Содержание

- 2. Cross Border Trade - direct sales from country of residence - via independent sales agent (commissioner)

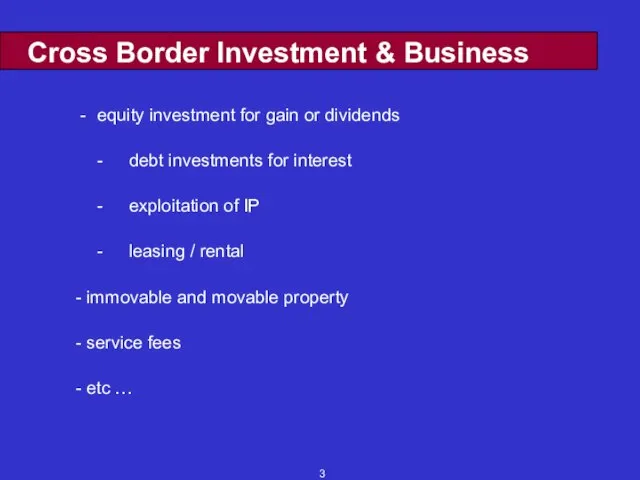

- 3. Cross Border Investment & Business - equity investment for gain or dividends - debt investments for

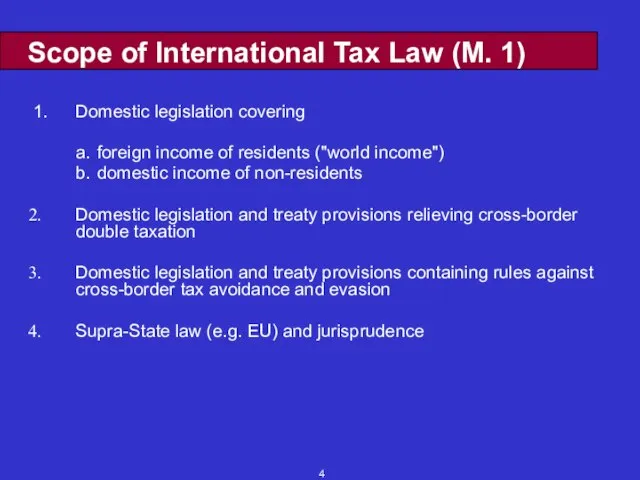

- 4. Scope of International Tax Law (M. 1) 1. Domestic legislation covering a. foreign income of residents

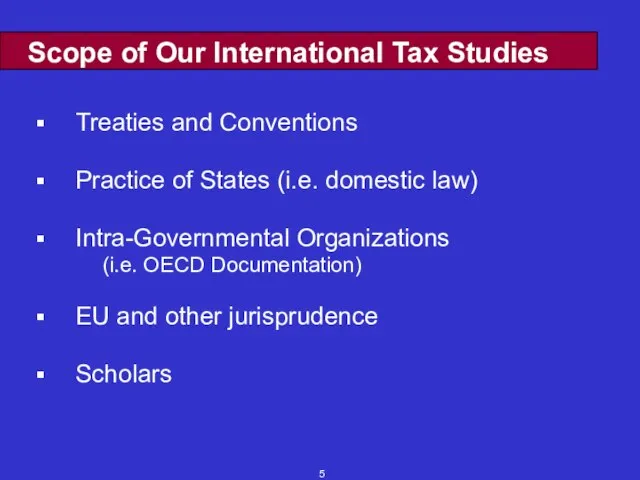

- 5. Scope of Our International Tax Studies Treaties and Conventions Practice of States (i.e. domestic law) Intra-Governmental

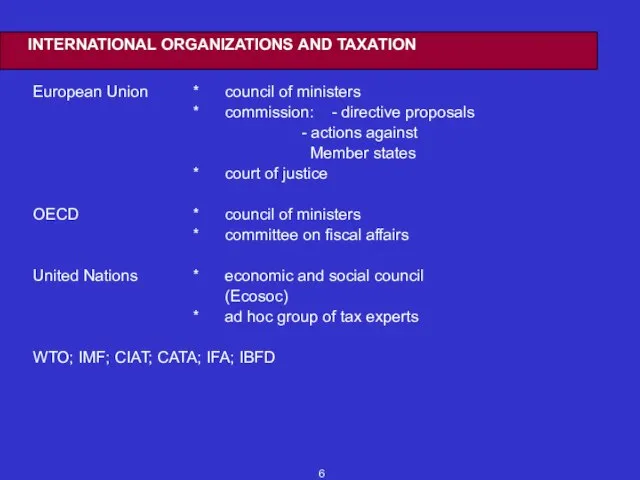

- 6. INTERNATIONAL ORGANIZATIONS AND TAXATION European Union * council of ministers * commission: - directive proposals -

- 7. What is a Treaty (M. 2) A tax treaty is an agreement between two States to

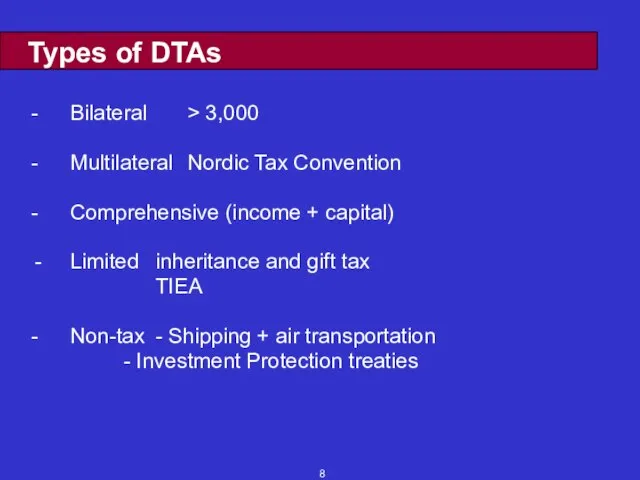

- 8. Types of DTAs - Bilateral > 3,000 - Multilateral Nordic Tax Convention - Comprehensive (income +

- 9. Interpreting a DTA m. 2 The Vienna Convention on the Law of Treaties. The OECD Commentary.

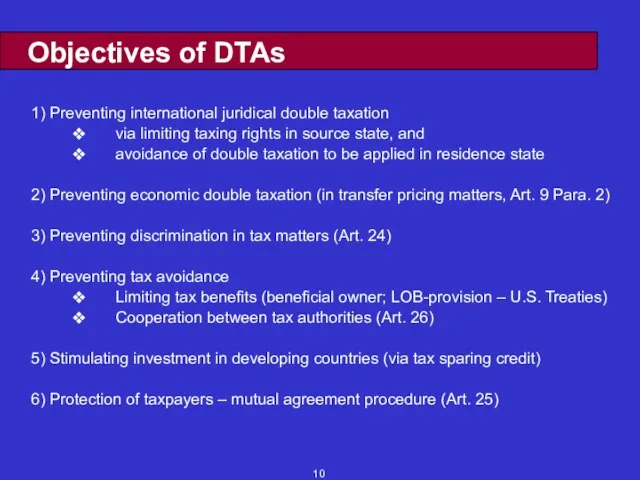

- 10. Objectives of DTAs 1) Preventing international juridical double taxation via limiting taxing rights in source state,

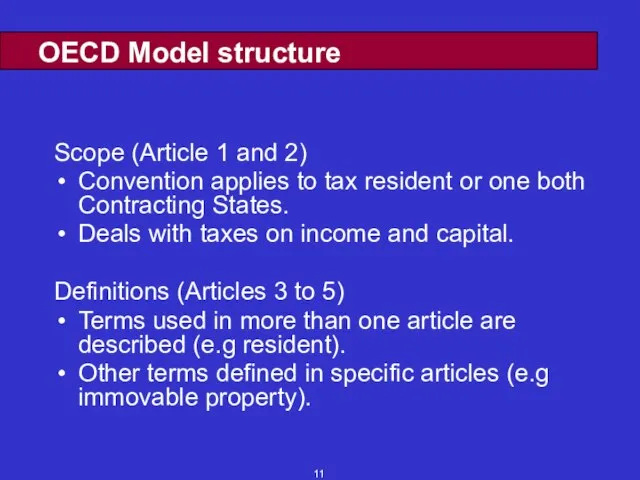

- 11. OECD Model structure Scope (Article 1 and 2) Convention applies to tax resident or one both

