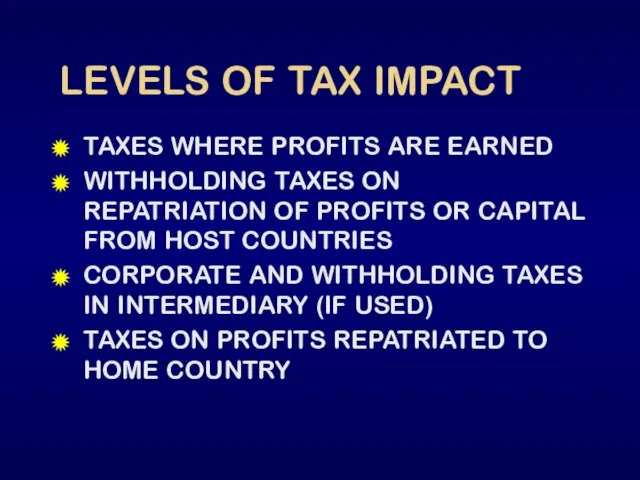

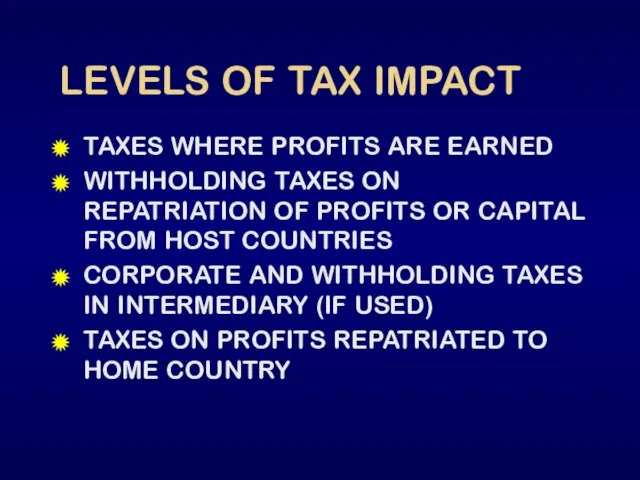

Слайд 2LEVELS OF TAX IMPACT

TAXES WHERE PROFITS ARE EARNED

WITHHOLDING TAXES ON REPATRIATION

OF PROFITS OR CAPITAL FROM HOST COUNTRIES

CORPORATE AND WITHHOLDING TAXES IN INTERMEDIARY (IF USED)

TAXES ON PROFITS REPATRIATED TO HOME COUNTRY

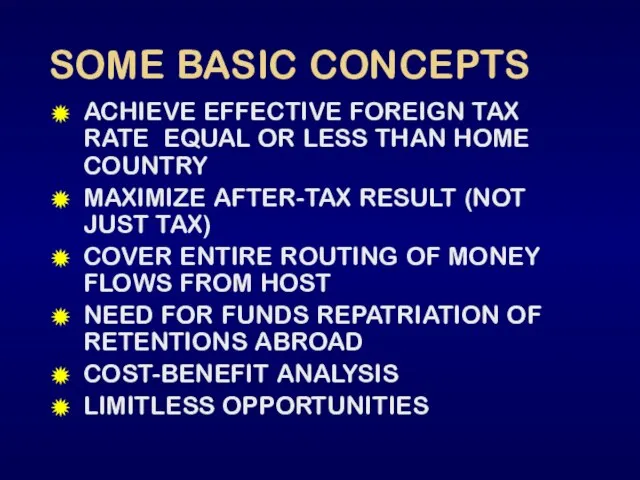

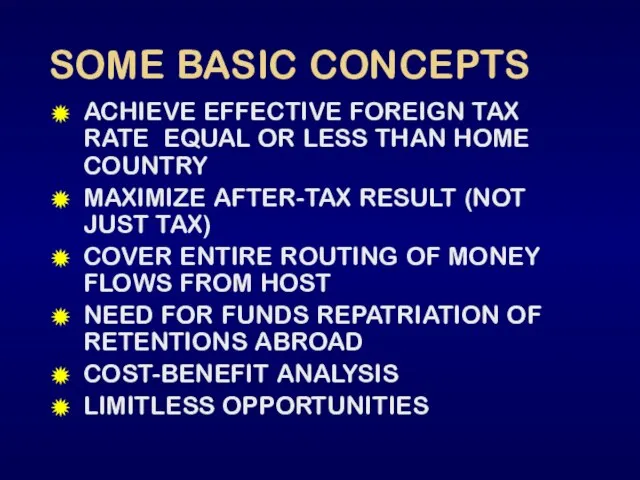

Слайд 3SOME BASIC CONCEPTS

ACHIEVE EFFECTIVE FOREIGN TAX RATE EQUAL OR LESS THAN HOME

COUNTRY

MAXIMIZE AFTER-TAX RESULT (NOT JUST TAX)

COVER ENTIRE ROUTING OF MONEY FLOWS FROM HOST

NEED FOR FUNDS REPATRIATION OF RETENTIONS ABROAD

COST-BENEFIT ANALYSIS

LIMITLESS OPPORTUNITIES

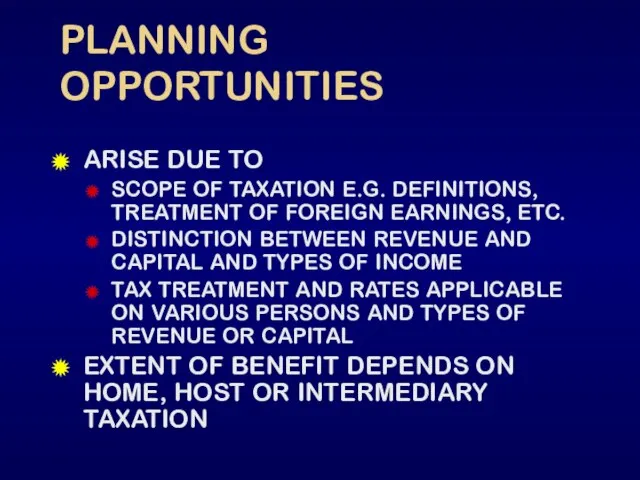

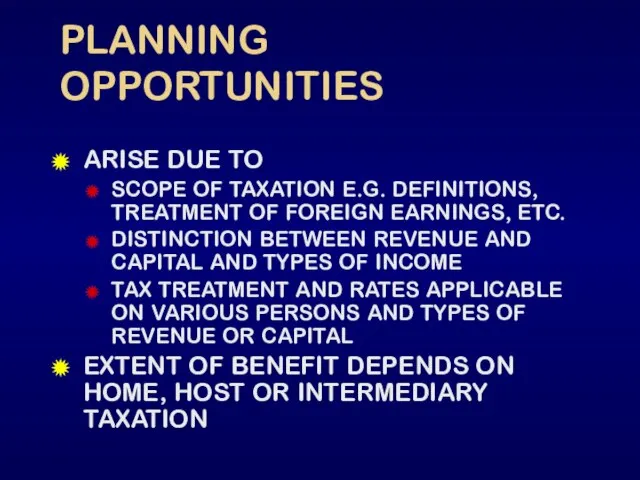

Слайд 4PLANNING OPPORTUNITIES

ARISE DUE TO

SCOPE OF TAXATION E.G. DEFINITIONS, TREATMENT OF FOREIGN EARNINGS,

ETC.

