Слайд 2Financial results of economic activity (revenue and profit)

Effectiveness and Financial diagnostics

Lecture

8

Results and effectiveness

of economic activity

Слайд 3to read

in Ukrainian

Економіка підприємства./ За заг. ред. С.Ф. Покропивного – К.: КНЕУ,

2001. – 528 с.

Економіка підприємства./ За ред. Шегди А.В. – К.: Знання, 2006. – 614 с.

Accounting standard # 3 “Financial results”

in English

http://en.wikipedia.org/wiki/Revenue

http://en.wikipedia.org/wiki/Profit_%28accounting%29

http://en.wikipedia.org/wiki/Income

http://en.wikipedia.org/wiki/Financial_ratio

http://en.wikipedia.org/wiki/Income_statement

Слайд 4Financial results of economic activity.

Part 1 Revenue

Revenue

is the amount

of money a company receives in exchange for its goods and services.

is usually listed on the first line of the income statement as revenue, sales, net sales or net revenue.

"Other Revenue" is money a company receives for activities that are not related to its original business.

For example, if a clothing store sells some of its merchandise, that amount is listed under revenue. However, if the store rents a building or leases some machinery, the money received is filed under "other revenue."

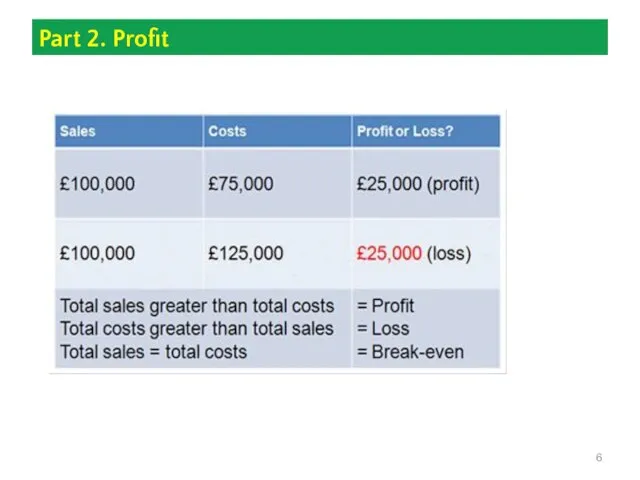

Слайд 5Part 2. Profit

Profit

is that money that your business retains after

all expenses have been paid and accounts have been settled.

is financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs and taxes needed to sustain the activity.

Calculated as:

PROFIT = TOTAL SALES less TOTAL COSTS

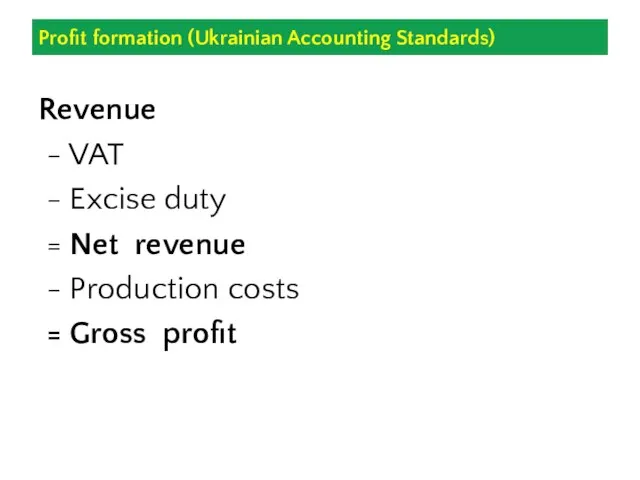

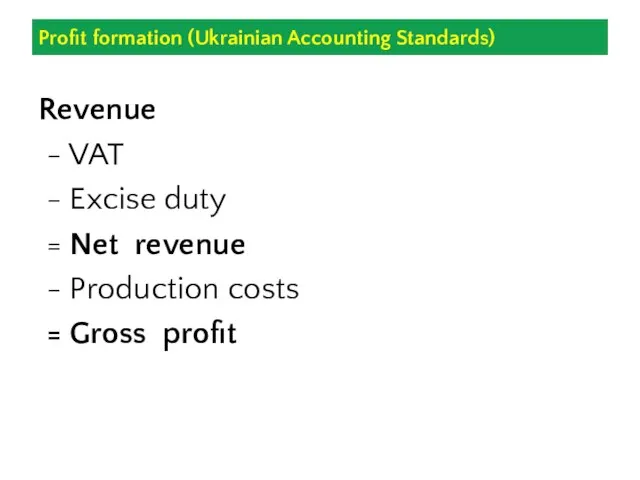

Слайд 7Profit formation (Ukrainian Accounting Standards)