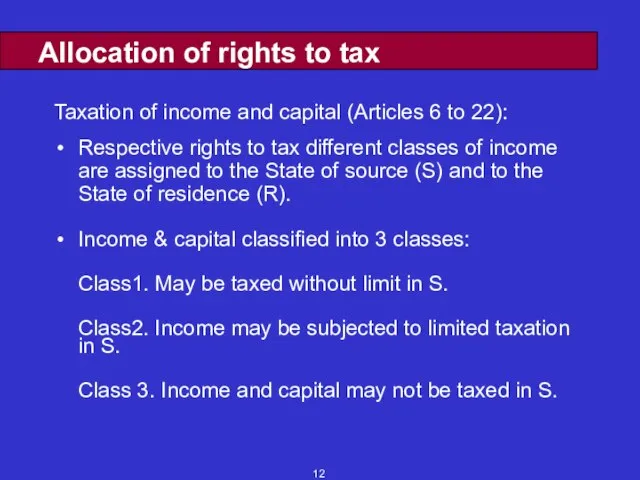

- 12. Allocation of rights to tax Taxation of income and capital (Articles 6 to 22): Respective rights

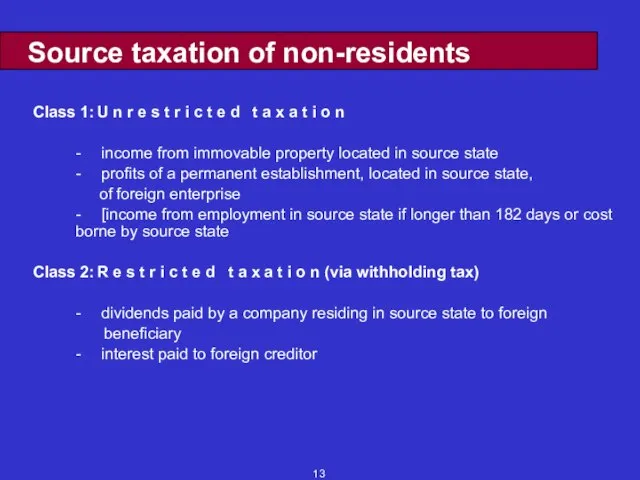

- 13. Source taxation of non-residents Class 1: U n r e s t r i c t

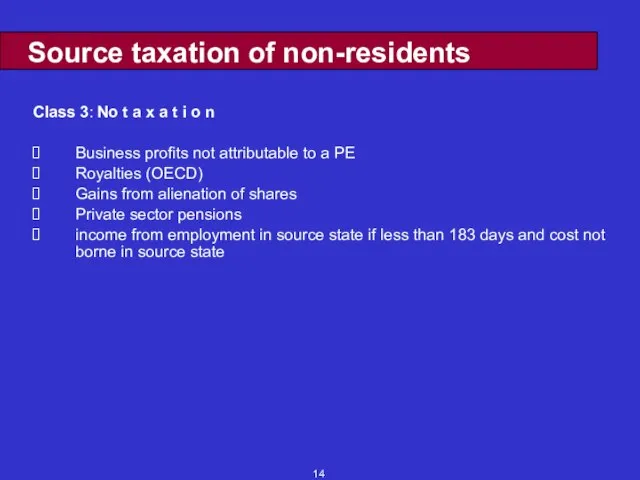

- 14. Source taxation of non-residents Class 3: No t a x a t i o n Business

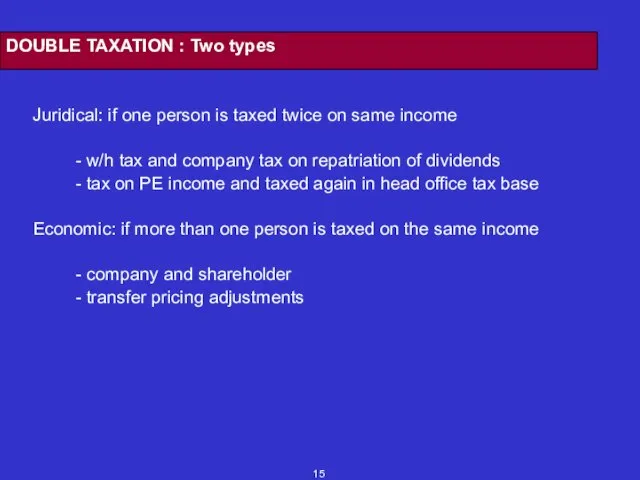

- 15. DOUBLE TAXATION : Two types Juridical: if one person is taxed twice on same income -

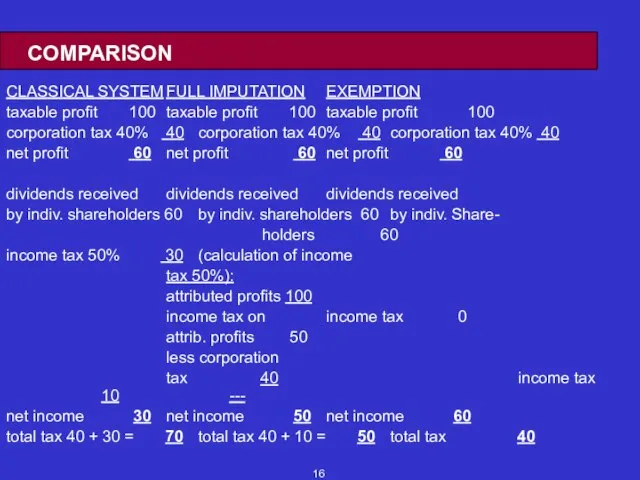

- 16. COMPARISON CLASSICAL SYSTEM FULL IMPUTATION EXEMPTION taxable profit 100 taxable profit 100 taxable profit 100 corporation

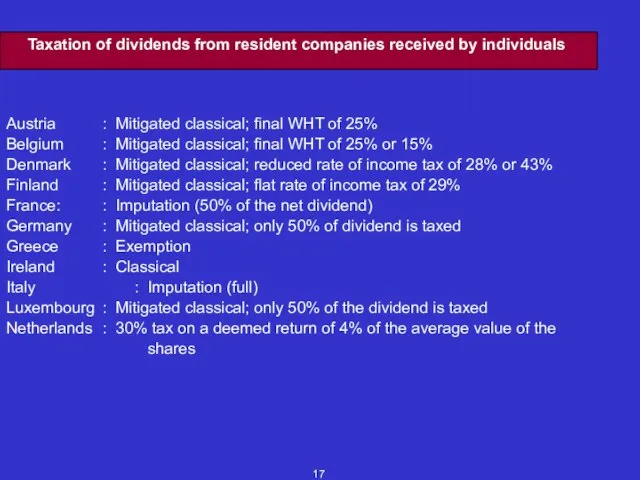

- 17. Taxation of dividends from resident companies received by individuals Austria : Mitigated classical; final WHT of

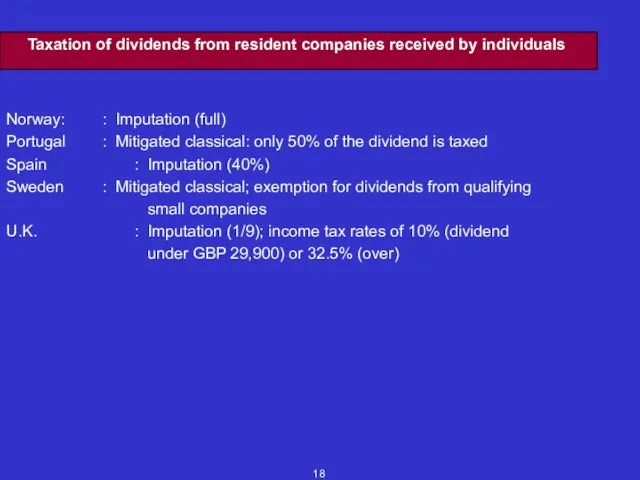

- 18. Taxation of dividends from resident companies received by individuals Norway: : Imputation (full) Portugal : Mitigated

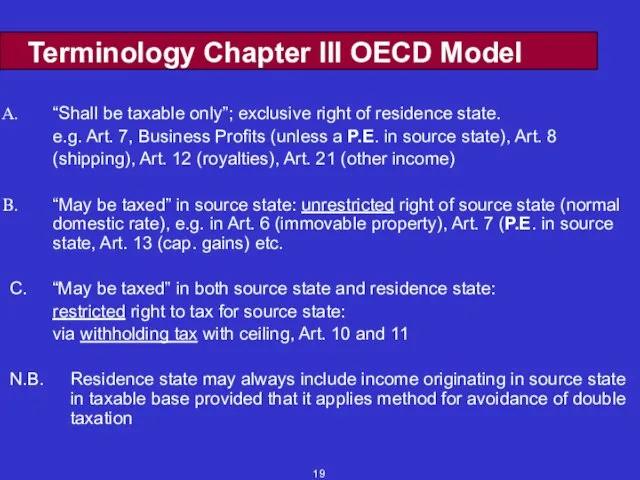

- 19. Terminology Chapter III OECD Model “Shall be taxable only”; exclusive right of residence state. e.g. Art.

