Слайд 2

Many innovative projects are financed internally from budgets set up for that

purpose and derived from the company's operating revenue.

However, from time to time it may be necessary to seek additional funds to carry through a development program where the capital needed is beyond the scope of the current budgets.

Слайд 3 The funding of projects is one aspect of the company`s overall business

strategy and the source and application of money is part of that plan.

Слайд 4 Broadly, funding and financial assistance can come from four major areas:

Professional lenders

and investors

Grants from government bodies

Interested parties

Private, non-professional investors.

Слайд 5Professional lenders and investors

1 class: those who interested only in lending

money (bank): can provide money in overdraft facilities (small sums and short-term period) – simple to arrange and comparatively cheap.

BUT if the bank sees fit it may demand instant repayment or part-repayment and long-term loans – can be arranged for periods up to 30 years, they vary from bank to bank and interest charges will be several percentage points above bank base rates.

Слайд 6Professional lenders and investors

2 class: those that lend money on the

basis of making an investments in the company (venture capital fund) exist to invest in industry by making money available for promising ventures in return for interest payments on the capital advanced and a share of the business. Money comes from man sources (insurance companies, pension funds and investment trusts. The primary interest of venture capital funds is those companies with high prospective growth rates not as yet floated on the equities market. They will look at proposals with high expected margins and large markets.

Слайд 7Stock market

can also be raised through the stock market: if a

company has grown sufficiently to make it worthwhile becoming publicly quoted, then capital can be raised through floatation. The initial cost of “going public” can be high and must be taken into account. For companies that are already quoted right issues are an attractive proposition: under this arrangement existing shareholders are invented as of right to buy additional shares in proportion to their existing shareholding.

Слайд 8Grants from government

Government should provide grants to enable industry to develop,

modernize and innovate in areas that are in national interests. Usually can be involved some schemes to encourage the development of innovative technology. Special schemes exist to promote development work in key technologies, they tend to run for several years and new ones are introduced as earlier schemes come to an end.

Слайд 9European Commission sponsors

ESPRIT, European Strategic Programme for research and development in information

technology

RACE, Research and development programe for advanced communication technology for Europe

SMART, small Firms Merit Award for Research and Technology

Слайд 10Interested parties

Organizations that are potential customers may be prepared to finance

some or all of project development. They may be willing to sponsor basic research but a commercial or potentially useful end must always be in view. In the public sector the defense ministries are among the largest purchasers of advanced technologies.

Слайд 11Non-professional lenders private investors

private investors

employees

personal friends and contacts.

Слайд 12Precept of investors

It should be made clear to all involved that

money put onto a project to create something new is speculative money, the profit is not guaranteed and it could all be lost.

Private investors are much more used to the concept of risk money and may well favor backing new development work in return for share of profits as an interesting and possibly more profitable way of investing surplus cash. (usually there are tax incentives and even full tax relief).

For a large projects could be created a syndicates of businessmen and investors

Слайд 13Innovative project life-cycle

Pre-investment phase:

1. Pre-investment researches and planning of a project

2.

Documents development and preparation for project implementation

Investment phase:

Bargaining and contract concluding

Project realization

Project shutdown

Слайд 14Pre-investment phase:

Pre-investment researches: forecast analysis, analyzing of conditions and project concept

development, project justification of future investment, selecting and matching of placement, eco-justification, expertise

Documents development and preparation for project implementation: development of design and survey works plan, paperwork development, approving of technical task, final decision-making of investment

Слайд 15Investment phase:

Bargaining and contract concluding: contract developing, agreement concluding, plan development

Project realization:

development of realization plan, schedules design, execution phase, monitoring and control, plan correction, costs covering

Project shutdown: commissioning, start of the object, demobilization of resources, exploitation, repair and manufacture development, close of project and demounting

Слайд 16Innovative project business plan should answer following questions

What is investment efficiency of

the project as against to simple market rate of lending rate. It is characteristic of simple alternative investment, for example bank deposit

What is the outlet measure (solvency, demand), profitable in conjecture, perspective, increasing and accessible for assimilation

Competitive advantages of the firm in correspondences with the market conditions

Level of stability of resource market (price, suppliers, conditions)

Слайд 17Innovative project business plan should answer following questions

Technical and commercial risks of

the project and ways of its minimizing

How many financial resources and in what form (money, loans, equipment, know-how) is required for production and future development?

What are the nearest perspectives of enterprise financial development and determining of unprofitability period?

What strategy of profit maximizing will be implemented by the firm (combination of prices, volumes of production, structure of expenses, volumes of first investments involved

Место учебного исследования в программе Intel «Обучение для будущего»

Место учебного исследования в программе Intel «Обучение для будущего» Презентация на тему Умножение натуральных чисел 5 класс

Презентация на тему Умножение натуральных чисел 5 класс  Использование компактных токамаков в качестве источника нейтронов для решения задач ядерной и термоядерной энергетики

Использование компактных токамаков в качестве источника нейтронов для решения задач ядерной и термоядерной энергетики НАПРАВЛЕНИЕ ПОДГОТОВКИ: ПЕДАГОГИЧЕСКОЕ ОБРАЗОВАНИЕ ПРОФИЛЬ ПОДГОТОВКИ ГЕОГРАФИЯ ШКОЛА ПЕДАГОГИКИ.