DISTINCTION BETWEEN REVENUE AND CAPITAL AND TYPES OF INCOME

TAX TREATMENT AND RATES APPLICABLE ON VARIOUS PERSONS AND TYPES OF REVENUE OR CAPITAL

EXTENT OF BENEFIT DEPENDS ON HOME, HOST OR INTERMEDIARY TAXATION

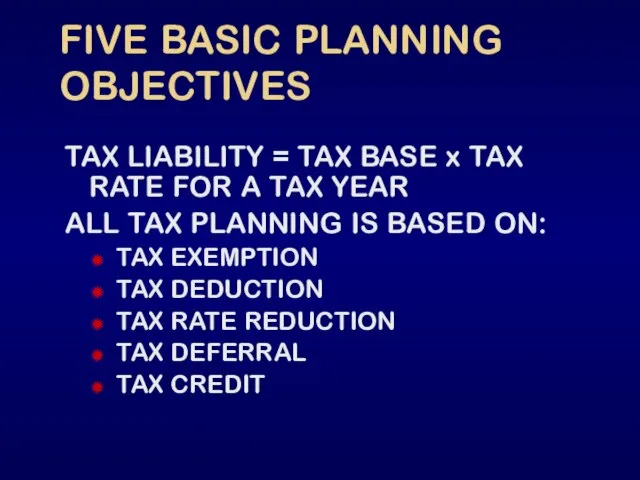

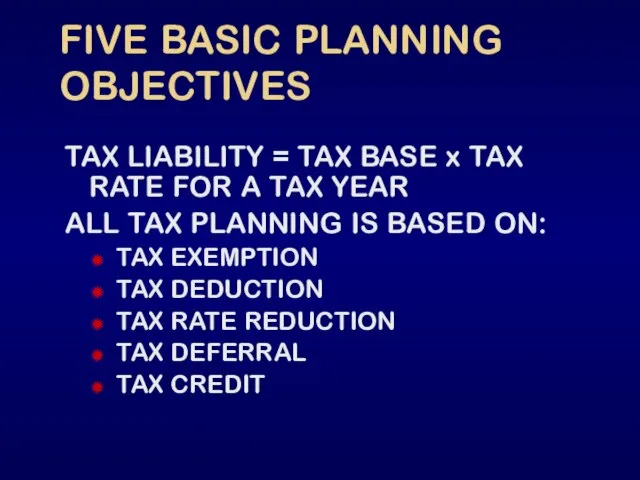

Слайд 5FIVE BASIC PLANNING OBJECTIVES

TAX LIABILITY = TAX BASE x TAX RATE FOR

A TAX YEAR

ALL TAX PLANNING IS BASED ON:

TAX EXEMPTION

TAX DEDUCTION

TAX RATE REDUCTION

TAX DEFERRAL

TAX CREDIT

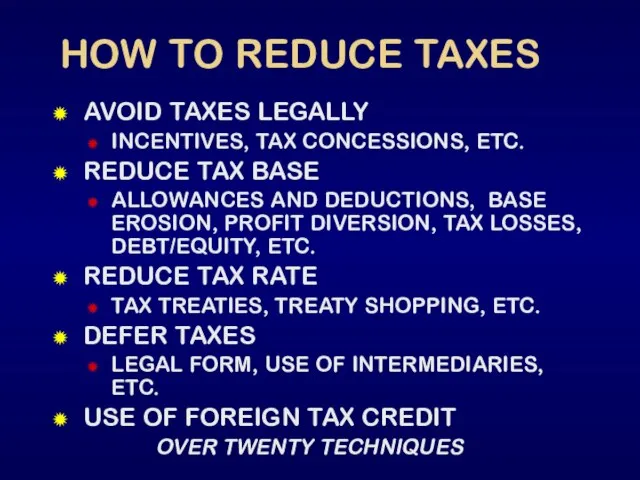

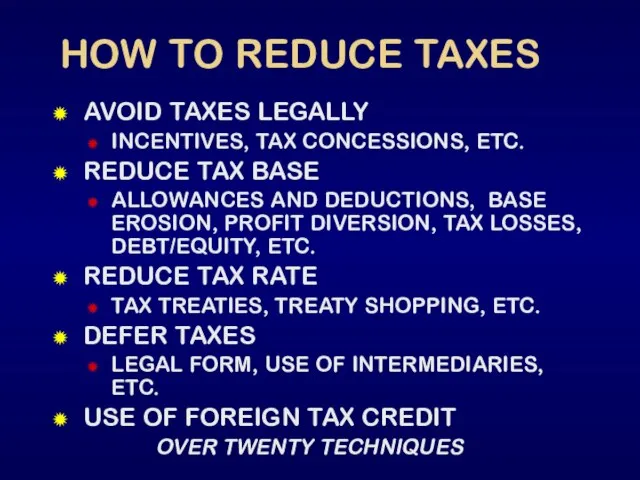

Слайд 6HOW TO REDUCE TAXES

AVOID TAXES LEGALLY

INCENTIVES, TAX CONCESSIONS, ETC.

REDUCE TAX BASE

ALLOWANCES AND

DEDUCTIONS, BASE EROSION, PROFIT DIVERSION, TAX LOSSES, DEBT/EQUITY, ETC.

REDUCE TAX RATE

TAX TREATIES, TREATY SHOPPING, ETC.

DEFER TAXES

LEGAL FORM, USE OF INTERMEDIARIES, ETC.