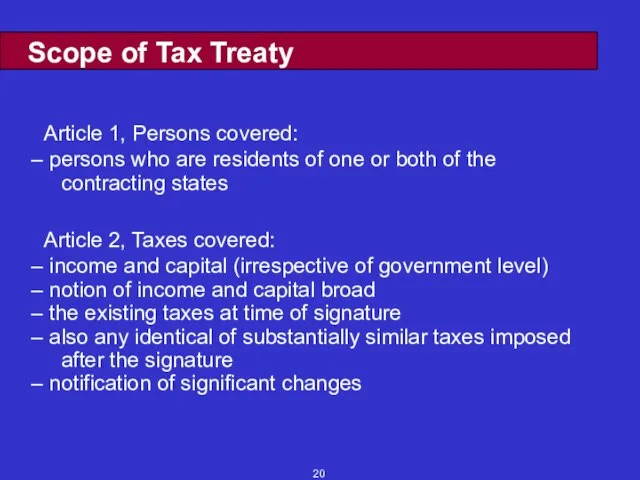

- 20. Scope of Tax Treaty Article 1, Persons covered: persons who are residents of one or both

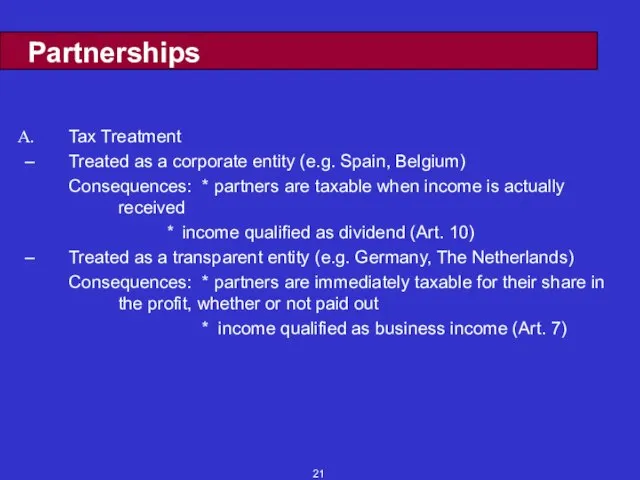

- 21. Partnerships Tax Treatment Treated as a corporate entity (e.g. Spain, Belgium) Consequences: * partners are taxable

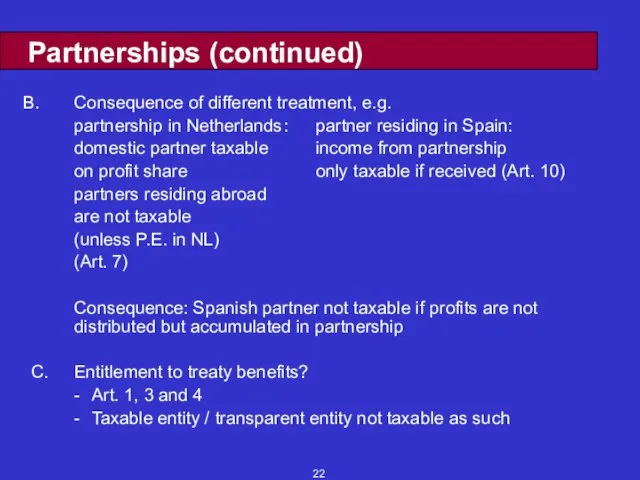

- 22. Partnerships (continued) Consequence of different treatment, e.g. partnership in Netherlands : partner residing in Spain: domestic

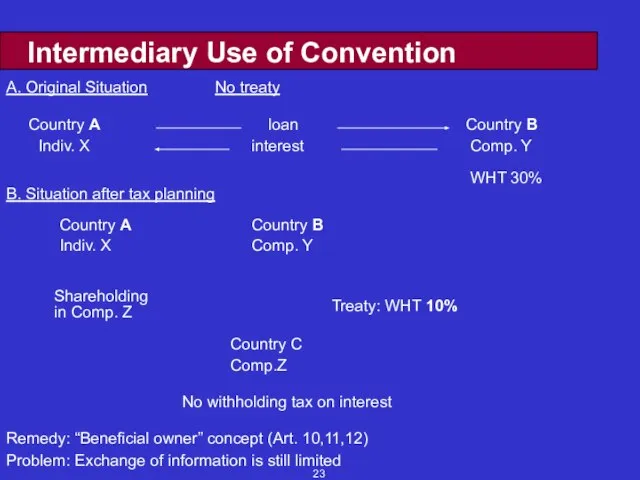

- 23. Intermediary Use of Convention A. Original Situation No treaty Treaty: WHT 10% No withholding tax on

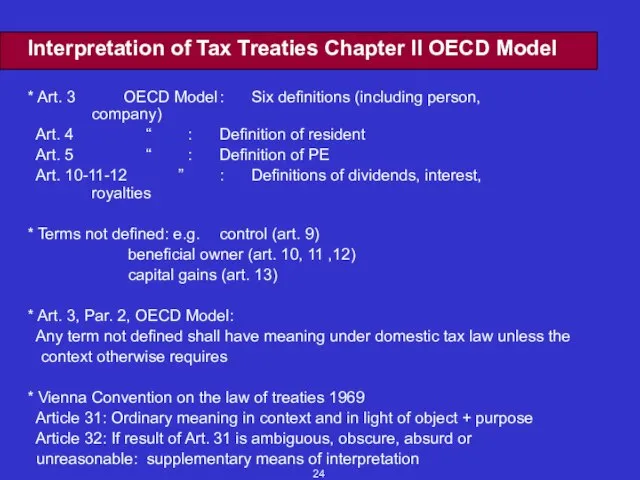

- 24. Interpretation of Tax Treaties Chapter II OECD Model * Art. 3 OECD Model : Six definitions

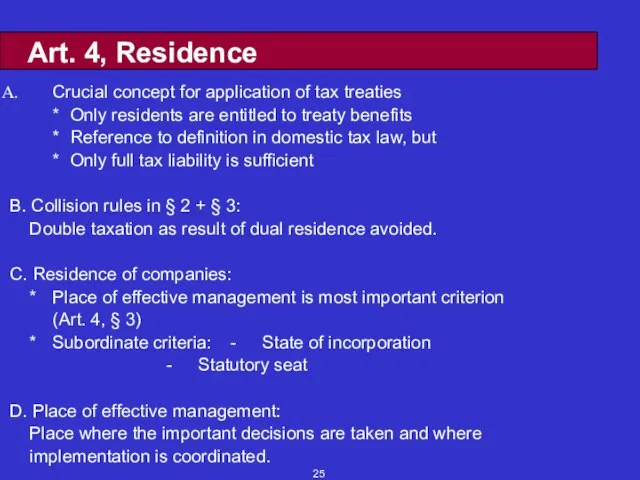

- 25. Art. 4, Residence Crucial concept for application of tax treaties * Only residents are entitled to

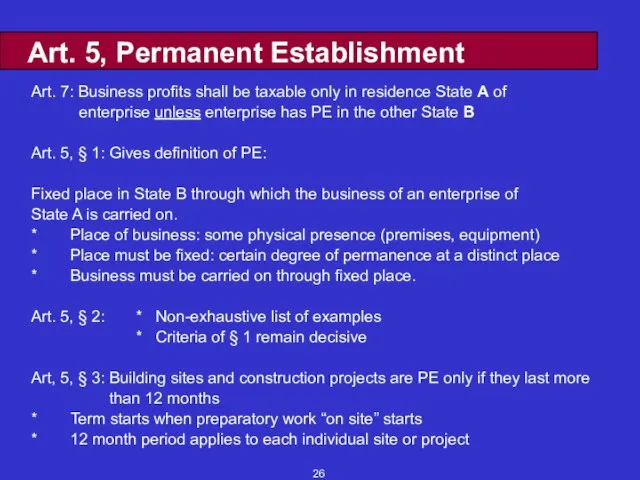

- 26. Art. 5, Permanent Establishment Art. 7: Business profits shall be taxable only in residence State A