НАПРАВЛЕНИЕ ПОДГОТОВКИ: ПЕДАГОГИЧЕСКОЕ ОБРАЗОВАНИЕ ПРОФИЛЬ ПОДГОТОВКИ ГЕОГРАФИЯ ШКОЛА ПЕДАГОГИКИ. SPEECH SOUNDS SYSTEM of English

SPEECH SOUNDS SYSTEM of English Профессии в цирке

Профессии в цирке Притяжение Земли

Притяжение Земли Процесс принятия и реализации управленческих решений

Процесс принятия и реализации управленческих решений Режим дня ученика

Режим дня ученика Что роднит музыку с изобразительным искусством?

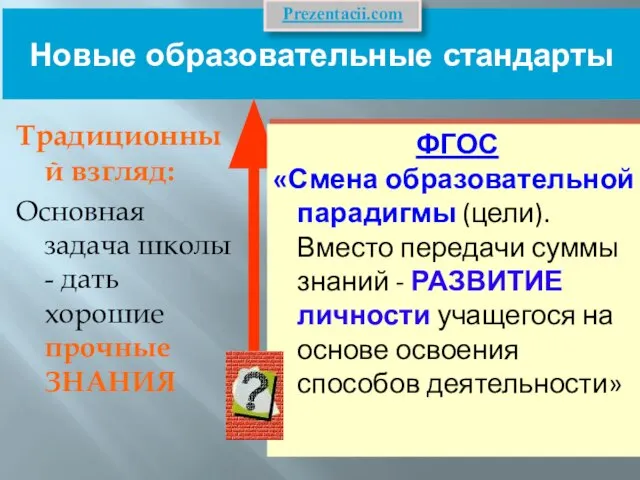

Что роднит музыку с изобразительным искусством? Новые образовательные стандарты

Новые образовательные стандарты ЗАО «Ю-Тверь»

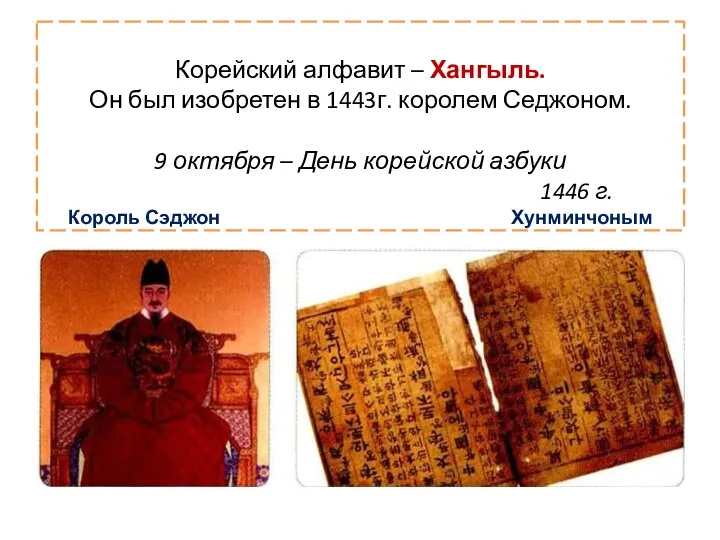

ЗАО «Ю-Тверь» Корейский алфавит – Хангыль

Корейский алфавит – Хангыль Little&big. Информация о студии

Little&big. Информация о студии Нюрнбергский процесс.Уроки истории.

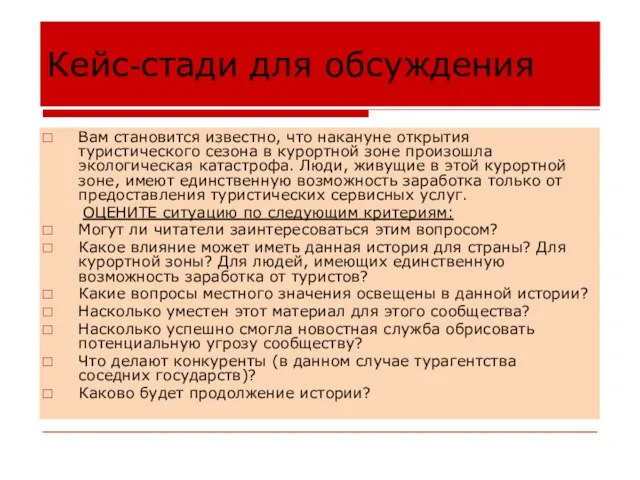

Нюрнбергский процесс.Уроки истории. Кейс-стади для обсуждения

Кейс-стади для обсуждения Не забывайте своих родителей

Не забывайте своих родителей Направление 230100.62 «Информатика и вычислительная техника» ОАО «АВТОВАЗ»

Направление 230100.62 «Информатика и вычислительная техника» ОАО «АВТОВАЗ» Страна "Геометрия"

Страна "Геометрия" Чтобы мне понравиться, парень должен быть:

Чтобы мне понравиться, парень должен быть: How to make ice cream

How to make ice cream Презентация на тему Виды театров

Презентация на тему Виды театров Золотой век русской культуры

Золотой век русской культуры Развитие сотрудников. Влияние на результат

Развитие сотрудников. Влияние на результат Интерьерное зеркало Reflection

Интерьерное зеркало Reflection «Современные формы контроля знаний учащихся по химии»

«Современные формы контроля знаний учащихся по химии» Роль моего предмета в будущей жизни ученика

Роль моего предмета в будущей жизни ученика Entertainment and Media. TV, types of programs

Entertainment and Media. TV, types of programs