USE OF FOREIGN TAX CREDIT

OVER TWENTY TECHNIQUES

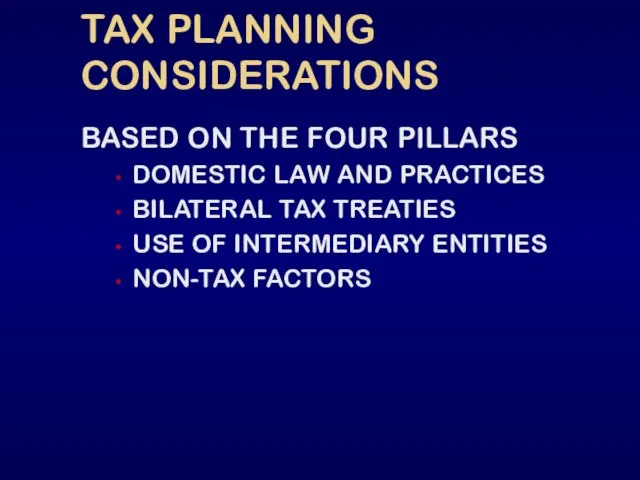

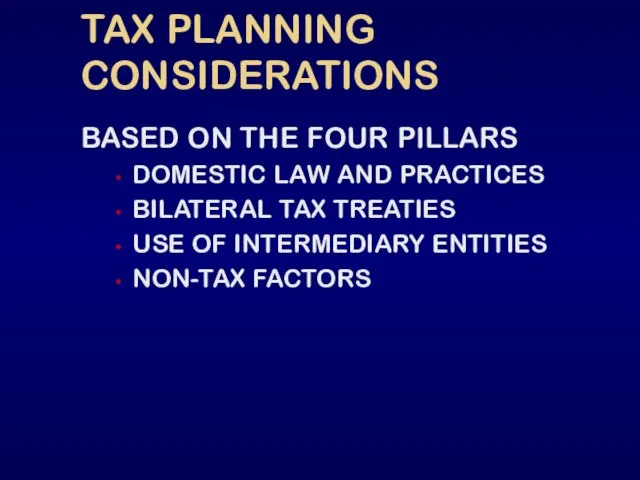

Слайд 7TAX PLANNING CONSIDERATIONS

BASED ON THE FOUR PILLARS

DOMESTIC LAW AND PRACTICES

BILATERAL TAX TREATIES

USE

OF INTERMEDIARY ENTITIES

NON-TAX FACTORS

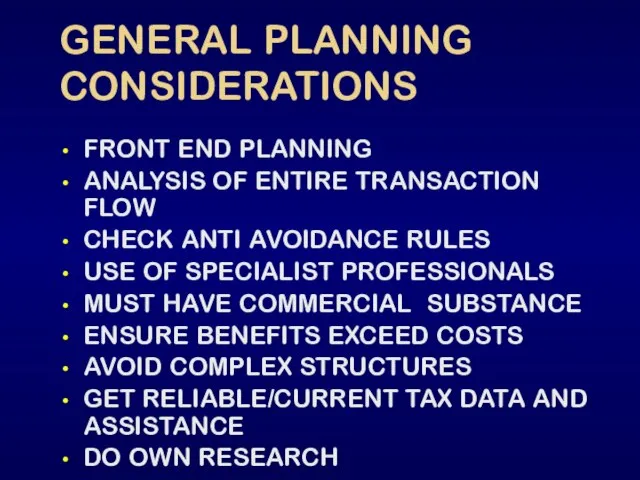

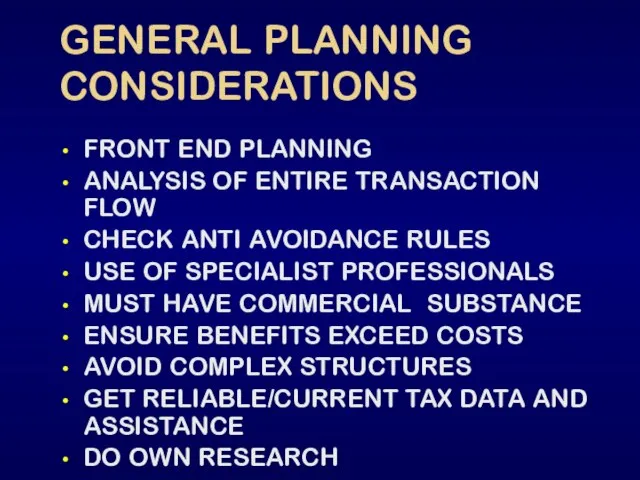

Слайд 8GENERAL PLANNING CONSIDERATIONS

FRONT END PLANNING

ANALYSIS OF ENTIRE TRANSACTION FLOW

CHECK ANTI AVOIDANCE RULES

USE

OF SPECIALIST PROFESSIONALS

MUST HAVE COMMERCIAL SUBSTANCE

ENSURE BENEFITS EXCEED COSTS

AVOID COMPLEX STRUCTURES

GET RELIABLE/CURRENT TAX DATA AND ASSISTANCE

DO OWN RESEARCH

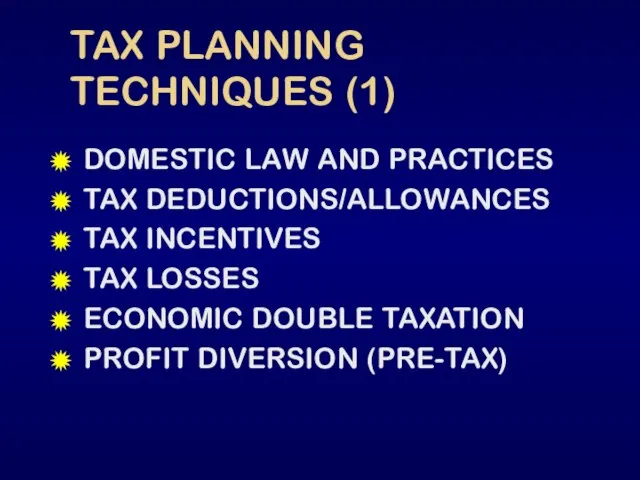

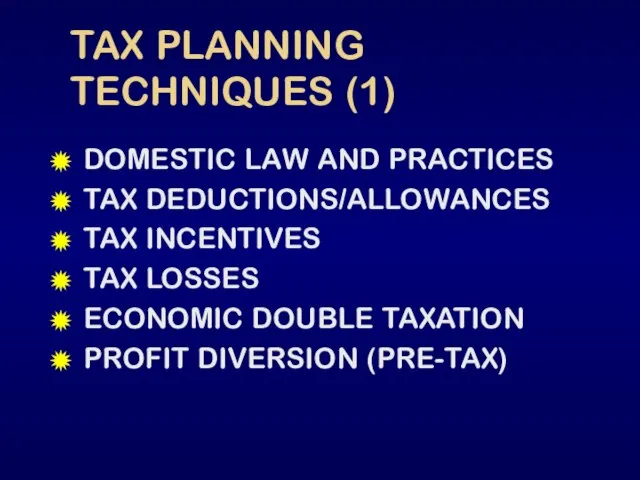

Слайд 9TAX PLANNING TECHNIQUES (1)

DOMESTIC LAW AND PRACTICES

TAX DEDUCTIONS/ALLOWANCES

TAX INCENTIVES

TAX LOSSES

ECONOMIC DOUBLE TAXATION

PROFIT

DIVERSION (PRE-TAX)

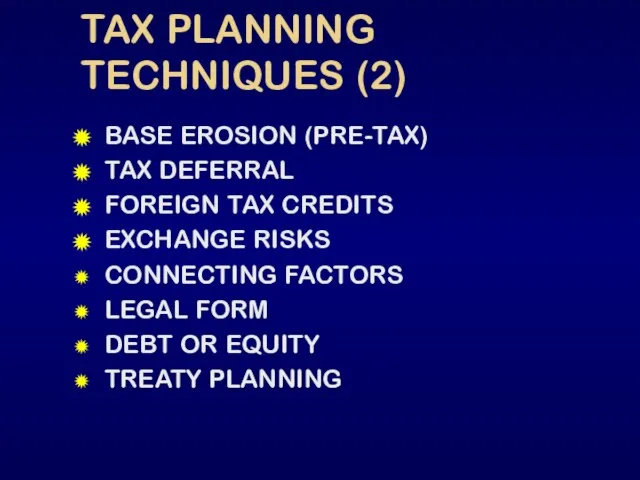

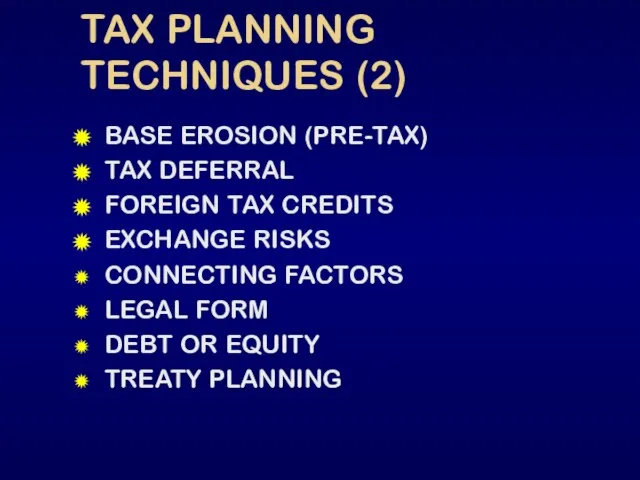

Слайд 10TAX PLANNING TECHNIQUES (2)

BASE EROSION (PRE-TAX)

TAX DEFERRAL

FOREIGN TAX CREDITS

EXCHANGE RISKS

CONNECTING FACTORS

LEGAL FORM

DEBT

OR EQUITY

TREATY PLANNING

Слайд 11TAX PLANNING TECHNIQUES (3)

