Слайд 2Bookkeeping

is the recording of financial transactions.

Transactions include:

sales,

purchases,

income,

receipts

payments

Слайд 3Bookkeeping is usually performed by a bookkeeper.

Слайд 4Bookkeeping is not accounting

Слайд 5There are 2 common methods of bookkeeping in the USA:

the single-entry bookkeeping

system

the double-entry bookkeeping system

Слайд 6accounting clerk

accounting technician

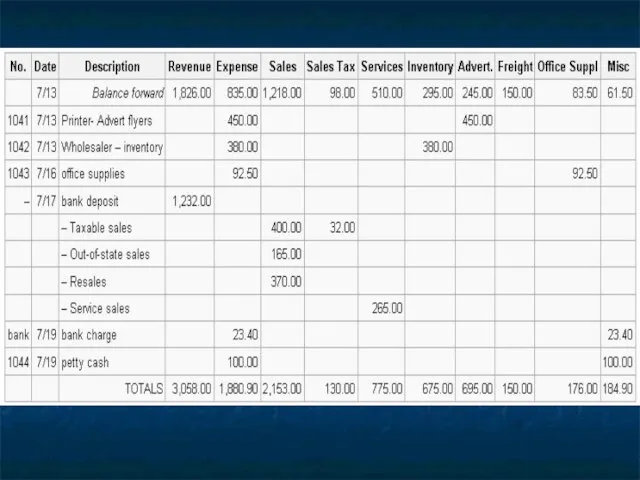

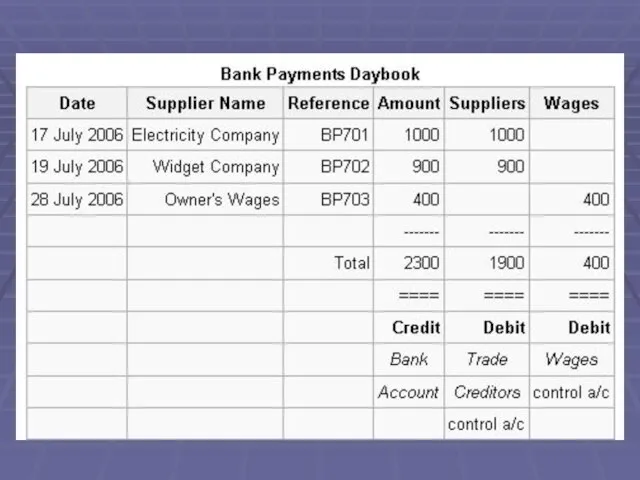

Слайд 9the correct day book,

suppliers ledger,

customer ledger

general ledger

Слайд 10Finally financial statements are drawn from

the trial balance, which may include:

the income statement, or P&L

the balance sheet

the cash flow statement

the statement of retained earnings

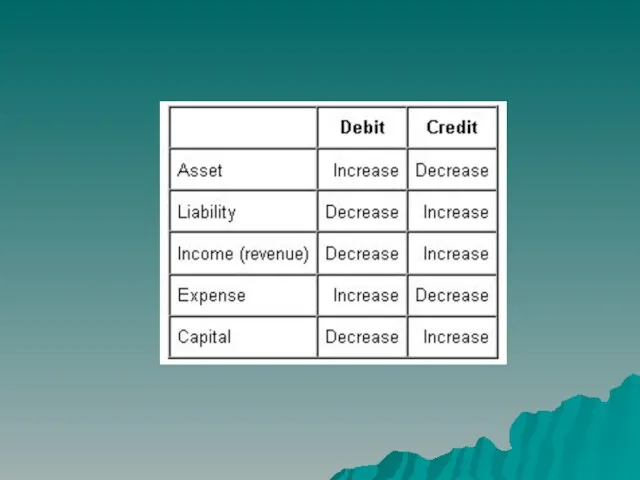

Слайд 13A double-entry bookkeeping system

Слайд 15assets = liabilities + equity

accounting equation:

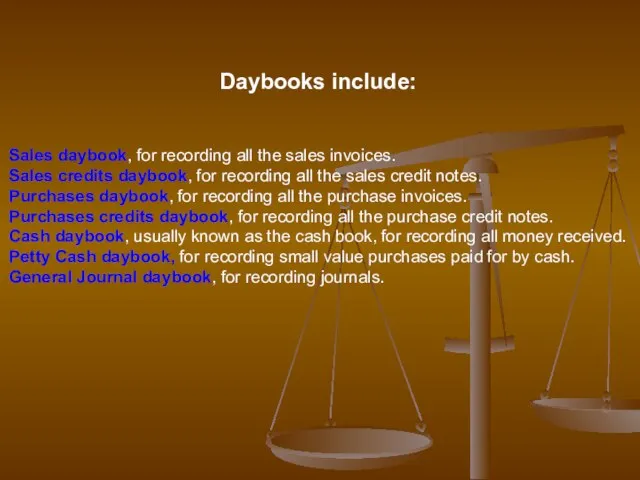

Слайд 17Daybooks include:

Sales daybook, for recording all the sales invoices.

