets.

The cost structure of banks limits their competitiveness to situations where their informational advantages outweighs their regulatory costs.

Limits on interest banks could offer was not relevant until the 1950s. In the decades that followed, the problem became apparent.

Слайд 73-month T-bill rates and Interest Rate Ceilings

Слайд 8The Purpose of Money Markets

Investors in Money Market: Provides a place for

warehousing surplus funds for short periods of time

Borrowers from money market provide low-cost source of temporary funds

Corporations and U.S. government use these markets because the timing of cash inflows and outflows are not well synchronized.

Money markets provide a way to solve these cash-timing problems.

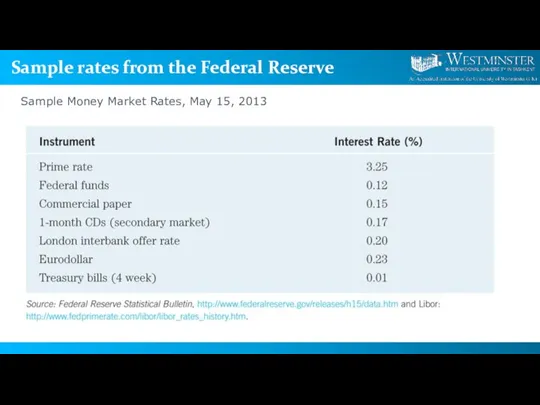

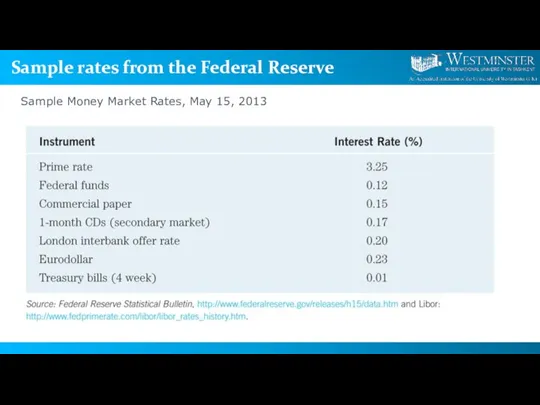

Слайд 9Sample rates from the Federal Reserve

Sample Money Market Rates, May 15, 2013

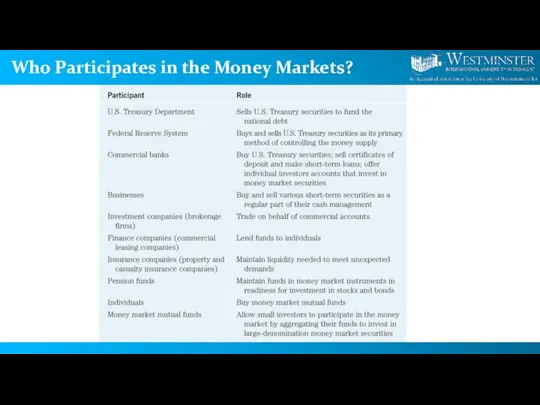

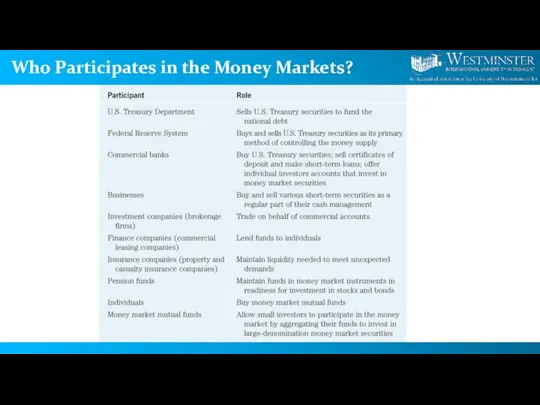

Слайд 10Who Participates in the Money Markets?