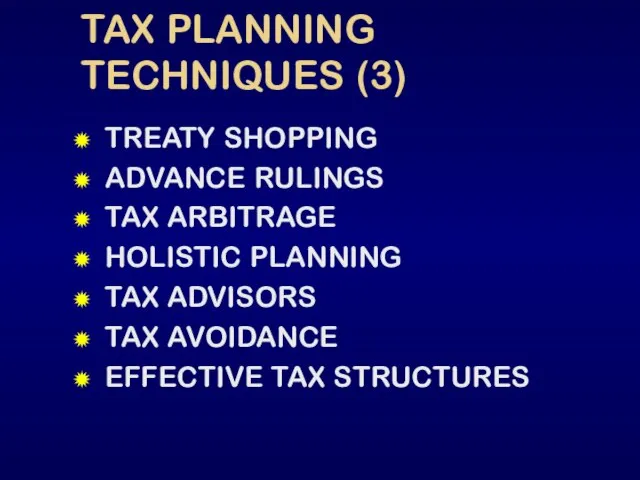

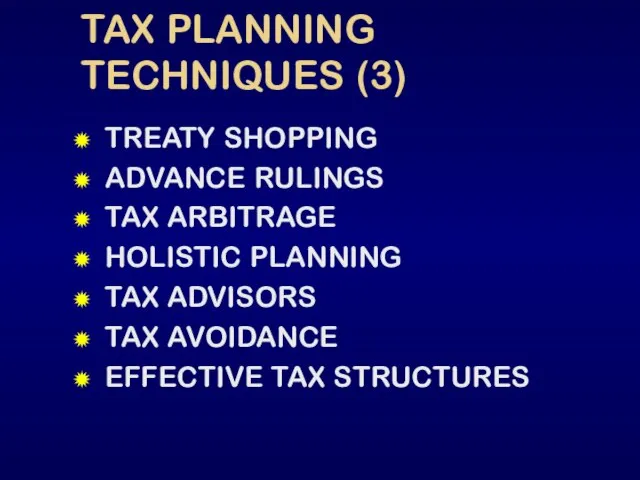

TREATY SHOPPING

ADVANCE RULINGS

TAX ARBITRAGE

HOLISTIC PLANNING

TAX ADVISORS

TAX AVOIDANCE

EFFECTIVE TAX STRUCTURES

Слайд 12 A TAX PLANNING METHODOLOGY

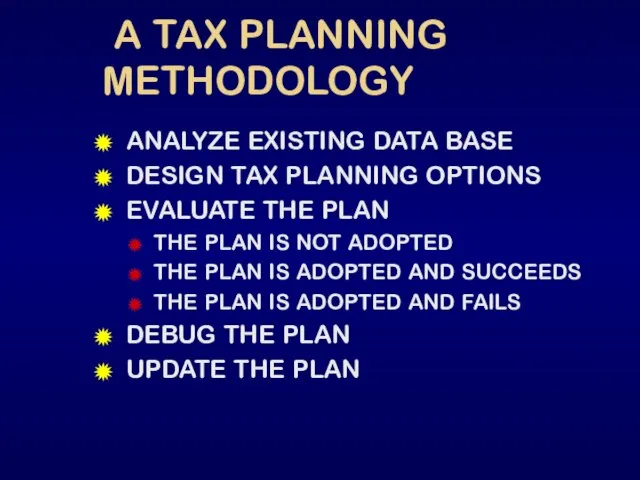

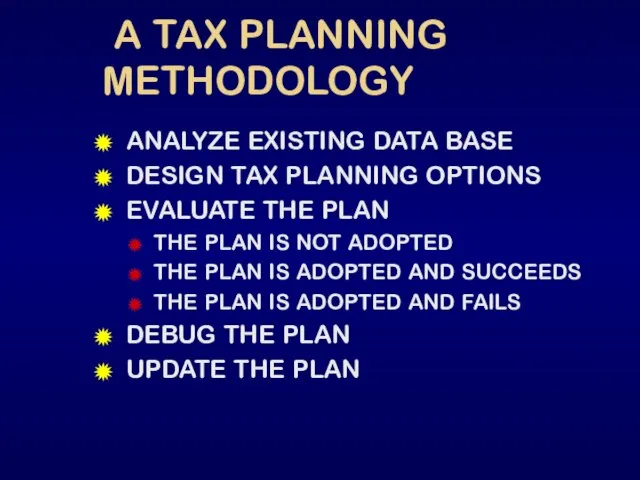

ANALYZE EXISTING DATA BASE

DESIGN TAX PLANNING OPTIONS

EVALUATE THE

PLAN

THE PLAN IS NOT ADOPTED

THE PLAN IS ADOPTED AND SUCCEEDS

THE PLAN IS ADOPTED AND FAILS

DEBUG THE PLAN

UPDATE THE PLAN

Слайд 13A PLANNING APPROACH

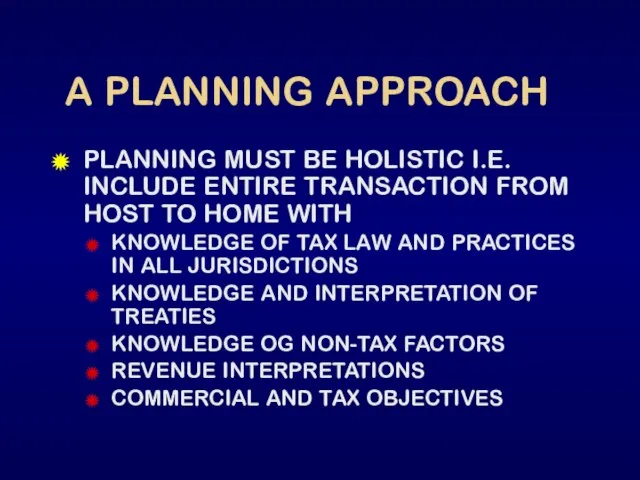

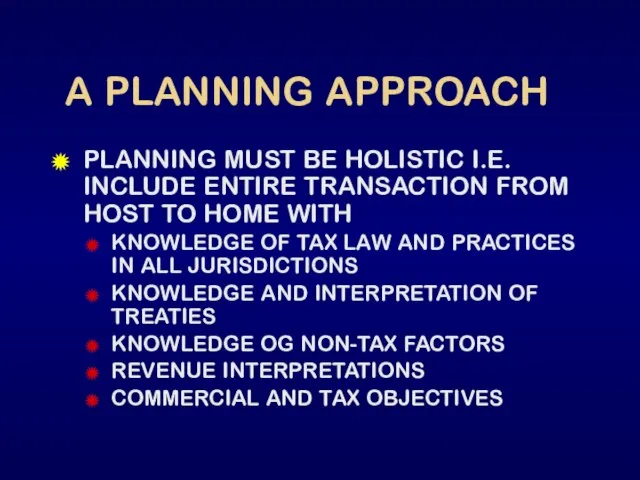

PLANNING MUST BE HOLISTIC I.E. INCLUDE ENTIRE TRANSACTION FROM HOST

TO HOME WITH

KNOWLEDGE OF TAX LAW AND PRACTICES IN ALL JURISDICTIONS

KNOWLEDGE AND INTERPRETATION OF TREATIES

KNOWLEDGE OG NON-TAX FACTORS

REVENUE INTERPRETATIONS

COMMERCIAL AND TAX OBJECTIVES

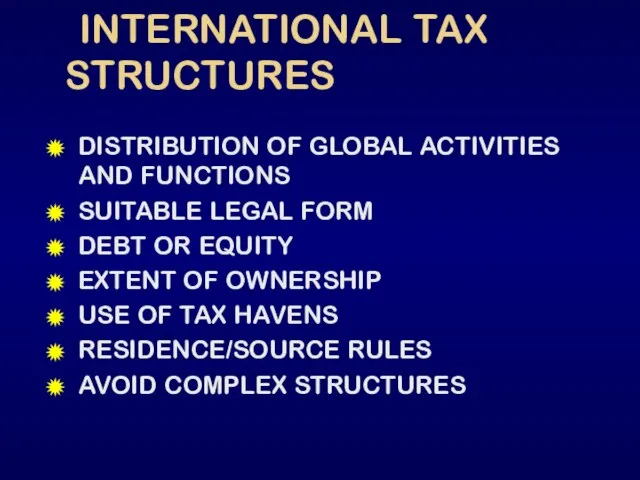

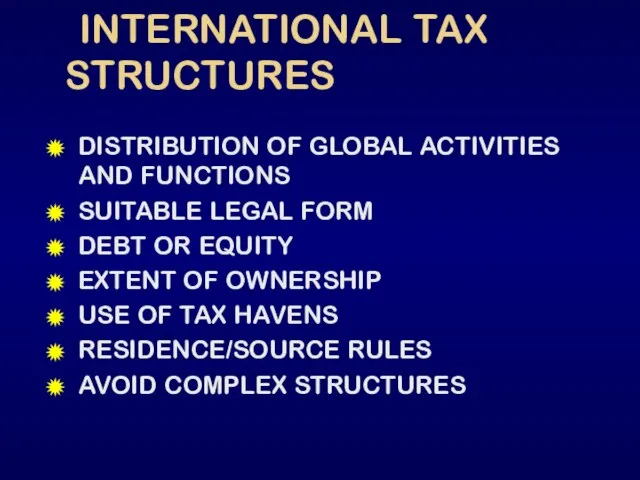

Слайд 14 INTERNATIONAL TAX STRUCTURES

DISTRIBUTION OF GLOBAL ACTIVITIES AND FUNCTIONS

SUITABLE LEGAL FORM

DEBT

OR EQUITY

EXTENT OF OWNERSHIP

USE OF TAX HAVENS

RESIDENCE/SOURCE RULES

AVOID COMPLEX STRUCTURES

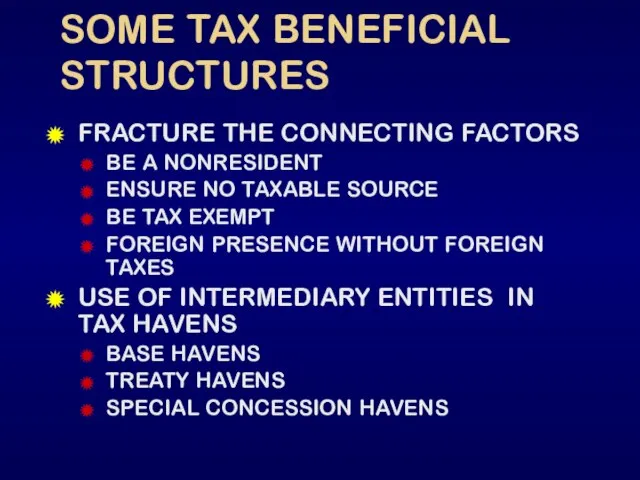

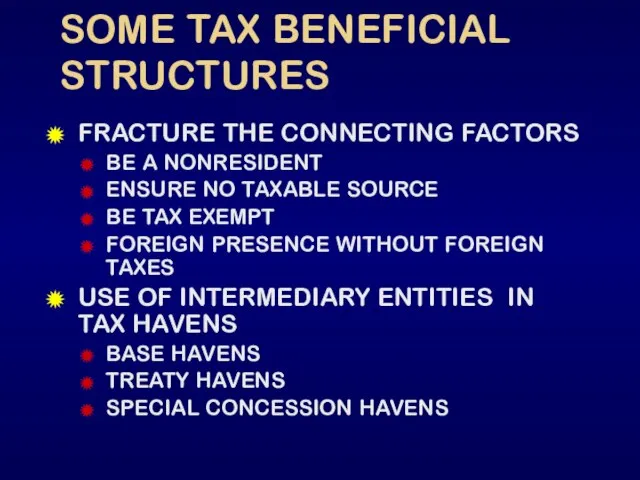

Слайд 15SOME TAX BENEFICIAL STRUCTURES

FRACTURE THE CONNECTING FACTORS

BE A NONRESIDENT

ENSURE NO TAXABLE SOURCE

BE

TAX EXEMPT

FOREIGN PRESENCE WITHOUT FOREIGN TAXES