Sales credits

daybook, for recording all the sales credit notes.

Purchases daybook, for recording all the purchase invoices.

Purchases credits daybook, for recording all the purchase credit notes.

Cash daybook, usually known as the cash book, for recording all money received.

Petty Cash daybook, for recording small value purchases paid for by cash.

General Journal daybook, for recording journals.

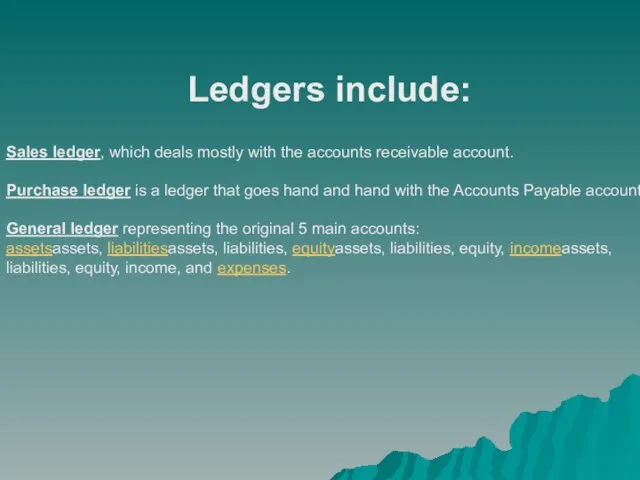

Слайд 18Ledgers include:

Sales ledger, which deals mostly with the accounts receivable account.

Purchase ledger is a ledger that goes hand and hand with the Accounts Payable account.

General ledger representing the original 5 main accounts:

assetsassets, liabilitiesassets, liabilities, equityassets, liabilities, equity, incomeassets, liabilities, equity, income, and expenses.