Слайд 11Money Market Instruments

Treasury Bills

Federal Funds

Repurchase Agreements

Negotiable Certificates of Deposit

Commercial Paper

Banker’s Acceptance

Eurodollars

Слайд 12Money Market Instruments: Treasury Bills

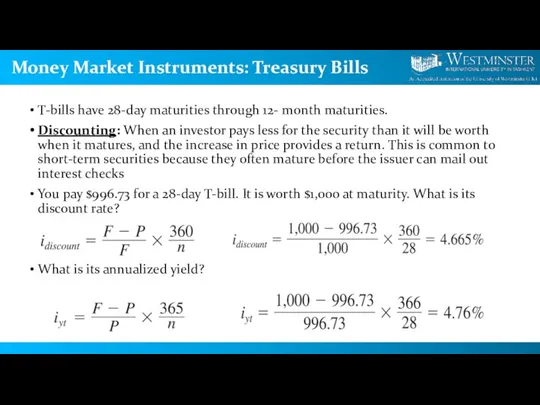

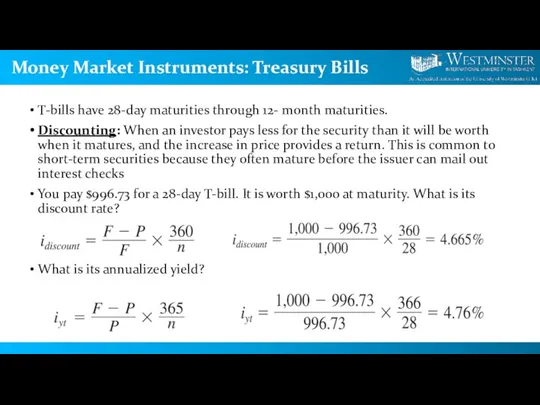

T-bills have 28-day maturities through 12- month maturities.

Discounting: When an investor pays less for the security than it will be worth when it matures, and the increase in price provides a return. This is common to short-term securities because they often mature before the issuer can mail out interest checks

You pay $996.73 for a 28-day T-bill. It is worth $1,000 at maturity. What is its discount rate?

What is its annualized yield?

Слайд 13Money Market Instruments: Treasury Bills

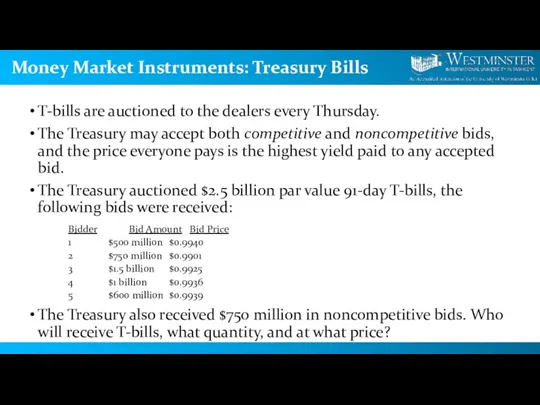

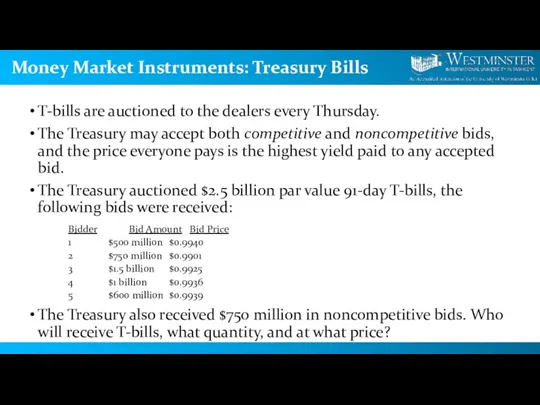

T-bills are auctioned to the dealers every Thursday.

The

Treasury may accept both competitive and noncompetitive bids, and the price everyone pays is the highest yield paid to any accepted bid.

The Treasury auctioned $2.5 billion par value 91-day T-bills, the following bids were received:

Bidder Bid Amount Bid Price

1 $500 million $0.9940

2 $750 million $0.9901

3 $1.5 billion $0.9925

4 $1 billion $0.9936

5 $600 million $0.9939

The Treasury also received $750 million in noncompetitive bids. Who will receive T-bills, what quantity, and at what price?