USE OF INTERMEDIARY ENTITIES IN TAX HAVENS

BASE HAVENS

TREATY HAVENS

SPECIAL CONCESSION HAVENS

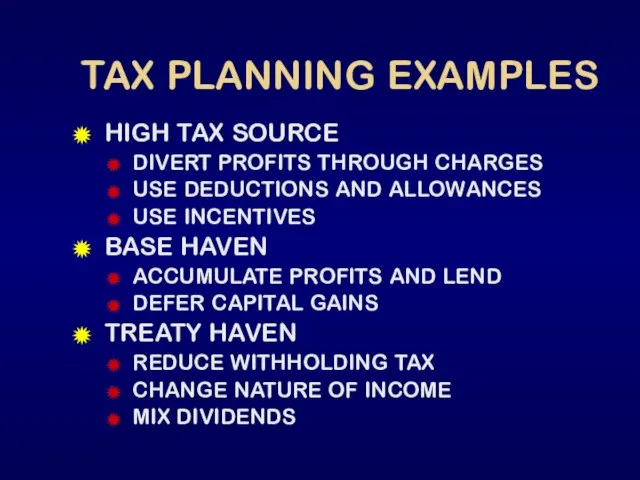

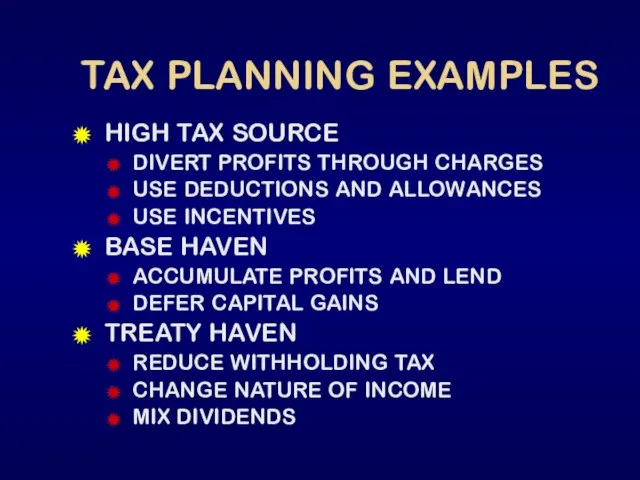

Слайд 16TAX PLANNING EXAMPLES

HIGH TAX SOURCE

DIVERT PROFITS THROUGH CHARGES

USE DEDUCTIONS AND ALLOWANCES

USE INCENTIVES

BASE

HAVEN

ACCUMULATE PROFITS AND LEND

DEFER CAPITAL GAINS

TREATY HAVEN

REDUCE WITHHOLDING TAX

CHANGE NATURE OF INCOME

MIX DIVIDENDS

Слайд 17INTERNATIONAL TRANSACTIONS

INTERNATIONAL TRADE AND FINANCE

TRANSFER OF TECHNOLOGY

INWARD INVESTMENTS

OUTWARD INVESTMENTS

MERGERS AND ACQUISITIONS

DISPOSALS OF

FOREIGN ASSETS

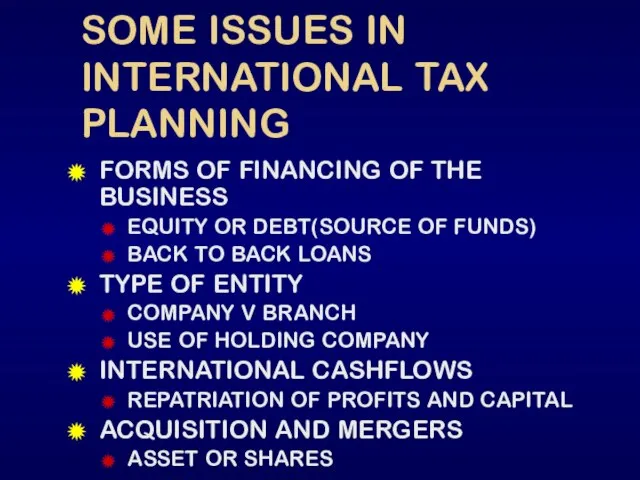

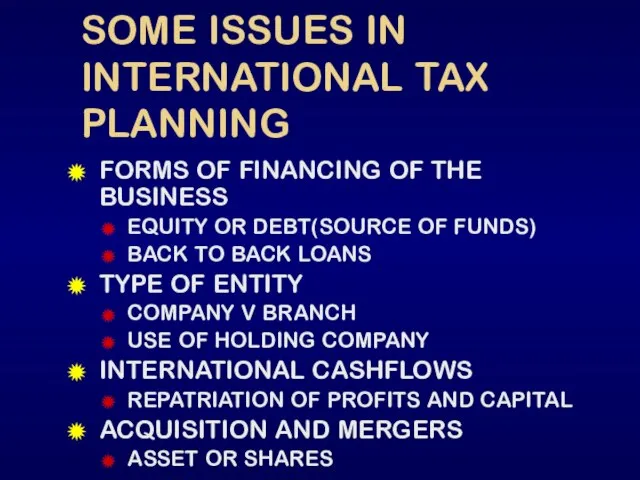

Слайд 18SOME ISSUES IN INTERNATIONAL TAX PLANNING

FORMS OF FINANCING OF THE BUSINESS

EQUITY OR

DEBT(SOURCE OF FUNDS)

BACK TO BACK LOANS

TYPE OF ENTITY

COMPANY V BRANCH

USE OF HOLDING COMPANY

INTERNATIONAL CASHFLOWS

REPATRIATION OF PROFITS AND CAPITAL

ACQUISITION AND MERGERS

ASSET OR SHARES

Слайд 19INTERNATIONAL TAX PLANNING – SOME CONCLUSIONS

REQUIRES DETAILED KNOWLEDGE OF LAWS AND PRACTICES

COMPLEX BUT FLEXIBLE

RISKY ANC COSTLY

MATCH RISKS WITH REWARDS

CAN BE VERY COST EFFECTIVE AND WORTHWHILE

NECESSARY TO BE COMPETITIVE

Слайд 20FORM OF LEGAL ENTITY

DIRECT SALE

AGENCY

REPRESENTATIVE OFFICE

BRANCH

COMPANY

SERVICE COMPANY

PARTNERSHIP

LICENSING OR FRANCHISE

Слайд 21FINANCING OF OVERSEAS ENTITY

DEBT OR EQUITY? HYBRIDS?