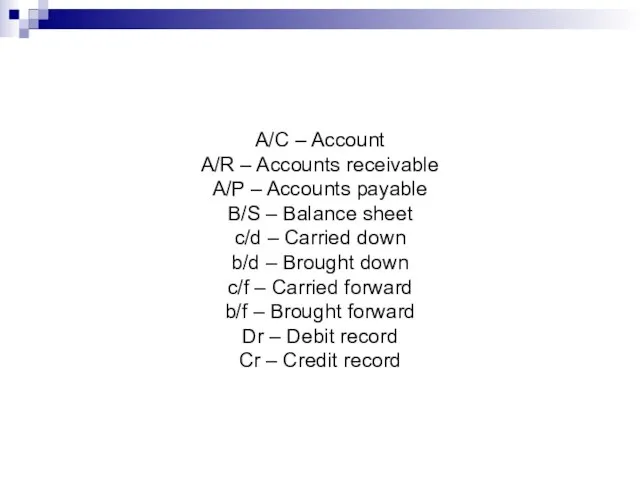

Слайд 19Abbreviations used in the

USA bookkeeping

Слайд 20

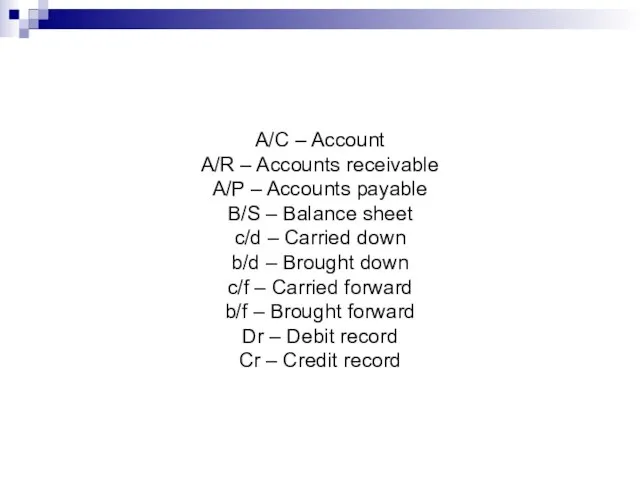

A/C – Account

A/R – Accounts receivable

A/P – Accounts payable

B/S

– Balance sheet

c/d – Carried down

b/d – Brought down

c/f – Carried forward

b/f – Brought forward

Dr – Debit record

Cr – Credit record

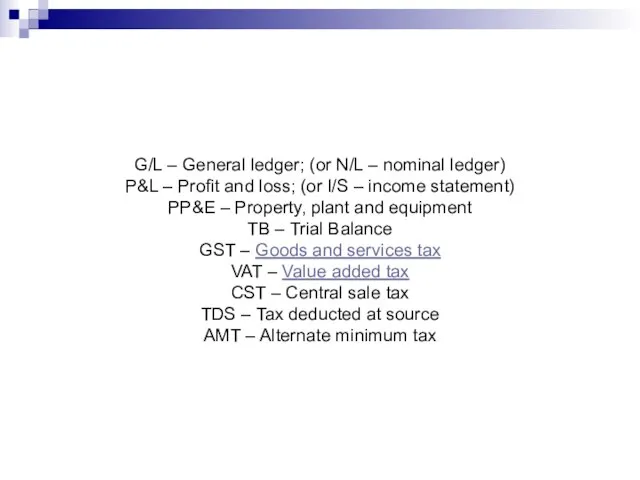

Слайд 21

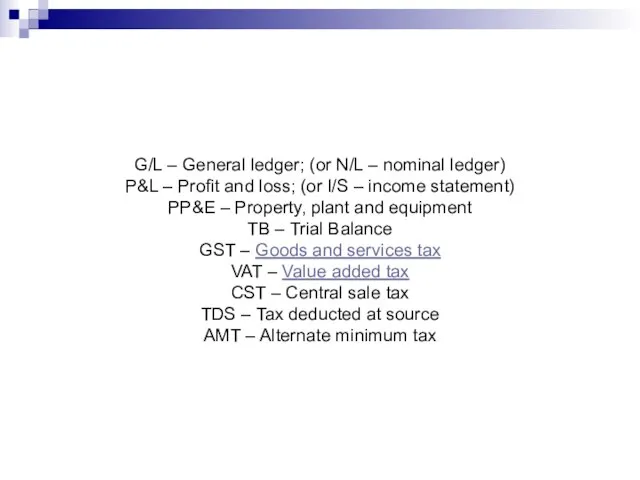

G/L – General ledger; (or N/L – nominal ledger)

P&L – Profit

and loss; (or I/S – income statement)