Слайд 14Money Market Instruments: Treasury Bills

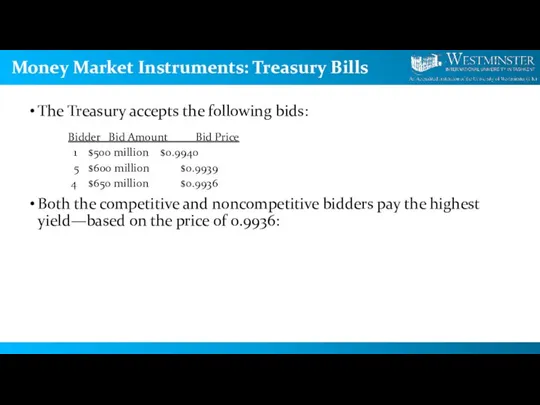

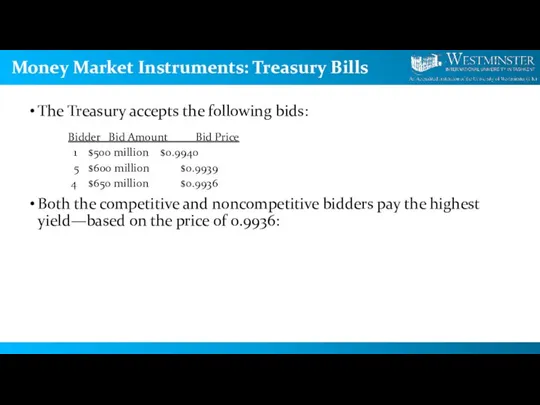

The Treasury accepts the following bids:

Bidder Bid Amount

Bid Price

1 $500 million $0.9940

5 $600 million $0.9939

4 $650 million $0.9936

Both the competitive and noncompetitive bidders pay the highest yield—based on the price of 0.9936:

Слайд 15Money Market Instruments: Treasury Bills

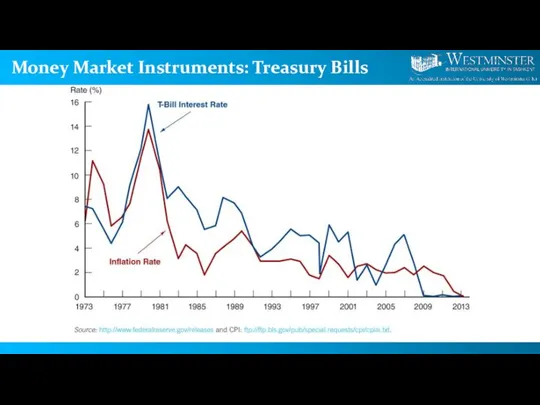

Слайд 16Money Market Instruments: Fed Funds

Short-term funds transferred (loaned or borrowed) between financial

institutions, usually for a period of one day.

Used by banks to meet short-term needs to meet reserve requirements.

Слайд 17Money Market Instruments: Fed Funds

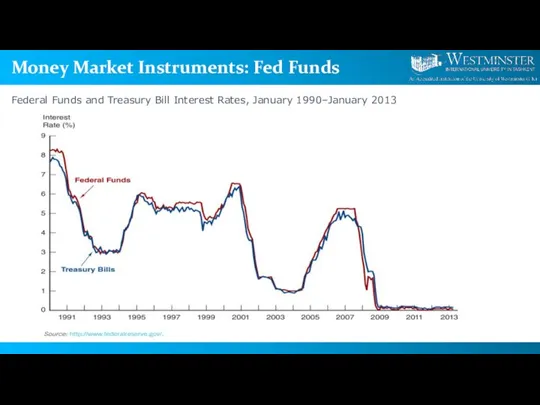

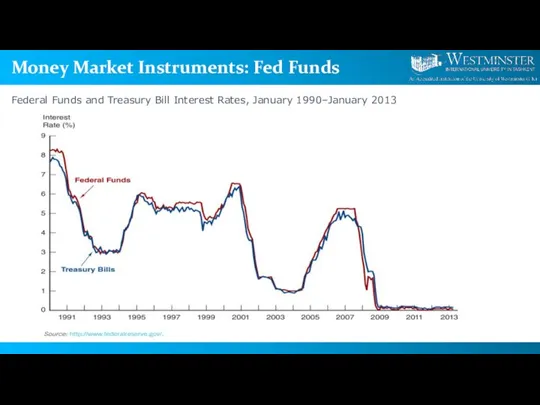

Federal Funds and Treasury Bill Interest Rates, January

1990–January 2013

Слайд 18Money Market Instruments:

Repurchase Agreements

These work similar to the market for fed

funds, but nonbanks can participate.