DEBT-EQUITY RATIO

IF DEBT -

OFFSET AGAINST

RELATED INCOME FLOWS

WHO SHOULD PROVIDE THE DEBT?

CURRENCY OF DEBT? FEGLs?

WITHHOLDING TAXES

ANTI-AVOIDANCE RULES

IS DEBT PREFERABLE ALWAYS?

Слайд 22INTERNATIONAL TAX PLANNING PITFALLS

PRACTICAL AND COMMERCIAL CONSIDERATIONS

COSTS

JURISDICTION CHANGE IN FUTURE

NON-TAX FACTORS

FRONT-END PLANNING

RELIABLE

TAX DATA

PROFESSIONAL ADVICE

RESIDENCE AND SOURCE RULES

ANTI-AVOIDANCE RULES

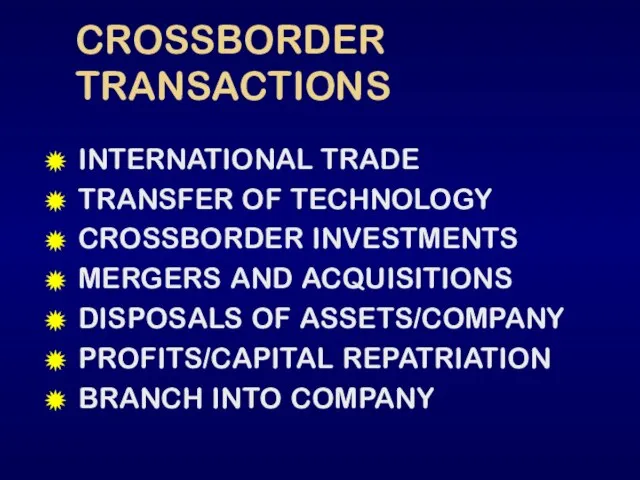

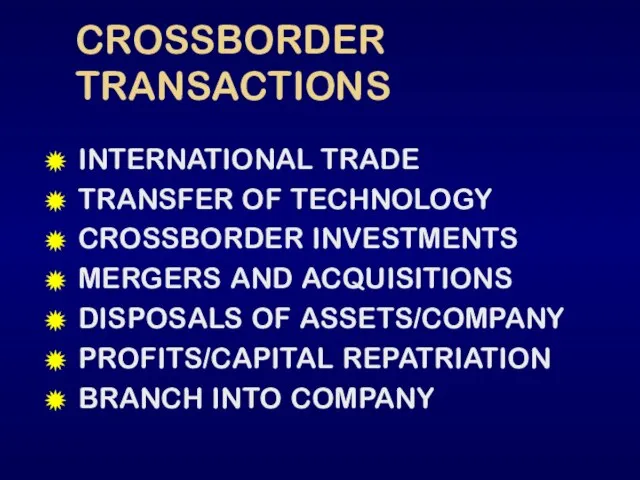

Слайд 23CROSSBORDER TRANSACTIONS

INTERNATIONAL TRADE

TRANSFER OF TECHNOLOGY

CROSSBORDER INVESTMENTS

MERGERS AND ACQUISITIONS

DISPOSALS OF ASSETS/COMPANY

PROFITS/CAPITAL REPATRIATION

BRANCH INTO

COMPANY

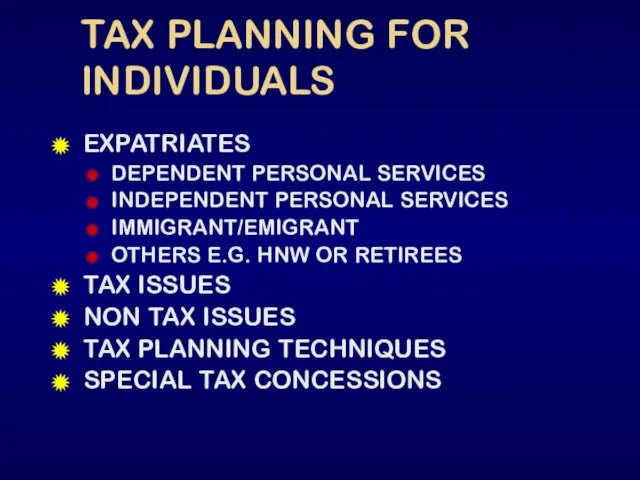

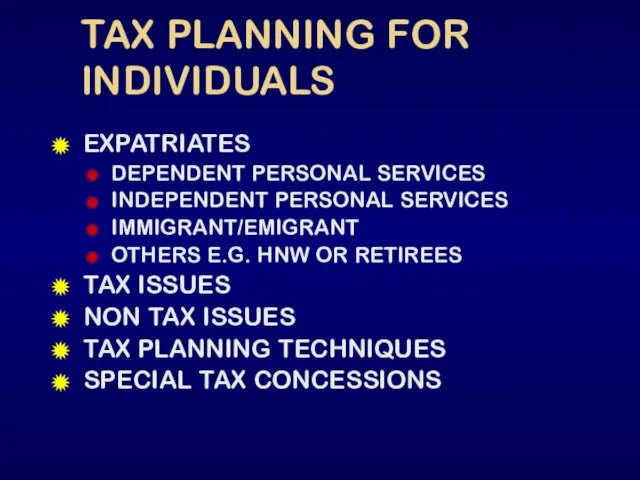

Слайд 24TAX PLANNING FOR INDIVIDUALS

EXPATRIATES

DEPENDENT PERSONAL SERVICES

INDEPENDENT PERSONAL SERVICES

IMMIGRANT/EMIGRANT

OTHERS E.G. HNW OR RETIREES

TAX

ISSUES

NON TAX ISSUES

TAX PLANNING TECHNIQUES

SPECIAL TAX CONCESSIONS