Revenue

- VAT

- Excise duty

=

Net revenue

- Production costs

= Gross profit

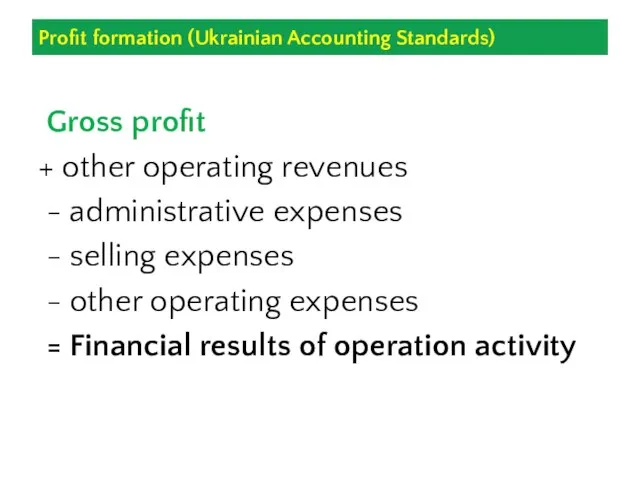

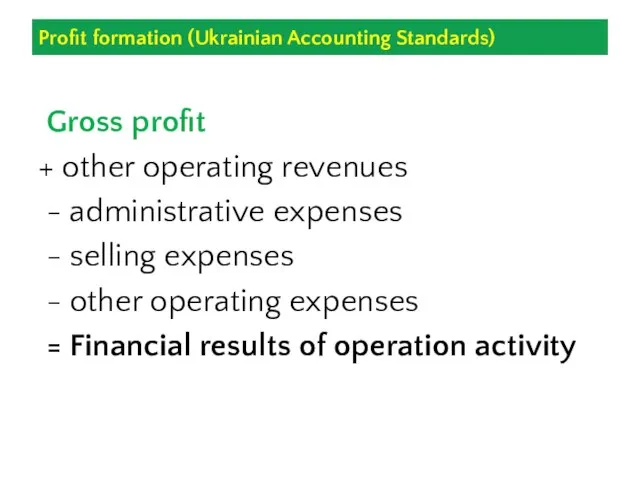

Слайд 8Profit formation (Ukrainian Accounting Standards)

Gross profit

+ other operating revenues

- administrative

expenses

- selling expenses

- other operating expenses

= Financial results of operation activity

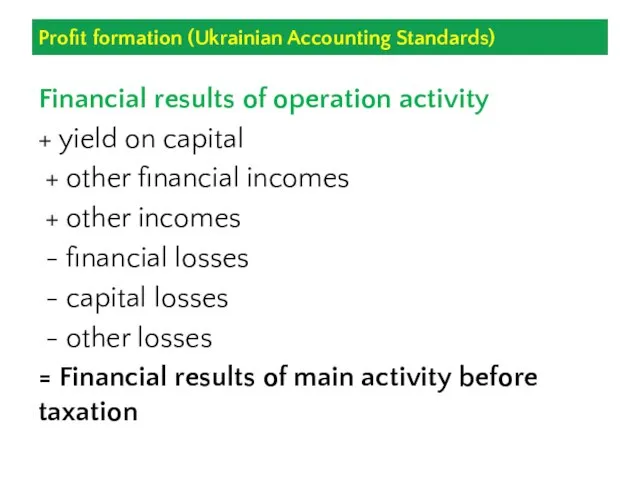

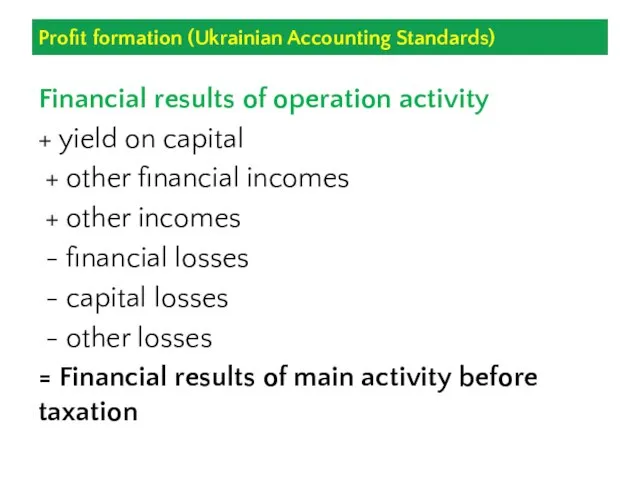

Слайд 9Profit formation (Ukrainian Accounting Standards)