- 27. Art 5, Permanent Establishment Art. 5, § 4: Which activities do not constitute a PE? *

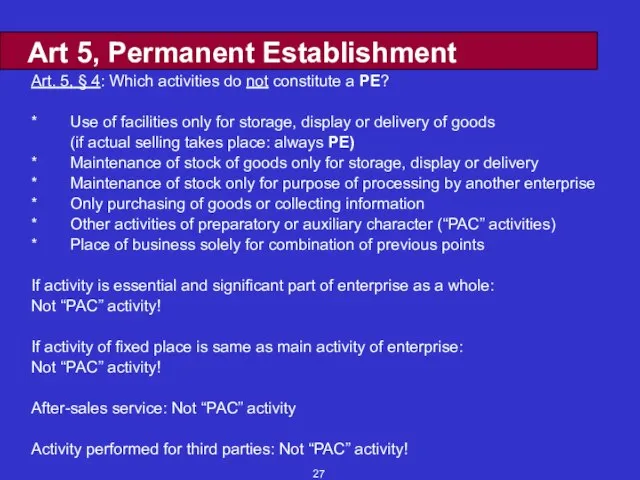

- 28. Art. 5, Permanent Establishment Art. 5, § 5 + 6: Does an agent constitute a PE?

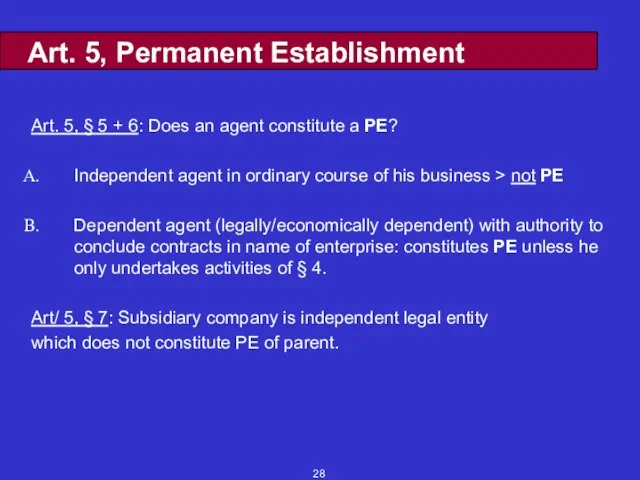

- 29. Electronic Commerce Selling Company X PC Customer PC * Is website a PE of the seller?

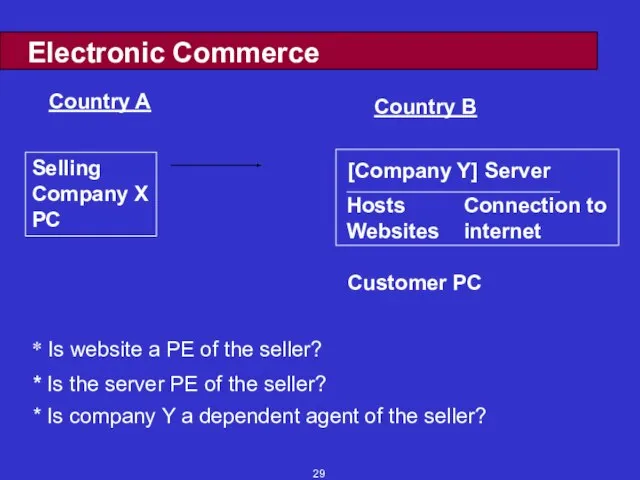

- 30. Article 7: Business Profits Country A Company X is non-resident Subsidiary is resident taxpayer in Country

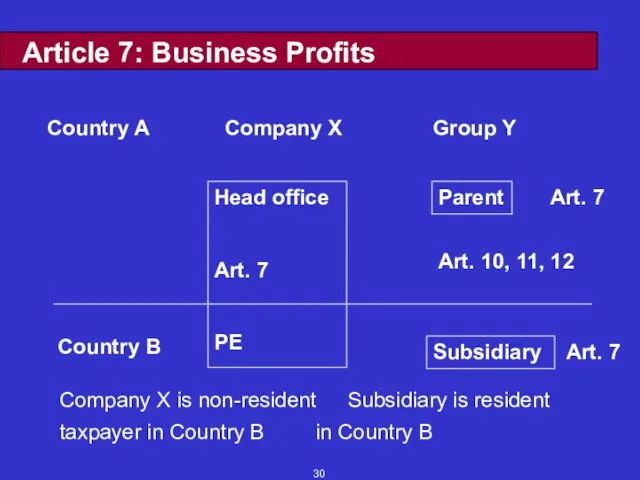

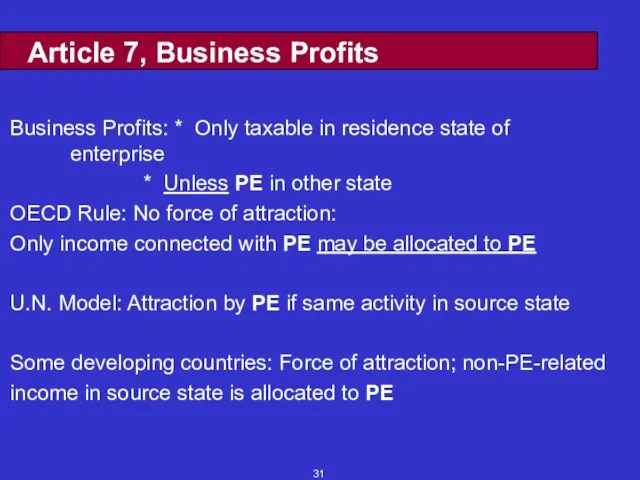

- 31. Article 7, Business Profits Business Profits: * Only taxable in residence state of enterprise * Unless

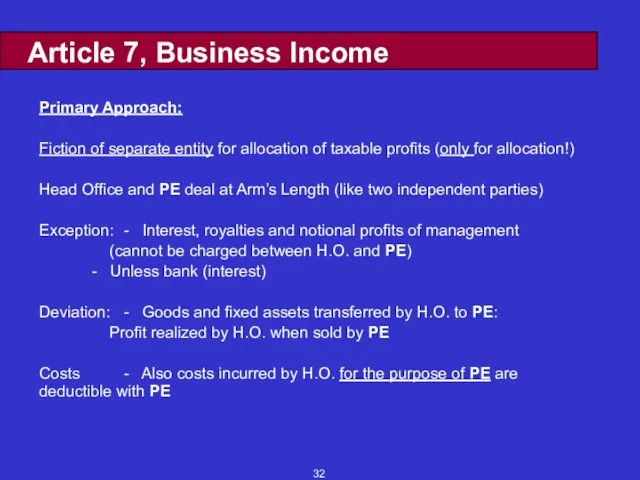

- 32. Article 7, Business Income Primary Approach: Fiction of separate entity for allocation of taxable profits (only

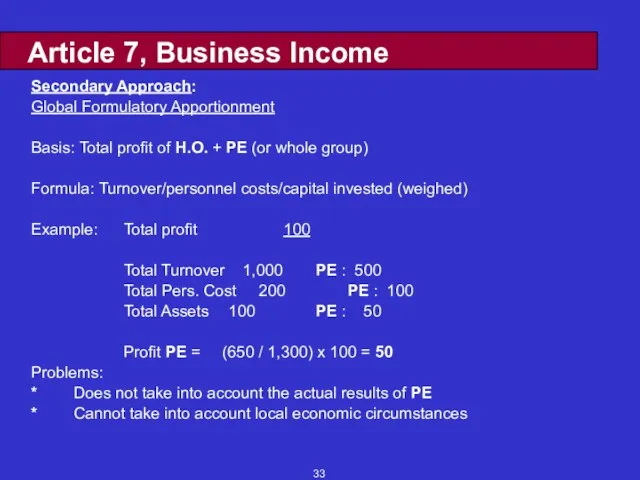

- 33. Article 7, Business Income Secondary Approach: Global Formulatory Apportionment Basis: Total profit of H.O. + PE