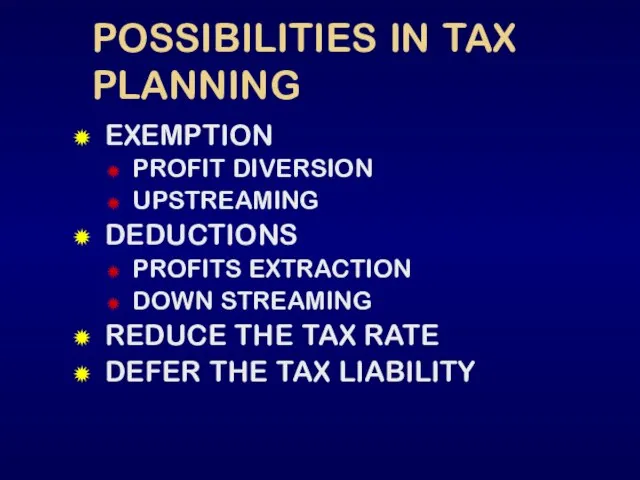

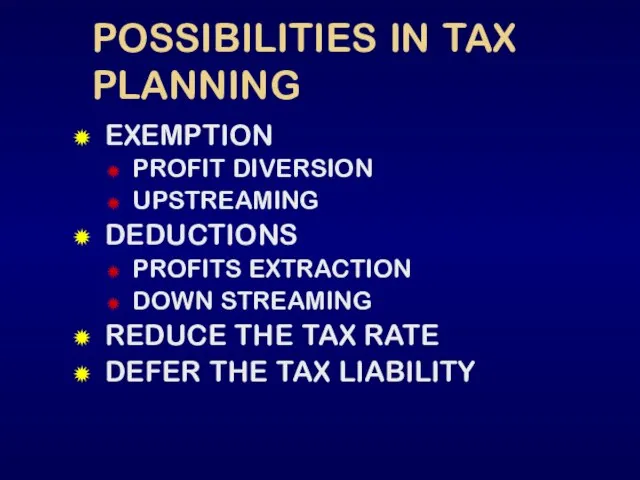

Слайд 25POSSIBILITIES IN TAX PLANNING

EXEMPTION

PROFIT DIVERSION

UPSTREAMING

DEDUCTIONS

PROFITS EXTRACTION

DOWN STREAMING

REDUCE THE TAX RATE

DEFER THE TAX

LIABILITY

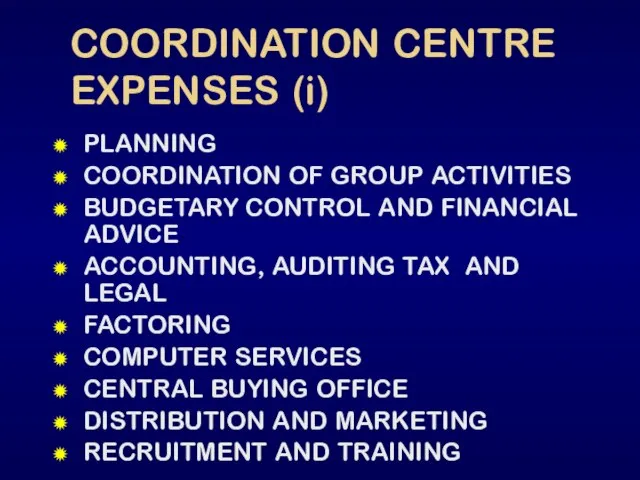

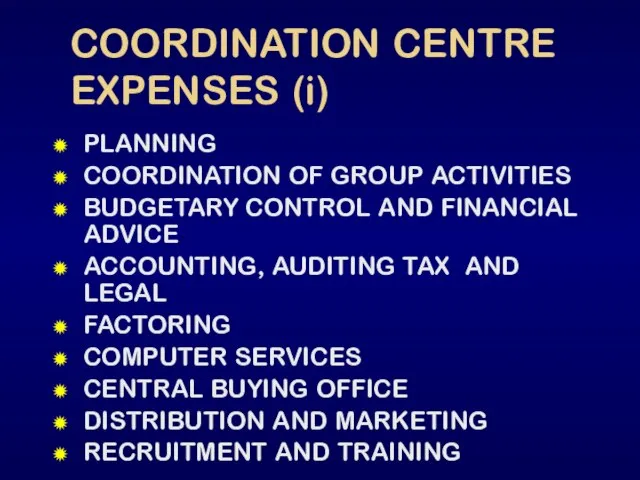

Слайд 26COORDINATION CENTRE EXPENSES (i)

PLANNING

COORDINATION OF GROUP ACTIVITIES

BUDGETARY CONTROL AND FINANCIAL ADVICE

ACCOUNTING, AUDITING

TAX AND LEGAL

FACTORING

COMPUTER SERVICES

CENTRAL BUYING OFFICE

DISTRIBUTION AND MARKETING

RECRUITMENT AND TRAINING

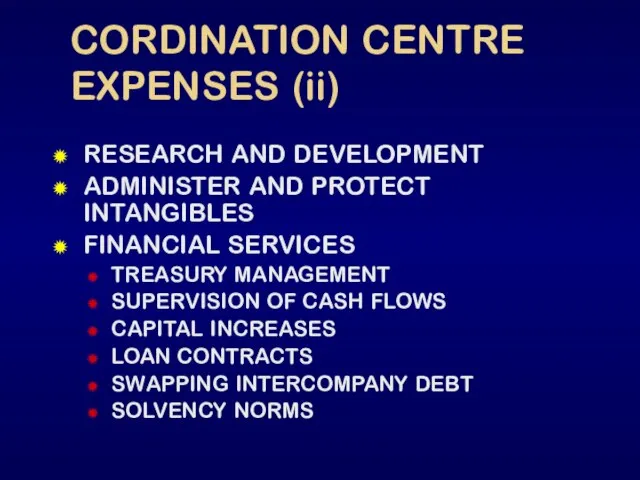

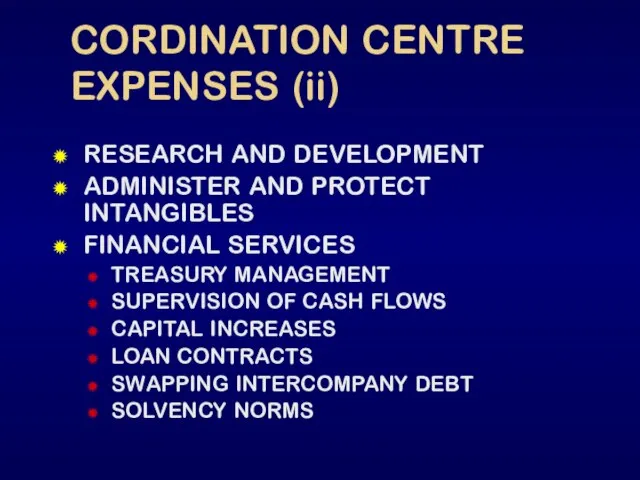

Слайд 27CORDINATION CENTRE EXPENSES (ii)

RESEARCH AND DEVELOPMENT

ADMINISTER AND PROTECT INTANGIBLES

FINANCIAL SERVICES

TREASURY MANAGEMENT

SUPERVISION OF

CASH FLOWS

CAPITAL INCREASES

LOAN CONTRACTS

SWAPPING INTERCOMPANY DEBT

SOLVENCY NORMS

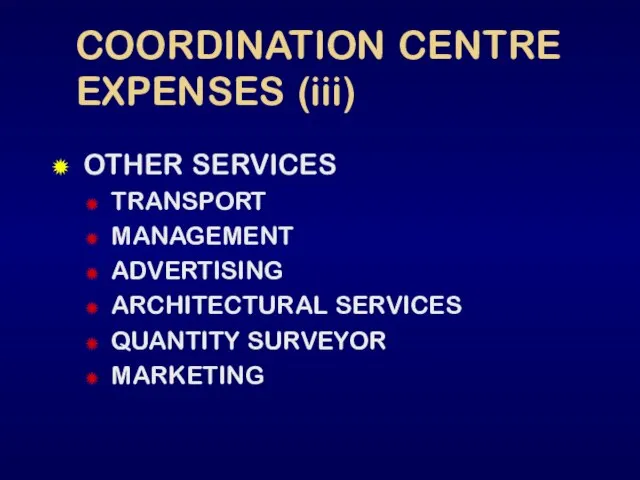

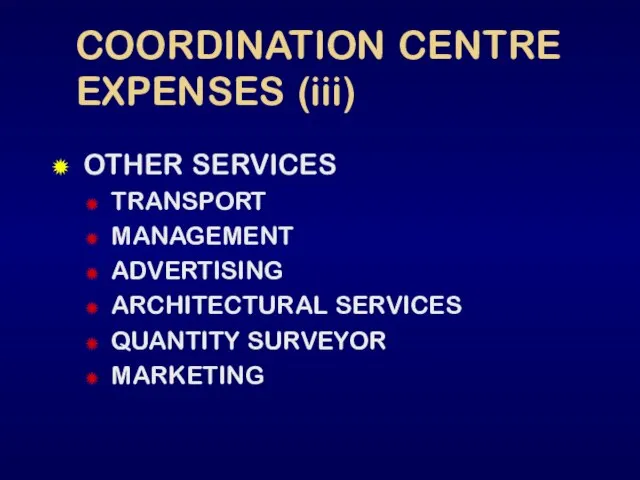

Слайд 28COORDINATION CENTRE EXPENSES (iii)