A firm sells Treasury securities, but agrees to buy them back at a certain date (usually 3–14 days later) for a certain price.

This set-up makes a repo agreements essentially a short-term collateralized loan.

This is one market the Fed may use to conduct its monetary policy, whereby the Fed purchases/sells Treasury securities in the repo market.

Слайд 19Money Market Instruments: Negotiable Certificates of Deposit

A bank-issued security that documents a

deposit and specifies the interest rate and the maturity date

Denominations range from $100,000

to $10 million

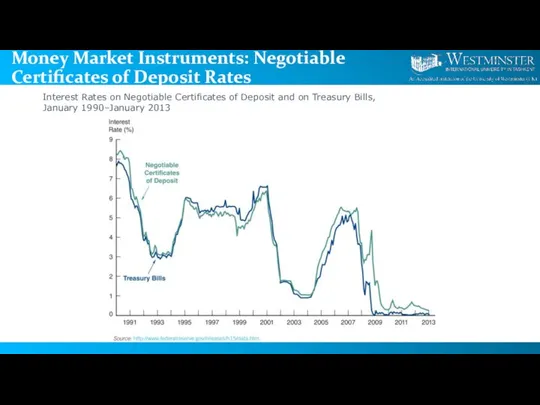

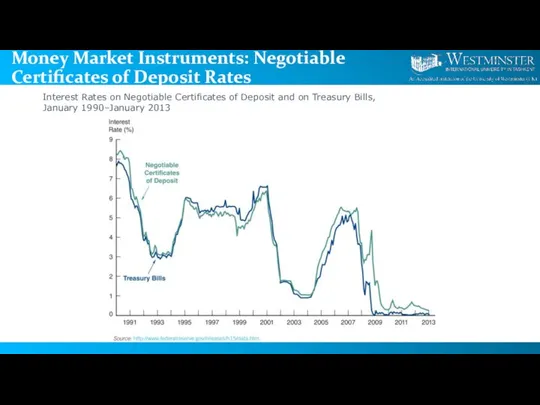

Слайд 20Money Market Instruments: Negotiable Certificates of Deposit Rates

Interest Rates on Negotiable Certificates

of Deposit and on Treasury Bills, January 1990–January 2013

Слайд 21Money Market Instruments:

Commercial Paper

Unsecured promissory notes, issued by corporations, that mature

in no more than 270 days.

The use of commercial paper increased significantly in the early 1980s because of the rising cost of bank loans.