PP&E – Property, plant and equipment

TB – Trial Balance

GST – Goods and services tax

VAT – Value added tax

CST – Central sale tax

TDS – Tax deducted at source

AMT – Alternate minimum tax

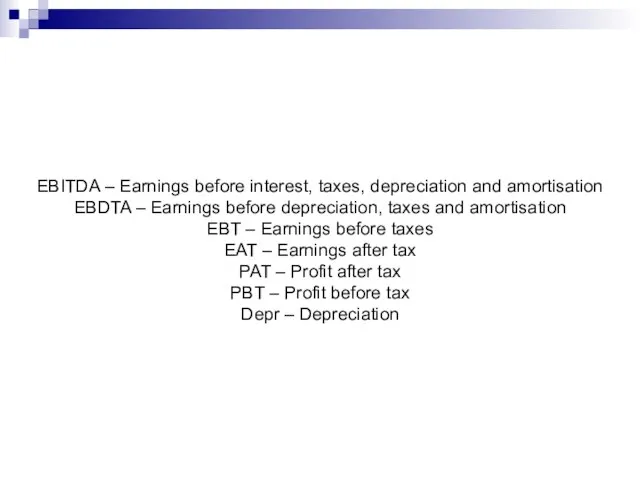

Слайд 22

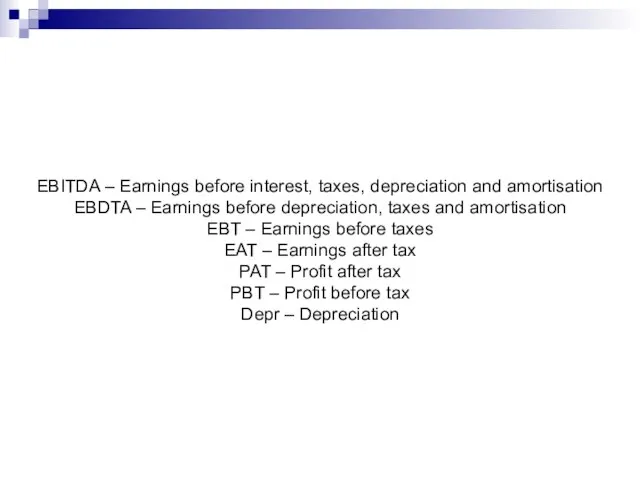

EBITDA – Earnings before interest, taxes, depreciation and amortisation

EBDTA – Earnings

before depreciation, taxes and amortisation

EBT – Earnings before taxes

EAT – Earnings after tax

PAT – Profit after tax

PBT – Profit before tax

Depr – Depreciation

(011)Sensor to bit calculations

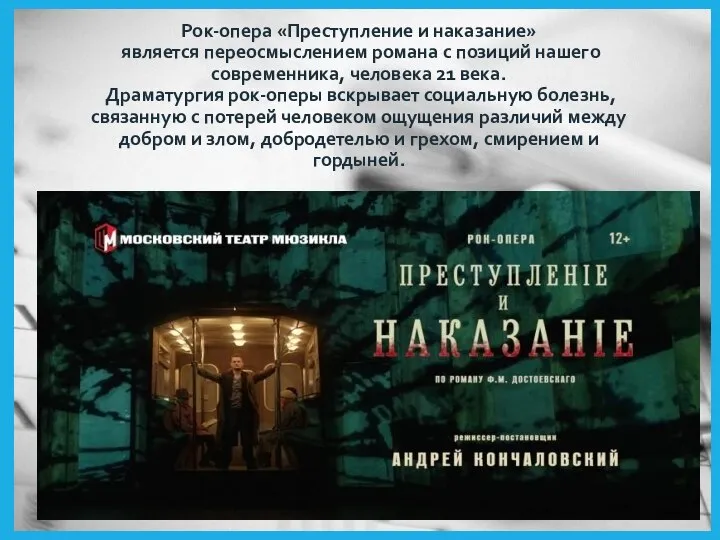

(011)Sensor to bit calculations СЕМИНАР по вопросу разработки, представления и регистрации в органах государственного пожарного надзора МЧС России деклараций

СЕМИНАР по вопросу разработки, представления и регистрации в органах государственного пожарного надзора МЧС России деклараций  Презентация на тему Конструирование и моделирование юбок

Презентация на тему Конструирование и моделирование юбок ПРОДВИЖЕНИЕ В ПОИСКОВЫХ СИСТЕМАХ Роскошь или эффективное средство развития бизнеса? Реалии современного Рунета

ПРОДВИЖЕНИЕ В ПОИСКОВЫХ СИСТЕМАХ Роскошь или эффективное средство развития бизнеса? Реалии современного Рунета тема для размышления123321

тема для размышления123321 RedCat SMM paket

RedCat SMM paket Многообразие рыб

Многообразие рыб Городские мотивы в лирике Н.А. Некрасова

Городские мотивы в лирике Н.А. Некрасова Технологии 3D рендера в проектах "Ил-2” и "Второй мировой".

Технологии 3D рендера в проектах "Ил-2” и "Второй мировой". Определение параметров муниципальных услуг

Определение параметров муниципальных услуг Основные направления деятельности студенческих отрядов

Основные направления деятельности студенческих отрядов Наука и образование

Наука и образование Внешняя политика России в 90-е годы

Внешняя политика России в 90-е годы Форматы мясного цеха

Форматы мясного цеха Спортивно-патриотические мероприятие, посвященное Дню защитника Отечества “А ты готов?“

Спортивно-патриотические мероприятие, посвященное Дню защитника Отечества “А ты готов?“ Организация исследовательской деятельности

Организация исследовательской деятельности Сложение и вычитание дробей

Сложение и вычитание дробей FIS Collection System Возврат долгов: от стратегии к задачам.

FIS Collection System Возврат долгов: от стратегии к задачам. Методические рекомендации по работе над творческим проектом

Методические рекомендации по работе над творческим проектом Исполнитель Робот

Исполнитель Робот Обязанности ООК и ООС

Обязанности ООК и ООС Осенние праздники

Осенние праздники Дополнение«Альфа-Авто»: Управление взаимоотношениями с клиентами, редакция 5Для автосалонов

Дополнение«Альфа-Авто»: Управление взаимоотношениями с клиентами, редакция 5Для автосалонов Подвижные игры с элементы баскетбола на уроках в начальной школе

Подвижные игры с элементы баскетбола на уроках в начальной школе Kasbga yo'naltirish trening slayd (5)

Kasbga yo'naltirish trening slayd (5) Прямоугольные треугольники

Прямоугольные треугольники Презентация на тему Favourite sports

Презентация на тему Favourite sports Презентация на тему Алкалоиды

Презентация на тему Алкалоиды