OTHER SERVICES

TRANSPORT

MANAGEMENT

ADVERTISING

ARCHITECTURAL SERVICES

QUANTITY SURVEYOR

MARKETING

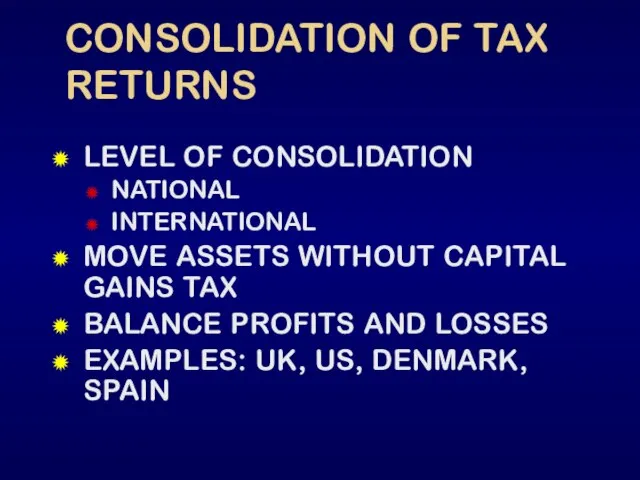

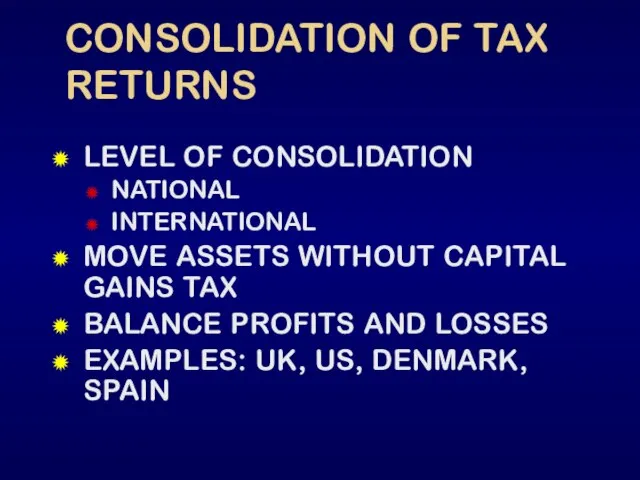

Слайд 29CONSOLIDATION OF TAX RETURNS

LEVEL OF CONSOLIDATION

NATIONAL

INTERNATIONAL

MOVE ASSETS WITHOUT CAPITAL GAINS TAX

BALANCE

PROFITS AND LOSSES

EXAMPLES: UK, US, DENMARK, SPAIN

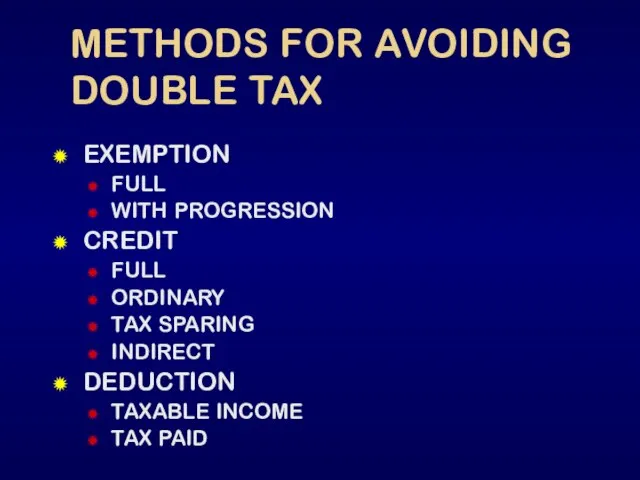

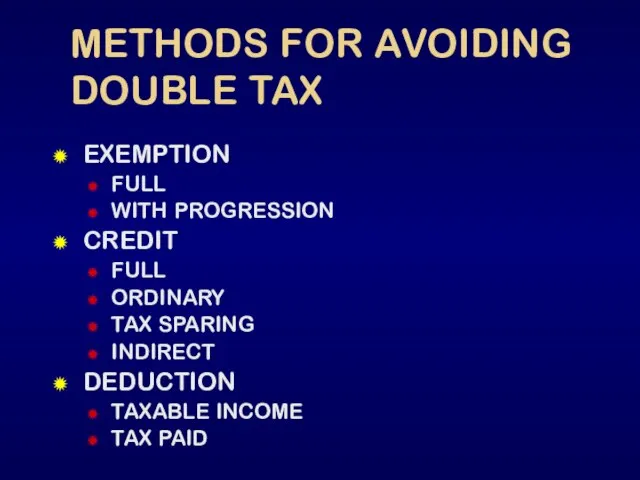

Слайд 30METHODS FOR AVOIDING DOUBLE TAX

EXEMPTION

FULL

WITH PROGRESSION

CREDIT

FULL

ORDINARY

TAX SPARING

INDIRECT

DEDUCTION

TAXABLE INCOME

TAX PAID

Опасные места

Опасные места 20140317_merzlikinaip_doc

20140317_merzlikinaip_doc ВИЧ и СПИД

ВИЧ и СПИД Анатомия

Анатомия Электронный документооборот как инструмент борьбы с бюрократией

Электронный документооборот как инструмент борьбы с бюрократией Винсент Виллем ван Гог

Винсент Виллем ван Гог Как выполнить выгрузкуотчетности в электронном виде из программ системы 1С:Предприятие

Как выполнить выгрузкуотчетности в электронном виде из программ системы 1С:Предприятие Преобразования фигур в пространстве

Преобразования фигур в пространстве Предельные одноосновные карбоновые кислоты. Сложные эфиры

Предельные одноосновные карбоновые кислоты. Сложные эфиры Дизайн. Коллаборация. Цифровые технологии. Кейс №3 Перерождение одного изделия в другое

Дизайн. Коллаборация. Цифровые технологии. Кейс №3 Перерождение одного изделия в другое Презентация на тему ДЕЙСТВИЕ ТАБАКА НА ОРГАНИЗМ ЧЕЛОВЕКА

Презентация на тему ДЕЙСТВИЕ ТАБАКА НА ОРГАНИЗМ ЧЕЛОВЕКА  Where is the dog?

Where is the dog? . 1)Прочитать числа: 509, 6001, 90050, 7000850127, 620022. Назвать в каждом из чисел цифру в разряде десятков, сотен. Какие из чисел меньше 1000? 2)Найти

. 1)Прочитать числа: 509, 6001, 90050, 7000850127, 620022. Назвать в каждом из чисел цифру в разряде десятков, сотен. Какие из чисел меньше 1000? 2)Найти ООО ГарантСтройХаус

ООО ГарантСтройХаус Пончики Пончкофф (фотографии)

Пончики Пончкофф (фотографии) Определение культуры. Типы культур

Определение культуры. Типы культур Искусства бумагокручения

Искусства бумагокручения Технологический процесс ручной дуговой сварки листовых конструкций из стали (ст-3пс)

Технологический процесс ручной дуговой сварки листовых конструкций из стали (ст-3пс) МЫ СКОРО УЙДЁМ СО ШКОЛЬНОГО ДВОРА…

МЫ СКОРО УЙДЁМ СО ШКОЛЬНОГО ДВОРА… Эффективные приёмы запоминания учебного материала

Эффективные приёмы запоминания учебного материала Административно-правовой статус

Административно-правовой статус Развитие личности младшего школьника средствами учебного диалога

Развитие личности младшего школьника средствами учебного диалога БЭК-ОФИС СОЗДАНИЕ, РАЗВИТИЕ, АВТОМАТИЗАЦИЯ

БЭК-ОФИС СОЗДАНИЕ, РАЗВИТИЕ, АВТОМАТИЗАЦИЯ Внеурочная работа по математике

Внеурочная работа по математике Слайды

Слайды ГОГОЛЬ: знакомый и незнакомый

ГОГОЛЬ: знакомый и незнакомый The Cable News Network

The Cable News Network Сила. Основы методики ее воспитания

Сила. Основы методики ее воспитания