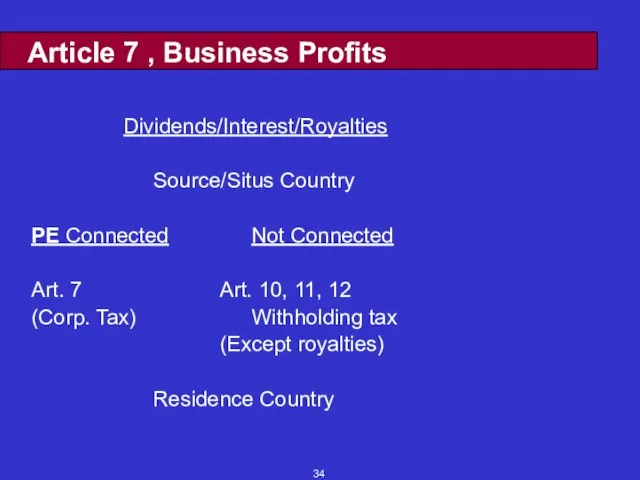

- 34. Article 7 , Business Profits Dividends/Interest/Royalties Source/Situs Country PE Connected Not Connected Art. 7 Art. 10,

- 35. Article 10: Dividends Dividends are profits distributed to shareholders: - officially declared dividends - informal (“constructive”)

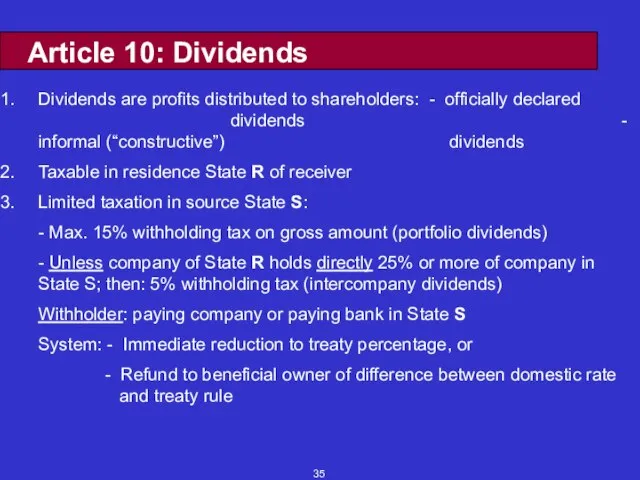

- 36. Article 10: Dividends (continued) 4. Only beneficial owner qualifies for reduced withholding tax 5. Note: Art.

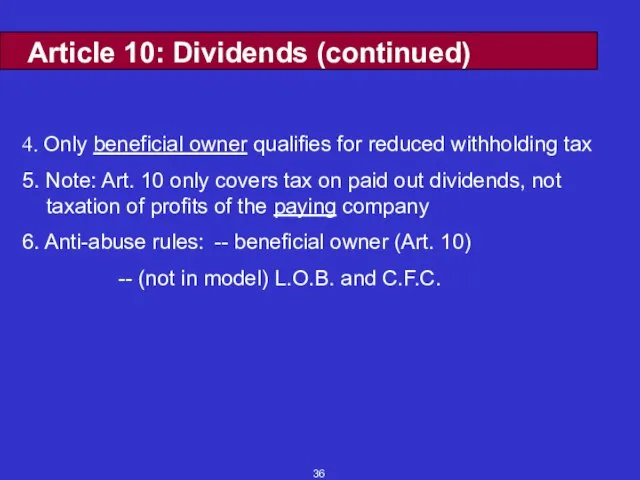

- 37. Article 11: Interest Interest is remuneration for money lent Taxable in residence State R of receiver

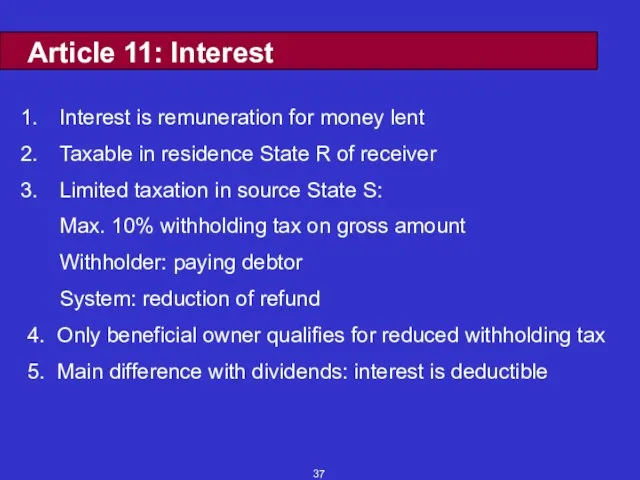

- 38. Article 12 : Royalties Royalties are payments for use (or right to use) of: -- Copyrights

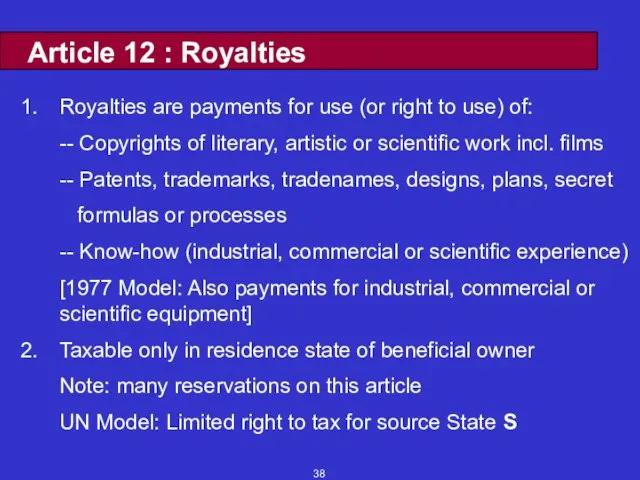

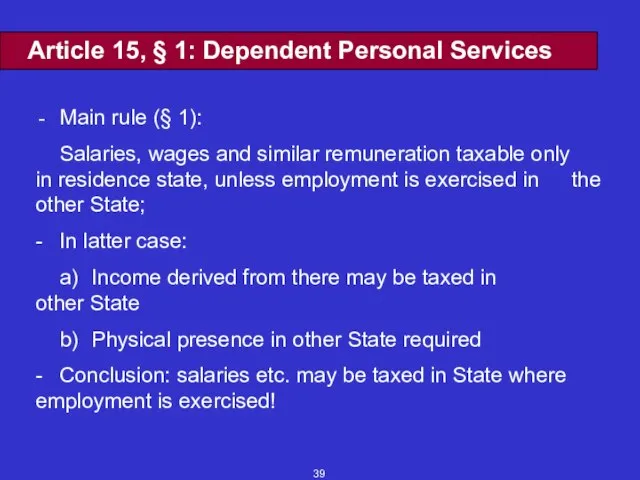

- 39. Article 15, § 1: Dependent Personal Services - Main rule (§ 1): Salaries, wages and similar

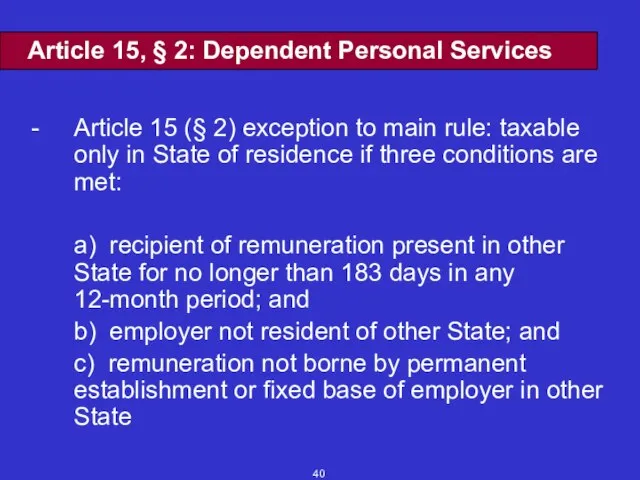

- 40. Article 15, § 2: Dependent Personal Services - Article 15 (§ 2) exception to main rule:

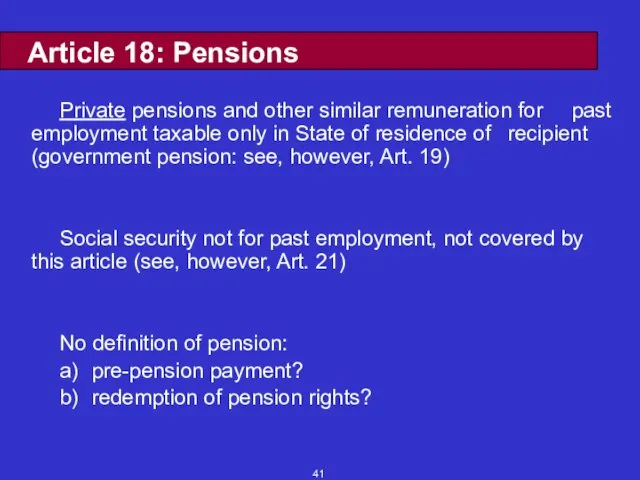

- 41. Article 18: Pensions Private pensions and other similar remuneration for past employment taxable only in State

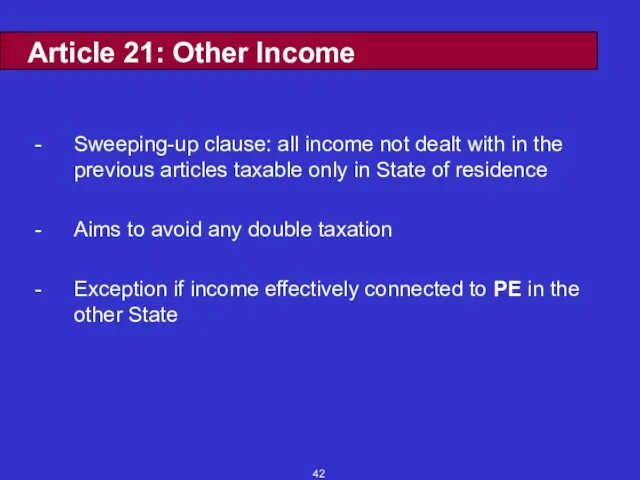

- 42. Article 21: Other Income Sweeping-up clause: all income not dealt with in the previous articles taxable

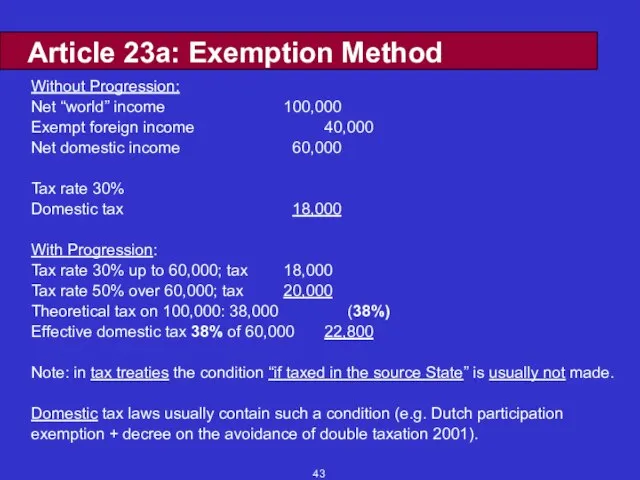

- 43. Article 23a: Exemption Method Without Progression: Net “world” income 100,000 Exempt foreign income 40,000 Net domestic

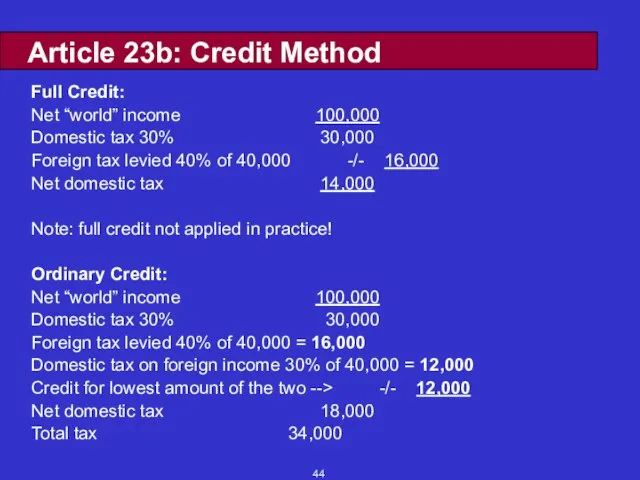

- 44. Article 23b: Credit Method Full Credit: Net “world” income 100,000 Domestic tax 30% 30,000 Foreign tax

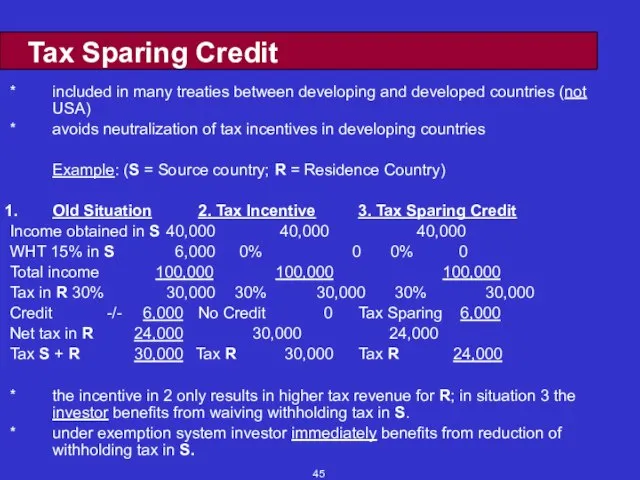

- 45. Tax Sparing Credit * included in many treaties between developing and developed countries (not USA) *

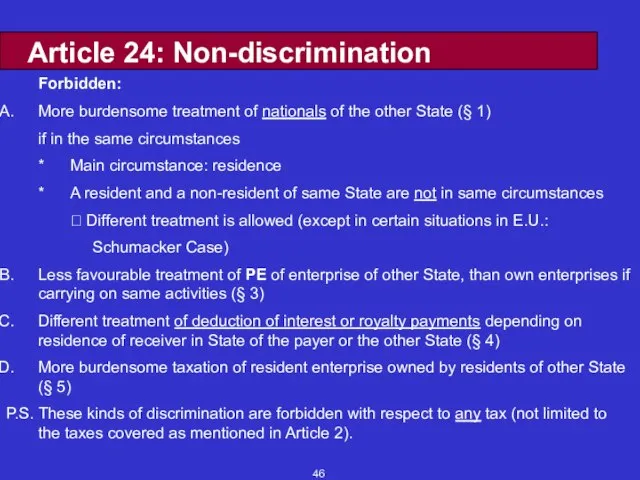

- 46. Article 24: Non-discrimination Forbidden: More burdensome treatment of nationals of the other State (§ 1) if

- 47. Article 25: Mutual Agreement Procedure Taxation not in accordance with provisions of convention: * resident may

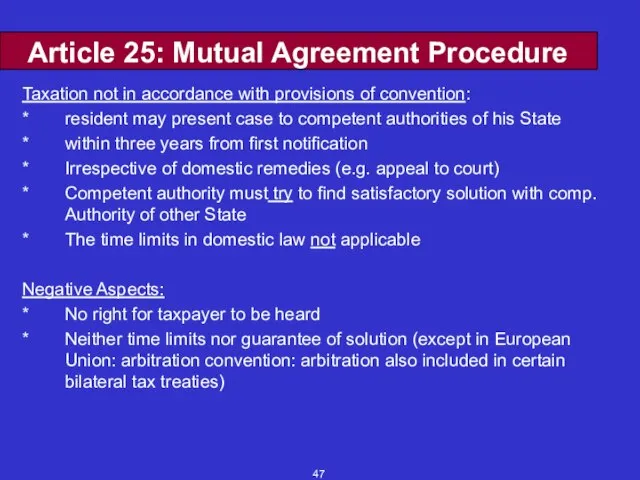

- 48. Article 26: Exchange of Information 1 Increasing number of international transactions underlines importance of cooperation between

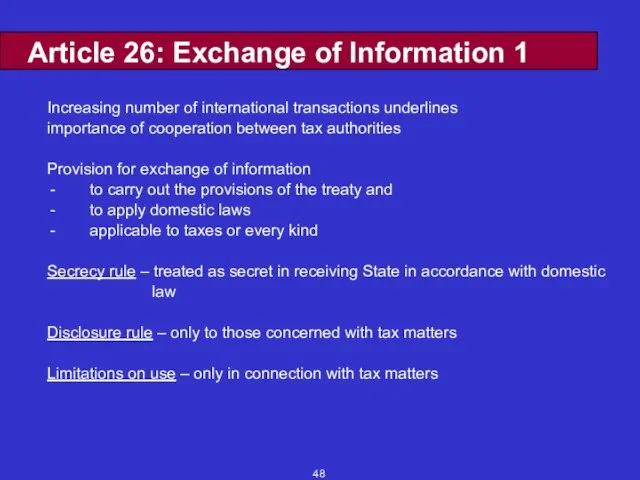

- 49. Article 26: Exchange of Information 2 Forms of Exchange More Recently automatic - simultaneous investigations spontaneous