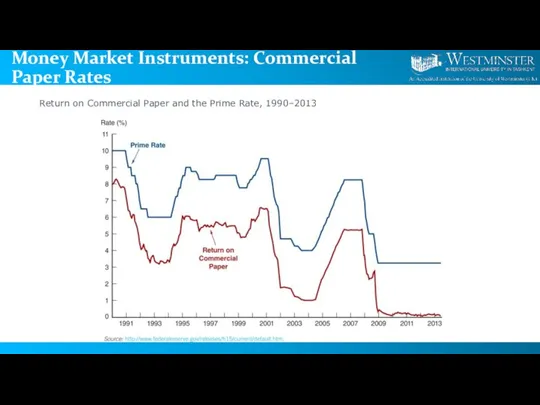

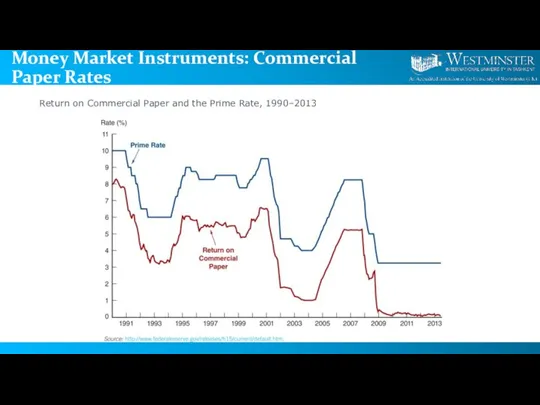

Слайд 22Money Market Instruments: Commercial Paper Rates

Return on Commercial Paper and the

Prime Rate, 1990–2013

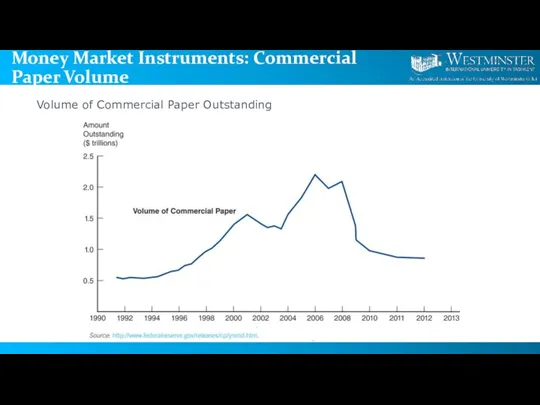

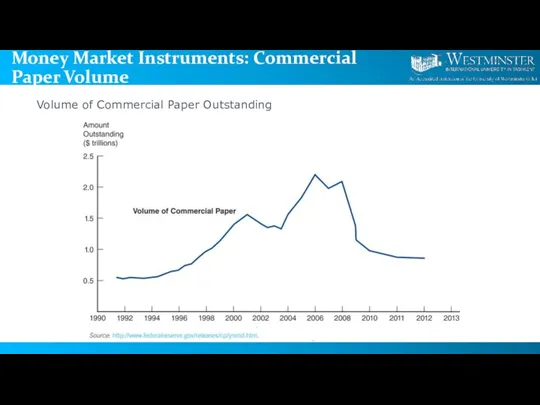

Слайд 23Money Market Instruments: Commercial Paper Volume

Volume of Commercial Paper Outstanding

Слайд 24Money Market Instruments:

Banker’s Acceptances

An order to pay a specified amount to

the bearer on a given date if specified conditions have been met, usually delivery of promised goods. These are often used when buyers / sellers of expensive goods live in different countries.

Advantages:

Exporter paid immediately

Exporter shielded from foreign exchange risk

Exporter does not have to assess the financial security of the importer

Importer’s bank guarantees payment

Crucial to international trade

Слайд 25Money Market Instruments: Eurodollars

Eurodollars represent Dollar denominated deposits held in foreign banks.

The

market is essential since many foreign contracts call for payment is U.S. dollars due to the stability of the dollar, relative to other currencies.

The Eurodollar market has continued to grow rapidly because depositors receive a higher rate of return on a dollar deposit in the Eurodollar market than in the domestic market.

Слайд 26Money Market Instruments: Eurodollars Rates

London interbank bid rate (LIBID)

The rate paid by

banks buying funds

London interbank offer rate (LIBOR)

The rate offered for sale of the funds

Time deposits with fixed maturities

Largest short term security in the world

Слайд 27Global: Birth of the Eurodollar

The Eurodollar market is one of the most

important financial markets, but oddly enough, it was fathered by the Soviet Union.

In the 1950s, the USSR had accumulated large dollar deposits, but all were in US banks. They feared the US might seize them, but still wanted dollars. So, the USSR transferred the dollars to European banks, creating the Eurodollar market.

Слайд 28Comparing Money Market Securities : a comparison of rates (1990-2013)

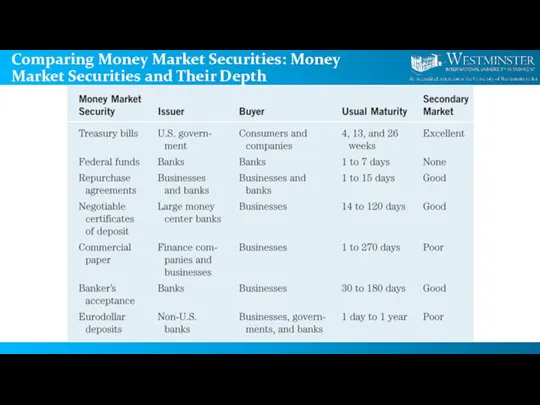

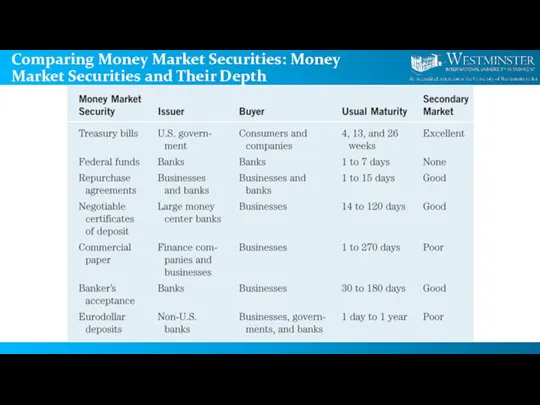

Слайд 29Comparing Money Market Securities: Money Market Securities and Their Depth