Financial results of operation activity

+ yield on

capital

+ other financial incomes

+ other incomes

- financial losses

- capital losses

- other losses

= Financial results of main activity before taxation

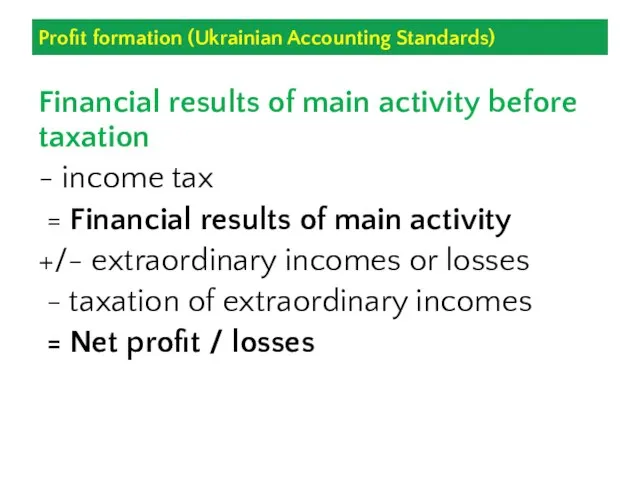

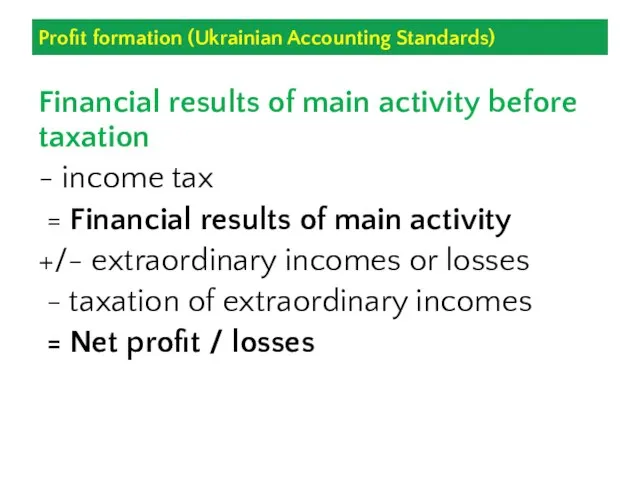

Слайд 10Profit formation (Ukrainian Accounting Standards)

Financial results of main activity before taxation

- income

tax

= Financial results of main activity

+/- extraordinary incomes or losses

- taxation of extraordinary incomes

= Net profit / losses

Слайд 11Gross profit equals sales revenue minus costs of good sold (COGS).

Earnings Before

Interest, Taxes, Depreciation and Amortization (EBITDA) equals sales revenue minus cost of goods sold and all expenses except for interest, amortization, depreciation and taxes.

Earnings Before Interest and Taxes (EBIT) or Operating profit equals sales revenue minus cost of goods sold and all expenses except for interest and taxes. It is also known as Operating Profit Before Interest and Taxes (OPBIT) or simply Profit Before Interest and Taxes (PBIT).

Слайд 12Earnings Before Tax (EBT) or Net Profit Before Tax equals sales revenue

minus cost of goods sold and all expenses except for taxes. It is also known as pre-tax book income (PTBI), net operating income before taxes or simply pre-tax Income.

Earnings After Tax or Net Profit After Tax or Net Income equals sales revenue after deducting all expenses, including taxes.

Income before extraordinary expenses represents the same but before adjusting for extraordinary items.

Earnings After Tax (or Net Profit After Tax) minus payable dividends becomes Retained Earnings.

Слайд 13Functions of profit

Evaluation – characterizes effect of economic activity

Distribution

– distribution of income between company and budget

Promotional – a source for promotion

Reproductive – a source for extended reproduction of capital and circulating assets

Слайд 14What influences profit?