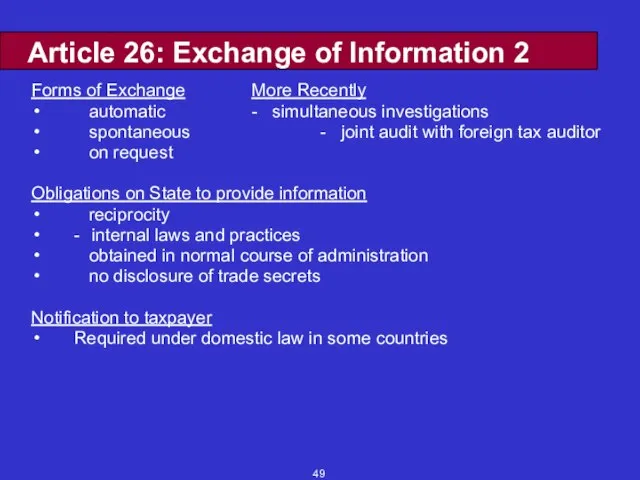

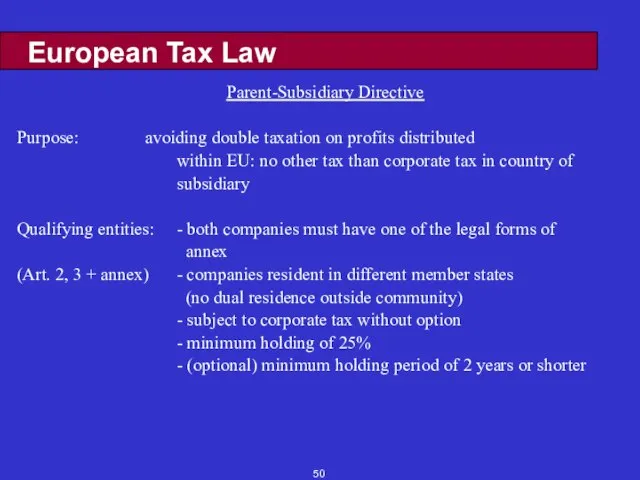

- 50. European Tax Law Parent-Subsidiary Directive Purpose: avoiding double taxation on profits distributed within EU: no other

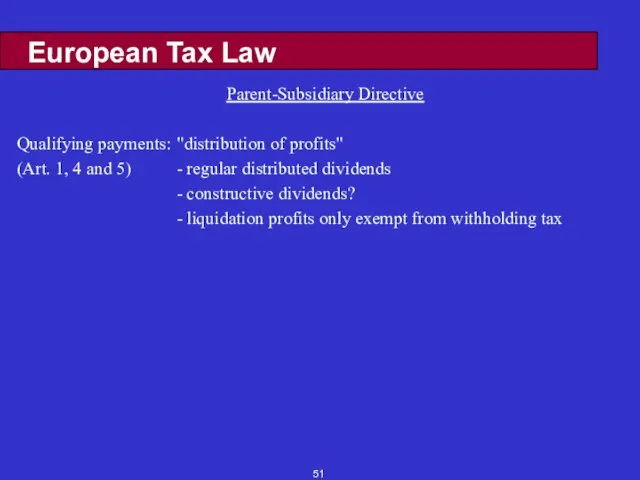

- 51. European Tax Law Parent-Subsidiary Directive Qualifying payments: "distribution of profits" (Art. 1, 4 and 5) -

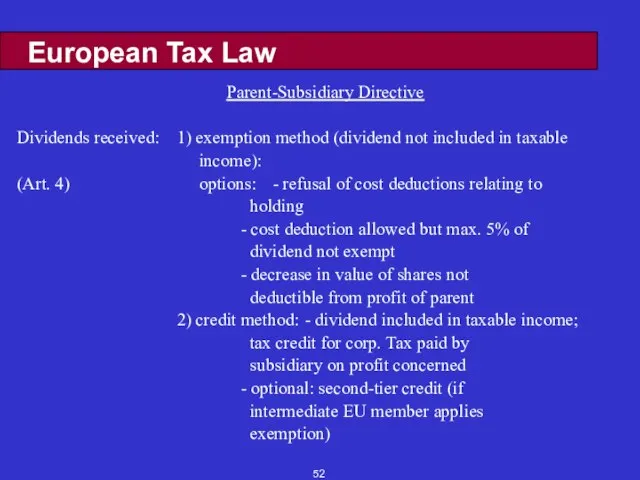

- 52. European Tax Law Parent-Subsidiary Directive Dividends received: 1) exemption method (dividend not included in taxable income):

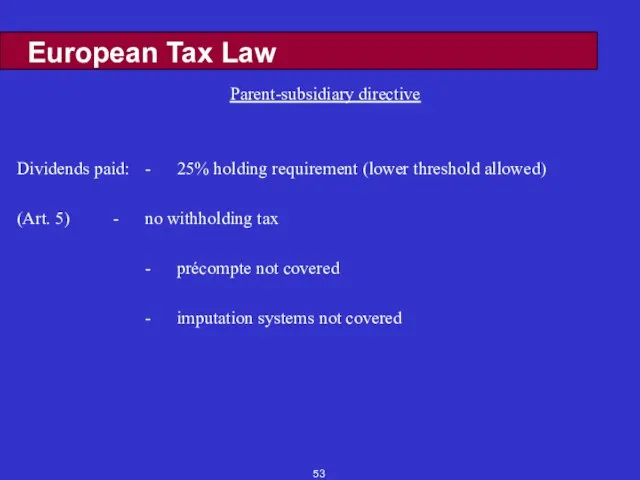

- 53. European Tax Law Parent-subsidiary directive Dividends paid: - 25% holding requirement (lower threshold allowed) (Art. 5)

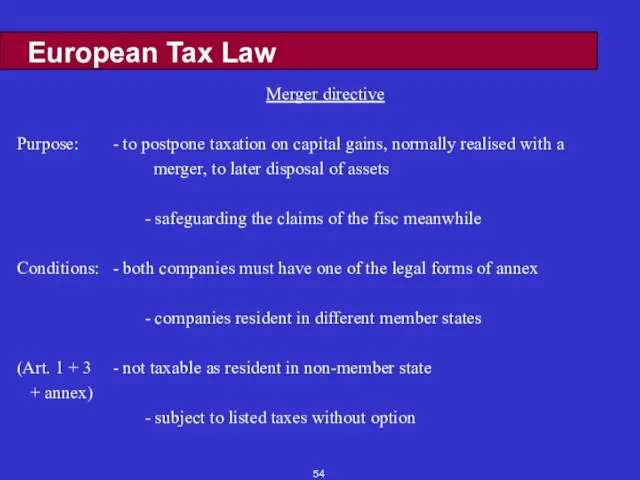

- 54. European Tax Law Merger directive Purpose: - to postpone taxation on capital gains, normally realised with

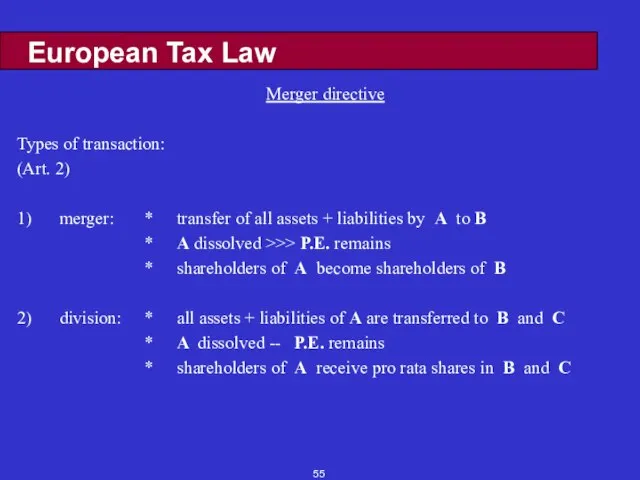

- 55. European Tax Law Merger directive Types of transaction: (Art. 2) 1) merger: * transfer of all