Этапы становления и развития экономической экспертизы как специальной отрасли экономических знаний

Этапы становления и развития экономической экспертизы как специальной отрасли экономических знаний Руководитель как субъект организаторской деятельности

Руководитель как субъект организаторской деятельности Характеристика Бреттон- Вудской валютной системы Подготовила: Еросова В. И Рудакова Т., МЭ-091

Характеристика Бреттон- Вудской валютной системы Подготовила: Еросова В. И Рудакова Т., МЭ-091 Бюджет и бюджетная система РФ

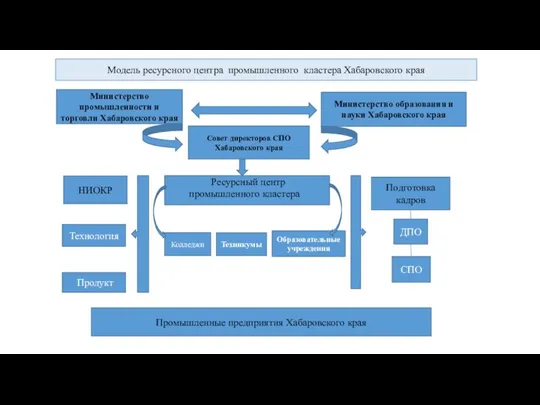

Бюджет и бюджетная система РФ Модель ресурсного центра промышленного кластера Хабаровского края

Модель ресурсного центра промышленного кластера Хабаровского края Формы международных экономических отношений

Формы международных экономических отношений Предмет исследования и актуальность геоэкономики

Предмет исследования и актуальность геоэкономики Основные макроэкономические показатели. Лекция 6

Основные макроэкономические показатели. Лекция 6 Организационная структура коммерческого банка Подготовила: Клеутина С. Группа МЭ-092

Организационная структура коммерческого банка Подготовила: Клеутина С. Группа МЭ-092 Режимы обменного курса и совокупный спрос (тема 12)

Режимы обменного курса и совокупный спрос (тема 12) Система цен в современной экономике

Система цен в современной экономике Бюджетирование. Сущность бюджета и бюджетирования

Бюджетирование. Сущность бюджета и бюджетирования Экономический рост и развитие

Экономический рост и развитие Демографическое положение в России

Демографическое положение в России Макроэномические показатели конкретной страны (инфляция, безработица, ВВП, внутренний и внешний долг)

Макроэномические показатели конкретной страны (инфляция, безработица, ВВП, внутренний и внешний долг) Концепция демографического перехода

Концепция демографического перехода Государственная поддержка юридических лиц и индивидуальных предпринимателей при трудоустройстве безработных граждан

Государственная поддержка юридических лиц и индивидуальных предпринимателей при трудоустройстве безработных граждан Утилизация отходов деревоперерабатывающих производств

Утилизация отходов деревоперерабатывающих производств Типы безработицы

Типы безработицы Мировые финансовые центры: роль и значение для мировой экономики Подготовила: Еросова Валерия, гр. МЭ-091

Мировые финансовые центры: роль и значение для мировой экономики Подготовила: Еросова Валерия, гр. МЭ-091 Экономические задачи, ЕГЭ

Экономические задачи, ЕГЭ Нелинейность как характеристика экономического развития России. Лекция 2

Нелинейность как характеристика экономического развития России. Лекция 2 Экономика. Рынок и спрос

Экономика. Рынок и спрос Кадры организации и производительность труда

Кадры организации и производительность труда Экономическое содержание государственного регулирования общественного воспроизводства

Экономическое содержание государственного регулирования общественного воспроизводства Имущество предприятия

Имущество предприятия Политика стабилизации экономики

Политика стабилизации экономики Сформирование государственной экономической политики: теория и практика

Сформирование государственной экономической политики: теория и практика