Changes in

sales

structure of assortment

prices of goods

prices

of raw materials

level of inputs of material and labour resources

Слайд 152. Financial diagnostics

Economic diagnostics – analysis and evaluation of results of activity

of the enterprise based on study of individual results and incomplete information with the purpose of exploration of possible perspectives of development and consequences of current management decisions

Слайд 16Effective economic activity

Enterprise utilizes existing assets effectively

Enterprise pays off its

debts in time

Enterprise is profitable

Слайд 17Financial diagnostics (1)

Full-scale financial analysis of results of economic activity of the

enterprise

Horizontal – by years

Vertical – internal structure

Financial ratios

Слайд 18Forms of financial statements

balance sheet

income (financial results) statement

cash flow

statement

equity capital statement

notes on annual financial accounts

Слайд 19Financial ratios

Operational analysis

Analysis of operational expenses

Analysis of assets management

Liquidity analysis

Analysis of long-term solvency

Profitability analysis

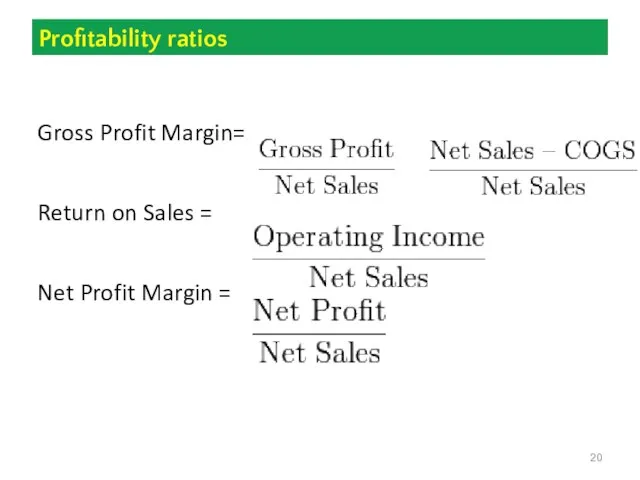

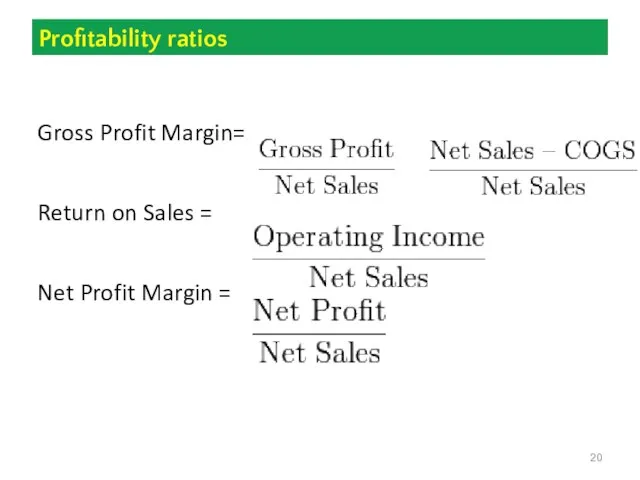

Слайд 20Profitability ratios

Gross Profit Margin=

Return on Sales =

Net Profit Margin =

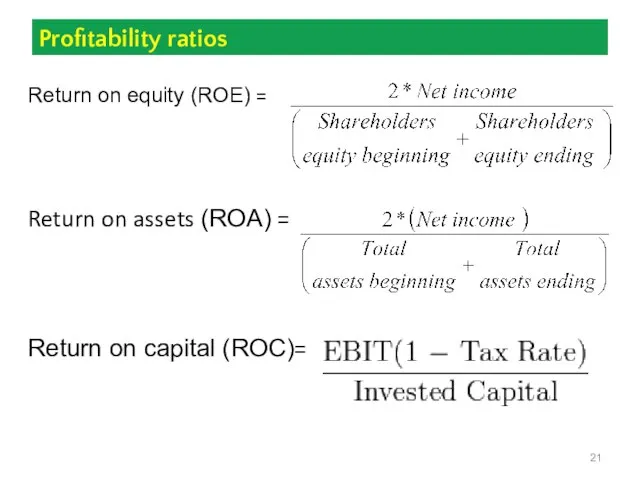

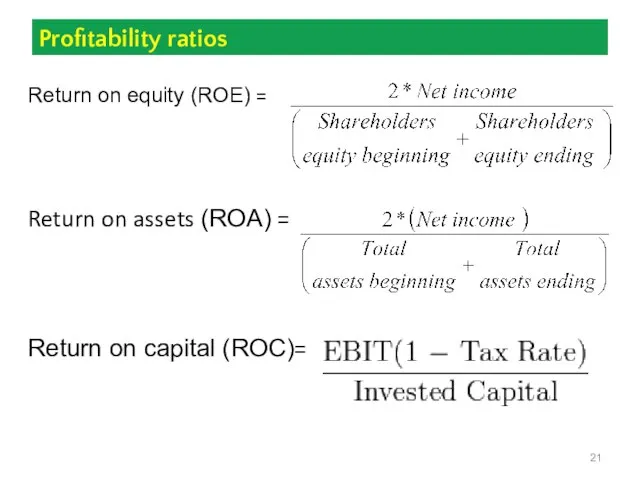

Слайд 21Profitability ratios

Return on equity (ROE) =

Return on assets (ROA) =

Return on capital

(ROC)=

РАЗВИТИЕУНИВЕРСАЛЬНЫХ УЧЕБНЫХ ДЕЙСТВИЙ В СТАНДАРАХ ВТОРОГО ПОКОЛЕНИЯ

РАЗВИТИЕУНИВЕРСАЛЬНЫХ УЧЕБНЫХ ДЕЙСТВИЙ В СТАНДАРАХ ВТОРОГО ПОКОЛЕНИЯ Испарение. Поглощение энергии при испарении жидкости и выделение ее при конденсации пара