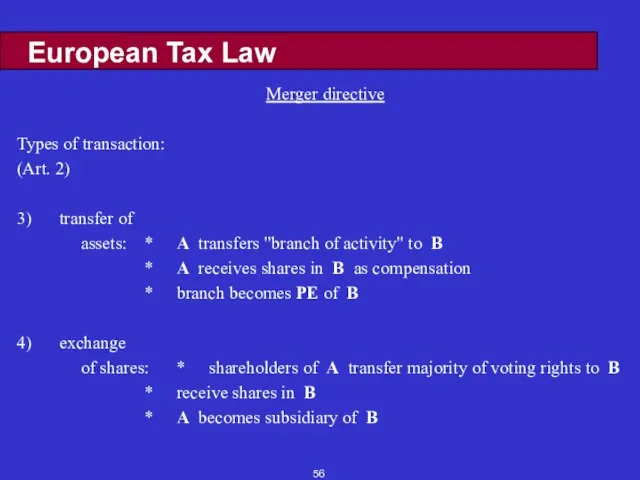

- 56. European Tax Law Merger directive Types of transaction: (Art. 2) 3) transfer of assets: * A

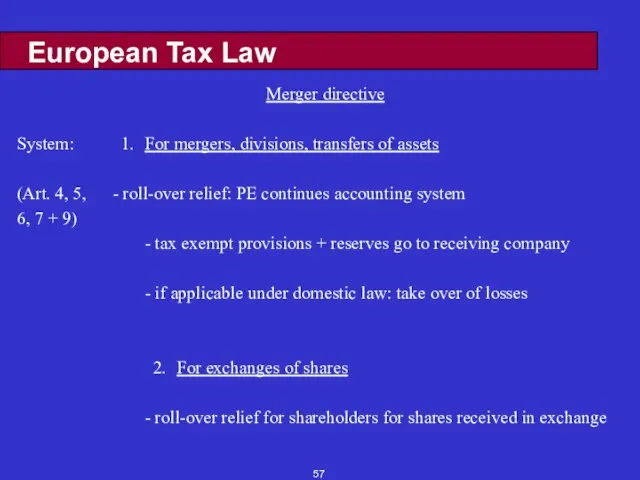

- 57. European Tax Law Merger directive System: 1. For mergers, divisions, transfers of assets (Art. 4, 5,

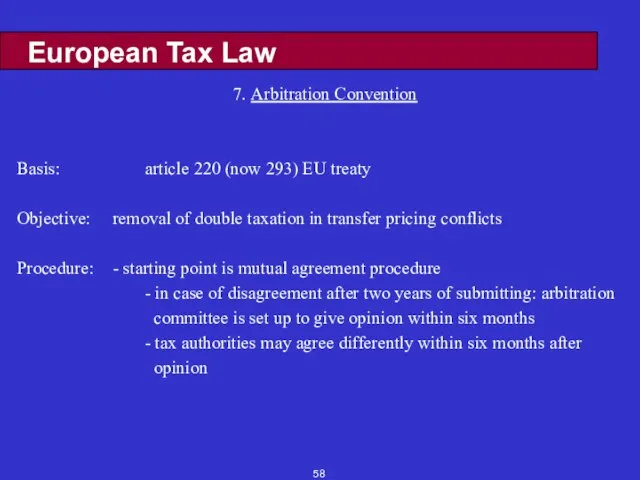

- 58. European Tax Law 7. Arbitration Convention Basis: article 220 (now 293) EU treaty Objective: removal of

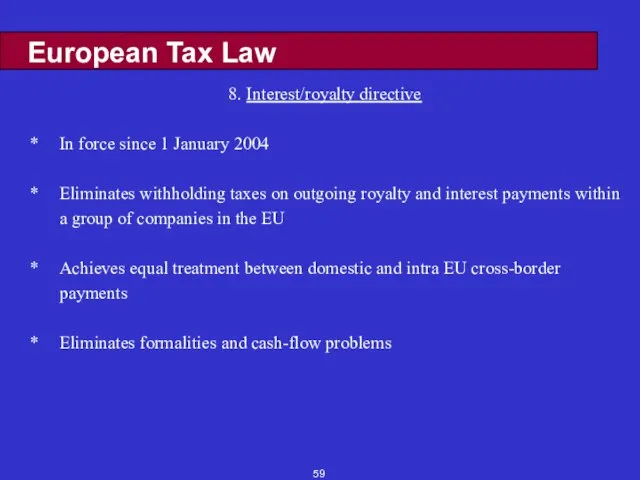

- 59. European Tax Law 8. Interest/royalty directive * In force since 1 January 2004 * Eliminates withholding

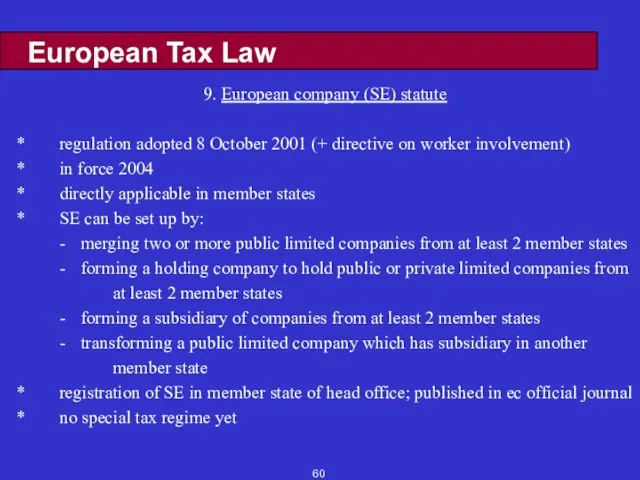

- 60. European Tax Law 9. European company (SE) statute * regulation adopted 8 October 2001 (+ directive

- 62. Скачать презентацию

Особенности истории России. Место России в мировом историческом процессе

Особенности истории России. Место России в мировом историческом процессе Оппортунистические инфекции

Оппортунистические инфекции  Всемирный день борьбы со СПИДом

Всемирный день борьбы со СПИДом Доказательная медицина и стандарты медицинской деятельности

Доказательная медицина и стандарты медицинской деятельности Система счетов и двойная запись

Система счетов и двойная запись Презентация на тему Лепка из пластилина

Презентация на тему Лепка из пластилина  Ночевала тучка золотая

Ночевала тучка золотая Revision

Revision Материально-производственная деятельность человека.

Материально-производственная деятельность человека. Как помочь ребёнку быть внимательным.

Как помочь ребёнку быть внимательным. Защитники земли русской. Работы учеников

Защитники земли русской. Работы учеников Презентация на тему ПОЛИТИЧЕСКИЙ ПРОГНОЗ: сущность, научные основы и принципы

Презентация на тему ПОЛИТИЧЕСКИЙ ПРОГНОЗ: сущность, научные основы и принципы  Словообразование (6 класс)

Словообразование (6 класс) 1 сентября. Классный час «От пера до компьютера».

1 сентября. Классный час «От пера до компьютера». Грамматические особенности перевода арабских фильмов на русский язык

Грамматические особенности перевода арабских фильмов на русский язык 1.3.2 Логические элементы ЭВМ

1.3.2 Логические элементы ЭВМ HTML

HTML Психологический климат в трудовом коллективе

Психологический климат в трудовом коллективе НОУ СОШ Гармония

НОУ СОШ Гармония Китайско-конфуцианская цивилизация

Китайско-конфуцианская цивилизация Каракули. Упражнение 2

Каракули. Упражнение 2 Презентация на тему Треугольники 7 класс геометрия

Презентация на тему Треугольники 7 класс геометрия  Moral Crisis in south Africa

Moral Crisis in south Africa Промоагентство

Промоагентство Презентация на тему Проблема темперамента и характера

Презентация на тему Проблема темперамента и характера Мой творческий путь в прозе и стихах

Мой творческий путь в прозе и стихах ПРОГРАММА«ТРИ ШАГА К УНИКАЛЬНОМУ СЕРВИСУ»GLOBAL SOLUTIONS Ltd.

ПРОГРАММА«ТРИ ШАГА К УНИКАЛЬНОМУ СЕРВИСУ»GLOBAL SOLUTIONS Ltd. Политические режимы. Типы политических режимов

Политические режимы. Типы политических режимов