Испарение. Поглощение энергии при испарении жидкости и выделение ее при конденсации пара ЧЕЛОВЕК И МИР ЛЮДЕЙ

ЧЕЛОВЕК И МИР ЛЮДЕЙ Общие и отличительные свойства ОБЪЕКТА

Общие и отличительные свойства ОБЪЕКТА Презентация на тему Наши домашние питомцы

Презентация на тему Наши домашние питомцы  Пищевая промышленность Хабаровского края и города Комсомольска-на-Амуре

Пищевая промышленность Хабаровского края и города Комсомольска-на-Амуре Аяулы жас келін

Аяулы жас келін Математический КВН«Мы пока не Архимеды…»

Математический КВН«Мы пока не Архимеды…» Создание безопасного пешеходного маршрута города Микунь

Создание безопасного пешеходного маршрута города Микунь Баскетбол

Баскетбол Исторический обзор садово-паркового искусства

Исторический обзор садово-паркового искусства Золотая пропорция в архитектуре г.Лангепас

Золотая пропорция в архитектуре г.Лангепас Информация об объекте. Краснодарский край, г. Краснодар, ул. Красная, д. 52

Информация об объекте. Краснодарский край, г. Краснодар, ул. Красная, д. 52 Презентация по обществознанию на тему: Современное искусство

Презентация по обществознанию на тему: Современное искусство Алгоритмы

Алгоритмы Старт карьеры-2009

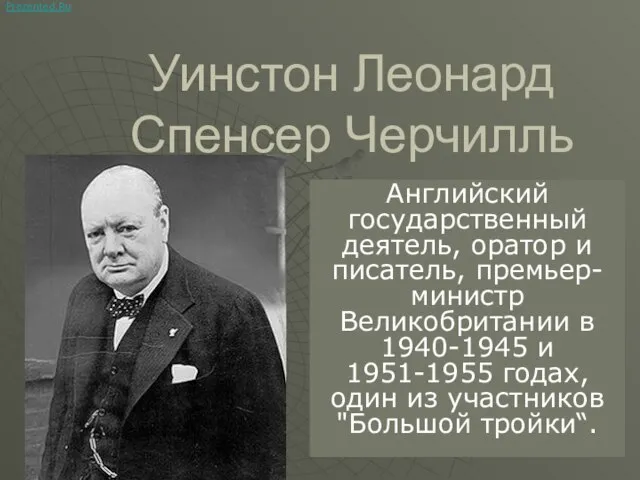

Старт карьеры-2009 Презентация на тему Уинстон Леонард Спенсер Черчилль Английский государственный деятель

Презентация на тему Уинстон Леонард Спенсер Черчилль Английский государственный деятель гоу детский сад комбинированного вида № 1565ЗОУО ДО г. МосквыЗаведующая Тищенко Т. Р.

гоу детский сад комбинированного вида № 1565ЗОУО ДО г. МосквыЗаведующая Тищенко Т. Р. ?

? Конфликты в деловом общении

Конфликты в деловом общении Рисование карманов, кокеток, складок различной формы

Рисование карманов, кокеток, складок различной формы Краснов

Краснов Новое в системе обязательного медицинского страхования как часть реформы здравоохранения в России

Новое в системе обязательного медицинского страхования как часть реформы здравоохранения в России Яблочный пирог

Яблочный пирог БЕЛОРУССКИЙ ГОСУДАРСТВЕННЫЙ УНИВЕРСИТЕТФАКУЛЬТЕТ МЕЖДУНАРОДНЫХ ОТНОШЕНИЙ

БЕЛОРУССКИЙ ГОСУДАРСТВЕННЫЙ УНИВЕРСИТЕТФАКУЛЬТЕТ МЕЖДУНАРОДНЫХ ОТНОШЕНИЙ Основы Конституционного строя РФ

Основы Конституционного строя РФ Эффективность продукта

Эффективность продукта Мохнатая азбука

Мохнатая азбука